Invest in IOTA: How to Invest in IOTA For Beginners

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

IOTA is a distributed ledger that adopts an approach different from the system used by conventional blockchains. The protocol focuses on providing super-fast transaction speeds and the expansion of the Internet of Things (IoT) ecosystem.

With the lofty mission set by the IOTA team, developers and investors in the market are interested in how the protocol will impact the IoT arena in the long run. We have prepared this guide to discuss all you need to know about how to invest in IOTA — inclusive of the best brokers to the risks involved.

Table of Contents

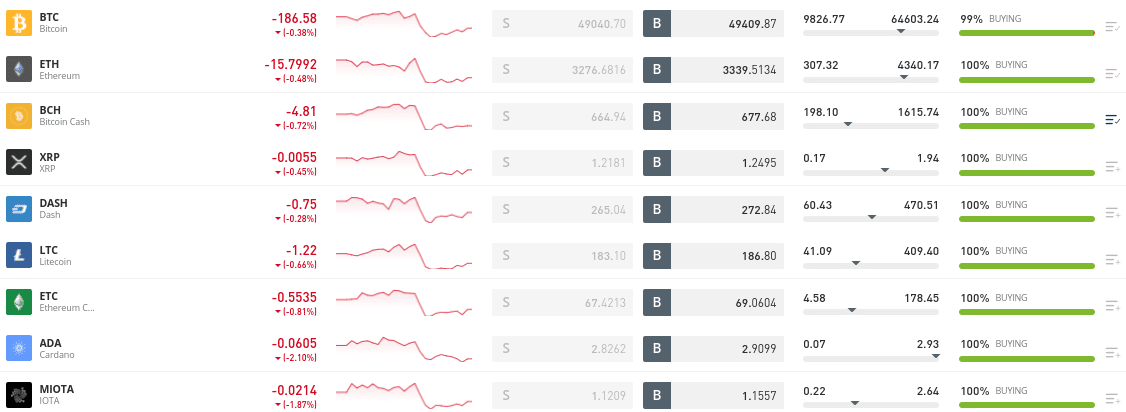

As a distributed ledger, IOTA seeks to offer great execution speeds, eliminating the congestion that comes with first-generation blockchains. This use case has contributed to the token’s growth in the market. So, you might find the coin listed on several investment platforms.

Below we have listed a selection of the best brokers that allow you to invest in IOTA safely.

These platforms have been extensively reviewed further down in this How to Invest in IOTA Guide

Suppose you have a general understanding of the cryptocurrency industry. If so, you might just need a brief overview of how to invest in IOTA.

In that case, this quickfire guide takes you through the steps involved in buying the token in under five minutes!

With the steps discussed above, you’ve just learned the process required to invest in IOTA. All in all, eToro has a friendly design that makes it easy to complete the steps within just a few minutes.

Cryptoassets are highly volatile unregulated investment products. Proceed at your own risk.

Smart investors will be concerned about the quality of their experience when investing in digital currencies. As such, when assessing different brokers that allow you to invest in IOTA, you’ll want to choose a platform that will offer you a safe and satisfactory service.

After all, there are numerous investment platforms in the cryptocurrency marketplace that should be avoided — as they might be unregulated or have a high-fee structure.

In this section, we discuss the features of the top IOTA brokers in the market, following our strict assessment of their services in terms of cost-effectiveness, user-friendliness, regulation, and more.

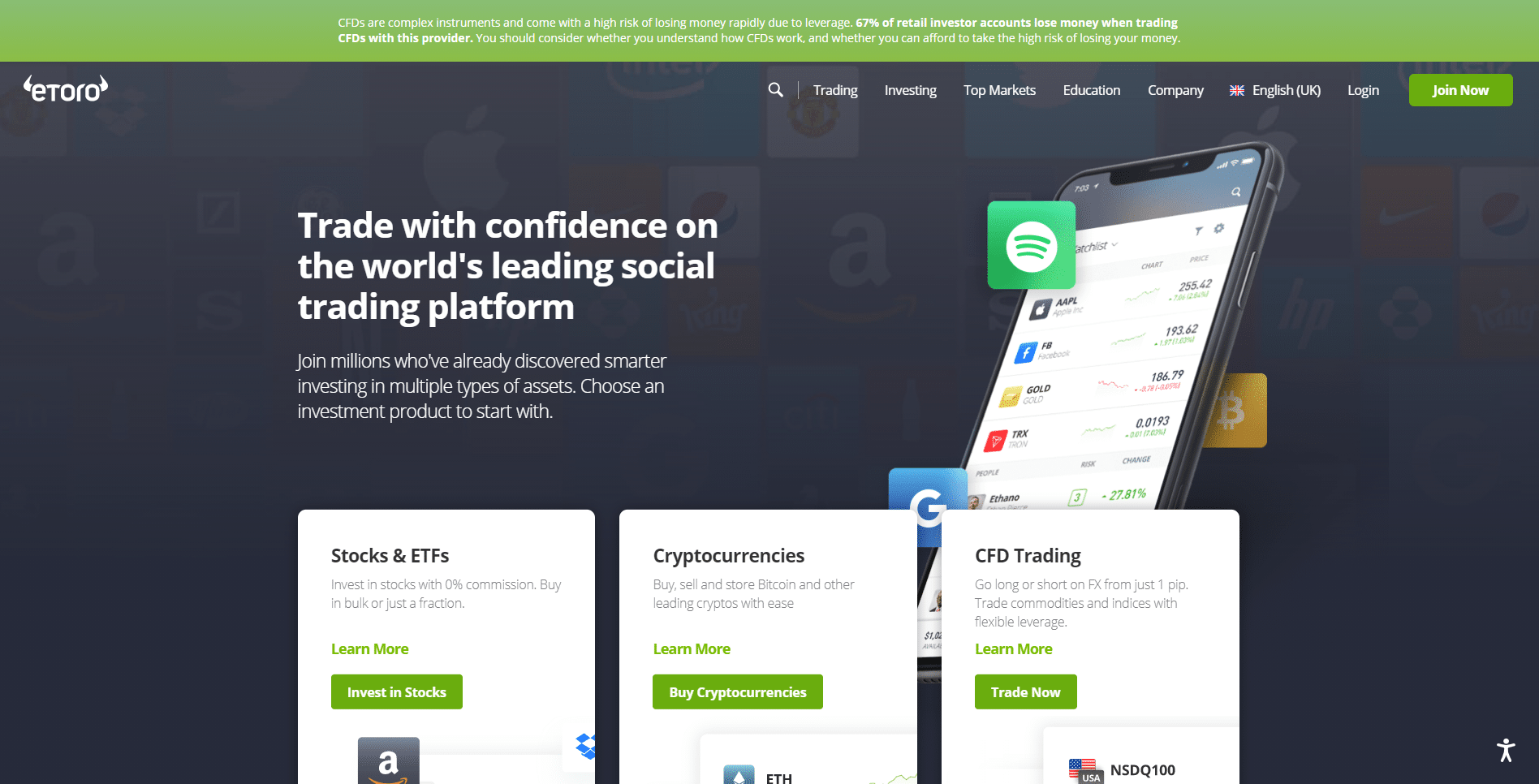

With over 20 million users, eToro has grown to become a reputable investment platform through which you can buy, store, and sell digital tokens. Some of the listed markets on the broker include Chainlink, Cosmos, EOS, Ripple, Stellar, and of course, IOTA. To begin your investment journey with this broker, you don’t need to have prior experience – as the platform is designed with a user-friendly interface. Within five minutes, you can complete the end-to-end process of creating an account, making a deposit, and opening your IOTA investment.

Furthermore, a core feature that stands eToro out is that the broker is heavily regulated. The platform is licensed across different jurisdictions including the UK, US, Australia, and Cyprus. With more than four regulators behind the broker, eToro is mandated to operate with high levels of transparency, meaning the platform has no hidden fees. Since the broker is adequately regulated, you can invest in IOTA without worrying about safety – meaning that you will enjoy security over your funds.

Getting started on eToro also comes easy in terms of fees. eToro is a spread-only platform — which means that you won’t pay any variable commissions as opposed to brokers like Coinbase. On eToro, you simply need to cover the mark-up between the ‘ask’ and ‘bid’ price. Furthermore, the broker requires you to make a minimum deposit of just $200 ($50 for US clients), after which you can proceed to invest in IOTA from $25. In even better news, making a deposit on eToro costs a competitive 0.5% — and US investors incur no fee at all.

After purchasing your IOTA tokens, you don’t have to worry about getting a secure private wallet. This is because eToro offers personal wallet services, which you can leverage to store your tokens in a secure manner. This also makes it super easy to sell your IOTA tokens, as you can create an order for that purpose directly from within your portfolio. Therefore, as a beginner looking to invest in a stress-free manner, eToro is a top broker you might want to consider.

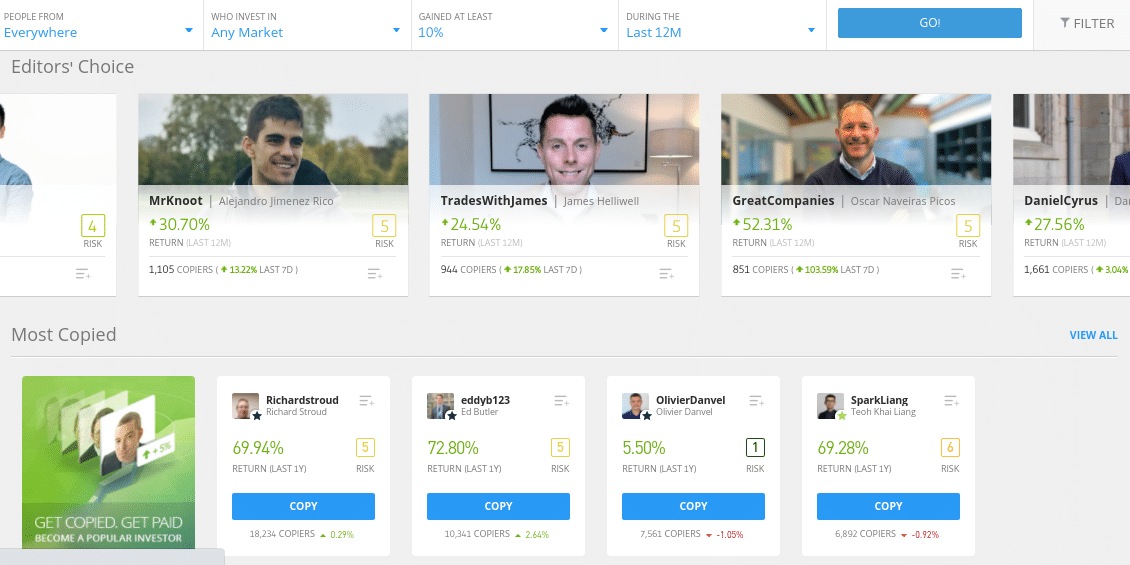

Finally, the broker provides you with tools and features you can leverage to have a seamless IOTA investment experience. For instance, you can choose to use the copy trading tool to invest in cryptocurrencies in a passive manner. Once you select an experienced investor, the broker will copy their positions and replicate them in your portfolio like-for-like. Additionally, eToro provides you with a social platform to interact with other investors. There is even a CryptoPortoflio – which gives you access to 16 digital currencies through a single trade.

Pros

Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

If you’re a newbie in the cryptocurrency industry, Coinbase is one of the best brokers you can use to invest in IOTA. Our research team found the broker to be super easy to use — as you need little knowledge to navigate the required steps while buying digital tokens on the platform. Notably, you’ll need to fulfill the KYC requirements of the platform – since it’s a regulated broker. For this purpose, you’ll be required to upload a selfie and your government-issued ID.

However, if you’re looking for a low-cost broker, Coinbase falls short in this regard. The pricing structure of the broker is a bit expensive — as you pay a transaction fee of 3.99% when you invest in IOTA using your debit or credit card. Therefore, as a beginner looking to invest on a budget, this will affect the potential returns on your investment. Nonetheless, Coinbase allows you to stay on top of the markets conveniently through the broker’s native mobile app, supported by both Android and iOS.

Another notable feature of the broker is its high priority for the security of users’ funds. You can elect to store your tokens in a vault for added safety – which comes with a 48-hour time-lock. Additionally, the broker has a two-factor authentication step to keep your account protected at all times. With this security feature, if you attempt to access your account from a different device, you’ll have to complete an extra verification step.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

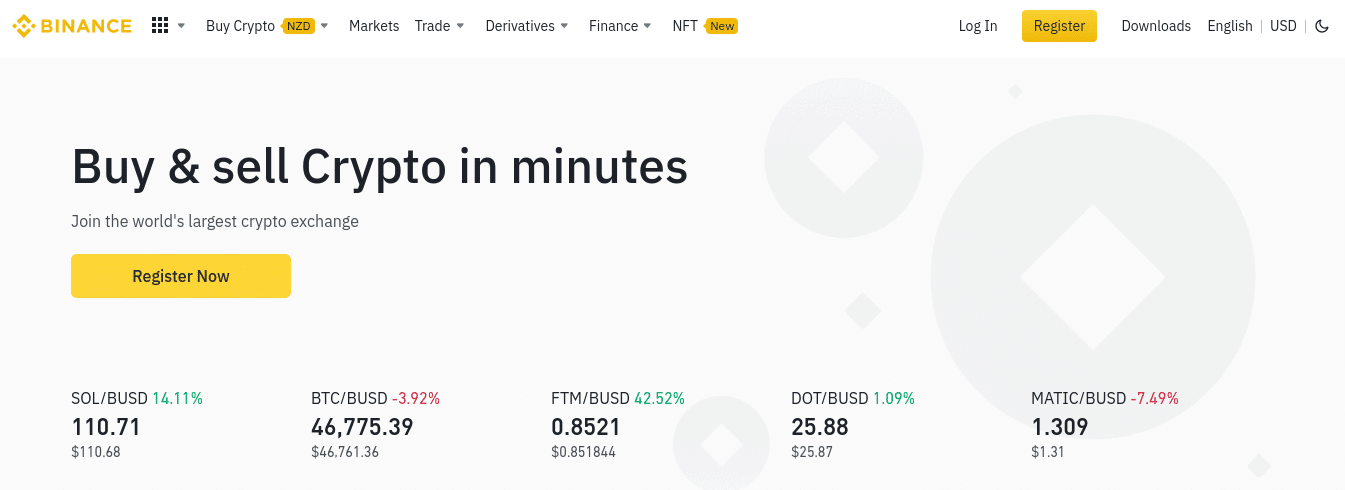

When you choose Binance as your online investment platform, you gain access to a wide range of cryptocurrency tokens that you can buy, sell, and trade. This includes Chainlink, Bitcoin, Litecoin, Stellar, IOTA, and hundreds more. However, to invest in IOTA through Binance, you’ll first have to buy a popular token like USDT. Then, you can exchange the USDT for IOTA, after which you can store your tokens safely.

Concerning storage facilities, Binance offers you numerous options in this regard. You can elect to store the tokens on the platform itself, meaning you don’t have to worry about looking after your private keys. Additionally, Binance stores the bulk of these tokens offline, which is a reputable method of keeping the coins super secure. However, if you don’t want to store your tokens on the platform, you can choose to move them to Trust Wallet, which is supported by Binance.

Notably, the markets you will be able to access and the amount of fees you’ll incur when using Binance are based on your location. For instance, Binance charges 0.5% for debit/credit card transactions if you’re from the US. Other regions, however, will typically pay more. Additionally, American investors can access just over 50 markets through the Binance US platform. However, those in other regions have access to hundreds of cryptocurrency tokens, providing a wider option for investment diversification.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

If you have a short-term trading plan for IOTA, eToro is a great broker for you to consider. With this platform, you can trade tokens without having to own them. Essentially, you trade cryptocurrencies based on their underlying value. This way, you don’t have to worry about getting a credible storage option for your IOTA tokens.

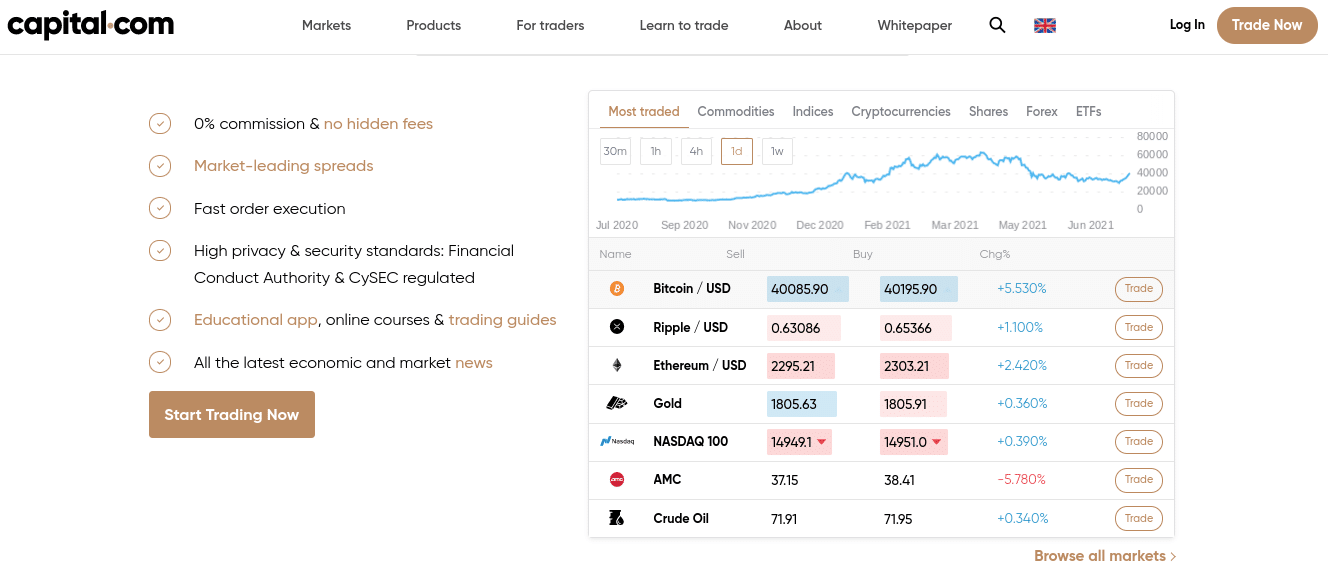

Although this appears sophisticated, Capital.com has a user-friendly interface that makes it seamless to use the platform. Additionally, if you’re looking to open trades with leverage, Capital.com also allows you to do just that. The broker provides varying leverage limits to investors based on their region. With leverage, you can open positions with more money than you have in your trading account.

Furthermore, the broker provides you access to over 200 digital tokens markets including IOTA. From our analysis of the broker in terms of its fee structure, Capital.com gets a superb score in this department. This is because you can trade IOTA – and all other supported markets, at 0% commission. Plus, the platform requires a minimum deposit of just $20 when using a debit/credit card. However, if you choose to add funds via a wire transfer, this minimum deposit requirement increases to $250.

Pros

Cons

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.25% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

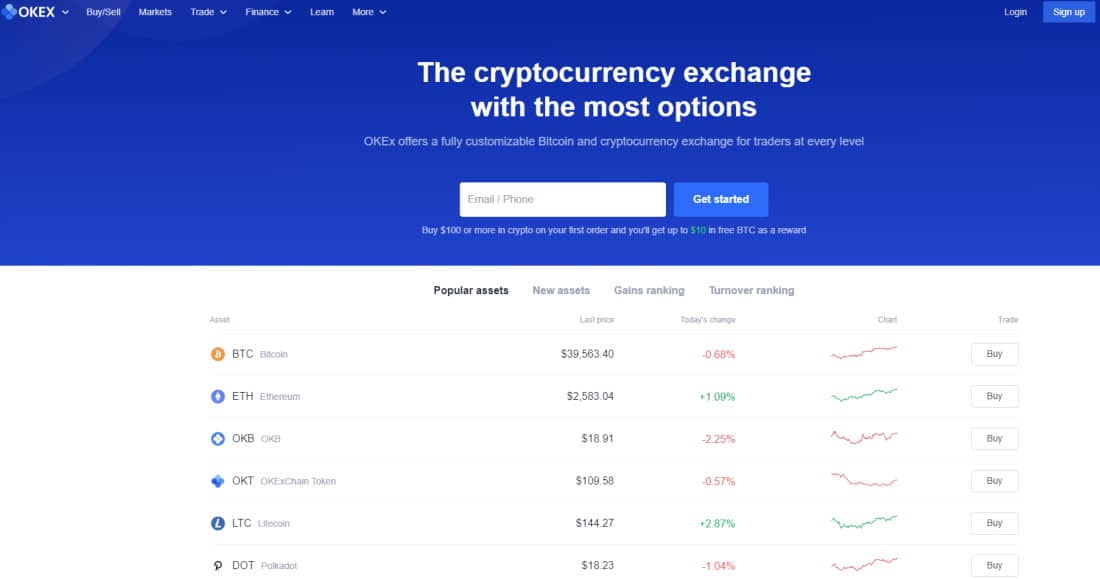

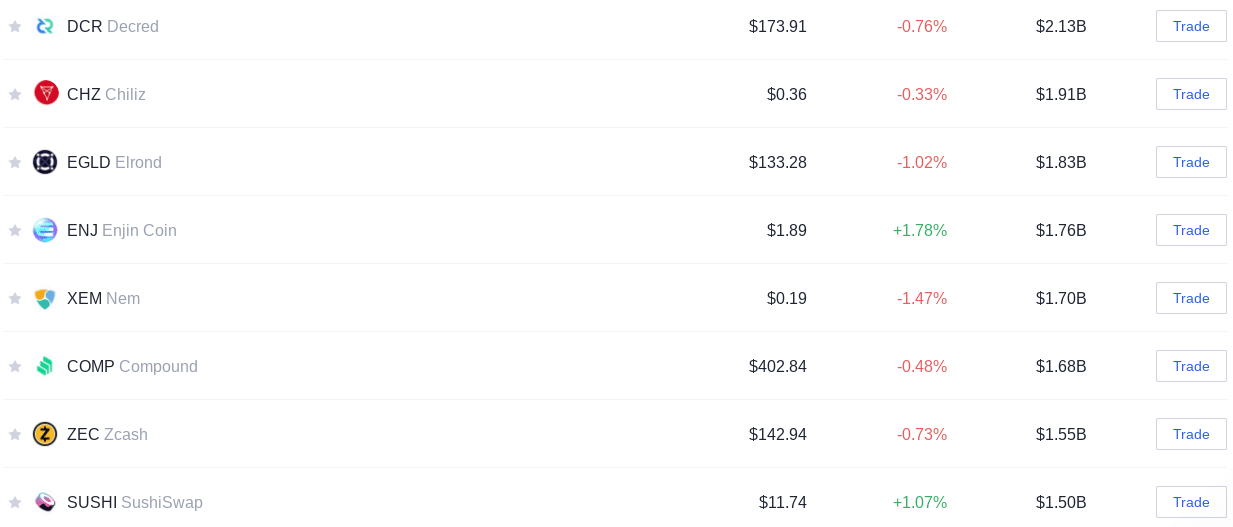

If you have some experience in the digital tokens industry, depositing cryptocurrency into an exchange should be an easy task. Suppose you hold some cryptocurrency tokens in an external wallet – you can exchange them for IOTA on OKEx. When you perform a crypto deposit, chances are that you’ll incur very low fees. Additionally, you likely won’t have to undertake an identity verification process.

In terms of the commission rates associated with exchanging digital tokens for IOTA, OKEx has a similar fee structure to Binance — as you’ll be charged just 0.10% on the transaction. To make the entire process convenient, OKEx has an easy-to-use buy/sell dashboard, which is suitable for newbies in the industry. The broker also provides educational resources that you can utilize to learn more about the markets.

Although unregulated, OKEx has been offering cryptocurrency trading services for more than 7 years. Over this period, the exchange has built a great reputation with approximately 20 million users globally. When you purchase your tokens through the exchange, you can decide to store them on the platform’s non-custodial wallet – which comes via a mobile app. This grants you complete control over your IOTA investment – since your private keys will only be accessible by you.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

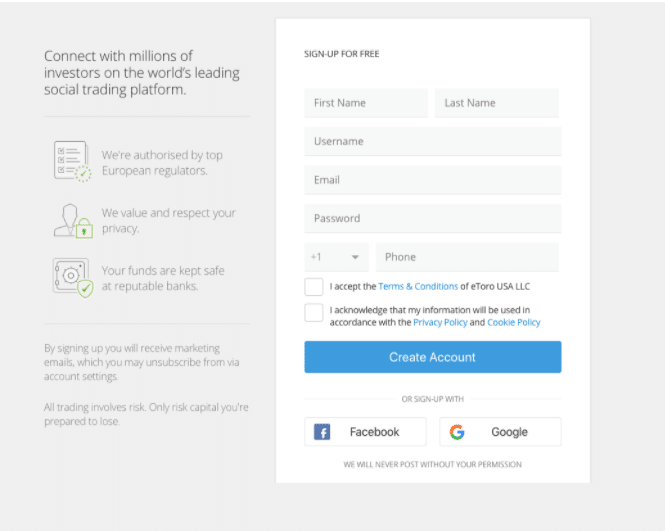

As an inexperienced investor, you will likely need an extensive discussion of the steps involved in using eToro to invest in IOTA. This detailed guide provides you with just that — as we have broken down each requirement to walk you through the IOTA investment process step-by-step.

eToro supports more than 30 cryptocurrencies including IOTA. However, to invest in any of these markets, you must first create an account.

This step will require you to provide some personal details such as your name, home address, contact information, and more. Then, choose a username/password for your account to complete the registration process.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

Once you create your account, eToro will require you to verify your identity before allowing you to invest on the platform. This verification process is a standard procedure and can be completed in under 2 minutes.

To complete this step, upload an ID issued by the government — which can be your passport, driver’s license, or any equivalent means of identification. Furthermore, you also need to provide a document that states your home address. eToro uses this as proof of residency.

Brokers often have varying minimum deposit requirements. On eToro, the minimum amount you can add to your account is $200. However, if you’re a US client, that amount is just $50.

After making this deposit, you can invest in IOTA from $25 upwards. To add funds, you can use any of the options supported by the broker – which includes:

Notably, if you want to invest in IOTA quickly, consider a payment option other than a wire transfer — as this method is slow to deliver your funds.

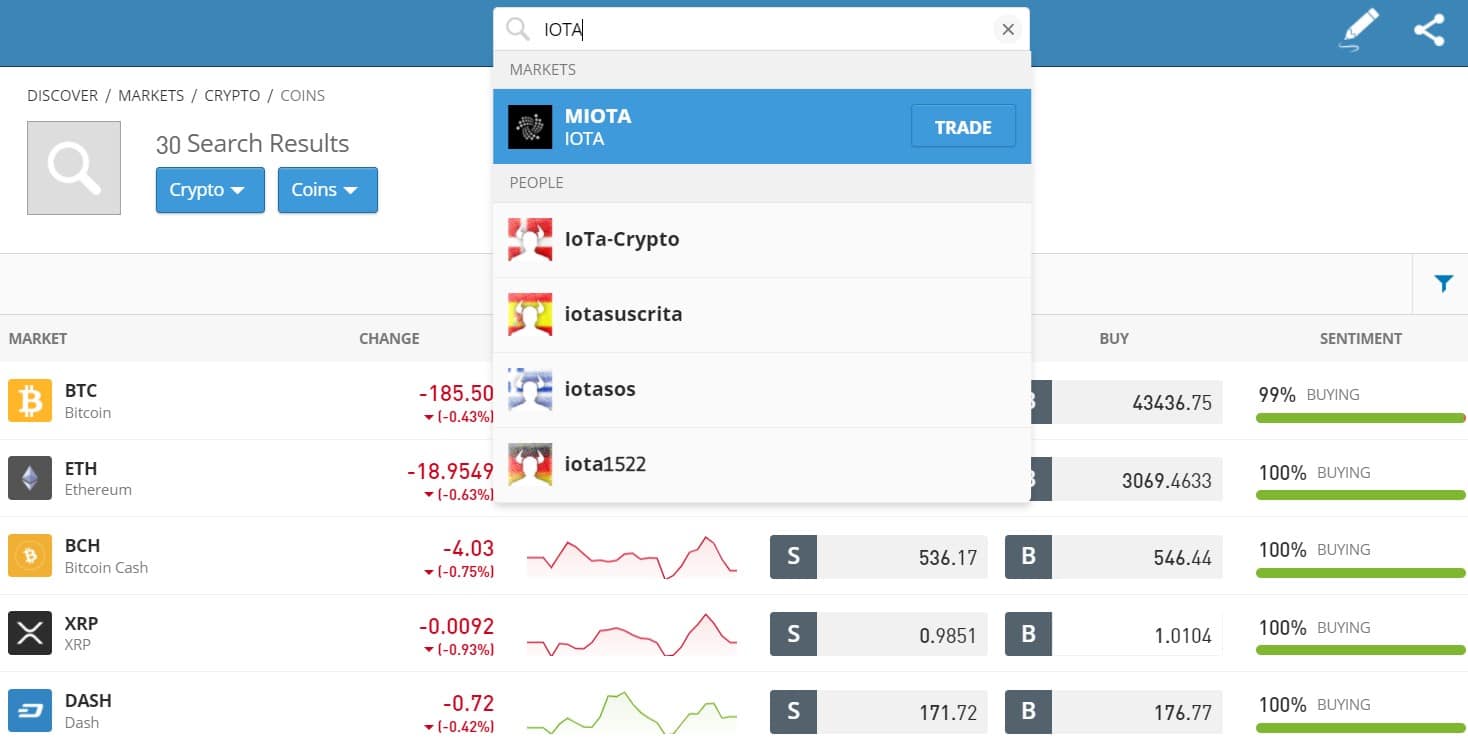

Next, go to your eToro dashboard and click on the search tab. Then, type ‘IOTA’ and pick the first option on the list.

Once you click ‘Trade,’ you’ll be taken to the final step of the IOTA investment process.

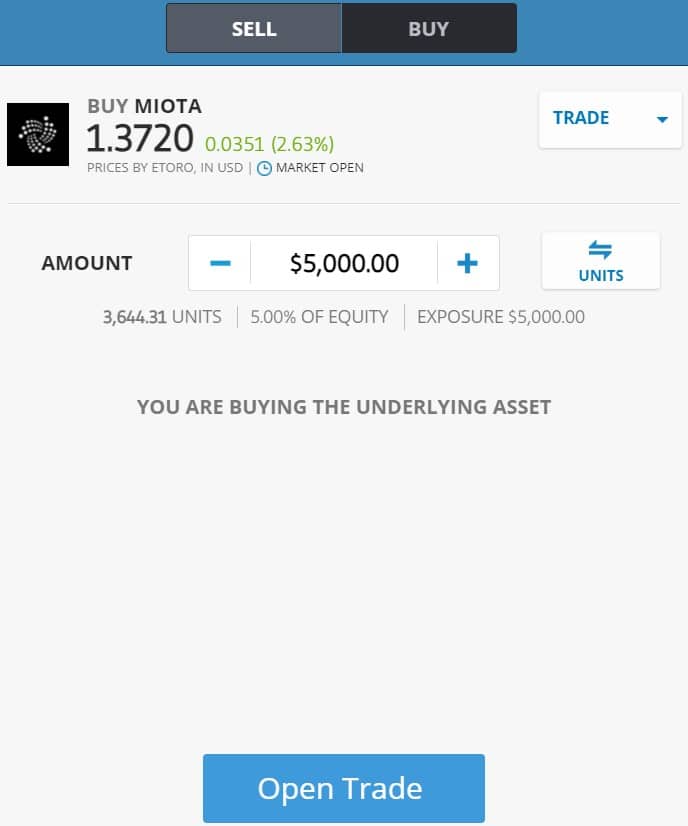

You are now on the IOTA order page. This is where you’ll input the amount of money you want to invest in IOTA. Since eToro’s minimum stake is $25, you can choose to open your investment an amount you are comfortable with, especially if you’re on a budget.

After entering the amount you wish to invest, confirm all relevant details, and click on “Open Trade.” Following that, you’ll be able to view your IOTA tokens from within your portfolio. Essentially, this means you’ve invested in the token and can hold on to your digital assets until you are ready to cash out!

You haven’t completely learned how to invest in IOTA until you know the required steps to cash out. After all, you’ll need to sell your tokens to realize the return on your IOTA investment.

Follow the steps below to get this done in under 2 minutes.

This entire process is seamless on eToro – because your tokens are stored in the broker’s in-built wallet. As such, you can sell them from there directly — saving you the stress of transferring your coins over from an external wallet.

The two prominent options through which you can invest in IOTA is either by using a broker and or a cryptocurrency exchange. We have discussed these two methods in the section below.

The first way to invest in IOTA is to use a broker. In most cases, brokers are regulated by leading financial institutions. For example, eToro is approved by the FCA, FINRA, SEC, and more.

On top of the features discussed above, a licensed broker like eToro will allow you to start investing in IOTA from just $25. This is highly suitable for you as a beginner looking to enter the IOTA market with minimal risks.

Alternatively, you can choose to use a cryptocurrency exchange. For some investors, this is an attractive option since certain cryptocurrency exchanges have a low-fee structure. Additionally, you can often trade on these platforms anonymously since you’re not required to upload your ID.

In fact, some cryptocurrency exchanges now have millions of users trading on their platforms. For instance, OKEx has more than 20 million user accounts. Nonetheless, these exchanges are unsafe for your IOTA investment journey – since there’s no regulatory body behind them. Therefore, you cannot completely ascertain the safety of your capital.

When learning how to invest in IOTA, you must first consider whether the token should be included in your portfolio. Since digital tokens are volatile, you need to understand the distinguishing features of IOTA that might impact the token’s performance in the market.

In this regard, we suggest that you do your own research. When you read extensively about the project, you’ll be able to conclude whether the token is indeed worthy of investment. The following sections have been written to help you through the decision-making process.

An important feature to note about IOTA is the protocol’s scalability. The network leverages a new approach to address some of the key challenges associated with first-generation blockchains – such as slow transaction speeds. IOTA utilizes a technological component referred to as ‘Tangle,’ which is a group of nodes that validate transactions.

This proprietary technology is highly scalable because the more devices or nodes added to the network, the better the protocol’s performance. The scalability of IOTA offers investors two notable advantages; decreased transaction times and low-cost transfers. These benefits have the potential of impacting the IOTA token’s value, as more developers and investors are drawn to the protocol.

Another impressive feature that comes with the IOTA protocol is its data marketplace.

The importance of this data stream cannot be overemphasized. For instance, programmers can leverage these data streams to develop high-end applications. This is a use case that might create a buzz around the IOTA token in the very near future.

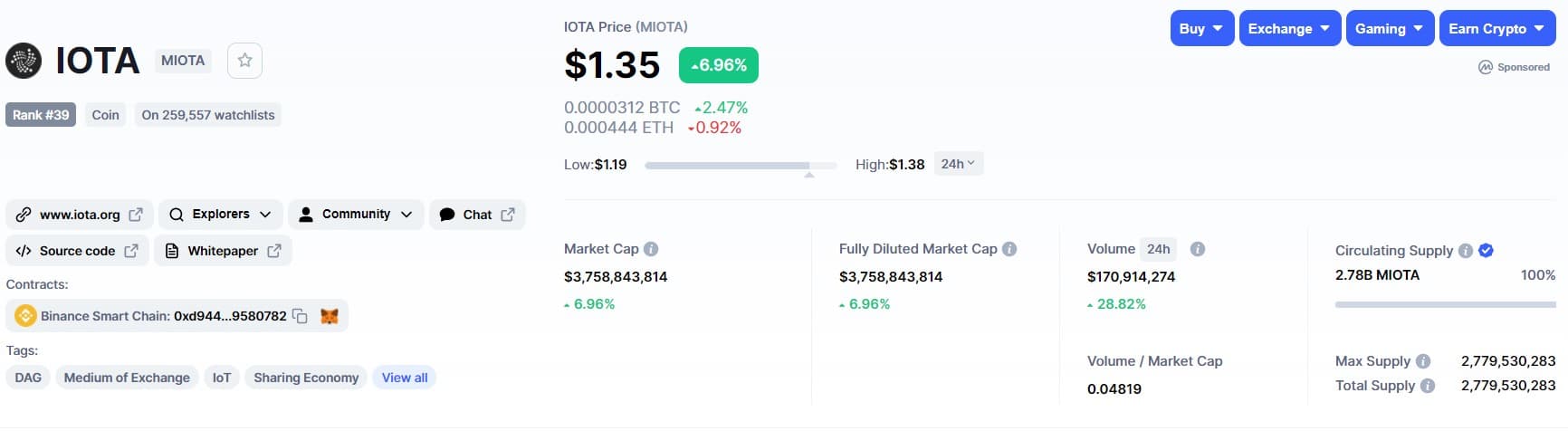

IOTA is an established project that has gone through numerous phases ever since it was launched. What originally started as the ‘Jinn’ project in 2014 rebranded to IOTA in 2015 – subsequently raising over $500,000 in token sales. In comparison, most of the 12,000+ tokens listed by CoinMarketCap were created within the past 2 years.

Essentially, IOTA has witnessed numerous highs and lows, which you can study to understand if there’s a pattern to the token’s price movements.

IOTA enjoys impressive community support from investors and developers who have taken an interest in the protocol. Due to the benefits of the network, especially in terms of fees and speed, developers can leverage the protocol for numerous purposes. For instance, IOTA allows developers to program MEMS sensor technology and various software packages.

Consequently, the protocol receives support from its community, which is an important element to consider when researching the token. After all, the quality of a token’s community often impacts the coin’s growth and expansion in the market.

As you learn about the right brokers and steps associated with investing in IOTA, you have to understand that buying the token comes with certain risks. While some of these risks are peculiar to the token, others are common to all cryptocurrencies.

Below are some of the risks you should know about when learning how to invest in IOTA.

Perhaps the most notable thing to discuss in terms of the risks associated with IOTA is that the protocol has been a victim of hacking twice.

These two incidences have affected investors’ confidence in the protocol. This is a crucial incidence worthy of contemplation before concluding on whether to buy the token or otherwise.

The cryptocurrency market is volatile, meaning prices will fluctuate across the day. Therefore, IOTA never has a stable price. So, if you invest in the token, you’ll hope that the coin’s price increases so you can secure a profit.

However, if the market moves unfavorably, you might incur huge losses.

Ultimately, you have to stay updated with the markets after investing in IOTA. This will ensure you know when prices increase so you don’t miss out on opportunities to cash out your investment.

When deciding on the broker to choose for your IOTA investment, the fee structure is an important consideration. This is because the costs you’ll incur when you invest in IOTA are determined by the broker you elect to use.

In summary, the cost of investing in IOTA is largely dependent on the broker you decide to use. Therefore, you should research adequately for brokers that offer an affordable service. For instance, when you use eToro, you only need to worry about the spread you’ll incur after opening your investment.

This How to invest in IOTA Guide has shown you that buying and selling the token is straightforward. Once you follow the discussed steps carefully, you’ll be able to invest in IOTA within just a few minutes.

Notably, selecting an IOTA broker is a highly delicate decision – as your choice will determine your investment experience. Therefore, we suggest considering eToro – because the low-cost broker is heavily regulated and easy to use for both beginners and experts alike.