Best Forex Broker Malaysia – Top Forex Brokers in Malaysia Reviewed

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

The foreign exchange market, or the forex market, allows you to trade ringgit for other currencies, such as US dollars, or to trade completely different pairs, like USD and GBP. Because you need two different currencies to conduct transactions in the forex market, they are known as currency “pairs”. Just like in any other market, the value of currency pairs is affected by a broad variety of factors that drive demand and supply. For instance, if there is a high demand for GBP following some favorable announcement released by the Bank of England, then the GBP value increases against, for instance, the dollar.

With trillions of dollars exchanged in this market, forex trading or investing can be extremely lucrative. Since there are many buyers and sellers, it’s a liquid market, so you can start trading even if you have low capital, and regardless of the time zone – you can trade forex in Malaysia 24 hours per day, Monday to Friday. In the next sections, you will find everything you need to know before joining the millions of forex traders that are currently taking advantage of the affordability and comfort provided by the best forex brokers in Malaysia.

Table of Contents

To help you get started on the right path, we have done our due diligence and selected the top five best Malaysian forex trading platforms. These are summarized below, but the next sections explore each of them in more detail, so you can understand how safe they are for Malaysian investors.

67% of retail investor accounts lose money when trading CFDs with this provider.

In the next sections, we will provide an in-depth review of each of our top forex brokers in Malaysia this year. We will introduce you to their main advantage and benefits, and let you know more about the disadvantages and what costs you should keep an eye on.

With more than 20 million users from all corners of the world, eToro is perhaps the most popular broker right now. It was founded in Israel in 2006 and, since then, it has proven a robust commitment to regulation and safety. As of this writing, eToro is regulated by the ASIC in Australia, the FCA in the United Kingdom, and the CySEC (Cyprus).

The platform provides plenty of trading opportunities. Apart from forex, you can also buy stocks, ETFs, cryptocurrencies, and other assets from the same user-friendly platform. Even more important, you can trade stocks and ETFs without any commissions. In other words, if you decide to hedge your forex positions, you can safely add stocks and other less volatile assets to your portfolio, and you don’t need to cover any extra fees for this.

Also, you can start trading even as a beginner as you can easily copy other traders who are interested in the same market as you are. You may review different master traders and decide which ones align with your interests based on their risk profile, assets, and activity, then choose to copy their positions – and eToro will open and close your positions as soon as the master trader adjusts their own, so you enjoy the same risk and return profile as an advanced forex trader without any research or effort required.

For Malaysian investors, it is worthwhile to mention that eToro is not locally regulated – in other words, it is not officially registered with the Suruhanjaya Sekuriti Malaysia (Securities Commission in Malaysia). However, it’s important to highlight the fact that eToro is not only regulated by the European Union institution and the United Kingdom commission, but also the Australian one, which means that the broker complies with very strict regulations. Under these institutions, eToro provides two main layers of protection for you and your capital:

For forex traders, eToro’s platform allows you to choose from about 50 currency pairs, including major ones like EURUSD, GBPUSD, AUDUSD, and many others. Unfortunately, eToro does not offer any MYR pairs, but its currency offering is continuously expanding.

Also, for beginners and even more experienced traders, major currencies like EURUSD prove more lucrative because of lower spreads (fees which tend to increase if the pair is minor or exotic) and less volatility compared to lesser used pairs. The spread is perhaps the most important fee forex traders must consider – it is a cost built into the price for buying or selling the currency you choose, and it can be higher or lower based on your chosen broker. For eToro, we have included a few examples below:

eToro Fees

| Forex Pair | Spread Amount |

| EURUSD | 1 Pip |

| USDJPY | 1 Pip |

| GBPUSD | 2 Pips |

| USDCHF | 1.5 Pips |

| NZDUSD | 2.5 Pips |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

AvaTrade is a reputable CFD broker that allows you to trade numerous forex pairs, commodities, cryptocurrencies, bonds, stocks, and ETFs, among others. It is highly appreciated for its mobile phone app, AvaTradeGo. If you plan to monitor your portfolio on the go, or you simply prefer a handheld device instead of a personal computer, its mobile phone app will help you achieve your objectives.

For advanced forex traders, the choice of forex trading platforms in Malaysia must be a top priority. Fortunately, AvaTrade is an extremely flexible broker, providing you with a broad range of choices: MetaTrader 4, which is one of the most popular forex trading platforms in the world, a proprietary platform, AvaOptions (to trade options), and MetaTrader 5 (typically used for stocks rather than forex).

Next, AvaTrade has a decent educational section, which recommends it for beginners and experienced traders alike. Similar to eToro, the broker has a commission-free structure and both deposits and withdrawals are free of charge. The broker also has a robust risk management system (AvaProtect), the Trading Central, and Duplitrade, where you will find plenty of tools and features.

AvaTrade Fees

| Forex Pair | Spread Amount |

| EURUSD | 0.9 Pips |

| USDJPY | 1.1 Pips |

| GBPUSD | 1.6 Pips |

| USDCHF | 1.6 Pips |

| NZDUSD | 1.8 Pips |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

If you are planning to build a solid trading foundation, Capital.com comes with plenty of helpful tools. One of the main features that recommend it as the best forex broker in Malaysia for beginners is its demo account, available both on its proprietary platform and on MetaTrader 4. Thus, if you want to get some real trading experience before risking your cash on MT4, Capital.com is an excellent choice.

The broker provides a low-cost trading environment, with more than one hundred forex pairs, and plenty of other assets, including more than 200 cryptocurrencies. It doesn’t charge any commissions for deposits, withdrawals, and there are no hidden fees. Similar to eToro, Capital.com is registered with the FCA in the UK, the CySEC, and the ASIC in Australia.

Unfortunately, if you need to open an Islamic account that complies with Sharia law, Capital.com does not provide one. eToro and AvaTrade would be great alternatives, as both of them accommodate this type of account.

Capital.com Fees

| Forex Pair | Average Spread Amount |

| EURUSD | 0.6 Pips |

| USDJPY | 80 Pips |

| GBPUSD | 1.3 Pips |

| USDCHF | 0.9 Pips |

| NZDUSD | 1.6 Pips |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

FXTM is only available on MT4 or MT5, so seasoned forex traders may find it more suitable for their needs. Also, the minimum deposits are quite high, depending on your chosen account type:

Instant execution means that your order is executed instantly at the price you agreed to; in times of volatility, which often happens in the forex market, the price changes very quickly, which means that the broker will not conduct your order and, consequently, you will be asked for a requote. In the case of instant execution, the spreads are fixed and typically higher than the real market spreads. Alternatively, market execution means that the broker will carry out your operation even if the price changes.

FXTM provides both its website and support service in Malay. Also, for all of its operations conducted in Malaysia, the broker is regulated by the FSC (Mauritius).

Finally, below you can find some of the main fees charged by FXTM.

FXTM Fees

| Type of Fee | Amount |

| Spread | Relative depending on account type and pair |

| Commission | Flexible (US$0.4 to US$2) |

| Withdrawals | US$3 via credit cards |

| Inactivity Fee | US$5 per month (after six months of inactivity) |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Scalping is a trading style in which you buy and sell assets during the same trading day – sometimes in a matter of seconds. The broker has received numerous accolades so far from reputable institutions, including Deloitte, UK Forex Awards, and Investment Trends.

The platform is suitable for scalpers as it boasts an execution time of about 30 milliseconds (ms) once you place an order. This is also suitable for expert advisors (to make automated trades).

Pepperstone provides two types of accounts. Razor account starts from 0 pips spreads, but there is a commission of about US$7 per transaction – this type is recommended to scalpers and algorithmic traders, and is also available as an Islamic account. The standard account starts at 0.6 pips minimum spread, has no commission, but is not available as an Islamic account.

Pepperstone Fees

| Forex Pair | Average Spread Amount |

| EURUSD | 0.69 |

| USDJPY | 0.74 |

| GBPUSD | 0.88 |

| USDCHF | 0.92 |

| NZDUSD | 1.42 |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Now that you are familiar with the best forex trading platforms and brokers in Malaysia, you need to consider several aspects when deciding which one is the best for you. When we considered the choices above, we selected each broker according to several factors. Some of these are discussed below and are of crucial nature when choosing the best forex broker.

First, it’s important to know that the Securities Commissions Malaysia (SCM) is not very popular among international brokers. The most important regulatory authorities, the ASIC, the CySEC, and the FCA, have a long history of keeping track of brokers’ activity and protecting investors.

As a Malaysian citizen, it’s important to know which institution regulates your chosen broker to avoid fraud and scams. Thus, when signing up with a broker, make sure you check its website to find out what licenses it holds and what protection it offers. In most cases, you need to check that the broker has negative balance protection – so you will never stand to lose more than you have, and protection in case of bankruptcy. Our top recommended forex broker in Malaysia, eToro, provides not only these two measures, but additional ones, too, so you enjoy maximum peace of mind.

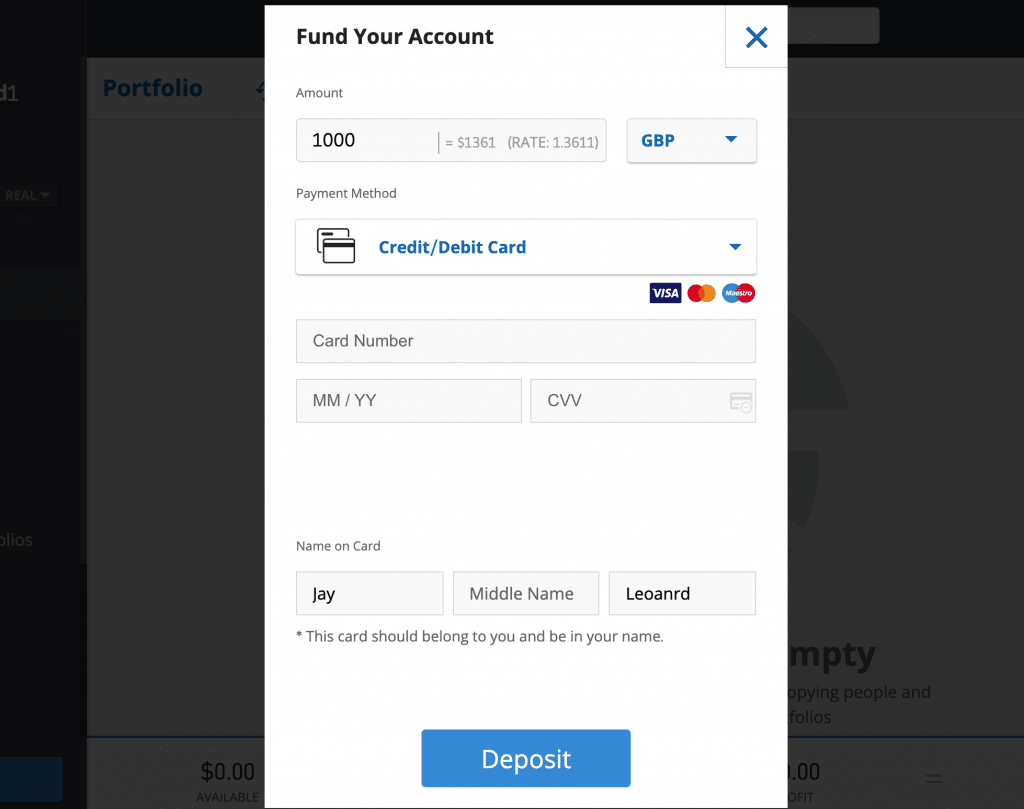

It is not a surprise that payment methods can be tricky when you reside in Malaysia. To ensure fast payment methods, you may want to opt for e-wallets or other methods apart from bank transfers, to make sure your payment won’t be canceled by the bank. For instance, eToro allows you to use popular e-wallets like PayPal and Neteller to deposit or withdraw your funds.

As we’ve seen above, not all brokers have the same forex pairs or provide the same variety. Yet, it is important to notice that not many investors go for very rare currency pairs because the spreads are very wide, and such pairs are extremely volatile, increasing your risk. In this case, you may want to make sure that your chosen broker has a decent variety of major, minor, and exotic pairs that suit your trading strategy.

The best forex broker for your needs should have low trading costs based on your approach. For instance, if you plan to open multiple transactions, a commission-free broker like eToro is recommended. The spreads on the forex pairs that interest you are also important. It’s worthwhile to notice that market or instant execution are also priced differently, so you may want to look into all the fees and charges in the broker’s terms and conditions documents before signing up.

Forex traders use leverage to multiply their transaction sizes. For instance, with $100 in cash in your trading account, you may be able to open a transaction worth $5,000 (1:50 leverage). The leverage you will have access to depends on your chosen broker, account type, and others. It can be extremely risky, so make sure you practice risk management techniques when using this tool to maximize your profit.

Now that you are equipped with everything you should know about trading forex in Malaysia, all you have to do is open an account. To make it easier for you, we have detailed each step using our top forex trading platform in Malaysia – eToro.

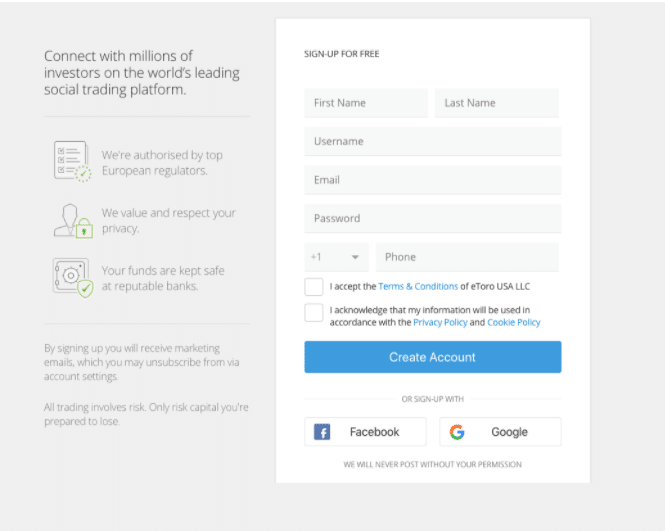

You need to click on the “Join Now” button and fill in the form to start the registration process. You will be required to create an account, so you must provide your personal details, as shown in the picture below.

67% of retail investor accounts lose money when trading CFDs with this provider.

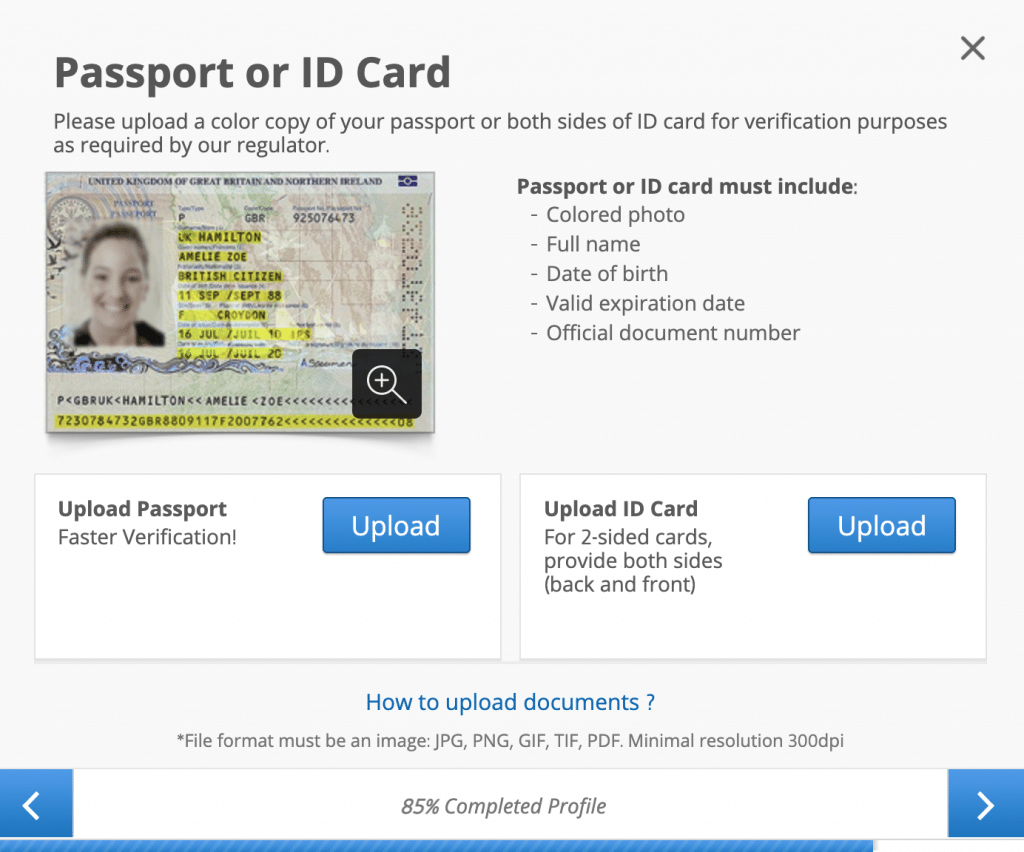

As we’ve discussed above, eToro is a regulated broker. This means that it needs to verify your identity via the KYC (Know Your Customer) process. This keeps the trading environment safe and compliant with current regulations.

The broker verifies your uploaded documents automatically. Then, you can access the trading platform and become familiar with it. Before depositing funds in your eToro account via one of the payment methods available, you can practice trading in your demo account.

Whether you use real money or virtual money, you enjoy the same functionality. To start finding the right forex pairs according to your strategy, simply look for the “Discover” button on the left side and select “currencies”. Here, you will see the complete list of currency pairs available, along with their buy and sell prices.

Finally, click on “trade” when you find the right currency pair using the appropriate analysis tools and techniques. In the new window, you can change the amount you want to trade, use leverage, and a few other tools, depending on the chosen asset.

Finally, choosing the best forex broker in Malaysia can be tricky due to the fact that not many of them are registered with the local regulatory institution. However, we have researched and selected the best international brokers that are regulated by multiple reputable institutions around the world, especially Australia, the United Kingdom, and the European Union.

Our top choice, eToro, is one of the best forex brokers in Malaysia, and it is highly recommended whether you are a beginner or advanced trader. You can register within a few minutes and gain access to one of the most popular trading platforms in the world with about 23 million registered users as of this writing.