15000 Loan – 5 Best $15000 Loan For Bad Credit in 2023

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

You don’t always need a significant amount of money for a loan; sometimes, all you need is a 15000 loan to cover your unexpected costs.

Most responsible lenders assess each application and lend just what the applicant can afford to repay. Furthermore, they enable you to return your debt at manageable intervals, such as weekly installments over a certain length of time.

However, internet lending firms take into account more than simply your credit score, so you may be able to apply for a $15,000 loan even if you have low credit, subject to affordability.

Table of Contents

15,000 Loans are unsecured personal loans that are short-term, small-sum, and have high-interest rates — also known as check advances, cash advances, post-dated check advances, and deferred deposit loans.

Because these loans are just for a brief period, the interest rates are pretty high. The average annual percentage rate on 15,000 loans is more than 500%.

You must authorize the lender to withdraw funds from your bank account in exchange for a loan. The whole loan amount, including any costs, usually is payable within 14 days – or when your next paycheck arrives. Lenders will enable you to prolong the loan if you do not have enough money to repay the loan entirely within the agreed-upon schedule. To extend the payday loan, additional costs are imposed.

Disasters in the home might occur at any time. A personal loan can help when you want to purchase a new washer and dryer but don’t have the money at that moment. Other significant expenditures, including an entertainment center or gaming laptops, might wind up costing more than you have in your bank or savings account.

With a personal loan, you can buy excellent household goods and devices right away, rather than needing to save for months. Although you’ll be required to pay interest and maybe upfront fees, a personal loan could save you money and time by allowing you to forgo using laundromats and other short-term but costly options.

A personal loan can help you pay for a car, boat, RV, or even a private jet. It’s also one method of paying for a vehicle if you don’t buy it straight from the manufacturer without depleting your savings account.

An ordinary wedding costs approximately $28,000, according to The Knot. Couples who do not have that type of money might use a personal loan to meet the expenses now and pay them back later.

Wedding loans can help pay for significant expenses such as the venue and the bride’s gown and lesser costs such as flowers, photography, the cake, and a wedding planner.

Besides, you may also need to consider taking a personal loan to pay for the engagement ring. Engagement rings can be expensive when a couple acquires a high-value jewelry type. If you don’t want to exhaust your savings account, obtain a personal loan to enable you to plan your engagement and wedding the way you’ve always imagined.

While a typical trip would not require you to go for a personal loan, you may need such a loan when going for a honeymoon and a luxury cruise. Personal loans can help you fund your dream holiday and make it a success when you graduated recently and want to go on a vocational trip, or you’re celebrating an anniversary.

Ace Cash Express is a lending company that offers quick loans to customers who cannot obtain loans from traditional banking institutions. The business was launched in 1968 and was rebranded by Populus Financial Group in 2019. We partially did this to rename the company and allow Populus Financial Group to act as a holding company for various brands.

Ace Cash Express defines itself as a lender of last hope for the underbanked and has no alternatives. It offers, among other services, installment loans, payday loans, cash advances, and title loans. However, the fees and interest rates on these loans are pretty high.

Individuals with good, bad, or no credit can use ACE Cash Express to get small-dollar loans and boost their credit scores through other credit agencies.

Pros

Cons

Big Picture Loans is a locally based lender that offers personal installment loans. The organization reported on its homepage that they accept 94% of all applicants and process all accepted loans the next working day.

Big Picture Loans uses its homepage website for advertising a “Financial Services License.” You should inform potential borrowers that this is not a state license but one given by the tribal administration. The corporation lacks checks and balances because it is not a member of the Online Lenders Alliance, which some other tribal lending institutions have chosen to join.

Pros

Cons

Blue Trust Loans, a web-based tribal lender, is owned and operated by the Lac Courte Oreilles Band of Lake Superior Chippewa. To qualify for a loan of up to $3,000, you must sign the documentation by 11:45 a.m. If you successfully apply on a business day, you must pay weekly, bi-weekly, semi-monthly, or monthly, depending on when you ar45 a.m.

Compared to traditional payday loans, Blue Trust Loans offers installment loans as an alternative to payday loans because users do not have to pay them back in full on the following paycheck. The loan is typically for nine months, with a payback schedule that corresponds to your paycheck dates. Depending on how often you are paid, you can be paid weekly, biweekly, semimonthly, or monthly.

Pros

Cons

Cash Central is an online lender that offers installment loans ranging from $300 to $5,000. You don’t need perfect credit to be authorized; it promotes loans as quick solutions to life’s problems. Loan restrictions, however, differ depending on where you live.

Moreover, Cash Central offers payday loans and credit lines, but your alternatives may be limited depending on your area. This lending platform is managed by Community Choice Financial, a nationwide financial services corporation launched in 2011.

Payback periods at Cash Central range from six to twenty-four months. You can choose to make payments monthly, semimonthly, or biweekly.

On the due date, the Cash Central automatically withdraws the money you owe. If you wish to pay your loan in another method, you must contact the lender.

Remember that when you make early loan payments, we will allocate your costs to any current interest and fees and then to the original loan.

Pros

Cons

Check City is a lending company with offices in Nevada, Colorado, Virginia, and Utah. This organization provides in-store and online payday loans, title loans, installment loans, tax services, insurance, and other services.

Check City provides exceptional lending services and impeccable BBB ratings in 17 countries. It’s a direct lender that offers quick and dependable online payday loans. Check City’s lender information is provided in their evaluation.

Pros

Cons

The loan application and review process is straightforward, and it takes a few minutes. Following your approval, funds will be wired directly into your bank account within 24 hours, and if you complete the application process early, you can get your funds on the same day.

There’s an extended payment plan for those who cannot manage to pay the loan on time. Check City can help you split your loan payments into four equal installments—there are no charges for this service.

However, this loan payment plan is available only once a year for every borrower. The amounts of loans offered are much higher than those provided by other payday loan companies. Those other payday companies have loan options of up to $500, while Check city has a maximum of $2,500.

Check City’s services are available in 16 states in the US, and they continue to extend their coverage. A majority of the payday loan companies are known to US borrowers in only ten or fewer states.

There are two application methods; you can either apply for loans online or visit their physical store.

Check City gives hope to the borrowers with bad credits. Conventional loan companies fear borrowers with bad credit risk and thus hesitate to approve their applications, whereas Check City provides unsecured loans.

The loan industry is not exempted when it comes to scammers. There are several scam companies in this industry, so borrowers are advised to take precautions. Private institutions and the government have put bodies in place to oversee the operations of loan companies.

These bodies regulate payday loan companies and ensure that borrowers are treated well. Check City is accredited by several bodies, including Better Business Bureau, UCLA, and CFSA.

Check City offers other services besides payday loans. They offer services like money orders, cash checking, installment loans, and others.

Compared to other emergency loan companies, Check city has high APR and fees. The APR rates depend on the number of loans, loan terms, and the state. The rates vary from 214.71% to 1173.21%.

Check City charges verification fees and a loan fee ranging from $15 to $30 for every $100 borrowed. Therefore, the amount you repay will be higher than the borrowed amount by far. You should do research and find out the APR rates and fees before signing any binding agreement.

Check City has a penalty fee for late payment, so you should ensure that you make payments in time. These charges add to the total loan cost.

Check City is only available in 16 states, even though it continues to expand to other states. The instore services are available in only four states though Check City services can be accessed online by borrowers in 16 states.

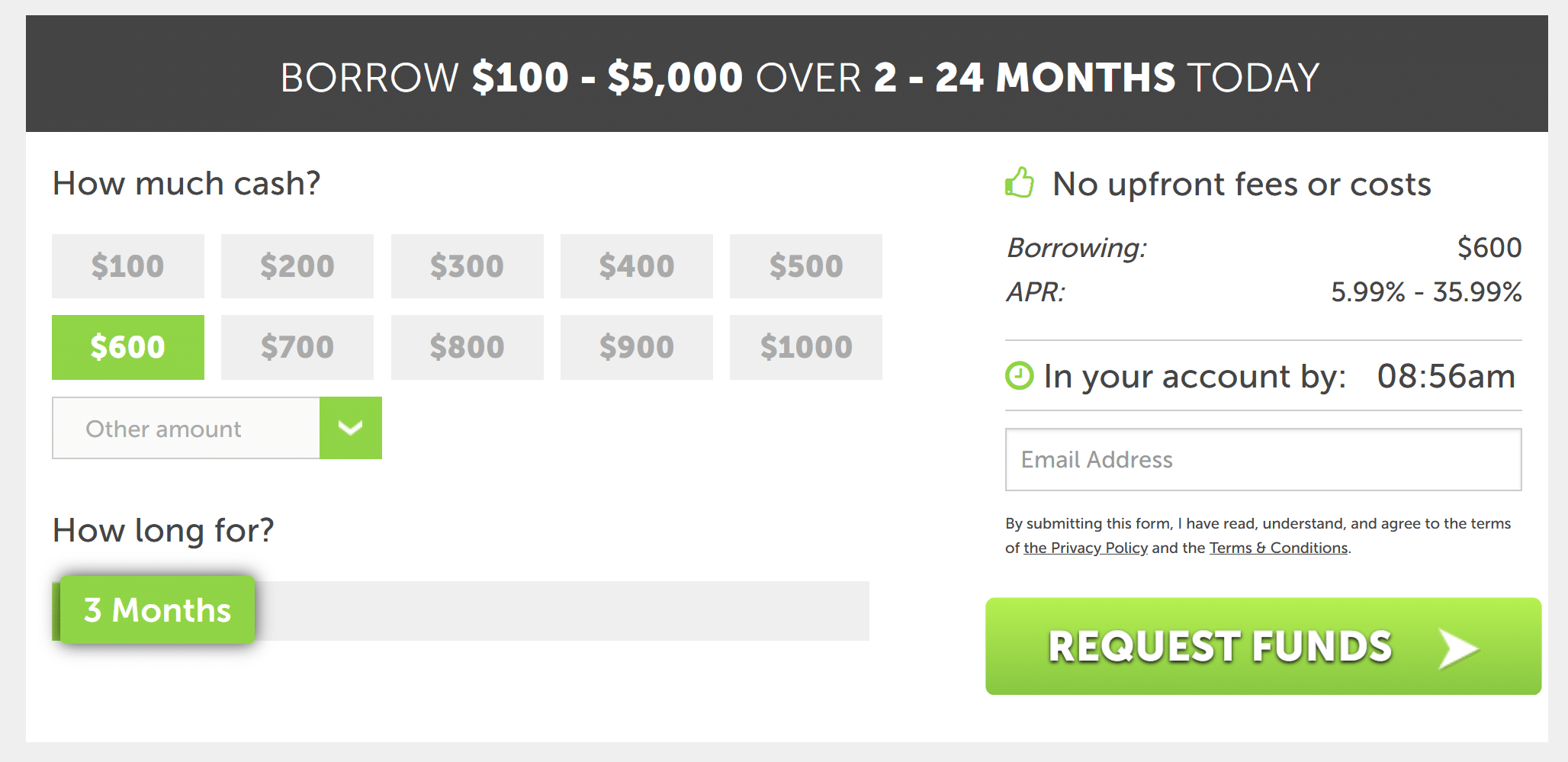

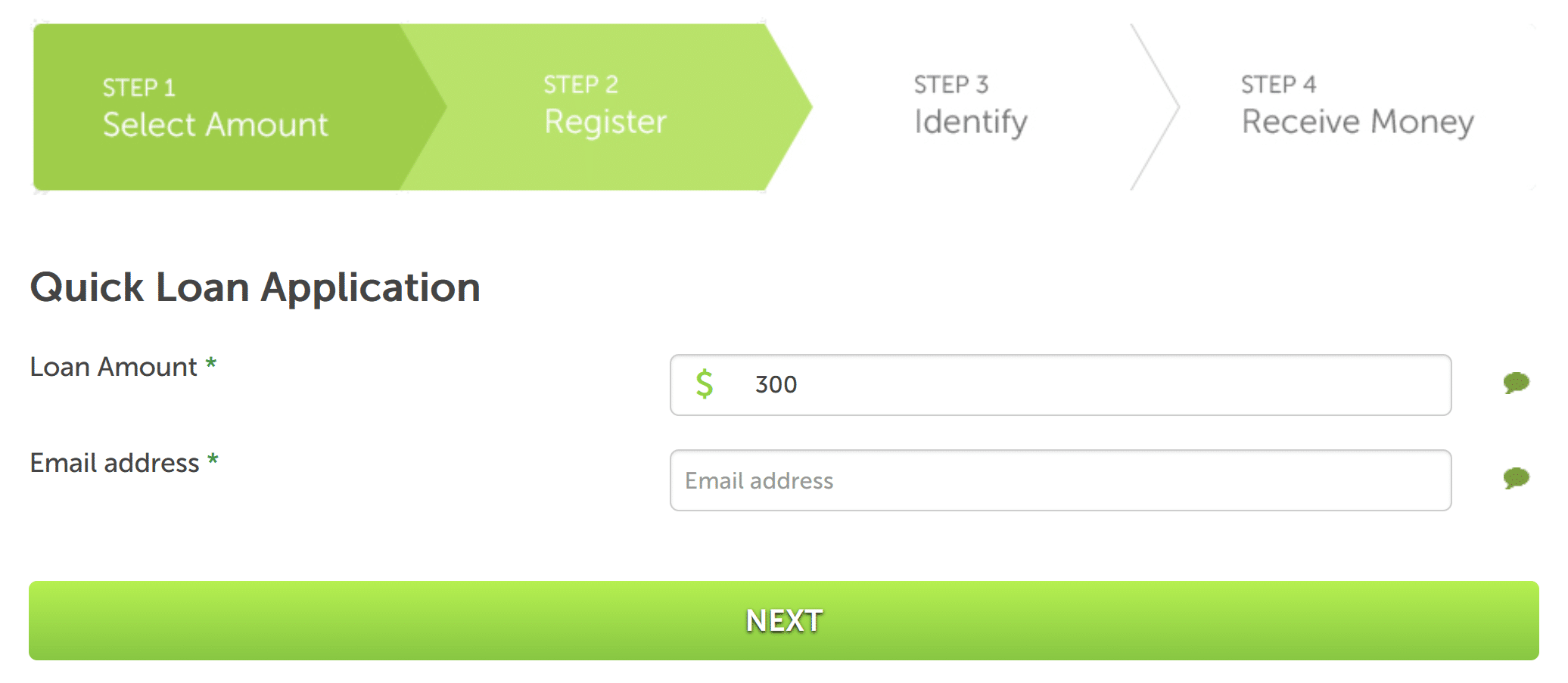

Go to Vivapaydayloans.com. The website has a simple setup. Go on the top right side of the screen and click on the “Apply Now” icon. This marks the beginning of the process of application.

The process of application entails filling an online form. The details required are your income information, name, and monthly expenses.

It takes only 2 minutes to get feedback on your loan application after filling out the form. You can either be successful, or your application may be rejected.

If your loan application is approved, you’ll have to sign a binding contract. Go through the loan agreement keenly and make sure you understand the terms and conditions before signing. Within 24 hours, you’ll receive funds in your bank account after submitting the signed agreement.

15000 loans come in handy when you have an emergency financial problem, especially if your subsequent payday is weeks away. You can apply for $15,000 loans from Viva Payday Loans, among the top-rated payday loan platforms. The application process is quick and straightforward. Visit their website and fill out the application form to begin the process of application.

CHECK OTHER LOANS: