How To Buy Litecoin Australia – Buy Litecoin In Under 5 Minutes

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

You may have heard about Litecoin from your friends, colleagues, relatives, or maybe you have read articles and watched some crypto-related videos. In any case, If you want to tackle Litecoin buying, this article is what you need. You’ll find a quick guide to buy LTC right away, then we discuss it in detail.

Table of Contents

Want to buy Litecoin Australia right away? Our top recommended cryptocurrency exchange is eToro; here’s how to get started:

You can see an ultimate top 5 brokers round-up to buy Litecoin in Australia down below. Make sure to check the features of each broker to understand which one is the best for you.

eToro is a well-regulated CFD trading firm founded in the United Kingdom that is currently available in over 60 countries worldwide. CFDs do not allow you to buy Litecoin in the classic sense. Instead, you pay the current market value of Litecoin, which is then locked up in a contract. If you start the contract and the Litecoin price is higher at the end, you’ll get any gains and your money back at the end of the contract. Losses occur in the same manner, so this isn’t a get-rich-quick plan. When making trading selections on eToro, you’ll need to conduct your due research, but it’s the same as it would be with a traditional ownership investment. eToro just eliminates the risks of ownership.

The platform also helps you to learn more about crypto, hence trade more efficiently. If you want to get started in the financial markets but are unsure how, the eToro Trading School is a great free resource. Providing a range of educational tools, it’ll help you to learn the basics of trading plus the latest insights from their market analysts.

Trading School is a three-part, 90-minute webinar covering topics from stocks, currencies, and crypto assets to trading strategies and risk management. It also includes:

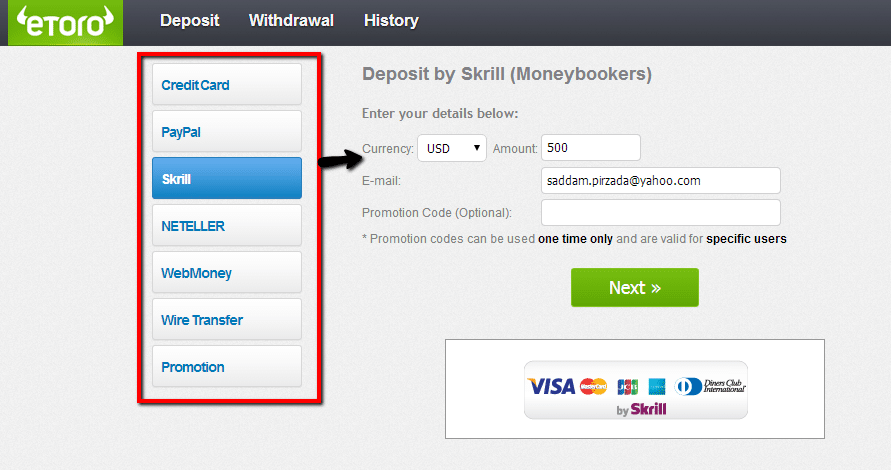

You have to make a first deposit of $200; then, you can start trading. The minimum exposure for Litecoin is 25 U.S. dollars. You can use Paypal, Neteller, Skrill e-wallets, and more classic payment methods such as credit/debit cards, wire transfers, etc.

eToro — Litecoin Fees

Trading with eToro entails 0% commission. However, the broker still charges in the form of spreads. You can find detailed information under the eToro Fees tab.

Assuming you’re about to open your first Litecoin position on eToro, let’s have a look at the possible spread size:

To find relevant data about other coins, check the Crypto spread tab on eToro.com.

Pros

The easiest way to buy LTC with PayPal

Offers Litecoin and other top-rated cryptocurrencies

You can buy Litecoin 100% commission-free

Use an e-wallet to fund your account

You only need $25 to invest in Litecoin

Automate your Litecoin trading using CopyTrading

FCA, SEC, and ASIC support eToro.com

You can trade a whole range of financial instruments and assets.

Cons

Since eToro works with U.S dollars, you can’t trade AUD directly

You pay a $5 fee to withdraw your funds.

CFDs come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading. Proceed at your own risk.

The broker provides trading access to more than 200 cryptocurrencies, including Litecoin, XRP, Bitcoin, Dogecoin etc. Capital.com is one of the best brokers regarding the instruments available to clients because it offers a diverse range of assets. With about 800,000 clients across the globe, the broker’s overall trading volume has long ago surpassed 90 billion U.S dollars.

One of the most significant benefits of trading with Capital.com is the low minimum deposit of $20 and withdrawal limit of $50. The broker holds client money in separate accounts; however, they are not insured by the platform. Furthermore, the broker offers several trading manuals, instructional resources, and access to the most recent news. These services are intended to educate and assist novice traders.

Capital.com Fees — Reliable Litecoin Broker in Australia

Investing in Litecoin with Capital.com entails paying the spread. Even though the spread isn’t something constant (the difference between buy/sell price), on August 10th, 2021, the LTC/USD spread is 0.6%. Meaning that you’ll pay 0.6% each time you open an LTC position on Capital.com.

Below, you can see other fees Capital.com does or does not charge when you trade Litecoin:

| Type of activity | Fees |

|

0% Fee |

| Crypto trading | The spread varies for each trading pair and instrument. |

| Overnight charge | The overnight fee is based on the leverage provided, not on the entire value of the Litecoin you buy. |

Pros

Convenient mobile application (IOS, Android)

High credibility, according to Trustpilot

Helpful educational materials available for traders

Competitive spreads

You can access new data covering cryptocurrencies, indices, stocks, futures, etc.

Cons

Some investors don’t appreciate CFD trading only.

Beginners can find a better place to trade LTC.

CFDs come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading. Proceed at your own risk.

AvaTrade has an attractive trading interface: it’s simple and easy to use, resulting in a pleasant user experience. The platform offers you comprehensive graphs and charts to evaluate the LTC price fluctuations. On top of that, AvaTrade provides trading features that traditional exchange platforms do not. For example:

Like most trading platforms, AvaTrade has a mobile/smartwatch app available for iOS and Android devices. Furthermore, you can open a free demo account which is valid for 21 days. Combining a demo account and a mobile app, you can practice trading without any risk, which is especially important for beginners.

AvaTrade Fees — Reliable Litecoin Broker in Australia

Account fees, deposits, and withdrawals are free of charge. Avatrade charges you $50 if you’re not active for three months straight. On top of that, if you don’t use the platform for more than 12 months, you have to pay a $100 administrative penalty.

As for trading itself, AvaTrade charges you spread. For example, the typical Litecoin spread is 0.6% over the market. You pay 0.6 % every time you open a Litecoin position.

Pros

Regulated around the globe.

You can trust for support and security.

You can use MT4 and MT5 trading terminals.

Trade Litecoin with leverage Up to 20:1.

High-class educational materials for beginners.

Support available in 14 different languages.

An abundance of trading & financial instruments.

Cons

Funds withdrawal might take extra time on weekends.

Some investors don’t like pushy managers.

CFDs come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading. Proceed at your own risk.

Coinbase has developed relationships with several well-known businesses, including Dell, Overstock, and Time Inc, lending authority to the platform. More than 35 million members from more than 100 countries only approve the broker’s reliability. The platform has an Authorized Payment License in Australia, which means the Financial Conduct Authority accredited the broker. If you’re searching for a top-tier site to purchase Litecoin in Australia, Coinbase, like eToro, is a fantastic option. The purchasing procedure generally takes less than 15 minutes and does not require any prior understanding of how investments function.

The broker doesn’t force you to invest big; you can start with a relatively small deposit. The exact minimum you’re going to need depends on your payment method. You can choose anything from debit/credit card to bank transfer. The biggest concern for investors working with Coinbase is comparatively high fees.

Coinbase — Buy Litecoin Australia Flat Fees

| Overall Transaction Amount | Transaction Fee |

| $10 or less | $0.99 |

| More than $10, less than or equal to $25 | $1.49 |

| More than $25, less than or equal to $50 | $1.99 |

| More than $50, less than or equal to $200 | $2.99 |

Coinbase Pro fees depend on the trading volume: the more you trade, the less your fees.

| Pricing Tier | Taker Fee | Maker Fee |

| Less than $10K | 0.50% | 0.50% |

| $10K to $50K | 0.35% | 0.35% |

| $50K to $100K | 0.25% | 0.15% |

| $100K to $1M | 0.20% | 0.10% |

| $1M to $10M | 0.18% | 0.08% |

| $10M to $50M | 0.15% | 0.05% |

| $50M to $100M | 0.10% | 0.00% |

Pros

35 million customers approve the broker’s excellent reputation.

Beginner-friendly interface, helpful hints all over the site.

A plethora of payment methods are available.

You can withdraw your funds to a private wallet.

Convenient mobile app.

FCA-accredited broker.

Cons

3.99% fee on debit card deposits.

You may lose money when trading; proceed at your own risk.

Binance, founded in August 2017 by Changpeng “CZ” Zhao, only took 180 days to become the world’s largest cryptocurrency exchange, a position it still maintains today. It’s a crypto behemoth, with more than 1.4 million transactions per second and more than 500 cryptocurrencies available for worldwide consumers to trade. The platform is mainly focused on trading services – meaning that you will be buying and selling digital currency pairs on a short-term basis. It’s also involved in more complex financial products like futures and options.

Binance provides two types of digital currency trading platforms: basic and advanced. Neither the basic nor advanced versions are 100% user-friendly: you need at least the basic understanding to trade on Binance. The primary distinction between the basic and advanced versions is that the advanced version provides a more in-depth technical analysis of digital currencies over time, including Litecoin’s in-depth analysis. The simplified versions offer beginner-friendly graphs and charts for the pairs you trade; order books and trade history are also available.

Binance Fees — Largest Litecoin Broker

Unless you pay with a credit/debit card, Binance offers quite competitive fees; they charge you a commission of 0.1 per slide. However, if you use a card, the transaction fee is 2%. Even though Binance is running a fee-reducing promotion, a 1% fee drop still doesn’t quench the thirst enough for many intraday traders (they offer a time-limited offer, charging you 1% for all Visa and MasterCard operations).

The spot trading fee is 0.1%, while Instant Buy/Sell fee is 0.5%. However, you can reduce fees if you hold BNB in your account.

| 30d Trade Volume (USD) | Maker / Taker Fees | Maker / Taker Fees

if you hold BNB |

| < 50,000 USD | 0.1000% / 0.1000% | 0.0750% / 0.0750% |

| ≥ 50,000 USD | 0.0900% / 0.0900% | 0.0675% / 0.0675% |

| ≥ 100,000 USD | 0.0800% / 0.0900% | 0.0600% / 0.0675% |

| ≥ 500,000 USD | 0.0700% / 0.0800% | 0.0525% / 0.0600% |

| ≥ 1,000,000 USD | 0.0500% / 0.0700% | 0.0375% / 0.0525% |

| ≥ 5,000,000 USD | 0.0400% / 0.0600% | 0.0300% / 0.0450% |

Pros

The largest trading volume on the market

Supports hundreds of crypto

Competitive fees

Fully supports Australian debit/credit cards

The crypto market is available anytime

Tablet and mobile apps to trade wherever you are

Unbeatable reputation and credibility

Good fit for veteran and medium-hand traders.

Cons

Not always suitable for beginners.

A standard charge of 2% on debit/credit card deposits.

You may lose money when trading; proceed at your own risk.

If you are still second-guessing yourself about buying Litecoin, this section is right for you. Let’s discuss some benefits LTC might bring to your investment portfolio.

Litecoin outperforms many math-based currencies in terms of transaction confirmation times and storage efficiency. With significant industry support, trade volume, and liquidity, Litecoin is a tried-and-true medium of exchange that works with Bitcoin.

One of the substantial benefits you can rely on investing in Litecoin is an open-source system, which means modifications to LTC protocol are simple. Technical advancements such as SegWit and the Lightning Network protocol become a reality due to the transparency of the coin’s code. Which naturally increases the demand for the coin: both among institutional and personal investors.

On top of that, Litecoin is a peer-to-peer network and a decentralized alternative to paper money, which means users don’t have to rely on third parties, central banks, or authorities. Nodes are scattered worldwide, and the network is open to people from all walks of life. As a result, there are almost no intermediary commissions and the risk of price manipulation. Transactions are quicker and more convenient than banking systems: that’s what stimulates the market demand for LTC.

The Litecoin blockchain differs from Bitcoin: LTC generates blocks every 2.5 minutes on average (4x times faster than BTC). Such a speed means that participants in the system, such as coin sellers who receive or send coins, are guaranteed to receive faster confirmations when making one block of transactions. Another vital advantage of Litecoin is scalability. Litecoin can process 56 transactions per second. By comparison, Bitcoin can process seven transactions per second, while Ethereum can currently process 15 transactions per second. Higher transaction rates may spin LTC coin’s price.

Litecoin is a flexible network that incorporates numerous improvements such as SegWit and the Lightning Network protocol to make transactions faster and easier. Interestingly, Litecoin creator Lee once said: “Imagine it’s two highways: today Bitcoin is packed with cars, and Litecoin is empty. Even with Bitcoins, cars today don’t drive on the Litecoin highway because it’s not connected and inconvenient (centralized exchanges and slow chain transfers). Lightning Network will build bridges across the highway. But a side benefit is that these bridges will connect the two roads together. Maybe there are enough bridges on Bitcoin to keep cars on the Bitcoin highway. I’m sure the convenience and cheaper tolls on the Litecoin highway will convince drivers to use Litecoin.” Non-stop improvements contribute to the value of Litecoin.

Since a former Google employee created Litecoin, the coin has some kind of built-in credibility somehow. Charlie Lee and his team regularly develop LTC, including better wallets, confidential transactions, and partnerships. Alba, for example, is one of the companies planning to use Litecoin for its smart contracts. As the company announced, “We chose Litecoin as the second asset class after Bitcoin for our smart-contracts investment solution. There are three main reasons:

Many exchanges offer Litecoin, with eToro being one of the most robust, enabling investors to purchase LTC and trade CFDs on more than 90 cryptocurrencies. All hardware wallets support Litecoin, and there are atomic exchanges between LTC and BTC. Furthermore, due to its lower price compared to other major currencies and its near-zero transaction fees and low volatility levels, LTC is an appealing choice for novices wanting to participate in the cryptocurrency market.

eToro exchange is one of the first cryptocurrency brokers to provide various payment options and other services. You can make deposits and withdrawals via Skrill, Neteller, PayPal on eToro. As long as you fill your account with a minimum of $200 and invest at least 25 U.S dollars, any payment method is available to you.

Since PayPal is a popular and convenient payment method worldwide, some Australian investors want to use PayPal to invest in Litecoin. However, not every exchange allows e-wallets to buy crypto. Most of the brokers focus on credit/debit cards or wire transfers instead. Even though you can find some brokers like Coinbase, which lets you link PayPal, you still can’t buy Litecoin. The reason is Coinbase uses PayPal for withdrawals, not purchases.

To buy Litecoin with PayPal, you should first register with eToro. Signing up is free, and you don’t have to deposit right away, so you can get a feel for the platform before going live. However, if you’re up to buying LTC, you have to top-up your account with some funds.

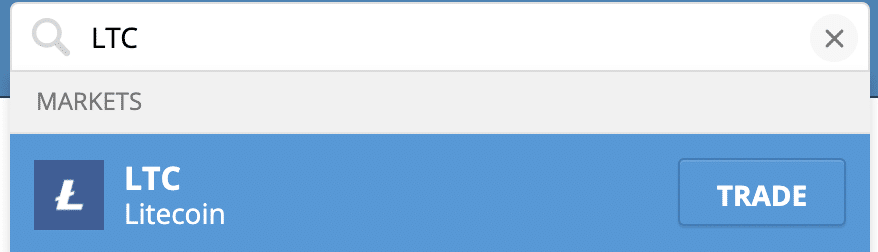

Once you’re ready to buy for LTC, it’s time to fund your account. Click the deposit button in the lower-left corner, then select PayPal. Enter the amount you wish to deposit; we recommend starting small and gradually scaling your investment. Now you should type LTC or Litecoin into the search bar, then click the ‘Trade’ and ‘Open Trade’ buttons.

eToro supports debit cards and charges you a 0.5% exchange fee. To buy Litecoin in Australia using a debit card, you must upload your ID first. The process is intuitive and takes less than five minutes.

Making a credit card deposit at eToro is as simple as entering your information and the amount you want to add to your account. Then you verify, confirm, and wait. Please note that credit card purchases have an extra fee called cash advance fee.

You can only buy Litecoin anonymously if you deal with an unregulated cryptocurrency exchange. We don’t recommend you to have any business with non-regulated brokers because they often have security and privacy issues.

Any reliable Australian cryptocurrency exchange must comply with government know-your-customer regulations; hence, you must verify your identity.

Unless you want to grapple with unexpected capital losses, you should consider and analyze all the risks related to Litecoin. To start, you can have a look at three significant risks associated with investing in LTC coins.

Many investors think Litecoin is the same as Bitcoin because LTC is Bitcoin’s fork, one of the main drawbacks of investing in LTC. On top of that, although Litecoin has revolutionized the crypto sector by improving Bitcoin, its uniqueness is gradually diminishing. To give an example, Bitcoin also adopted the SegWit protocol, abandoning the achievements and prestige of Litecoin.

Although Litecoin has a solid development team, LTC has lost some credibility. More specifically, Charlie Lee sold his assets at a record high Litecoin in 2017, which caused people to question his faith in the coin. In addition, the abandonment of the defunct Litepay service has also caused mixed reactions among crypto-enthusiasts. While the original introduction of the Litepay service produced a boom in LTC pricing, Team LTC said, “We are very disappointed that this saga ended this way, and we apologize for the lack of due diligence that could have revealed some of these issues earlier. We are currently working hard to tighten our due diligence practices to ensure this does not happen again.”

About a third of all dark web underground sellers accepted Litecoins back in 2018. The number probably rose since then because Litecoin transactions are faster than BTC. Plus, governments pay less attention to regulate LTC than BTC. Some investors don’t like dealing with such “shaky” crypto.

Buying Litecoin in 2021 is easy and only takes four basic steps. If you want to invest in Litecoin, follow our four-step instructions.

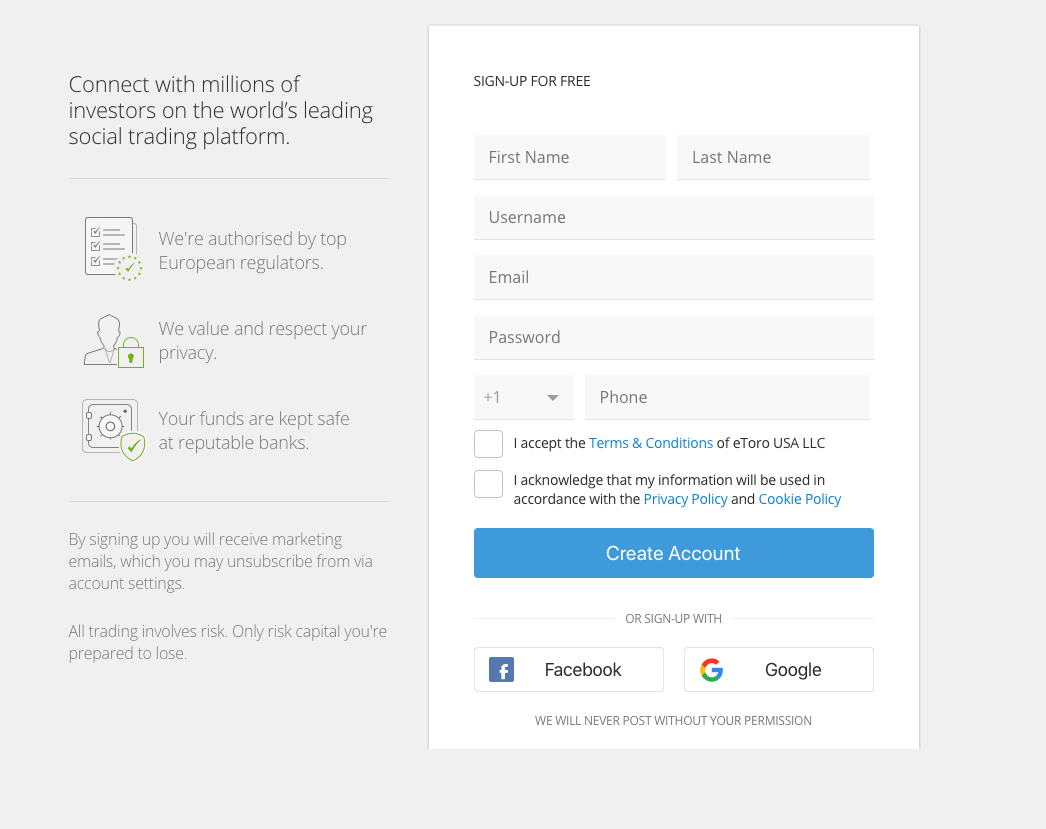

To get started with investing in Litecoin, you need a minimum deposit of just $25. But, first, let’s take a look at the account opening process.

Buy Litecoin with 0% Commission Now >

Fill the form to continue. You have to verify your identity if you want to invest big. However, you can skip this step and verify your account at any time.

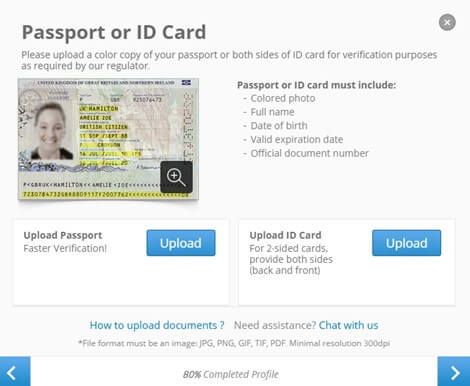

You need your I.D. and proof of address to verify your account: any official document works as proof: recent utility bill, bank statement, driving license, receipt, etc. You can skip uploading and scan documents whenever you feel comfortable.

Funding your trading account is an effortless process. You may deposit dollars into your account using a variety of methods. Select the form of payment that is most convenient for you and complete the steps outlined below:

Now you can use the search box to buy Litecoin. Type Litecoin or into the search box and click on the ‘TRADE’ button.

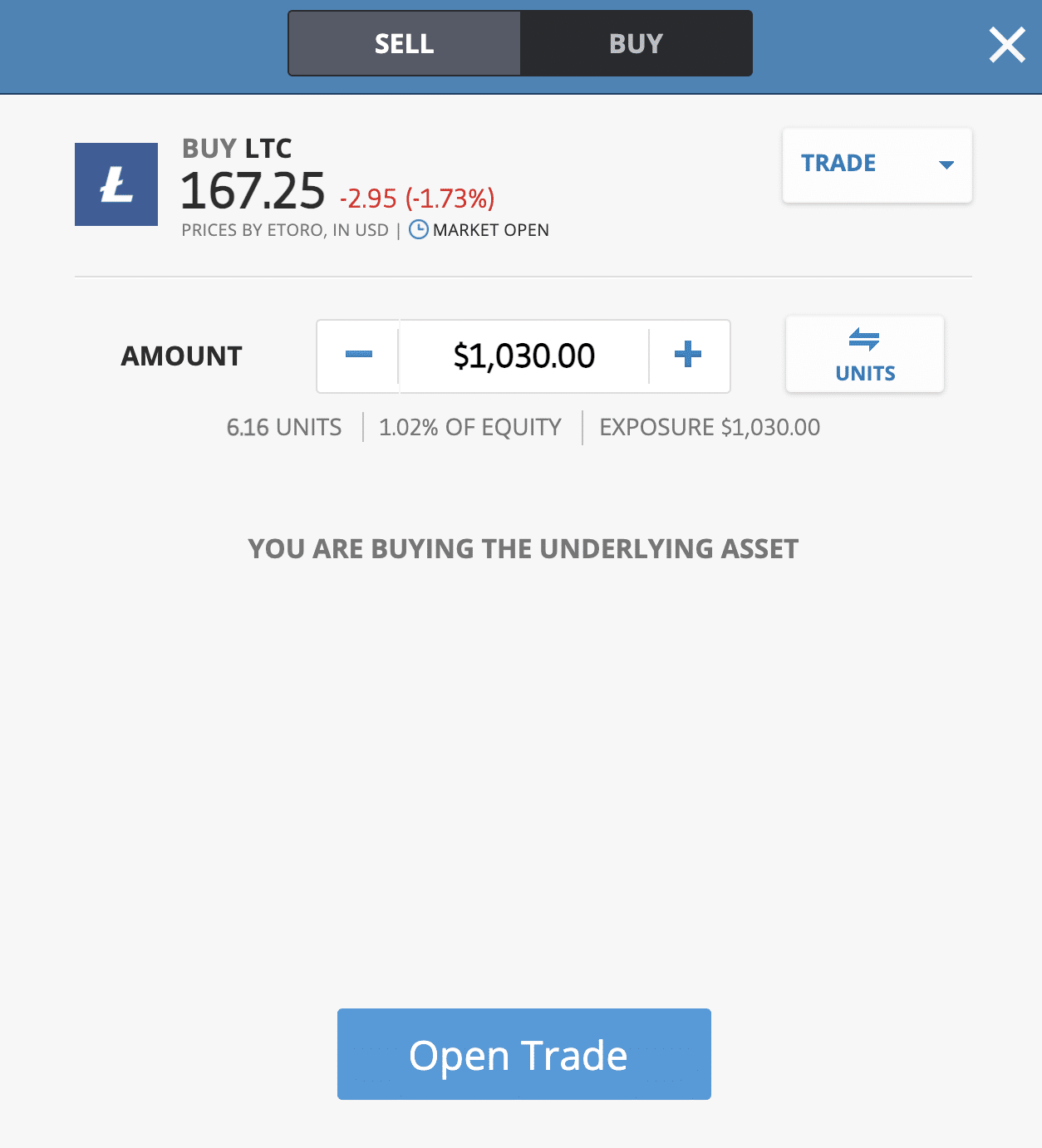

Once the order form opens, it’s high time to enter your stake. Ensure it’s higher than $25 U.S. dollars, as the minimum amount to invest in Litecoin is $25.

At this stage, you can see how many coins you get, overall equity, and exposure. In the example above, you will get 6,16 Litecoins for $1,030 invested.

You can see both the ‘Set Order’ or ‘Open trade’ buttons depending on the market’s condition. You’ll see the ‘Open Trade’ button if you enter the market during standard market hours. If the market is closed, you’ll see the ‘Set Order’ button. To finish your commission-free LTC investment, click the ‘Open Trade’ option.

To check the value of your Litecoin investment, go to the ‘Portfolio’ tab of your eToro account.

As a proven alternative to Bitcoin, Litecoin is a very inexpensive and ultra-secure way to make payments. Especially when it comes to microtransactions, such as paying for a cup of coffee, etc. In addition, the Litecoin community is working to introduce all kinds of new fintech gadgets that are designed for Bitcoin. Litecoin developers are currently working to increase privacy (including confidential transactions and MimbleWimble), implement the lightning network protocol, and develop smart contract applications. LTC, as a classic and secure altcoin, has a very bright future.

Litecoin was developed as a lightweight version of Bitcoin, eliminating some of its shortcomings. LTC is a classic altcoin with more than ten years of experience in the market. Developers can easily add software updates and new technologies to Litecoin.

As with Bitcoin, there is also a built-in scarcity. There are only 84 million LTC. Litecoin is severely undervalued compared to other cryptocurrencies. For example, Bitcoin is much slower and more expensive to use. Another advantage of Litecoin is that people who live in third-world countries and do not have bank accounts can quickly and inexpensively buy this coin.

LTC is an excellent alternative to paper money compared to Ethereum. Ethereum is rather “fuel” than money per se, but it can be used as such. Moreover, the concept of Ethereum is much more difficult to understand than that of Litecoin.

LTC is digital P2P money with built-in scarcity, which works faster as a transaction, making it easier to implement because it requires little knowledge. Install the wallet app on your smartphone, and you’ll have your own Swiss Litecoin bank account with which you can transact almost immediately. As Bitcoin grows in popularity, price, and transaction costs, users will look for cheaper and faster alternatives — one of them is Litecoin.

Litecoin has made significant progress and has even been included as a payment instrument in Venezuela’s leading international payment system. Through the Partia Remesas remittance platform, foreigners can send Litecoins to family members and friends in Venezuela, who receive bolivars to their local bank account through Remesas. Interesting here is that the platform charges a 15% fee, meaning that the Venezuelan government secretly collects LTC.

Litecoin Foundation owns 9.9% shares of the German bank WEG. The Litecoin Foundation received them as a donation from the Swiss blockchain company TokenPay. Together, they own almost 20% of the shares of this conservative German bank, which works mainly for real estate investors. So in the long term, could Litecoin be recognized as a possible cryptocurrency for buying real estate in Germany? We can’t be sure: all that remains is to follow the cryptocurrency market’s trends.

On August 10th, Litecoin dropped by 0.52 percent. LTC closed the day at $165.45, up 11.09 percent from the previous day. The coin climbed to an intraday high of $168.42 in the early afternoon following a turbulent morning. Then Litecoin dropped to a late afternoon intraday low of $158.86, falling short of the first major resistance level at $177.

Keeping away from the first major support level at $151, Litecoin returned to $167 levels before easing back. Finally, the coin just fell 0.06 percent to $165.35. Generally, LTC had a rocky start to the day, falling to an early morning low of $165.19 before recovering to a high of $166.19.

Early on, Litecoin didn’t challenge the key support and resistance levels.

The Litecoin community is actively developing projects. Litecoin has clear potential for further growth and is undoubtedly a severe competitor to other cryptocurrencies. Let’s have a closer look at LTC’ price.

If you’re planning to buy Litecoin, you can always check the price at eToro. To find out how much one Litecoin is worth, type LTC or Litecoin into your search query.

For example, on August 12, 2021, one Litecoin on eToro was worth about $170.

| Date | Open | High | Low | Close | Adj Close | Volume |

| Aug 10, 2021 | $156.06 | $157.44 | $151.29 | $151.29 | $151.29 | 1.88B |

| Aug 01, 2021 | $144.51 | $150.56 | $135.99 | $147.80 | $147.80 | 9,1B |

| Jul 01, 2021 | $144.14 | $147.84 | $104.33 | $144.93 | $144.93 | 45B |

| Jun 01, 2021 | $188.12 | $197.68 | $105.57 | $144.14 | $144.14 | 72,7B |

| May 01, 2021 | $271.14 | $412.96 | $118.64 | $188.03 | $188.03 | 220,5B |

| Apr 01, 2021 | $197.52 | $335.02 | $195.53 | $271.17 | $271.17 | 198,9B |

| Mar 01, 2021 | $164.98 | $229.37 | $163.97 | $197.50 | $197.50 | 132,9B |

| Feb 01, 2021 | $129.57 | $245.96 | $126.35 | $164.93 | $164.93 | 257,4B |

| Jan 01, 2021 | $124.67 | $185.78 | $114.96 | $129.57 | $129.57 | 285,4B |

| Dec 01, 2020 | $87.58 | $138.32 | $70.23 | $124.69 | $124.69 | 232,2B |

| Nov 01, 2020 | $55.59 | $93.58 | $51.61 | $87.57 | $87.57 | 140,2B |

| Oct 01, 2020 | $46.23 | $60.30 | $44.02 | $55.59 | $55.59 | 69,9B |

| Sep 01, 2020 | $61.11 | $64.18 | $42.54 | $46.28 | $46.28 | 51,4B |

However, the price of LTC is likely to stay below $300 and is unlikely to repeat its record high of $412.96 set on May 10, 2021. So what will happen to Litecoin’s price in the coming years?

| Month | Open | Low-High | Close | Mo,% | Total,% |

|

2021 |

|||||

| Aug | $144 | $136-$219 | $205 | 42.4% | 42.4% |

| Sep | $205 | $171-$255 | $238 | 16.1% | 65.3% |

| Oct | $238 | $221-$255 | $238 | 0.0% | 65.3% |

| Nov | $238 | $186-$238 | $200 | -16.0% | 38.9% |

| Dec | $200 | $156-$200 | $168 | -16.0% | 16.7% |

|

2022 |

|||||

| Jan | $168 | $168-$209 | $195 | 16.1% | 35.4% |

| Feb | $195 | $195-$242 | $226 | 15.9% | 56.9% |

| Mar | $226 | $226-$280 | $262 | 15.9% | 81.9% |

| Apr | $262 | $250-$288 | $269 | 2.7% | 86.8% |

| May | $269 | $269-$334 | $312 | 16.0% | 117% |

| Jun | $312 | $312-$387 | $362 | 16.0% | 151% |

| Jul | $362 | $362-$449 | $420 | 16.0% | 192% |

| Aug | $420 | $328-$420 | $353 | -16.0% | 145% |

| Sep | $353 | $348-$400 | $374 | 5.9% | 160% |

| Oct | $374 | $374-$464 | $434 | 16.0% | 201% |

| Nov | $434 | $365-$434 | $392 | -9.7% | 172% |

| Dec | $392 | $358-$412 | $385 | -1.8% | 167% |

*According to Tradingbeasts.com

| Year | Mid-Year | Year-End | Tod/End,% |

| 2023 | $331 | $391 | +153% |

| 2024 | $356 | $402 | +161% |

| 2025 | $357 | $375 | +143% |

| 2026 | $409 | $439 | +185% |

| 2027 | $398 | $426 | +176% |

| 2028 | $453 | $480 | +211% |

| 2029 | $477 | $502 | +225% |

| 2030 | $527 | $552 | +258% |

*According to Coinpriceforecast.com

When you eventually get around to cashing your Litecoin out, the process will vary depending on how you bought it and stored it.

For example, if you made the Litecoin purchase at eToro, the process would look like the following:

Litecoin might remain a sought-after asset next year as well. Despite some decline and high volatility, many experts advise investing in this coin — Litecoin has more advantages than Bitcoin: it’s more secure, processing speed is higher, and costs are lower. LTC is constantly improving technology, which makes it even more attractive to new investors in the future.

Although the coronavirus pandemic is still ongoing, financial markets are slowly recovering. In response to the massive support from the heads of the world’s largest central banks, investors are increasingly looking for ways to hedge risks. Against this backdrop, Litecoin, Bitcoin, and other leading cryptocurrencies will act like attention magnets.

If Litecoin can surpass its current price and hold on for the long term, the coin is predicted to retest its historical high. The LTC/USD high is likely to remain below $300 for most of next year.

If you are not attracted to investing, you can try cryptocurrency trading. The eToro broker offers a convenient platform with a wide range of technical indicators and financial instruments and allows you to copy trades of successful traders. Check eToro to learn more.