Trading Platforms Australia – 5 Best Share Trading Platforms Australia 2023

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

If you live in Australia, you perhaps know that there are ample trading opportunities. Online brokers have quickly multiplied as more and more people (like me and you) have found the benefits of online trading. Whether you have a 9-5 job, stay at home, or simply want to pick up trading as an income-generating hobby, you will surely need the best trading platform in Australia.

To help you out, we’ve collected all the information on your behalf, so we can discuss and review the top trading platforms in Australia, regardless of your trading experience. In case you are a beginner, you may also want to check our step-by-step guide at the end of this article, which will teach you how to open a trading account right now and place your first orders.

Table of Contents

One of the key aspects you should be interested in is the cost structure of each trading platform. In other words, is the platform suitable for trading style or will you have to incur high fees each time you place a trade? We’ve considered the fees, ease of use, and the number of assets. These are our picks for the best trading platforms in Australia right now:

Next, we’ll have a deeper insight into each of these trading platforms and why they are the best on the market right now, along with a full breakdown of their disadvantages, so you can make an educated decision.

There are dozens of domestic and foreign trading platforms in Australia that provide you with access to local or international investment vehicles. Whether you want to trade stocks, bonds, exchange-traded funds, or cryptocurrency, the best platforms in the industry should offer you much-needed support throughout your trading journey.

eToro is an Israeli broker that provides a proprietary trading platform under the same name. The broker is fully regulated not only by the Australian Securities and Investment Commission (ASIC) but also by the Financial Conduct Authority (FCA) in the United Kingdom, among others.

The main feature about eToro that makes it stand out from the crowd and recommends it as the overall best trading platform in Australia is the diversify of its offering, which is ideal for any trader regardless of their experience. For instance, as a beginner or first-time trader, you may want to use the social-trading features. In other words, you can follow other experienced traders, and even copy their trades or portfolios. This allows you to automate your trading decisions by following master traders.

If you are more experienced, you can take advantage of eToro’s other features. For instance, veteran traders use CFDs (contracts-for-difference) to speculate on price movements. Also, you can even use leverage, which allows you to multiply your gains (or losses) without increasing your capital. This is available on a wide array of assets, ranging from stocks to indices and cryptocurrency.

Apart from its flexible trading features, eToro is also cost-competitive. For instance, you can buy shares and ETFs with no trading commission. Also, you only need a deposit of US$50 to start your trading journey, and there’s the same minimum amount required to trade stocks. Others, like cryptocurrencies, can be bought for only US$25.

The base currency for an eToro account is US dollars, so you will have to pay a small conversion fee of 50 pips unless you can directly transfer US dollars from an e-wallet like PayPal. Also, the trading platform has a wide range of stocks from the Australian, British, and American stock exchanges, among others.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

If you want to become an active trader but you have a hectic lifestyle or you’re not so tech-savvy, AvaTrade is perhaps the best pick. The broker provides a plethora of trading platforms and apps, depending on your objectives.

First, AvaOptions is the only trading platform on the list that allows you to trade options and forex. It is a versatile mobile phone app that allows you to choose your strategy, confidence intervals, and shows other quick metrics like profit/loss to allow you to manage your portfolio on the go. Apart from options, you can also use it to trade more than 40 currency pairs.

For beginners, AvaSocial is a user-friendly mobile phone app that allows you to learn from the best traders in the world and then automate your trading decisions. Experienced traders can also save significant time on a daily basis by following other expert traders.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Capital.com has a strong reputation as a regulated forex and CFD broker. The company has recently expanded, opening its first office in Melbourne in September 2023. Similar to eToro, it is regulated by the Australian Securities and Investments Commission (ASIC), apart from foreign institutions, including the UK’s FCA and the Cyprus Securities and Exchange Commission.

The account opening experience is smooth and fast. With a minimum deposit of only US$20, the platform is an excellent option if you want to trade in Australia. Additionally, the platform has its own free educational app, known as Investmate, that provides everything you should know about the trading world via interactive lessons, quizzes, and videos.

Experienced traders benefit from Capital.com’s broad array of services, including real assets, CFDs, and spread betting. Also, you benefit from tight spreads (or small fees), risk management tools, and others. Furthermore, Capital.com can also be connected to your MetaTrader 4 account, which is the most popular trading platform in the world.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

If you are planning to buy US stocks or ETFs, Superhero has a zero-fee policy and you only need US$100 to get started. However, ASX shares come with a flat fee of US$5 per transaction. The trading platform does not offer other assets apart from stocks and ETFs, so it may not be ideal if you are planning to create a diversified portfolio or trade more volatile assets, such as forex or cryptocurrency.

Superhero’s online trading app is easy to use and compatible with your mobile phone. The no-nonsense interface allows you to invest in stocks and ETFs, stay up to date with live pricing and news, and you can see a full breakdown of your portfolio performance, dividends, tax obligations, and others. You do not need to pay any management fees, but there is a 0.5% forex transfer fee if you plan to buy US assets.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

If you are looking for a cheaper alternative to buy ASX stocks, Sharesies has no minimum investment – you can even start your portfolio with one cent! Sharesies is a trading platform that provides stocks and ETFs from the US, Australian, and New Zealand stock exchanges. However, each trade comes with a brokerage fee – 0.5% for trades up to $1,000, and 0.1% for trades above this amount.

One of the highlights of the trading platform is that you can easily start trading with any amount. For instance, if you decide to save $5 on your daily coffee, you can simply deposit this cash into your account and buy shares. Also, Sharesies is available to anyone above 16 years old and it has a “Kids Account”, which is an excellent way to teach your children financial literacy.

Please note that the “Kids Account” is not available in Australia. You will also need to be over 18 to sign up to the platform in Australia.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

There are many trading platforms available in Australia – some of them are long-established incumbents, others are newer companies trying to get the ball rolling. Picking the right one for your needs can be tricky as you need to keep in mind several considerations before depositing your hard-earned cash. Let’s see what you should consider before registration.

Undoubtedly, your security and safety are the main aspects you should consider. Although we’ve only listed regulated trading platforms, there are many other unregulated ones available online. Our top choices are regulated by ASIC, the Australian authority that makes sure the broker follows certain safety and security protocols. For instance, eToro keeps segregated accounts, which means that the company does not use clients’ deposited money to run the business. In case of liquidation, it means that your capital remains safe.

Next, the variety of payment methods is important as it means that you can easily and quickly withdraw or deposit cash into your account. You need to check what payment methods are supported by your chosen broker, especially since you will have to fund it to start trading.

For instance, many popular brokers like eToro provide all the main options, such as bank transfer, credit or debit card payments, and e-wallets (like Neteller, PayPal, and Skrill). If your chosen broker provides only bank transfers, either for withdrawal, deposits, or both, this may be a significant drawback since bank transfers typically take 5-7 business days to be reflected in your account.

When choosing the best trading platform in Australia, you need to check whether it provides access to the type of assets that interests you. For instance, short-term traders may want to have access to cryptocurrency or forex, while medium-term traders may also be interested in ETFs, stocks, and other options.

Another thing to consider is whether you can buy real assets or CFDs. There are trading platforms like eToro that support both, while others are only CFD providers. CFDs come with higher risk and an overnight fee; if you plan to buy and hold, these small fees could easily add up and bite into your profit. Advanced traders planning to trade derivatives may still want to have access to both real assets and derivatives just in case they plan to add real stocks to a longer-term portfolio, too.

If you’re planning to become a trader, or you are already an experienced one, you should be familiar with two key concepts: leverage and short-selling.

Leverage

In short, leverage means that you can place trades higher than your capital. For instance, if you have $500, you can use leverage to place a trade worth $1,000. This is a leverage ratio of 1:2; the remaining money is borrowed from your broker and you get to keep all the profit.

When you close the position, the borrowed funds return to your broker. Because of this borrowing, leverage typically comes with an extra small fee, depending on your chosen broker. However, leverage can not only multiply your profit – it can also multiply your losses. If the market goes against you, you can virtually lose unlimited money.

This is where regulation comes in and why you should always opt for a regulated broker. For instance, regulated brokers like eToro come with negative balance protection – which means you cannot lose more than what you have in your account. In Australia, and many other countries around the world, regulating authorities impose certain leverage limits to accounts for extra protection.

Short-Selling

Short-selling is a similar concept in that it refers to borrowing shares from your broker, then selling them at the market price. This means you can make a profit during bear markets, or when the share price decreases.

In general, traders are either bulls, profiting when the prices go up, or bears hunting prices that go down. Short-selling is typically quicker and easier via CFDs rather than real assets since contracts-for-difference allow you to speculate on the price movement of the underlying asset (i.e., a stock) rather than going through the hurdles of short-selling actual shares.

All trading platforms have some type of fee since this represents the revenues of a company. However, brokers and trading platforms have variable cost structures, so you need to be informed before opening an account.

Payment Fees

Deposits and withdrawals are free for some brokers, while others do charge hefty amounts. What you should keep in mind is the base currency of your broker since you will be charged a fee when changing currency. eToro, for instance, charges only 0.5% when depositing AUD. If you have a US dollar account, you can deposit money for free, but eToro does have a small withdrawal charge.

Commissions

Some brokers charge commissions, or a fee when you buy and sell assets, others will charge you a spread – which is a fee marked in the buying and selling price of your chosen asset. The spreads are also regulated by authorities, but each trading platform may have its own spreads that vary within acceptable limits.

Overnight Financing

If you trade derivatives like CFDs, leveraged or not, you will have to cover overnight financing fees. This means that you cover this fee to keep the position open overnight. To avoid them, you can day trade, or open and close positions during the same day to avoid overnight fees.

Researching and analysis are two key aspects when you are a trader. Building a strategy based on guesswork or intuition increases your risk exponentially. As a result, it’s highly recommended to do your due diligence before investing in different assets. To help you out, your chosen trading platform should provide resources for research and analysis.

For traders with little experience or who want to automate trading, copy trading features are a must. eToro is the most popular platform in this regard which allows you to copy experienced traders. In other words, once you copy a trader, the platform will copy their positions automatically, so your portfolio is adjusted every time the master trader adjusts their own portfolio.

The best trading platform in Australia should provide flawless customer service. Ideally, you should have access to online chat support for quick replies, and this should be available 24/7 or 24/5 for your convenience.

Finally, your chosen trading platform should also be available on your mobile phone. This provides you with maximum flexibility, so you can check and manage your portfolio on the go.

There are many trading platforms available in Australia – some of them are long-established incumbents, others are newer companies trying to get the ball rolling. Picking the right one for your needs can be tricky as you need to keep in mind several considerations before depositing your hard-earned cash. Let’s see what you should consider before registration.

Now that we have discussed everything you should know about choosing the best trading platform in Australia for your needs, all you have to do is open an account and start trading. To help you get started, we put together this quick step-by-step guide on how to open your eToro account.

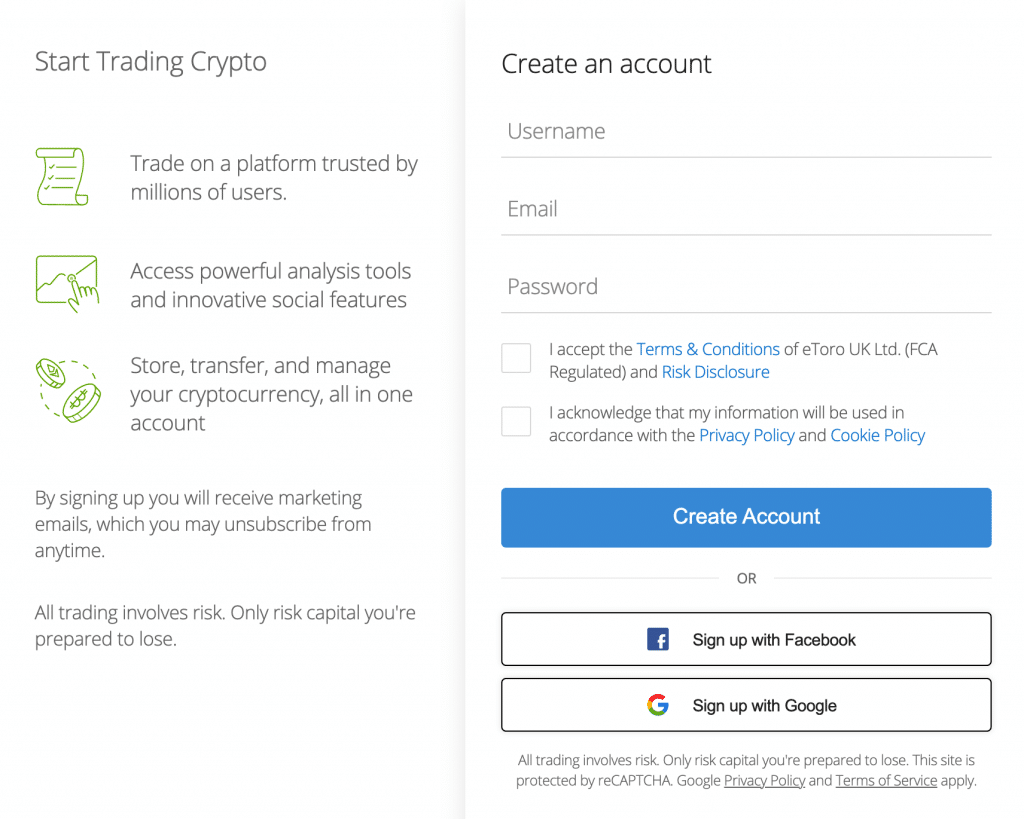

First, you need to complete a quick form with your name, username, email, and chosen password. Make sure you go over the terms and conditions before signing up.

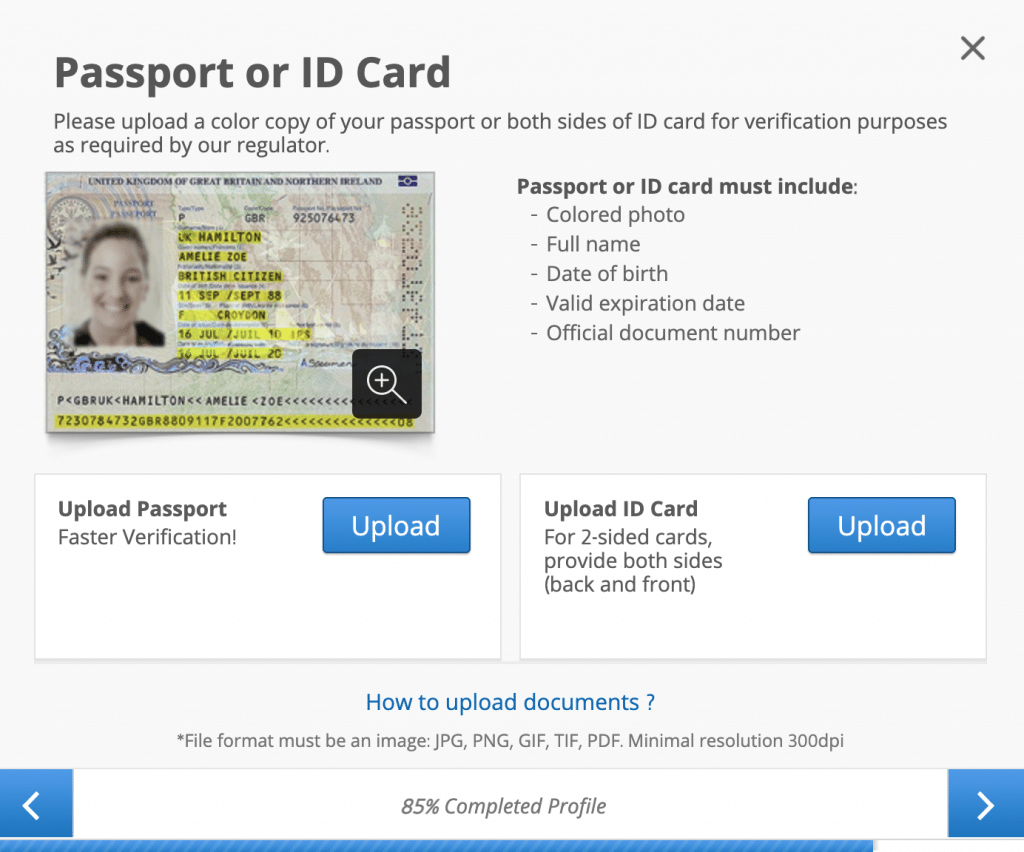

The KYC process is compulsory for regulated brokers. eToro needs you to upload your ID and proof of address, such as a utility bill. The broker will then quickly verify your uploaded documents and validate your trading account.

Next, choose your preferred payment methods and deposit your capital. You need to make the first deposit of at least US$50. eToro allows you to deposit money from an e-wallet, visa card, or other payment methods.

Once you fund your account, you can now become familiar with all the assets available on eToro’s trading platform. Start researching today’s risers or fallers, look up specific assets using the search bar at the top of the screen, or have a look at master traders’ comments.

Finally, once you find the desired assets, place your trading order. Select the asset, then choose “buy” to open a long position or “sell” if you want to short-sell the asset. Add the amount, set the stop-loss or take-profit levels if applicable, and submit the trade.

All in all, this guide explained everything you need to know about the best trading platforms in Australia right now. One of the best and most versatile trading platforms is eToro, providing easy access to many markets around the world and combining ease of use with social trading features and derivative trading. eToro is regulated, safe, and ideal for both beginners and veteran traders.