Invest in ASX Australia – Investing in ASX Beginner’s Guide 2021

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Investing in the ASX is a great way to gain exposure to the price movements of the ASX 200 index. But what is the ASX 200 and how do you invest in it?

The ASX 200 is a stock market index that covers 200 large-cap businesses that are listed on the Australian Stock Exchange. Learn how to trade and invest in the ASX 200, as well as what factors influence the index’s performance.

Table of Contents

Investing in ASX starts with a top-rated, regulated online trading platform. But with so many CFD brokers out there, how do you choose the right one that suits your trading needs?

After reviewing the best online brokers out there, we found that eToro is the safest and cheapest option for beginner traders.

In this section of our Investing in ASX guide, we’ll cover three of the best brokers to consider in 2021, offering the lowest fees, safest platforms, and fastest trade executions.

eToro serves clients in over 120 countries, including Australia, and is regulated by the Australian Securities and Investment Commission (ASIC), CySEC, and the UK’s FCA.

With an eToro trading account, there are two ways you can gain exposure to indices:

Since eToro facilitates fractional share trading you can invest in a percentage of a whole ETF or stock index CFD with a minimum investment of just $50.

You can search for a specific stock index CFD such as the SPX500, UK100, and the AUS200 via the search bar at the top of the dashboard.

Alternatively, you can browse through 13 stock indices by clicking on the ‘Discover’ tab from the navigation bar.

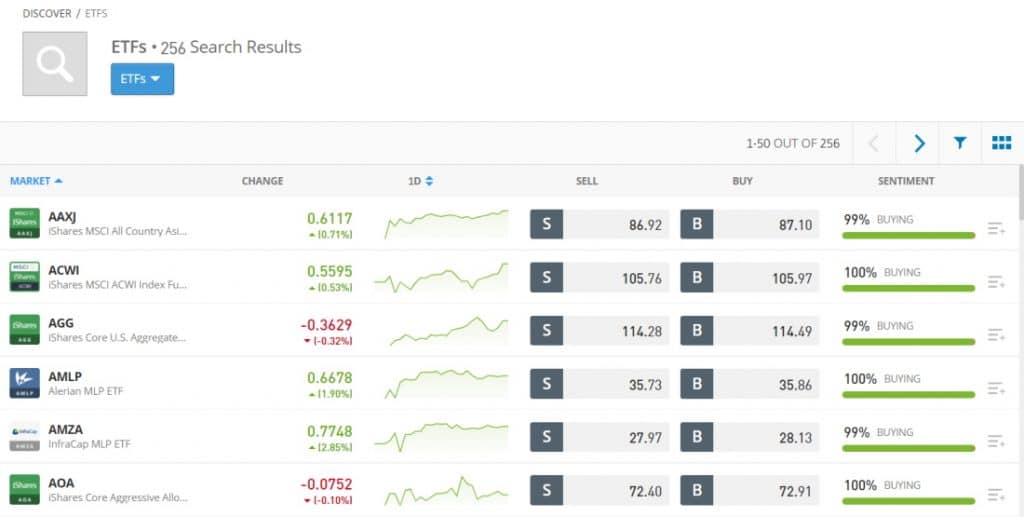

eToro gives you access to a wide range of 256 ETFs (exchange-traded funds), covering many index funds such as the SPDR S&P 500 ETF and iShares Core FTSE 100 UCITS ETF.

You can trade the ASX 200 via financial derivatives such as contracts for difference. A CFD lets you speculate on the price of the ASX 200 either increasing or dropping as it tracks the price of the benchmark index.

When you trade ASX 200 through CFDs you’ll be opening leveraged positions. Leverage lets you stretch your investing capital to gain greater share market exposure while only having to commit an initial margin. Nevertheless, leverage can amplify both potential losses and profits.

On the other hand, you cannot invest directly in the ASX 200 because it’s an index, as opposed to a tangible asset like stocks or commodities. But, you can gain exposure to its price movements by investing in ASX 200 ETFs or individual stocks listed on the ASX 200.

68% of retail investor accounts lose money when trading CFDs with this provider.

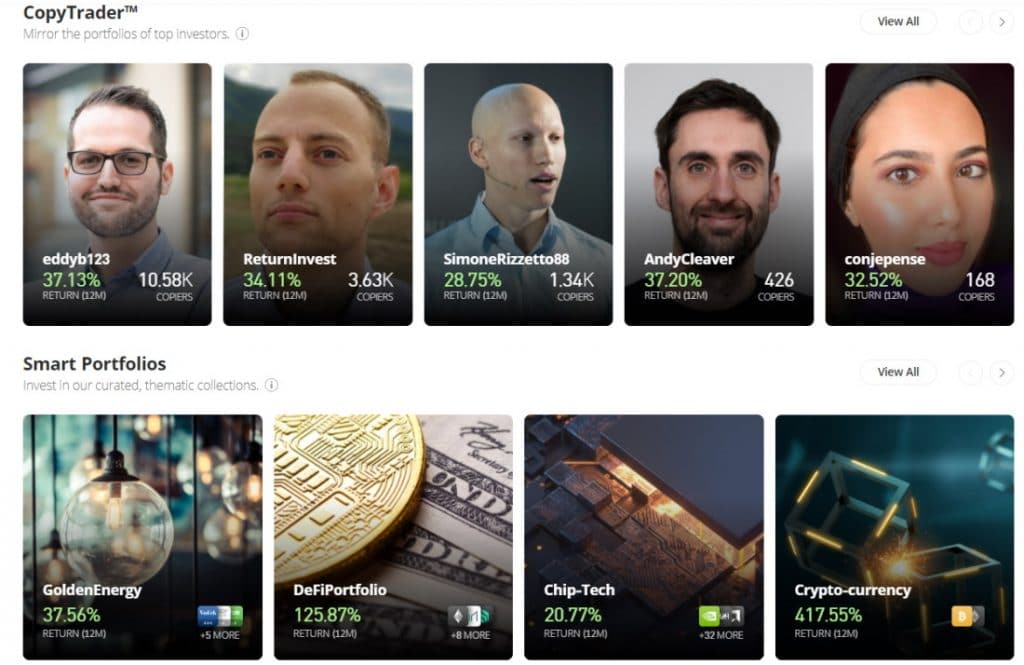

Copy trading is arguably eToro’s best feature for beginners. CopyTrader is one of the most iconic features eToro has to offer.

CopyTrader is the main driver behind social trading, allowing you to see what real people are doing in real-time, discover and follow investors you like, as well as imitate their trading strategies with a few clicks.

One of the main reasons the platform is regarded as one of the leaders of the fintech revolution is CopyTrader and CopyPortfolios. The CopyTrader tool’s basic concept is straightforward: select the traders you want to replicate, pick how much you want to invest, and copy everything they do automatically in real-time from the comfort of your own home.

The CopyTrader tool from eToro is a game-changer in the online trading sector since it allows you to build an investment portfolio based on real, tried and tested investment strategies.

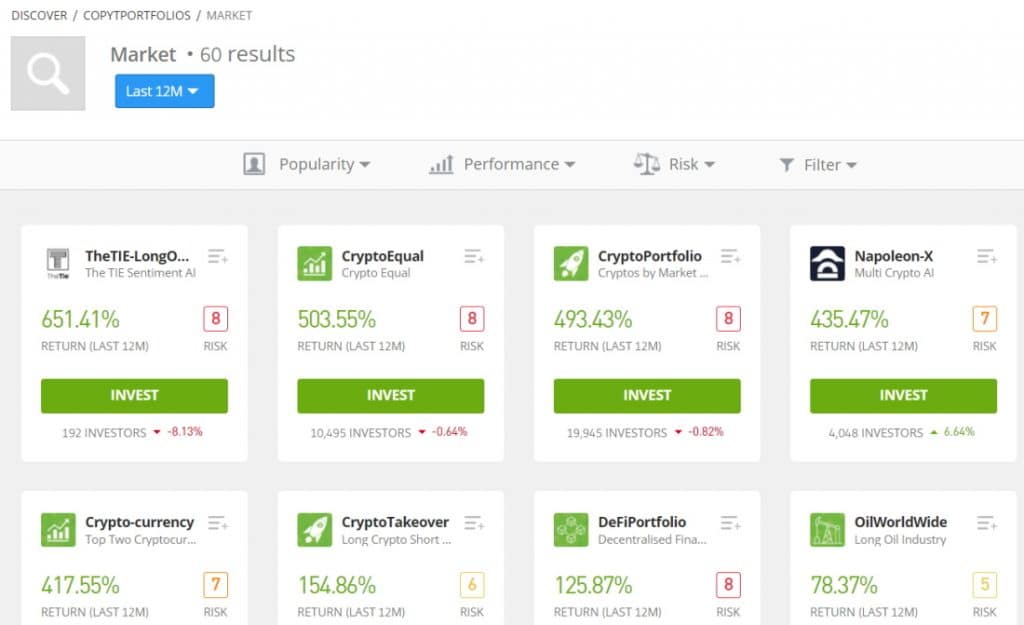

CopyPortfolios can be broken down into three main groups:

This unique, passive approach to investing helps traders diversify their portfolios, reducing long-term risk, and maximising current market opportunities. Each CopyPortfolio is rebalanced regularly.

eToro is fully regulated by several top-tier financial authorities including the UK’s FCA (Financial Conduct Authority), CySEC (Cyprus Securities and Exchange Commission), and ASIC (the Australian Securities and Investments Commission).

On top of that, eToro offers negative balance protection and holds all client funds in segregated bank accounts. You’ll also have the option to set up 2FA on both the web-based trading platform and the mobile app.

eToro is one of the best discount brokers out there. This means you’ll be buying and selling stocks and ETFs without paying a penny in commissions. When it comes to CD trading you will face overnight financing fees. Furthermore, when it comes to forex trading the only fees you will incur are the bid-ask spreads. This is simply the difference between the bid and ask prices.

When it comes to non-trading fees these are also very low. For example, there are no account or deposit fees to worry about. On the other hand, there is a small $5 withdrawal fee and a $10 inactivity fee after 12 months of no-login activity.

| Fee Type | Fee Amount |

| Commission | 0% |

| Spread Fee | Variable low spreads |

| Deposit Fee | $0 |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 after 12 Months |

| Account Fee | None |

| Cost of investing in Stock Index CFDs | Tight spreads, overnight financing fees |

Pros

Cons

68% of retail investor accounts lose money when trading CFDs with this provider.

Account opening is simple and 100% digital. AvaTrade has several deposit and withdrawal methods, all of which are free of charge. It also provides a wide range of user-friendly research and educational tools.

On the other hand, its portfolio of financial instruments is restricted to forex, various CFDs (for stocks, indices, commodities, and so on), and cryptos. Inactivity costs are above average, and FX trading fees are rather expensive.

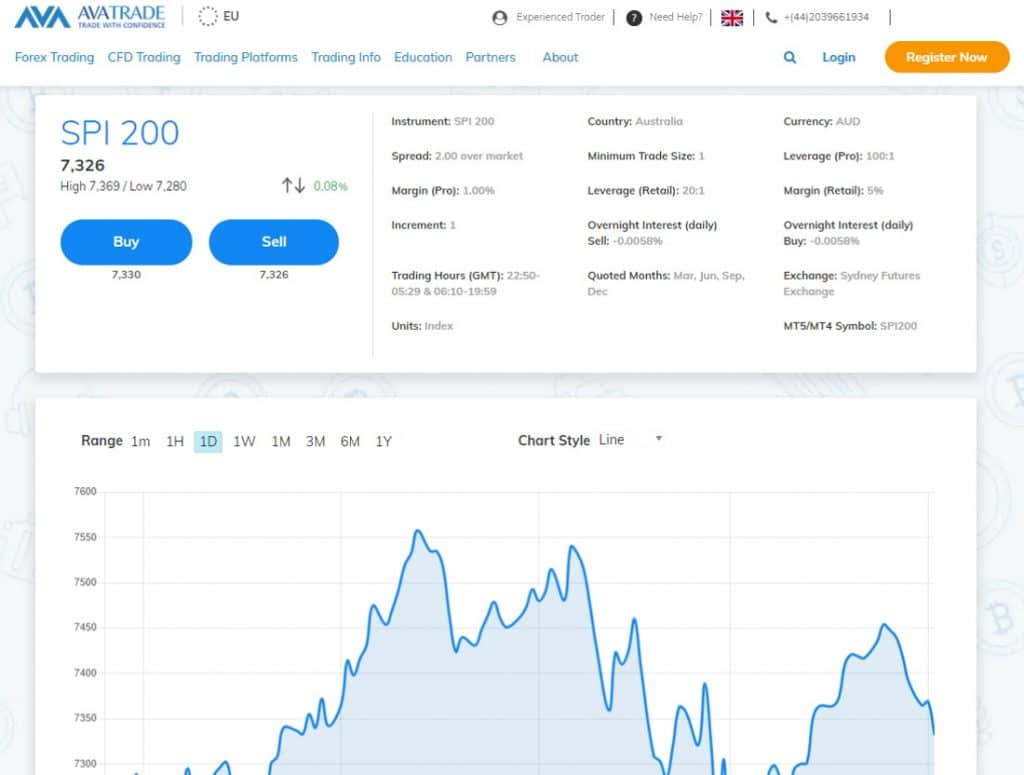

AvaTrade supports low CFD and average forex fees. This includes 0% commission trading as the fees are included in the market spread. In terms of non-trading fees, there are no deposit fees, withdrawal fees, or account fees charged by the broker.

On the flip side, there is a $50 inactivity fee per quarter after three months of inactivity. Additionally, after one year of inactivity, a $100 administrative fee is charged.

The minimum deposit is just $100 and you can use a bank transfer, credit/debit card, or electronic wallet.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Spread Fee | Variable bid-ask spreads |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $50 per quarter after 3 months inactivity |

| Account fee | None |

| Cost of investing in SPI 200 CFD | Spread: 2.00 over market |

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

Capital.com charges minimal forex and stock CFD commissions. Opening an account is straightforward. Customer service is great; they respond quickly and thoroughly.

On the downside, its supported products are limited to CFDs (equity, index, crypto – not available to UK traders, commodities, currency) and actual stocks. Traders based in Australia do not have access to real stocks. Price alerts are not available on the web trading platform, and minor account base currencies are not supported.

In comparison to other CFD brokers, Capital.com boasts a large assortment of CFD, FX, and crypto products. However, popular asset categories such as real ETFs, funds, and futures are absent.

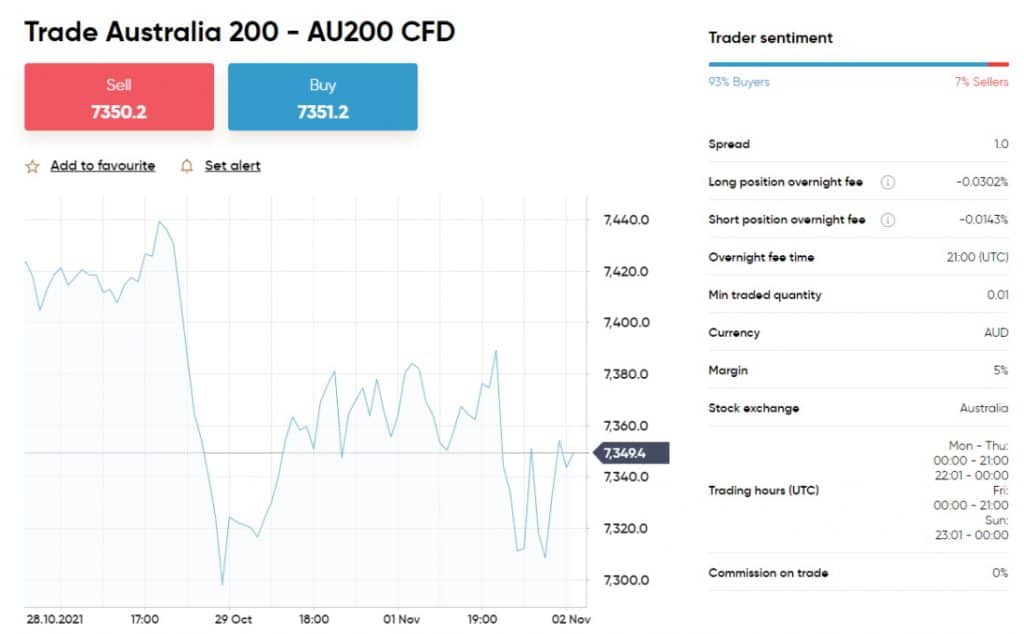

Capital.com offers low trading fees. It’s fantastic that FCA and CySEC investors can trade real stocks without paying a penny in commission. There are no inactivity or withdrawal costs, thus non-trading fees are also on the low end of the fee spectrum. Stock index CFD costs, on the other hand, aren’t cheap.

Capital.com does not charge a fee for making a deposit. Apple Pay may be used to add funds to your brokerage account in addition to bank transfers and credit/debit cards.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Spread Fee | Variable dependent on asset |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $0 |

| Account fee | None |

| Cost of investing in AU200 CFD | Spread: 1.0 Pip |

Pros

Cons

76.72% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

| Broker | Commission | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| eToro | 0% | $0 | $5 | $10 monthly (after a year of inactivity) |

| AvaTrade | 0% | $0 | $0 | $50 per quarter (after 3 months inactivity) |

| Capital.com | 0% | $0 | $0 | NA |

Investing in index funds has a few major drawbacks:

Follow this four-step process to start investing in ASX right now.

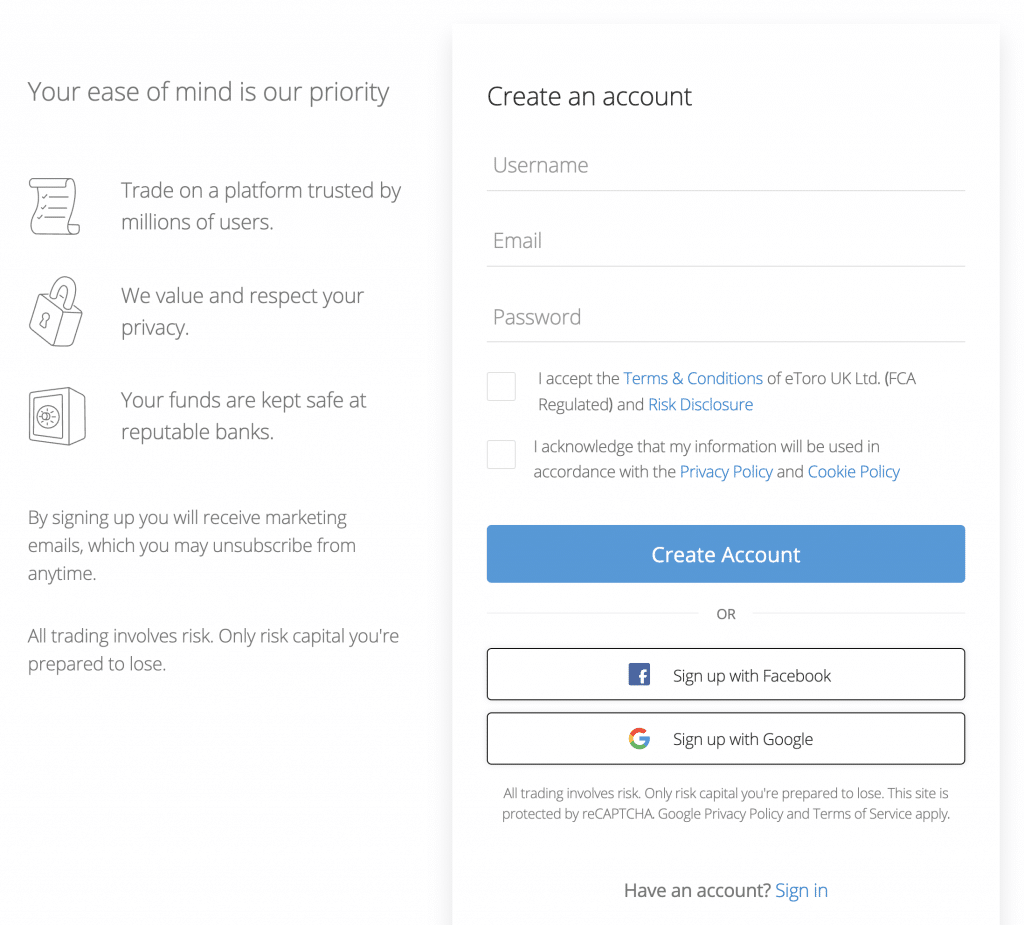

Head over to the eToro website and click on ‘Join Now’ to set up a new trading account. Enter your details and create a username and password for your brokerage account.

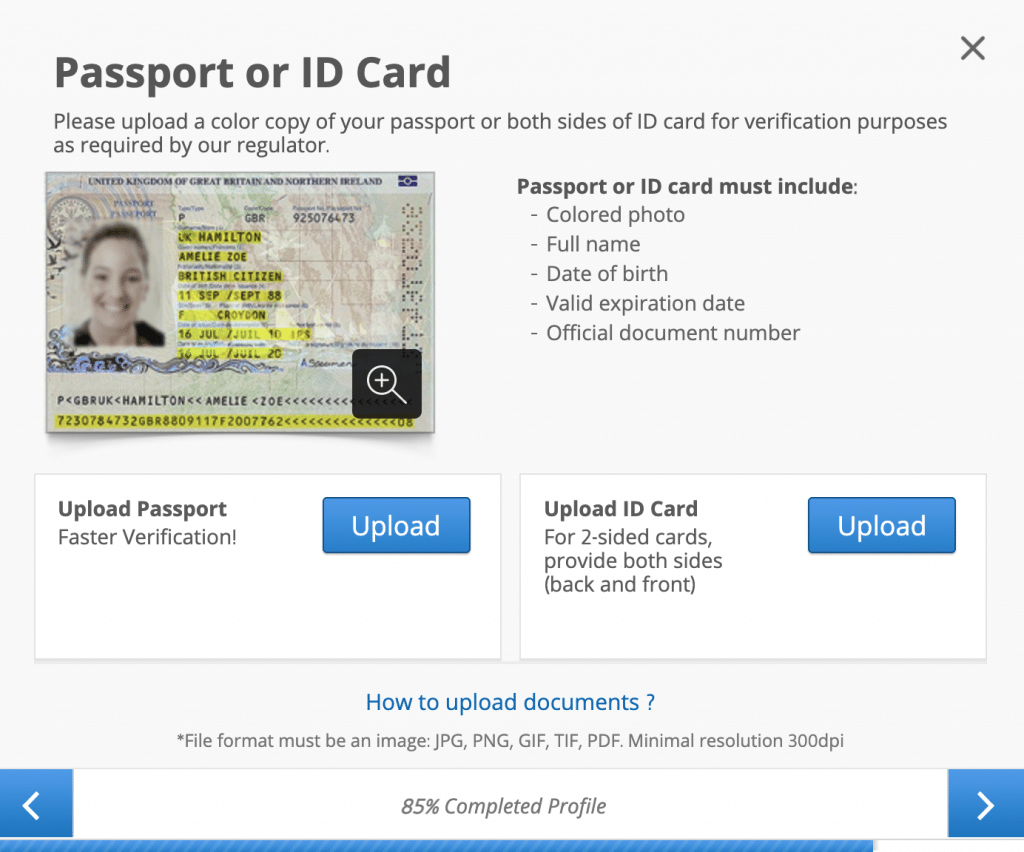

As part of the KYC process, you’ll need to verify your account by providing proof of identity and address. You can do this by uploading a copy of your driving license and a recent bank statement.

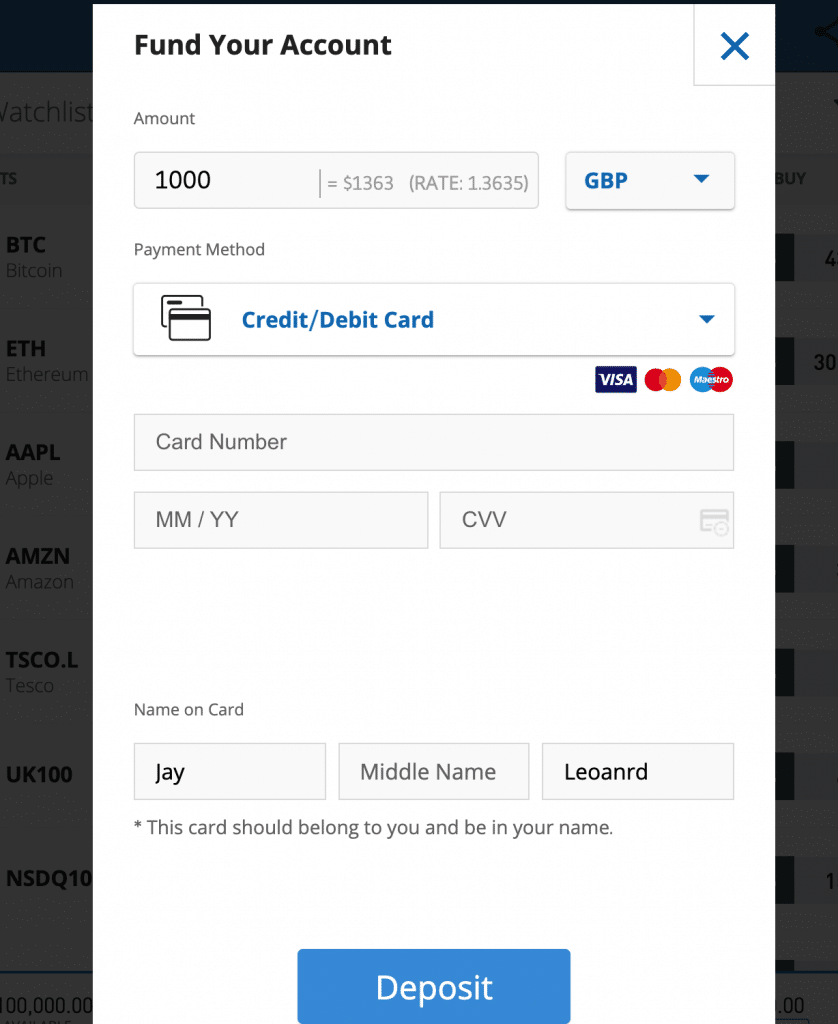

It’s simple and quick to fund your account. By tapping on the ‘Deposit Funds’ button you can fund your account using a variety of payment methods, including debit/credit cards, bank transfers, and e-wallets.

There are also no deposit fees to pay, and the minimum deposit amount is only $50.

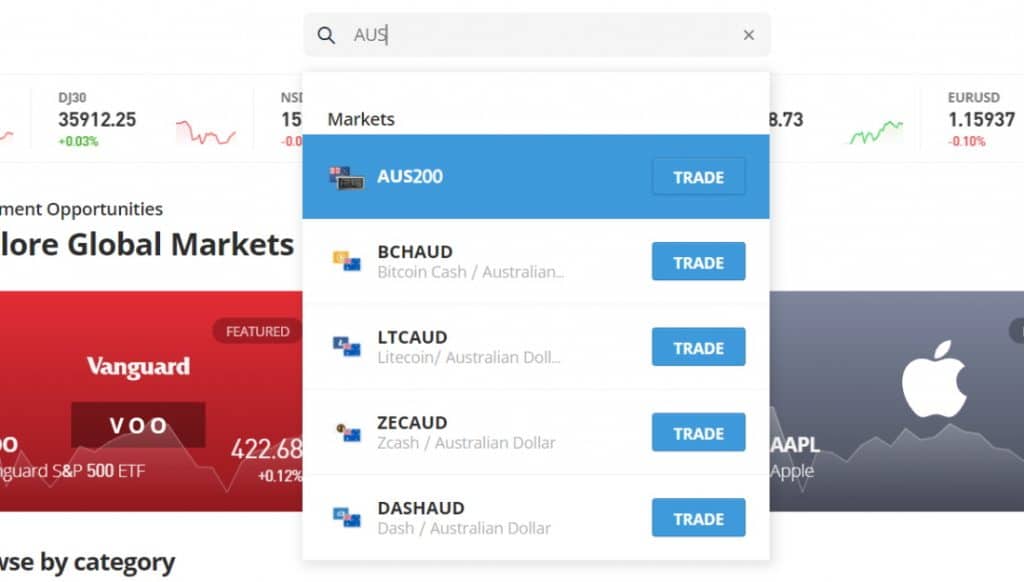

You can invest in ASX by searching for AUS200 in the search bar. Alternatively, you can browse through the different stocks and ETFs by clicking on the ‘Discover’ tab in the navigation bar.

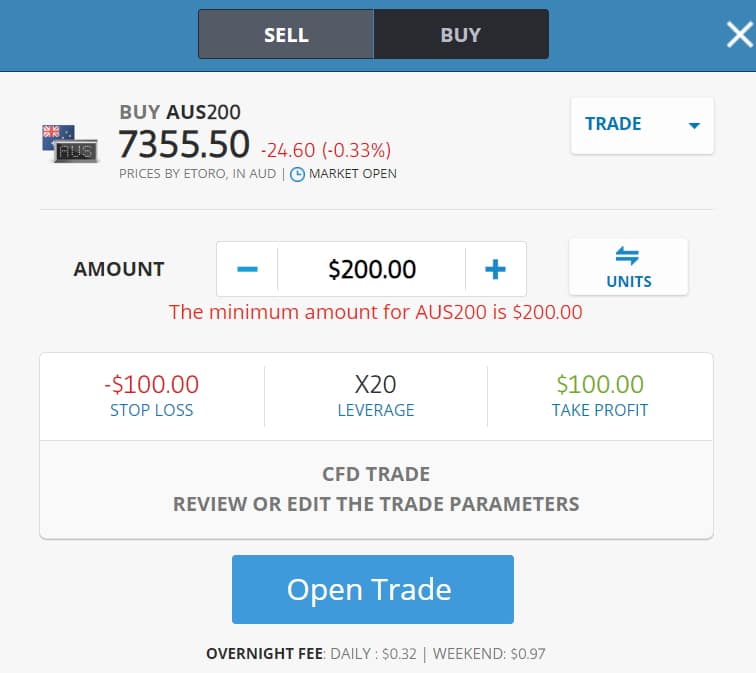

Once you’ve found your preferred asset, click on ‘Trade’. From there you’ll be able to specify the investment amount, alongside leverage, and stop-loss or take-profit orders. It’s important to keep in mind that the minimum investment amount for the AUS200 CFD is $200 if you use leverage above 5:1.

When you’re happy with your choices click on ‘Open Trade’.

Recent economic events and market news can all impact the ASX 200’s market value. If you want to gain exposure to the ASX 200 benchmark stock index for the Australian stock market then we recommend the social trading platform eToro.

The ASX 200 consists of 200 large-cap Australian stocks covering several industries such as finance, healthcare, energy, and manufacturing.

68% of retail investor accounts lose money when trading CFDs with this provider.