Invest In Litecoin – How To Invest In Litecoin For Beginners

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Litecoin – which is often referred to as the Silver to Bitcoin’s Gold, is a popular cryptocurrency that was first launched in 2011. This makes it one of the most established digital tokens in the crypto asset industry.

In this guide, we walk you through the process of how to invest in Litecoin safely and which brokers you might want to consider when completing your purchase.

Table of Contents

With over a decade in the cryptocurrency industry – it makes sense that hundreds of online platforms allow you to invest in Litecoin. Below we list the best Litecoin brokers active in the market right now.

Further down in this guide on how to invest in Litecoin, you will find full reviews of the above brokers.

If you’re looking to invest in Litecoin right now – the steps below will walk you through the process in under five minutes. For our tutorial, we’ll show you how to complete the process safely with eToro – a regulated online broker that permits a minimum Litecoin investment of just $25.

By following the four simple steps outlined above, you’ve just learned how to invest in Litecoin in under five minutes! By using eToro, you can keep your LTC tokens stored on the platform until you are ready to cash out – which you can do 24/7.

Cryptoassets are highly volatile unregulated investment products. Proceed at your own risk.

On the one hand, it’s notable that you have hundreds of platforms to choose from when thinking about the best place to invest in Litecoin. However, this means that it can be a time-consuming task to separate the good from the bad. After all, there are plenty of cryptocurrency platforms that should be avoided – not least because they are not regulated or licensed by a reputable financial body.

To save you from having to spend countless hours researching which broker is suitable for you, below you will find a pre-vetted selection of the best platforms allowing you to invest in Litecoin online.

Our researchers found that the overall best platform to invest in Litecoin is eToro. Launched in 2007 and used by over 20 million investors of all shapes and sizes, eToro allows you to buy and sell cryptocurrencies with ease. You do not need to have any prior experience in this industry to complete the Litecoin investment process – which is especially handy for newbies. In fact, the end-to-end process of registering an account, depositing funds, and placing a buy order should not take you more than five minutes.

Before we get to metrics like fees and supported payment methods, we should make it clear that eToro is heavily regulated. It is authorized and regulated by financial bodies in the UK, Europe, and Australia – as well as with the SEC in the US. This means that ultimately – you can invest in Litecoin from the comfort of your home without needing to worry about the safety of your hard-earned trading capital. To get started with the LItecoin investment process, you only need to meet a minimum deposit of $200 ($50 for US clients).

You can choose from a wide range of deposit types – with the most convenient including debit/credit cards, Paypal, and Neteller. Bank wires are also supported but expect to wait a couple of days for the funds to arrive. Deposits cost just 0.5% at eToro, albeit, US clients have this fee waivered. Once you’ve got funds in your eToro account, you can proceed to invest in Litecoin at a minimum stake of just $25. This makes it super easy to diversify into other crypto assets – with eToro supporting more than 30 alternative tokens.

This includes Bitcoin, Ethereum, EOS, Cardano, AAVE, Decentraland, XRP, and more. Additionally, if you’re based outside the US, eToro also gives you access to stocks, ETFs, commodities, forex, and indices. What we also like about eToro for the purpose of investing in Litecoin is that you don’t need to worry about storing your tokens in a private wallet. Instead, eToro offers an in-house custodial wallet – meaning it will safely store your LTC tokens on your behalf. This also means that you can sell your tokens at the click of a button from within your eToro account.

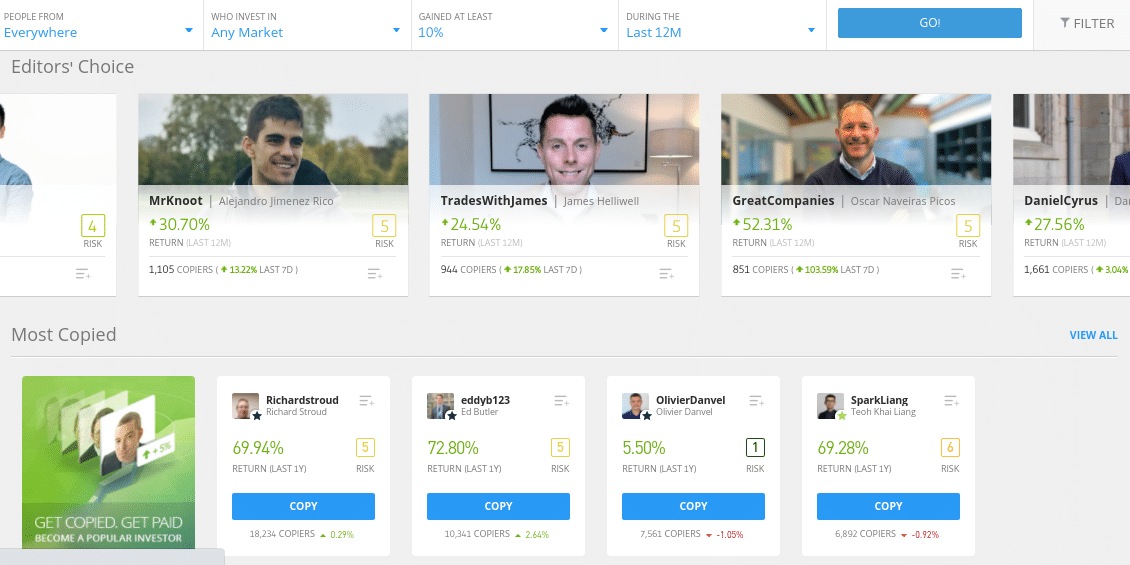

eToro also makes our pick as the best broker to invest in Litecoin as it offers passive trading tools. For instance, you have the option of copying another eToro trader – so anything that they invest in will be replicated in your own account. You can also invest in a diversified basket of cryptocurrencies through a single trade. This portfolio will be managed by the eToro team – so no input is required. Again, this is ideal for newbies that wish to invest but have no knowledge of how crypto assets work.

Pros

Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

Many inexperienced investors will also look to a platform like Coinbase when purchasing digital currencies for the very first time. The platform is simple to use and requires little to no knowledge of cryptocurrencies to get started. You will, however, need to go through a KYC process before you can get started – which requires a copy of your ID and a selfie. After that, you can transfer funds from your bank account on a fee-free basis and then proceed to invest in Litecoin.

The standard trading commission payable at Coinbase is 1.49% – which is one of the most expensive pricing structures we came across. Furthermore, things get even more costly if you choose to invest in Litecoin with a debit or credit card. This is because Coinbase will charge you a huge transaction fee of 3.99%. Then, when you get around to cashing out your Litecoin investment – you will pay a commission of 1.49%. Nevertheless, Coinbase also comes with its benefits – especially when it comes to safety.

For example, Coinbase has a great reputation in this industry and it is appropriately regulated in the US. Plus, the platform is used by over 56 million clients, and the parent company of Coinbase is listed on the NASDAQ exchange. Internal security features include mandatory two-factor authentication and device whitelisting. The latter will require an extra security step should you log into your account with a new laptop or mobile phone. Crucially, Coinbase keeps 98% of client funds in cold storage.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

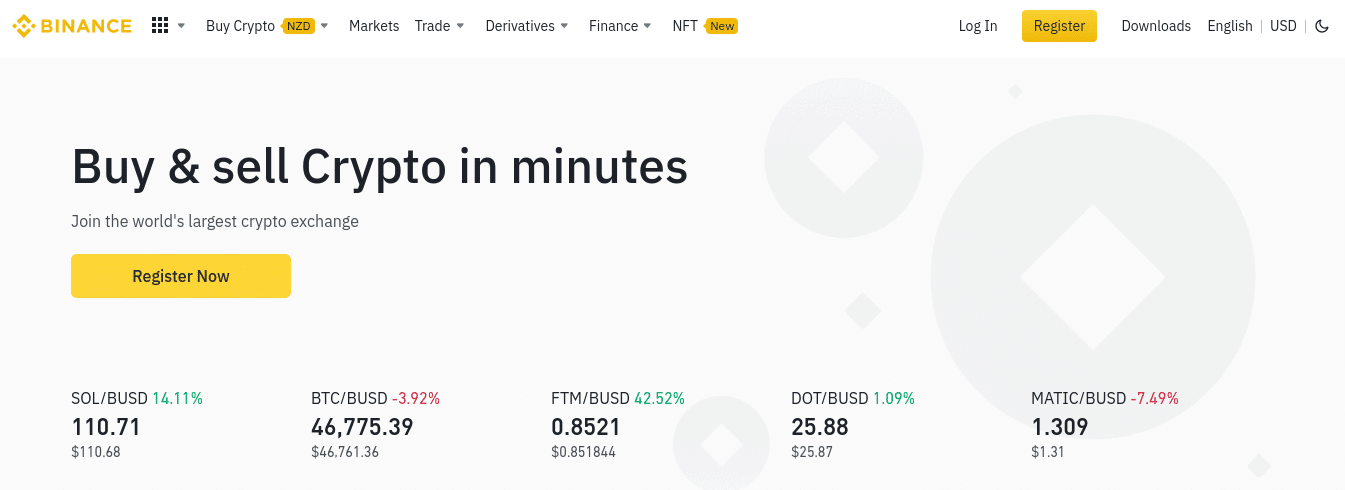

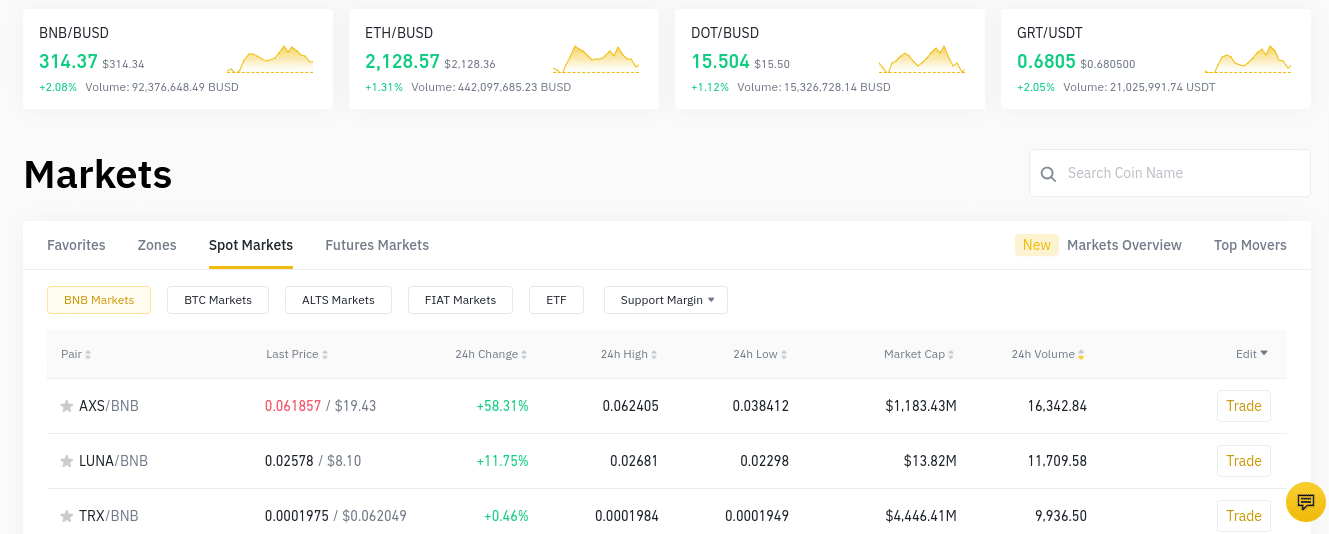

Binance is an online cryptocurrency exchange and broker that offers heaps of cryptocurrencies. The specifics of what you will have access to and how much you pay will ultimately depend on where you are based. For example, if you are based in the US, you will be able to invest in Litecoin with a debit/credit card at a fee of 0.5%. This works out at just $5 for every $1,000 purchased. Alternatively, the same debit/credit card offering outside of the US can cost as much as 4%

Nevertheless, Binance gives you plenty of options when it comes to storing your Litecoin tokens. For example, some investors will choose to leave their tokens stored on the Binance platform – which means you do not need to worry about safekeeping your private keys. You will still benefit from a secure storage facility, as Binance offers two-factor authentication and IP/device whitelisting. Plus, the majority of client digital assets are held in cold wallets. You can also elect to withdraw your tokens to the Trust Wallet app – which is backed by Binance.

The other option is to deposit your digital tokens into the Binance savings account. The only issue here is that Litecoin attracts a very small APY of 0.32% per year. Other cryptocurrencies, though, attract an interest rate in excess of 10% – so this is also worth considering should you wish to diversify. In terms of trading fees, the standard commission at Binance is just 0.10 per slide. If you’re based in a country that permits digital asset derivatives, Binance also offers cryptocurrency futures, options, and leveraged markets.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

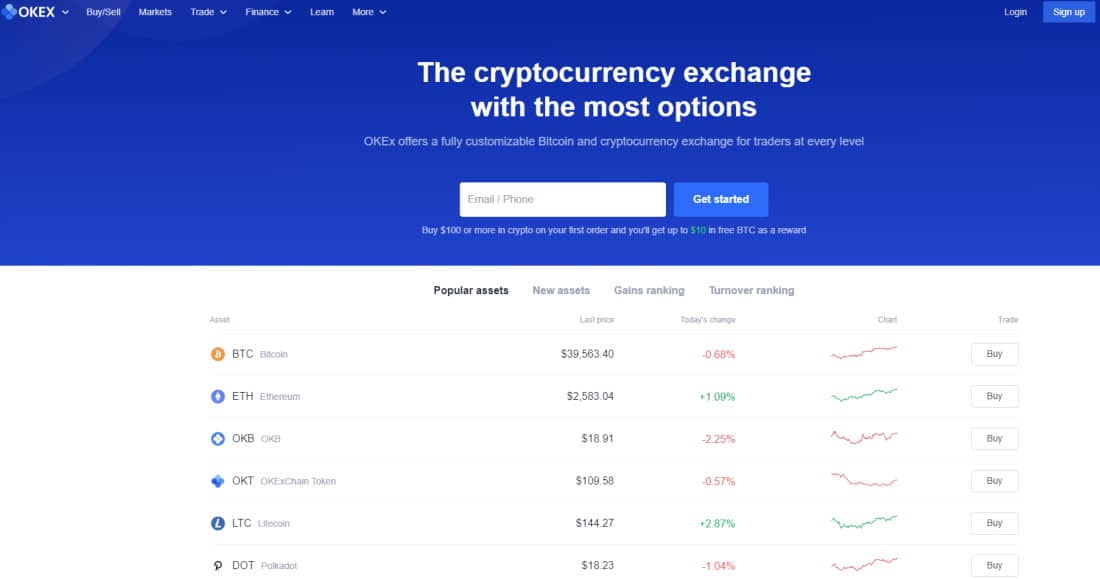

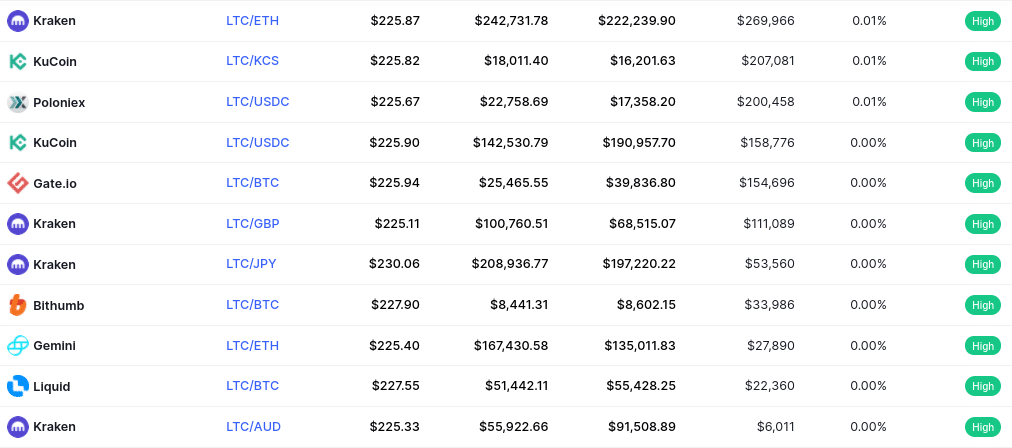

There are several markets that include Litecoin – such as BTC/LTC, ETH/LTC, and USDT/LTC. You can, however, deposit any supported cryptocurrency of your choosing. For example, if you currently hold a less liquid token like AAVE, you can deposit this into OKEx, swap it for Bitcoin, and then finally – exchange BTC for Litecoin. Much like Binance, OKEx also offers cryptocurrency derivatives. This includes futures and high-leverage crypto markets.

In terms of safety, OKEx has been around since 2014 and now serves over 20 million clients in more than 200 nations. The exchange allows you to store your Litecoin tokens in its own custodial wallet, albeit, you might also consider using the OKEx mobile app for this purpose. In doing so, you will have full control over your Litecoin investment – not least because you will be the only person to have access to your wallet’s private keys. Other notable features at OKEx include a savings account, crypto loans, and tradable markets on over 400+ pairs.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

The final option worth considering is Webull – a popular stock, ETF, and cryptocurrency broker based in the US. This option will be particularly attractive to US clients that wish to invest in Litecoin with just a few dollars. After all, Webull requires a minimum deposit of just $1 – so you will be buying a small fraction of a single token. For instance, if LTC is priced at $200 and you invest $2 – you will own 1% of a single Litecoin. This is also the case for other supported digital currencies that Webull lists.

Although not super-extensive, the Webull asset library includes Bitcoin, Dash, Ethereum, Stellar, Cardano, and more. We should make it clear that on the one hand – it is notable that Webull is a 0% commission broker. This means that irrespective of how much you decide to invest, you won’t pay any direct trading fees. However, don’t forget that Webull still has to make money – which it does via the spread. This is simply the mark-up that Webull charges between the buy and sell price of Litecoin.

Webull notes that this starts at 1% when investing in cryptocurrencies, but we found that this is much higher when purchasing Litecoin. Nevertheless, we do like the fact that there is no minimum deposit requirement in place, which makes Webull even more attractive for those on a small budget. It’s best to deposit funds with ACH at this brokerage site – as the platform charges $8 when opting for a domestic bank wire. Finally, Webull gives you the option of investing in Litecoin on its main website or through the iOS/Android mobile – both of which are user-friendly.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

If this is your first time investing in a crypto asset like Litecoin – then we would imagine that you require a more detailed walkthrough than we gave earlier in our quickfire guide.

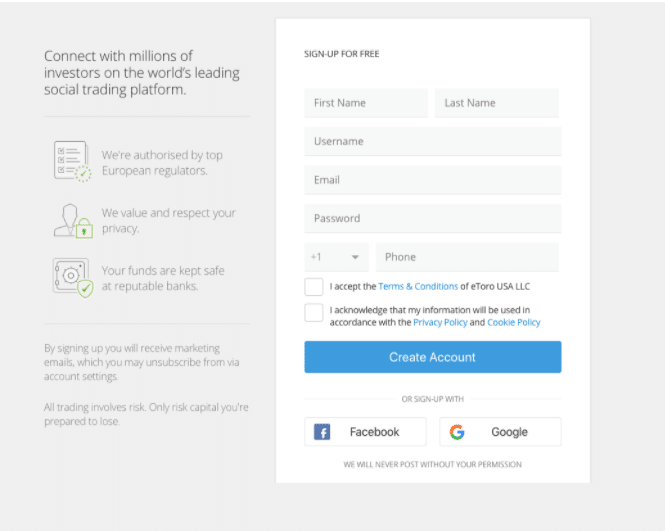

Irrespective of which cryptocurrency you wish to invest in, you need to go through a trusted broker that supports your preferred payment method. We found eToro to be the best option here – as the broker is regulated and supports a wide range of deposit types. But, before you get to the payment process, you will need to open an account.

You can do this by visiting the eToro website and clicking ‘Join Now ‘. Next, enter your personal information and contact details as prompted. This will include your first and last name, home address, mobile number, and email address.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

You will also need to go through an automated KYC process before you can invest in Litecoin. We say ‘automated’, as the eToro system will verify your documents in less than 1-2 minutes.

The two documents required are proof of identity and verification of your home address. The former can include a passport, driver’s license, or any other accepted government-issued ID.

eToro doesn’t offer an Instant Buy feature per-say, as you will first need to deposit some funds into your account before you can invest in Litecoin. With that said, you can deposit funds instantly when opting for one of the supported payment methods listed below:

eToro also supports traditional bank account transfers as a means to deposit funds. But, this can take a few days to process. As such, if you want to invest in Litecoin instantly, it’s best to go with a debit/credit card or e-wallet.

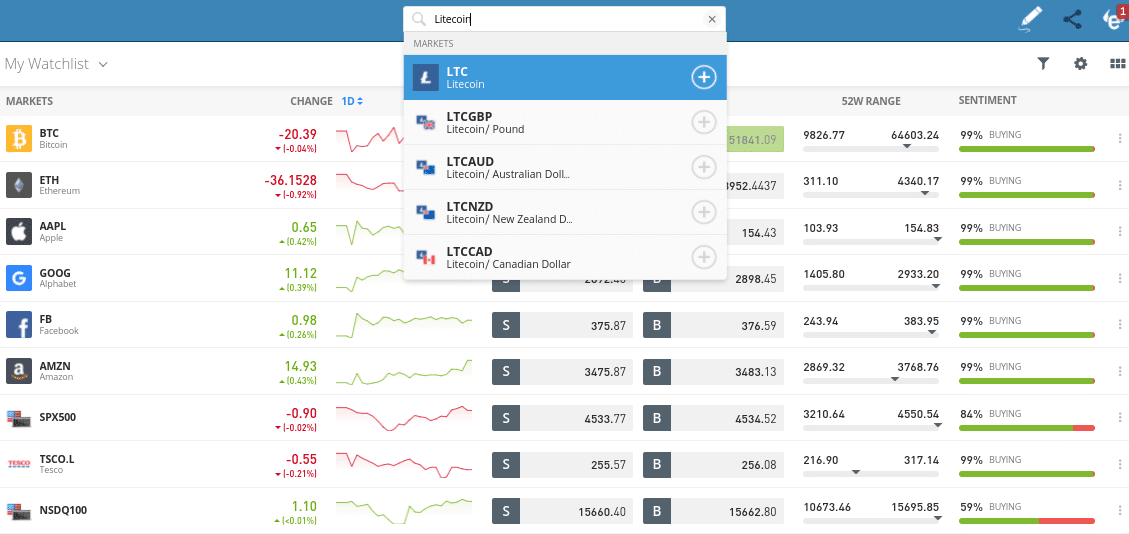

The next step is to search for Litecoin so that you can go straight to the relevant investment page.

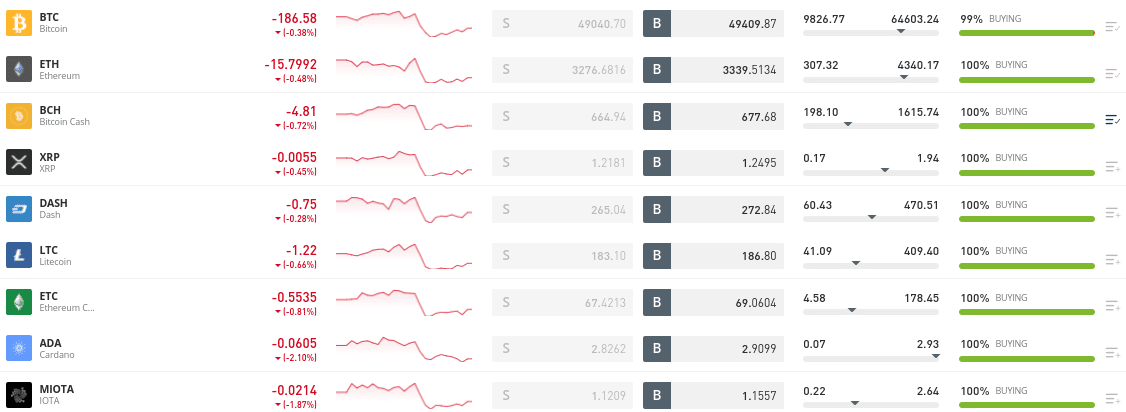

As you will see from the image above, there are several eToro markets that contain Litecoin. However, if you want to directly invest and own Litecoin – as opposed to trading the digital token via CFD instruments, click on the result at the top.

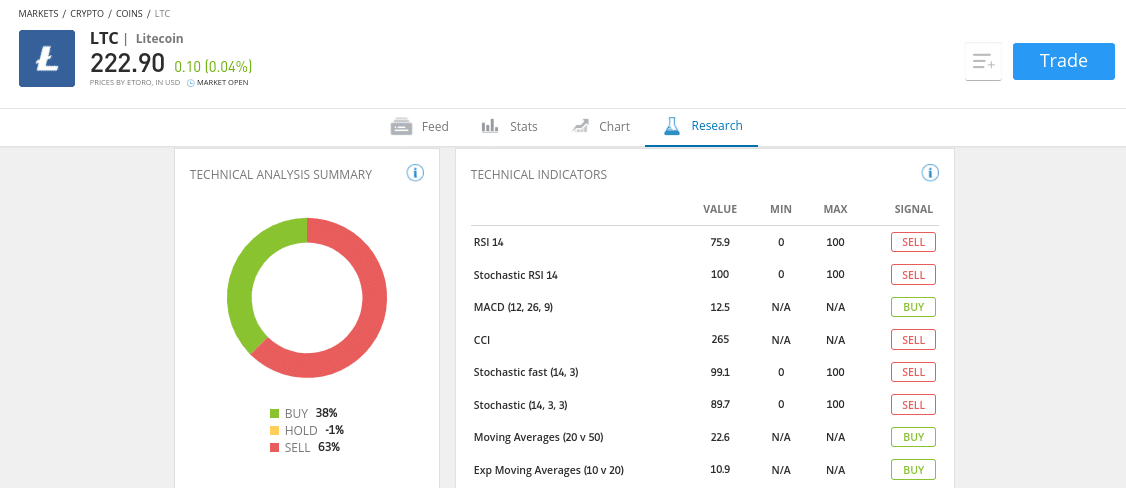

On the next page, you will be presented with some information on Litecoin – such as its current pricing chart and a news feed from other LTC investors. To invest in Litecoin right now – click on the ‘Trade’ button.

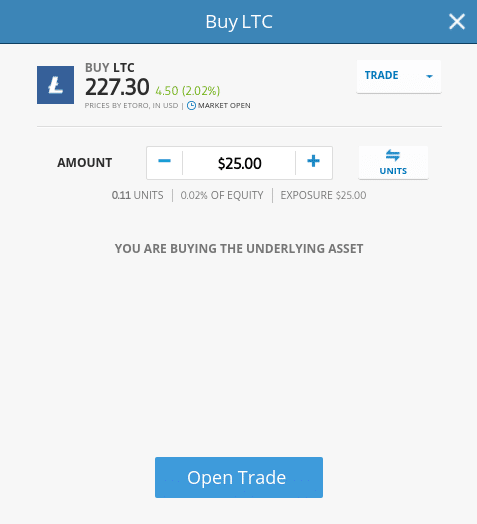

This will then display an order box like in the image above. You will now need to enter your stake – which is the amount you wish to invest in Litecoin ($25 minimum).

To finalize your order, click on the ‘Open Trade’ button. Within a couple of seconds, your Litecoin investment will be executed by eToro and the tokens will then be viewable in your portfolio.

The only way that you can make money by investing in Litecoin is if the value of the crypto asset increases in the open marketplace. If it does – and you are happy with your returns, you will need to sell Litecoin back to fiat money. At eToro, you can do this 24 hours per day – 7 days per week.

Assuming that you have already had your identity verified, you can then withdraw the cash to your bank account or debit/credit card – depending on which payment method you originally used.

As this guide has explained thus far, there are many ways to invest in Litecoin. The method you choose should be based on your own preferences – so check out the mini-sections below to make an informed decision.

When using a Litecoin broker to complete the investment process, you will likely be using a provider that is regulated. This means that you know for sure that you are using a legitimate platform.

Furthermore, you will be purchasing Litecoin directly from the broker itself. When you complete your purchase, the regulated broker will store your tokens for you – which makes the investment process even more convenient.

You can also invest in Litecoin via a cryptocurrency exchange. Interestingly, although some exchanges now support deposits in the form of debit/credit cards and bank transfers – most of these platforms are still free of regulation. A good example here is OKEx – which is based offshore in the Seychelles.

If you’re an inexperienced trader that is looking to invest in Litecoin without having first performing in-depth research – you might want to pause. Crucially, Litecoin – like all cryptocurrencies, is volatile and speculative. This means that there is every chance you will lose money from your investment if the markets turn against you.

To ensure you are fully informed on the benefits and drawbacks of investing in Litecoin – be sure to read through the sections below.

According to the cryptocurrency data aggregation website CoinMarketCap, there are over 11,000 digital tokens that can be traded online. Most of these were launched within the past 12-18 months, which leaves little in the way of an established track record.

In other words, Litecoin has gone through dozens of bear markets and is still here to tell its story.

Litecoin, like most cryptocurrencies, has enjoyed great success in 2021. At the start of the year, the digital currency was priced at $124 per token. Fast forward to May of the same year and Litecoin hit a 52-week high of $401.

This represents very impressive gains of 223% in just five months. However, we should also note that as of September 2021, Litecoin has since dropped down to a pricing range of between $170 and $230.

Partnerships are crucial in the cryptocurrency space – especially for tokens that aim to become widespread mediums of exchange. Litecoin stands out in this respect, as the digital asset has made several notable partnerships in recent years.

For each partnership that Litecoin makes, this adds further legitimacy to the project.

On the one hand, Bitcoin is considerably larger than Litecoin in more ways than one – especially when it comes to market valuation and global awareness. With that said, the Litecoin network is actually a lot more efficient than its Bitcoin counterpart. At the forefront of this is the speed at which transactions are processed. Litecoin takes just 2.5 minutes, which Bitcoin is four times slower at 10 minutes.

On top of researching the benefits of investing in Litecoin – you also need to consider the risks. Like all investments, the main risk is that you might end up walking away with less money than you originally started with.

The main risks are investing in Litecoin are discussed below:

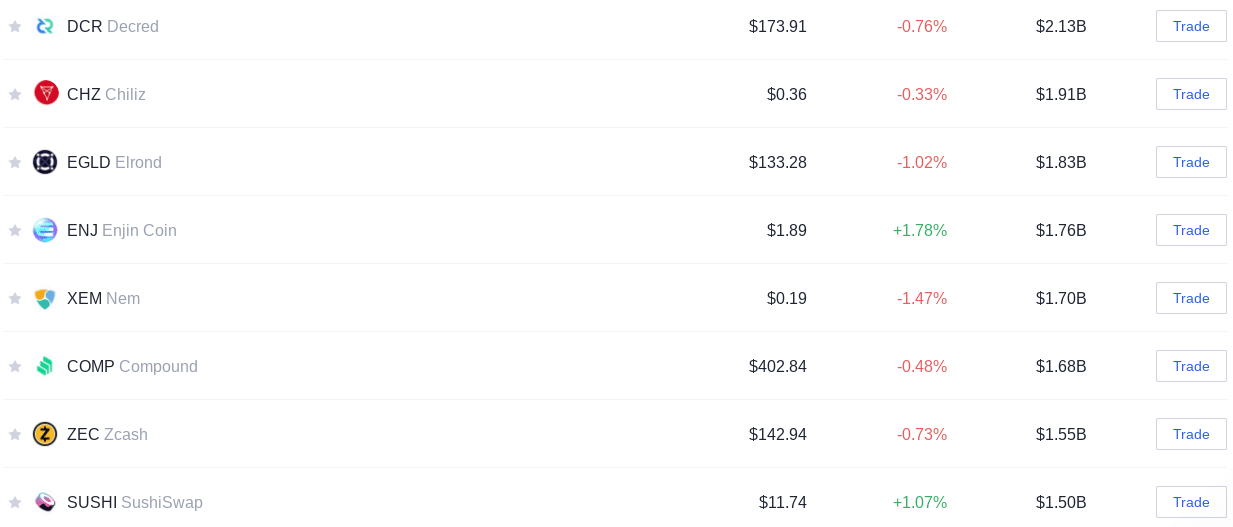

For many years, Litecoin was firmly positioned as a top-five cryptocurrency in terms of market capitalization. However, Litecoin is slowly but surely fading away in this respect. For instance, at the time of writing in late 2021, Litecoin is now placed as the 12th most valuable digital asset. It has since been overtaken by the likes of Dogecoin, Uniswap, Polkadot, and Solana.

We mentioned earlier that Litecoin performs four times faster than Bitcoin when it comes to confirmation transactions – with the network requiring 2.5 minutes per block.

However, in today’s market, this is now viewed as incredibly slow. For example, there are plenty of other blockchain projects that can verify transactions instantly – or in less than a few seconds. In many ways, this could make Litecoin redundant.

Finally, you also need to consider just how volatile Litecoin is. This risk isn’t applicable just to Litecoin – but to the wider cryptocurrency industry. Nevertheless, the value of your Litecoin investment can move parabolically – with double-digit percentage gains and losses within a 24-hour period still not uncommon.

You’ll need to use a trusted online broker to invest in Litecoin safely – which will attract fees.

The good news is that by doing some research – you are sure to find cheaper options in the market. For instance, eToro will only charge you 0.5% to use a debit/credit card – and nothing if you are a US client. Ultimately, it’s really important that you have a firm understanding of your chosen broker’s pricing structure before you open an account.

The process of investing in Litecoin is now a simple and stress-free procedure – especially when using a safe and regulated broker like eToro. Our researchers found that this top-rated platform allows you to invest in Litecoin from just $25 and in under five minutes. You will only pay the spread to buy and sell LTC tokens and best of all – the broker supports instant payments via debit/credit cards and e-wallets like Paypal.