Invest in Index Funds Australia – Investing in Index Funds Beginner’s Guide 2021

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Looking to invest from Australia in an index fund? Index funds are a type of mutual fund that support you in regular, low-risk investments over the long term in the stock market and sector indices.

Nowadays, traditional index funds are outshone in popularity by index Exchange Traded Funds (ETFs). Index ETFs give you the same exposure to market indices, but generally offer lower management costs and higher trading flexibility.

We look into the pros and cons of index funds vs. index ETFs. If neither suit your investment priorities, you might like to investigate trading off indices for short-term profit using CFDs (Contracts-For-Difference). We introduce three reputable brokers which welcome Australian investors and can get you started on your index investment journey, however you choose to embark.

Table of Contents

To invest in indices, follow this simple four-step strategy:

As an Australian investor, you need to find a broker or fund manager which accepts Australian Dollars (AUD). All three brokers we examine below offer good reputations for user-friendliness and regulation. All three accept AUD.

1. eToro – Overall Best Broker to Invest in Index Funds Australia

With 20 million investors spread over 120+ countries, eToro has established itself as a reputable brokers ideal for beginners.

Since its foundation in 2006, eToro has put its back into making investments as easy and safe as possible. Regulated by no less than 4 sovereign bodies – including the Australian Securities & Investment Commission (ASIC) – eToro offers commission-free investing in a secure, friendly environment. eToro boasts an interface that really is easy to use, as well as a wide global selection of stocks, indices, ETFs, commodities and crypto.

eToro index ETFs

eToro provides over 250 ETFs and most of them are index ETFs.

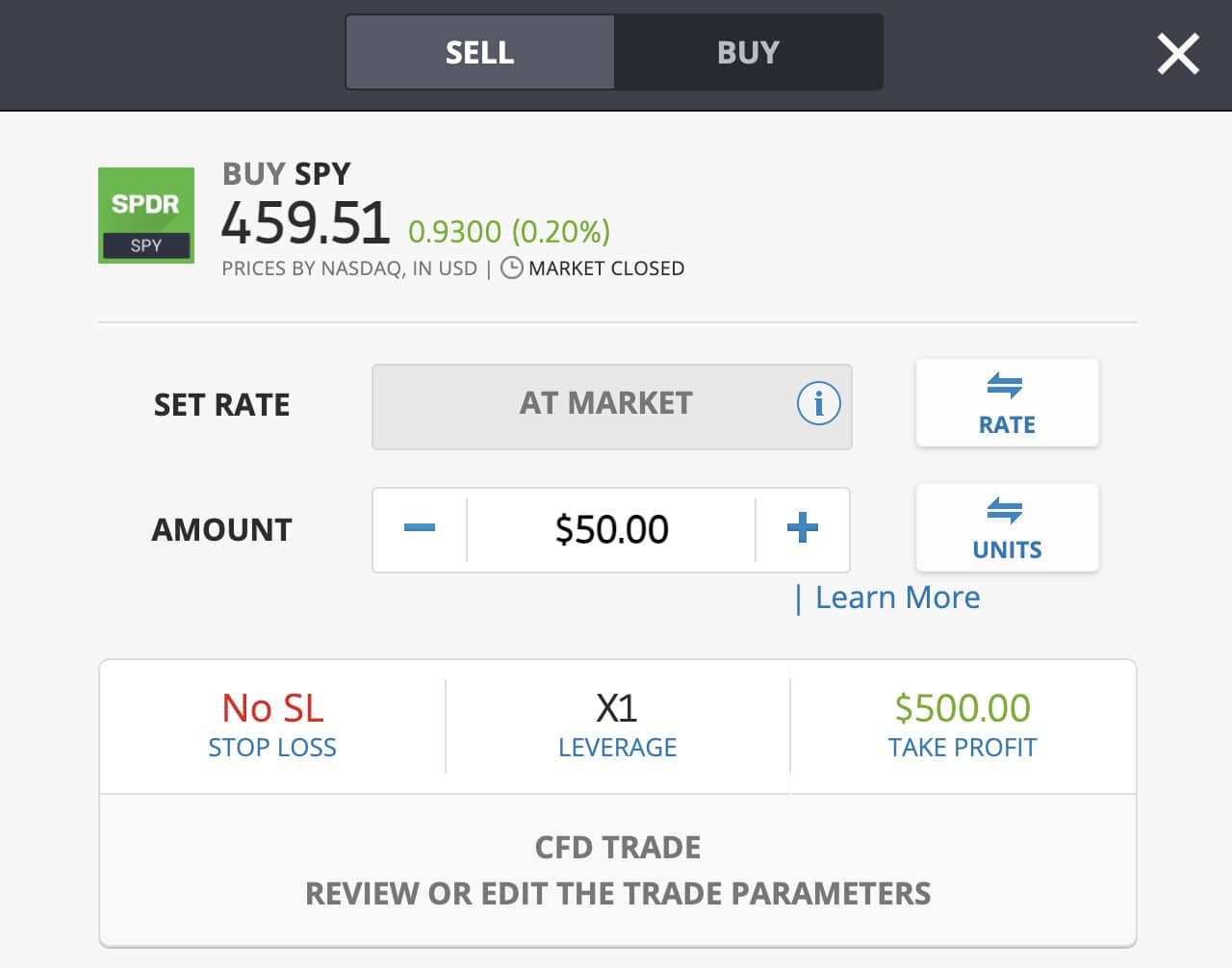

A classic index ETF is the SPDR S&P 500 ETF (SPY). This index ETF is classic in the purest sense: SPY was the very first ETF of all time, founded in 1993. Now there are 7500+ ETFs!

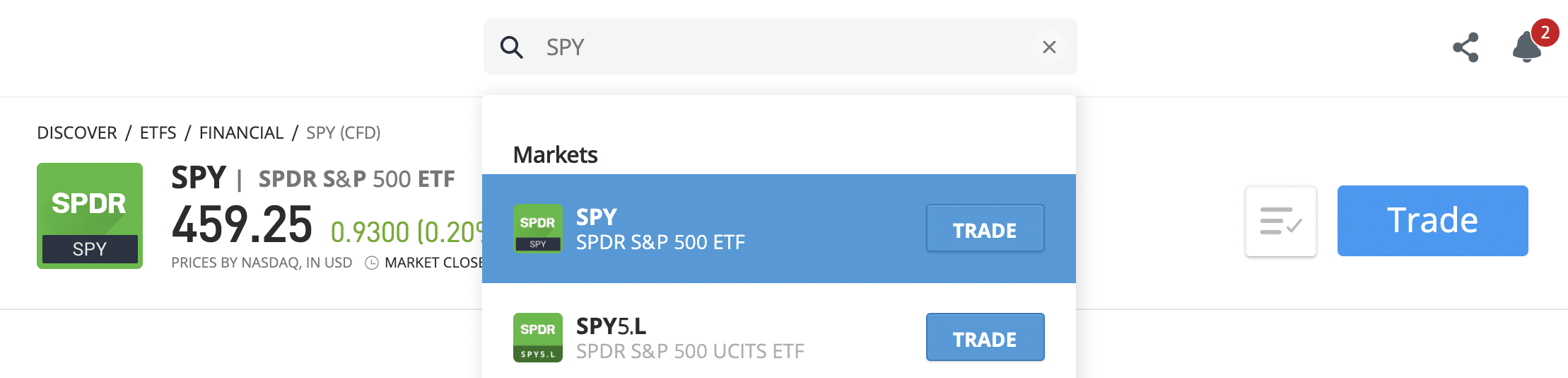

Find this index ETF by entering the ETF’s ticker name ‘SPY’ into eToro’s top toolbar:

SPY tracks the US S&P 500 Index. This index tracks the top biggest 500 firms listed at US stock exchanges. SPY has a staggering $386 billion USD under management. Since 1993, it has delivered an annual return of 10% on average.

SPY has close to 1.4 million followers on eToro. Over 4% of eToro investors have SPY in their portfolios.

You can buy into SPY commission-free with eToro. But, as with all brokers, a spread fee applies.

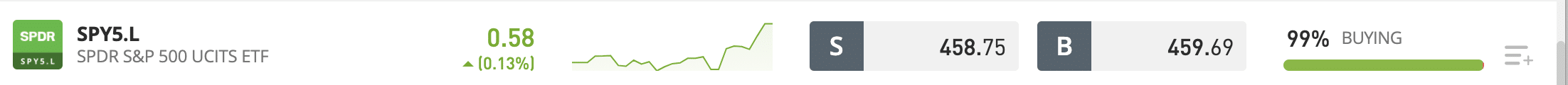

The spread is the difference between the buying and selling prices you will be offered. Because SPY is heavily-traded, the spread fee is very small.

The spread is the difference between the Sell (S) price and the Buy (B) price.

The spread for SPY at the time the above screenshot was taken is therefore 459.69 minus 458.75 = 0.94.

The spread percentage fee is the spread divided by the Buy (B) price, multiplied by 100.

The spread percentage for SPY is therefore (0.94/459.69)*100 = 0.20%. You will not be charged the spread percentage fee as a separate fee. Rather it will come into play when you buy into the ETF and sell out of it.

It is important to understand that investing in traditional index funds as opposed to ETFs does not incur a spread fee of any kind. Rather you can make regular investments and withdrawals into a traditional index fund without incurring any cost. However, where traditional index funds incur costs is in the Expense Ratio.

Index funds tend to have much higher Expense Ratios than ETFs. With index funds, the Expense Ratio is sometimes called the ‘Ongoing Cost Fee’ (OCF). Expense Ratios and OCFs are expressed as a percentage. They shows you how expensive a fund is to run.

SPY, for example, has an Expense Ratio of 0.0945%. This means, effectively, that for every $100 increase in assets under management, the ETF’s management will only pass on $100 minus (0.0945%*$100) = $99.91 to investors. With ETFs, the Expense Ratio is deducted at the source of every transaction and used to run the ETF. With ETFs, you do not need to worry about being hit with an Expense Ratio bill out of the blue.

By comparison, the Expense Ratio for Vanguard’s US Equity Index Fund, which tracks the entire US S&P Index, is 0.10%.

Trading indices as CFDs with eToro

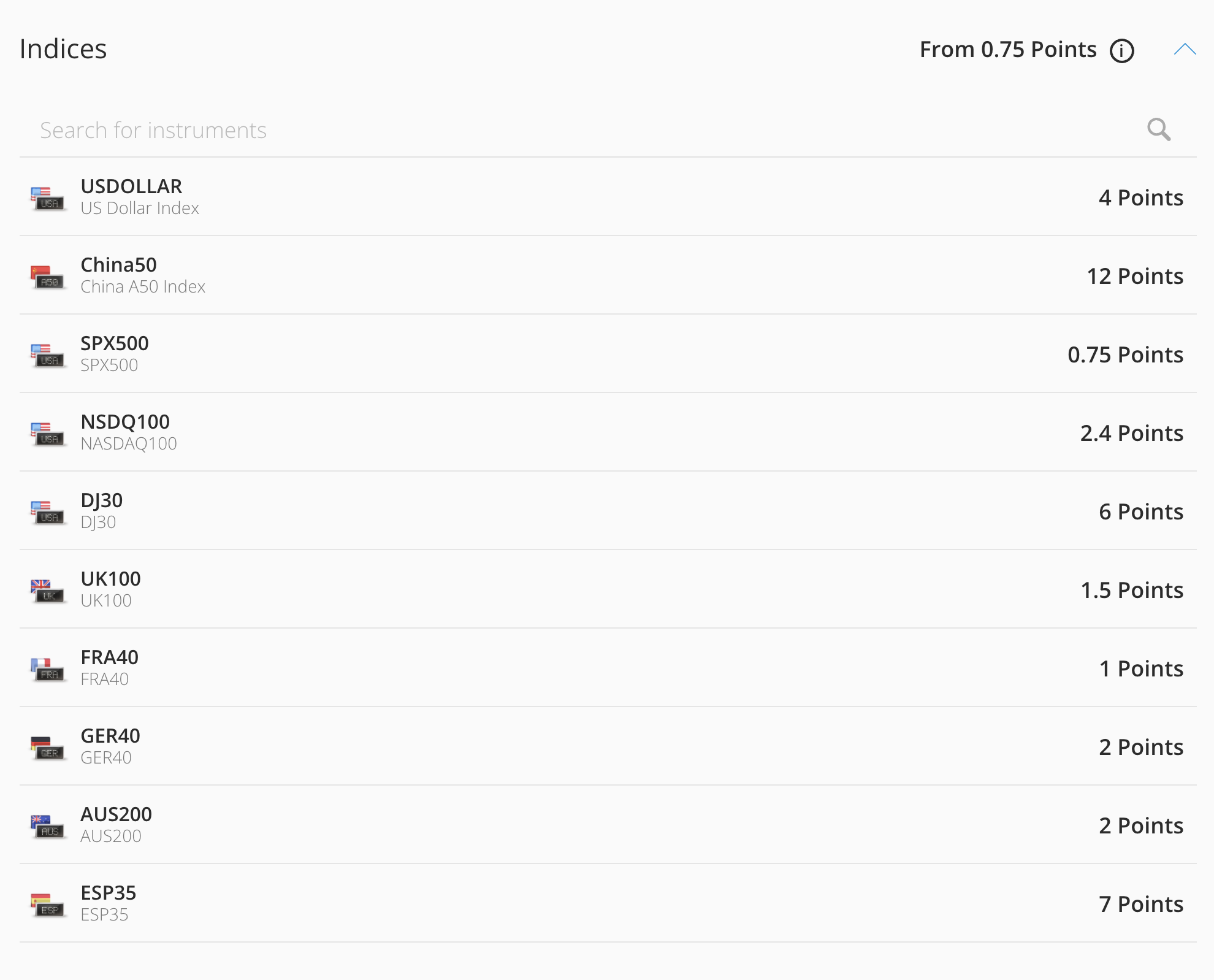

With eToro you can also look into trading indices using CFDs (Contracts-For-Difference).

With index funds and index ETFs, the idea is to benefit over the long term from increases in markets as a whole. With CFD trading, the idea is to benefit from short-term changes in the index, and nip in and out of positions. eToro allows to trade 13 sovereign stock market indices. Overnight fees apply, depending on the index. And a CFD spread fee applies too, depending on which stock market index is traded. Here are some examples:

With eToro, you can use CFDs to go short on index movements (ie. bet that the index falls). You can also leverage your investment (whether long or short) by up to 100x in order to maximise your exposure to tiny changes in index value.

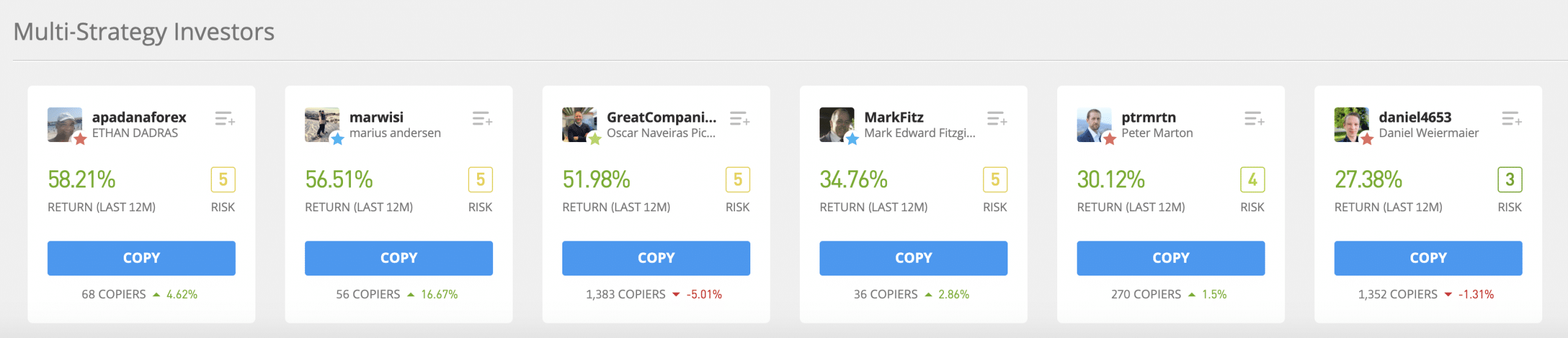

With CopyTrader and CopyPortfolios, eToro allows beginner investors to learn from their more experienced counterparts.

eToro CopyTrader

CopyTrader allows you copy, in real-time, the trades of successful investors free of charge. You simply allocate a certain amount of funds to be invested, pick an investor to copy, and eToro will do the rest. You can audition traders to copy based on their past portfolio performance and risk rating.

You can copy many investors at the same time, as well as exit copying at any time. Note that you will be charged any transactions fees that apply as your funds are invested, but you will not pay a service charge for the CopyTrader service itself.

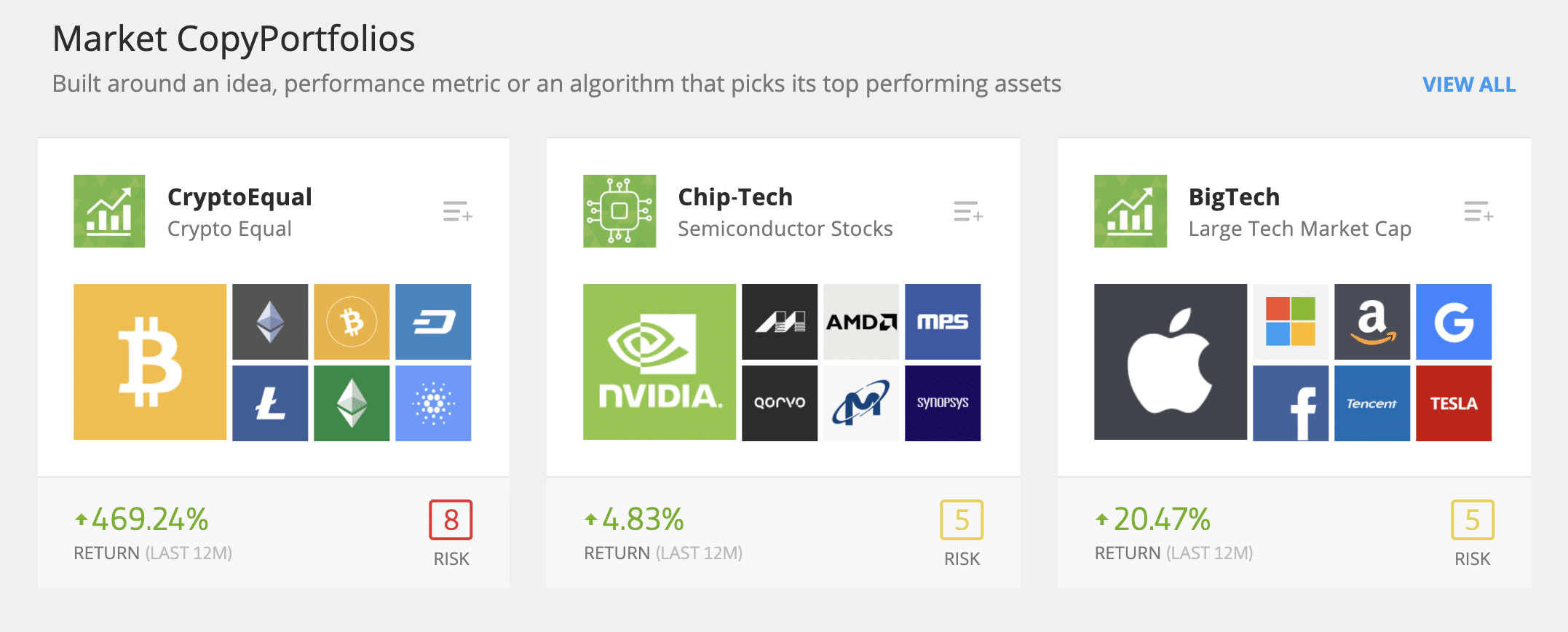

eToro CopyPortfolios

CopyPortfolios allow investors to buy into a managed portfolio. These portfolios are organised around certain sectors and themes. Strictly speaking, none reflect an actual stock market or sector index. Each, rather, focuses on a specific index of its own making. The Chip-Tech CopyPortfolio, in the centre of the screenshot, below invests in major chip-tech stocks – but does not follow an existing index of chip-tech stocks.

You will need a minimum of $1000 USD to invest in a CopyPortfolio.

eToro is regulated in the US by FinCEN, in the UK by the Financial Conduct Authority (FCA), in Australia by the Australian Securities and Investments Commission (ASIC) and by the Cyprus Securities & Exchange Commission (CySEC) in Cyprus.

Spread fees apply to ETFs, depending on the ETF. CFD fees apply when going short on an ETF.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Deposit Fee | $0 |

| Withdrawal Fee | $5 |

| Inactivity Fee | $10 monthly fee applies after 1 year of inactivity |

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

AvaTrade is a regulated CFD broker with snappy telephone-based customer service and a good selection of ETFs and indices to trade. AvaTrade is set up for Australian clients with a dedicated Australian website, and accepts AUD as a deposit currency.

AvaTrade offers many platforms to explore including MT4/MT5, DupliTrade, ZuluTrade, AvaOptions and AvaSocial. AvaSocial is of particular interest to newbies. AvaSocial is AvaTrade’s mobile-only social trading app, aimed at beginners: it offers a fun place to pick up tips and learn the ropes of investing, but it is quite new.

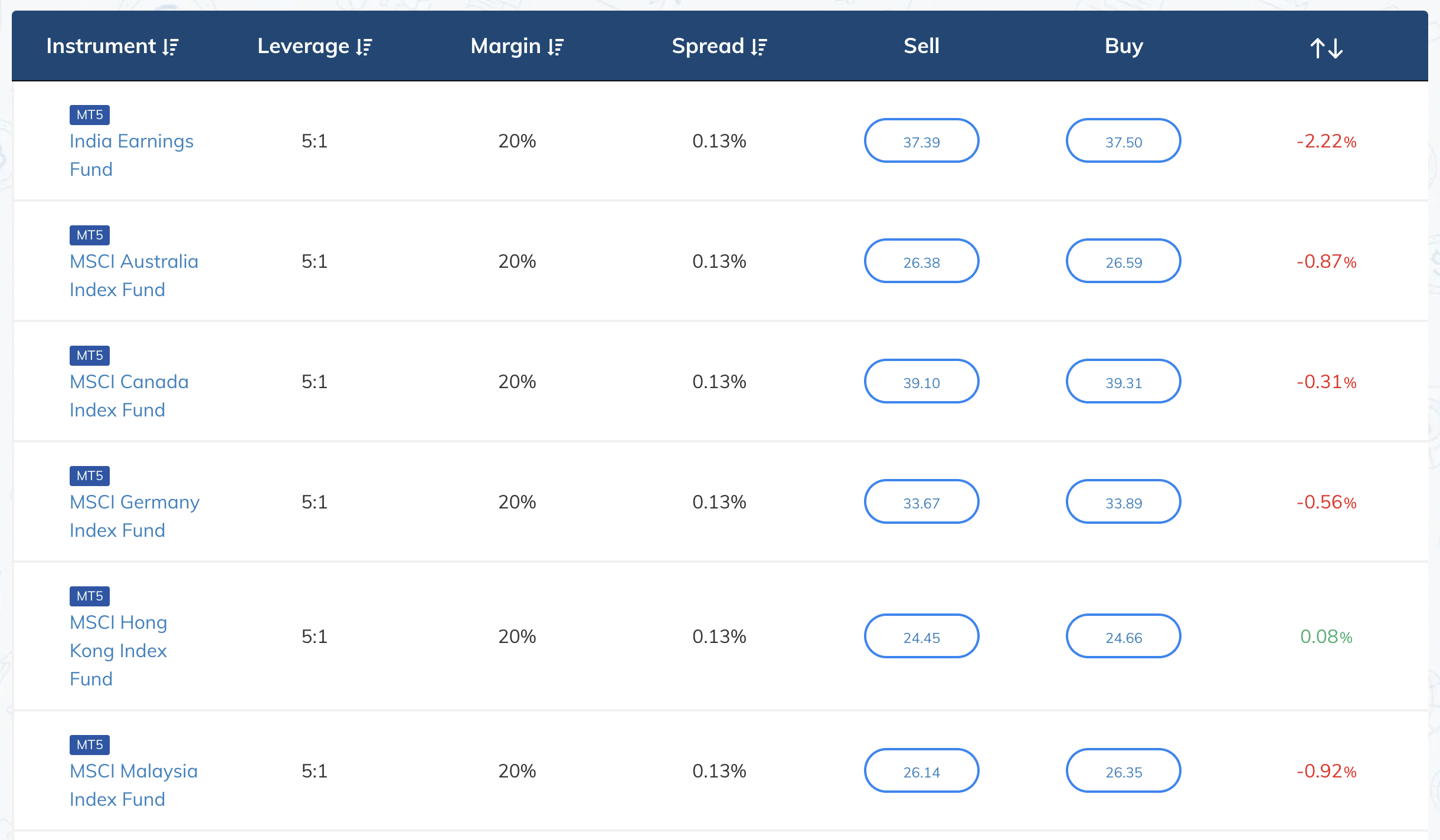

60+ index ETFs are offered by Avatrade. Here are a few.

Note that a leverage of 5:1 applies automatically with AvaTrade because all trading is done with CFDs. With AvaTrade, your account is run on margin. Although ETFs, by nature of their diversification, are low-risk instruments, margin trading comes with the risk that you can lose a lot of money very quickly. Beginners are advised to begin their index fund journey with eToro – where CFD trading is optional – and graduate to checking out AvaTrade once some experience has been gained.

AvaTrade is regulated in no less than seven global jurisdictions by ASIC, CySEC, The Central Bank of Ireland, the FSA, the FSRA, the ISA, the FSCA, and the FSC.

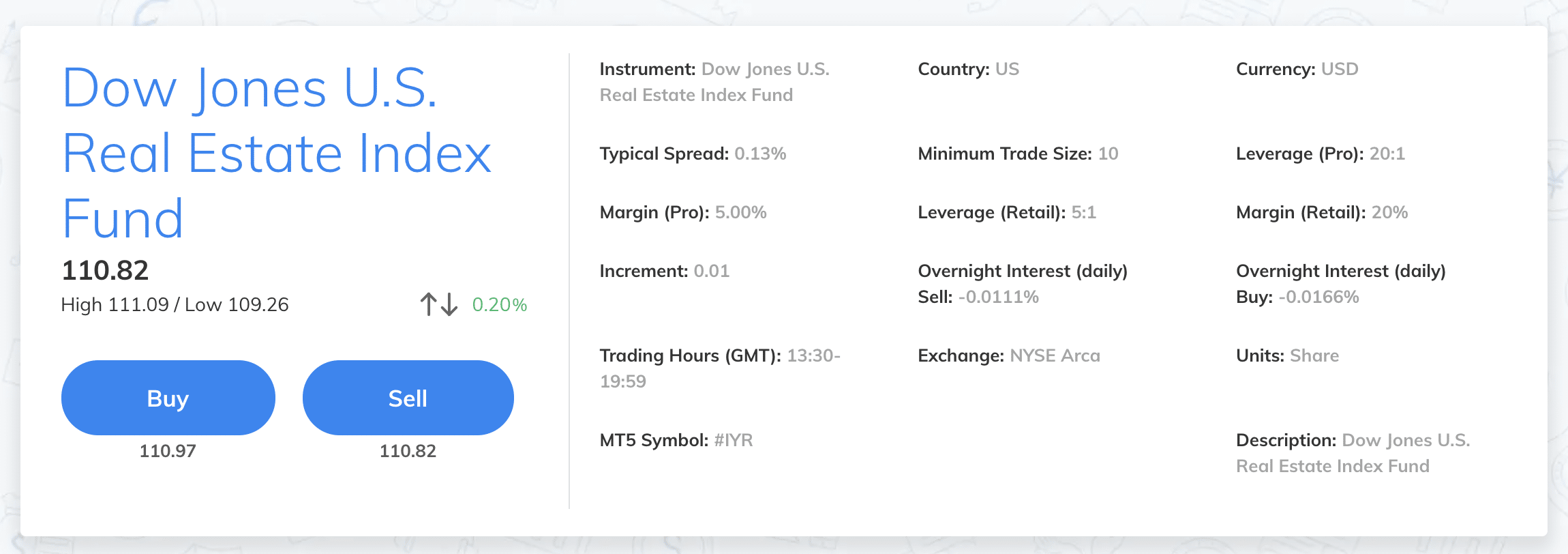

A minimum spread fee of 0.13% is levied on all AvaTrade ETF trades. An overnight fee also applies to ETF positions.

| Fee Type | Fee Amount |

| Commission Fee | NA |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $50 per quarter after 3 months inactivity |

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

With over $7 trillion USD under management and 30 million investors, Vanguard is a regulated US mutual fund provider. Vanguard offers dedicated support to Australian investors via its Australian website.

Investment legend John C. Bogle founded Vanguard in 1975 with the very first index fund. This was the Vanguard 500 fund, which tracks the S&P 500 Index. Bogle’s new idea was to rule out the risk of investing in individual stocks and invest in the whole market at once instead.

As Bogle put it, ‘Don’t look for the needle in the haystack. Just buy the haystack!’ This principle of diversification applies nowadays to both index funds and the more flexible ETFs which developed from them.

Vanguard is a fund specialist, with 209 US funds, and 230+ funds outside the US. Vanguard also offers ETF and stock trading.

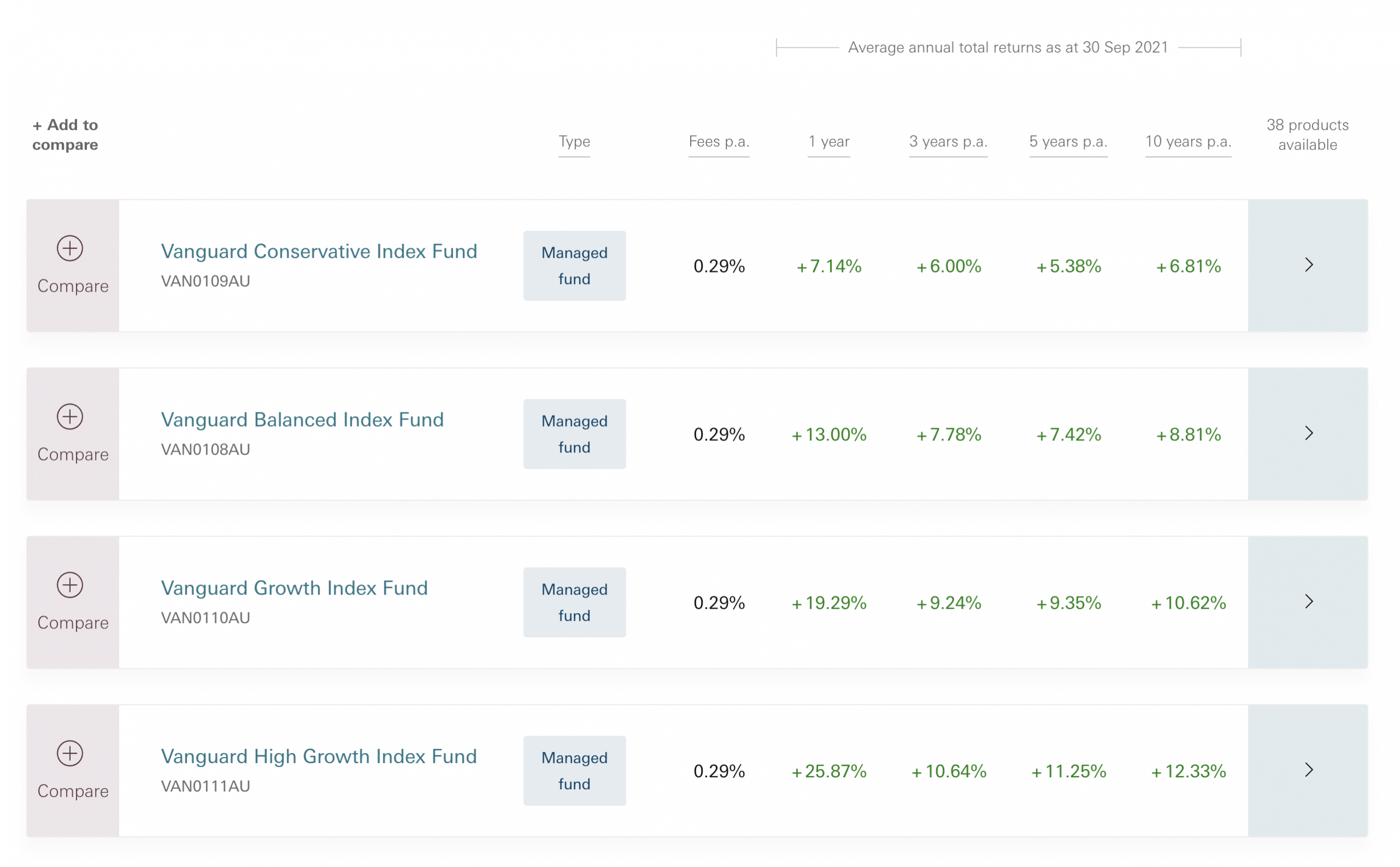

Vanguard offers a total of 38 index funds to Australian investors. Here are a few examples:

Vanguard Fees

Vanguard charges Australian investors a fixed management fee of 0.29% to invest in one of their own funds. To invest in an ETF with Vanguard, a management fee of 0.27% is levied, along with a flat $9 brokerage fee every time you buy or sell. Other requirements apply.

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| eToro | $0 | $5 | $10 monthly (after 12 months inactivity) |

| AvaTrade | $0 | $0 | $50 per quarter after 3 months inactivity |

| Vanguard | $0 | $0 | NA |

Inactivity fees apply to your total broker account, rather than your holding in a single index fund or ETF.

Index funds and index ETFs often cover exactly the same investment ground. For example, the same index is invested in via both the Vanguard Australian Shares Index ETF and the Vanguard Australian Shares Index Fund.

Index funds and index ETFs offer different advantages:

Buying into an ETF is a modern way to benefit from the low-cost diversification offered by old-style index funds – but without costly account and management fees. That is why ETFs have swelled in number from 1 in 1993 to over 7,600 today.

If you are looking to invest for the long haul, index funds are a great investment. Historical data shows beyond doubt that stock market indices rise over time, even if they suffer the odd bad year. The idea with index funds is to buy-in for the long-term and benefit from the entire market growing naturally. But you do have to be patient.

With both index funds and index ETFs, the investor is exposed to far less risk than those involved in backing individual stocks. That is because index funds and ETFs track entire sector indices of hundreds of companies.

The risk with index funds is that account and management fees are too high. ETFs developed from index funds precisely because this was a problem historically. But, nowadays, index fund fees tend to be lower than they were.

Here’s your four-step strategy to invest in indices with eToro from Australia:

67% of retail investor accounts lose money when trading CFDs with this provider.

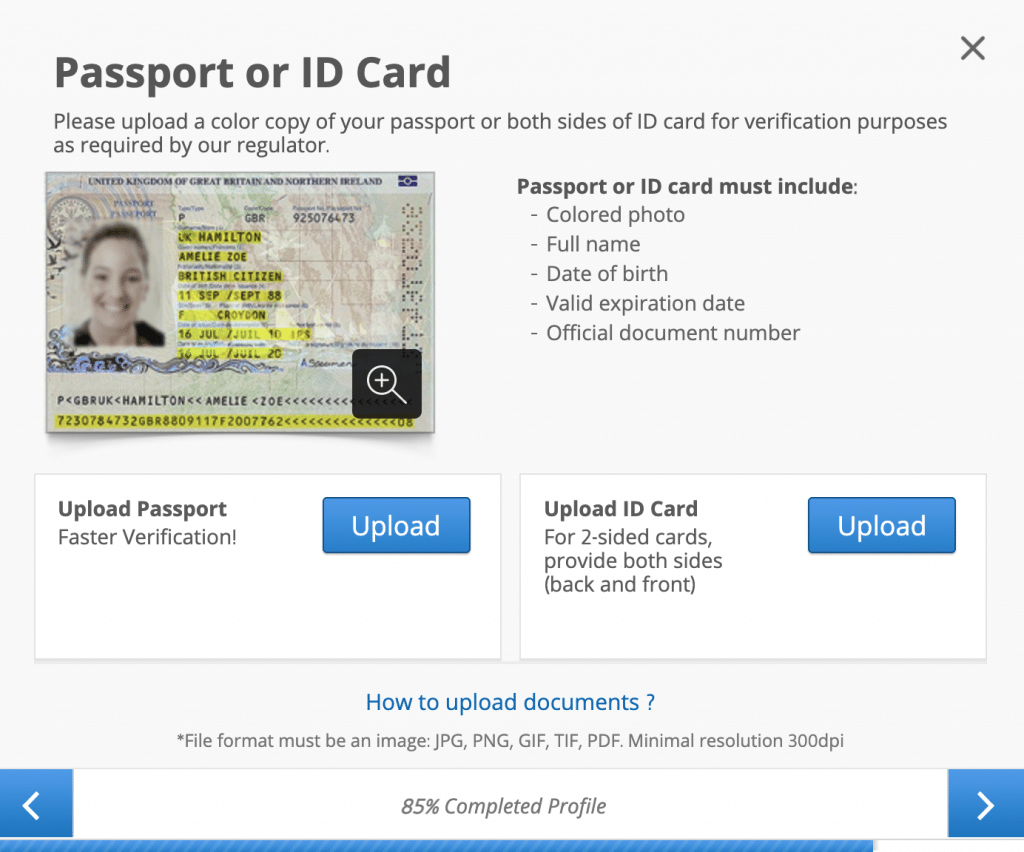

Verification of accounts is now a standard part of the sign-up process for fund providers and brokers. This is because of what is known as KYC (Know Your Customer) legislation.

eToro makes verification as painless as possible. You will need to upload scans of proof of identity as well as proof of address. For quickest verification, use a decent scan of your passport. Ensure that your passport is in date.

For proof of address, eToro will take any of: internet/phone bill/council tax/water/gas/electricity bill, tax letter/bill, a letter from your council/municipality, and bank/credit card statement.

If your documents are digital-only, eToro will accept screenshots. eToro provides good help pages to assist you in the verification process.

Once you are verified, you will be notified via email. The portrait in your online account will then feature a green tick. Once verified, you are good to deposit funds.

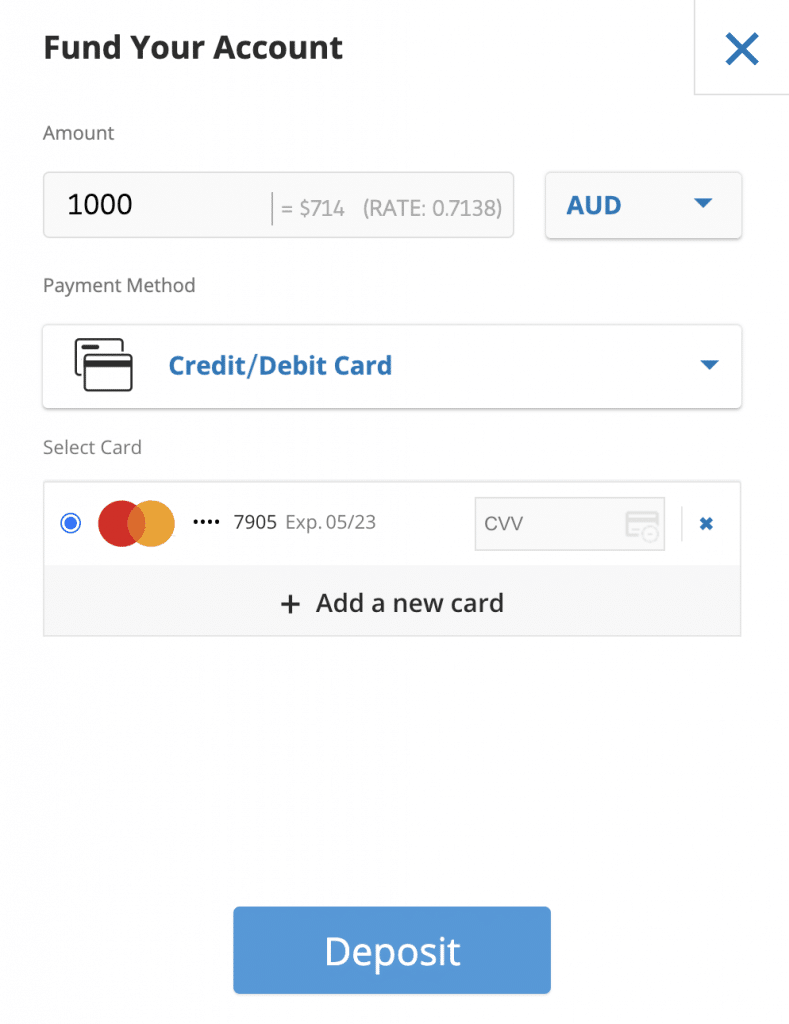

At the bottom left of the eToro interface, press the blue ‘Deposit Funds’ button. You can’t miss it! You will then be presented by the dialogue box below. eToro makes 15 deposit currencies available, including AUD. A currency conversion fee of 50 pips applies when converting AUD to eToro’s account currency of USD. For AUD, eToro provides credit/debit cards, bank transfers and PayPal as deposit methods.

Top tip: eToro uses the same method you used to deposit funds to transfer funds when you come to withdraw funds. So plan ahead.

To review what eToro has to offer in the way of investable assets, press the ‘Discover’ button on your left toolbar:

Now you will see this toolbar across the middle of the screen:

Click on ‘ETFs’ to browse index ETFs. Then click on the logo or name of an ETF to explore it further. You will be able to review it with stats, charting functions and other investors’ opinions. To investigate charting functions, look to the top-right of the chart that comes up. Press on the double-arrow symbol.

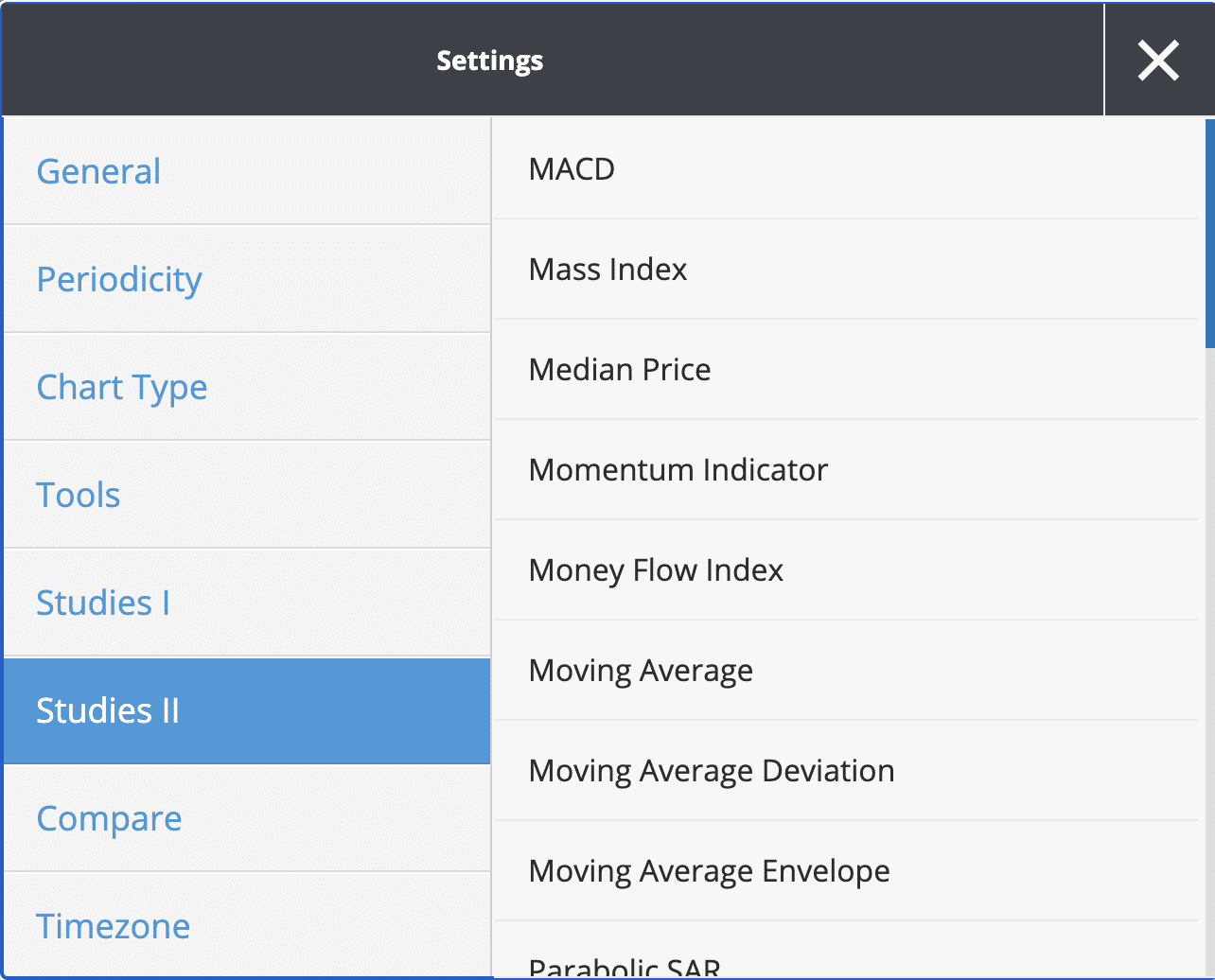

This will bring up these charting options. You do not need to change them. Just feel free to experiment.

When you are ready to review your transaction options, press the blue ‘Trade’ button.

Classic index fund providers like Vanguard have modernised their offerings over recent years. But the future belongs to brokers that offer index ETFs rather than index funds. Although index funds do offer some advantages over ETFs in supporting the methodical investor, it is very important to check any account fees that apply. Modern brokers tend not to charge investors for the service of simply having an account.

ETFs are considered to be the low-cost answer to the problems that index funds faced investors with.

With 250+ ETFs to browse, we recommend eToro as an excellent port of call for the beginner looking to check out indices in general. For over 15 years, eToro has been optimising its offering to suit newbies – and 20 million eToro investors are the evidence of that. It is difficult to think of a broker interface that is easier to use than eToro’s and trading is commission-free.