How to Buy Decentraland Australia – Buy Decentraland In Under 5 Minutes

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

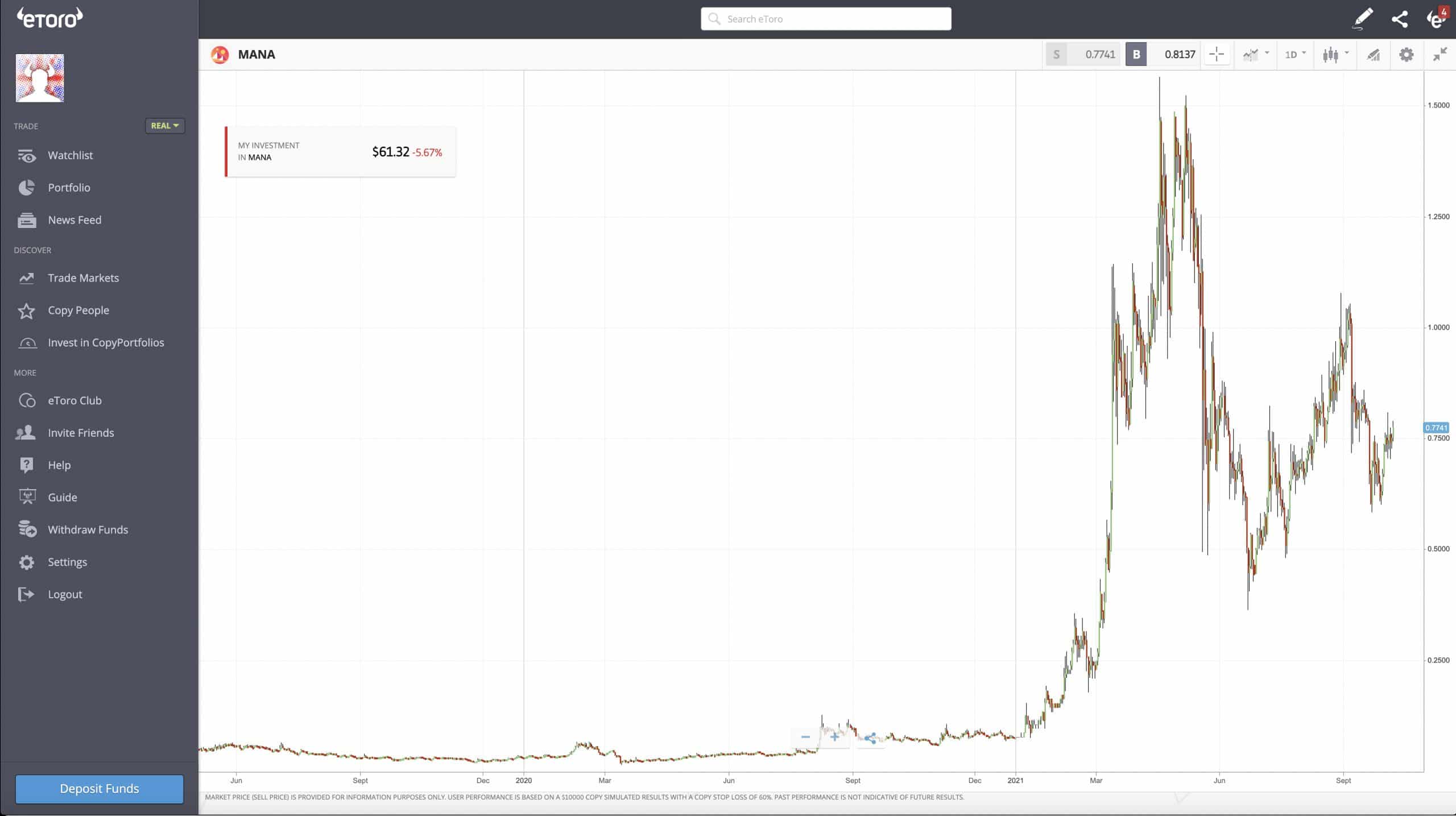

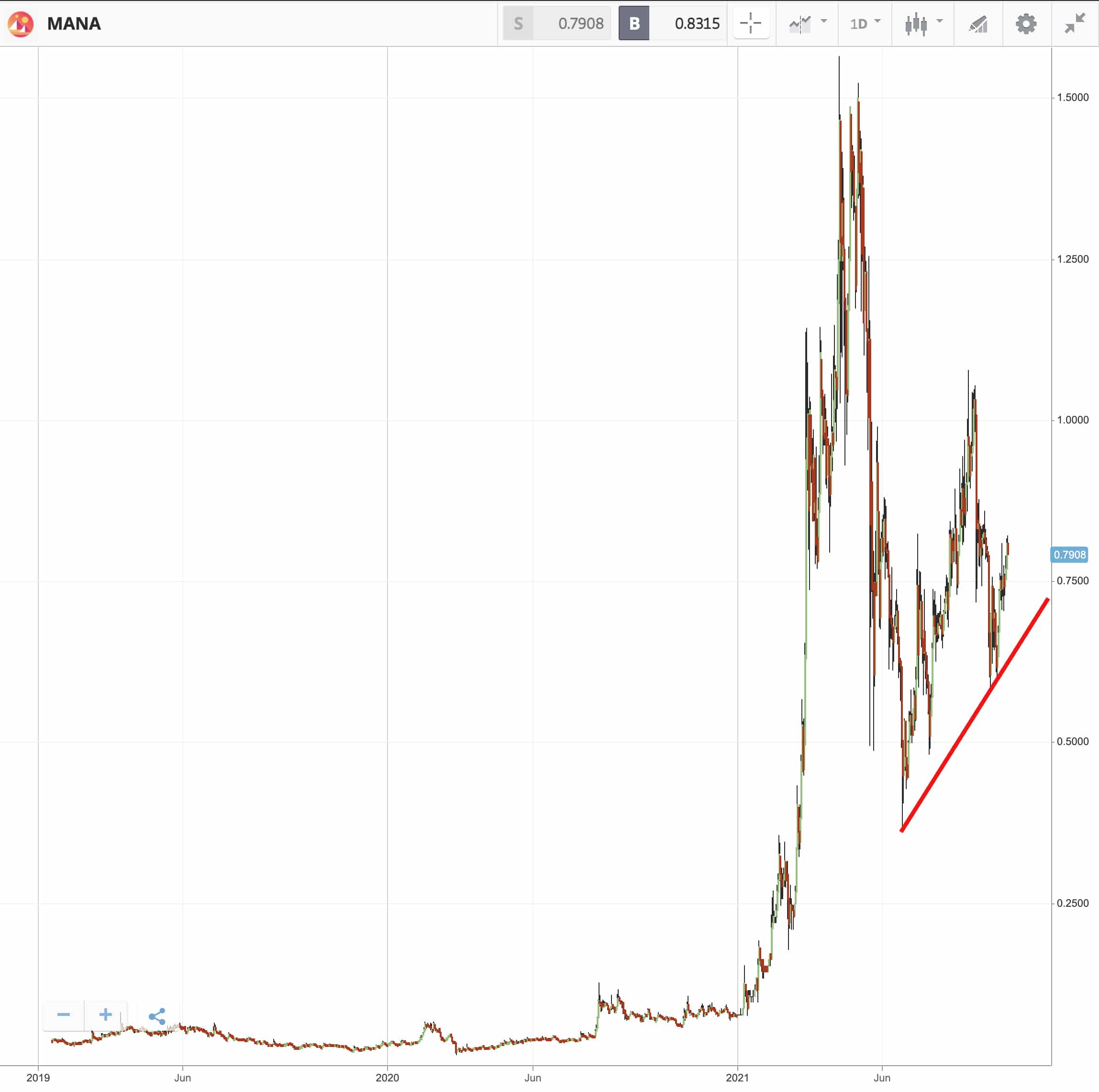

Living in Australia and want to learn how to buy Decentraland (MANA)? The Ethereum-based crypto of the virtual world Decentraland has rocketed in price this year from under $0.08 USD in December 2020 to an All-Time-High (ATH) of $1.60 USD in May 2021. That’s a 2000% price increase in just 6 months.

Here we present a swift four-step strategy to get your hands on Decentraland with a reputable broker. What’s more, we run down the strengths and weaknesses of Decentraland as a potential addition to your crypto portfolio.

Table of Contents

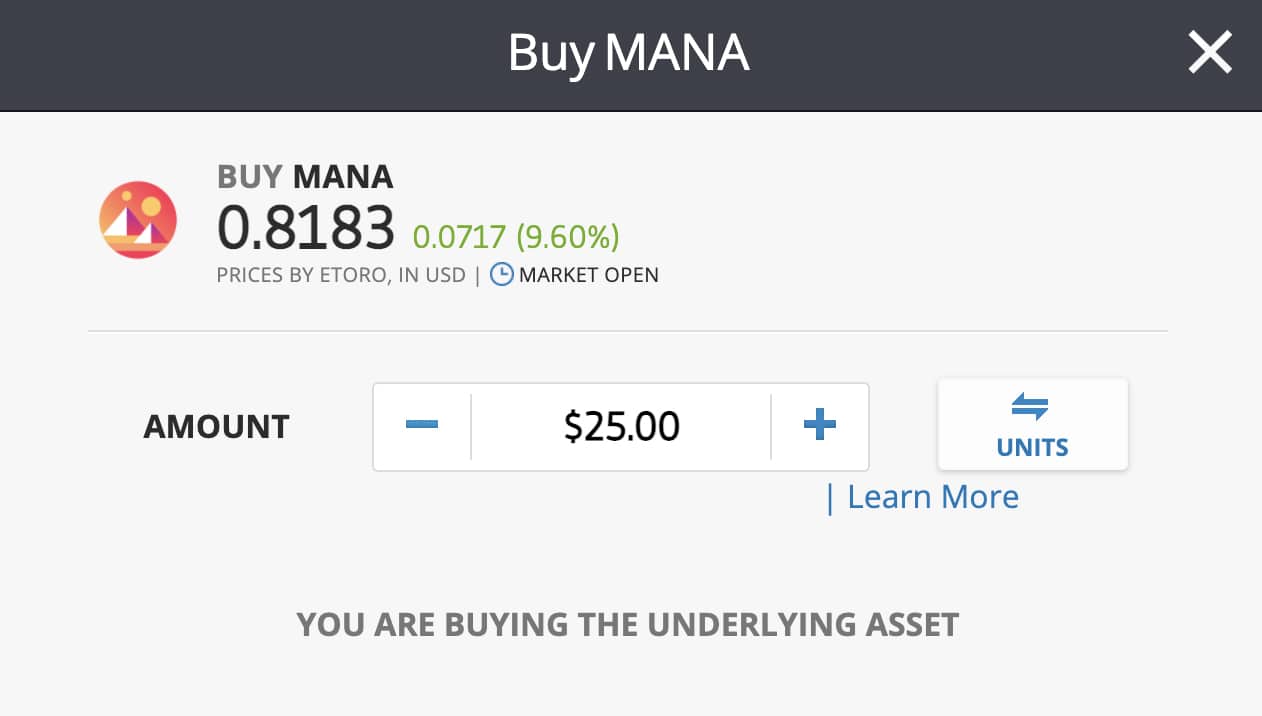

With the eToro trading platform, you need to take just four simple steps to purchase Decentraland (MANA).

MANA is the currency that powers online metaverse Decentraland. In this virtual world, users can buy land (called LAND) and develop real estate. The metaverse is fully owned by its user-base, and everything tradeable is a Non-Fungible Token (NFT). There are 7 good reasons to buy Decentraland (MANA):

From Australia, you have the choice to buy Decentraland from a broker or from an exchange. Exchanges – like Binance and Kraken – generally offer lower fees. But often with exchanges, the complexity of offerings and even the user interface itself is baffling. What’s worse, exchanges are generally not regulated. That means you have nobody to complain to if your crypto gets stolen, or if there’s another serious problem with the service you receive.

Stick with brokers! With a broker, you can find stringent regulations that will keep you safe when you buy Decentraland. What could be more important?

The larger the user-base, the more reliable the service: that’s a good rule to follow when you are choosing a broker. Boasting regulation with the Cyprus Securities & Exchange Commission (CySEC), the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), it is no wonder that global broker eToro has attracted 20 million members.

eToro has spent 14 years since its creation in 2007 on building a service that works simply and safely for investors of all types. As well as cryptos like Decentraland, there are stocks, ETFs, indices, commodities, forex and crypto on offer.

From Australia, you can buy your Decentraland with eToro with a couple of clicks. Decentraland has over 270,000 followers on eToro, with 1.85% of all eToro users holding the asset. There are 31 other cryptos on offer, as well as a clutch of crypto-pairs.

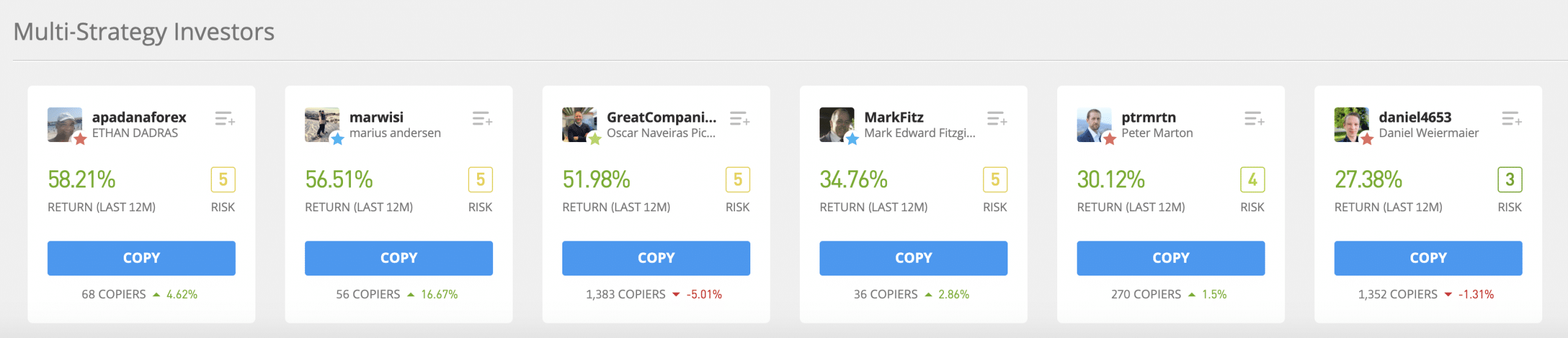

If you want to branch out from just buying Decentraland, consider eToro’s proprietary CopyTrader service. With it, you can copy successful investors for free. You can use CopyTrader to set aside some funds and review traders by stats on how well their portfolio has performed. Pick one (or several) traders and the software will automatically copy their trades in real-time with your money. You can set stop losses to avoid losing too much in the event of a disaster.

For crypto purchases like buying Decentraland from Australia, eToro charges no fees other than the spread between buying and selling price. Unlike with other brokers, there are no transaction fees on top. All you need to factor in are a couple of non-trading fees:

If you buy your Decentraland with eToro:

eToro — Decentraland Fees

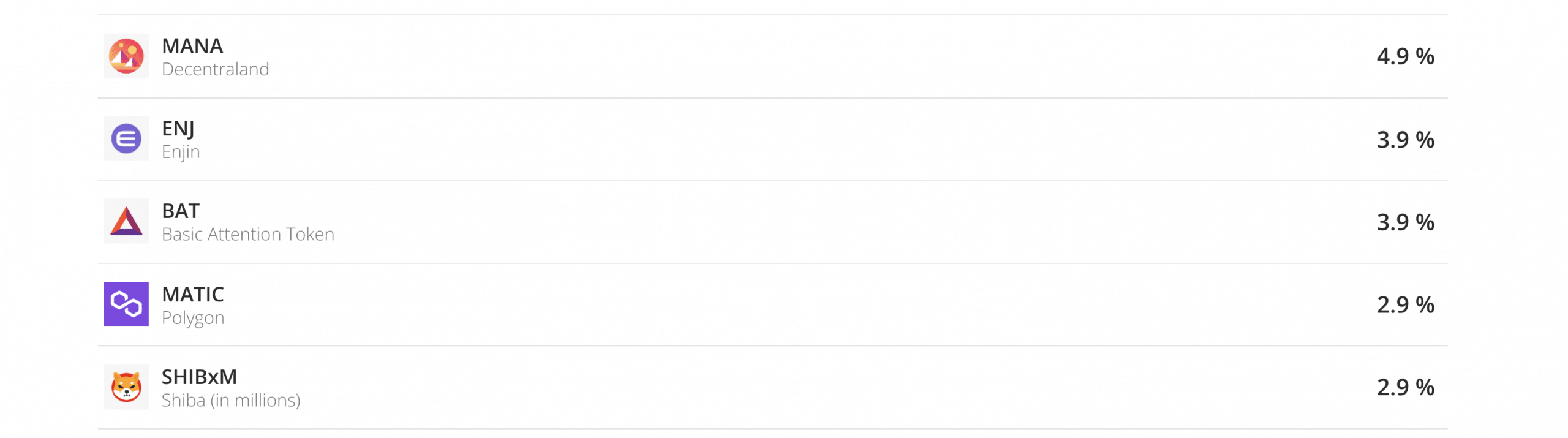

eToro charges only a spread fee on crypto transactions, including Decentraland. The spread fee for Decentraland is 4.9%.

Does that mean you get charged 4.9% on the spread between buying and selling prices that you are offered? No. What eToro mean by ‘spread fee’ is the spread itself. 4.9% is the spread, expressed as a percentage of the buying price. There is no other charge.

So, eToro expresses the size of the spread as a percentage of the buying price. This percentage is then subtracted from the buying price to arrive at the selling price. The difference between the two prices is the spread.

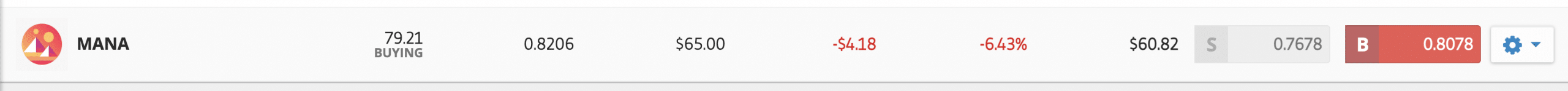

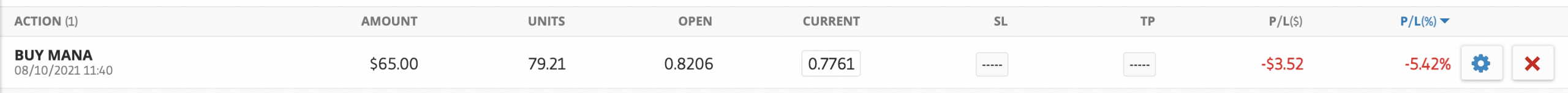

Here’s a real-world example of a Decentraland (MANA) holding in an eToro portfolio:

Look to the right of the strip above. Ignore everything but the two boxes, one grey and one red, on the right.

In the red box, the Buy (B) price is $0.8078 USD.

In the grey box, the Sell (S) price is $0.7678 USD.

The Spread = B minus S = $0.04 USD.

The Spread = 4.9% of the Buy Price.

By offering a spread between the buying and selling prices available for a particular asset, eToro are not doing anything new. ‘Bid/ask spreads’ have been an established part of market-making for as long as stock markets have been around. It is the only way a broker can cover their costs. To be utterly transparent to traders, eToro highlights the spread as a ‘fee’ that needs to be factored in.

Here is another way of looking at eToro’s spread fee on Decentraland:

eToro Spread Fee on Decentraland (MANA) – Example

| Your initial investment: | $100 USD |

| Sample Decentraland ask (buy) price: | $1.00 USD |

| Your position size: | 100 Decentraland units |

| eToro typical spread for Decentraland: | 4.9% |

| Total spread fee for a round trip of Decentraland buy and sell: | = 4.9% (spread fee) * $1.00 USD (Decentraland buy price) * 100 (your position size) = $4.9 USD. |

Wide spreads apply to cryptos that have lower trading volumes. Along with crypto Maker (BKR), Decentraland (MANA) attracts the highest eToro current crypto spread fee because of its relatively low trading volume on global markets.

eToro’s spread percentage is very low for cryptos that have high liquidity. A 0.75% eToro spread fee applies, for example, to market-leading Bitcoin (BTC), which claims 40% of the total crypto market and boasts the highest market capitalisation. A 1.9% spread fee applies to other coins with high trading volumes, such as Ethereum (ETH), Litecoin (LTC) and Bitcoin Cash (BCH).

eToro’s spread fees generally don’t change. But, if the liquidity of a crypto does dramatically change, expect the spread fee to adjust too.

Pros

Cons

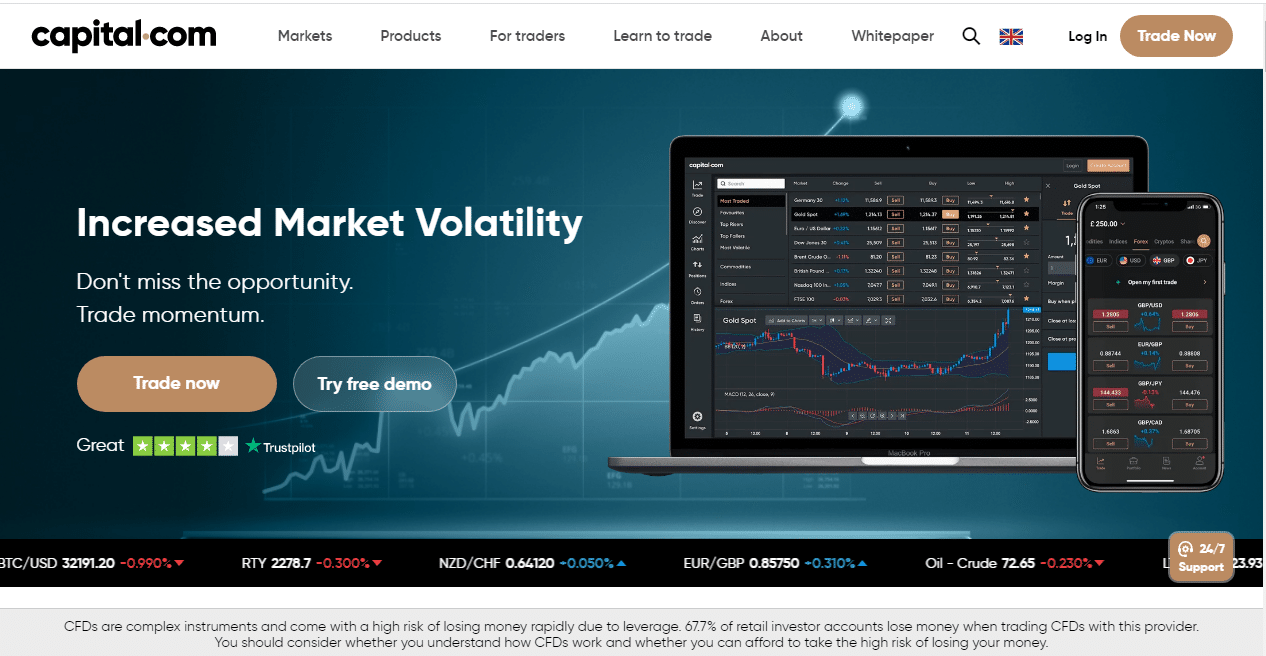

If you are an Australian investor with a debit card, then US exchange Coinbase can help you buy Decentraland. A 3.99% trading fee applies on any debit card transaction. Coinbase does not currently offer any other means of payment for Australian investors other than debit card.

A 0.5% spread fee will also apply to your Decentraland purchase. Combined with the debit card fee of 3.99%, this makes for a total fee of 4.49% on the price of your Decentraland. You can make a minimum trade of as little as $2 USD, but – as an Australian investor – you will not be able to sell your Decentraland back to Coinbase. What you can do is to keep it in a Coinbase wallet, or transfer it to your own crypto-wallet.

Fees and limited options for Australian investors aside, Coinbase offers some big advantages in the form of over 50 cryptos to invest in, US regulation, reasonable security and an established user-base of 56 million investors.

Pros

Cons

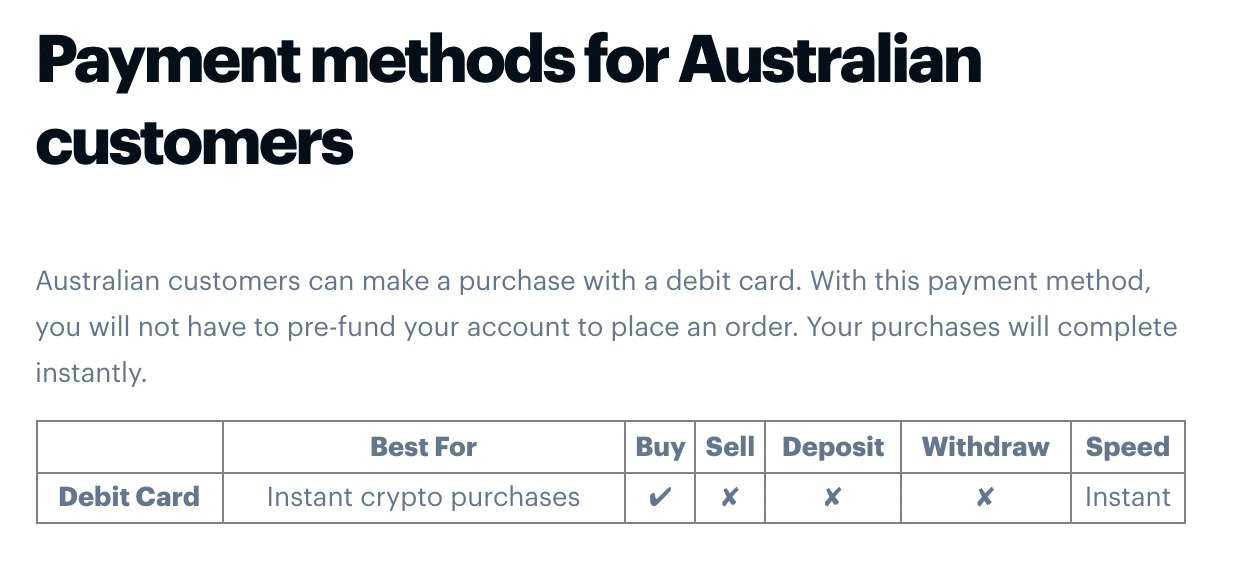

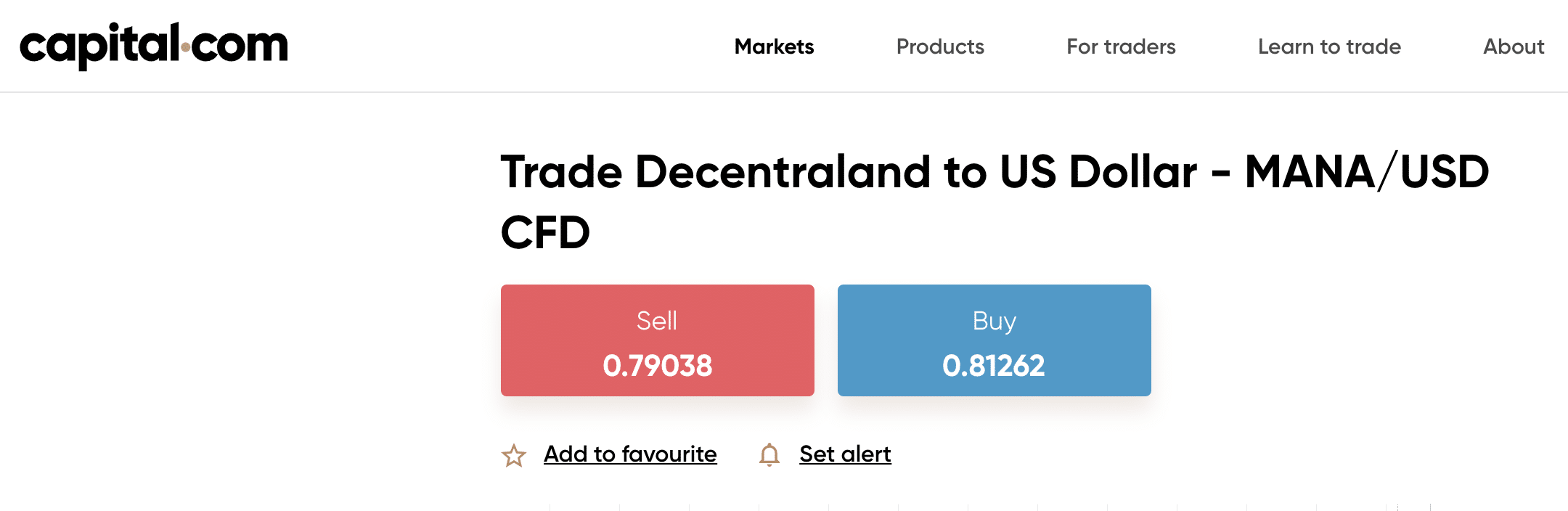

In 2021, CFD broker Capital.com opened to the Australian market. Trading is regulated by the Australian Securities and Investments Commission (ASIC) and a Capital.com office has opened in Melbourne.

Capital.com only offers CFDs (Contracts-for-Difference). This means you will never own the Decentraland that you buy. Rather, you will enter into a contract with Capital.com to be exposed to changes in the price of Decentraland. As a dedicated CFD broker, Capital.com provide leveraged trades and margin accounts. This makes the broker great for seasoned investors, but newbies should stick with eToro.

Capital.com organise their crypto CFDs in currency pairs. The simplest way to purchase exposure to Decentraland is to buy a Decentraland/USD pair. This means you will benefit by the difference in price between Decentraland (MANA) and the USD.

Capital.com will charge both a spread fee and an overnight fee on this trade, but does not charge a commission fee.

Australian investors can deposit funds with bank transfer, Visa/Mastercard/Maestro and Apple Pay.

Note that CFDs on cryptos are considered so risky that they are banned in the UK, for example. That’s because, with CFDs, you can often use margin trading to borrow money from your broker and increase your relative gains and losses. The notorious volatility of the crypto sector makes this margin trading especially dangerous. Capital.com offers a margin guarantee, which means you cannot lose more than is in your account. But you can lose it all. Margin trading remains a definite no-no for crypto beginners.

Pros

Cons

With over 500 cryptos – including Decentraland – Binance is the world’s biggest crypto exchange.

Binance once offered anonymous trading. But recently Binance has brought in a number of KYC (Know Your Customer) protocols. This means you will have to sign up formally, using personal information, as for a broker.

You can use PayID/Osko to deposit Australian Dollars (AUD) into your Binance account – once you have verified your ID. You can also buy crypto instantly with debit/credit card. Into your Binance wallet, you can also deposit a number of cryptocurrencies to trade with. Australian customers will be pleased to hear that Binance offers dedicated help pages for Australia-related issues.

Binance has a reputation for offering some of the best fees around. It offers a tiered fee structure, which takes into account how much you have traded with Binance in the last 30 days as well as how much of Binance’s own crypto, BNB, you hold. As a first-time investor with Binance, expect a fee of 0.1% on your trade.

Pros

Cons

Based in California, Kraken is a crypto exchange that permits Australian investors to purchase Decentraland with AUD. Using PayID/Osko, you can deposit AUD into your Kraken account (no fee). With an intermediate/advanced account, you can use a credit card to purchase cryptos instantly (1.5% transaction fee + €0.25 card fee).

To purchase Decentraland with other cryptocurrencies you have imported into Kraken, you need only supply a few personal details. But to buy Decentraland with fiat currency (ie. AUD) you must submit to Kraken’s full verification process.

As with the exchange Binance, Kraken uses a tiered fee structure based on how much trading you have done with the exchange in the last 30 days. As a newcomer to Kraken, you can expect a minimum charge of 0.26% on your Decentraland purchase.

Kraken has extended its service to Australia as a result of acquiring long-running Australian exchange Bit Trade in January 2020.

Pros

Cons

You only need to take four steps to buy Decentraland from Australia with eToro.

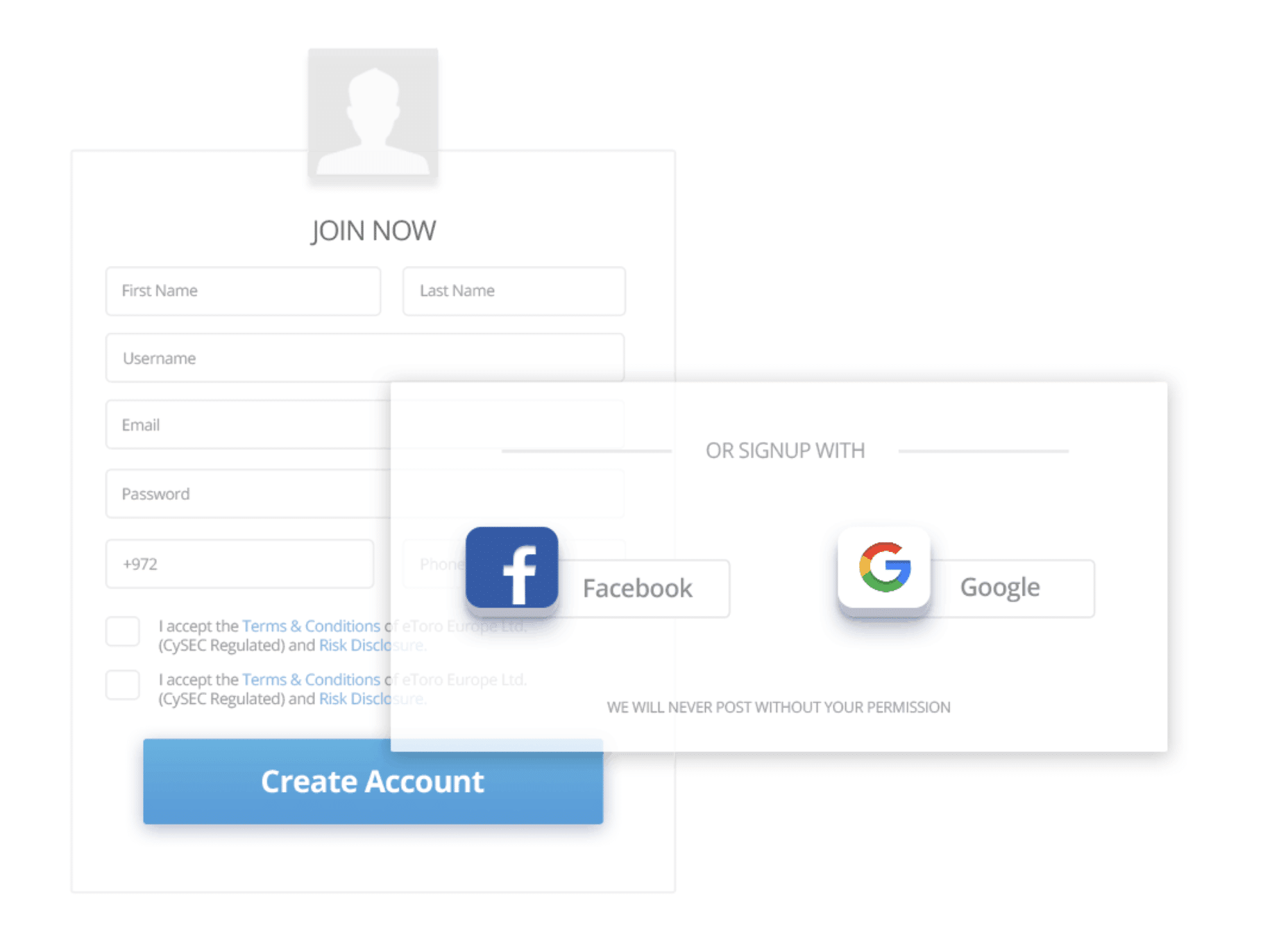

Navigate to the eToro website and fill out some simple details. Or sign-up via Facebook or Google.

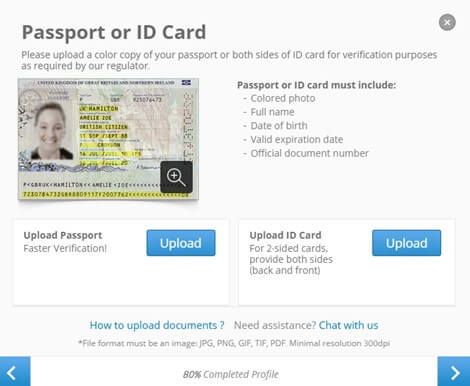

Step 2: Verify Your Account & Upload Your ID

You can upload a scan of your passport or ID card. Or eToro software will scan it for you.

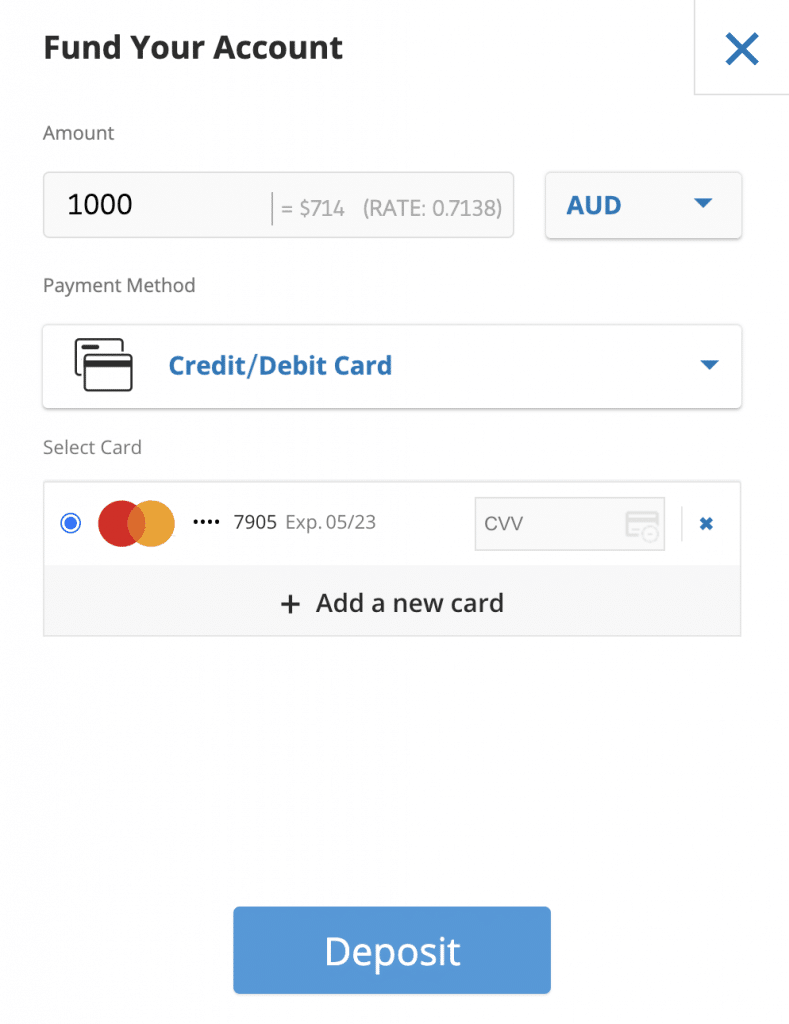

Australian dollars (AUD) are accepted by eToro as a deposit currency. Once inside your eToro account, depress the blue ‘Deposit funds’ button at the bottom left of your screen. This brings up the window above. Simply type in the preferred amount of deposit (minimum $50 USD equivalent). Then select Australian Dollars (AUD) as the preferred currency, or another if you prefer. Then select payment method.

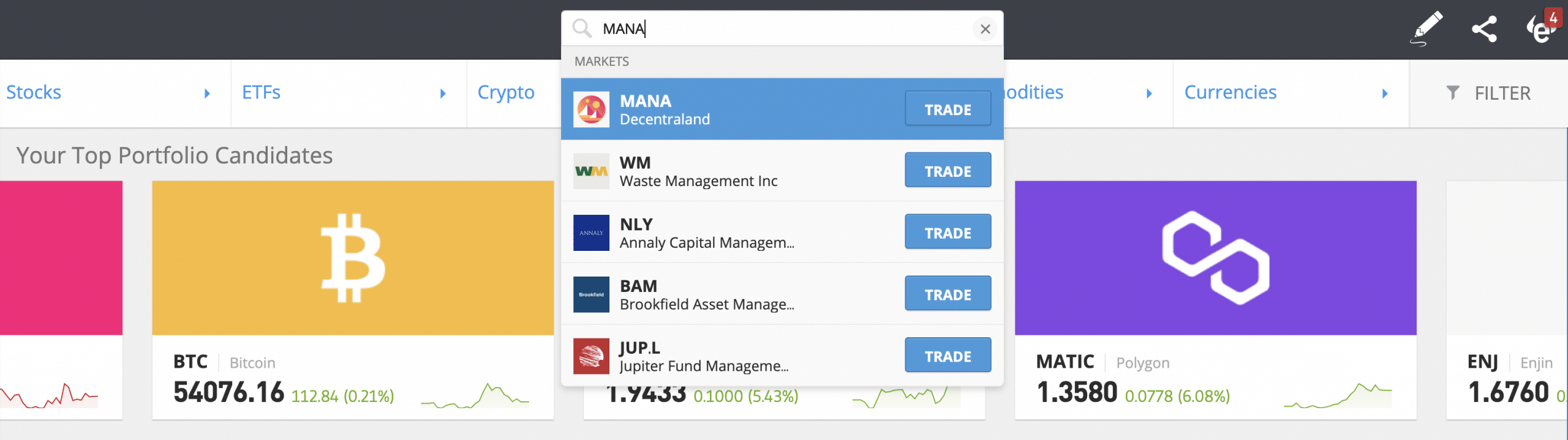

In eToro, input ‘MANA’ into the top search bar.

Press the blue TRADE button. This will take you to your buying options:

Note that eToro trades are denominated in USD. But you can configure your account figures to show in AUD.

Decentraland (MANA) experienced a price explosion in the first six months of 2021. From its all-time-low (ATL), the price of MANA rose by 3500% and hit an all-time-high (ATH) of $1.60 in May. Then it fell and found support below $0.5 USD in June. Now Decentraland, sitting around the $0.80 USD mark, is on an upwards trajectory.

The main risk of buying Decentraland (MANA) is that other metaverses which offer virtual land to buy – like The Sandbox, Cryptovoxels, and Somnium Space – will become more popular than it. The Sandbox has SAND as its in-world currency. Cryptovoxels uses ETH (Ethereum). The Somnium Space has CUBE. Just like in the real world, interest in particular real-estate markets wax and wane. Interest in MANA might recede.

There is also the risk that, after the initial flurry of interest in Decentraland in the first six months of 2021, the price will never again hit the heights it did. Of course, if Decentraland becomes the virtual real-estate market of global choice, MANA’s ATH of $1.60 will seem like a drop in the ocean.

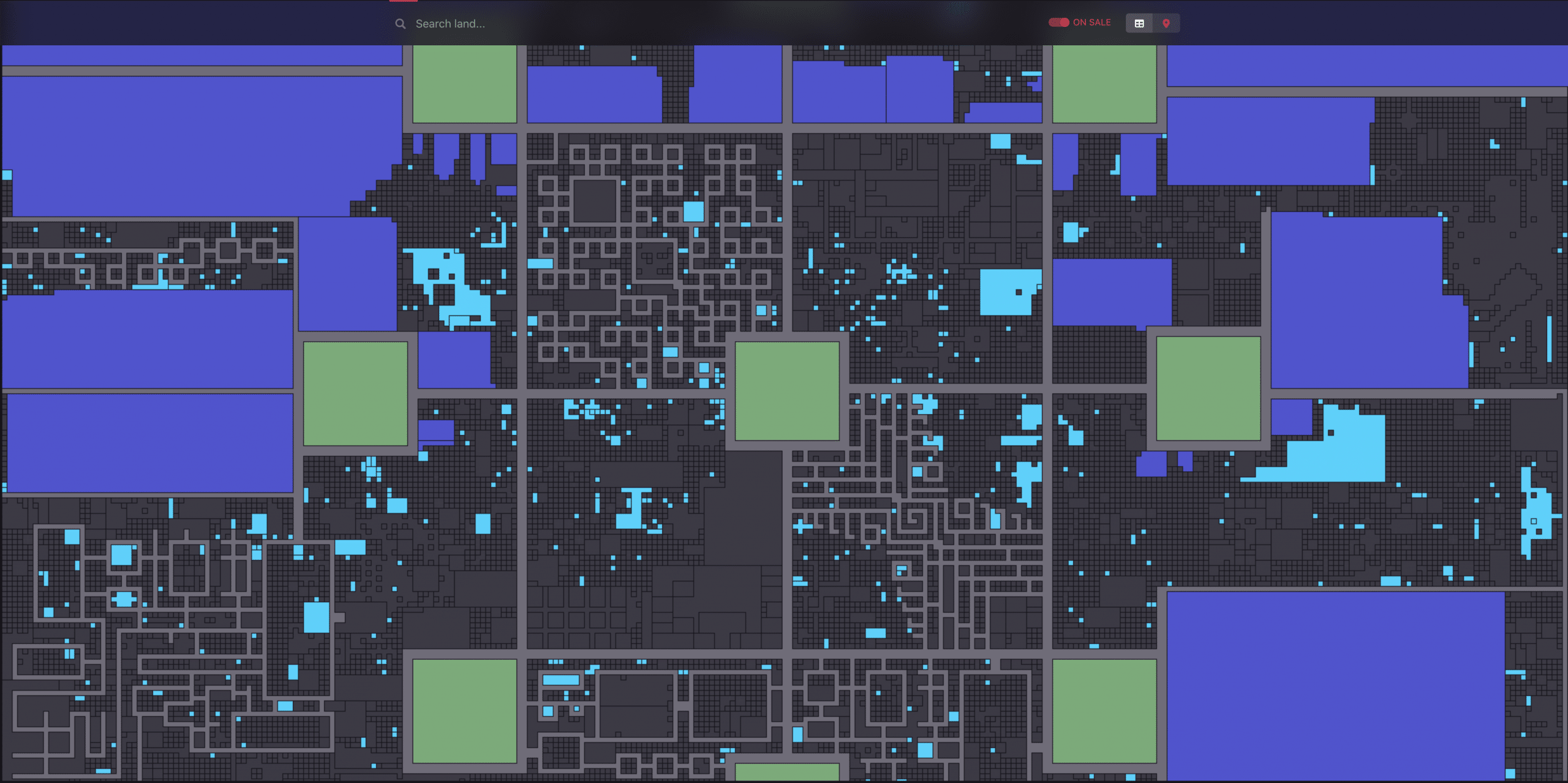

Underpinning positive price projections for Decentraland (MANA) is the fact that the available parcels of land in Decentraland are limited to 90,000. Below is an overview of the Decentraland virtual space. Available land parcels are shown as dots coloured cyan (light blue).

As a metaverse, Decentraland offers limitless opportunities for virtual interactions like music, art and gaming. Ibizan super club Amnesia, for example, are taking part in a four-day festival of music and culture in Decentraland in October, 2021. All this activity involves the currency MANA, which is what investors can trade via brokers and exchanges for fiat currencies – like the Australian Dollar – as well as for other cryptocurrencies.

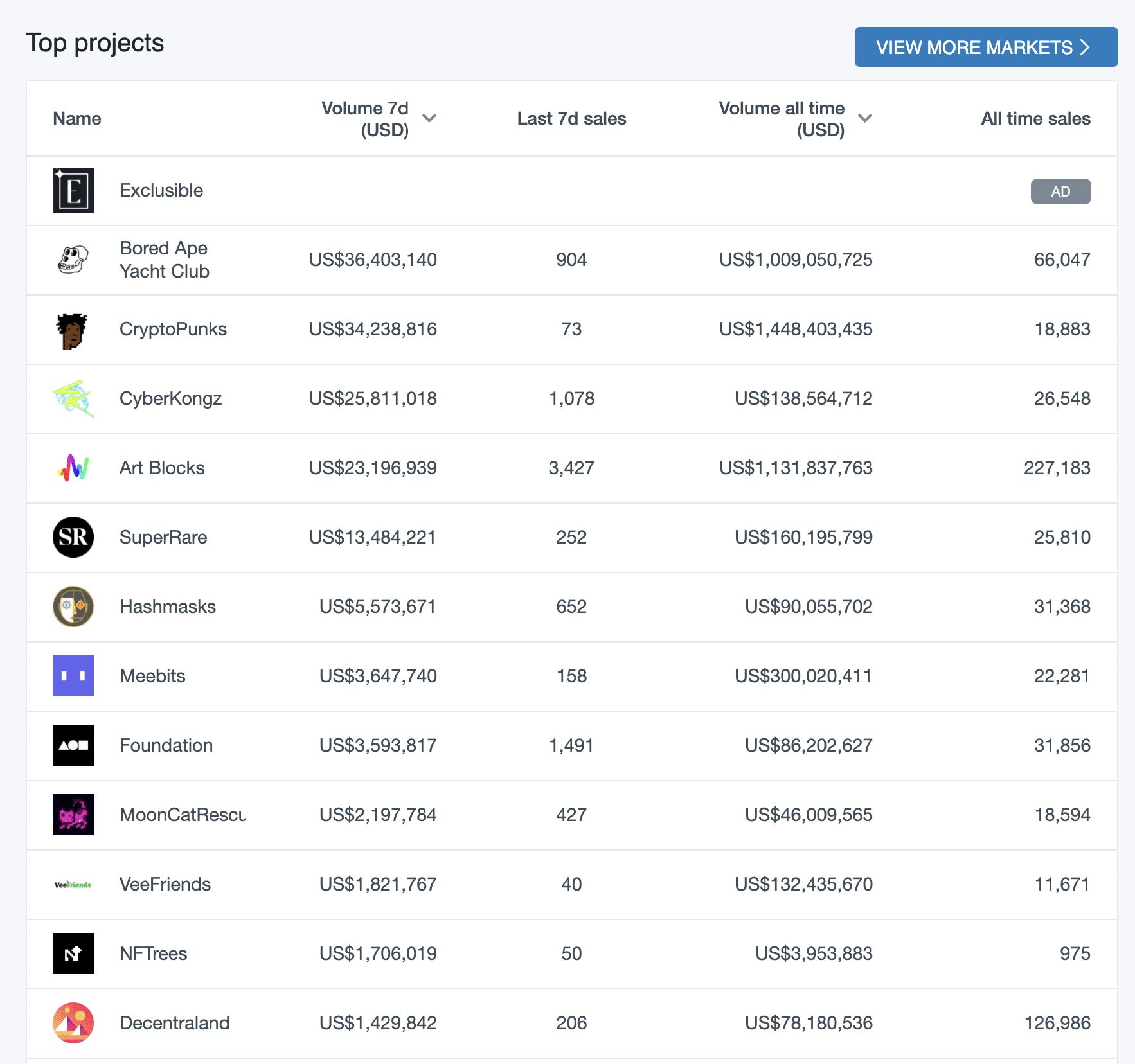

In the last seven days, Decentraland has hosted the twelfth-highest sales volume in all online Non-fungible Token (NFT) marketplaces. That’s seven-day sales topping £1.4m USD. Decentraland boasts an all-time sales capitalisation of $78m USD and almost 127,000 transactions.

Is It Always Safe To Invest In Cryptocurrency?

Given that there are 9,000+ cryptos in existence in a sector worth over $2 trillion, it is unlikely that the crypto sector is going to implode. This has always been the fear of those with a bearish view. Increasingly, though, we are seeing real-world businesses investing in the technologies underpinning individual cryptos (like the world of Decentraland in which MANA is the currency). And we are seeing institutions – like mercahnt banks and hedge funds – take a new interest in cryptos as a means of hedging against fiat currency inflation as well as benefitting from price appreciation.

In eToro, selling Decentraland could not be simpler. You navigate to your portfolio and press the red cross at the right of your Decentraland listing. That will open your selling options. It takes seconds.

Conclusion

Already 180,000 people follow Decentraland on Twitter. Decentraland (MANA) is likely to remain a popular crypto. That’s because the Decentraland community voted to progressively reduce the supply of MANA with the aim of increasing demand for it. Every time a parcel of LAND, an avatar or a wearable is sold on Decentraland, a 2.5% MANA tax applies. This fee is then burnt – ie. destroyed forever. Already, 600 million MANA of the original maximum supply of 2.8 billion has been burnt as a result.

When it comes to buying Decentraland (MANA), an online broker is a safer bet than an exchange. And eToro, as the biggest online broker, offers levels of regulation, choice and simplicity that other brokers have yet to match.