Best Forex Broker UAE/Dubai – Top 5 Forex Trading Platforms Reviewed 2021

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

If you live in Dubai or anywhere else in UAE, you perhaps know that there is a huge variety of forex brokers nowadays. But, which one is the best one for you? In this article, we’ve done our due diligence to select the best forex trading platforms in UAE and Dubai and introduce you to the world of forex trading. The next sections break down several important concepts and help you choose the best forex trading platform for your needs.

Table of Contents

Without further ado, here are our top five picks for the best forex brokers in UAE. We have selected them according to cost, features, and ease of use:

67% of retail investor accounts lose money when trading CFDs with this provider.

In this section, we will dive deep into details and present you all the main aspects regarding each forex broker, why you may want to consider it for your forex trading needs, and how to benefit from its offerings.

eToro was established in 2007 in Tel Aviv, Israel. Since then, it has grown into one of the most popular brokers on a global level, providing a broad range of assets. As of this writing, eToro has 49 currency pairs available for trade, such as EURUSD, GBPUSD, but also minor pairs like NZDCAD and GBPAUD.

To start trading on eToro, you need at least US$50 – this is both the minimum deposit and the minimum amount required to trade forex. Buying and selling currencies on this trading platform is done via CFDs – which means that you don’t own the actual assets, but rather you use agreements based on the underlying asset (contracts-for-difference). These are a type of derivative that allows you to speculate on the price movement of different currencies and you can use up to 20x leverage.

eToro is popular due to its low-cost structure, too. There is no trading commission charged. However, in the case of trading forex, you should keep in mind that you need to cover the spread – this is a fee built into the price you will see on the trading platform and is as low as 1 pip (0.0001 units of a currency) for most popular currencies, and up to 20-50 pips for less popular pairs, such as USDTRY.

Also, eToro boasts social trading features. This means you can copy successful traders’ portfolios, invest in ready-made portfolios, and keep in touch with other users on the platform, similar to any other social media platform.

| Forex Pair | Spread Amount |

| EURUSD | 1 Pip |

| USDJPY | 1 Pip |

| GBPUSD | 2 Pips |

| USDCHF | 1.5 Pips |

| NZDUSD | 2.5 Pips |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

If you want a forex broker that provides access to the world’s most famous forex trading platform, AvaTrade is perhaps the best choice. It is a trusted forex broker with a one-size-fits-all approach to forex trading. It has one of the most competitive trading platform offerings: apart from MetaTrader 4, you can also sign up with ZuluTrade and DupliTrade (for social copy trading), the proprietary platform known as AvaTrade WebTrader, the proprietary options platform known as AvaOptions, and the mobile trading platform AvaTradeGO.

The price is also highly competitive within the industry. For instance, the EURUSD pair comes with a spread of only 0.9 pip. However, some of the less popular pairs like EUR/ZAR or EURRUB come with quite high spreads of 90 or even 700 pips.

AvaTrade does not score very high on educational content, but the wide array of trading platforms does help to choose the best one according to your skills and knowledge.

The proprietary platform, AvaTrade web platform, comes with “Trading Central”, a section that features analyst views, market buzz, and an economic calendar. Depending on your chosen trading platform provided by AvaTrade, you have access to more or less trading tools and analysis features.

| Forex Pair | Spread Amount |

| EURUSD | 0.9 Pips |

| USDJPY | 1.1 Pips |

| GBPUSD | 1.6 Pips |

| USDCHF | 1.6 Pips |

| NZDUSD | 1.8 Pips |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

IG Markets is a trusted global forex broker with about 20,000 CFDs and approximately 100 forex pairs, making for one of the broadest offerings on the market. Although there is no minimum deposit required for a bank transfer, other payment methods like cards require you to deposit at least US$300, which is significantly higher than the other brokers.

IG comes with a user-friendly proprietary trading platform. It boasts many practical features, endless trading tools, including many features for risk management. However, perhaps the main drawback and advantage at the same time is that the default view is empty in the beginning. On the good side, you can choose how to populate it with your favorite tools and features. On the bad side, you need to spend some time designing your layout. Also, you can save multiple layouts once you create them.

The charting features are also quite advanced. You can choose from nearly a dozen indicators, 30 advanced features, and tools, and you can opt for one of the six chart types. This makes IG Markets the best choice if you are seeking a personalized experience. Traders with a well-defined strategy will find that standard-looking platforms may be less useful if you cannot customize them.

| Forex Pair | Average Spread Amount |

| EURUSD | 1.13 Pips |

| USDJPY | 1.26 Pips |

| GBPUSD | 2.38 Pips |

| USDCHF | 2.29 Pips |

| NZDUSD | 2.7 Pips |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

For a full forex trading experience, FP Markets clearly stands out from the crowd. It has approximately 130 tradable symbols and a broad choice of CFDs. There are approximately 60 forex pairs to choose from and you can use both the MetaTrader suite and its proprietary Iress platform. However, if you plan to focus on forex, it’s best to use MetaTrader since the Iress platform is geared towards share trading.

It is considered one of the best brokers on MetaTrader 4 despite its fewer tradeable symbols compared to others. One of the main reasons is the range of 12 add-ons you can choose from. Known as the “Trader Toolbox”, this will improve your experience and help you chase returns.

There are more than 50 indicators and chart types available, but traders who use advanced order types like trailing stop may find it a bit lacking. Yet, you can easily find lots of research in the “Traders Hub” on FP Market’s website. Here, you can opt for one of the two analyses available: fundamental or technical.

One of the best aspects when it comes to FP Markets if you choose to trade forex via MT4 or MT5 is the fact that you can actually choose between two different account types, according to your trading objectives and strategy.

The standard account starts at 1 pip spreads for forex and requires a $100 or equivalent minimum deposit. The second type, the raw account, comes with the same minimum required balance, but spreads start at 0 pips. Instead, you will have to pay US$3 per lot. Thus, for small trades, you may want to choose the standard account, while the raw account is ideal if you place large orders. For both accounts, there is a minimum account size of 0.01 lot.

| Forex Pair | Average Spread Amount |

| EURUSD | 1.19 Pips |

| USDJPY | 1.46 Pips |

| GBPUSD | 1.59 Pips |

| USDCHF | 1.61 Pips |

| NZDUSD | 1.65 Pips |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Plus500 is a UK-regulated CFD broker that provides access to numerous financial markets. Available in about 50 countries, the functional platform boasts no commissions and competitive spreads. You can access the platform via your preferred device, including PCs, smartphones, and tablets.

You can create watchlists to keep track of your desired forex pairs, analyze different charts, and monitor your open positions. With more than 100 indicators available, technical traders may want to opt for this platform. These can be applied to numerous chart types, including tick ones.

Unlike MetaTrader 4, for instance, Plus500 does not support automated trading. Social trading features are not available either. Depending on the chosen market, you may be able to place guaranteed stops, but these have a higher spread. Also, you cannot add a guaranteed stop to an order to have already placed.

In terms of cost, Plus500 is not very transparent. Its spreads are variable, but you can see the spread when you open a new position. As of this writing, Plus500 advertises competitive spreads starting from 0.01% on major currency pairs and higher for other pairs, as illustrated below.

Looking for the best CFD brokers? Look no further! We’ve got all the info you need to make an informed decision. With our in-depth reviews, you can find the perfect broker for your needs. So what are you waiting for? Get started today!

| Forex Pair | Average Spread Amount |

| EURUSD | 0.01% |

| USDJPY | 0.01% |

| GBPUSD | 0.01% |

| USDCHF | 0.02% |

| NZDUSD | 0.03% |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

If you are looking to trade forex in Dubai or UAE, there are plenty of trading platforms within your reach. However, not all of them are suitable for different trading purposes. Below, you will find the most important aspects to consider when choosing your ideal broker.

Regulatory compliance is an important matter to be taken into consideration. Not all forex brokers are safe; if you prefer not to opt for one of our regulated brokers recommended above, you need to do your due diligence when choosing one.

For instance, eToro may not be locally regulated (i.e., in Dubai or UAE) and doesn’t have a local office, but it is regulated by numerous other authorities around the world, including the US, Australia, and the UK.

To find out if your chosen broker is regulated, you need to access their website and read the “About Us” section or the footnote – this should mention the license number and what regulatory authority it is registered with.

Many online brokers require a small amount to get started – typically US$50-US$200. One of the great things about forex trading is that you can use leverage to multiply your buying power.

Once you start trading, you will perhaps want to withdraw your profit. To do so, you need to make sure that the broker supports a payment method that’s convenient for you. Some of the most popular choices include credit cards, wire transfers, PayPal, and others.

Not all forex trading platforms in UAE have the same offering. Some of them may offer more or fewer forex pairs. When choosing the broker, try to find out if it provides the forex pairs you’d like to trade.

However, all of our recommended brokers have the main currency pairs you may want to trade, and they have between 40 and 100 options available. Keep in mind that exotic or minor pairs typically come with higher spreads (costs) and they can be more volatile and risky than major pairs (like those with USD).

Fees are extremely important when trading forex. Although we have exemplified some of the spreads for a few currency pairs above, there are a few more types of fees you should consider before signing up.

In general, brokers charge either commissions (fixed fees per transaction) or spreads, which is the cost built into the price you see on the platform. Apart from this, you should look for any other costs, including deposit or withdrawal fees, additional fees for placing stop orders, inactivity fees, and currency conversion fees (depending on the base currency of your chosen broker).

Also, keep in mind that swaps are fees for forex positions open for more than 24 hours. These are a type of interest rate, so they are forbidden under the Sharia law. Thus, you should avoid brokers that offer accounts that charge swaps and opt for an Islamic account instead.

Based on your chosen broker, you will be able to use leverage to multiply your trade size. For instance, if you deposit $1,000, you can choose 1:20 leverage, which means that you can place an order valued at $20,000. Leverage can greatly enhance your profit, but also your losses, so make sure you practice good risk management.

Once you decide which broker is best for you, you need to open an account. To help you with this process, we have detailed all the steps below, using our top recommended forex broker in UAE and Dubai – eToro.

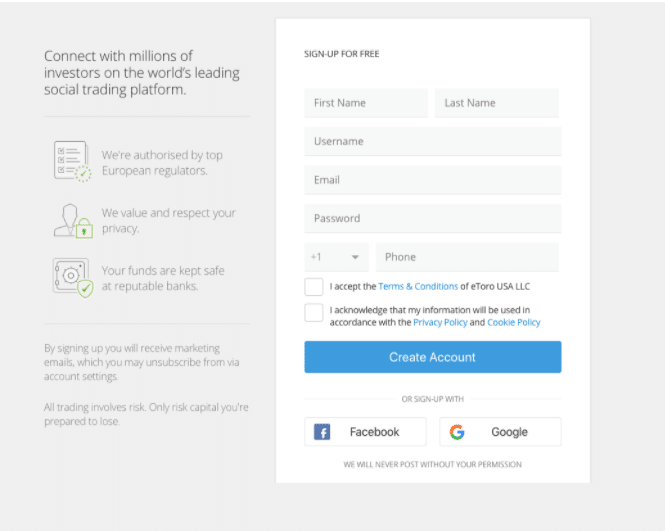

First, you need to access eToro and click on “Join Now”. Fill in the form using your full name, email address, and use a strong password to protect your account.

67% of retail investor accounts lose money when trading CFDs with this provider.

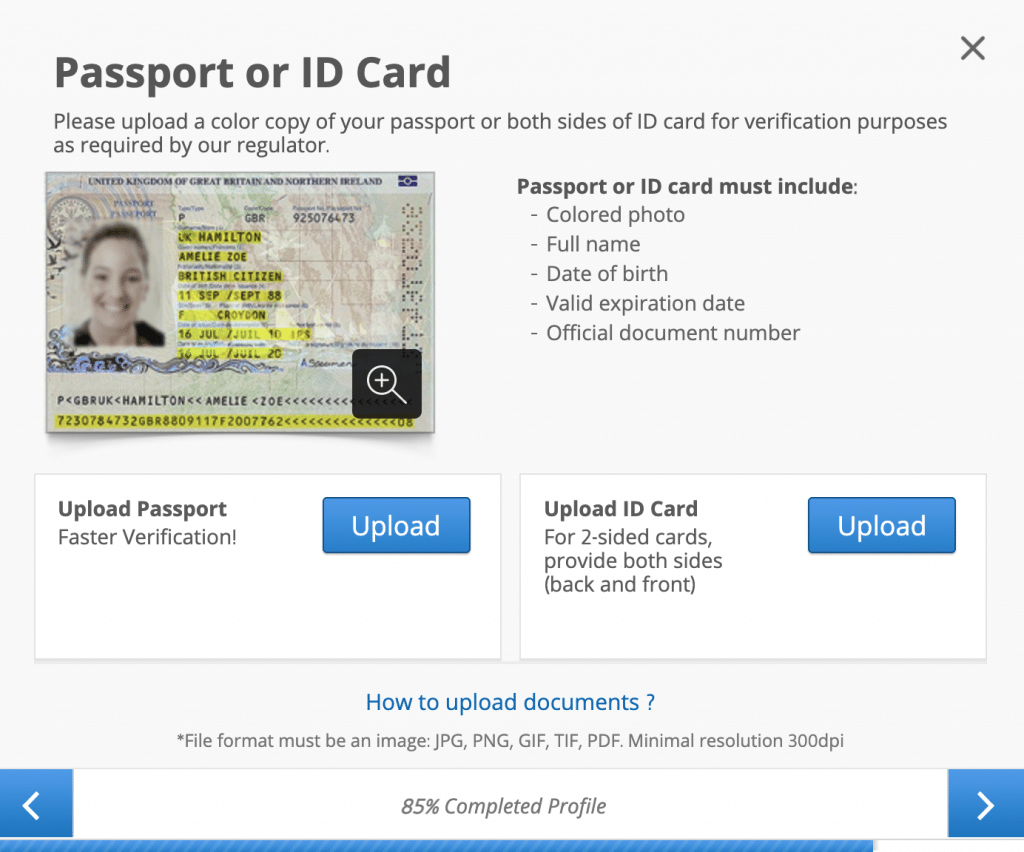

Next, you need to verify your identity to comply with current regulations. As eToro is a safe and regulated broker, uploading your government-issued ID and proof of address is compulsory. Follow the prompts to upload the documents; then, the broker will automatically check and validate your account.

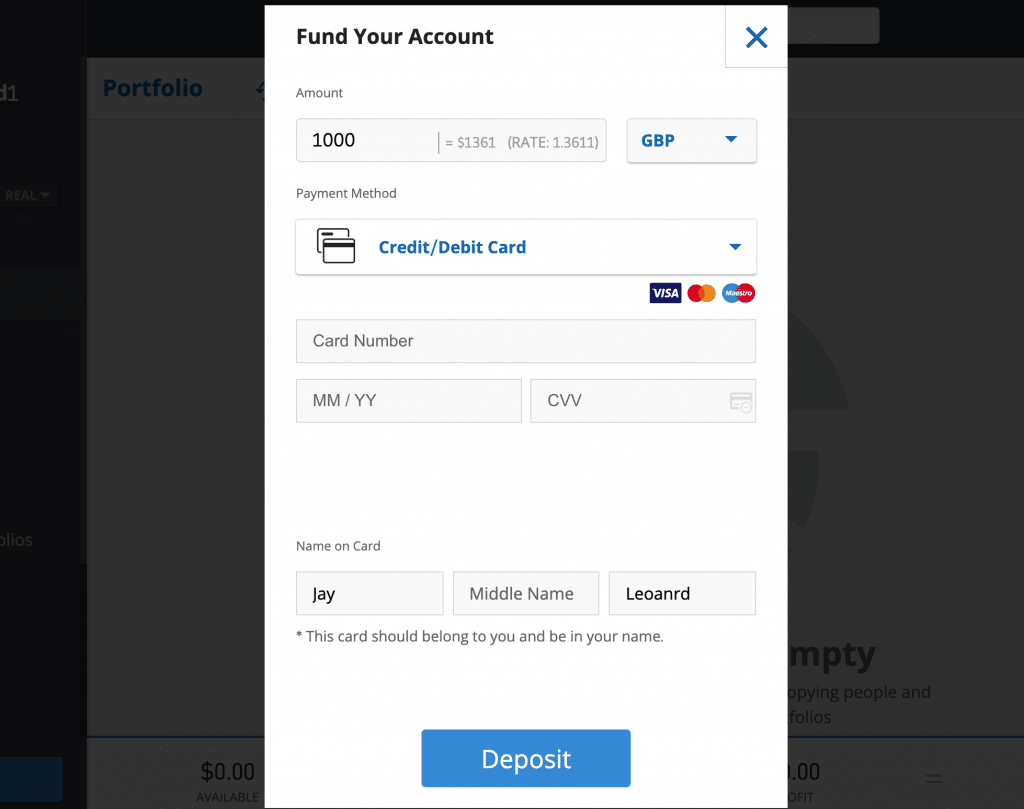

Now that you opened your eToro account, you can deposit your capital via one of the many supported payment methods. For an Islamic account, you need to deposit at least US$1,000. Then, contact eToro’s customer service and make a request to change your account type to Islamic.

Once your account type is changed and you deposit your capital, you can start looking for forex pairs. eToro has a dedicated currency section under the “Discover” tab on the left side. Alternatively, you can type in the search bar the forex pair you want to trade.

Finally, all you need to do is click on “Trade”. Add in the amount of capital you want to use, whether you want to leverage your position, take-profit, and stop-loss levels. From here, you can also opt for short-selling the forex, too, by clicking on the “sell” button.

If you opt for a trustworthy broker that provides all the tools and guidance you need, your experience will be smoother and more enjoyable. You will also have more time to manage your portfolio, stay up to date with the latest economic news, and grow your wealth. Our top recommended forex broker in Dubai is eToro, one of the most popular trading platforms in the world that will provide you with everything you need to get started with your forex trading journey.

Looking for the best online trading platforms? Look no further! Our experts have compiled a list of the top platforms to help you make the most of your investments. Whether you’re a beginner or a pro, we’ve got the perfect platform for you. So what are you waiting for? Start browsing and find the right one for you today!