NFTs Explained – What Is An NFT & How Do NFTs Work? Full Guide For Beginners in 2022

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

NFTs have been around since 2012, but like most things blockchain, they only gained mainstream popularity during the 2020 pandemic. Over the past couple of years, we’ve witnessed the boom in NFTs – you’ve definitely heard of Beeple’s “Everydays – The First 5000 Days” NFT, which auctioned for about $69 million. NFTs created new opportunities for artists, celebrities, and corporations to connect with their fan base. However, the uses of NFTs transcend digital arts. They also have consequential real-life applications.

Table of Contents

NFTs are crypto tokens that represent ownership of unique items. With NFTs, we can tokenize anything, from real estate, pieces of art to collectibles, ensuring that ownership belongs to one individual at a time. The abbreviation NTF stands for Non-Fungible Token. This means that no NFT is similar to another. Here, non-fungibility means that an NFT is a unique digital asset that can’t be exchanged in the ratio of 1:1 for another.

Theoretically, any asset can be digitized and become an NFT – drawings, digital files, art, video clips, or even physical objects. The NFTs must contain information that proves their uniqueness so that the respective owner can always be traced back and assert their claim. Thanks to their unique and irreplaceable nature, they are considered digital proof of ownership of assets. Through blockchain technology, the ownership of these tokens can be verified and transferred. Examples include digital works of art, computer game objects, digital tickets, or domain names. However, it can also be digital proof of ownership of physical objects such as paintings or other individual pieces.

NFTs are unique tokenized versions of other assets. These can be digital assets such as images, music, videos, and GIFs. They can also be real-world items like title deeds, legal documents, tickets for events, etc.

The primary objective of the NFT is to effectively assign a claim of ownership, which can easily be tracked on the blockchain. And since NFTs are created using blockchain technology, they possess properties of the blockchain -transparency, and immutability. Minting any NFT goes through the same process as transacting with cryptocurrencies – a new block is created, the information is validated, and then recorded into the blockchain. Every NFT created has a unique identifier giving them the non-fungibility property; even when the creator creates multiple replicas, they will each be unique, akin to bar codes on different products of the same brand.

When an NFT is transferred from one person to another, the ownership is managed using metadata and unique ID, which cannot be replicated. That is why only a single person can own the NFT at a time.

For us to understand NFTs well, we must first understand the concept of fungibility.

When an asset is fungible, it means that it is mutually interchangeable with another identical asset. Here’s an illustration of fungibility. Take currencies, for example, fiat or crypto; they are fungible. If you have a $100 note, you can exchange it with another $100 note or an e-payment of $100. Similarly, you can exchange $100 for an equal amount of other fiat or cryptocurrencies. In either scenario, you do not lose any value. More so, you can break down the $100 into smaller denominations and still retain its value. This is the primary idea behind fungibility.

As we mentioned, you can create NFTs of virtually anything. NFTs are becoming a serious trend with increasing acceptance and popularity. It almost seems as if there are no limits to possible application scenarios and assets that find their way into the digital universe and thus often become a lucrative investment. These are the top sectors where NFTs thrive:

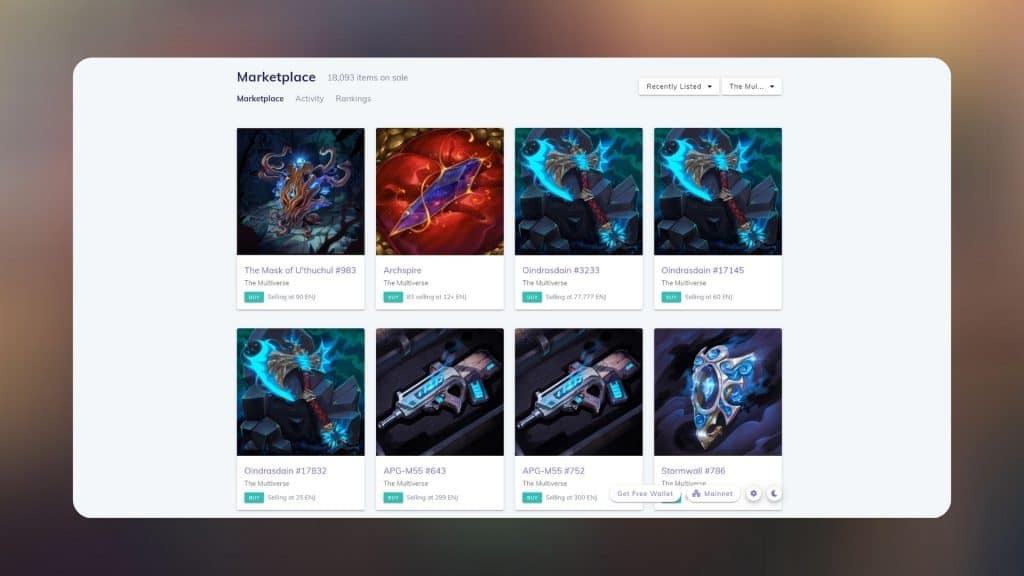

The gaming industry was one of the earliest industries to recognize the potential of NFTs. NFTs can provide ownership records for in-game items, fuel in-game economies, and bring a host of benefits to the players. There are different gaming categories where NFTs are used differently. For Trading Card Games (TCG) like Magic: The Gathering or Hearthstone, it is quite simple to imagine how NFTs will be used. Each trading card is an NFT, and cardholders can trade or hold on to them while they appreciate.

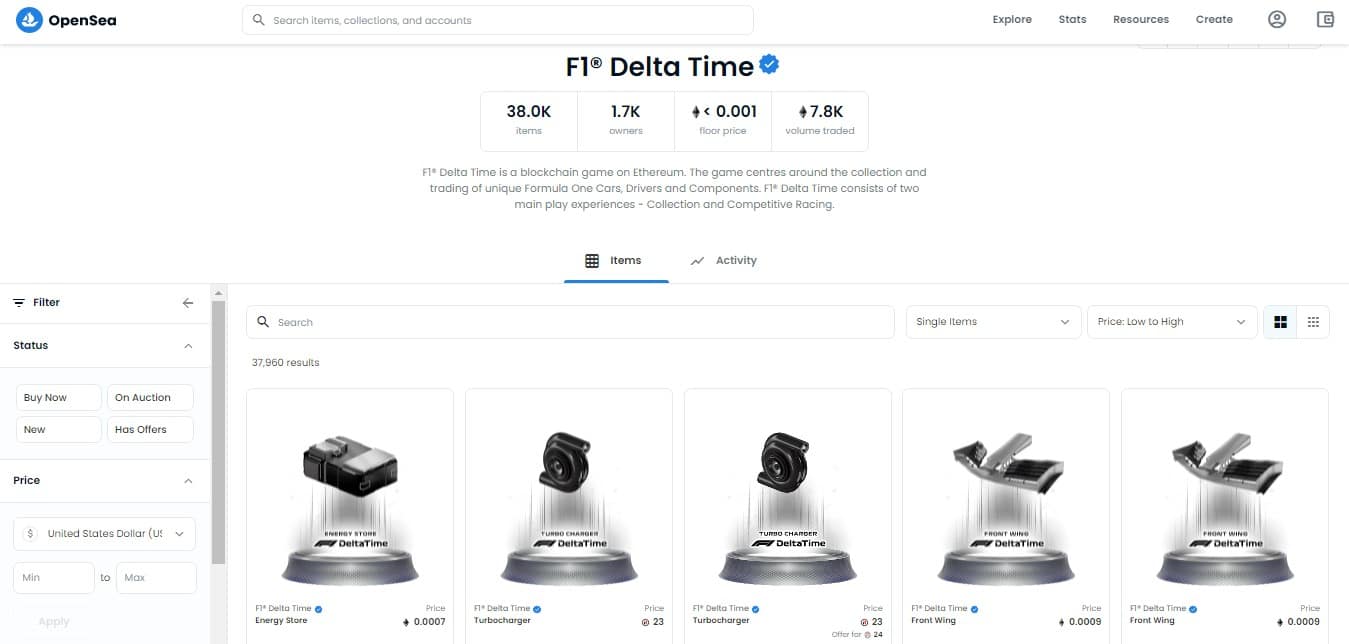

For first-person shooter (FPS) games like Counter-Strike, players use NFTs to customize the characters. They allow players to monetize their in-game characters and weapons and trade them with other players without an intermediary. With blockchain-based games, like F1® Delta Time, players retain ownership of their gaming characters while controlling all their in-game assets. These can include playing cards, skins, equipment, and entire characters. All these are converted into NFTs, making it easier to trace and validate ownership while making it easier to trade. NFTs are one of the biggest contributors to the increased popularity of blockchain gaming.

NFT gaming is quite different from blockchain gaming; it mainly involves collecting valuable NFTs and trading them. Just like the good old-fashioned trading card collection. Some of the top NFT games include Axie Infinity, Gods Unchained, and CryptoKitties.

Decentralized finance also benefits from NFTs, specifically through NFT-backed loans and fractional ownership. With the NFT-backed loans, some dApps allow users to take crypto loans using NFTs as collateral.

In fractional ownership, NFT creators can also create smart contracts that allow different investors to own “shares” in an NFT without buying the entire NFT. This gives you the chance to own popular NFTs that you might otherwise never afford.

Copyright infringement has been the greatest nightmare for all artists. All artists have to do is turn their works of art – videos, music, paintings, photographs, etc. – into NFTs. You can consider an art NFT as the digital “first edition.” When it comes to music and art, NFTs don’t necessarily mean that the buyer outright owns the underlying work of art. It only means that they own the digital certificate of authenticity. The idea here is to have a digital signature the same way physical art pieces have signatures of the artists who created them, making it easier to track the authenticity.

This obviously begs the question, if the buyer doesn’t own the underlying work of art, then why are most NFTs going for millions of dollars? The answer is scarcity! For art creators, this creates scarcity, and since they are non-fungible, there’s only one in existence. It is this scarcity that drives their value. Moreover, artists can set terms within the NFT (using smart contracts), for example, a contract stipulating that the creator will receive a specified percentage upon each resale of the NFT. The potential is unlimited!

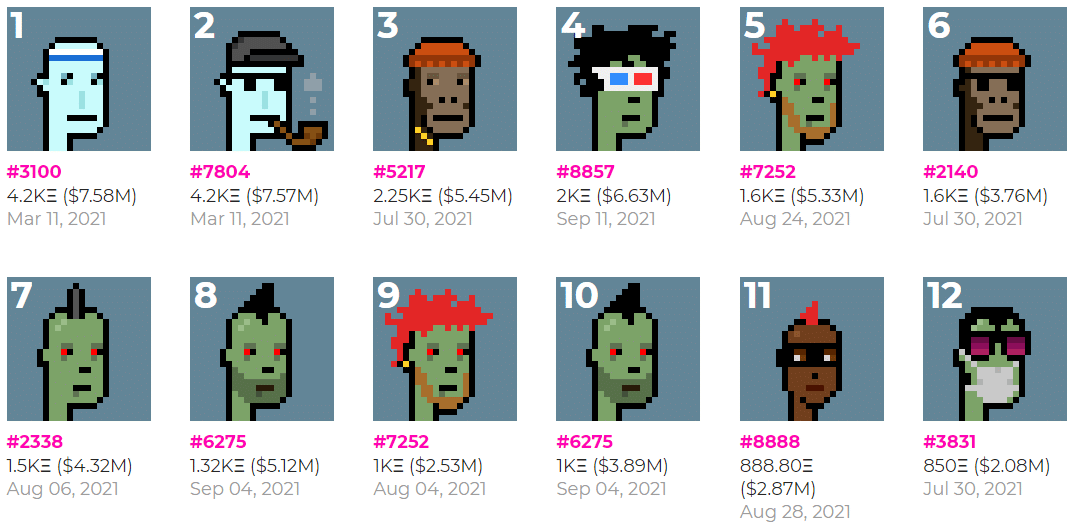

NFTs essentially get their value from the fact that they are rare and scarce, which makes them ideal collectors’ items. Take CryptoPunks, for example; they have no particular utility except to be collected for their more or less rare characteristics. The same goes for the Pudgy Penguins or the Bored Ape Yacht Club. The sports industry has not been left behind either. Traditionally, the sports industry has been leading when it comes to collectible items – especially trading cards. And when it comes to NFTs, the industry hasn’t been left behind either. The top two NFT projects in sports are NBA Top Shot and Sorare.

The boundary between an artistic and collectible NFT is extremely fine, but both can be bought and sold after a while. While the initial intention of creation will make it possible to define which category an NFT falls under, the use will change this category over time!

Now, in a world where you can create an NFT of just about anything imaginable, how do you avoid ending up with a worthless NFT? The trick here is to treat NFTs like any other investment, conduct thorough due diligence. There are also NFT rarity tools that will help you speed up the process.

The ones we’ve mentioned above are just the mainstream application of NFTs. However, there is no limit to how NFTs can be used. Here are other areas that could benefit from the unique features of NFTs:

Although NFTs garnered mainstream popularity in early 2020, they have been around for the better part of the past decade. Here’s a quick review of the history of NFTs.

Their history can be traced back to Colored Coins, which were introduced in 2012. They are arguably the first NFTs in existence, even though they didn’t entirely have the same characteristics of NFTs as we know today. They were a result of an experiment to expand on the use cases for BTC, and consisted of smaller denominations of bitcoin, sometimes as small as 1 Satoshi. And contrary to the name, there were no literal colored coins. This was just a way of customizing the coins by embedding some metadata to make them unique enough to represent whichever asset you want.

The easiest way to understand what colored coins were is to think of it as erasing the writing on a $100 note and printing anything you want on it. The possibilities are endless here – you could make your currency, a coupon, tickets, etc., but still, retain the $100 value. However, this presented a challenge in itself – they could only function in a permissible environment. And although Colored Coins ended up as a failed experiment, they helped advance the research into NFTs – specifically with the launch of the Counterparty, a layer on top of Bitcoin.

The first big leap was in 2015, with the creation of “Spells of Genesis,” which is the first-ever blockchain mobile trading card game. This was followed by ‘Force of Will’ in 2016, another trading card game. However, the NFT ecosystem as we know it today took shape in 2016 with the introduction of Rare Pepes on Counterparty. This NFT became an instant hit and led to the establishment of the “Rare Pepe Meme Directory,” containing millions of memes from the community.

It wasn’t until 2017, when NFTs shifted to Ethereum, that its adoption surged. 2017 saw the creation of CryptoPunks and CryptoKitties and the launch of NFT marketplaces, including OpenSea and Enjin.

Creating an NFT is a surprisingly simple process. All you need to do is set up an account at a marketplace like OpenSea that allows its users to create NFTs. Although anyone can create an NFT, that doesn’t mean you can make money by selling NFTs. Tons of NFTs created by random people are never sold or only sold at extremely low prices. In most cases, the value of NFTs usually depends on the artist’s or the auction house’s reputation, like in the case of Beeple’s “Everydays – The First 5000 Days”. But in most cases, their value depends on contagion, as was with CryptoKitties.

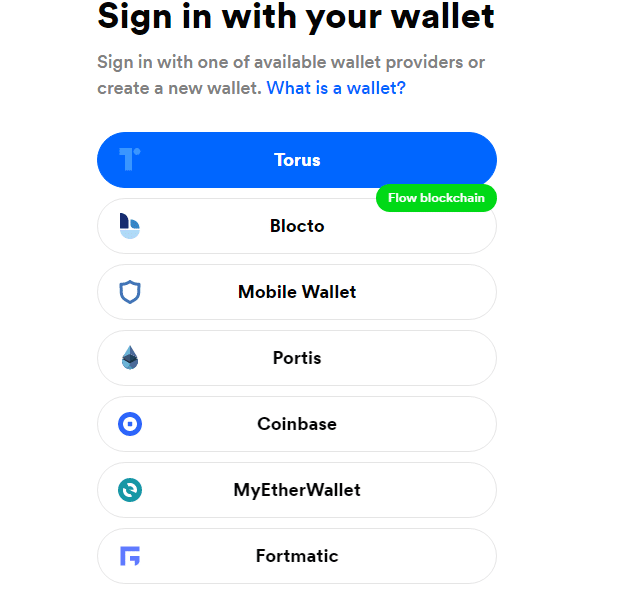

There are several platforms where you can create your own NFTs. So, before you start, you must first decide which blockchain you want your NFTs to be based on. Ethereum and Binance Smart Chains are the leading NFT blockchains, but other blockchains are increasing in popularity. They include Flow, Tron, EOS, Polkadot, Tezos, Cosmos, and WAX.

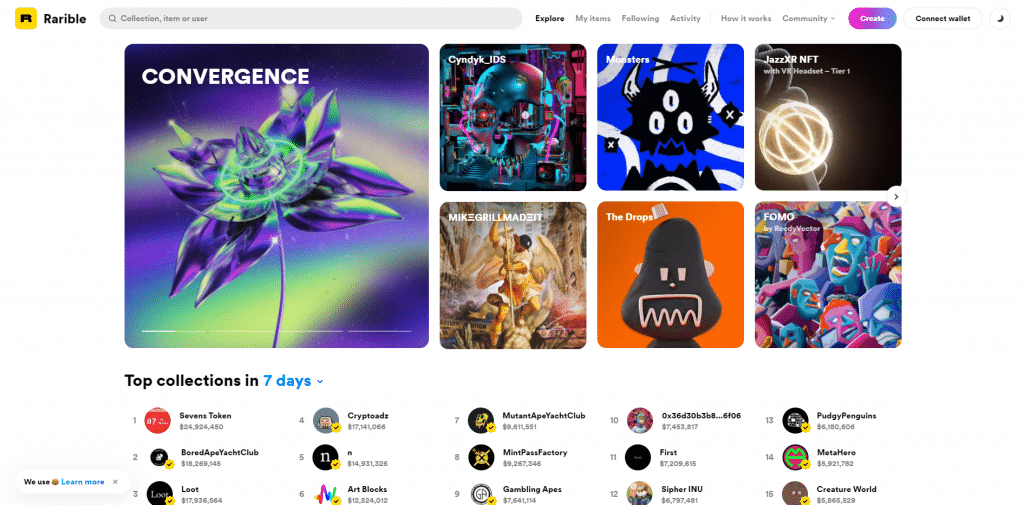

Note that each blockchain has its NFT standards. That is, if you create an NFT artwork on the Ethereum blockchain, you can only sell it on platforms that support Ethereum. Here’s a step-by-step guide on how to create an NFT with Rarible.

You’ll first need to connect to your wallet. Rarible currently supports 7 wallets.

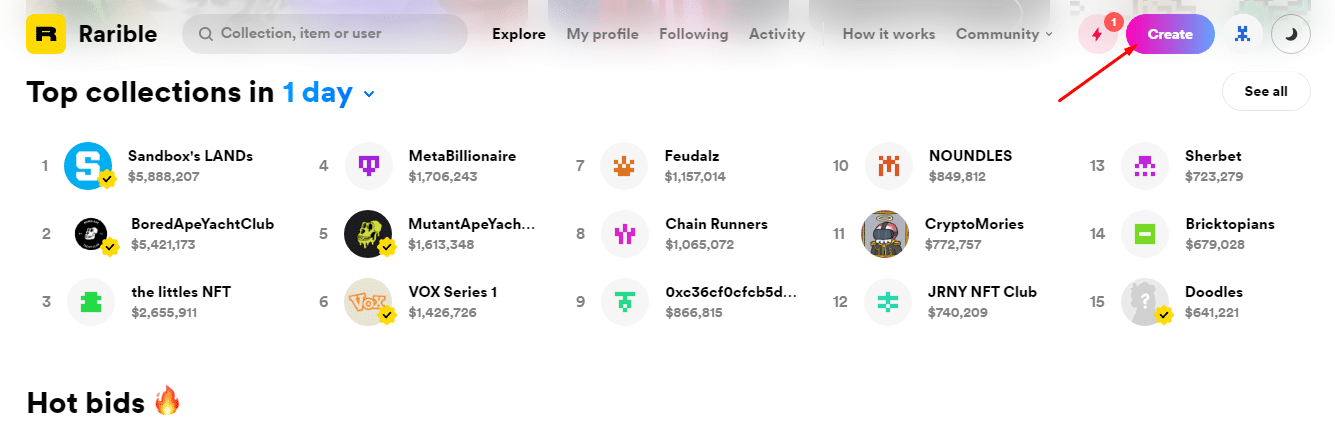

Once you’re logged in, click on the “Create” tab on the top right of the dashboard.

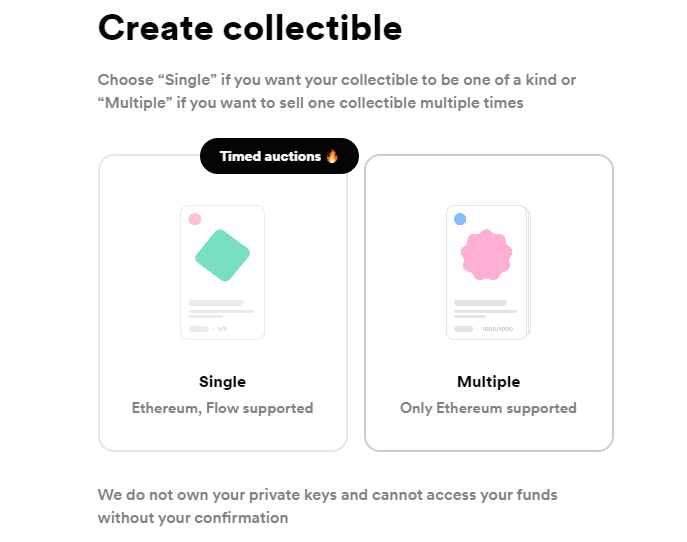

You can choose to create 1 NFT or multiple NFTs. Single NFTs are created with Ethereum’s ERC721 token standard, while multiple NFTs are created with the ERC1155 token standard. In this, we’ll select “Single.”

Note that there is no fundamental difference in terms of transactions. When you select Multiple, you need to determine the number of copies.

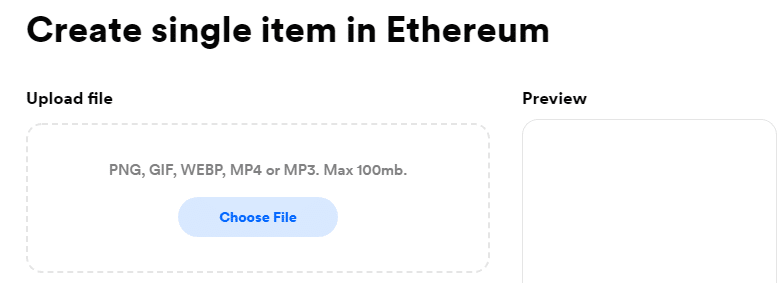

Next, upload the file you intend to turn into an NFT. This can be a JPG, PNG, GIF, MP4, MP3, or WEBP file with a maximum of 100MB.

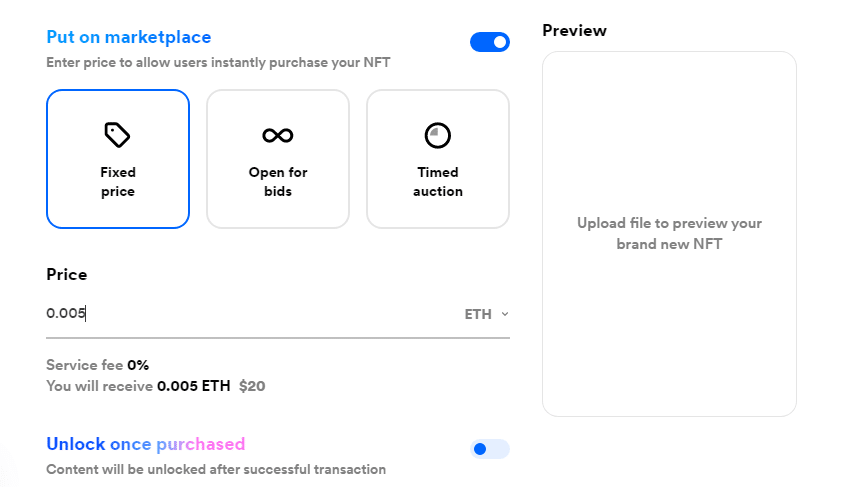

You can put your NFTs immediately on the marketplace for a fixed price or leave it open for bids. In our case, we’ll set a fixed price. You can also add information such as a link to a HD image, code, and digital key to be given to the recipient for the work by opening the “unlock once purchased” section.

Note that you can mint ERC-721 or RARI NFTs.

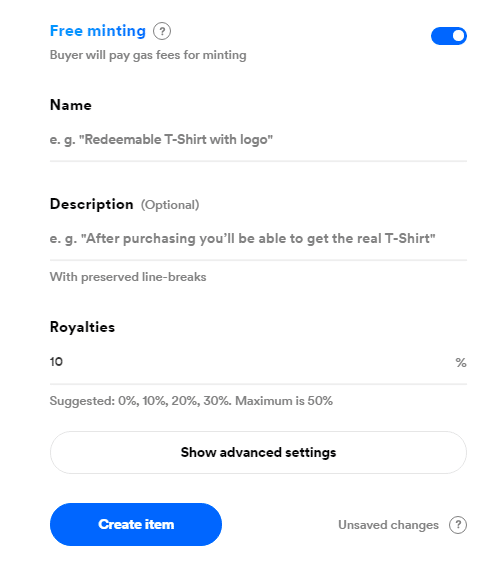

This is arguably the most important step when creating the NFT – the details of the NFT. You get to set the name of the NFT, its description, the royalties you’ll receive every time your NFT is sold, and the properties of the NFT.

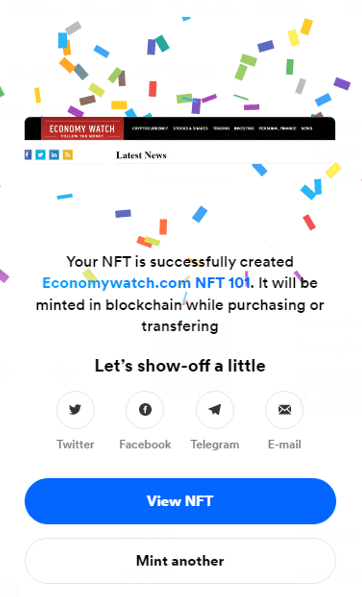

Now you’re ready to create the NFT. Simply click on the “Create item” tab and let Rarible mint your NFT. That’s it!

If you’re looking to buy or sell NFTs, these are the top marketplaces for you.

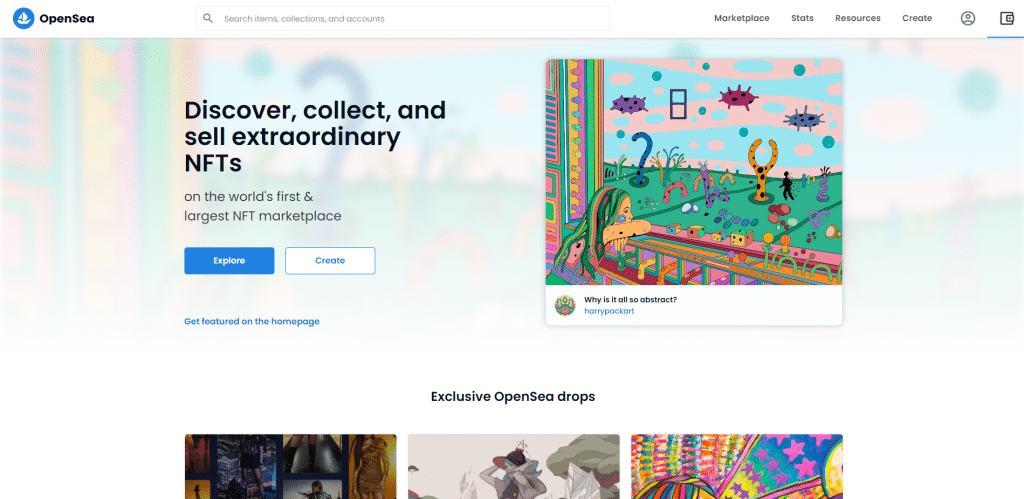

OpenSea is the largest NFT marketplace. Founded in 2017, it allows trading of all types of NFTs, including collectibles, gaming NFTs, digital art, domain names, and other Ethereum-based digital assets. The sheer number of NFTs offered on OpenSea rivals any other marketplace. However, the platform doesn’t have a native token.

Pros:

Cons:

67% of retail investor accounts lose money when trading CFDs with this provider.

Rarible is a community-owned NFT marketplace where users can create (mint), buy, and sell NFTs, and the platform’s native token – RARI – is used for governance. It is a non-custodial marketplace which means that users have complete ownership of their NFTs and tokens.

Pros:

Cons:

67% of retail investor accounts lose money when trading CFDs with this provider.

Enjin was founded in 2009 but later pivoted to NFTs in 2017 and is currently the top marketplace for gaming NFTs. Since the platform is targeted at gamers, it’s widely regarded as the marketplace that popularized the ERC-1155 token standard because gaming NFTs are often used in multiple games. Over 1.16 billion NFTs have been created on Enjin so far, and about 12.4 million ENJ are locked in assets.

Pros:

Cons:

67% of retail investor accounts lose money when trading CFDs with this provider.

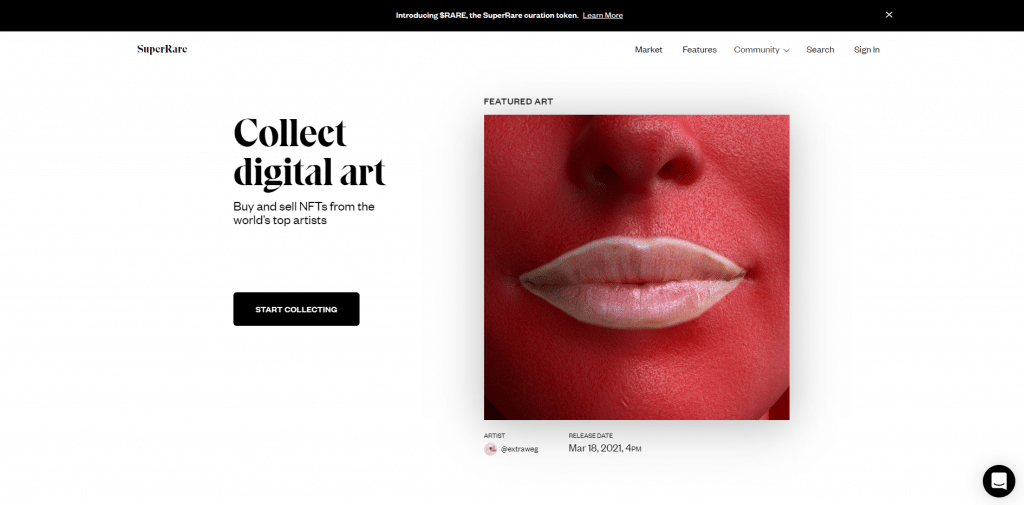

SuperRare is an NFT marketplace dedicated to rare digital art – basically, a digital art gallery dealing only in single editions of digital art. This means you get to buy and sell NFTs from the world’s top artists. All NFTs on SuperRare are of ERC 721 token standard. What sets SuperRare from other platforms is its mobile app, artists’ social profiles, and live auctions.

Pros:

Cons:

67% of retail investor accounts lose money when trading CFDs with this provider.

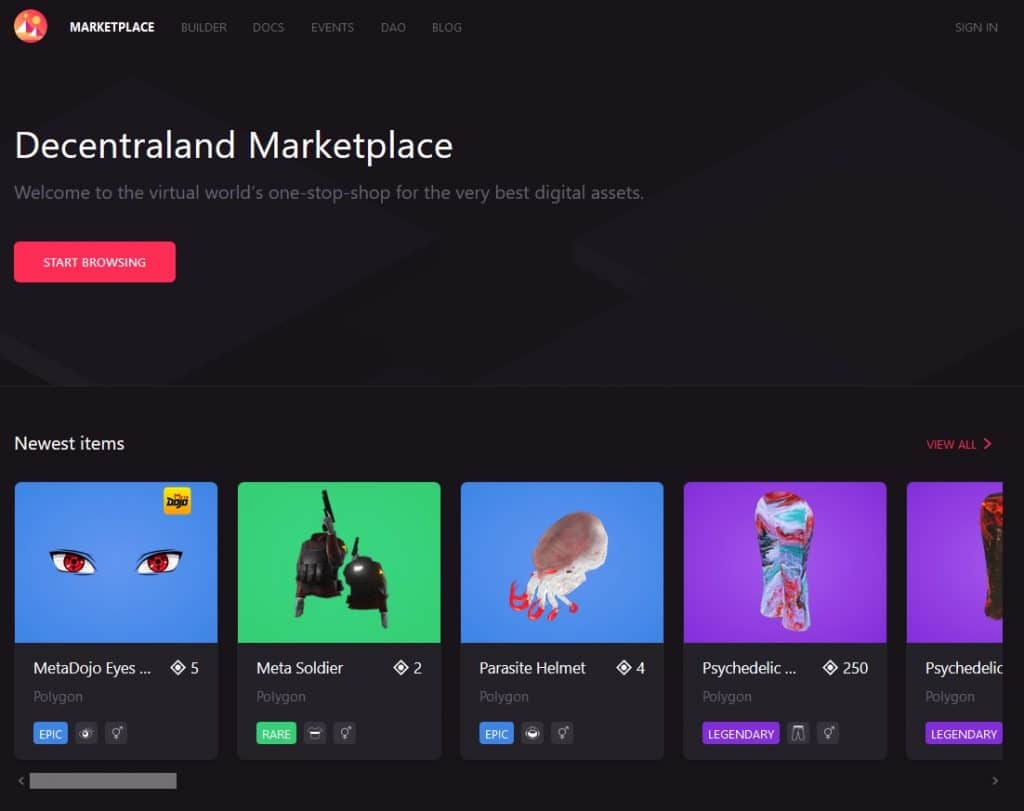

Decentraland is best described as a virtual reality platform for NFT trading. It specifically focuses on virtual real estate, where anyone can buy unique pieces of virtual real estate and develop it to their preference. The platform’s native token is MANA, which holders can use to pay for NFTs in the marketplace and for governance.

Pros:

Cons:

67% of retail investor accounts lose money when trading CFDs with this provider.

Axie Infinity is primarily a marketplace for the Pokémon-inspired videogame Axie Infinity. The marketplace allows users to monetize the mythical battle creatures called Axies, which can be bought, customized with over 500 body parts, trained, and used in fights. These creatures can also reproduce, making them an ideal investment.

Pros:

Cons:

67% of retail investor accounts lose money when trading CFDs with this provider.

NBA Top Shot is an online company launched by Dapper Labs and supported by the NBA. Users simply bid on, purchase, and sell digital highlights of NBA games. The NBA’s top shot concept is to publish and sell digital basketball trading cards. However, instead of static images of players, NBA Top Shot cards contain video clips from previous games. Each clip is a unique token. Purchasing NBA Top Shot NFTs is done through the queueing process – first come, first served. And once a particular NFT pack is sold out, users can only trade them on the peer-to-peer market afterward.

Pros:

Cons:

67% of retail investor accounts lose money when trading CFDs with this provider.

NFTs have unlimited potential. Whether you’re interested in NFTs for speculative investment or their inherent potential for real-life application, this guide has given you a fair idea of what they are, how they work, and how they are and can be used.

FAQs