Invest In Maker – How To Invest In Maker For Beginners

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

MKR – which is an ERC-20 token, is one of the hottest projects in the crypto space. In a nutshell, MKR governs the Maker ecosystem which in turn – supports the stablecoin DAI. DeFi tokens like this offer an innovative financial service that enables users to borrow and lend digital currencies without intermediaries.

Your best chance at success when learning how to invest in Maker is to buy MKR tokens via a creditable platform. In this guide, we explain how to invest in Maker in 5 minutes or less with a regulated and lost-cost cryptocurrency broker.

Table of Contents

As we said, the best way to invest in Maker is via a credible platform. See below the best in the industry.

Whilst this list of trustworthy places to invest in Maker should save you some time, you can also study our full reviews of each provider after the short sign-up guide that follows.

This guide will cover each important aspect of how to invest in Maker. First, please find below an easy-to-follow walkthrough. Note that we opted for eToro for this demonstration. This is because it has the approval of huge regulatory organizations such as the FCA, SEC, and ASIC. Moreover, the platform is easily operated for beginners and allows you to invest in Maker from $25.

After the completion of step 4, eToro will credit your portfolio with the MKR tokens you purchased.

Cryptoassets are highly volatile unregulated investment products. Proceed at your own risk.

When researching where to buy Maker, our expert team studies various important characteristics.

This includes:

We also take the platform for a test drive to ensure it’s easy to use for most skill sets. See below the best places to invest in Maker – with each platform reviewed in full.

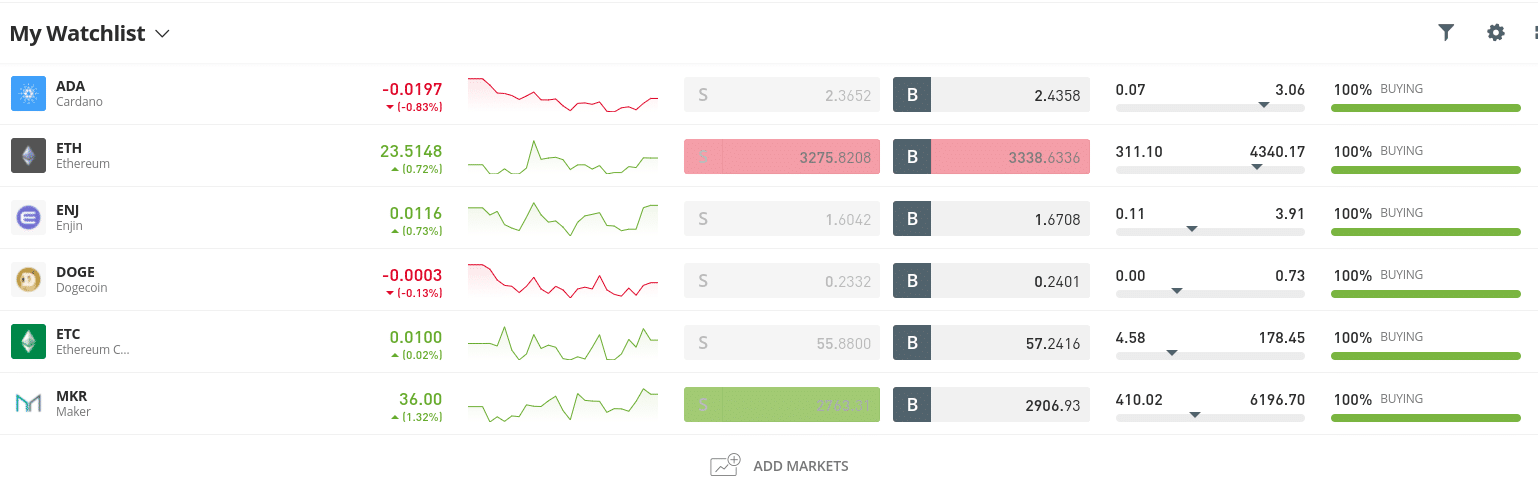

eToro is one of the world’s leading investment platforms for multiple reasons. You can invest in Maker here on a spread-only basis which means there are no fixed or variable commission fees, unlike many online brokers. We checked out the average difference between the sell and buy price of a range of cryptocurrencies and found the lowest spread to be very competitive at 0.75%. You will also find a further 29 digital markets including Basic Attention, Dogecoin, UniSwap, NEO, Binance Coin, and Stellar. eToro also lists some of the oldest and biggest tokens including Ethereum, Bitcoin, and Litecoin.

When thinking about how to invest in Maker, you should pay attention to which payment methods might be supported by the platform. At eToro, you can add money to your account with a credit/debit card, e-wallet, or bank wire transfer. This includes PayPal – which isn’t often supported by crypto brokers. eToro is regulated by financial bodies the SEC, the FCA, CySEC, and ASIC – with consent from FINRA. It also enables you to store digital currencies you’ve purchased within your account, which provides a level of peace of mind not offered by unlicensed crypto exchanges.

At eToro, you can complete each step of KYC and have a fully operative brokerage account to invest in Maker within 5 minutes. Moreover, US clients will not pay a fee to fund their account here, as eToro is denominated in USD. Other nationalities will be charged 0.5% to exchange their currency for US dollars – which is still really competitive. The first-time minimum deposit varies. For instance, for US citizens this is $50, whereas UK clients pay $200 (around £145). As such, when carrying out research on how to invest in Maker, you should check which amount applies to you.

Most newbies or even seasoned investors want to lessen the risk involved with the digital currency markets. At eToro, it’s possible to invest in Maker without needing to purchase a full token. The minimum investment starts from $25. This amount allows you to buy just 0.01 units of MKR – at the time of writing. With that said, the price of cryptocurrencies is always subject to change. There is also an eToro app that is free to download and permits you to invest in Maker on the move. You can also use charting tools, view indicators, and take part in the social trading platform where you can comment and ‘Like’ other investors’ posts.

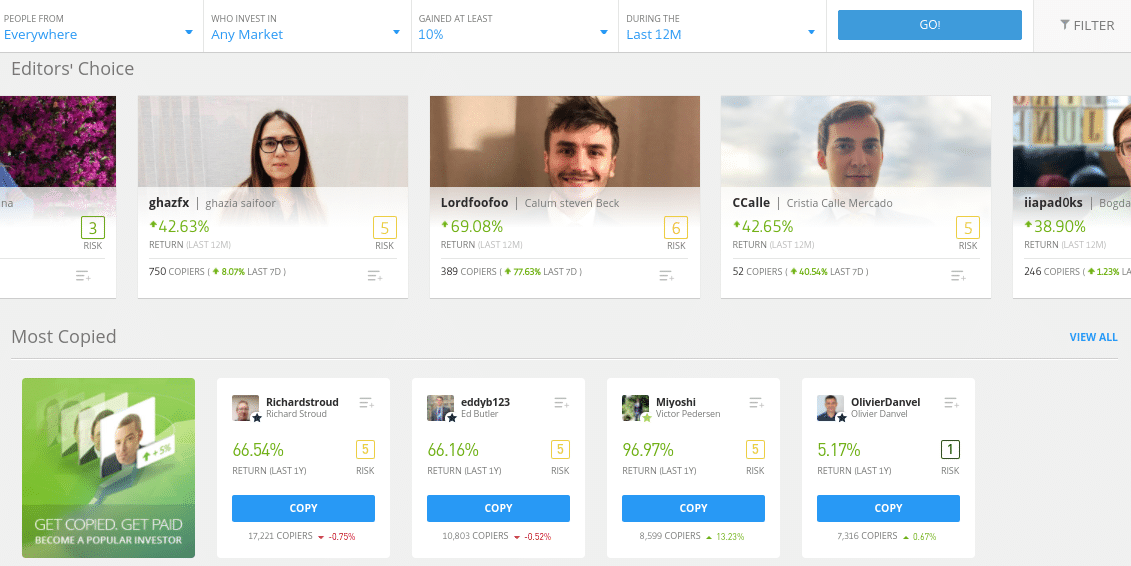

Some people prefer a laid-back investing technique. One of the simplest ways to achieve this is to invest in one of the pre-vetted investors listed on the eToro Copy Trading page. You can allocate some funds to a person you like the look of and any order they place will be reflected in your own portfolio – in proportion. Ergo, if they risk 25% of their trading balance on Maker and 25% on Enjin – 50% of the amount that you invested in the Copy Trader is now allocated to MKR and ENJ tokens. You can also check out the CopyPortfolio tool which is a basket of varying crypto assets under a single investment. This is automatically managed and rebalanced.

Pros

Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

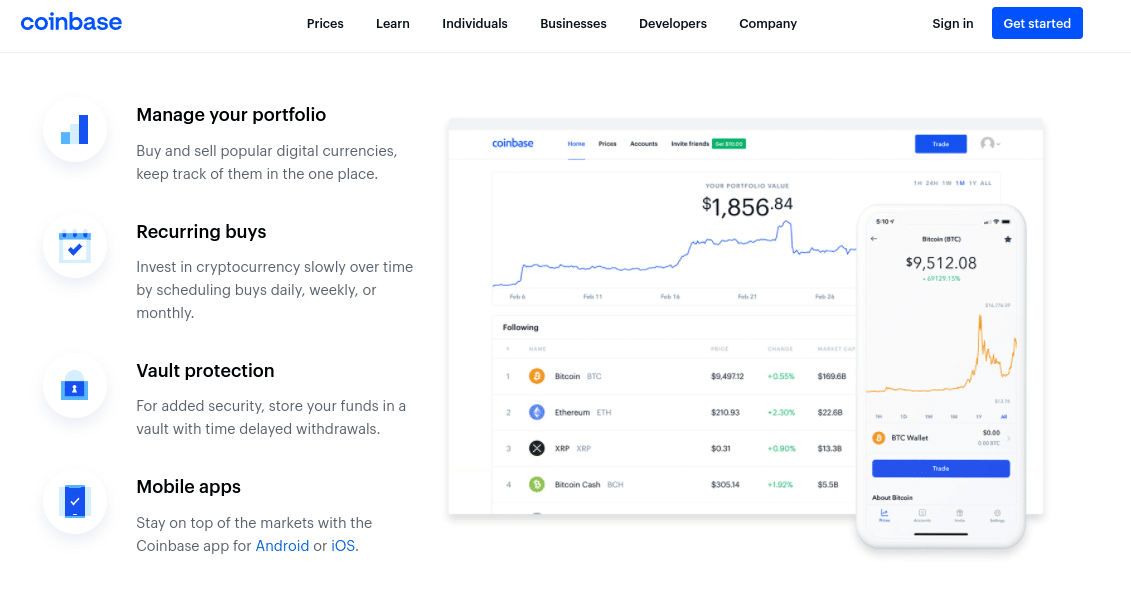

Coinbase is another viable option for those looking to invest in Maker. The platform is straightforward and easily accessible – making it compatible with complete beginners looking to invest in Maker. As well as MKR tokens, we found large-cap cryptocurrencies to include Litecoin, Bitcoin Cash, Ethereum, and Bitcoin amongst others. You will also find offerings such as Algorand, Polygon, Dogecoin, XRP, Stellar Lumens, DAI, and more. Unlike spread-only broker eToro, this platform stipulates a standard commission charge of 1.49%.

As such, if you allocate $1,000 to invest in Maker you will be charged $14.90. Importantly, this fee is also payable when closing your position. There are other charges to consider here, too. For instance, we found that debit and credit card deposits come in at 3.99% of the amount added. In other words, if you fund your account with $1,000, Coinbase will take $39.90. It has to be said this is very pricey. The only way to skip the deposit fee is to complete a bank transfer. The problem with this is that bank transfers will delay your ability to invest in Maker – as the payment takes days to be added to your account balance.

As with all the best places to invest in Maker, you will be required to finish the KYC process when signing up and making a deposit. In other words, the platform needs to validate your ID and address to operate within the regulatory guidelines it has been given. If you wish to try a dollar-cost averaging strategy, you can utilize the Recurring Buy feature offered by Coinbase. This saves you from placing regular orders manually and therefore allows you to invest in Maker without doing anything. There is also a free app available to download which is easy to use and allows you to buy, sell, and swap supported cryptocurrencies.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

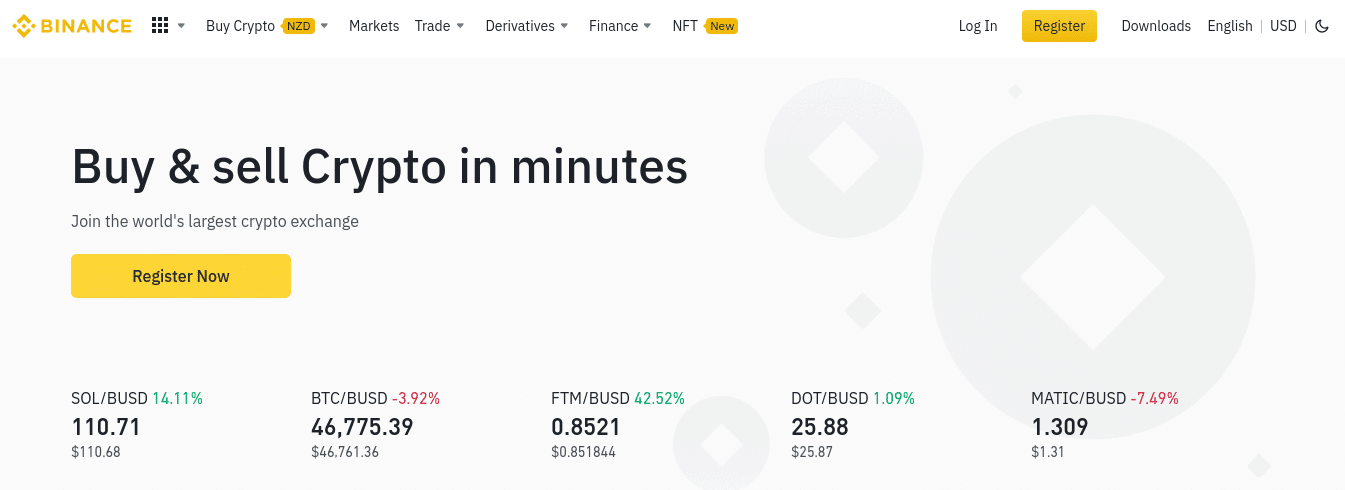

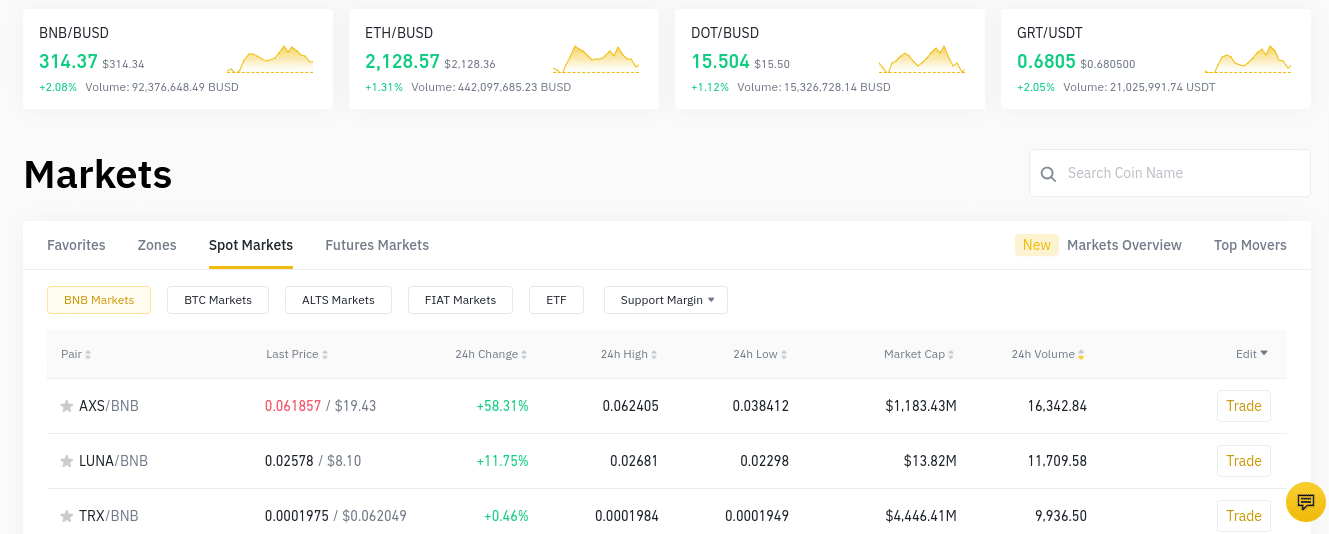

Many cryptocurrency investors lessen their vulnerability to one market by diversifying. At Binance, you can invest in Maker as well as a long list of other markets. We found Ethereum Classic, Tron, Dogecoin, Aave, Monero, Terra, Dash, and a plethora of other digital assets. This well-known crypto exchange also has a site called Binance US for American clients. The latter features 50 digital assets and charges 0.5% for instant debit and credit card deposits.

The main Binance platform stipulates 1.8% on debit and credit card deposits for UK clients. However, some other parts of the world could be charged up to 3.50%. As such, you need to make sure you check potential fees for your region before opting to invest in Maker via this exchange, as the costs may be unviable long term. If you would prefer to fund your account using a bank transfer, you will also need to ensure this is possible where you reside.

There is a standard commission fee at Binance – which is a reasonable 0.10% – charged both when buying and selling. Notably, this will be reduced by 25% if you opt in to pay your fees using BNB tokens. People who trade large volumes of cryptocurrencies will also receive a discount on such charges. Beginners might find the academy useful here as it includes educational material that is specific to the blockchain and crypto industry. We also discovered many trading guides covering the financial markets.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

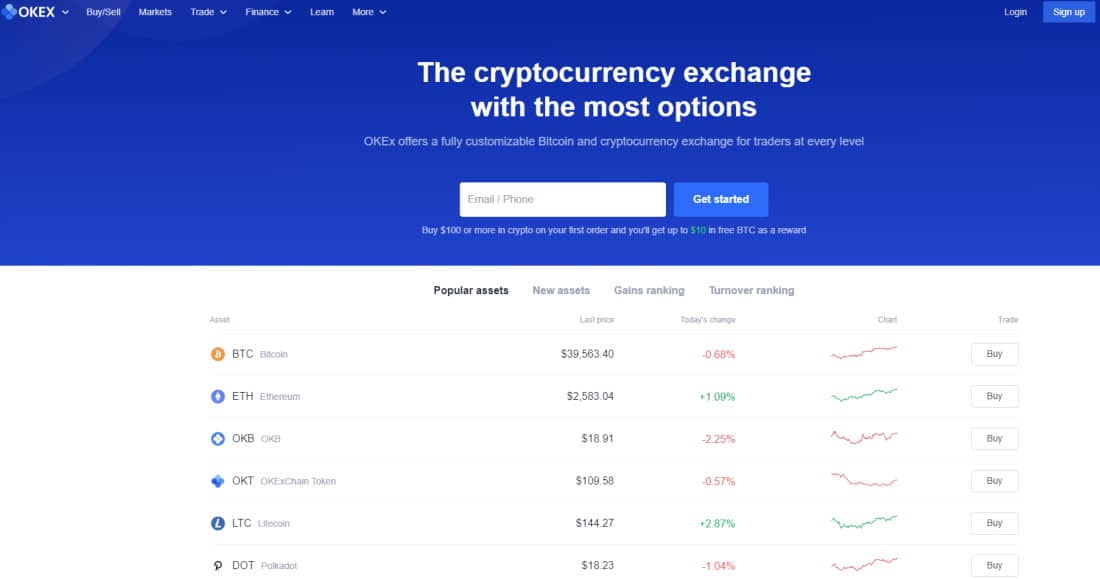

If you already have some Tether, Ethereum, Bitcoin, or any other leading crypto asset – you might want to invest in Maker at OKEx. This is because the platform supports crypto deposits – which also saves you from taking part in the KYC process. In this case, you can create an account and make a deposit using your existing tokens – provided they are listed. In addition to Maker, we found tons of alternatives and in excess of 400 pairs to trade at this crypto platform.

Popular crypto markets include Chainlink, Litecoin, Filecoin, Monero, NEO, Litecoin, SushiSwap, Bitcoin, and Cardano. Let’s say you are completely new to investing in cryptocurrencies, so are yet to hold any tokens. if this is the case, OKEx supports fiat deposits after the KYC process has been completed. This spans 30 fiat currencies – such as GBP, USD, AUD, EUR, and JPY – to name a few. Investing in Maker should be simple here. To make a deposit, choose between a credit/debit card or bank transfer.

OKex charges 0.10% per trade, meaning if you place an order worth $1,000, the exchange will take $1 as a commission fee. If like many people, you would like to have the option of accessing your investment in the palm of your hand – then you can head over to the app store on your phone and download the free app offered by OKEx. Here, you can access all account features as found on the main OKEx platform.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

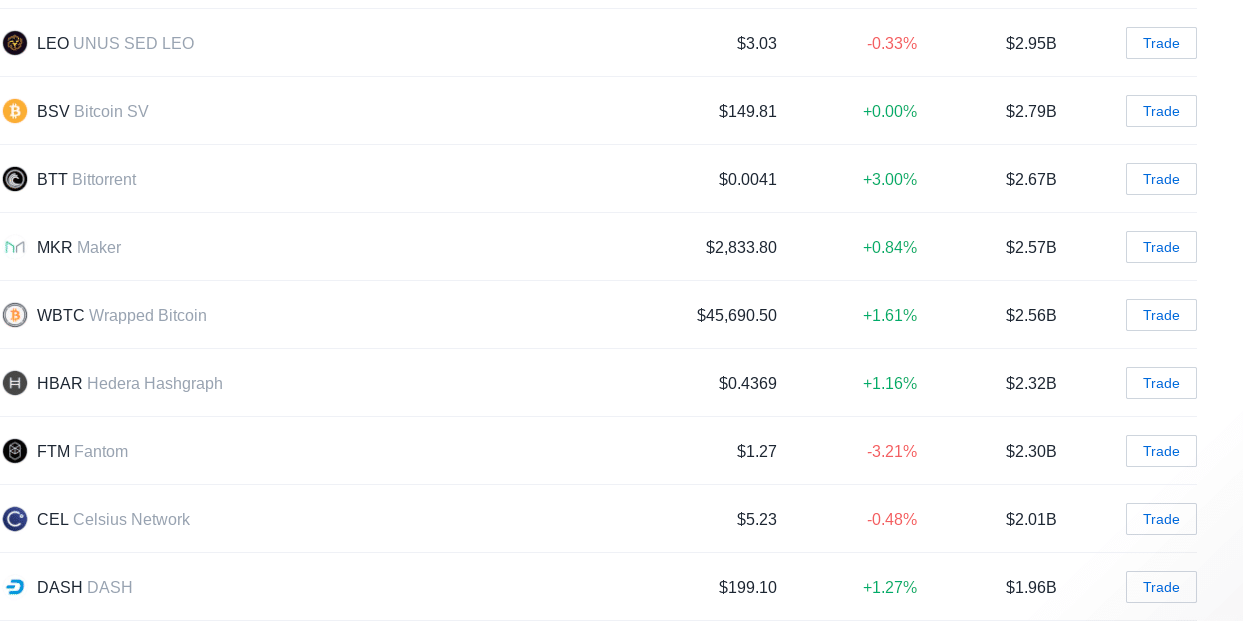

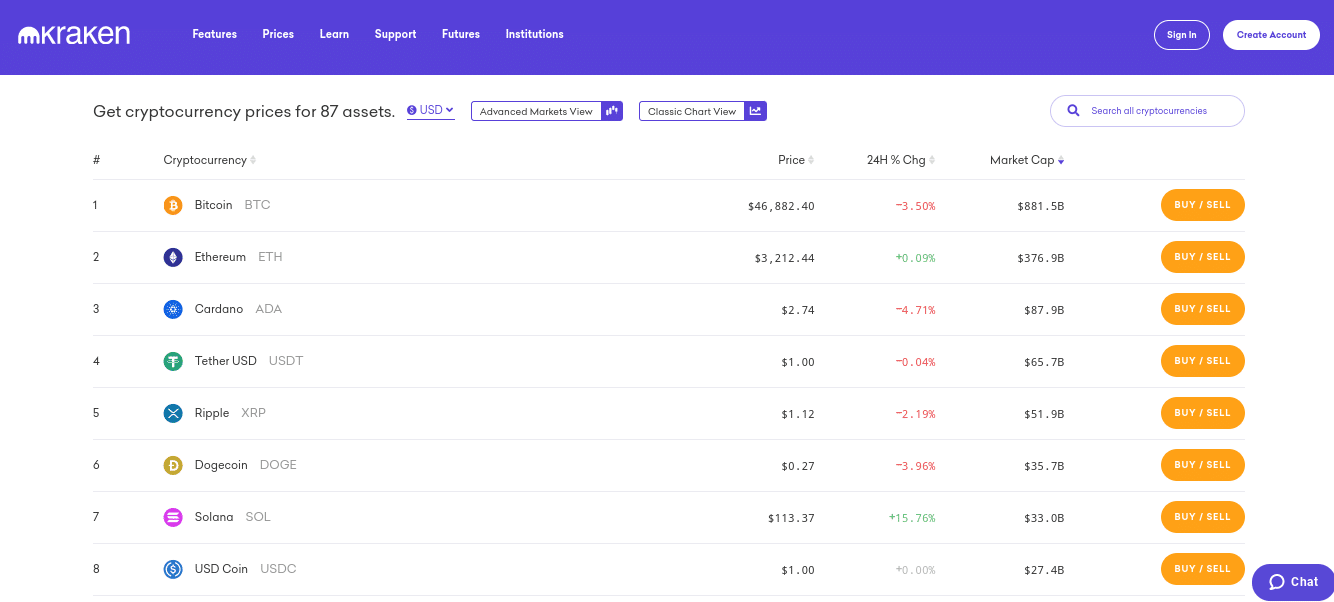

Kraken is a large crypto exchange with a good reputation and over 70 cryptocurrency tokens – including MKR. You can invest in Maker here from $5 upwards and other assets listed include Ripple, Solana, Bitcoin, Tether, Compound, and Litecoin. You will also find tons of other digital asset offerings of all different shapes and sizes. This broker complies with AML laws, so you will need to finish the KYC process to add funds to your account and make a purchase.

Supported fiat currencies to invest in Maker include USD, GBP, CAD, AUD, and more. Deposit methods include FedWire for US clients, and many other countries can also fund their accounts with a credit and debit card. Some payment types are fee-free, but you will need to check this information against your country and also your chosen method. The first time you make a deposit, Kraken adds a 72-hour hold on all withdrawals. This is for security purposes.

The minimum deposit to get started and invest in Maker is $10 and commission fees will vary depending on how much you trade. To give you an example, if you think you will allocate less than $50,000 within a 30-day period you will have to pay Kraken 0.26% on every order. If you risk more than $10 million, you benefit from a lower charge of 0.10% for each buy or sell position. Granted, this amount of risk is highly unachievable and inadvisable for beginners. Finally, Kraken also offers margin trading – which allows you to invest with more money than you have in your trading account.

Pros

Cons

at eToro, #1 Broker in the Crypto Space

Cryptoassets are highly volatile unregulated investment products. Proceed at your own risk.

By this point in our guide, you should have a clearer idea of the best platforms to invest in Maker. The next step is to sign up with your chosen broker.

We have elected to use eToro to demonstrate how to invest in Maker in a safe and secure manner. This is due to the reasons discussed in our eToro review, which included a strong regulatory standing, low fees, a wide variety of crypto assets, and low minimum investments.

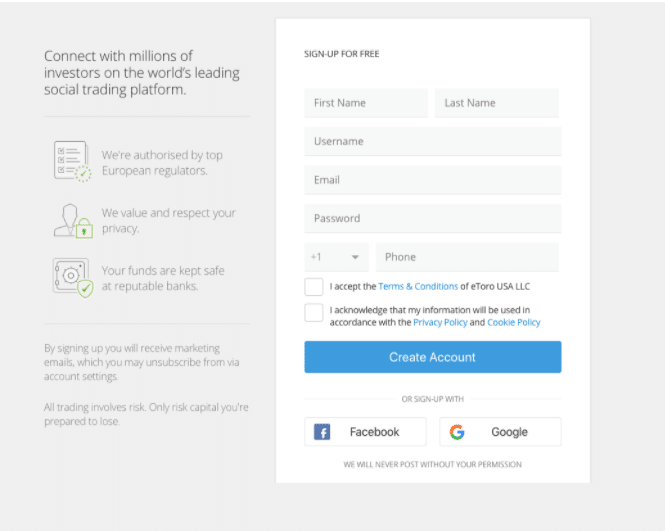

To put everything you’ve learned in this guide on how to invest in Maker to good use – create an account with the regulated platform eToro.

You can sign up for free:

You will also need to tick the relevant boxes and confirm you have read the T&Cs and acknowledge the privacy policy. This is standard practice in regulated spaces and enables the broker to be transparent to its clients.

eToro will also ask you for your tax number, date of birth, and residential address – and ask some uncomplicated questions regarding your trading history. Again this is nothing to worry about and takes seconds to complete. eToro will also validate your mobile number by sending you a code.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

Once step 1 is complete, you can move on to the all-important KYC undertaking. This couldn’t be easier and is necessary so you have a fully operational trading account. This will allow you to deposit as much as $10,000 to invest in Maker – not that we recommend risking such a high amount.

You will find a list of accepted documents on the eToro platform, but most people opt for a passport to validate their ID and a recently dated bank statement to back up the address.

To add funds to your account to invest in Maker, you must decide on the preferred deposit option from the list available to you.

eToro supports a plethora of payment methods inclusive of the following:

As we mentioned in our earlier review, US clients will not pay a fee to fund their account and can deposit from $50. Many other countries must deposit a minimum of $200 and will be charged a low fee of 0.5% to swap their local currency for USD. This is still competitive, and it’s important to remember you don’t have to invest the whole amount.

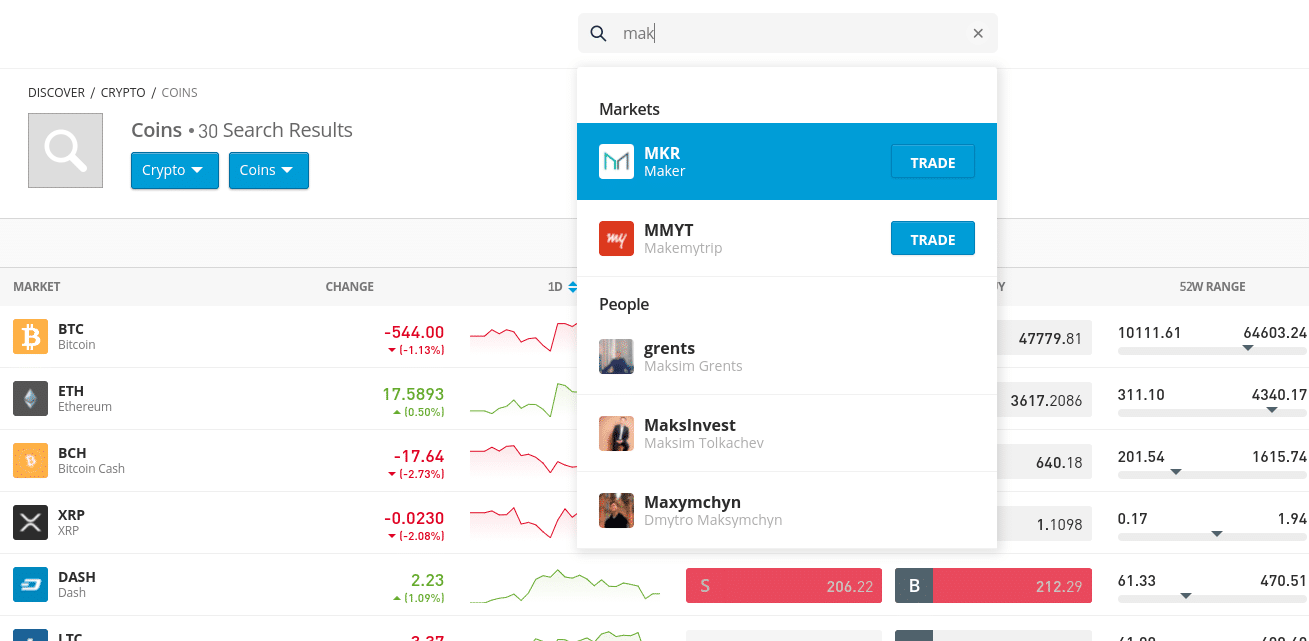

Next, use the built-in search bar to search for Maker.

As you can see, this will reveal the asset you are looking for, and anything else that looks like it. As such, it’s important to ensure you are clicking the correct asset before you confirm with the ‘Trade’ button.

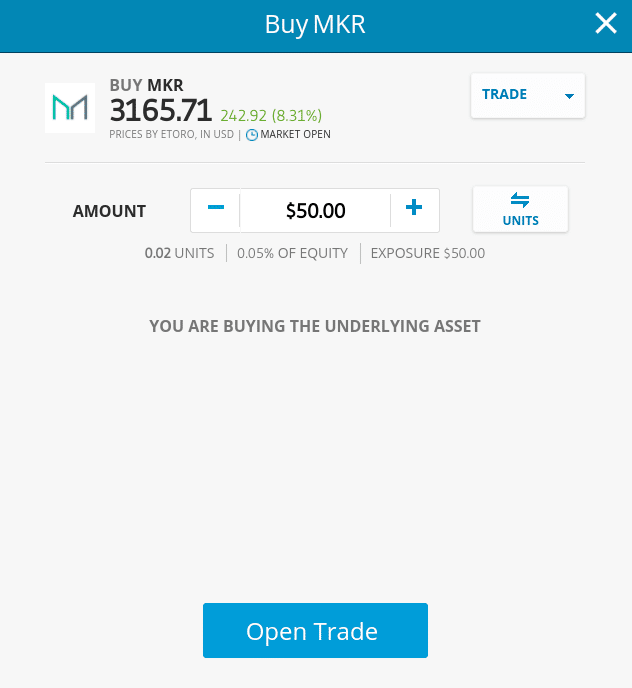

When you see the order box appear, make sure it says ‘Buy MKR’ at the top so you know you are about to invest in Maker and not something else. eToro supports investments starting from a minimum of $25. Here we are about to allocate $50 to MKR tokens – which at this time affords us 0.02 units.

Small investments are great for new investors as it’s a low-risk way to get the ball rolling and access this speculative cryptocurrency. Type the amount you wish to invest in Maker, check your order over, and press ‘Open Trade’ to verify that you want to go ahead. eToro will swiftly add the MKR tokens to your newly set up portfolio!

Once you know how to invest in Maker, you will also need to be aware of how to sell your tokens when the moment takes you.

Let’s assume you followed the above 5 step guide to invest in Maker at eToro:

It really is that simple. Furthermore, as eToro is able to store your MKR tokens for you at no extra cost – you can ‘HODl’ for as long as you wish. This prevents the arduous task of looking for a wallet and keeping your private keys safe.

When you are exploring how to invest in Maker, you will no doubt see different platforms offering access to the cryptocurrency markets. No two investors are the same, so it can be hard to decide what might be the best decision for you.

To make this decision easier, below you will find the two best ways to invest in Maker.

You could decide to invest in Maker at a cryptocurrency exchange, although it has to be said this is risky business – especially for people unfamiliar with the inner workings of keeping digital assets safe.

A much more secure option is to invest in Maker at a platform that answers to financial authorities such as the SEC and the FCA for example. This way, at least you can count on the brokerage adhering to standards and thus operating in a safe environment.

As we said, regulated online brokers offer the best way to invest in Maker. For instance, eToro complies with rules laid out by regulatory bodies located in the US, the UK, Australia, and Cyprus – as well as gaining the approval of FINRA, an independent organization in the US.

Aside from the peace of mind regulation brings, another benefit is that there is no doubt the brokerage is adhering to the long list of rules associated with retail investment accounts and thus – will offer you a legitimate financial service.

If you invest in Maker via online broker eToro, there is no need to deal with other traders at an exchange or use a separate crypto wallet. Moreover, the broker will keep your MKR tokens in your portfolio for safekeeping, which means you can access them at any time if you decide to cash out for a profit.

MKR tokens are gaining momentum amongst crypto-curious newbies, as well as seasoned traders and investors. When you commit yourself to learn how to invest in Maker, you are buying into a DeFi (decentralized finance) asset, which as we said, is believed by some commentators to be the future of financial services as we know them.

You will see some of the other reasons you may want to invest in Maker below.

The chances are you’ve heard about the buzz surrounding DAO (decentralized autonomous organizations). Next, we explain why when you invest in Maker; you are also taking part in a bigger operational protocol.

DAOs cut out the hierarchy and bureaucracy involved with traditional financial transactions. We are referring to negotiations that with fiat money would usually be carried out via government-regulated banks and third-party organizations.

Maker allows you as a user to have a say in various aspects of how the project is run. Specifically, this means that when you invest in Maker, you can opt to take part in the governance of MKR tokens. This is done by voting, discussing, and debating on the operation and management of the digital asset with other users.

See below to throw some more light on the subject, including what you might vote on:

As you can see, when you invest in Maker and thus hold MRK tokens, you become a stakeholder of the system and can participate in both executive votes and governance polls. The more you invest in Maker, the more power you have when it comes to voting as each token you hold.

As you may know from researching how to invest in Maker, this is a DeFi project – which means the application aims to challenge traditional financial services such as banks. As such, MKR tokens can use smart contracts on the powerful Ethereum blockchain, enabling users to earn interest. This also means you can lend others digital currencies just like you would with say US dollars or British pounds.

This is just one reason you might want to master how to invest in Maker, as the project has also grown a great deal since its release.

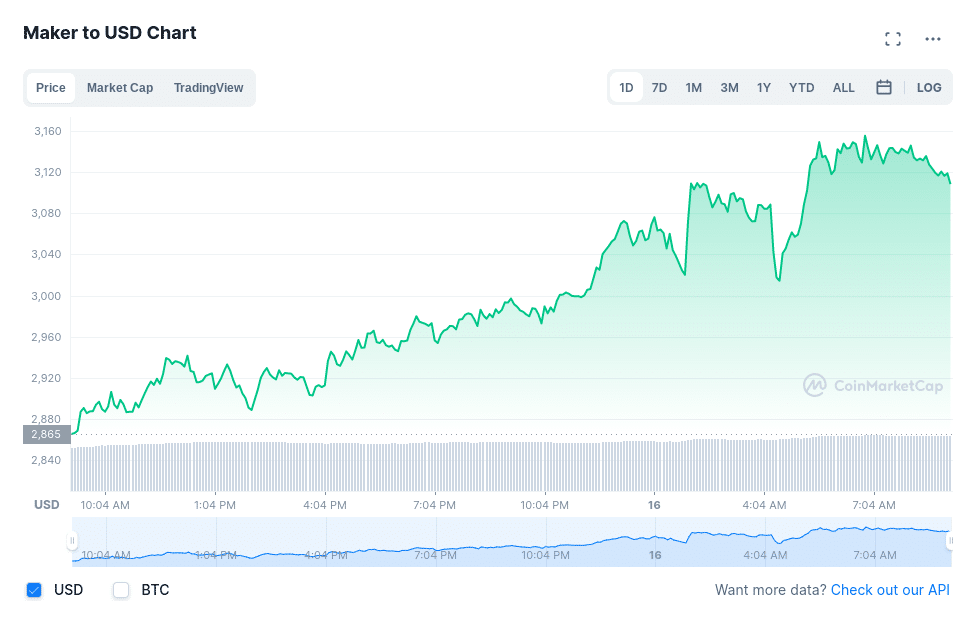

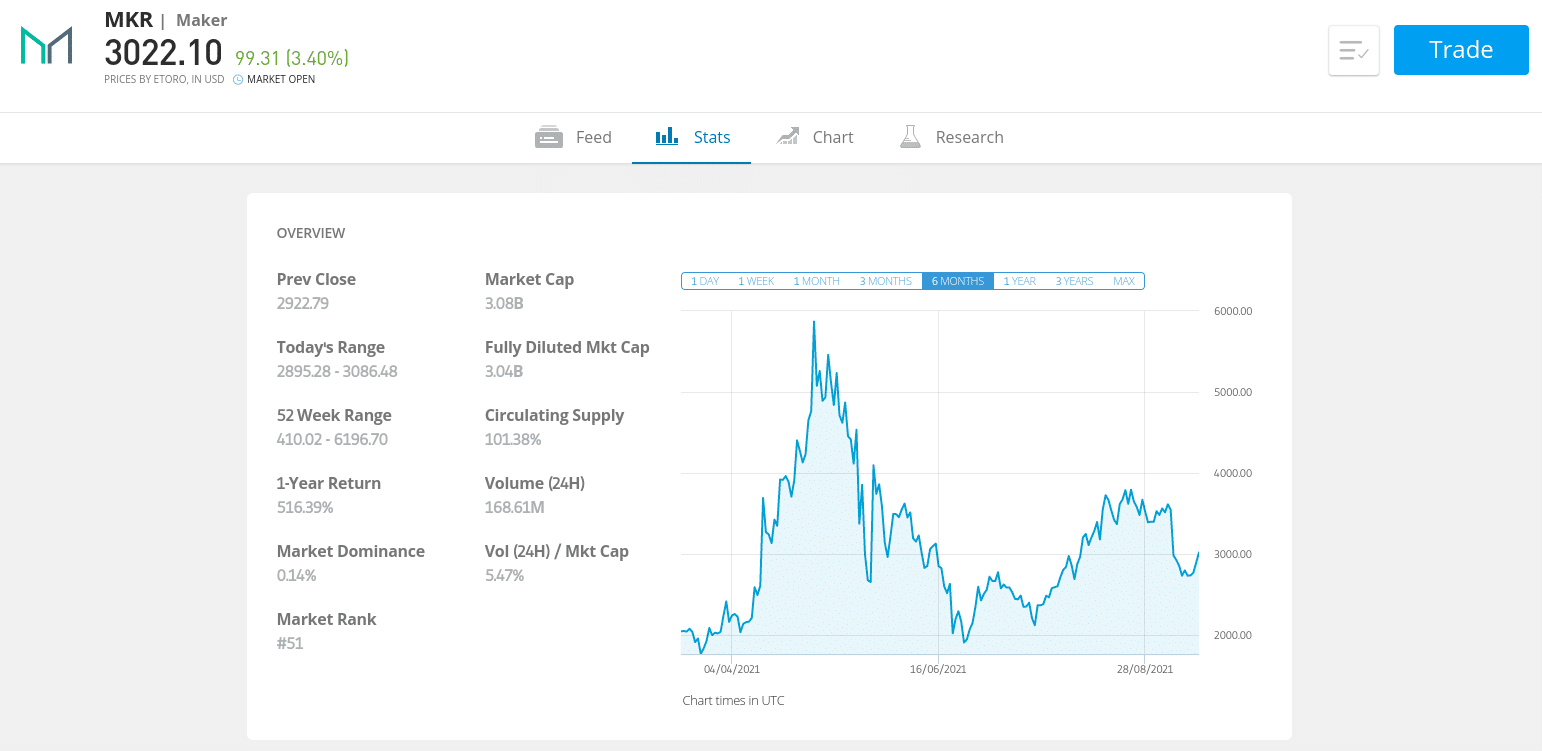

Let’s take a look at the growth of Maker since 2017:

The hype surrounding DeFi projects shines the spotlight on digital assets like Maker. Crypto analysts believe MKR tokens will skyrocket over the coming years. Despite this prediction, cryptocurrency traders and investors frequently encounter high levels of volatility, so when you begin to invest in Maker, do bear this in mind.

You can lower your risk exposure and get your foot in the door to invest in Maker in small amounts via high-ranking broker eToro. This starts from as little as $25.

As you are familiarizing yourself with the fundamentals of how to invest in Maker, you should also know this cryptocurrency has the advantage of high usability.

MKR tokens serve multiple functions within the Maker ecosystem and we list just some of these uses next:

Maker is able to drive demand for tokens partly down to its value as a DeFi governance project, but as you can see, it also serves other purposes. This is quite the opposite of the many pump-and-dump schemes on the cryptocurrency scene, where people create digital assets that are worthless – unbeknownst to newbie investors.

Some market commentators believe Maker has every chance of continuing to climb higher over the coming years. With that said, before going ahead and risking your money – you should also embark on your own fact-finding mission to ensure you understand the finer details of how to invest in Maker.

What are the Risks of Investing in Maker?

It’s no secret that investing in crypto assets is fraught with risk. When you invest in Maker or any other cryptocurrency, there is no telling whether the price of the asset will skyrocket or plummet.

See a few points below to give you an idea of the risks you might consider before you invest in Maker:

See below for inspiration on how to invest in Maker in a more risk-averse manner:

Finally, when you begin to invest in Maker, only ever allocate an amount you could face losing, as experiencing a loss is a very real possibility. Remember that eToro will let you buy Maker in manageable amounts of $25 and over.

No matter what crypto asset you are thinking about investing in, there will be some costs involved for the service offered. This might be charged for simply adding funds to your account, or perhaps executing your order.

Below you will find some customary fees to invest in Maker:

The importance of checking fees before you invest in Maker needs little explanation. You can see what a huge impact this might have on your take-home profit.

Maker is one of the more popular DeFi projects in this space. And the more attention an asset gets, the more brokers list it amongst their supported cryptocurrencies. Answering the question of how to invest in Maker is easy if you elect to do so via a well-established and regulated brokerage. It’s establishing which platforms are trustworthy that stumps most investors.

We checked out heaps of platforms covering both unregulated exchanges and also online brokers. This research found that the most convenient and safe option for newbies is undoubtedly eToro.

Numerous regulatory bodies approve of and regulate the broker including the FCA, ASIC, and the SEC. You will be able to invest in Maker in small amounts thanks to the broker’s minimum order stipulation of just $25. Furthermore, you will only pay the spread and can fund your purchase by credit/debit cards, PayPal, Neteller, wire transfer, and more.