MT4 Trading Platform – Compare Top MT4 Trading Platform Brokers in Australia

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

MetaTrader or MT is the most popular trading platform in the world favoured by forex traders, but it can be used for many other markets. Experienced investors also opt for MetaTrader, since its interface allows for automated trades, displays a broad range of trading indicators, and is completely free of charge.

However, as MetaTrader is a third-party trading platform, you need to pick a broker first if you want to obtain access to it. The platform is free of charge, but its revenues come from the software licenses sold to brokerages, so the cost structure depends on your chosen broker. If you want to get started with the most popular trading platform right now, check out the next sections to find out what you need to do.

Table of Contents

As briefly mentioned above, MetaTrader is a third-party trading platform that can only be accessed if you choose a licensed broker. Although most brokers in Australia provide access to this platform, not all of them are cost-efficient or worthy of your attention. To help you out, we’ve curated a list of the top brokers in Australia that provide you with access to MetaTrader 4:

Scroll down to find out more about each broker and how they may help you achieve your trading objectives.

MetaTrader 4 is the most popular trading platform in the world created in the early 2000s. MetaTrader 5 also came out in 2010, although most traders still prefer MT4.

MT4 is completely free of charge, but you will have to do your due diligence and pick an MT4-licensed broker to be able to use it. Below, we will introduce you to the best brokers in Australia that offer access to the MT4 trading platform.

AvaTrade is a global broker with a commission-free cost structure. You can trade with only A$100 and choose from a broad range of assets, including forex, shares, commodities, and bonds. There are no withdrawal or deposit fees, and it’s also recommended for beginners due to its broad range of educational resources.

To access MT4, you need to open an account with AvaTrade and choose MT4 as your trading platform. AvaTrade MT4 further provides you with the entire range of MT4 features and tools for financial analyses, ranging from interactive charts to varied timeframes and built-in indicators.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Capital.com is also an ASIC-regulated broker which has partnered with MetaTrader 4. You can access all the native features of the platform, there are no inactivity fees or withdrawal fees, providing a great opportunity for beginners and veterans alike. This low-cost broker is ideal for all trading styles and strategies – whether you are a beginner, high-frequency trader, or an investor.

The broker provides access to numerous videos that cover the basics of trading. These are supplemented by trading courses and quizzes to ensure that new traders become accustomed to all the trading jargon and functions.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

FP Markets is one of the most popular MT4 brokers in Australia. Regulated by the ASIC, experienced forex traders opt for it due to its low spreads that start at 0 pips for major pairs, such as EUR/USD. If you are a forex day trader, you will be able to leverage different tools to take advantage of market volatility.

What makes this broker stand out from the crowd is the FP Markets MT4 traders toolbox. This bundle contains 12 trading tools to ease your trading experience. For instance, you can use the correlations trader or the correlation matrix – these can help you understand the forex price action and how some currency pairs are correlated in the market.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Another well-known Australian, ASIC-regulated MT4 broker is Pepperstone. If you opt for a standard MT4 account, you can start trading without paying any trading fees or commissions. Also, the bundle known as Smart Trader Tools is a package you can access on your MT4 account and includes up to 28 indicators and expert advisors that will help you improve your trade execution. You will also be able to access Autochartist, a plugin that automatically recognizes price trends, but only if you have at least A$500 in your trading account.

Also, Pepperstone is ideal for scalpers due to its ECN execution. This refers to an “electronic communication network” and it automatically connects traders to liquidity providers. In other words, you enjoy faster execution speeds as all orders are automatically executed without requiring a “middleman”, unlike many other brokers, which would result in delays.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

If you are planning to start your trading career, IC Markets may be the best choice. It has a wide range of educational resources, including courses, market analysis, and webinars. Also, the broker provides 24/7 support for MT4 users.

Depending on your strategy, you can choose one of the two account types available. The raw spread account usually comes with 0 pip spreads, but you need to cover a commission per trade of US$3.5. Alternatively, you can opt for the commission-free standard account, but the spreads start at 1 pip.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

There are numerous brokers that provide access to the MT4 trading platform in Australia. Below, we will review a few crucial aspects you should consider before starting your trading journey.

The regulation and security of your trading account are partly related to your broker and partly related to your trading platform – MT4 in this case. Fortunately, all of our recommended brokers are regulated by the Australian authority – the ASIC. Regarding MetaTrader 4, the platform uses data encryption technology to conceal your crucial data (like your IP address) when you make trades.

MT4 does not have standalone withdrawal and deposit methods, so all of your transactions are conducted via your broker. This also means you need to cover any fees or charges incurred by your broker if any. Also, the payment methods available depend on your chosen broker. For instance, a versatile broker like AvaTrade or Capital.com offer a wider choice of payment methods, but not all brokers do. Some of them may only allow bank transfers which can take up to 7 business days to be reflected in your account.

MT4 was initially designed for forex traders, although now it provides a broad range of other assets, too. Most forex brokers will provide MetaTrader 4 for their users, while other brokers may support CFDs on other markets, including stocks, commodities, and indices. However, MetaTrader 4 was specially designed for forex trading while MetaTrader 5 was created mostly for equities and commodities.MetaTrader 5 lacks the popularity that MT4 enjoys nowadays, and the highly customisable MT4 interface recommends it for a wide range of trading strategies, even if you opt for multi-asset class portfolios.

Many traders use leverage and short-selling in their trading strategies. Let’s find out more about these concepts and whether such functions are available on MT4.

Leverage

Leverage is a financial tool that allows you to increase your exposure. For instance, 1:2 means that for each $1 in your account, you can control $2. Subsequently, 1:30 leverage means that for every $1 in your account, you can invest up to $30.

Leverage is supported by the MT4, but it usually needs to be accessed via your broker’s interface. Usually, you can access the brokerage account by opening the Navigator tab in your best trading platform Australia, then clicking on “Accounts”. There, you will be able to see your base currency (i.e., AUD) and the leverage ratio, depending on which broker you use.

Short-Selling

Short-selling is usually associated with shares. Essentially, it means borrowing the stock from your broker, then selling it and cashing in the profit (if the price decreases) or supporting the losses (if the price increases). In forex, going short simply means that you place a sell order – there’s no need to borrow the currency to short it.

Platform fees refer to any costs you need to cover to achieve your trading objectives, make transactions, deposit or withdraw money, among others. MetaTrader 4 is completely free of charge; however, depending on your chosen broker, you will have to cover certain costs.

Payment Fees

Payment fees refer to all the costs you need to cover to deposit or withdraw money from your trading account. If you plan to trade for a living, payment fees could easily bite into your daily profits, so it’s important to check the terms and conditions of your chosen broker. For instance, AvaTrade does not charge you any payment fees when you deposit or withdraw money.

Commissions & Spreads

As MT4 is a popular forex trading platform, you will most likely not encounter commissions – unless you opt for a commission-charging broker like FP Markets. Most forex brokers charge you spreads instead – which is a fee built into the prices you see for their assets. Some brokers like AvaTrade and Capital.com charge low spreads of around 1 pip or less.

Commissions are fixed fees per trade when you invest in stocks or other exchange-traded assets. These also vary depending on your chosen broker. As MT4 is not specially designed for other assets apart from forex, you may want to sign up with eToro, an online broker that provides commission-free trading of CFDs on stocks, ETFs and other assets, and you can also trade real assets, unlike MT4 where you only have access to CFDs.

Overnight Financing

If you leave your forex trades open overnight, you will earn or lose money. This depends on the interest charged on your chosen currency, which is calculated based on the interest rates of the two currencies you chose. The overnight fees also depend on the price movement of your currency pair, broker’s commission, the forward market, and the swap points. CFDs on assets, including commodities or cryptocurrencies, also include overnight fees.

MetaTrader 4 does not provide access to any third-party research and analysis. However, the platform does offer alerts and tools for staying up to date with the latest events and news. Depending on your chosen broker, you will be able to access more educational sections. For example, AvaTrade provides beginner-friendly articles and videos, along with third-party providers’ offerings like SharpTrader.

MT4 does not have a copy trading feature per se, like eToro has, for instance. However, traders can broadcast signals to other traders, allowing you to follow them. You can simply watch what others do in the market and copy their moves in real-time. Some traders may require you to pay a fee to see their signals, although this cost is reasonable. Many traders provide their signals for free, too.

There is no customer support offered by MetaTrader 4, although there is a webpage with helpful topics, such as user interface, tools, auto trading, and more. If you want access to customer service, you need to choose a broker that provides access to a live chat feature and phone support like AvaTrade.

One of the best highlights of MetaTrader 4 is that it is accessible from virtually anywhere via your laptop (Linux, Mac, or Windows) or your mobile phone (iOS or Android). The mobile trading app is user-friendly and customisable but may seem complicated at first if you are a beginner.

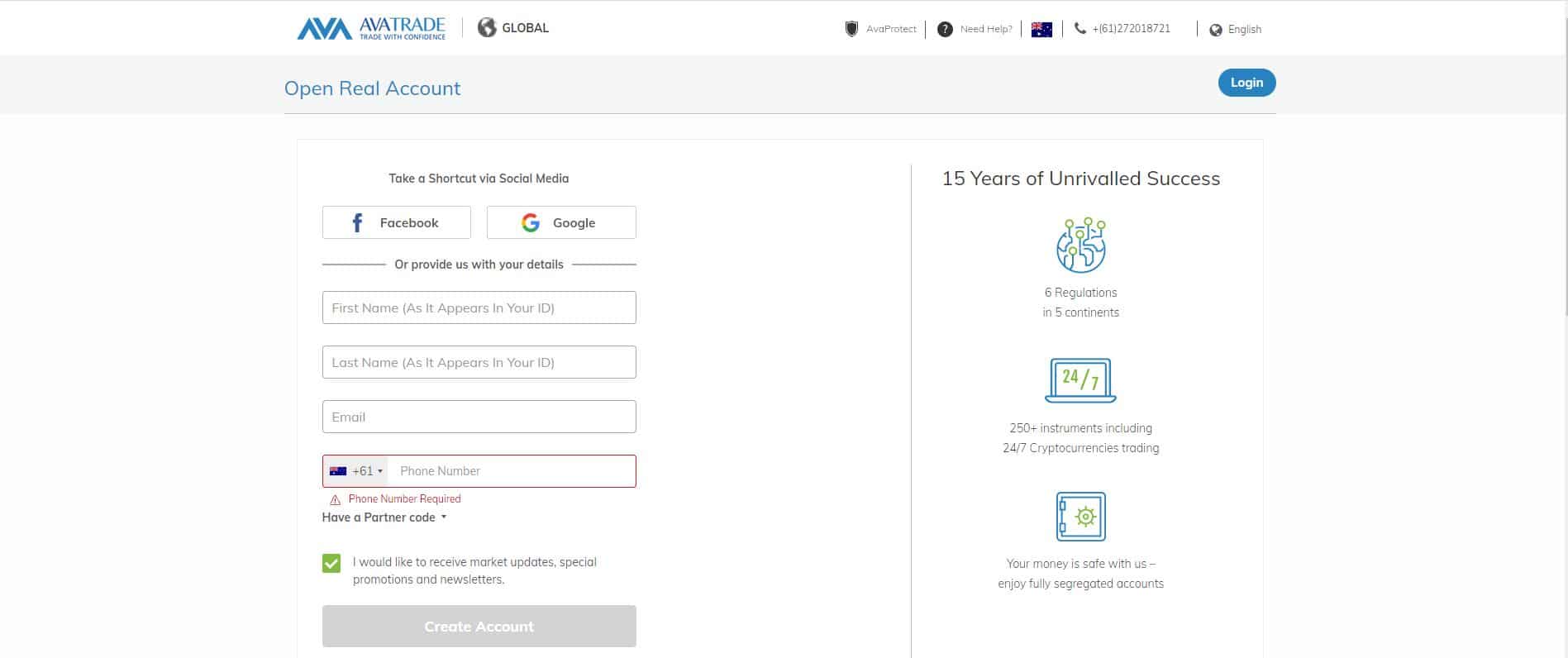

Now that you know how you can access the MT4 trading platform – via different brokers, we will introduce you to a quick step-by-step guide on how to sign up and choose MT4 as your trading platform. Most brokers provide different trading platforms to their users, so you must check that your chosen broker is MT4 licensed. Below, we will use our best overall broker to access MT4, AvaTrade, to illustrate this process.

First, you need to register with AvaTrade. Access the registration page and complete your details – first name, last name, email, and mobile phone number.

All regulated brokers will require you to upload your government-issued ID and proof of address. This process is necessary to verify your identity and validate your account.

Next, use AvaTrade’s download link to download AvaTrade MetaTrader 4 on your chosen device. Once the download is complete, run the file and log in to Meta Trader 4 with the AvaTrade account details you used earlier to create a trading account.

You need to access your AvaTrade account to make a deposit. The broker requires you to add at least $100 to your account to start trading. Use one of the supported methods and add funds to your brokerage account.

Finally, access MetaTrader 4 and begin your trading journey. Get familiar with all the platform’s tools and features, use charts and indicators to conduct analysis, and find the best assets for your portfolio. You can also start trading on your demo account if you want to polish your skills. When you are ready, place your order on the MT4 trading platform and make sure to use risk management tools to protect your capital.

Overall, the best brokers to access the MT4 trading platform in Australia depend on your budget, objectives, and trading style. We have presented you with a choice of five different brokerages with varied offerings, benefits, and drawbacks. Our top pick, AvaTrade, is a budget-friendly broker that provides access to educational resources, numerous assets, and is licensed to provide you access to the MT4 trading platform. With a minimum deposit of only $100, you can start trading at any time.

It’s highly recommended to use the demo account feature to test your strategy before investing in the real markets. Forex and derivatives like CFDs can be extremely risky due to market volatility, so you should always do your due diligence when choosing assets and implement a sound risk management strategy to protect your funds.