Best Forex Broker Saudi Arabia – Top 5 Forex Trading Platforms Reviewed 2021

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Forex brokers make it easier for traders to trade currencies in the foreign exchange markets. All forex platforms are slightly different from each other, but they also share quite a few features in common. With the abundance of features and brokers to choose from, things can get complicated. We created an elaborate tutorial so you can have an easier time deciphering some of the features available in the market and choosing the most suitable forex broker for your trading operations.

Forex trading has gained tremendous popularity in the past few decades and brokerage solutions ensued. Forex trading platforms offer traders access to Forex markets through their trading platforms and they offer traders the opportunity to start trading Forex, commodities, indices, and CFDs. In this forex tutorial, we will delve into various forex platforms and uncover their features and fees with the hopes of helping you find the best forex trading platform in Saudi Arabia for 2021 and explaining the important aspects of forex trading.

Table of Contents

Forex or foreign currency trading has been a popular trading activity for a very long time. FX markets offer high liquidity, 24-hours activity and a dynamic and global environment for trading enthusiasts. But you will need a reliable forex trading platform to execute your plans.

With that said, let’s explore the best Forex trading platforms in Saudi Arabia that you can start using today!

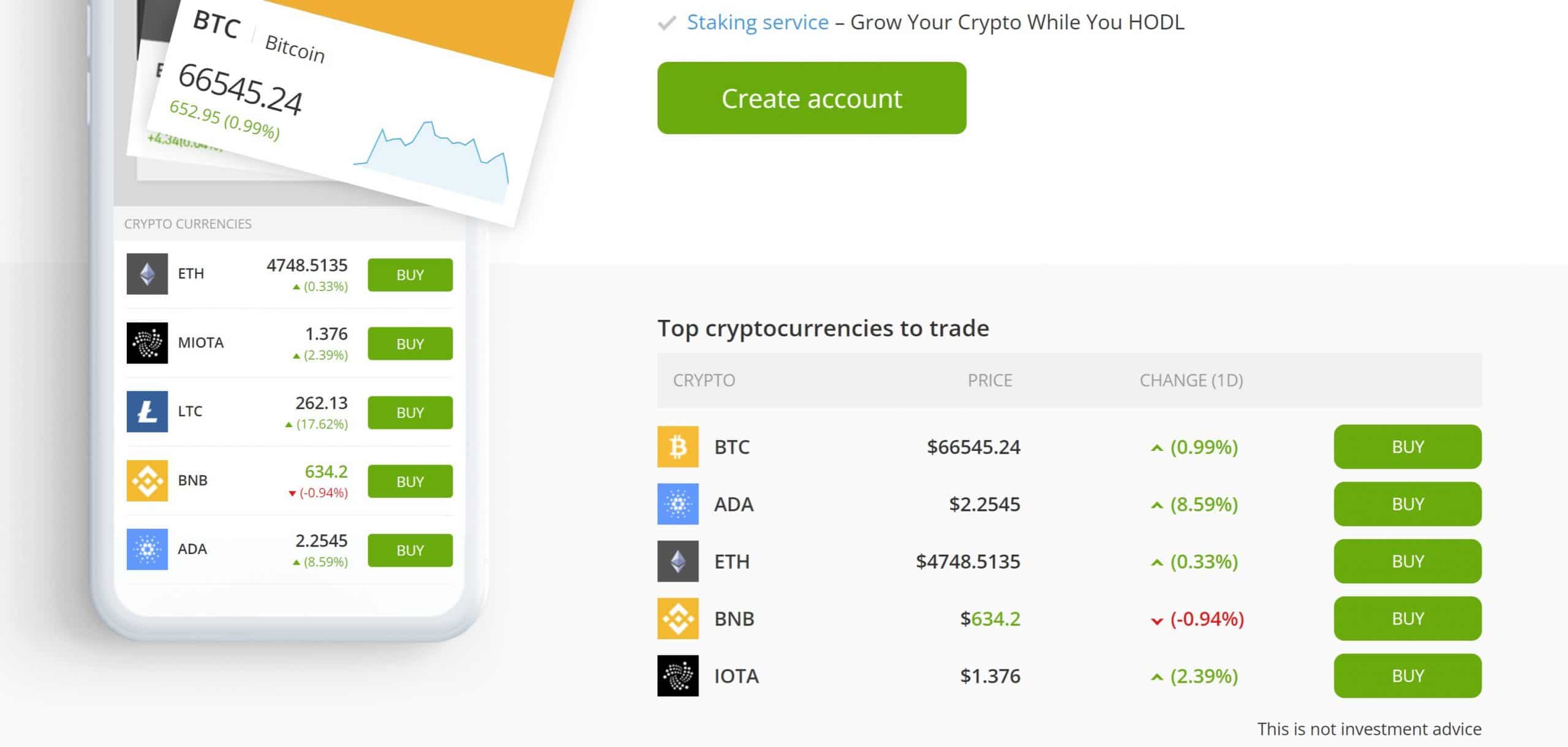

A popular trading app, eToro is dominating the financial app market, and for good reason. The eToro

app has all of the popular features, such as charting, and traders can trade stocks, commodities, and currency pairs. The eToro app offers 60-second trades, as well as 30-minute trades among other intervals and traders can open multiple positions at once.

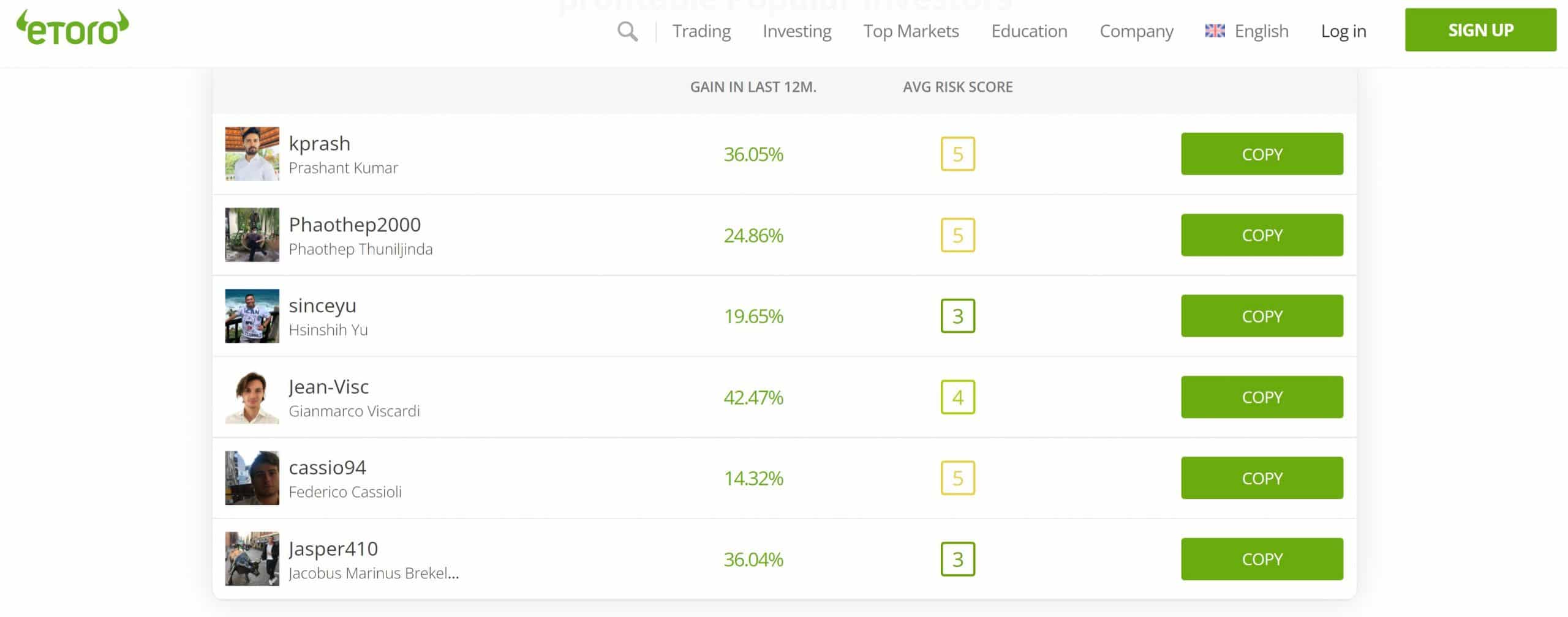

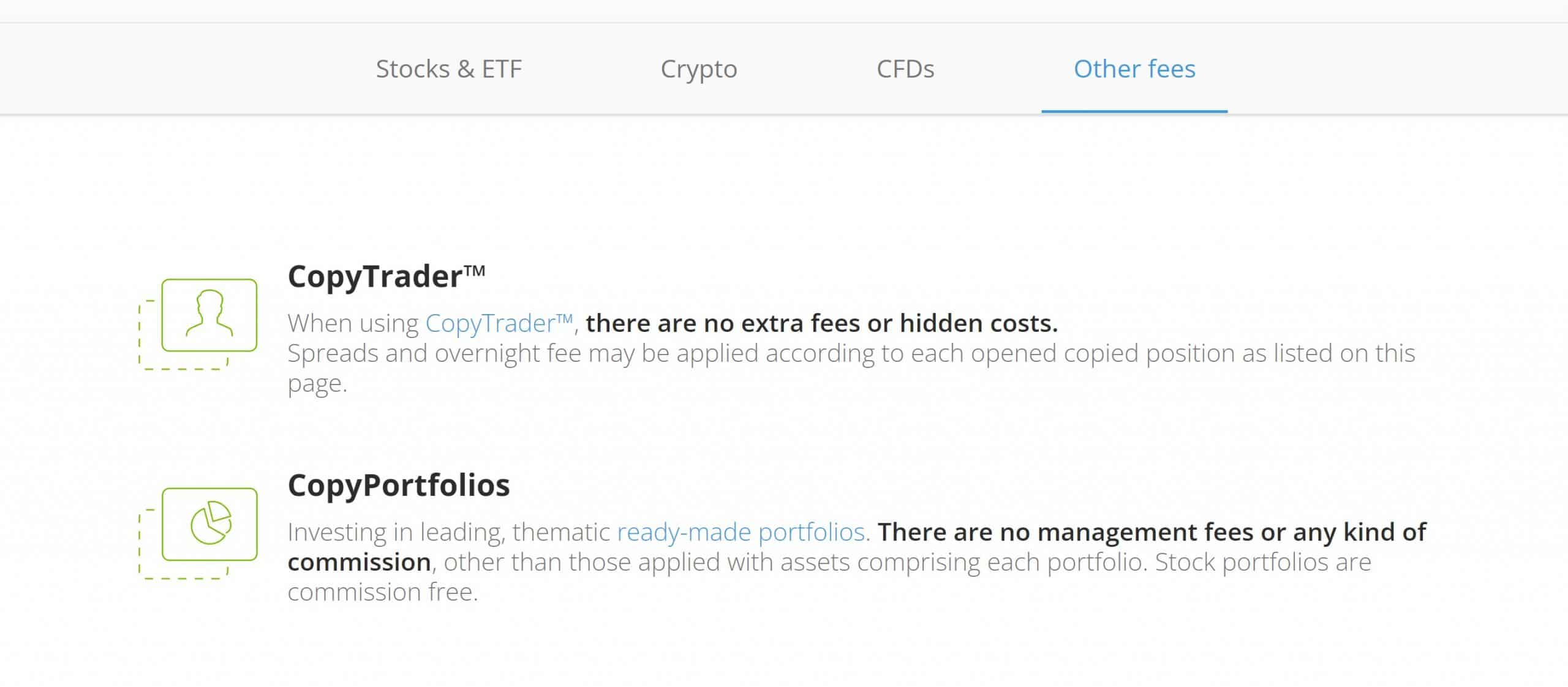

CopyTrader and CopyPortfolio are tools that let investors trade other people’s portfolios. That means you can trade other people’s forex ideas. By “copying” someone’s portfolio, you essentially become a co-investor. As in, every trade you make on CopyTrader or CopyPortfolio is a trade you make in your account, and every dollar you make is a dollar you make in your account. But you also share other people’s profits and losses.

eToro CopyPortfolios is an innovative tool that lets forex traders invest in top-performing portfolios built by influential traders on the platform from all over the world. This automated trading system can be attractive for some forex traders who are looking for alternative opportunities.

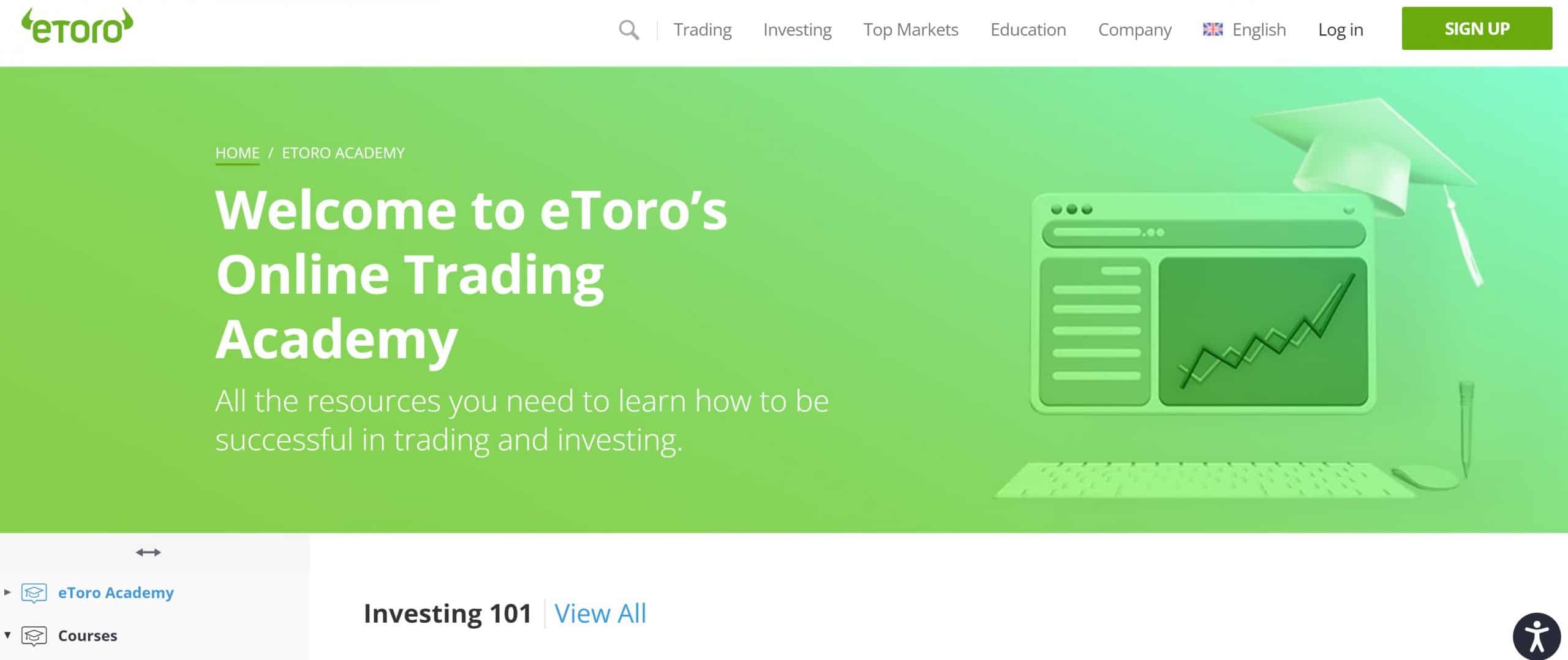

eToro Academy is an ambitious new initiative launched by world-leading social trading network eToro. It offers an online educational platform that provides free and easily accessible financial education to anyone, anywhere. eToro Academy courses are created by eToro and eToro’s expert educators and range from introductory level to advanced. They include courses on Investments, Trading, Forex, and Economic & Financial Data.

eToro doesn’t charge any fees for using its platform and providing financial services. Some fees are charged for withdrawing money ($5) and being inactive for many months (6 months). There are also spreads that can generate some cost for traders depending on the type of investment, the amount being invested, and the frequency of trading

eToro is regulated in the European Union and Australia but not in the United States. The European Union has a strong regulatory system which is reassuring. Additionally, the US regulations can be less protective for clients in this perspective sometimes. For example, in the United States, the brokers who manage money have no legal obligation to provide their customers with any level of protection.

Aside from regulations, features such as the 2FA authentication system and SSL encryption for data makes eToro a more secure platform.

Pros

products including many forex pairs.

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

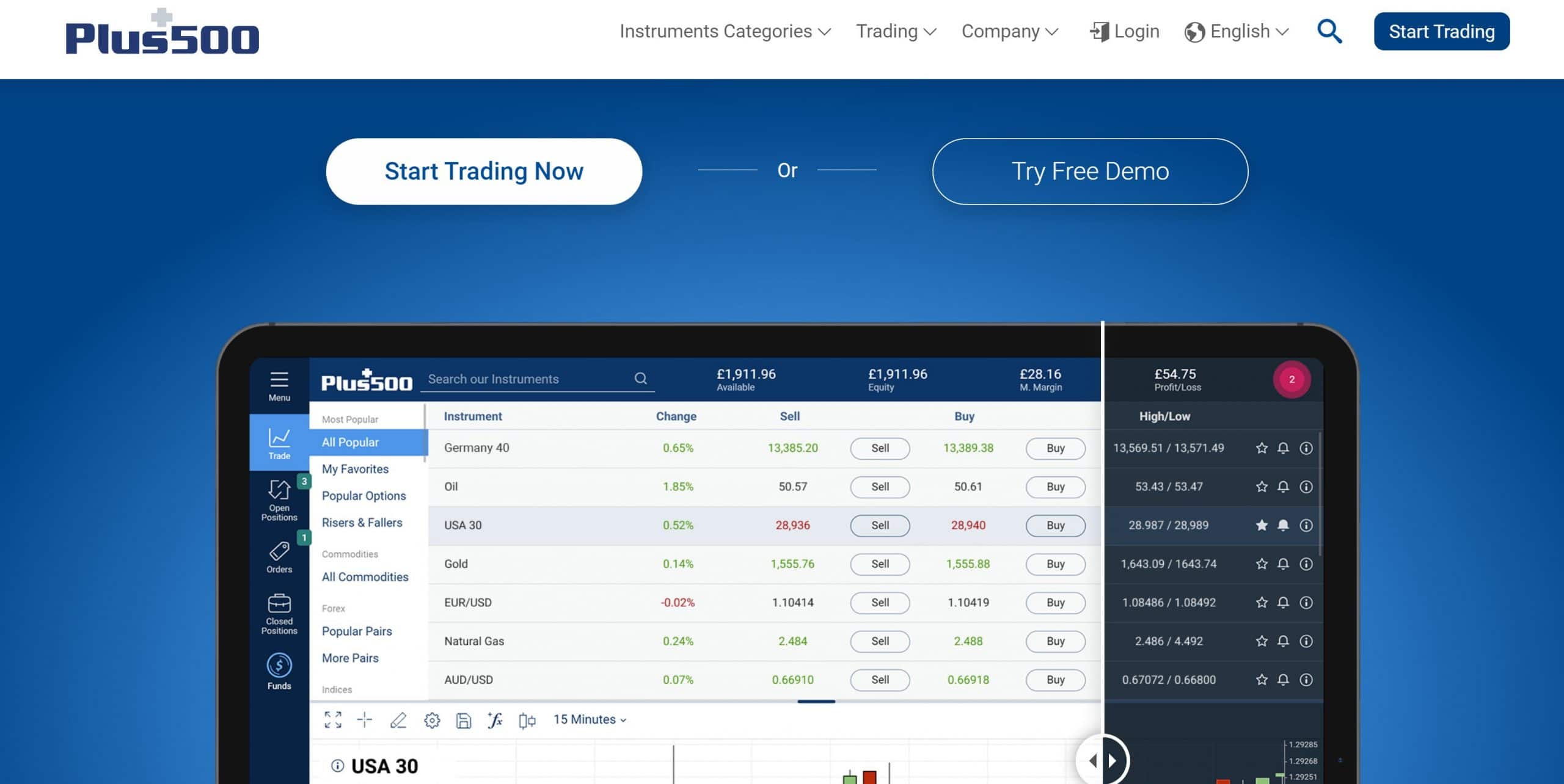

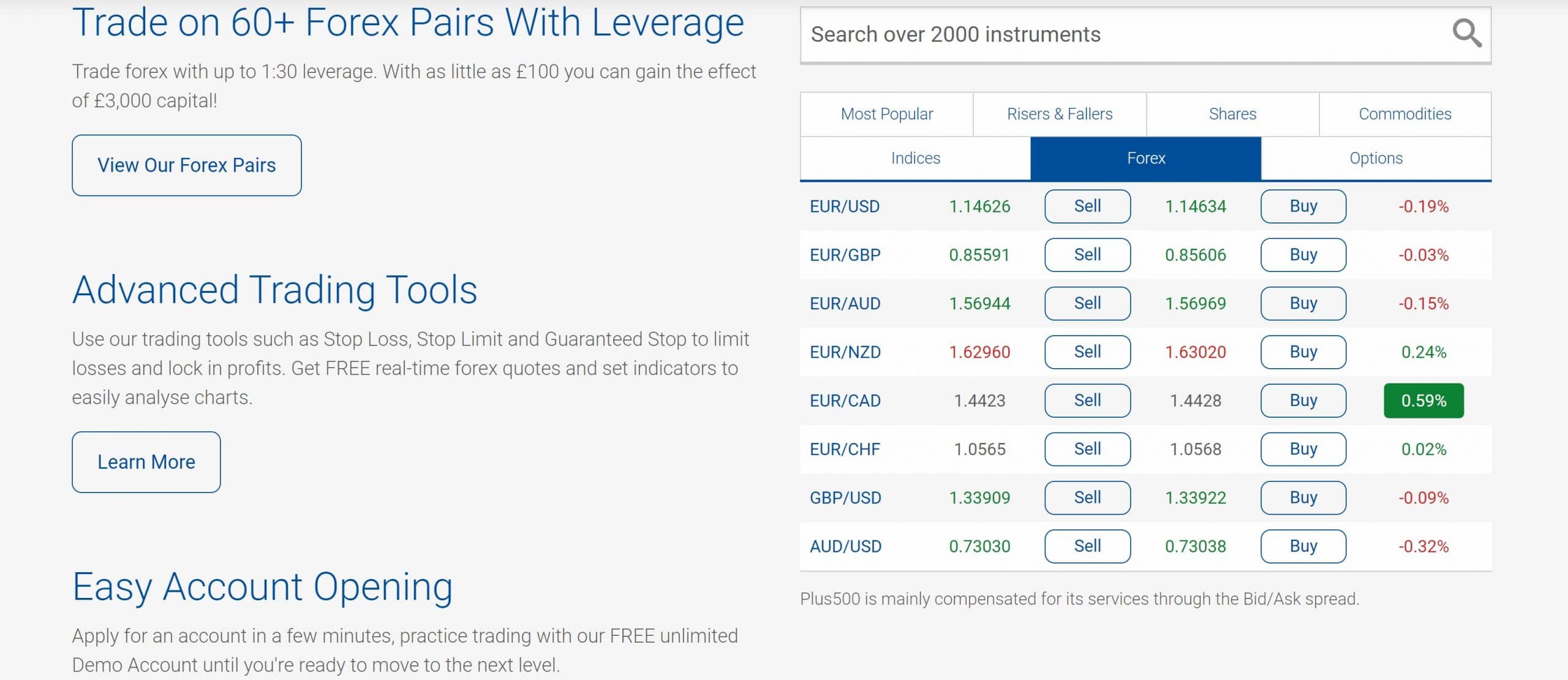

Plus500 is another great place for you to place your forex orders in the major financial markets. The platform is available for countries around the globe, including Saudi Arabia. It offers an array of features that are ideal for both new and experienced traders. This includes the tools to trade shares, currencies (forex), options/CFD’s and commodities.

Plus500 is a CFD platform where it lets the user trade several financial products including Forex, commodities, equities, and indices without actually owning the underlying asset. This means users don’t have to own shares in a company to take advantage of speculations on price changes. CFD is an innovative product that makes trading more efficient and practical in many cases. This allows traders to have to try and predict what direction prices will evolve for hundreds of financial assets.

Plus500 is mainly compensated for its services through the “market spread”, A spread is a difference between the price offered by buyers and sellers (bid-ask spread).

Plus500 offers one of the most secure trading environments available. The trading platform is guarded by multiple layers of security, including 256-Bit SSL encryption, and 2-factor identification. All funds are stored in segregated accounts, and funds are protected by various financial authorities.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

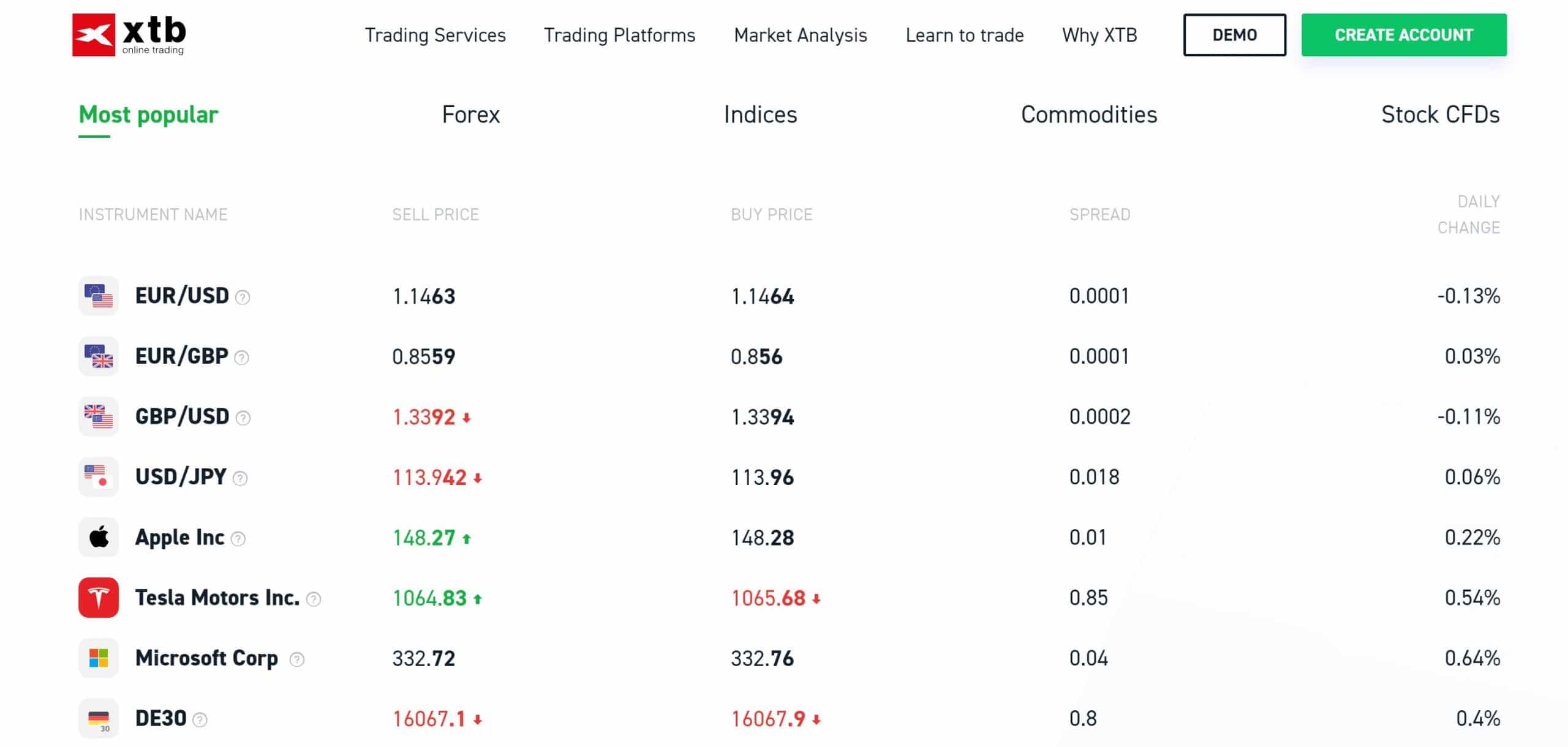

XTB is one of the best fx trading platforms in Saudi Arabia that provides traders with some of the lowest spreads in the market across all asset classes. It is among some of the most competitive Kiwi Dollars vs. Euro price spreads you will find anywhere. You can also find pricing for both major and exotic pairs alike such as NZD/JPY, NZD/KRW, EUR/USD or USD/GBP. XTB made headlines throughout the industry only about a year ago when they announced their entrance to Saudi Arabia; although it had been available for anyone outside of Australia to use for some time beforehand.

XTB is a Forex broker that provides traders with a wide range of services. On their website, you can find an explanation of the various services and accounts they offer, educational material, and a demo account. XTB is a platform where you can trade a vast number of foreign exchange instruments, including currency pairs, indices, stocks, energies, and so on. At the same time, you can open different trading accounts depending on your budget and wishes. That way you will be able to trade at XTB based on your financial situation.

For “Standard” accounts, XTB advertises minimum FX spreads of 0.5 with no commission and 0.1 plus a commission for the “Pro” accounts.

XTB Ltd is authorized and regulated by the Financial Conduct Authority (FCA). Client Money is treated based on strict accordance with the FCA’s rules and regulations which can be reassuring regarding safe practices. Unfortunately, XTB doesn’t seem to offer 2FA security on its native forex platforms which can be concerning to some security-conscious traders.

Pros

Cons

and Pro) transactions

67% of retail investor accounts lose money when trading CFDs with this provider.

Forex trading is a financial activity that involves speculating on price fluctuations for various global currencies with an aim to profit. Basically, you forecast whether a certain currency will strengthen or weaken in relation to another. Also, forex trading happens all over the world from Sunday night to Friday night on a 24-hour basis. The market is estimated to have a daily turnover of around $5 trillion. Because of its flexibility and low entry capital requirements, it’s a popular trading field in which practically anyone can participate.

Besides hobbyist traders, the forex market is also dominated by brokers, banks, and other financial institutions. The market is usually extremely abuzz in huge metropolises like New York, Hong Kong, London, and Tokyo. FX has both pros and cons. Keep reading to learn some of them.

If you have ever travelled outside your country, the chances are high you have already participated in a forex trade. You exchanged your local currency to that of the new destination which is a simple form of foreign currency exchange. But it’s more than that. When big companies or central banks purchase a country’s currency in large amounts, its demand goes higher and the rate ticks upwards.

Here’s a good example; you travel to Europe from the US. So you change your $100 into say 80 Euros. You decide not to use the money. On your way back, the economy has moved a little favouring one currency at the disadvantage of the other. So you stand to either gain or lose. Let’s say initially the exchange rate was 1 Euro=1.25 dollar. If the Euro goes higher the dollar could come down to say, 1.50. This means you don’t get back $100 for your 80 Euro. Instead, you get $120 (80 x 1.5) because of the updated currency rate. By investing in euros instead of US Dollars in that period of time, you ended up making $20 or 20% profit on your capital.

On a large scale, if you keep predicting whether a currency will go up or down and placing orders, you stand to win or lose based on each prediction and timing of your orders. That’s how forex works in a nutshell. Bear in mind that there are many commodities, shares, indices and even cryptocurrencies available on most forex platforms which you can also trade besides foreign currencies.

Benefits

Risks

World currencies aside, there are many assets you can trade with a forex account. Let’s dig into a few common choices.

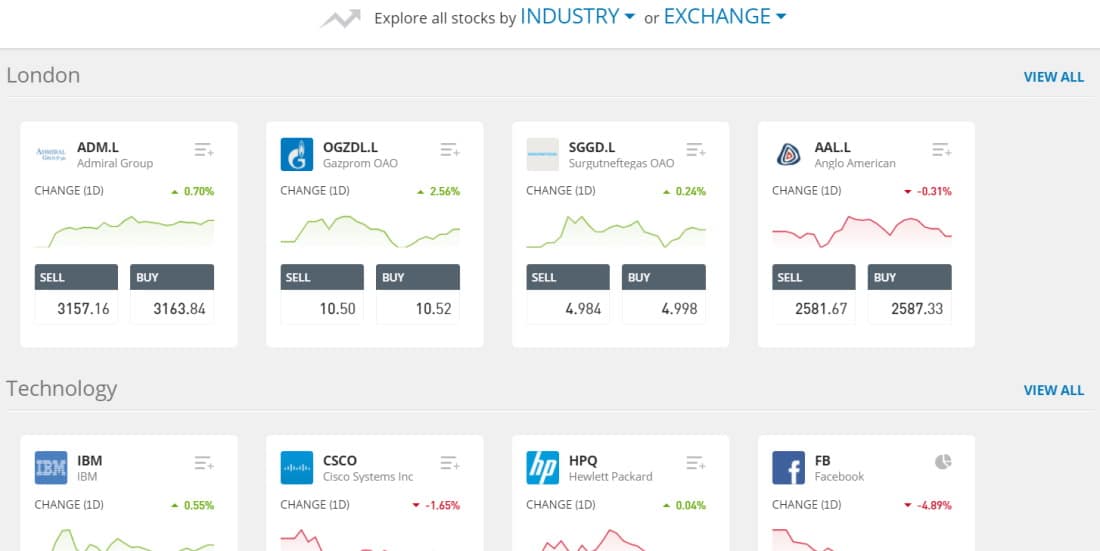

Stocks represent a company’s worth. When you buy them, they give you a certain degree of ownership and control. Some of the most lucrative stocks from recent years are Apple, Google, Amazon, Netflix, Tesla and Facebook.

ETFs (Exchange-Traded Funds) refer to a pool or bucket of different assets. With stocks, you buy shares individually. However, a single ETF can consist of a variety of stocks, bonds, and other securities. So why ETFs? It saves investors research time, contributes to diversity, helps with risk management and you can also benefit from a rising price when you decide to sell your ETF shares.

When it comes to finding the best ETFs to invest in, don’t go it alone. Let our experts help steer you in the right direction with our list of the best ETFs to invest in today!

You’ve possibly heard of Bitcoin at this point. But it’s not the only popular crypto asset nowadays. Together with Dogecoin, Ethereum, Litecoin, Ripple, and thousands of others cryptocurrencies have been gaining significant ground in the finance world. Apart from Bitcoin, the rest of the coins go by the name Altcoins and the name stands for “alternative coins.”

As a revolutionary invention that is believed to shape the future of finance, cryptocurrencies have become a tradable asset and a popular one at that. Because of their high volatility, they indeed present huge trading opportunities as well as risks. Most of the time, altcoins are paired with Bitcoin, other altcoins or fiat currencies. Crypto trading platforms allow investors to rapidly adopt crypto-asset strategies and get involved with this innovative technology.

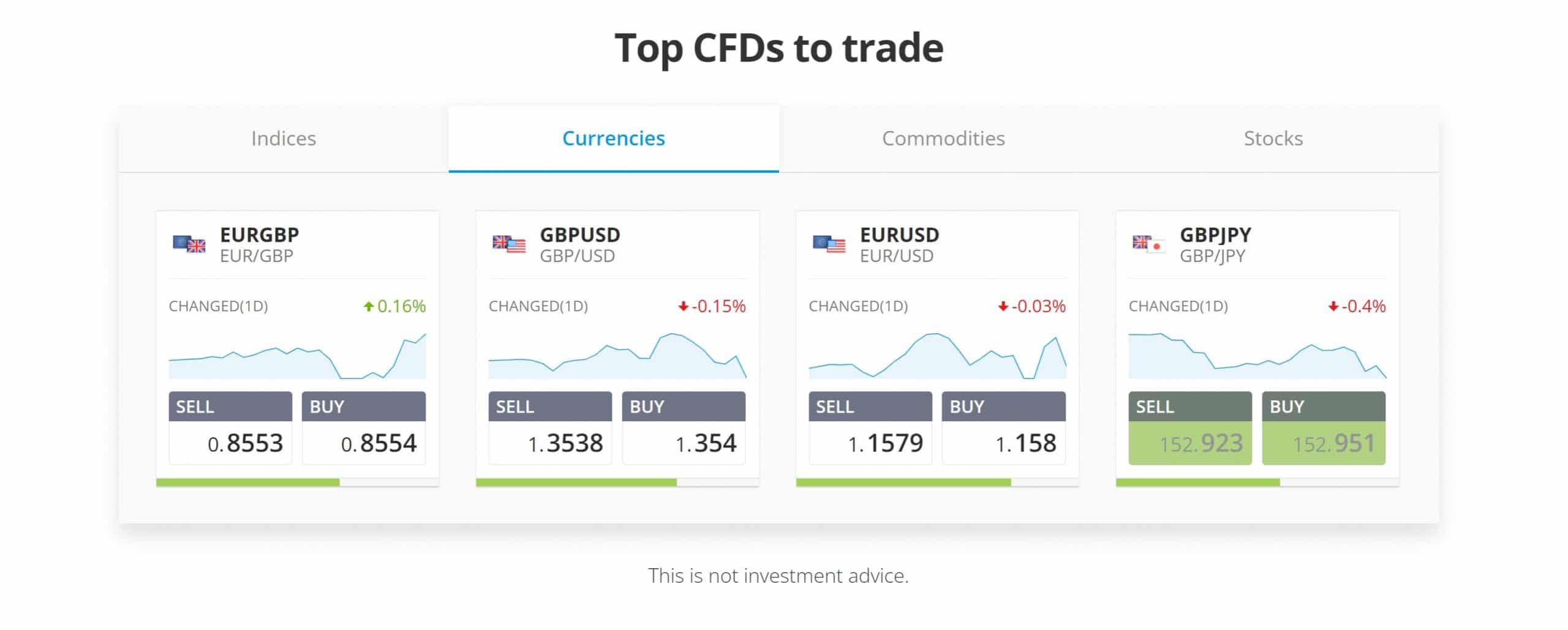

CFDs (Contract for Differences) is a trading model that allows traders to place bets on the price movement of stocks, currencies, indices, and commodities. With this approach, you don’t need to own an asset. You simply speculate whether the price of a particular security or derivative will go up or down. If you bet that the price will go up and that happens, the broker will pay you. If unfortunately, the price dips instead of rising as you predicted, you lose to your broker and have to cover the losses. Brokers usually don’t take directional positions and just facilitate whichever direction you’d like to trade.

Looking to get into the world of CFDs? Check out our list of the best CFD brokers. We’ve scoured the internet to find the best brokers out there, so you can focus on making money. With options for both beginners and experts, we have a broker for everyone. So what are you waiting for? Start trading today!

Forex trading platforms bridge the gap between the buyer and the seller. And for fostering such a profitable business, you might stop to wonder, just how do they make money? Well, let’s get to that:

Spread refers to the difference between the bid and ask prices. In other words, it’s the difference between buying and selling prices. Let’s say you buy a share of XYZ for $121 and its selling price is $120. If you sell it right away, you lose $1 dollar which is the spread.

Spreads are ideal for some traders since there are no additional charges to be expected. However, some platforms widen spreads for CFDs more than the market figure to make more profits. This is something to be careful about in forex trading. Additionally, sometimes spreads widen due to market conditions and lack of liquidity or high volatility. Because of all of these factors, it’s important to find a trustworthy brokerage platform.

Forex commissions can be established in two ways; a flat rate per trade or a percentage that is based on trading volume. The former can be disadvantageous if you are making lots of transactions. For instance, if you are buying and selling 1000 times a month, this would have a significant impact in terms of trading fees. But if you are making a few trades a month with high volumes you might not care about these fees per transaction as much.

Thankfully, with brokers striving to attract new clients and keep the ones already in, incentives are common.

Non-trading fees

Some forex charges may include fees that are not directly linked to your trading activity. For instance, an inactivity fee is expected for anyone that leaves their account dormant after a certain time, usually 6 or 12 months. The rate usually changes between $5 and $20 per month.

To encourage more members to join a broker’s platform, some don’t require deposit or withdrawal fees. However, it’s not rare to come across services that demand withdrawal and deposit fees which vary depending on the amount or method used. If you want to load your account with funds or withdraw to a different currency, there’ll usually be currency conversion fees. Also, should you open a position that needs to remain open for a day, most agencies will charge you a small overnight fee of around a dollar but it can be higher depending on the platform as well.

Before you can trade forex assets, you must pick the platform to place your orders in the market. Of course, your choice can affect your performance. Reliable trading partners are a must if you are taking your forex activity seriously. Here are a few main factors to consider.

Forex trading gives you the ability to trade as many products as possible. So, you would need access to multiple currencies and in many pairs, so you can switch things up whenever you feel like it.

You have to pay your broker in one way or another. If they don’t ask for fees or commission, then they are going to earn from your spreads. In this case, you may want to find out how many pips they demand per trade. There’s no point in you being overcharged when there are many affordable yet effective services.

If you want the chance to go big on your trading, you will likely consider leverage at some point. Some brokers allow traders very high leverage of 50:1 and above while others are more prudent and risk-averse. This guarantees big wins (and unfortunately big losses as well.) If you want such a feature, make sure to use it cautiously and choose your platform accordingly.

You will need an account with many features that can help you make accurate predictions. Without a chart, you cannot tell where the trends are headed. You would need to look elsewhere and with all the pressure at hand, that could be considered an inconvenience. Apart from charts, you need analytics tools that show strength indicators, moving averages, market news, economic insights and volatility indicators. Alerts are awesome for bringing your attention to the changing margin levels, prices, or market conditions.

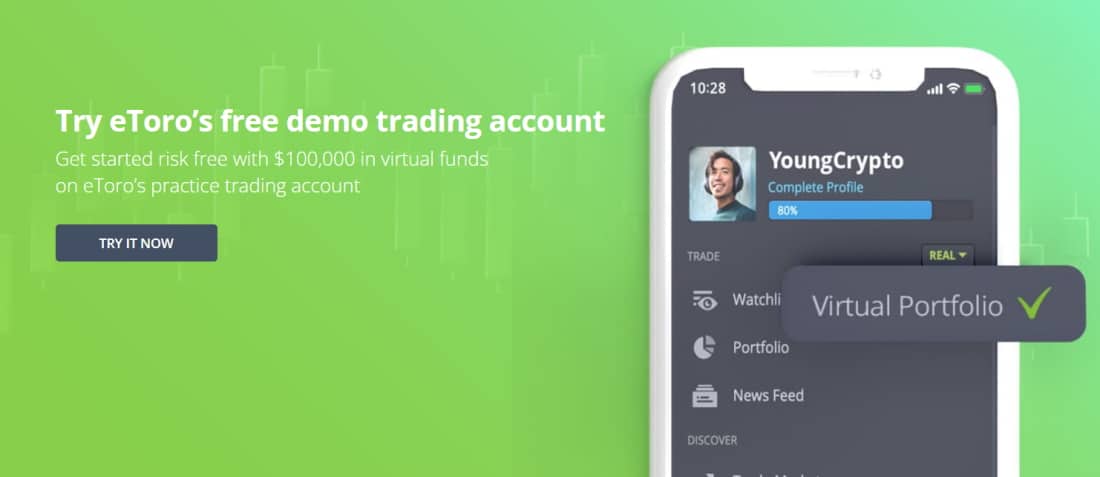

Demo trading is a common offering on many forex trading platforms. It allows novice traders a chance to experience the feel of the real market with dummy currencies. If you like the features and product offering, you can go ahead to sign up with your full details.

When you open a demo account with eToro, you’ll have unfettered access to the copy trading platform, along with a pre-set balance of $100,000 in virtual funds to experiment with. You can then add funds to your virtual or real account by opening a ticket through the customer support feature.

The forex market is extremely big which makes it impossible to have a centralized regulatory body. For this reason, your broker must be regulated by trustworthy agencies so that in case they land in an unpleasant situation, you are assured that your dues will be fully (or at least partially) paid.

Security is just as important. Every broker is required to get some sensitive information from you like credit card numbers, passport, utility bills, etc. if such info lands in the wrong hands, your identity can be stolen. Plus, poor security can disrupt normal trading which could translate to unnecessary losses.

Forex trading continues around the clock (24 hours). And it is the duty of your broker to ensure during this time that everything runs smoothly. When something like a glitch happens and you need assistance, they should provide feedback in the shortest time possible.

Besides speedy response, you must check for the availability of multiple communication channels so you can switch to the preferred one and get help faster. Just one more thing; politeness of customer agents and the quality of their service must be taken into consideration too.

Forex trading can be rewarding if you get the right training and work with the right forex trading platform in any place including Saudi Arabia. Sure, there will be a few trials and errors at the beginning of your journey but if you remain committed and learn the trade, you might also find lots of joy and increase your intellectual capacity in the financial world. We recommend referring to this well-researched article to assist you in your decision-making progress. All the best.