How To Buy Ethereum Australia – Buy Ethereum In Under 5 Minutes

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Perhaps you are just starting to invest and want to add Ethereum to your portfolio, or maybe you already have an investment portfolio and want to diversify it.

This article will assist you in buying Ethereum and evaluating it.

Table of Contents

Follow these steps to purchase your first Ethereum on eToro:

If you are going to invest your capital, it’s reasonable to ask why you should invest in Ethereum. Let’s consider the main advantages of buying Ethereum.

A significant crypto market’s development is the growth of Defi (Decentralized Finance). These are decentralized financial services, which can be seen as the next stage of developing decentralized apps.

Defi companies are service providers that provide loans on the Ethereum blockchain.

Let’s say you have 100 ETH left over. You can offer them in a kind of marketplace as a loan. Someone else might be willing to make a deal, and then the terms are written into the smart contract, and the borrower offers collateral. Nothing else is needed.

Many of these services guarantee that you will get high interest on the ETH lent.

As Defi continues to grow, companies that use ETH as collateral will also show growth.

With Bitcoin renewing its all-time high, all eyes have turned to it. Volumes and interest rates are rising, and new investment organizations are emerging. However, crypto investors engaged in long-term planning prefer Ethereum 2.0. This project is already in the top 30 in terms of capitalization.

Because the network will not be implemented entirely for several years, the ETH 2.0 blockchain upgrade is not represented on many rating resources. The system will pay a % commission for each transaction validators complete.

The proof-of-stake algorithm will replace the less energy-efficient proof-of-work method, which created network congestion this fall, and investors will get new coins in exchange for old coins in a 1:1 ratio. There is no way to reverse the switch.

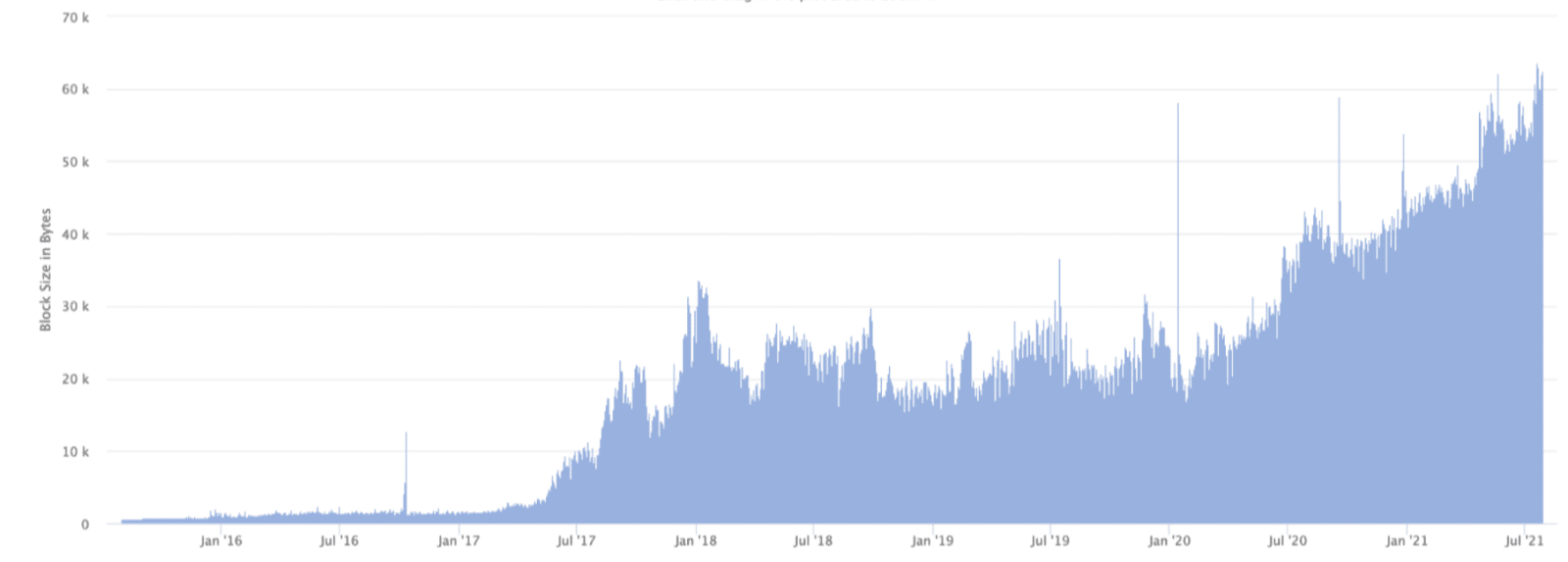

Mining equipment manufacturers are focusing their efforts on creating better ASIC miners. In June 2021, users could earn a monthly profit of $13,000 in ETH and $7500 in BTC. The network’s hashing rate and block size have already reached an all-time high.

Ethereum is expected to switch from its current Proof-of-Work protocol to Proof-of-Stake by 2023. Miners will no longer need energy-efficient mining. Instead, Ethereum, which has undergone stacking, will protect the network.

Some experts argue that this will increase its scalability, security, and resilience. Consequently, Ethereum’s value should also rise.

The desire for stable income from stacking on the one hand, and the short payback period of the hardware on the other, will keep the excitement around the cryptocurrency alive.

By the end of 2023, the average value of the cryptocurrency is expected to reach $2718.875 at a growth rate of 49.97%.

Visa’s pilot program uses USD Coin (USDC), a stable cryptocurrency whose value is directly tied to the U.S. dollar, Visa said. The transaction uses Ethereum, an open-source blockchain. The Crypto.com platform and digital asset bank Anchorage are helping with the transactions.

Visa completed its first settlement transaction, sending USDC to Visa’s Ethereum address at cryptocurrency bank Anchorage. The company intends to make the feature available to more partners by the end of 2021.

When paying with a cryptocurrency card, the digital currency is converted into “regular” fiat money. The cryptocurrency wallet will be able to deposit them into a connected bank account.

Back in 2020, Visa company announced that digital assets and blockchain technology would be an essential part of the company’s future. Mastercard will also start working with cryptocurrency — the company announced plans to support cryptocurrency in 2021. Major financial companies, including BNY Mellon and BlackRock Inc, have also introduced support for digital currency in their systems. In addition to payment firms, manufacturers and service providers are entering the market. Not long ago, Elon Musk announced that Tesla might accept cryptocurrency as payment for its cars again.

Sharding is the process that divides the Ethereum network into multiple areas, called segments, which allows various transactions to be processed simultaneously. Proof-of-work requires that all complete nodes store data on the Ethereum network, and the algorithm used to achieve consensus is very computationally intensive.

As the Ethereum network grows, the increasing number of transactions and miners prevents the system from dealing with these technical limitations. To solve this problem, sharding is used. This process involves distributing data between different nodes on the network. Thus, nodes no longer need to store large amounts of data and process all transactions. To use sharding effectively, a modification of the coin was created called Ethereum 2.0. If this technology solves the problems of scaling and speed, the value of Ethereum will likely increase significantly as functionality improves.

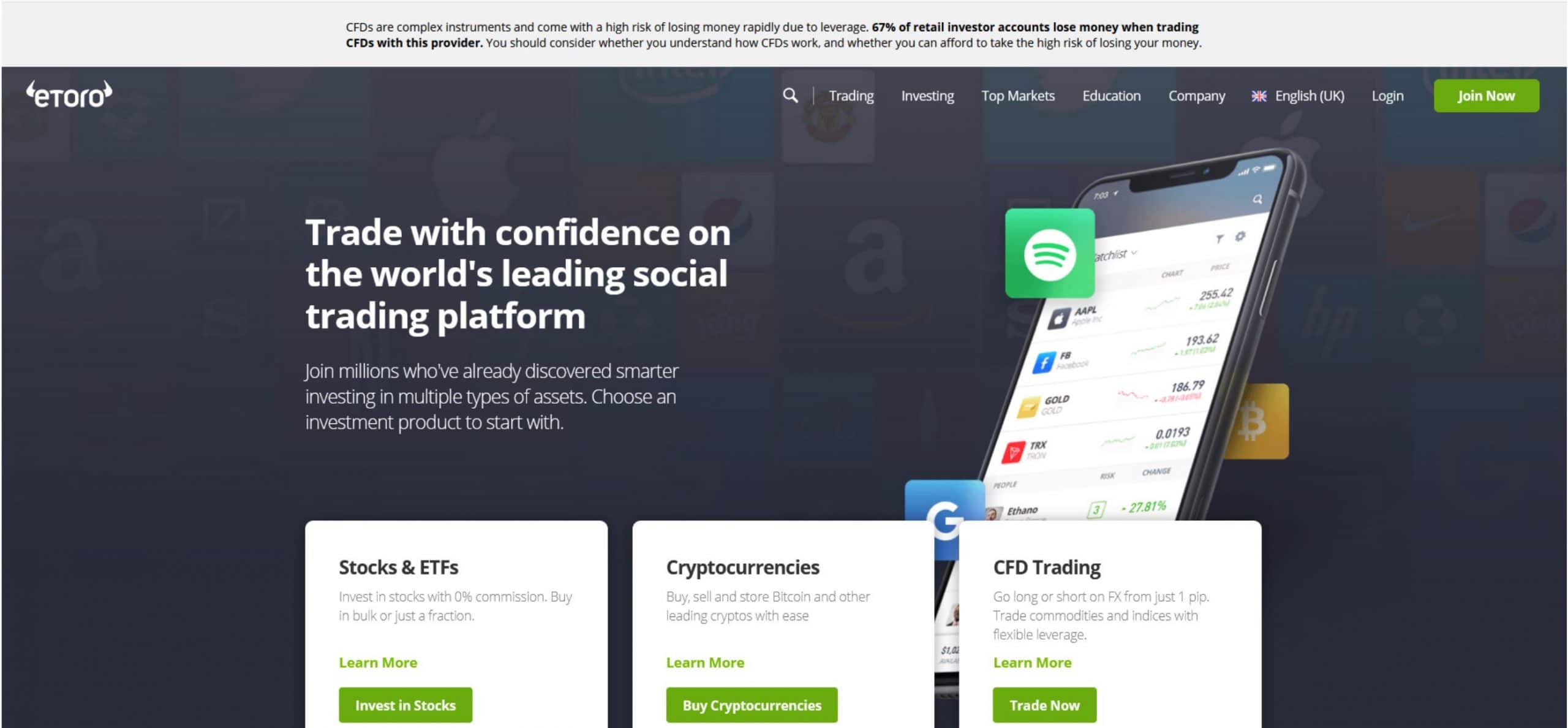

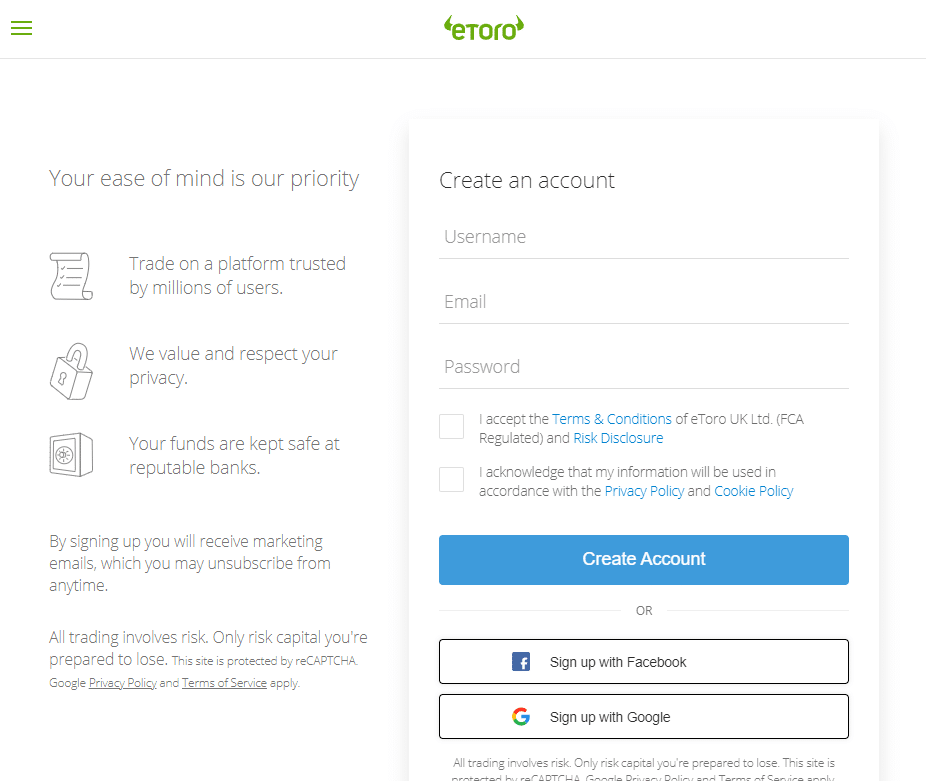

eToro is the best Ethereum platform where all your crypto needs are under one roof. The platform is a well-known leader in social trading and investing for newbies.

Trade and invest in the most popular crypto, stocks, and exchange-traded funds (ETFs).

Currency pairs, indices, and commodities may all be traded using CFDs. Investing in the financial markets has never been easier.

If you want to invest in Ethereum or other crypto assets with no worries, eToro is your choice:

eToro — Ethereum Fees

The only trading fees charged by eToro are spreads, as detailed in the table under eToro Fees section in Crypto spreads. For example, Open BUY (Long) position on ETH:

Pros

Supports 120+ cryptocurrencies.

Change crypto to crypto in a blink of an eye.

Private wallet and unlosable security key.

Transfer your crypto anywhere on the blockchain.

Buy & sell crypto in no time.

Hassle-free deposits & withdrawals.

Free market research & analysis tools to grow your capital.

Connect with other crypto traders and copy their trading styles.

Cons

Long support response time.

67% of all retail investor accounts lose money when trading CFDs with this provider.

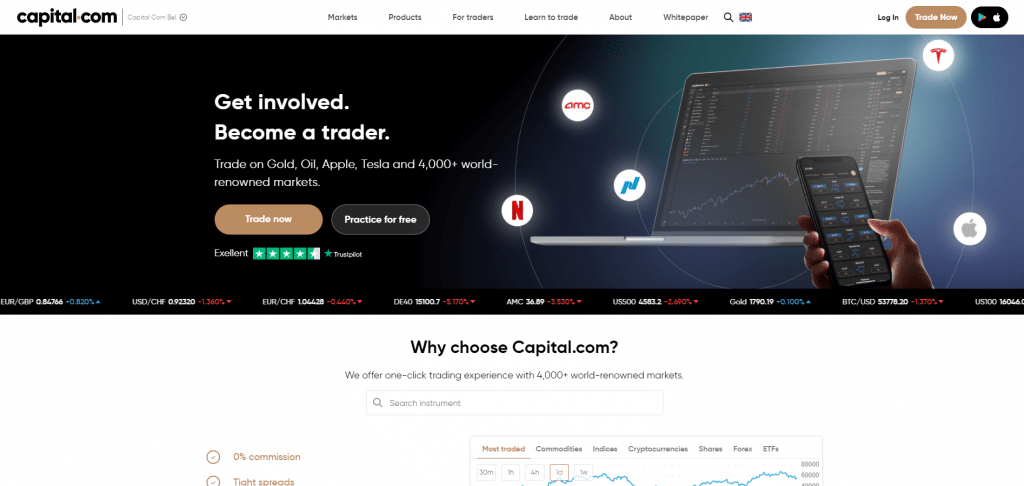

Capital.com is the leading online brokerage firm for trading derivatives without commissions. The financial markets include CFDs and spread betting instruments, which means you can speculate on the rise or fall of an asset without needing to take ownership.

In addition, Capital.com offers competitive spreads on a variety of instruments.

With market-leading variable spreads, Capital.com makes commission-free investing easy.

Cryptocurrencies are all the rage right now, but if you’re like most people, you don’t want the hassle of owning and storing them.

With Capital.com, you can trade CFDs on cryptocurrencies like Ethereum without ever having to worry about them. That means you can enjoy all the benefits of trading cryptocurrencies while still keeping your money safe.

Plus, with high liquidity and leveraged trading options, you can make even more money on your investments.

Capital.com is your go-to platform for access to over 6,100 markets. With a user-friendly interface and expert market analysis, you’ll be making savvy investment decisions in no time.

Capital.com enables you to trade a variety of popular cryptocurrencies against various fiat currencies. This means that you can take advantage of market movements and make money from your successful predictions.

What’s more, with Capital.com, you can also trade crypto-cross pairs. This means that you can trade two different cryptocurrencies against each other, for example, ETC/BTC or LTC/BTC.

So what are you waiting for? Sign up today and start trading cryptocurrencies today!

Pros

Cons

67% of all retail investor accounts lose money when trading CFDs with this provider.

Introducing Crypto.com — the easiest way to buy, sell, and trade cryptocurrencies like Ethereum.

With over 250+ digital currencies listed on Crypto.com’s exchange, you have everything you need to get started in the world of crypto!

Whether you’re a seasoned trader or just getting started in crypto, Crypto.com is your one-stop shop for all things digital currency!

Crypto.com’s trading fees are some of the lowest in the industry, and they offer a variety of payment methods to make it easy for you to get started.

Crypto.com offers 0.4% maker/taker fees on trades for new users with a monthly trading volume of $25,000 or less and who don’t have any CRO staked. This makes it one of the most affordable platforms out there – perfect for those who are just starting out.

Are you looking for ways to save on your crypto trading fees? Look no further than Crypto.com. Crypto.com’s volume-based fee structure offers discounts the more you trade, and staking CRO gets you even bigger savings.

With multi-factor authentication and offline cold storage, you can rest assured that your funds are always safe. And with FDIC insurance of up to $250,000 on U.S. dollar balances, you can feel confident that your money is protected even in the event of a cyberattack.

Crypto.com’s simple and easy-to-use interface makes buying, selling, and trading cryptocurrencies a breeze.

With Crypto.com, there’s no need to waste time navigating complicated exchanges. They do all the hard work for you so you can focus on making profits.

So what are you waiting for? Start trading today!

Pros

Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection

Сoinbase is the most popular trading platform in the U.S. However, the broker is also available in Australia. The main advantages of Coinbase are a solid variety of altcoin choices, a straightforward, user-friendly interface, high liquidity, and more.

Coinbase is one of the simplest ways to get started with cryptocurrency investment. It is simple to join up for and purchase cryptocurrencies in a matter of minutes. It also includes a learning program that rewards users with bitcoin to learn more about how cryptocurrency works.

Looking for a more sophisticated trading experience? Look no further than Coinbase Pro! Coinbase Pro is perfect for experienced investors who want to make the most of their money.

With powerful features and a user-friendly interface, Coinbase Pro makes it easy to trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin. So whether you’re looking to make a quick profit or you’re in it for the long haul, Coinbase Pro has everything you need to get the most out of your investment.

Coinbase — Buy Ethereum Australia Flat Fees

| Overall Transaction Amount | Transaction Fee |

| $10 or less | $0.99 |

| More than $10, less than or equal to $25 | $1.49 |

| More than $25, less than or equal to $50 | $1.99 |

| More than $50, less than or equal to $200 | $2.99 |

Coinbase Pro fees are based on the transaction amount, so you pay less for trading more.

If you place a buy order (buy limit) below the current market bid price or place a sell order (sell limit) above the current ticker price, you are a maker.

If you place a buy order (market order) by immediately matching it with an order available in the order book, or you place a sell order (market order) by matching an existing buy cryptocurrency order from the order book, you are a taker.

| Pricing Tier | Taker Fee | Maker Fee |

| Less than $10K | 0.50% | 0.50% |

| $10K to $50K | 0.35% | 0.35% |

| $50K to $100K | 0.25% | 0.15% |

| $100K to $1M | 0.20% | 0.10% |

| $1M to $10M | 0.18% | 0.08% |

| $10M to $50M | 0.18% | 0.08% |

| $50M to $100M | 0.15% | 0.05% |

Pros

The exchange is popular in the U.S. market, one of the major cryptocurrency markets.

Simple and clear interface, which is easy to understand if you are just starting to trade.

Relatively low commissions if you trade a lot.

Good for beginners because they offer a lot of useful materials for self-education in finance and investing.

More than 50 cryptocurrencies are available to trade.

Cons

Relatively high fees.

67% of all retail investor accounts lose money when trading CFDs with this provider.

Binance is a trading platform focused on cryptocurrency trading. Its excellent reputation and many reviews indicate that the exchange is highly trustworthy and ideal for novices. There is also a multitude of educational materials available on the subject of finance and investment.

The site draws users of uncommon cryptocurrencies due to its large range of currencies, which gives a high degree of liquidity. The exchange also boasts high speed and the technical ability to process thousands of transactions every second.

Binance Fees — Reliable Ethereum Broker in Australia

The general Binance spot trading fee is 0.1%, while Instant Buy/Sell fee is 0.5%. However, you can reduce fees if you hold BNB in your account.

If you hold Binance coins (BNB) on your account or pay commission with them, the amount of commission will vary depending on your BNB-related activity: the more active you’re, the fewer fees will be.

Fees depend on the amount of BNB coins in your account and your total trading balance for the last 30 days. Each day, your balance and BNB coin volume are evaluated. As a result, the system assigns you a certain tier level, and you get corresponding Maker/Taker fees.

| 30d Trade Volume (USD) | Maker / Taker Fees | Maker / Taker Fees

if you hold BNB |

| < 50,000 USD | 0.1000% / 0.1000% | 0.0750% / 0.0750% |

| ≥ 50,000 USD | 0.0900% / 0.0900% | 0.0675% / 0.0675% |

| ≥ 100,000 USD | 0.0800% / 0.0900% | 0.0600% / 0.0675% |

| ≥ 500,000 USD | 0.0700% / 0.0800% | 0.0525% / 0.0600% |

| ≥ 1,000,000 USD | 0.0500% / 0.0700% | 0.0375% / 0.0525% |

| ≥ 5,000,000 USD | 0.0400% / 0.0600% | 0.0300% / 0.0450% |

Pros

You can trade advanced instruments such as futures and options.

Increased leverage for margin trading.

Good technical support to answer any questions you may have.

The platform offers lower fees than some other brokers.

Cons

You are constantly motivated to buy BNB (coin which belongs to Binance).

The company periodically has difficulties with the laws of different countries, which leads to a local freeze or decrease in the level of trading.

67% of all retail investor accounts lose money when trading CFDs with this provider.

Buying Ethereum in 2023 is easy and only takes four basic steps. If you want to invest in Ethereum, follow our four-step instructions.

To start investing in Ethereum, you need a minimum deposit of just $10. But, first, take a look at the account opening process.

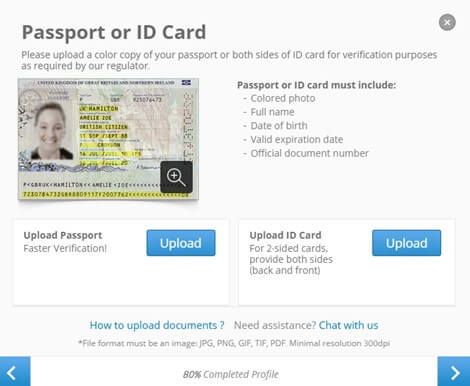

Fill the form to proceed further. You may need to scan some documents if you’re planning to invest big. However, you can skip this step and verify your account later.

Buy Ethereum with 0% Commission Now >

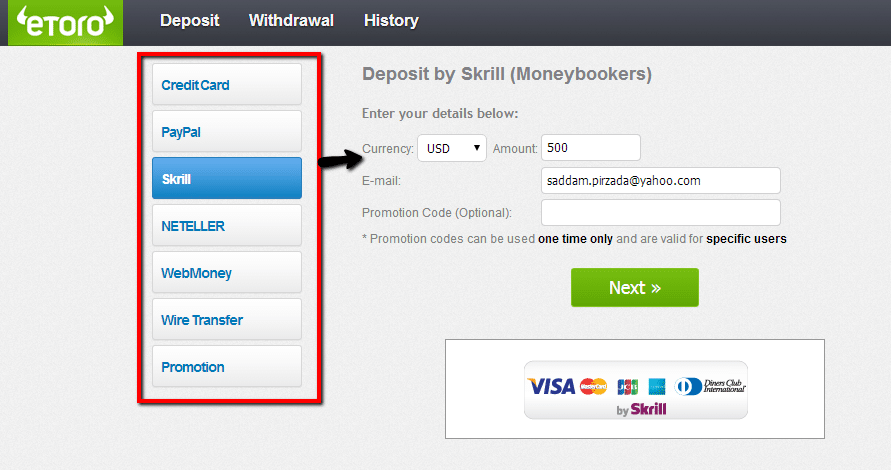

Funding a trading account is a simple process. You may deposit dollars into your account using a variety of techniques. Simply select the form of payment that is most convenient for you and complete the procedures outlined below:

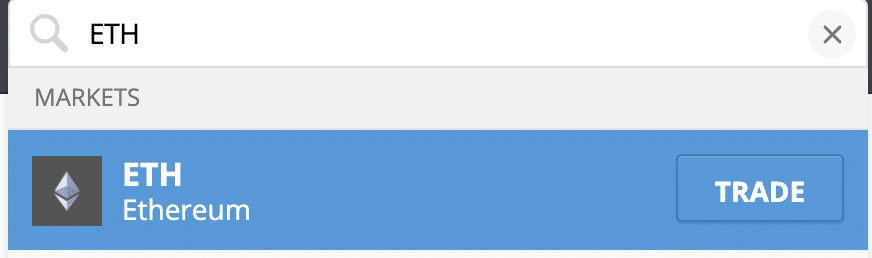

Now you can use the search box to buy Ethereum. Type Ethereum or ETH into the search box and click on the ‘TRADE” button.

Once the order form opens, it’s time to enter any stake higher than $10 U.S. dollars, as the minimum amount for ETH is $10.

You can see both the “Set Order” or “Open trade” buttons, depending on the market’s condition. If you enter the market during standard market hours, you’ll see the ‘Open Trade’ button. If the market is closed, you’ll see the “Set Order” button. Click “Set Order to schedule your transaction.

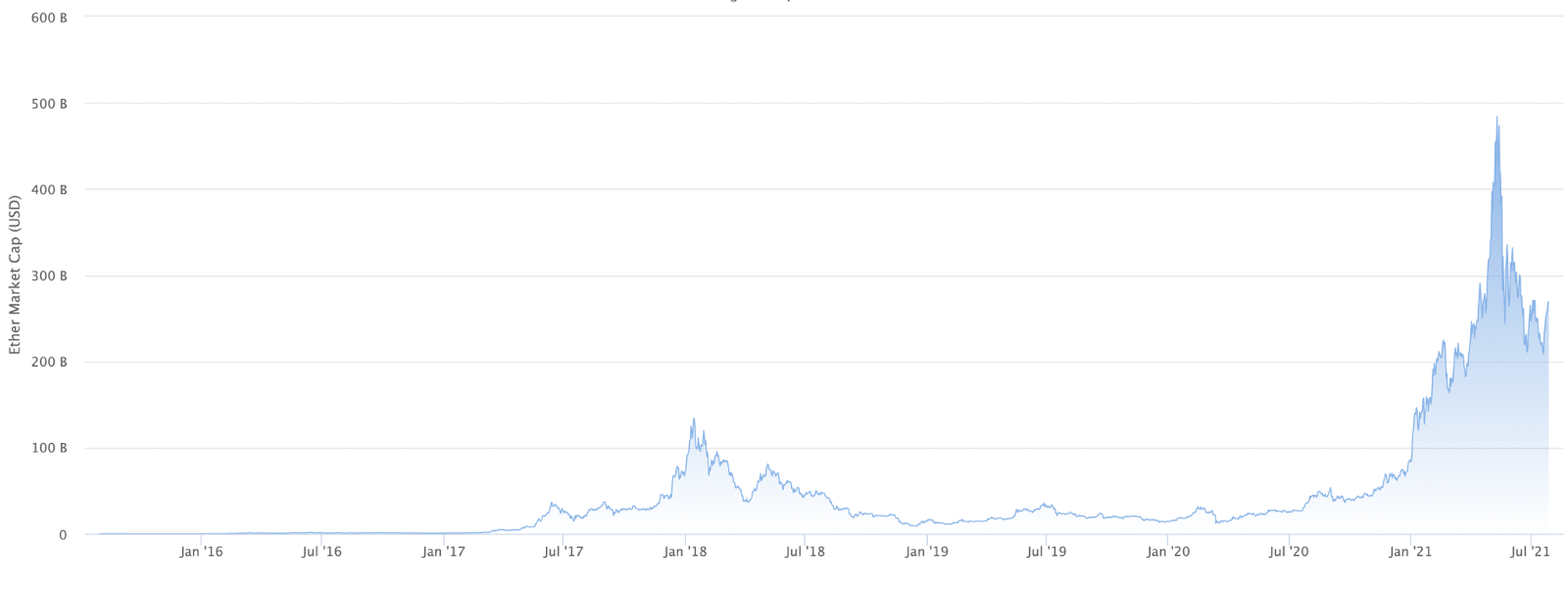

Ethereum has updated historic highs in value recently. That’s why we studied the reasons for the rapid growth of cryptocurrency and several negative factors that can stop it.

Last January, the Ethereum exchange rate renewed its historical maximum. Its growth began on January 22; during the next 20 days, the value of the cryptocurrency increased by 67%, reaching the mark of $1790.

During 2020, the value of the token increased about five times. Experts are generally optimistic about its prospects and are confident that this trend will continue in the coming months. Some of them, such as Fundstrat Global analysts, suggest that the world’s second most capitalized cryptocurrency may continue to grow and reach the $10,500 mark.

One of the causes for the fast rise in the value of ETH might be the long-awaited introduction of the Ethereum 2.0 network’s zero phases. It was postponed numerous times due to technical issues, but the first block was ultimately created on December 1.

The ETH 2.0 network uses the proof-of-stake (PoS) algorithm. Thanks to it, altcoin holders will earn from stacking – an alternative mining method in which network members profit by blocking some tokens in their account in favor of the validation mechanism.

The possibility of additional passive income attracts users and stimulates the growth of cryptocurrency. In two months of Ethereum 2.0, more than 3 million ETH was blocked. This has already led to the annual stacking yield drop: from nearly 20% to 9%, but the number of investors continues to grow.

Another important factor in Ethereum’s rise in value has been the bitcoin rally. Without a doubt, the leading crypto coin has become a powerful driver for the entire cryptocurrency market, whose capitalization beat $1 trillion for the first time in early 2021. At the same time, the yield of ETH is growing faster: since the beginning of January, the world’s largest cryptocurrency has risen by 54%, while ETH price has sky-rocketed increasing by more than 70%.

In addition, in February, the Chicago Mercantile Exchange (CME) launched futures on ETH. On the first day of trading, users of the trading platform scored 388 contracts for 19,400 ETH (about $33 million) — the exchange’s management called this “overwhelming” market reaction to the financial product.

Some analysts suggest that the launch of Ethereum futures can attract institutional investors. Large-scale market participants may have a positive impact on its value. However, this may have the opposite effect (remember bitcoin’s surge in late 2017). At that time, both Chicago exchanges, the CBOE and the CME, began trading futures on the world’s largest cryptocurrency. Many users launched BTC shorting wave, which quickly collapsed the coin’s value.

ETH 2.0 protocol, which should cope with the limited bandwidth of the network and increase its scalability.

However, the launch of the main Ethereum 2.0 network, which has already taken place, has not yet had a significant impact on commissions — since the beginning of the year, their average daily size has already renewed its historic high, breaking the $20 mark several times. As of February 11, it dropped slightly to $15.

Lower fees can be a serious competitive advantage for other blockchains. For example, the volume of USDT transactions on the Tron blockchain has been steadily outpacing Ethereum since early January. Analysts suggest that this is due to the lower transaction fees in Tron.

The solution to the problem of high commissions could be the final transition to ETH 2.0, believes co-founder and CEO of the Holyhead project Anton Mozgovoy. “PoS significantly reduces the cost of commissions. This is connected with cheapening of the mining process – instead of using expensive electricity, we will switch to a new consensus algorithm, which will require only a computer and an internet connection,” he claims.

“Usually, a miner receives both a commission and a reward for each block mined. However, with the implementation of the EIP1559 update, the base reward will be burned, and the “tip,” that is, the reward for speeding up a transaction, will remain with the miners. With the new monetary policy, ETH may become a deflationary coin,” Mozgovoy shared.

The transition to Ethereum 2.0 will solve the problem of high commissions, agrees defi-agency.com co-founder Nikolai Avramov. “However, there are concerns that in the short term, at least throughout 2021, this protocol will continue to exist as a parallel network. Of course, when the final transition happens, the problem with commissions will be solved, but for now, it is difficult to predict when exactly that will happen,” he added.

Ethereum 2.0 Phase Zero is currently in testing mode. The activation of the Berlin upgrade, with the release of which the new protocol should become live, has yet to occur. Its debut has been postponed numerous times; originally scheduled for June 2020, it was shifted to the fall and then again postponed until January 2021. This deadline has also been put back indefinitely; the developers believe that the upgrade is almost ready to go live, but they have yet to identify the block number on which the hard fork will be activated.

“The delay in the update release is primarily because the developers are thoroughly testing the code. This needs to be done because the cost of a mistake is very high. Ethereum is a huge ecosystem and a major global blockchain product used in a huge number of projects. From this point of view, it has even more value than bitcoin,” notes Spaceswap.app CEO Vladimir Nikitin.

“Many users complain about the long development of Ethereum 2.0, but only because they don’t understand the colossal amount of work that developers need to do,” notes Mozgovoy. According to him, the launch of ETH 2.0 should not affect the value of the cryptocurrency in the future. “It’s simple here: the demand for working projects grows all the time, and now all the projects on Ethereum have either significant positions,” he commented.

The decentralized finance (DeFi) sector, with the majority of its projects operating on the Ethereum blockchain, has been one of the key growth drivers for ETH in 2020. The amount of money blocked on it has increased 30-fold in the last year, reaching $40 billion at the time of writing.

However, DeFii’s rapid growth has demonstrated the major problems of the Ethereum network — insufficient bandwidth and high fees. This has led to other blockchain platforms for smart contracts appearing on the market, ready to compete with ETH.

Among them, Polkadot, which also provides interaction between different blockchains, is most often mentioned. This project’s unofficial name is the “Ethereum slayer.” Still, many consider this statement questionable: the two projects are at different stages of development, so it is not easy to compare their capabilities.

Nevertheless, Polkadot is attracting interest from investors – between mid-December and February, the value of its DOT token quadrupled. In terms of capitalization, it is firmly entrenched in the top five largest cryptocurrencies in the world. Polkadot is very aggressive and positioning itself to build its blockchain networks instead of ETH. I’m not sure Polkadot can entirely displace it, but it will take a significant market share from it.

Another potential competitor of ETH is the Binance Smart Chain project. “I see it as a potential competitor to Ethereum shortly — this project has good marketing, a large budget, and a large number of users,” Vladimir Nikitin believes.

However, Binance Smart Chain also has its disadvantages. First of all, it’s an extremely centralized consensus, which can increase developers’ dependence on the Binance exchange policies.

Cardano, Chainlink, and Near Protocol are three other projects that might challenge Ethereum’s monopoly in the smart contract market. However, it is too early to conclude that ETH’s position is significantly jeopardized, according to some experts.

“At the moment, it would be more correct to say that ETH is DeFi. It’s not just about the level of activity within the network but also about innovation, research, and, of course, the community. First, something happens in Ethereum, and then it is copied to other blockchains. So the only killer of ETH right now can be ETH 2.0,” he concluded.

If you want to multiply your capital, you should analyze the potential of an asset and its risks. Let’s consider the main risks associated with investing in Ethereum.

The crypto industry has not changed significantly since last year. Cryptocurrencies are still a risky asset, promising, but with an uncertain status. However, if the industry was fueled by positive news and increased attention, these factors no longer have the same power. Ethereum is one of the coins with relatively high volatility.

One of the most important concerns that Ethereum hopes to address with the update is scalability. Ethereum is now executing transactions at a snail’s pace of 15 per second. Given the size of the network (about four times the number of developers as any other platform), this is proven to be a genuine barrier to mainstream adoption.

Ethereum 2.0 is expected to fix the problem, ushering in a new age of 10,000 transactions per second. However, the distribution is taking its time, and there is no set end date for when ETH 2.0 will be available.

No other non-traditional money has the same issue with ownership distribution as Ethereum. In reality, if the currency has one big flaw, less than 400 people possess more than a third of all circulating units. What’s the harm in that? There is a slew of reasons why concentrated ownership by a few bigwigs, or whales, in the cryptocurrency ecosystem spells danger for ordinary investors. To begin with, when so few people control such a large portion of the company’s overall assets, there is a genuine risk of price manipulation.

Even though crypto whales don’t always have bad intentions, all it takes for them is to sell their holdings, and the coin’s price could shoot up or down at a moment’s notice. Whales are a significant problem related to investing in Ethereum.

If you ask anybody on the street to name a cryptocurrency, you will almost certainly hear Bitcoin nearly every time. There’s a cause for this, and it’s unmistakably the financial media. The networks are often reporting on Bitcoin’s latest highs and lows, as well as corporate celebrities who have gotten on the virtual currency bandwagon. Almost all of this reporting ignores the reality that other types of alternative money exist.

But there is another advantage to being unknown: chances abound for those who have heard of ETH. Not only can you participate in the buying and selling of a crypto-coin that is not influenced by media reporting, but you also have the opportunity to transact business in a newer form of virtual money that still has a lot of space to develop. Depending on who you are, not being well-known may be both a positive and a negative. If you are an investor who knows that everything has advantages and disadvantages, the fact that ETH is not well recognized can be a significant advantage.

There are only a few factors that can significantly affect the price of Ethereum. Let’s briefly look at what factors are changing the price now and what factors can do so in the future.

An update to Ethereum 2.0 will lead to technical improvements and the development of its network, some analysts believe. The transition to a new algorithm and the introduction of sharding will allow the product to scale significantly.

Thanks to this, ETH will be able to hold first place in the ranking of altcoins, as there are now blockchain platforms, which in terms of bandwidth, network efficiency, and the number of dApps applications are competing with Ethereum. From this point of view, the price of the coin is likely to rise.

Ethereum’s upgrade will allow it to gain certain advantages over its main competitors, EOS, and TRON and compete with Defi projects. They are currently firmly in a niche in which the main profits come from stacking.

On the other hand, the launch of the updated platform will provide more benefits for project development and transaction acceleration. For this reason, the platform will likely cement its status as the most popular platform for deploying new projects.

In addition, Ethereum will penetrate deeper and deeper into the decentralized finance market. Also, the number of transfer fees will decrease. All of this will allow Ethereum to compete, perhaps even with Bitcoin, in the future.

Updating the network is first and foremost about expanding the number of users. Today the majority of blockchain projects are created just on the Ethereum platform.

A simple example: now there are 213 officially registered projects working in the field of decentralized finance.

Ethereum is a parental platform for about 200 of these projects. The transition to the updated 2.0 platform will attract even more partners who will use blockchain for their projects, speed up transactions and make them almost free of charge.

Ethereum blockchain has already become the foundation for decentralized finance infrastructure, decentralized exchanges, lending, stacking, and other products.

In addition, most stacking coins, including Tether (USDT), which recently entered the top 3 cryptocurrencies by capitalization, are also based on ETH.

Thus, Buterin’s platform can become the backbone for a new financial system worldwide, which will naturally increase the coin price.

However, despite the success of Ethereum 2.0, the idea, though good, is still at an early stage of implementation. In this case, the transition to the second version consists of three phases, which can take quite a long time, which will harm the coin’s price.

| Month | Open | Low-High | Close | Month,% | Total,% |

| 2021 | |||||

| Aug | 2415 | 2121-3175 | 2534 | 4.9% | 11.3% |

| Sep | 2534 | 1981-2534 | 2130 | -15.9% | -6.4% |

| Oct | 2130 | 1932-2222 | 2077 | -2.5% | -8.7% |

| Nov | 2077 | 2077-2578 | 2409 | 16.0% | 5.8% |

| Dec | 2409 | 2409-2990 | 2794 | 16.0% | 22.8% |

| 2022 | |||||

| Jan | 2794 | 2794-3369 | 3149 | 12.7% | 38.4% |

| Feb | 3149 | 3149-3909 | 3653 | 16.0% | 60.5% |

| Mar | 3653 | 3653-4534 | 4237 | 16.0% | 86.2% |

| Apr | 4237 | 4237-5259 | 4915 | 16.0% | 116% |

| May | 4915 | 4915-5714 | 5340 | 8.6% | 135% |

| Jun | 5340 | 4172-5340 | 4486 | -16.0% | 97.1% |

| Jul | 4486 | 4486-5568 | 5204 | 16.0% | 129% |

| Aug | 5204 | 5204-6460 | 6037 | 16.0% | 165% |

| Sep | 6037 | 5466-6288 | 5877 | -2.7% | 158% |

| Oct | 5877 | 5877-7062 | 6600 | 12.3% | 190% |

| Nov | 6600 | 6600-8192 | 7656 | 16.0% | 236% |

| Dec | 7656 | 5981-7656 | 6431 | -16.0% | 183% |

| Year | Mid-Year | Year-End | Tod/End,% |

| 2023 | $9,131 | $10,775 | 376% |

| 2024 | $11,194 | $12,633 | 458% |

| 2025 | $14,054 | $14,984 | 562% |

| 2026 | $16,333 | $17,016 | 652% |

| 2027 | $17,740 | $18,968 | 738% |

| 2028 | $20,187 | $20,609 | 811% |

| 2029 | $21,768 | $22,920 | 913% |

| 2030 | $24,066 | $25,206 | 1,014% |

| 2031 | $26,340 | $27,469 | 1,114% |

| 2032 | $28,593 | $29,712 | 1,213% |

| 2033 | $30,826 | $31,936 | 1,312% |

When the time comes to cash out your Bitcoin, the procedure will differ based on how you purchased it and where you keep it.

For example, if you are buying Bitcoin using eToro, the procedure would be as follows:

If you use an Ethereum wallet, you’ll be able to manage your Ethereum portfolio with ease. The best Ethereum wallets will keep your investment safe and sound.

Investing in Ethereum can diversify your portfolio if you have already started investing, or it can be a great place to begin investing. The main thing is to take all the risks into account and don’t over-risk.

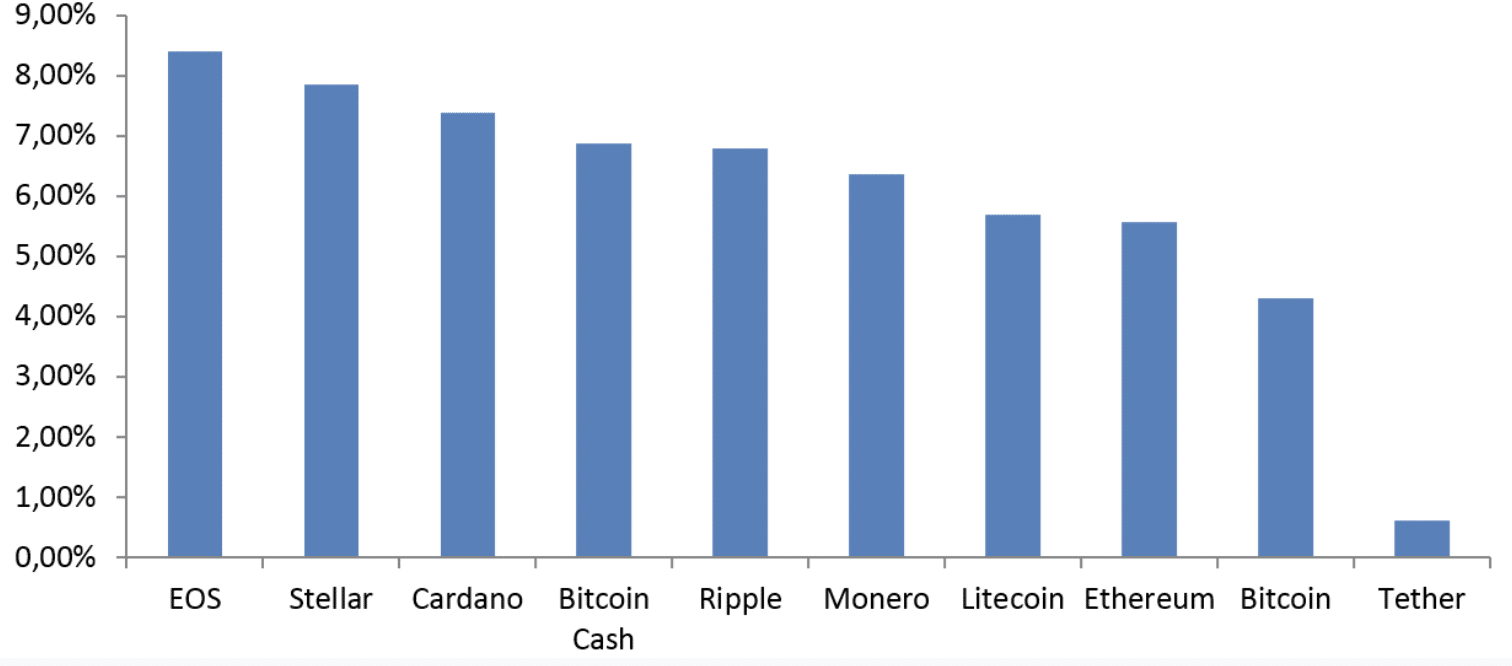

For example, instead of investing only in Ethereum, you can also invest in Bitcoin or other cryptocurrencies available on eToro.com.

Etoro offers Bitcoin, Bitcoin Cash, Ripple, Litecoin, Cardano, Stellar, and much more.