Invest In Cardano – How To Invest In Cardano For Beginners

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Cardano (ADA) is one of the best performing cryptocurrencies of 2021 – so interest in this digital token is growing rapidly. If you’re wondering how to invest in Cardano safely and in a low-cost manner – this guide is for you.

Not only do we show you how to invest in Cardano in under five minutes with a regulated broker – but we also review the best ADA platforms operating in this space.

Table of Contents

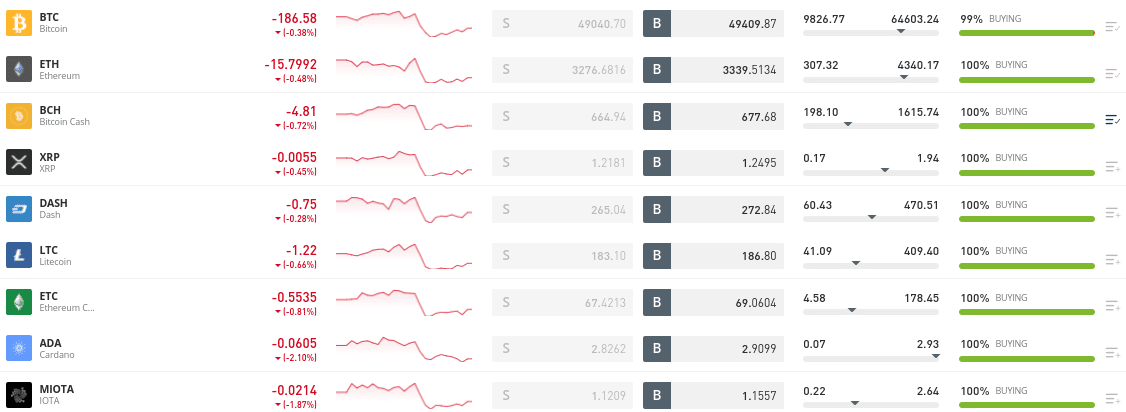

Choosing the right broker to invest in Cardano is crucial – as there are hundreds of platforms giving you access to ADA tokens. Below you will find a snapshot overview of the best Cardano providers in this arena.

If you’re still not sure which Cardano broker is best for you – we review the above platforms in great detail further down in this guide.

If you don’t have time to read this in-depth guide in full and wish to invest in Cardano right now – follow the steps below. In doing so, you will be able to invest in Cardano at regulated and low-cost brokerage site eToro in under five minutes.

And that’s it – you have just learned how to invest in Cardano in under five minutes. The ADA tokens will appear in your eToro portfolio within seconds – where they will remain until you decide to cash out.

Cryptoassets are highly volatile unregulated investment products. Proceed at your own risk.

One of the most important things to consider when learning how to invest in Cardano is the broker that you choose to complete the process with. After all, there are many platforms in this space that should be avoided – not least because they operate in an unregulated manner. On top of safety, your chosen Cardano broker must support your preferred payment method and offer competitive trading fees.

With this in mind, below you will find a selection of the best brokers that allow you to invest in Cardano from the comfort of your home.

eToro is an online broker that was first launched in 2007. The platform now serves over 20 million clients from over 100+ countries and is billed to go public later this year. In terms of why eToro stands out as our number one broker to invest in Cardano – this is for several key reasons. Firstly – and unlike the vast bulk of cryptocurrency brokers operating in this space, eToro is heavily regulated. It holds licenses with three reputable financial bodies – namely ASIC (Australia), the FCA (UK), and CySEC (Cyprus).

For those of you looking to invest in Cardano from the US – you will be pleased to know that eToro is approved by the SEC and FINRA. eToro not only stands out in terms of safety, but it also offers super-competitive fees. For instance, the broker only charges 0.5% to deposit funds with a debit/credit card, e-wallet, or bank wire. US clients get an even better deal – as the deposit fee is scrapped in its entirety. Buying and selling cryptocurrencies at eToro will only require you to cover the spread – which starts at 0.75%.

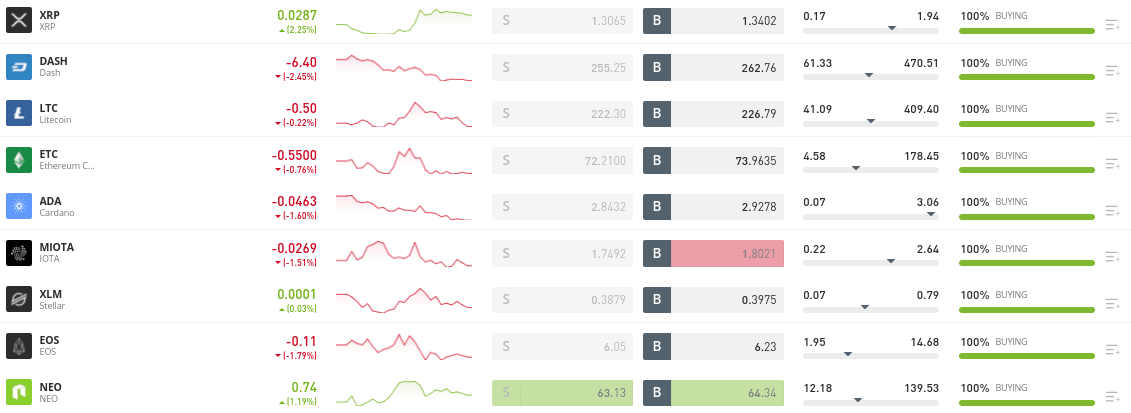

We should also note that eToro supports fractional investments – which means that you can purchase any quantity of ADA tokens as long as you meet the minimum threshold of $25. This is also the case with the 30+ other cryptocurrencies that eToro supports. This list of markets includes everything from EOS, Bitcoin, and Ethereum Classic to Dogecoin, AAVE, and Litecoin. eToro even offers a professionally managed portfolio that will get you access to a full basket of digital assets. This operates like an ETF – as eToro will regularly rebalance the portfolio on your behalf.

You can also trade digital tokens passively via the Copy Trading feature. This allows you to choose from thousands of verified traders that use the eToro platform to invest. Once you’ve found a trader you like and chosen how much you wish to invest (minimum $500) – all subsequent positions will be mirrored in your own account. You can get started at eToro by opening an account and uploading a copy of your ID – which shouldn’t take you more than five minutes. You can then invest in Cardano online or via the eToro Android/iOS app.

Pros

Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

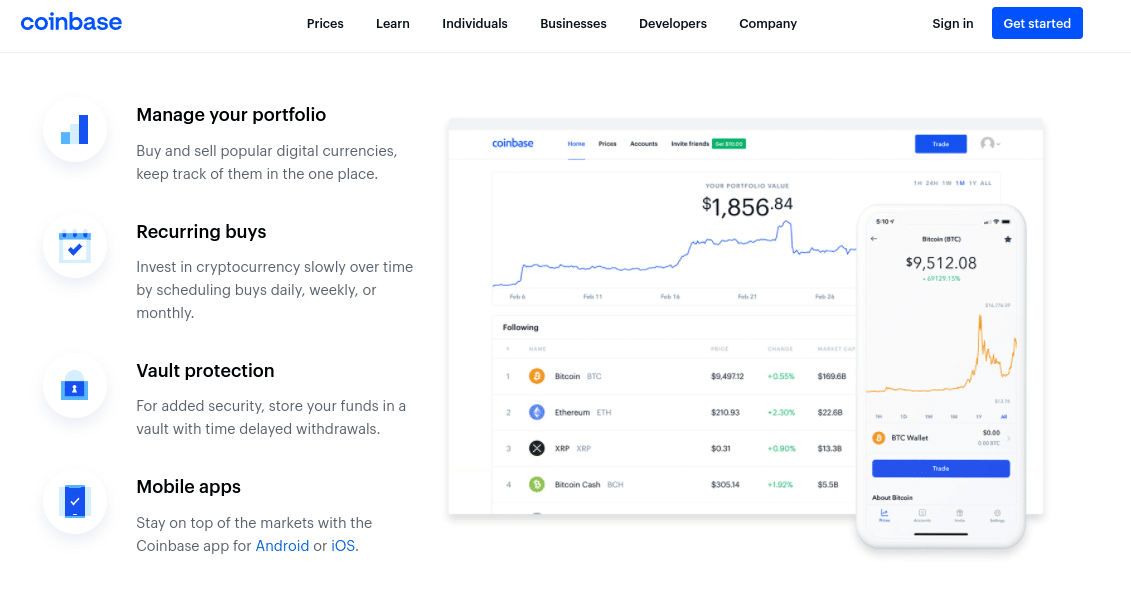

Coinbase is a popular cryptocurrency broker that not only allows you to invest in Cardano from the comfort of your home – but dozens of other cryptocurrencies. This covers lots of mainstream digital tokens like Bitcoin, Litecoin, Ethereum, and Dogecoin. You can also access less liquid markets – many of which come in the form of ERC-20 tokens. Although Coinbase is expensive – which we cover shortly, the platform does allow you to invest in Cardano in a simple and burden-free way.

This is because Coinbase was designed with beginners in mind – so the platform itself is very easy to use. Once you have registered an account and provided a copy of your government-issued ID – you have the option of investing in Cardano via the Instant Buy feature. In a nutshell, this allows you to invest in cryptocurrencies instantly by using your debit or credit card. The fees associated with the Instant Buy option stand at 3.99% of the transaction amount. If you’re investing less than $200 – you will pay a flat fee.

But, this will work out at more than 3.99% – so do check this before proceeding. You can also deposit funds into your Coinbase account by performing a bank transfer. This will take 1-3 working days to arrive (depending on your location) – but you won’t be required to pay any deposit fees. Instead, once the money arrives, you will pay a commission of 1.49% to manually invest in Cardano. This commission is also charged when you get around to cashing your Cardano investment out.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

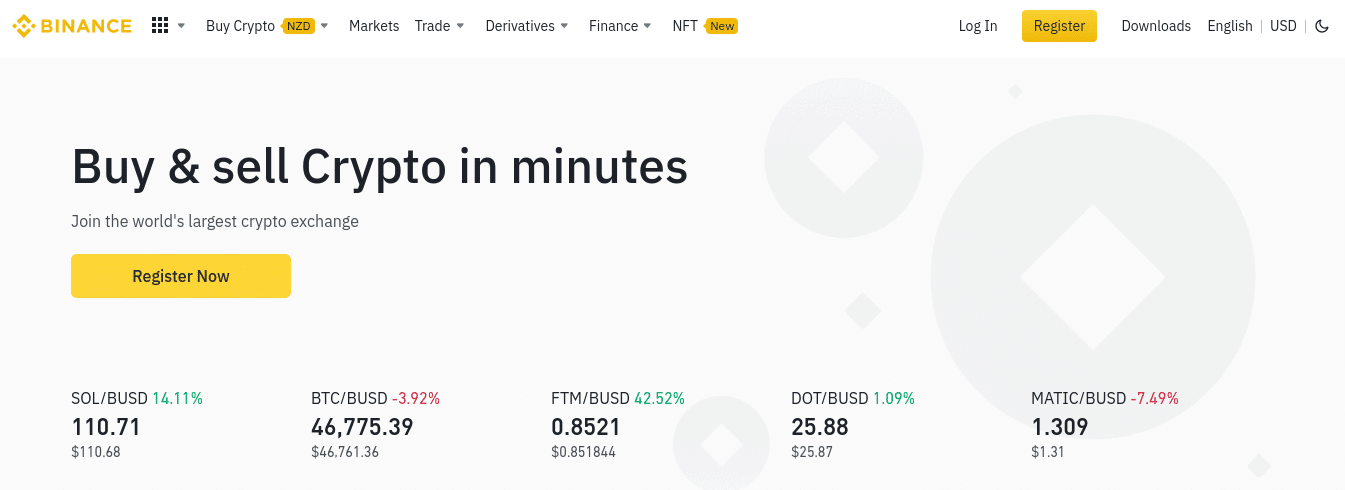

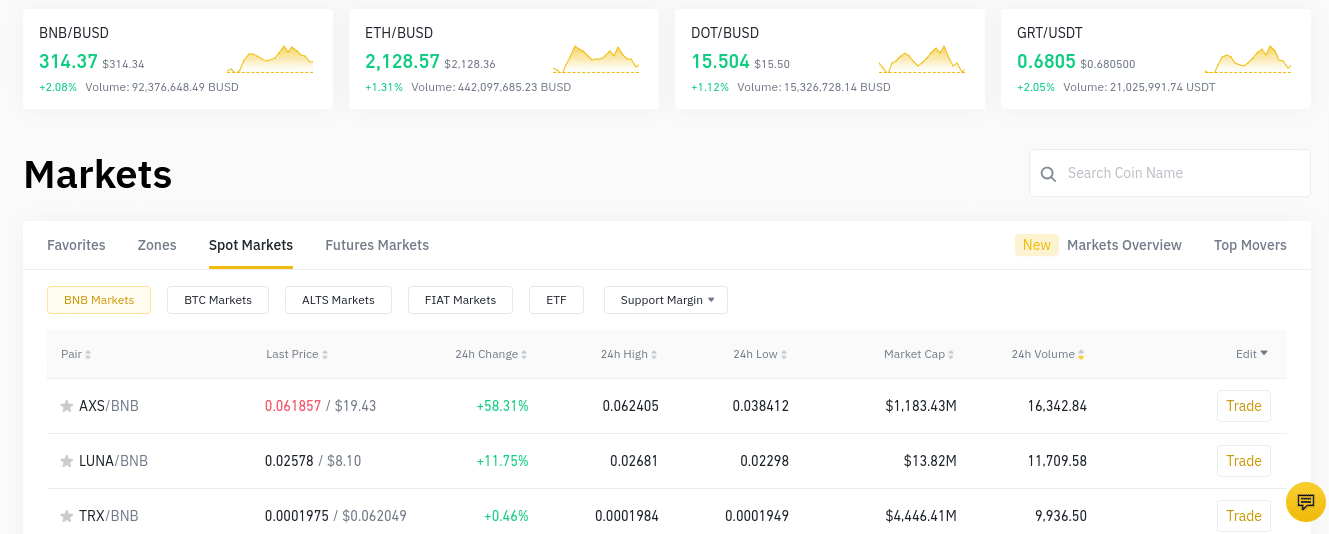

Binance is a good option if you are planning to invest in cryptocurrencies other than just Cardano. In total, this popular cryptocurrency exchange hosts hundreds of digital tokens of all shapes and sizes. As such, Binance is suitable for those of you that wish to create a diversified portfolio of crypto assets. When it comes to fees, this will depend on various factors – such as where you are based and your preferred payment method. For instance, if you’re based in the US – you can invest in Cardano instantly with your debit/credit card at just 0.5%.

But, the same process in other regions of the world can cost up to 4% – so do check this before proceeding. In some countries, Binance also allows you to deposit funds via a bank transfer – which is usually fee-free. Once you have capital in your Binance account, you can then buy and sell digital currencies at the exchange’s standard commission rate of 0.10% – which is very low. Even lower fees are available for those of you that trade larger amounts or hold a minimum number of BNB tokens.

The Binance platform itself is jam-packed with additional tools and features – such as its crypto savings accounts. This allows you to earn interest on your chosen crypto asset – just like you would with a traditional bank. Binance also supports Cardano staking – which again, allows you to earn interest. This currently stands at 8.38% per year when locking your ADA tokens up for 90-days, and 5.09% on 30-day agreements. You can also spend your Cardano tokens in the real world via the Binance debit card – which is issued by Visa.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

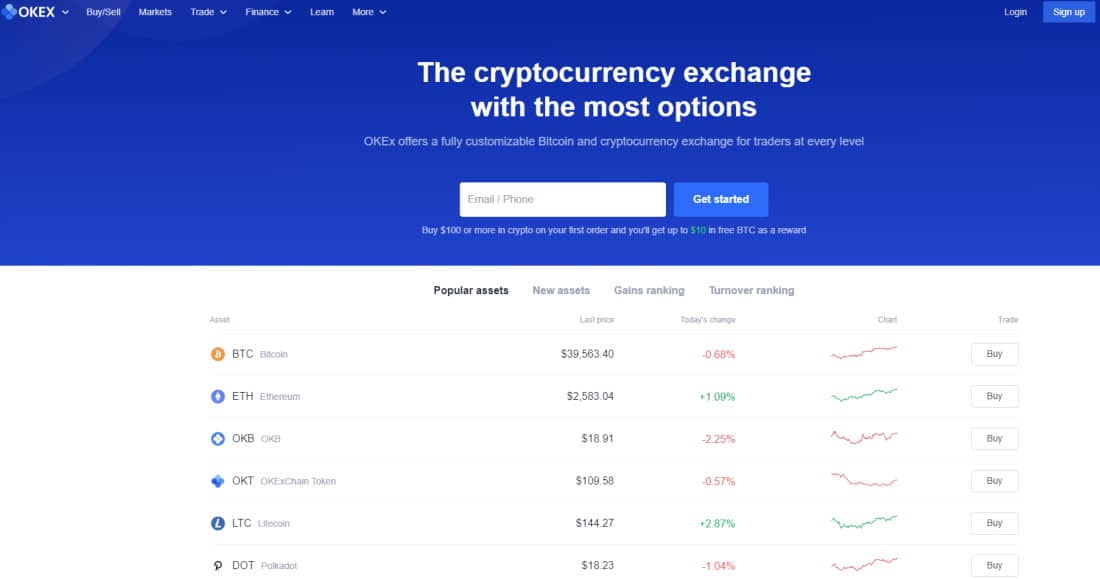

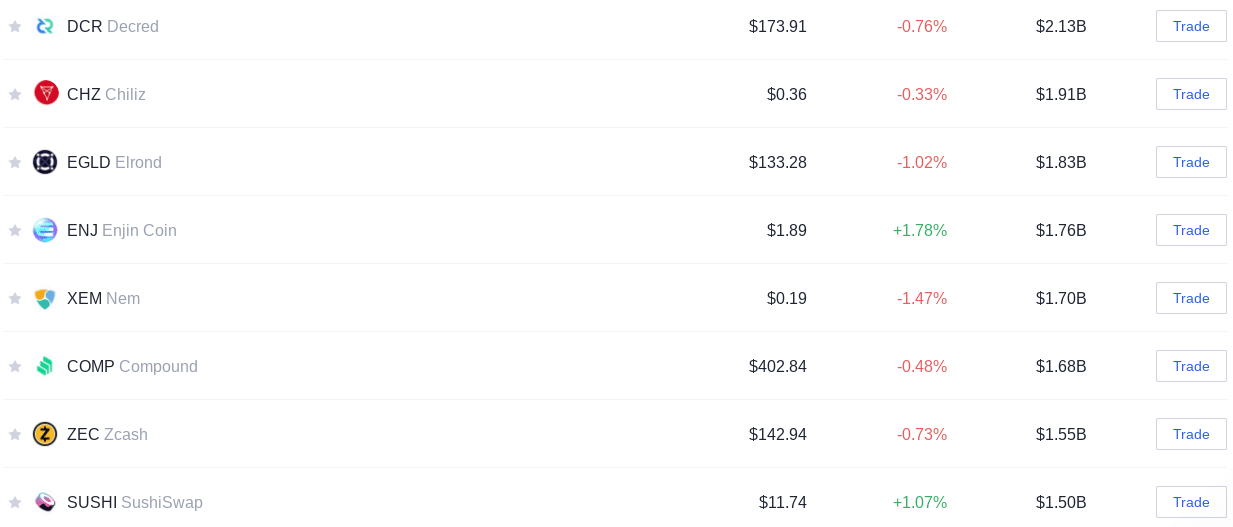

OKEx supports over 400 trading pairs in total, meaning that you have heaps of options when it comes to depositing funds. For instance, whether you wish to fund your account with Ethereum Classic, XRP, Litecoin, Dogecoin, or Bitcoin Cash – OKEx has you covered. Once you have completed your crypto-to-crypto trade, you can withdraw the ADA tokens to a private wallet within minutes. Or, you might also consider using the OKEx mobile wallet – which gives you full control over your private keys.

The other option you have is to deposit your ADA tokens into the OKEx savings account. In doing so, you can earn a huge APY of 9.31% per year. This rate would require you to lock your tokens away for 90 days. If you prefer to have access to your ADA tokens at any given time, the flexible savings account pays an APY of 1.88%. Although OKEx is best used when depositing funds with crypto, we should note that the exchange also supports debit/credit card payments. The fees, however, are much higher than the likes of eToro – so do bear this in mind.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

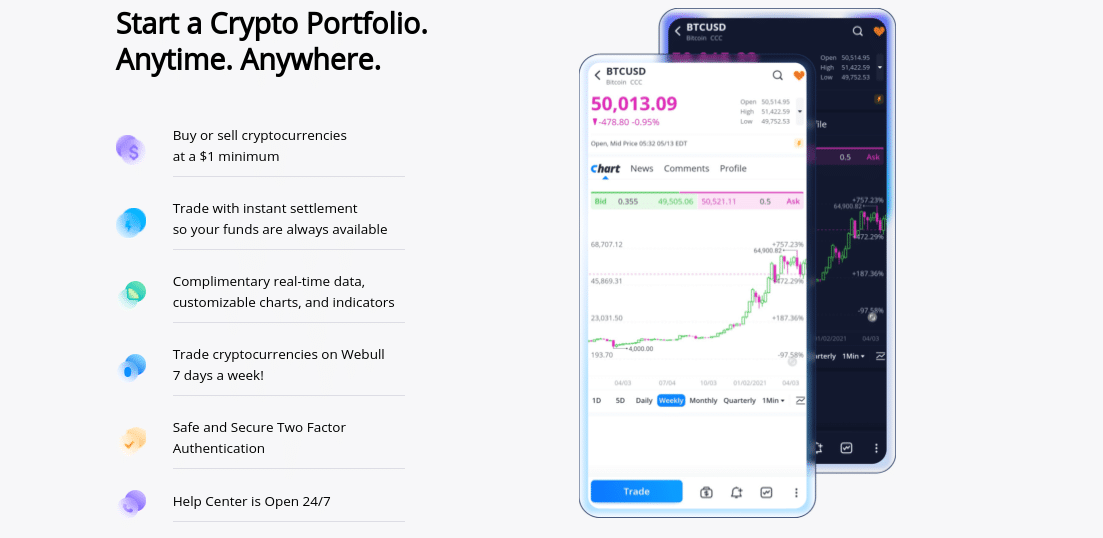

Webull is a popular brokerage site that also offers a user-friendly mobile app. This platform – which is only available to US clients, is ideal if you are a beginner that wishes to invest in Cardano with a small amount of money. This is because Webull requires a minimum investment of just $1 per trade. This will allow you to dabble with digital currencies in a slow and steady manner. Alongside Cardano, Webull offers a wide range of other cryptocurrencies which you can also buy from just $1.

This includes everything from Bitcoin, Litecoin, and Zcash to Stella, Ethereum, and Dogecoin. Webull also offers alternative asset classes – which is great if you wish to diversify your portfolio away from crypto assets. For example, you can invest in thousands of US-listed stocks and ETFs, and even trade options. When it comes to fees, Webull allows you to invest in Cardano on a commission-free basis. You do, however, need to key an eye on the spread. This starts at 1% at Webull, albeit, the actual figure can and will fluctuate throughout the day.

If you like the sound of Webull, you can get started relatively easily. You will need to register an account and then proceed to deposit funds via ACH or a domestic bank wire. There is no minimum deposit requirement at Webull, but bank wire transfers cost $8 per transaction. ACH deposits and withdrawals are free. Finally, and perhaps most important, Webull is heavily regulated in the US. As such, you can invest in Cardano and other cryptocurrencies in a safe and secure environment.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

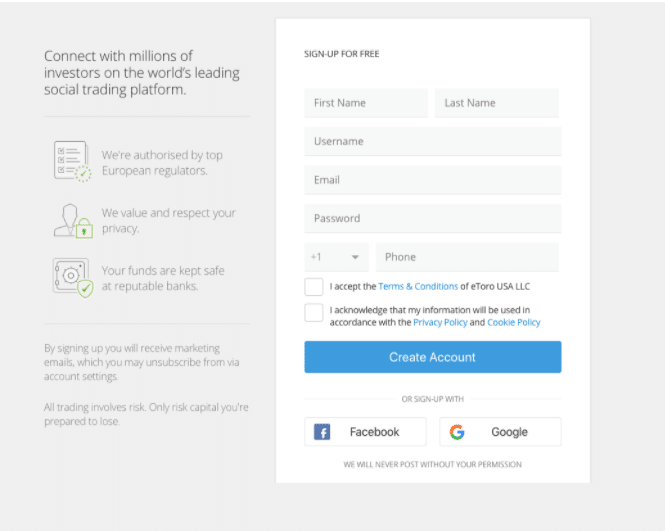

In this section of our guide, we are going to walk you through the process of how to invest in Cardano every step of the way. This includes the steps required to open an account with top-rated broker eToro, making a deposit, and then finally – investing in Cardano.

We mentioned in our eToro review that the broker is heavily regulated – so all new customers must open an account by providing some personal information. This includes the basics such as your name and nationality, home address and date of birth, and national tax number.

You will also need to provide eToro with your mobile number and email address.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

The next step when opening an account with eToro is to verify your identity. For this, you will be asked to upload two verification documents – namely, your government-issued ID and a proof of address. The latter needs to include your name and address, and be dated within the past three months.

Once you have uploaded the above two documents, your account should be verified within two minutes. When it is, you can then proceed to make a deposit.

eToro supports the following payment methods:

The minimum deposit for first-time customers is $200 and you will pay a fee of 0.5% on the transaction. However, if you are based in the US, there is no deposit fee and the minimum drops down to just $50.

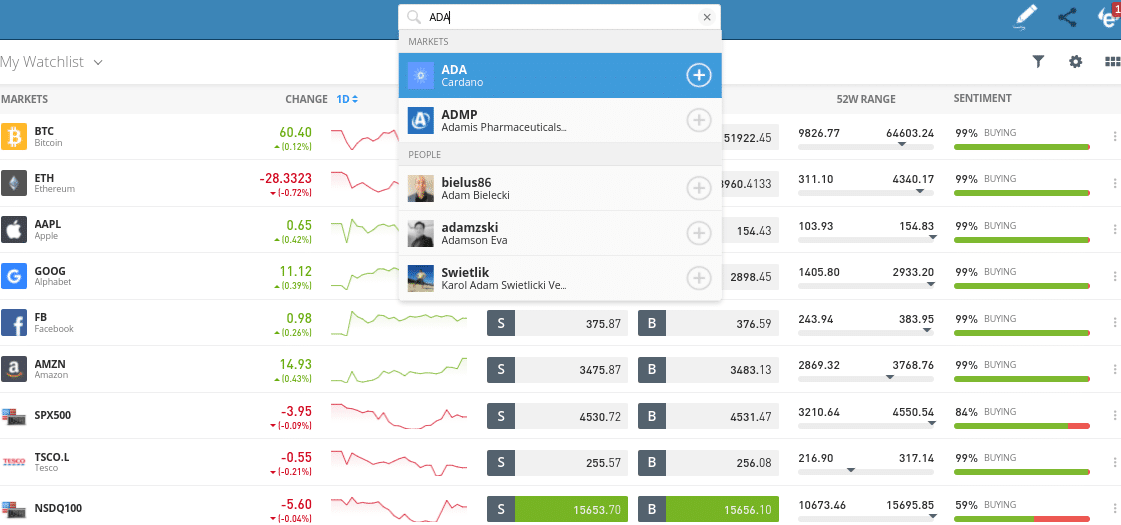

You should now have a verified eToro account that is funded with trading capital. Next, you can enter ‘ADA’ into the search box and click on the result that loads.

Then, click on the ‘Trade’ button to populate the Cardano investment form.

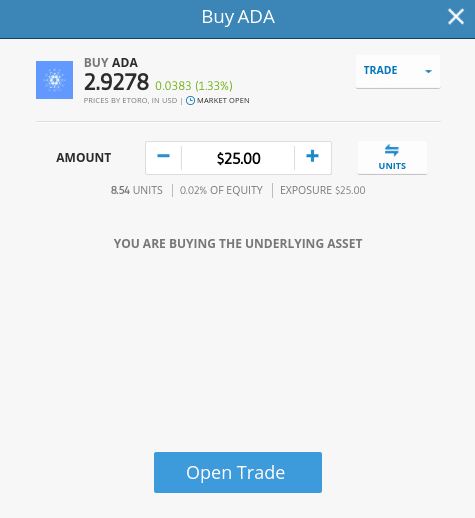

And finally – you can now invest in Cardano. You will see an order box like in the image below. In our example, we are looking to invest $100 into Cardano. You can, however, invest any amount from just $25.

Once you have entered your stake, confirm the investment by clicking on the ‘Open Trade’ button.

Once you have invested in Cardano at eToro, the ADA tokens will appear in your account portfolio. It is here that you can view the current value of your Cardano investment in real-time.

You can then use the funds to invest in other cryptocurrencies or simply withdraw the money to your bank account.

Cardano, like most cryptocurrencies, can be purchased from the comfort of your home. With that said, there are many ways to invest in Cardano – so it’s wise to think about which methods are right for you and your financial goals.

Below we discuss these methods so that you can invest in Cardano with your eyes wide open.

When you invest in Cardano via an online broker, you will be purchasing the ADA tokens directly from the platform in question. This means that you can avoid having to deal with other market participants. By using a broker, you will also be able to ensure that you are investing in a safe and secure way. This is because the best Cardano brokers are regulated and authorized by reputable financial bodies.

For example, by investing in Cardano with eToro – you will be using a broker that is regulated by the FCA, ASIC, and CySEC. With such a strong regulatory framework governing its platforms, eToro has the legal remit to accept fiat currency deposits. This means that you can easily invest in Cardano by using an e-wallet, debit/credit card, or bank wire.

You might also consider investing in Cardano via a cryptocurrency exchange.

Although you might be tempted to use an unregulated Cardano exchange for access to low fees, a wide selection of cryptocurrencies, and perhaps high leverage facilities – these platforms should be avoided. After all, if anything goes wrong, you will have nowhere to turn.

Cardano is one of the best-performing digital currencies of 2021. But, this isn’t to say that you should just go gung-ho and invest in Cardano without first having done some homework. After all, Cardano – and all cryptocurrencies for that matter, are vulnerable to high volatility levels and market speculation.

To help clear the mist – consider the following factors before investing in Cardano today:

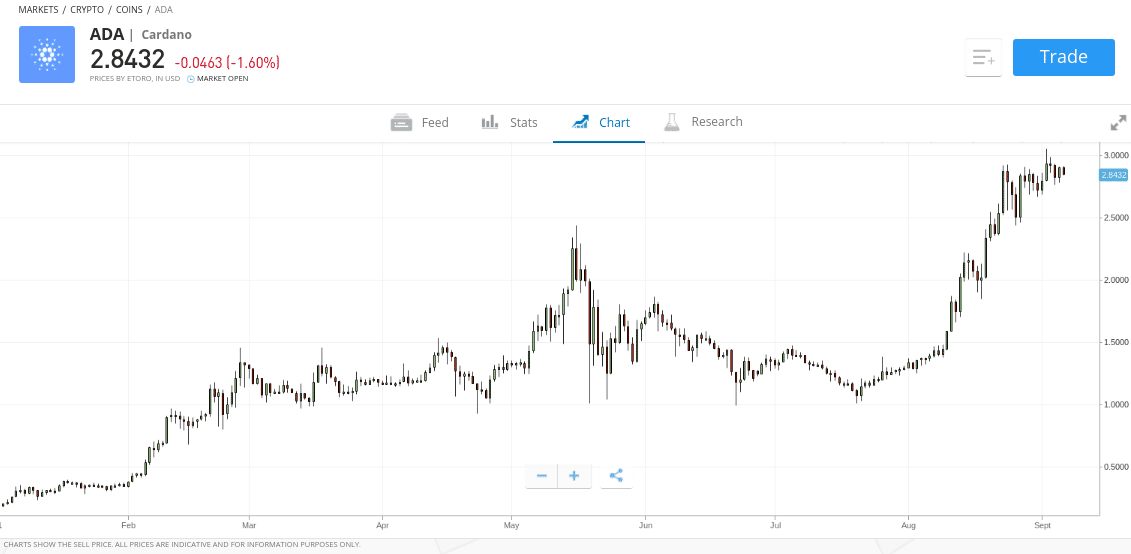

At the time of writing in September 2021, Cardano has positioned itself as the third-largest cryptocurrency in terms of market capitalization. This stands at over $92 billion. However, to truly understand just how well ADA has performed in recent years, we need to explore Cardano’s price action since it was launched in 2017.

Back in 2017, you would have been able to invest in Cardano at a price of just $0.026 per token. Although the digital currency remained somewhat flat in the four years to follow, ADA finally took off in 2021. At the start of the year, ADA was priced at $0.18. Fast forward to September 2021 and the digital currency is trading at over $2.89.

This means that in just nine months of trading, an investment in Cardano would have generated returns of over 1,500%. With that said, had you invested when the digital currency first launched in 2017 – your returns would now stand at over 11,000%.

In terms of the underlying technology itself, Cardano is one of the best-performing cryptocurrency networks in this space.

Furthermore, Cardano also offers full support for smart contract technology – which is another area of the cryptocurrency arena that is expected to grow exponentially in the coming years.

On top of generating huge capital gains over the past few years, Cardano also offers the opportunity to earn regular income via staking. For those unaware, staking refers to the process of contributing your ADA tokens to the Cardano network to help verify and confirm transactions. In return, you will earn a share of any transaction fees that are collected along the way.

Crucially, Cardano is one of the best staking coins in this marketplace, as the yields on offer can be very attractive. For instance, at platforms like eToro and Binance – you can earn up to 8-9% per year. This regular income can be earned in conjunction with an ADA price increase, meaning that you can grow your capital on two fronts.

You also need to consider the added risks that cryptocurrencies like Cardano present before you proceed.

The main risks that we identified are as follows:

There are several ways in which you can mitigate the risks of investing in Cardano. For instance, you might consider diversifying your investment into other assets. Not only might this include other cryptocurrencies, but alternative investments like stocks and index funds. You can also consider investing in small but frequent sums to ensure you are not overexposed to a single cost price.

The costs associated with investing in Cardno will depend on many factors – such as:

To give you an idea of what fees to consider when investing in Cardano, Coinbase charges 3.99% when using the Instant Buy feature with your debit or credit card. You can reduce this fee greatly by choosing eToro – which charges just 0.5% on fiat currency deposits (0% for US clients).

You also need to consider trading commissions and the spread. The former is a fee charged when you buy and sell Cardano. For instance, Coinbase charges 1.49% while Webull is commission-free. However, Webull charges a somewhat uncompetitive spread – which starts at 1%.

All in all, if you’re looking for the cheapest way to invest in Cardano without compromising on safety, eToro is by far the best option in the market.

In summary, Cardano has firmly positioned itself as a top-five cryptocurrency in terms of market capitalization. This means that investing in the digital asset has never been easier – not least because you have hundreds of brokers and exchanges to choose from. But, with so many options in this market – many of which are unregulated and/or charge high fees – we would suggest sticking with a reputable platform like eToro.

In doing so, you will be investing in Cardano in a safe and secure manner – as eToro is authorized and regulated by several financial bodies. It is also approved by the SEC and FINRA in the US. eToro allows you to invest in Cardano from just $25 and it supports debit/credit cards, e-wallets, and bank transfers. And crucially – eToro is a low-cost broker too, as it allows you to invest on a spread-only basis.