Featured Articles

Having the Renminbi in the SDR Club

On 30 November 2015, the IMF announced that the Chinese renminbi (RMB) was to be included in its special drawing rights (SDR) currency basket. Joining the SDR — the IMF’s chief international reserve asset for member states — meant that...

Service ISM Hits a Six-Year Low, and the Dollar

The US dollar was already trading with a heavier bias before the shockingly poor service ISM. The August non-manufacturing ISM tumbled to 51.4, a six-year low, from 55.5 in July. Markit, which does its own survey, showed a smaller decline...

The Down Under Dollar is Making a Move

Since late July, I have been looking for the Australian dollar to turn lower. Instead, the Aussie has continued to climb. It has risen in ten of the past eleven weeks. As this Great Graphic, created on Bloomberg, these gains...

Forex Participants Watch the JPY100.00 Level

This Great Graphic was created on Bloomberg. I use it to illustrate a possible head and shoulder pattern that has been carved by the US dollar against the yen. Head and shoulders patterns are most often regarded as a reversal...

The Lure of a New Gold Standard

Today is anniversary of the final blow to the dollar-gold standard. By August 15, 1971, the exchange of dollars for gold was limited to central banks, and US President Nixon unilaterally ended it. There was a brief attempt to resurrect...

New Zealand’s Central Bank Cuts, but the Currency Shrugs

The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone. After closing the North American session 0.5% higher yesterday to snap a five-day losing streak, it has...

The Dollar Might Receive a Boost from the Employment Report

The robust US employment report before the weekend allowed the dollar to recoup the losses it experienced earlier in the week against most of the major currencies. The Australian dollar and Japanese yen managed to hold onto minor gains for...

For a Clearer Picture, Use the Real Trade-Weighed Dollar

This Great Graphic, created on Bloomberg, depicts the Federal Reserve's real broad trade-weighted index of the dollar. Real means that it is adjusted for inflation differentials. Broad means that it covers a wide number of US partners. Trade-weighted means that...

Several Variables Help Explain the Canadian Dollar

Our informal and simple model for the Canadian dollar has three variables: oil, interest rates, and general risk environment. Over time, the coefficient of the variables can and do change. Of the three variables, the general risk environment is the...

Slow Start for the Dollar

What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. What promises to be a busy week has begun off slowly. The...

Divergence between the U.S. and other Economies Keeps Dollar Bull Case Alive

Our underlying constructive outlook for the US dollar remains intact. It is broadly based on the divergence between the US and most other major economies. The US acted early and aggressively to counter the Great Financial Crisis. Unorthodox policies, such...

Other Currencies Matter

The US dollar is easily the most traded currency, and despite the plethora of other currencies, it is on one side of nearly 90% of all trades. Yet the movement in the foreign exchange market presently is not so much...

When is a Bottom a Bottom?

With the Bank of England apparently surprising the market more than one might have expected, given the split surveys, many are thinking sterling has bottomed. If it has bottomed, where could it go? A number of technical considerations suggest toward...

Is the Yuan Really Weak?

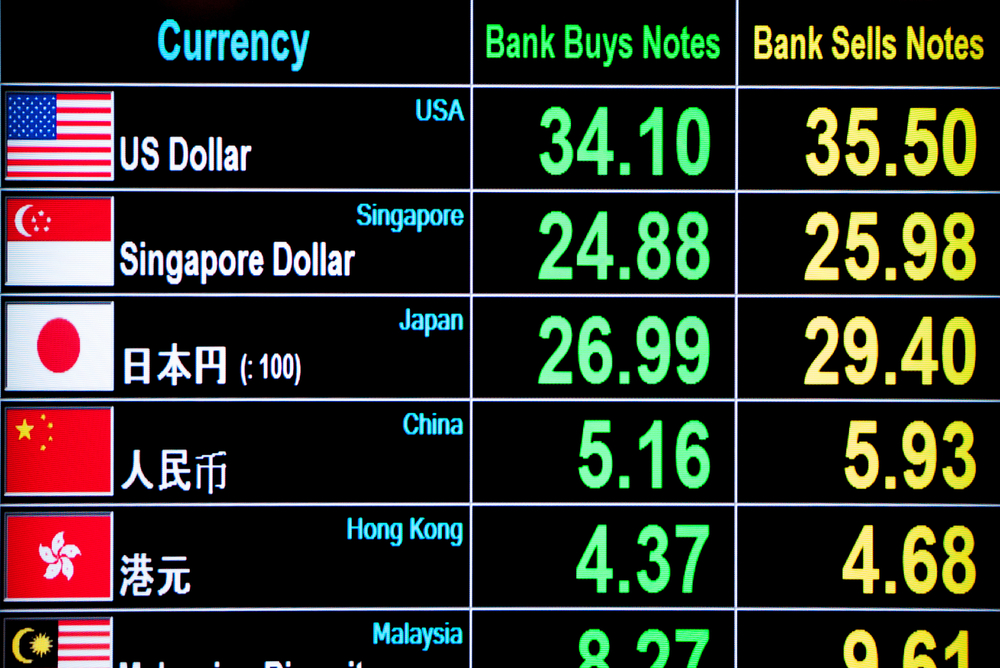

Here are two Great Graphics that portray two time series: the dollar-yuan exchange rate and the yuan against a trade-weighted basket. The first chart comes from a highly reputable consulting firm. It replicates the trade-weighted basket that Chinese officials unveiled...

Pound Pounded as BOE Action Portends Easing and UK PMI Comes in Weak

The British pound has been hammered to fresh lows just above $1.3115. The euro is moving toward GBP0.8500. The immediate catalyst is three-fold. First, one of the UK's largest property funds has moved to prevent retail liquidation. Second, the BOE...