How To Buy XRP Australia – Buy XRP In Under 5 Minutes

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

As XRP comes a close second with 6th place in terms of trading volume, you may wonder how to buy XRP in Australia.

This guide will help you to buy XRP in no time. On top of that, you can see the coin’s analysis and price predictions.

After reading the article, you’ll understand whether the coin is an investment dead-end, a goldmine, or something in-between.

Table of Contents

Want to buy XRP Australia right away? Our top recommended cryptocurrency exchange is eToro; here’s how to get started:

We’ve listed the top six brokers available in Australia. You can find the best features of each down below.

Founded in 2007, broker eToro now has more than 13 million users in 140 countries, including Australia. The broker grew to prominence thanks to its copy-trading platform, an innovative tool that allows you to copy the trades of other investors.

The ease with which you can implement copy trading is a key feature of this gem platform. You can automatically replicate the trades of the most successful and skillful investors worldwide.

eToro is the best exchange when it comes to buying XRP in Australia. First of all, eToro holds three key licenses, including the FCA, ASIC, and CySEC.

Close attention to security, privacy, and reliability — that is what makes eToro the number one trading platform that has attracted over 23 million investors worldwide.

If you’re looking for a credible broker with some history under its belt, eToro is a no-brainer.

The exchange requires a minimum deposit of $50. You can use an Australian debit/credit card, bank transfer, and e-wallets. PayPal, Neteller, and Skrill e-wallets are available on eToro.

To get started with XRP, you only need $10 to open a position.

While eToro operates multi-asset brokerages (offering stocks, commodities, and forex trading), you can diversify your investment portfolio and grow capital even more efficiently.

eToro — XRP Fees

eToro only charges trading fees in the form of spreads, as specified in the table under the eToro Fees section in Crypto spreads.

Let’s assume you’re about to open your first XRP position. How much is the spread going to be?

Pros

Cons

67% of all retail investor accounts lose money when trading CFDs with this provider.

Capital.com provides trading access to over 3,700 assets, including 27 indices, 200 cryptocurrencies, 37 commodities, 3293 shares, and 138 currency pairs.

Significantly, Capital.com is one of the best brokers regarding the instruments available to clients because it offers a diverse range of assets. The firm has already completed trades worth more than $88 billion. Capital.com currently has over 788,000 clients worldwide.

One of the most significant advantages of trading with Capital.com is the low minimum deposit of $20 and the low minimum withdrawal of $50. The broker keeps client funds in separate accounts; the platform doesn’t insure them, though.

In addition, the broker provides a variety of trading guides, educational materials, and access to the most recent news. These services have been designed to educate and support new traders.

Capital.com Fees — Reliable XRP Broker in Australia

Trading on Capital.com implies paying spreads — the difference between the Buy and Sell prices. As a trader, you’ll pay the spread for each position you open.

The spread changes according to several factors, including the asset you trade and the market’s situation. For example, on August 10th, 2021, the XRP to USD spread is 0.02280.

| Type of activity | Fees |

|

0% Fee |

| Crypto trading | The spread varies for each trading pair and instrument. |

| Overnight charge | The overnight fee is based on the leverage provided, not on the entire value of the XRP you buy. |

Pros

Cons

67% of all retail investor accounts lose money when trading CFDs with this provider.

Crypto.com is a renowned cryptocurrency exchange with over 250 digital assets available for buying, selling, and trading.

Whether you’re looking to invest in major cryptocurrencies like Ripple or trying to get in on the latest altcoin or DeFi token, Crypto.com has you covered.

Plus, with 0.4% maker/taker fees on trades under $25,000 per month, you can keep more of your hard-earned cash in your wallet!

With Crypto.com’s volume-based trading fees, the more you trade, the more you save.

And if you stake CRO, you can pay your fees in CRO and get even bigger discounts!

Grow your portfolio with a leading crypto platform that offers security, stability, and deep discounts for CRO holders.

Crypto.com provides live customer support 24/7 so you can get the help you need when you need it most. With expert staff on hand, you’ll be able to get back to trading in no time.

When it comes to keeping your money safe, Crypto.com is a clear choice. They use multiple layers of security, including multi-factor authentication and whitelisting, to make sure your account is always protected.

In addition, Crypto.com utilizes the Ledger Vault technology to keep your assets safe and sound.

With an easy-to-use platform, diverse selection of coins, and low fees, Crypto.com makes it easy for you to get started with cryptocurrency trading.

So what are you waiting for? Sign up today and start building your crypto portfolio!

Pros

Cons

Cryptoassets are highly volatile unregulated investment products. No EU investor protection

Coinbase, which debuted three years after Bitcoin’s inception in 2009, is a cryptocurrency exchange that allows active traders to buy, sell, or hold more than 50 virtual assets, including XRP, Bitcoin, and others.

Coinbase has formed partnerships with many mainstream corporations, including Dell, Overstock, and Time Inc, which adds this platform a good deal of credibility.

Approximately 73 million verified users from over 100 countries is a piece of bright evidence. The platform holds an Authorized Payment License in Australia, meaning that the FCA regulates it.

Coinbase, just like eToro, is a good choice if you’re looking for a super-star platform to buy XRP Australia. The purchase process usually takes less than 15 minutes and requires no prior knowledge of how investments work.

You can invest small – with minimums varying depending on your preferred payment method. Coinbase supports both a debit card and an Australian bank transfer payment method.

The biggest disadvantage of using Coinbase is the platform’s fees: they’re above the average. However, if you appreciate safety & security, that may not be an issue.

For experienced investors, Coinbase Pro offers all the tools you need to make smart trades. Its advanced charting tools let you analyze market trends and make informed decisions, while its fast transaction speeds ensure that you’re always in control. So if you’re looking for a reliable and user-friendly platform, look no further than Coinbase.

Coinbase — Buy XRP Australia Flat Fees

| Overall Transaction Amount | Transaction Fee |

| $10 or less | $0.99 |

| More than $10, less than or equal to $25 | $1.49 |

| More than $25, less than or equal to $50 | $1.99 |

| More than $50, less than or equal to $200 | $2.99 |

Coinbase Pro Fees

Coinbase Pro fees depend on the trading volume: the more you trade, the less your fees.

| Pricing Tier | Taker Fee | Maker Fee |

| Less than $10K | 0.50% | 0.50% |

| $10K to $50K | 0.35% | 0.35% |

| $50K to $100K | 0.25% | 0.15% |

| $100K to $1M | 0.20% | 0.10% |

| $1M to $10M | 0.18% | 0.08% |

| $10M to $50M | 0.18% | 0.08% |

| $50M to $100M | 0.15% | 0.05% |

Pros

Cons

67% of all retail investor accounts lose money when trading CFDs with this provider.

AvaTrade‘s web trading platform is both intuitive and accessible, resulting in a seamless user experience. It provides users with a detailed graph/chart to analyze the price movements of various assets.

Furthermore, AvaTrade also offers advanced trading platforms such as MetaTrader 4, MetaTrader 5, and automated trading platforms like DupliTrade and ZuluTrade.

AvaTrade, like most trading platforms, allows users to trade on the go with its mobile/smartwatch app, which is available for both iOS and Android devices.

Moreover, AvaTrade provides a free demo account (valid for three weeks) that allows users to test their trading skills without the risk of losing money.

AvaTrade Fees — Reliable XRP Broker in Australia

Account fees, deposits, and withdrawals are free of charge.

Avatrade charges you $50 if you’re not active for three months straight. On top of that, if you don’t use the platform for more than 12 months, you have to pay a $100 administrative penalty.

As for trading itself, AvaTrade charges you spread. For example, the XRP spread is 1.5% over the market. You pay 1.5% every time you open an XRP position.

Pros

Cons

67% of all retail investor accounts lose money when trading CFDs with this provider.

Binance is one of the largest cryptocurrency exchanges in terms of trading volume. The platform is mainly focused on trading services – meaning that you will be buying and selling digital currency pairs on a short-term basis. It’s also involved in more complex financial products like futures and options.

Binance provides two types of digital currency trading platforms: basic and advanced. Neither the basic nor advanced versions are 100% user-friendly: you need at least the basic understanding to trade on Binance.

The primary distinction between the basic and advanced versions is that the advanced version provides a more in-depth technical analysis of digital currencies over time, including XRP in-depth analysis.

The basic version’s dashboard includes simplified graphs and charts for the pairs you’re trading, order books, and trade history.

Binance Fees — Largest XRP Broker

Unless you pay with a credit/debit card, Binance offers quite competitive fees; they charge you a commission of 0.1 per slide. However, if you use a card, the transaction fee is 2%.

Even though Binance is running a fee-reducing promotion, a 1% fee drop still doesn’t quench the thirst enough for many intraday traders (they offer a time-limited offer, charging you 1% for all Visa and MasterCard operations).

The spot trading fee is 0.1%, while Instant Buy/Sell fee is 0.5%. However, you can reduce fees if you hold BNB in your account.

| 30d Trade Volume (USD) | Maker / Taker Fees | Maker / Taker Fees

if you hold BNB |

| < 50,000 USD | 0.1000% / 0.1000% | 0.0750% / 0.0750% |

|

≥ 50,000 USD |

0.0900% / 0.0900% | 0.0675% / 0.0675% |

| ≥ 100,000 USD | 0.0800% / 0.0900% | 0.0600% / 0.0675% |

| ≥ 500,000 USD | 0.0700% / 0.0800% | 0.0525% / 0.0600% |

|

≥ 1,000,000 USD |

0.0500% / 0.0700% | 0.0375% / 0.0525% |

| ≥ 5,000,000 USD | 0.0400% / 0.0600% | 0.0300% / 0.0450% |

Pros

Cons

67% of all retail investor accounts lose money when trading CFDs with this provider.

XRP ranks sixth among the largest cryptocurrencies by capitalization, behind such crypto-world mastodons as Bitcoin, Ethereum, Dogecoin, and Tether.

The news backdrop for XRP remains positive, and the long-term outlook for XRP remains favorable. But predicting whether it will return to the highs is still tricky.

There are too many uncertainties in the short and medium-term, and markets have become very sensitive to the slightest change in investor sentiment. Let’s break down the positives of investing in XRP.

XRP CEO Brad Garlinghouse recently suggested that Bitcoin’s dominance in the market is about to end. The tokens solving specific tasks will take over the palm. Of course, he was referring primarily to XRP.

Until Brad Garlinghouse’s prophecy comes true, XRP may float along with Bitcoin and the rest of the market, experiencing sporadic spikes on the back of news about XRP victories.

So far, there is a strict correlation between the token’s dynamics rate and changes in the price of Bitcoin.

XRP’s rise & fall journey coupled with the entire cryptocurrency market and the reasons for appreciation are similar to the general prerequisites that cause crypto to rise or fall in value.

The number of tokens is strictly limited and will no longer increase, even though this factor will only come into effect after XRP sells its entire stock of coins.

To date, only 39.2 billion tokens have been issued out of the 99.99 billion existing XRP units. The company sells 1 billion tokens each month, producing inflation just as much as mining Ethereum.

All transaction fees are burned off. That is, XRP becomes smaller with each transaction. This process is prolonged, but it is happening, and over time, the irreversible reduction in the token supply may impact its exchange rate.

Some experts are skeptical about the rally, but others say that the coin’s price may sky-rocket.

XRapid is a technical solution to provide extra liquidity for banks. The technology leverages Ripple’s XRP as a bridging currency.

According to Ripple, XRapid removes global payment delays while drastically decreasing their cost, making cross-border payments fast and affordable.

While xRapid technology thrives and new XRP-related features appear, the coin’s price only benefits. In the long run, the coin’s rally is indeed possible.

Some experts claim the XRP coin has an excellent chance to compete with Ethereum.

If you’re planning to buy XRP, you can always check the XRP price at eToro. To find out how much one XRP is worth, type XRP or Ripple into the search box on the broker’s website.

For example, on October 06, 2021, XRP on eToro is worth almost $1.10.

| Date | Open | High | Low | Close | Adj Close | Volume |

| Oct 06, 2021 | $1.06 | $1.09 | $1.02 | $1.08 | $1.08 | 3.7B |

| Aug 08, 2021 | $0.81653 | $0.83838 | $0.78598 | $0.78893 | $0.78893 | 4.1B |

| Aug 01, 2021 | $0.74594 | $0.77628 | $0.69784 | $0.74651 | $0.74651 | 15.6B |

| Jul 01, 2021 | $0.70479 | $0.76815 | $0.51791 | $0.74779 | $0.74779 | 73B |

| Jun 01, 2021 | $1.04210 | $1.09964 | $0.51271 | $0.70637 | $0.70637 | 98.9B |

| May 01, 2021 | $1.59841 | $1.75882 | $0.65225 | $1.04658 | $1.04658 | 307.2B |

| Apr 01, 2021 | $0.57396 | $1.96500 | $0.55900 | $1.59167 | $1.59167 | 481.6B |

| Mar 01, 2021 | $0.41511 | $0.60262 | $0.41359 | $0.57387 | $0.57387 | 134.1B |

| Feb 01, 2021 | $0.49251 | $0.74482 | $0.34427 | $0.41495 | $0.41495 | 293.9B |

| Jan 01, 2021 | $0.21985 | $0.49970 | $0.21582 | $0.49231 | $0.49231 | 212.7B |

| Dec 01, 2020 | $0.66452 | $0.67916 | $0.17483 | $0.21985 | $0.21985 | 357.9B |

| Nov 01, 2020 | $0.23974 | $0.76802 | $0.22877 | $0.66434 | $0.66434 | 277.5B |

| Oct 01, 2020 | $0.24237 | $0.26346 | $0.23012 | $0.23974 | $0.23974 | 54.2B |

| Sep 01, 2020 | $0.28161 | $0.30321 | $0.22063 | $0.24231 | $0.24231 | 42B |

Many investors in Australia want to buy XRP with PayPal: mainly because PayPal is a popular, safe, and convenient payment method. It allows you to buy anything on the web easier and faster, including crypto assets.

However, surprisingly few brokers in Australia let you use e-wallets to start an investment; exchanges mainly focus on debit/credit cards and wire transfers. Even though some cryptocurrency exchanges, such as Coinbase, allow you to link a PayPal account, the operations are usually limited to withdrawals rather than purchases.

eToro accepts XRP payments via PayPal and buy cryptocurrency to your eToro wallet. Using PayPal to buy XRP on eToro is as simple as a piece of cake. You should follow three quick steps:

If you have any difficulties buying XRP through PayPal, you can check the detailed eToro XRP guide for PayPal.

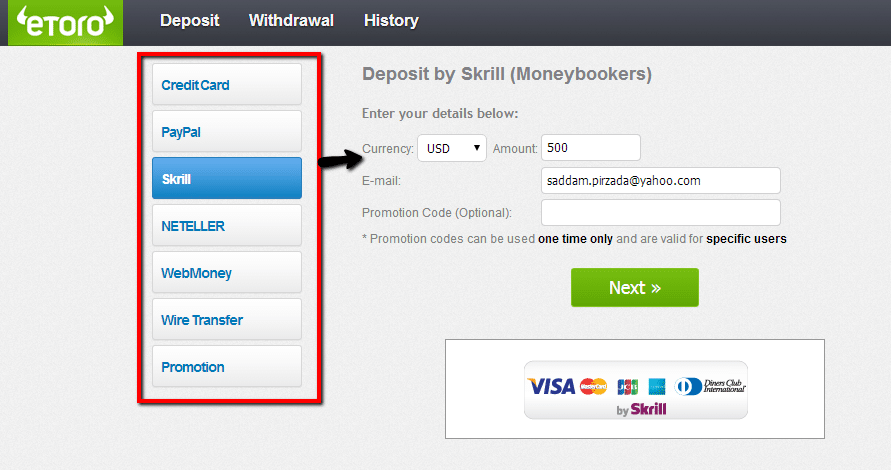

The FCA-regulated broker eToro also supports deposits and withdrawals through Skrill and Neteller. As long as you fund your account with a minimum of $50, you can choose a whole range of payment methods available on eToro. The minimum amount you can invest in XRP through PayPal, Neteller, and Skrill is $10.

In Australia, you can buy XRP anonymously, but only through an unregulated cryptocurrency exchange. To comply with government know-your-customer (KYC) regulations, all regulated cryptocurrency exchanges require you to verify your identity. However, unregulated XRP brokers lack government protection. We don’t recommend dealing with non-regulated brokers.

The most significant barrier preventing newcomers from investing in XRP is safety. Many investors believe that cryptocurrency markets are risky and unregulated.

Part of the reason for this fear is that there are simply too many loopholes, tricks, and so on. You should follow basic safety rules when investing in XRP or any other asset.

First and foremost, you should ensure that a government agency has accredited your broker for cryptocurrency control.

For example, the Australian Securities and Investment Commission (ASIC), the Financial Conduct Authority (FCA) in the United Kingdom, or the Securities and Exchange Commission in the United States (SEC).

The government does not give licenses far and wide, especially for cryptocurrency exchanges. The regulator manages the initial registration of all crypto-asset service providers such as wallets, exchanges, brokers, and so on and maintains their registry and developing market policy.

Working with ASIC, FCA, or SEC-regulated brokers entails some crucial benefits for you as an investor. Particularly, you will benefit from the following safe-conducts:

Another advantage of using regulated brokers is buying XRP using a whole range of payment methods.

For example, debit/ credit card, wire transfer, etc. eToro is an excellent example of a regulated broker, approved by many governments, including Australia.

Buying XRP in 2023 is easy and only takes four basic steps. If you want to invest in XRP, follow our four-step instructions.

To get started with investing in XRP, you need a minimum deposit of just $10. But, first, let’s take a look at the account opening process.

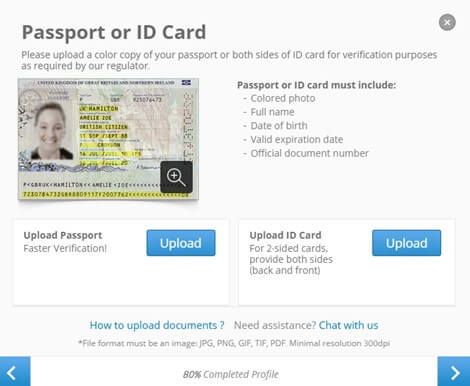

Fill the form to continue. You have to verify your identity if you want to invest big. However, you can skip this step and verify your account at any time.

Buy XRP with 0% Commission Now >

Funding your trading account is an effortless process. You may deposit dollars into your account using a variety of methods. Select the form of payment that is most convenient for you and complete the steps outlined below:

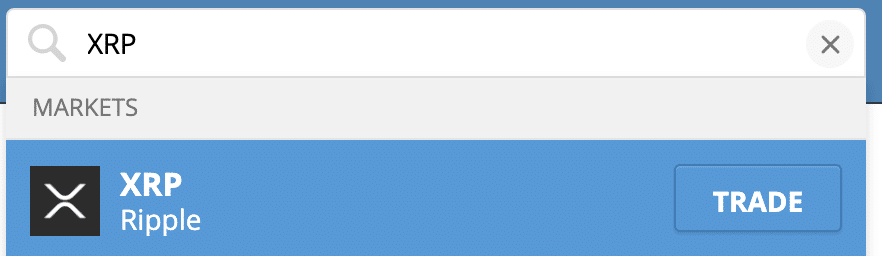

Now you can use the search box to buy XRP. Type XRP or Ripple into the search box and click on the ‘TRADE‘ button.

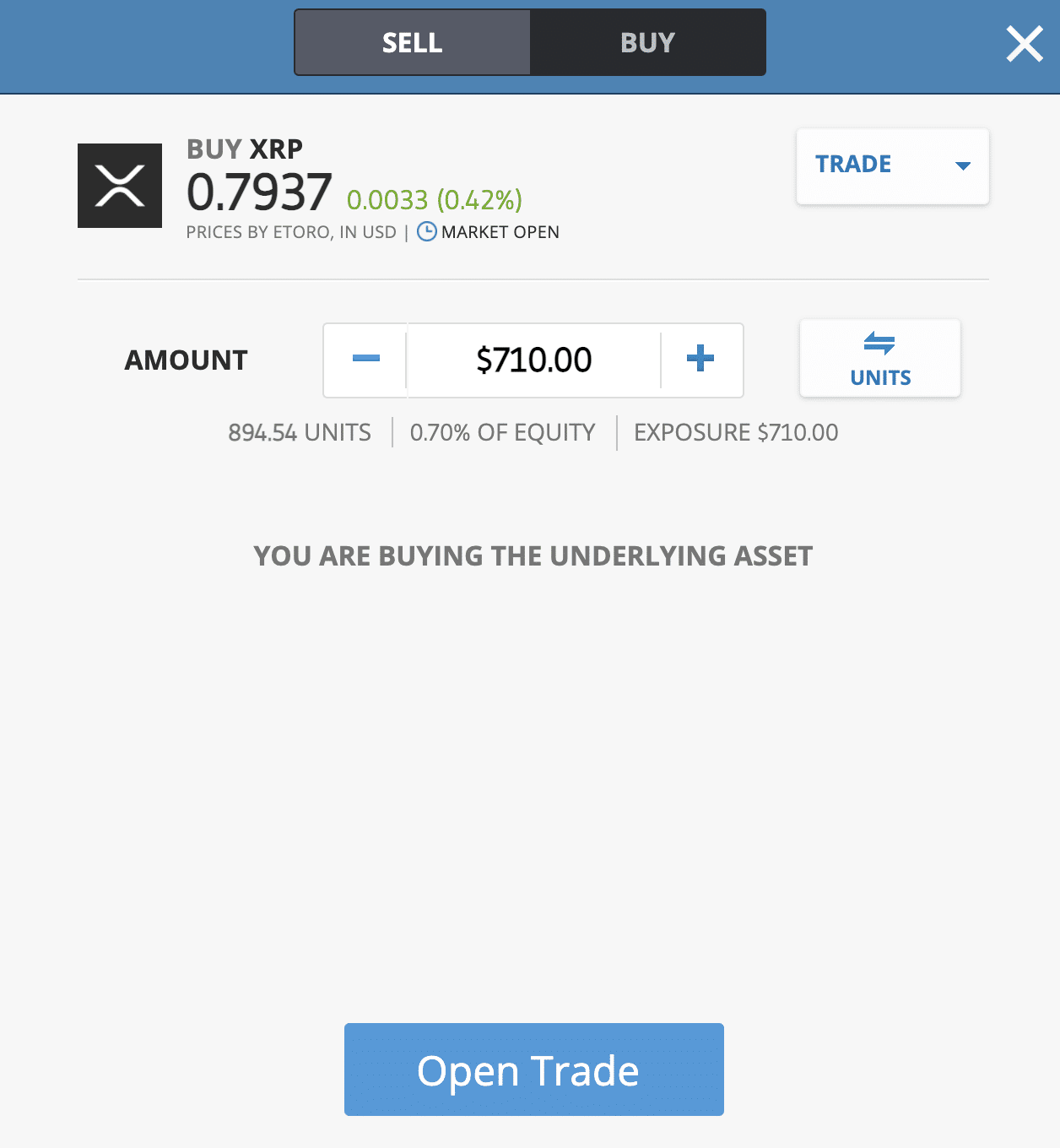

Once the order form opens, it’s high time to enter your stake. Ensure it’s higher than $10 U.S. dollars, as the minimum amount to invest in XRP is $10.

At this stage, you can see how many coins you get, overall equity, and exposure. In the example above, you will get 894,54 XRP units for $710 invested.

You can see both the ‘Set Order‘ or ‘Open trade’ buttons depending on the market’s condition. You’ll see the ‘Open Trade’ button if you enter the market during standard market hours. If the market is closed, you’ll see the ‘Set Order’ button.

To finish your commission-free XRP investment, click the ‘Open Trade’ option. You can always check the value of your XRP investment by going to the ‘Portfolio’ tab of your eToro account.

During 2020, the XRP coin’s market price has been relatively stable. Only a couple of medium-term bullish and bearish trends affected the price slightly. After an uptrend at the beginning of the year, the price declined for a month from February to March.

The next bullish trend emerged in July but ended less than a month later. The main increase came in November when the price reached a high of $0.79.

What are the reasons for the rise and fall of XRP? If you think there’s something specific behind these price movements, that could not be the case. XRP’s major trends correlate positively with the movement of BTC, so even a halving of Bitcoin can affect the price of XRP. The cryptocurrency follows the trend of the primary market.

Nevertheless, there have been certain events worth mentioning. Investor sentiment determines the price direction of any asset. The supply and demand factor of XRP plays a considerable role.

In April 2020, XRP co-founder Jed McCaleb sold 54 million XRP coins. Unsurprisingly, the price dropped when the event went public.

Another important XRP price factor is new agreements with leading banks. For example, HDFC Bank Limited, India’s largest bank, joined XRPNet in August, and Bank of America, the second-largest bank in the United States, joined in November.

In December, leading U.S. exchanges such as Coinbase and Binance announced their support for Flare Networks’ upcoming Spark token giveaway. After the giveaway, 45 billion tokens were distributed to XRP holders.

The price of XRP rose on the news, but the correction was not long in coming. As a rule, such events have short-term market effects that are not visible on larger time frames.

Now let’s look at the most significant event, which is still affecting XRP’s position. Some time ago, the Securities and Exchange Commission accused blockchain company XRP Inc. and its founders Brad Garlinghouse and Christian Larsen of selling $1.3 billion worth of unregistered securities in 2013.

XRP has always maintained that digital currency is a currency, not security. Otherwise, they would have to comply with many different rules under U.S. law.

In two days, from December 22-23, 2020, XRP fell from about $0.50 to just under $0.30. The coin moved from third to fourth in ranking (crypto capitalization), giving way to Tether stable coin. Then XRP started 2021 at a low point. The coin was only able to surpass $0.40 on Jan. 30.

After the surge, XRP traded in a narrow range of $0.40 to $0.60 from late January through April 4. The strong uptrend lasted from April 5 to April 14, when the price reached $1.80 (January 2018 high).

The rally was driven by two lawsuits that ended in favour of XRP. As a result, XRP rose from seventh to fourth place in the most popular cryptocurrencies in 1.5 weeks.

On August 8th, Ripple’s XRP dropped 4.62 percent. The coin finished the week up 7.47 percent at $0.77952, partially erasing a 9.77 percent surge on Saturday. After a bullish start to the day, XRP briefly rallied to an intraday high of $0.84169 before correcting.

Ripple’s XRP fell to a late afternoon intraday low of $0.77277 after falling short of the first significant resistance line at $0.8442. Ripple’s XRP briefly approached $0.79 levels before easing slightly, dodging the first main support level at $0.7673.

Ripple’s XRP fell 0.96 percent to $0.77204 on August 9. Ripple’s XRP rose to an early morning high of $0.78365 before dropping to a low of $0.78365.

To understand whether the coin is a dead-end asset or a potentially good investment, let’s have a deeper look at the XRP’s price predictions.

| Month | Open | Low-High | Close | Mo,% | Total,% |

| 2021 | |||||

| Aug | $0.74 | $0.70 —$1.23 | $1.15 | 55.4% | 55.4% |

| Sep | $1.15 | $1.00 —$1.42 | $1.33 | 15.7% | 79.7% |

| Oct | $1.33 | $1.30 —$1.50 | $1.40 | 5.3% | 89.2% |

| Nov | $1.40 | $1.10 —$1.40 | $1.18 | -15.7% | 59.5% |

| Dec | $1.18 | $0.92 —$1.18 | $0.99 | -16.1% | 33.8% |

| 2022 | |||||

| Jan | $0.99 | $0.99 —$1.23 | $1.15 | 16.2% | 55.4% |

| Feb | $1.15 | $1.15 —$1.42 | $1.33 | 15.7% | 79.7% |

| Mar | $1.33 | $1.10 —$1.33 | $1.18 | -11.3% | 59.5% |

| Apr | $1.18 | $1.18 —$1.47 | $1.37 | 16.1% | 85.1% |

| May | $1.37 | $1.07 —$1.37 | $1.15 | -16.1% | 55.4% |

| Jun | $1.15 | $1.15 —$1.42 | $1.33 | 15.7% | 79.7% |

| Jul | $1.33 | $1.23 —$1.41 | $1.32 | -0.8% | 78.4% |

| Aug | $1.32 | $1.04 —$1.32 | $1.12 | -15.2% | 51.4% |

| Sep | $1.12 | $1.12 —$1.34 | $1.25 | 11.6% | 68.9% |

| Oct | $1.25 | $1.25 —$1.55 | $1.45 | 16.0% | 95.9% |

| Nov | $1.45 | $1.17 —$1.45 | $1.26 | -13.1% | 70.3% |

| Dec | $1.26 | $1.13 —$1.29 | $1.21 | -4.0% | 63.5% |

*According to Longforecast.com

| Year | Mid-Year | Year-End | Tod/End,% |

| 2023 | $2.06 | $1.91 | +143% |

| 2024 | $1.98 | $2.23 | +183% |

| 2025 | $2.33 | $2.15 | +173% |

| 2026 | $2.34 | $2.53 | +222% |

| 2027 | $2.72 | $2.91 | +270% |

| 2028 | $3.10 | $3.11 | +295% |

| 2029 | $2.65 | $2.79 | +255% |

| 2030 | $2.93 | $3.07 | +290% |

*According to Coinpriceforecast.com

Before you take XRP for a spin, let’s discover some crucial risks to consider.

Just as there will only ever be 21 million Bitcoin; the supply of Ethereum is infinite, production will slow over time. Because of the limited supply, demand may rise in the future, resulting in significant price increases and higher profits for early investors.

Ripple is unique. All XRP coins have already been pre-mined and are in circulation.

XRP is not a “true” cryptocurrency. Many people believe it violates the principles of decentralization and economic autonomy.

Unlike Bitcoin, which is mined and then anonymously exchanged between users, Ripple was created specifically for the banking and finance industry. Its primary goal is to solve problems in the banking industry.

Unlike Ethereum and Bitcoin, all of Ripple’s XRP coinage has been pre-mined, which means that no new coins will be released to the market.

This has resulted in its developers owning a sizable portion of it (Ripple chairman Chris Larsen currently owns nearly a third of all XRP), which worries many investors.

In 2020, The SEC charged Ripple and two executives with conducting an unregistered securities offering for $1.3 billion. This immediately affected and is still affecting XRP’s price even today.

Even though the cloud-thickening stage is left far behind and things are looking up for Ripple’s SEC case, there is still some exposure. It looms over Ripple like a gloomy cloud.

Significantly, Ripple’s SEC lawsuit could have a lasting impact on crypto. Nevertheless, Ripple isn’t out of the woods yet.

As of October 19th 2021, XRP price currently stands at $1.09 as renewed hope appears in XRP holders amid the ongoing SEC vs. XRP lawsuit. The latest on the case indicates that the SEC seek to request a two-month extension.

When you eventually get around to cashing your XRP out, the process will vary depending on how you bought it and stored it.

For example, if you made the XRP purchase at eToro, the process would look like the following:

If you are looking to invest in Ripple safely, you first need to find the best XRP wallets that will protect your investment.

Should I invest in XRP? Should I buy or sell the coin? These are essential questions for any investor. The risks of tighter regulation will have a big impact on the cryptocurrency market in the coming year. It could grow because of the active development of digital currencies by central banks.

Regulators do not want to loosen control over cash flows to resist the advancement of cryptocurrencies. The impact will be even more substantial than in 2017 – 2018. On the other hand, the expected development of DeFi is another risk for XRP.

Ironically, COVID-19 may support the virtual market. There is no reason to expect an end to the pandemic anytime soon, so demand for cryptocurrency, including XRP, will remain relatively high.

Whereas individuals used to be the dominant driving force in the market, in 2021, it will be institutions. Thus, we are likely to see a smooth growth of the XRP coin next year. Even despite the recent drop in the rate due to the lawsuit.

The events of April-June 2021 confirmed that XRP/USD still has major speculative characteristics. The pair has good volumes and volatility. XRP has shown that it can triple its value, followed by bumping along the bottom within weeks — a perfect scenario for aggressive traders.