Active vs Passive Investing Australia – Beginner’s Guide 2021

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Active investing as well as passive investing are common portfolio strategies that involve the process of buying or selling risk-optimized and diverse assets either in quick successions where the investments are continuously monitored for their activity with the goal of exploiting profitable conditions or through long-duration investment horizons, which involves minimal trading in the market.

Some common examples of passive investments include index funds, dividend stocks, and real estate investment trusts, while an example of active investments includes stocks, bonds, and mutual funds.

This brokerage review was created for investors who might be interested in pursuing active or passive investing strategies. Below, you will find well-researched information regarding the differences between active and passive investing and some brokerage solutions that will help you get started with either trading strategy, alongside their various pros, cons, and fee structures.

Table of Contents

Having the right brokerage is a critical aspect when it comes to both active, as well as passive investing. This is why we would recommend eToro, which was established all the way back in 2007 and has served millions of clients since its time on the market. You can get started with eToro within just a few minutes; all you have to do is follow these steps.

No matter what kind of plan you have when it comes to buying assets, you can accomplish any strategy through specific offerings brought to you by brokerages. Passive trading will give you the benefit of not generating too many trading fees, while active trading will let you reap the benefits of daily price movements of specific assets. Additionally, many brokerages will provide you with access to short-selling orders, alongside other various trading strategies, which might be a good reason to consider them for this type of trading activity.

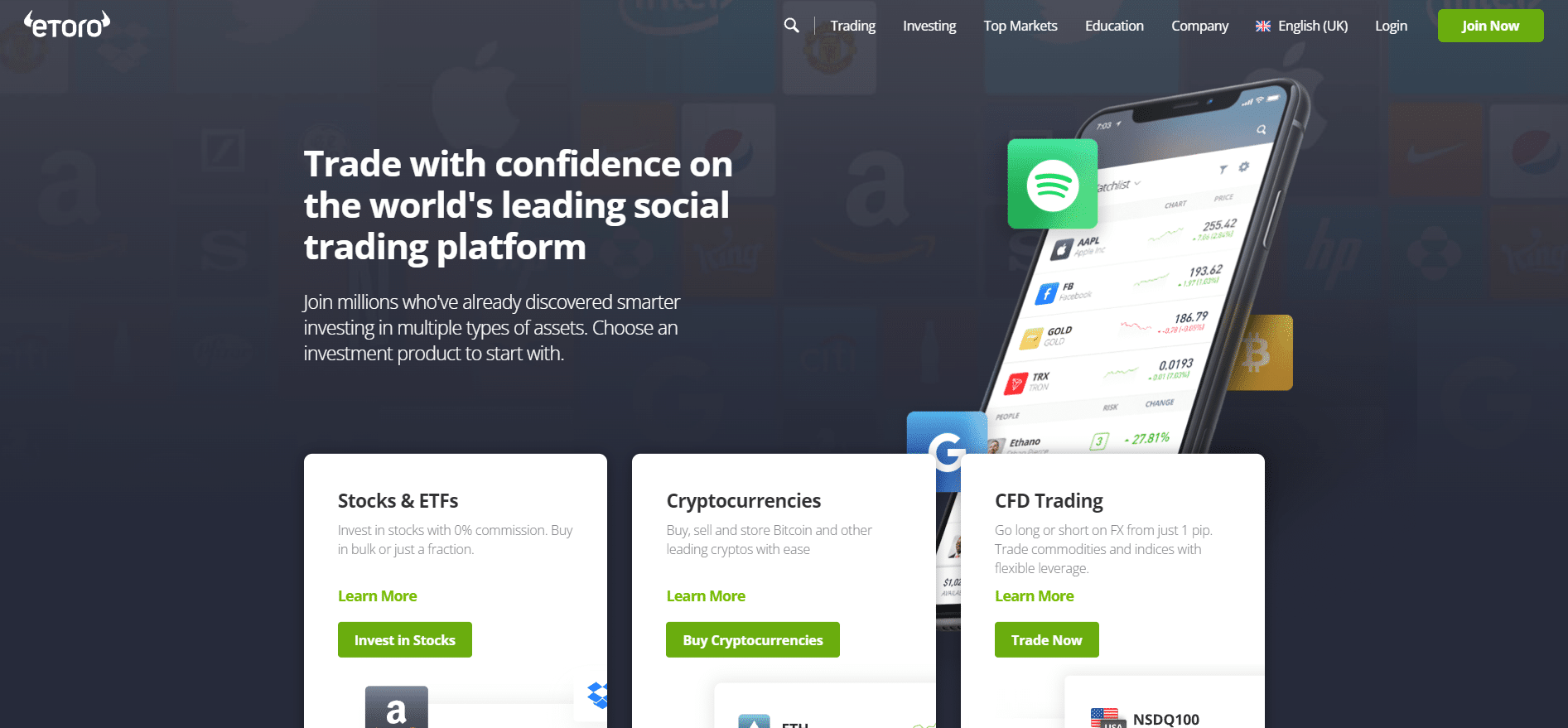

eToro is by far one of the best and leading social trading platforms that will allow you to invest in forex, commodities, cryptocurrencies, indices, and even stocks. It is an easy-to-use and straightforward option that will provide you with an excellent experience on both the desktop client as well as the mobile application. You can explore as well as analyze various CFDs through this platform, and you can buy and sell underlying assets efficiently.

You can build your passive or even active investing portfolio and enjoy benefits that you will not find elsewhere, such as near-immediate execution of market orders, which can come in handy for active investing, as well as no deposit fees. eToro even offers easy investments in stocks, ETFs, CFDs, and forex pairs, and the popular investor program will identify the best traders who can share their skills and knowledge and allow you to copy their trading.

eToro is safe in terms of both privacy as well as security, as it is a well-regulated platform. It was founded in 2007 and has stood the test of time, as it is now licensed in many jurisdictions. Additionally, eToro has also collaborated with FinTech Acquisition Corp to become a publicly renowned trading company.

That said, the company will be enlisted in the NASDAQ stock exchange, which brings a higher level of transparency and regulation. Furthermore, eToro ensures that their clients’ funds are kept secured in tier 1 banks, and all of the personal information is secured through SSL encryption, which ensures the privacy of the users. This way, your privacy, and safety can be guaranteed under their strict security as well as privacy measures.

When it comes to opening an account on eToro, the process itself is free. eToro does not charge you any ticketing or management fees as well. That said, investments in stocks and trading can also be considered commission-free on the platform. eToro makes its revenue from the bid/ask spreads of the assets.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | $0 |

| Withdrawal Fee | $5 |

| Inactivity Fee | $15 (Monthly) |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

SpreadEx is a British company that offers financial spread betting. The company also has a reputation for sports fixed-odds betting and sports spread betting. If you want to get started with either active investing or passive investing, SpreadEx could be an excellent platform for this kind of purpose due to the fact that they offer CFDs.

SpreadEx has a reputation for being a stable brokerage and company. It is authorized and regulated by the FCA (Financial Conduct Authority) and has safeguards in place in accordance with the FCA client money rules.

It is also a member of FSCS (Financial Services Compensation Scheme), which is exceptional. This makes it a trustworthy and solid exchange.

SpreadEx deals with commodities, stocks, cryptocurrencies, ETFs, Bonds, CFDs, forex, and more. Funding your account can be achieved through the usage of credit cards or debit cards, wire transfers, or even cheques. The platform is user-friendly, and the company offers sports betting products.

| Fee Type | Fee Amount |

| Commission Fee | $0 |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $0 |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

easyMarkets is an excellent multi-assets trading platform that has hundreds of assets on offer. It has a reputation for using the latest technology as well as innovative tools. By paying a premium for a feature known as undo, which can help you undo a losing trade within 1,3 or 6 hours, you can undo a trade if a market moves against a direction you had in mind. It offers a unique tool through which you can freeze the price that you see and have the advantage of carrying out your trade.

easyMarkets is also regulated by Australian securities as well as ASIC, which is an investments commission regulatory body. Cyprus Securities and CySec even regulate it, and the trading platform is an average-risk trading platform that has gained a lot of trust from its traders throughout its time on the market. Keep in mind that it does not trade publicly. However, it is authorized by a tier-1 regulator.

easyMarkets spread starts at $0.04, and it is free and has no account fees to use, no deposit fees, and no withdrawal fees. The platform has a well-developed trading software with support for both desktops as well as mobile devices.

Alongside all of this, it offers excellent learning resources, trading software, a solid mobile application, and excellent charting tools.

| Fee Type | Fee Amount |

| Commission Fee | 0% (for spread only account type) |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 (applies to only certain methods) |

| Inactivity Fee | $15 per month (after 12 months of inactivity) |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Active investing is when you consistently buy and sell as an investor. Active investors will typically purchase investments and continue to constantly monitor them on a daily basis with the goal of exploiting profitable conditions as a result of their efforts.

The decisions are made through the usage of fundamental analysis, while quantitative methods are used as well. The goal here is to draw on input from analytics, each of which specializes in different sectors.

The goal here is to buy and sell investments with the goal of beating the market. A stock market index, for example, could be a benchmark that can be used to compare how well your stocks are doing.

Unlike passive investing, you will be highly involved in active investing. Active investors need to look at the price movements of their stocks multiple times a day, with the goal of getting short-term profits.

Passive investing refers to a buy-and-hold portfolio strategy for long-term investment, with minimal trading in the market. That said, index investing is one of the most common forms of passive investing. Passive investments are a lot less complex when compared to active investments and offer superior results over medium to long time-frames than active trading. Through passive investments, you can invest in stocks, CFDs, and ETFs.

To get a clearer perspective about active and passive investments and see if they are good investments, you will need to go over the benefits of each option and understand the risks. Generally, both options have the potential to provide you with solid returns.

One of the main benefits that you get by actively investing is that you get to adjust your portfolio to align with the market conditions as they take shape, which is excellent for risk management. Additionally, you also get access to short-term opportunities, as you can implement swing trading strategies to trade market ranges or take advantage of the momentum at the time.

Actively investing will also allow you to meet specific needs and achieve a high level of diversification, retirement income, or a targeted investment sum.

When we take a look at passive investments, one of the most prevalent benefits is that there are low fees. This is due to the fact that nobody is picking stocks, so oversight is a lot less expensive. There’s also a high level of transparency due to the fact that it is always clear which assets are in index funds. The buy and hold strategy does not result in a massive capital gains tax throughout the year as well. And best of all, owning an index or group of indices is a far less complex investment method than a dynamic and active strategy that will acquire a lot more research to achieve.

You need to be aware of the risks involved with each method of investment as well, so you can make an educated decision on which option will work best for you.

One of the main risks with active investments is the costs and potential losses. The main way through which active investing can be costly is due to the fact that you will be making consistent transactions regularly, and commissions can impact the overall investment return as a result. Investors who invest with an active strategy will also need to pay a lot more fees, and if you are using an investment manager or a hedge fund, these can start stacking up.

The risks of passive investments, on the other hand, are in the fact that they are limited to a specific index or a predetermined set of investments, with little to no variance. Additionally, passive funds might never end up beating the market, due to the fact that the holdings are locked in to track the market. A passive fund might beat the market by a small margin. However, it will never post big returns such as active traders would get.

In this section, we will look at the simple steps that are involved with starting your investments on a well-established platform such as eToro.

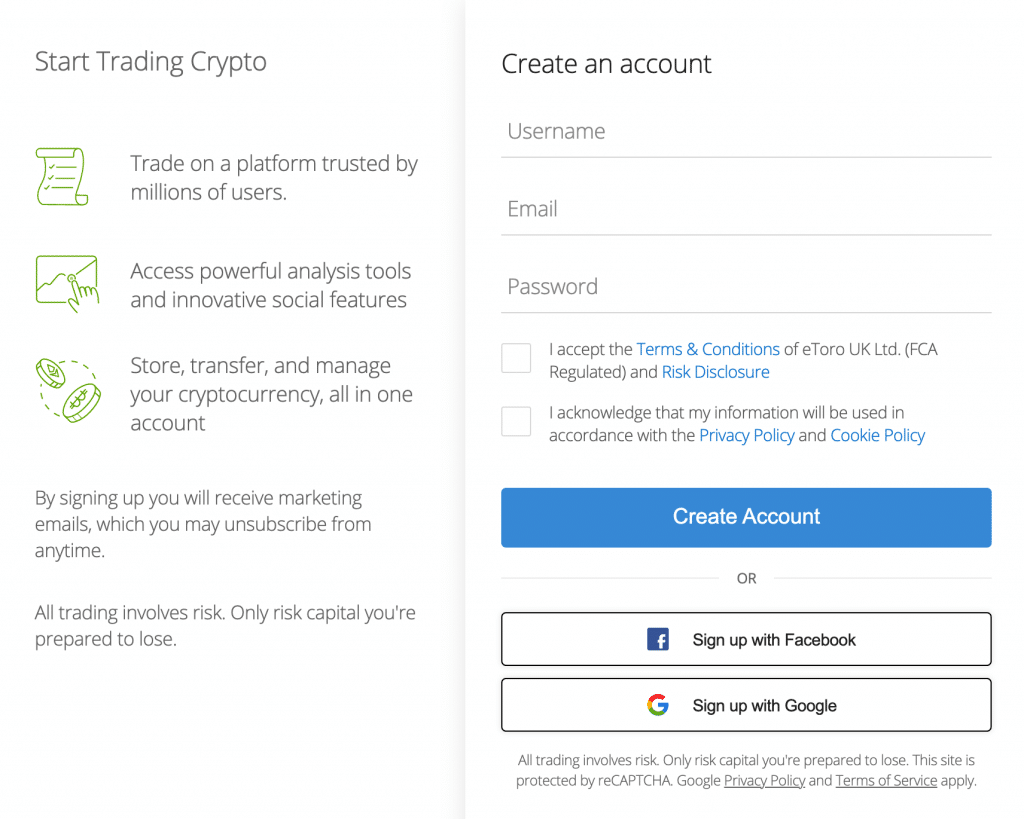

Opening a brokerage account might seem like a much more difficult task than it will actually end up being for you. This is because eToro offers free account registration, and you can have a brokerage account on the platform within minutes. All you need to do is type “eToro.com” in your browser, press on “Join Now,” and fill in the required information.

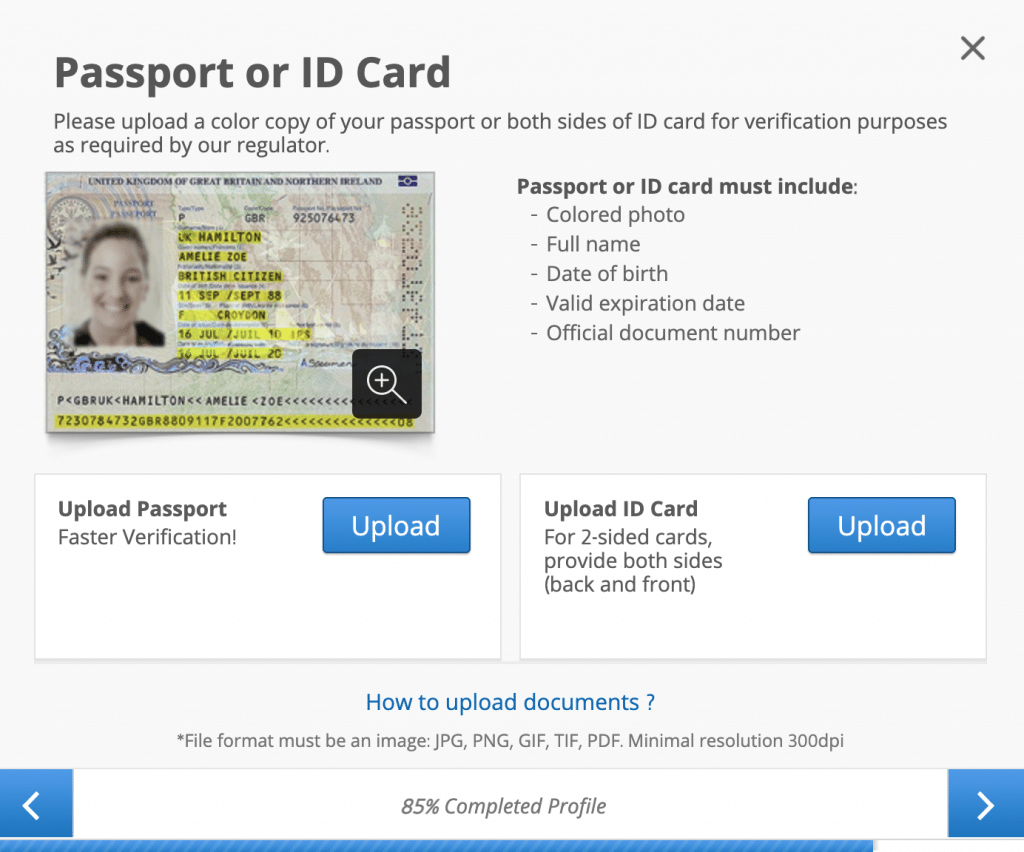

Once you sign up, you will have a brokerage account, but the process isn’t completed yet. You will need to get the account verified so that you can use it for trading purposes. Account verification requires a few personal documents and takes about 15 minutes to complete at the most if you have everything ready. You will need to provide a photo ID proof of address, and if everything goes according to plan, you should be verified quickly.

After your account has been verified, you will be a step closer to buying as well as selling financial assets on the brokerage platform. All you will really have to do after that point is to top-up your brokerage account with funds. To do this, you can deposit funds without any fees by using different payment methods on eToro. All you have to do is click on “Deposit Funds” and enter the amount you want to deposit for trading or investing. Then, simply press “Deposit,” and your funds will be transferred. eToro will provide you with the opportunity to deposit using credit or debit cards, e-wallets, PayPal, Skrill, and so on, and the bank

Once your eToro account is fully funded, you will be allowed to start trading on the platform. If your main focus is on passive investing, you could take advantage of risk-optimized and diversified assets such as ETFs; however, if your focus is on active investing, you can invest in other options available for you on eToro. To buy just about anything you have decided to, you will need to search for the specific option in the search bar. So, for example, if you want to buy a CFD, just type in the name of an index or a stock into the search bar and press on “Trade,” where you can proceed with the amount that you would like to invest. By clicking on “Buy.” Ensure that the investing strategy you have selected works best for you, and good luck with either active or passive investing.

Whether you decide to participate in active or passive investing, the methods discussed here for Australian traders have hopefully given you a heightened perspective as to what you need to look out for. While these are both powerful investing strategies in their own way, having a reliable platform that can be used to execute them is also essential.

eToro, SpreadEx, and easyMarket all have a solid reputation and are useful for carrying out both active and passive strategies in Australia.

You should always consider a regulated broker and ensure that they have a high level of security. We recommend eToro due to the fact that it is well trusted and fully regulated and used by millions on a daily basis.