Bitcoin Mining – How Does Bitcoin Mining Work? Ultimate Bitcoin Guide for Beginners!

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

By connecting specialist hardware to a computing device, you can engage in Bitcoin mining. In doing so, you stand the chance to earn Bitcoin in return for contributing excess computing power. However, as Bitcoin has grown to a trillion-dollar asset class, mining is now an extremely expensive process.

Nevertheless, this guide will run you through the ins and outs of how Bitcoin mining works and what alternatives are available for those who wish to access this arena without outlaying a large amount of capital.

Table of Contents

If you’re looking to start Bitcoin mining today to earn passive income, the quickfire guide below will walk you through the process in under five minutes. This tutorial will show you the required steps with StakeAdvisor, which is one of the best Bitcoin mining platforms in this marketplace.

And that’s it – you’ve just learned how to mine Bitcoin without needing to buy any expensive hardware devices or consume huge levels of electricity.

In order to mine Bitcoin remotely, you will need to choose a suitable platform. Below you will find an overview of which Bitcoin mining providers stand out from the crowd.

Further down in this guide, we review the above Bitcoin mining platforms.

Before explaining how Bitcoin mining works, it is important to have a grasp of why it is necessary to keep the blockchain ecosystem secure. In a nutshell, the Bitcoin blockchain is decentralized, which means that no single person or authority has control over the network. In turn, this means that in order to verify transactions in a transparent and secure manner, Bitcoin requires a process known as mining.

In its most basic form, this process seeks to solve super-complex mathematic equations to ensure that each and every Bitcoin transaction is valid. Each equation is so complex that it requires advanced hardware to complete the process successfully. Not only that, but each equation takes 10 minutes to solve via a trial and error system.

Once the equation is solved, the Bitcoin block is marked and valid and thus – it is posted to the blockchain ledger. As a result, the individual miner that was successful in solving the complex equation is rewarded in Bitcoin. This originally amounted to 50 BTC, but this has since been reduced to 6.25 BTC. More on this later.

If you’re thinking about mining Bitcoin yourself, there is much to understand before you proceed. After all, as we will discuss in much detail shortly, the traditional process requires a large capital outlay. Not only in terms of specialist hardware but electricity output, too. Fortunately, we offer some great alternatives to conventional Bitcoin mining later in this guide.

Bit first, let’s explain the core fundamentals of how Bitcoin mining works step-by-step.

Whether it’s Bitcoin, Ethereum, or EOS – all blockchain networks that claim to be decentralized must have a consensus mechanism in place to confirm and validate transactions. Otherwise, there would be no way to know whether or not a transaction was legitimate without a centralized entity being involved in the transfer.

And, as each equation is so complex in size, this ensures that no single person or entity has the ability to hack the Bitcoin network or post transactions that are not valid.

Every time somebody transfers Bitcoin to another user, the transaction will be included in a block. Each block amounts to 1 MB and it will contain multiple transactions. Furthermore, it takes 10 minutes for one block of transactions to be marked as valid.

However, to complicate things even further, the Bitcoin blockchain has a halving mechanism in place. This simply means that the Bitcoin mining reward on offer reduces in size by 50%.

This will happen approximately every four years. And as such, the most recent Bitcoin halving took place in 2020, whereby the mining reward went from 12.5 BTC to 6.25 BTC. Naturally, this means that by mining a Bitcoin block, you are receiving fewer rewards in terms of the number of tokens.

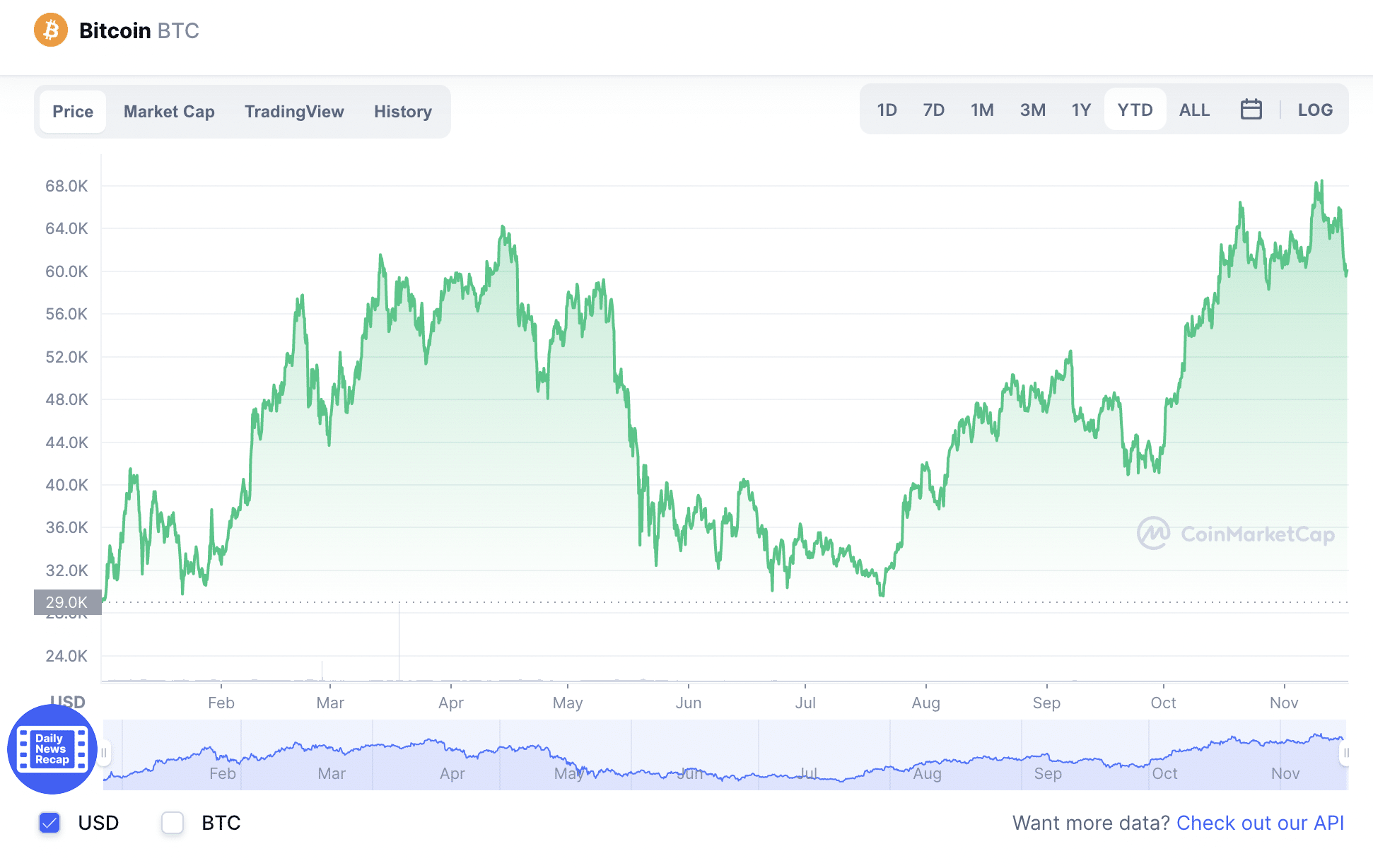

However, it is also important to remember that Bitcoin is now a trillion-dollar asset. That is to say, when the network previously rewarded Bitcoin miners at 50 BTC per block, the digital currency was trading at less than $1.

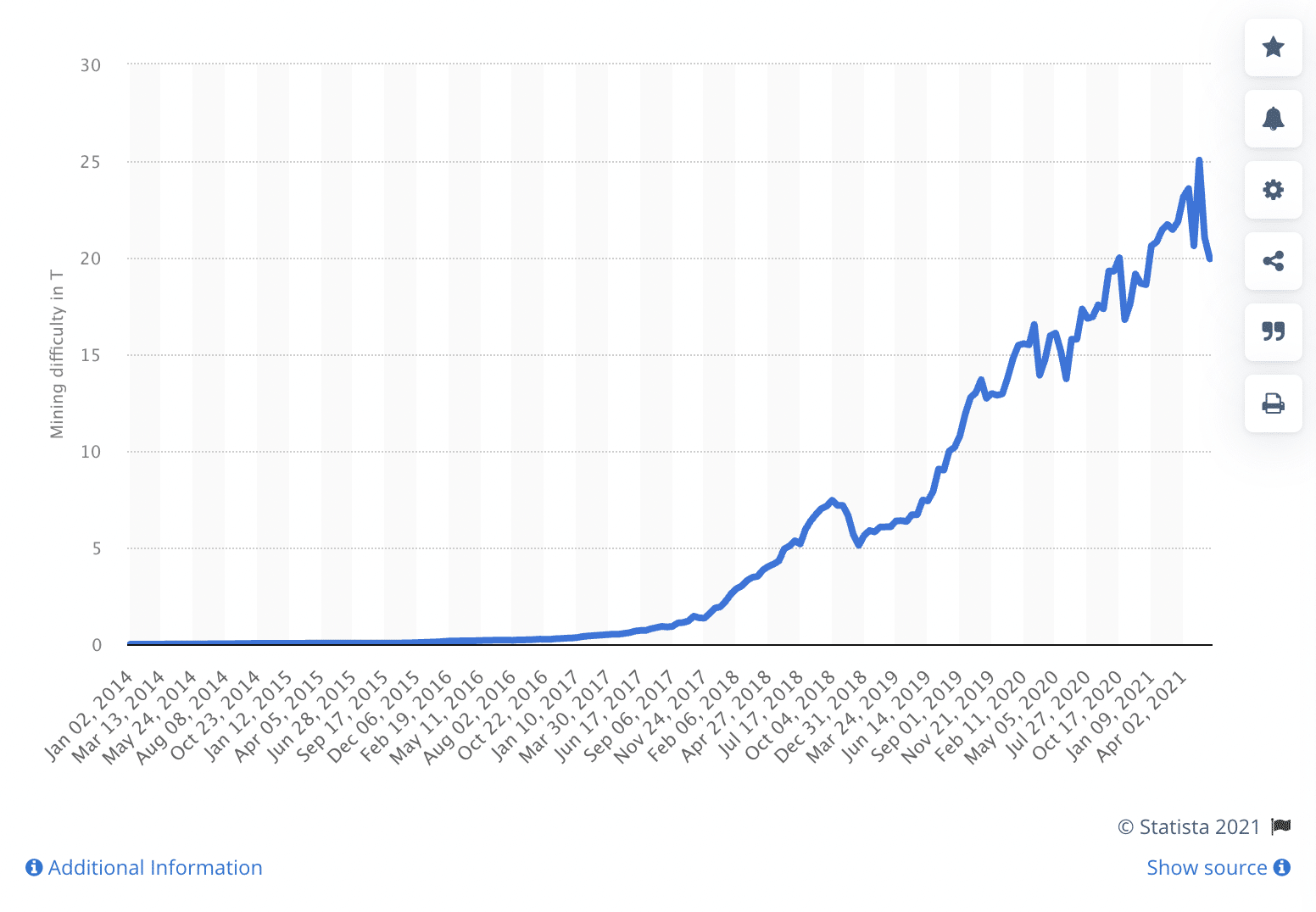

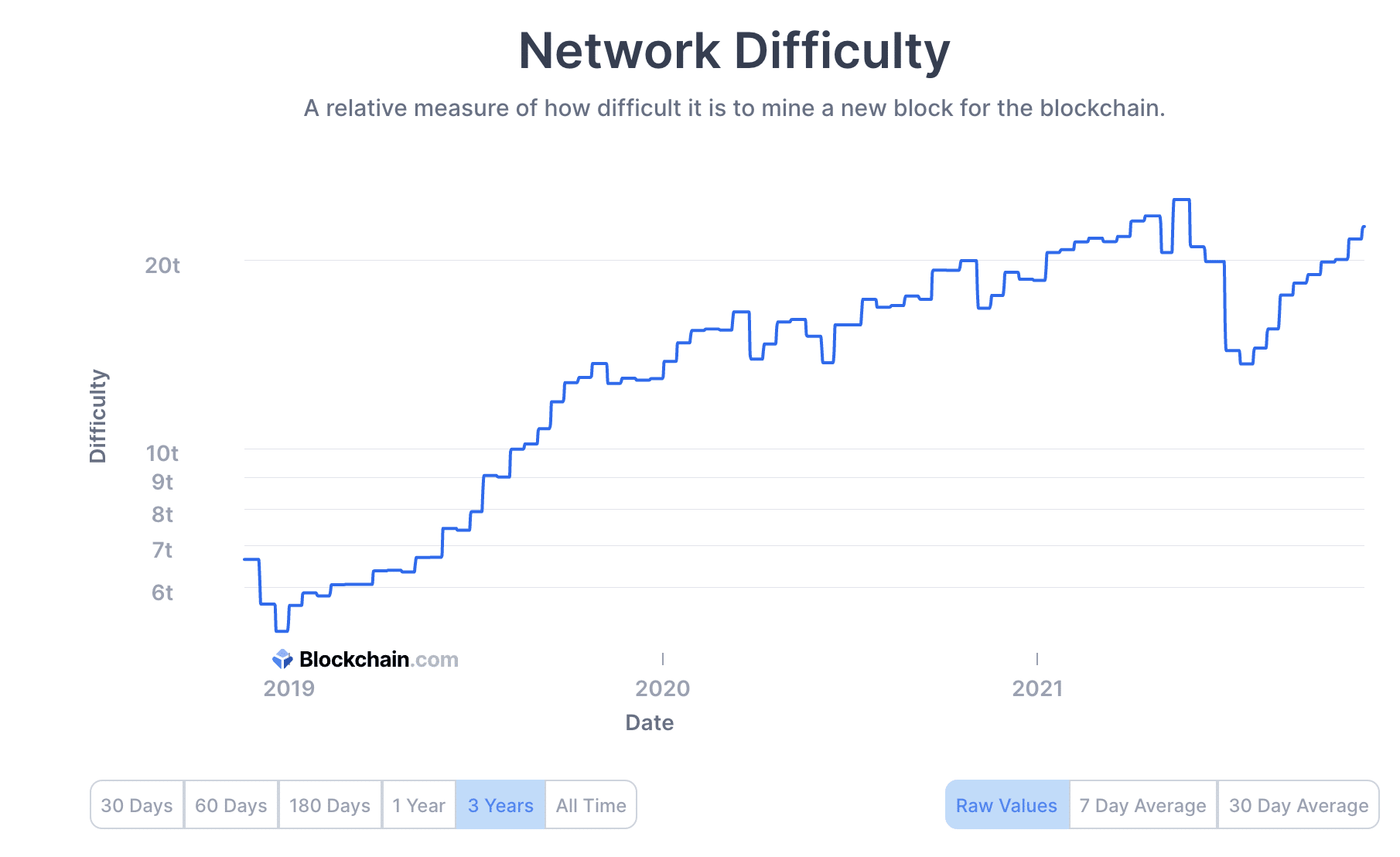

In its most basic form, Bitcoin mining ‘difficulty’ measures how easy or challenging it is to mine a single block. This can be quantified in terms of the terahash levels required.

For instance, if the Bitcoin mining difficulty is on the low side, this means that it is easier to successfully mine a block, as less electricity consumption is required.

In other words, the difficulty of the aforementioned equation that needs to be solved is lower. Naturally, as the difficulty level increases, so does the required terahash and thus – the equation becomes more complex.

This is a super important concept to understand when learning how to mine Bitcoin, as this will have a direct impact on the costs involved. This is because as the difficulty increases, you will need more powerful hardware to be successful and have higher levels of electricity consumption.

Now, back in the early days of Bitcoin, you could literally mine a block by using a cheap graphics processing unit (GPU). This meant that anyone with a standard desktop device could easily mine Bitcoin from the comfort of home, not least because there were very few people involved with the cryptocurrency at that time. This meant less competition and thus – Bitcoin mining was a simple and low-cost endeavor.

To reiterate, this is because as the Bitcoin mining difficulty increases, as does the complexity of the equation that needs to be solved to successfully mine a block. In turn, this means that more advanced and specialist hardware is needed, which increases the cost. And these specialist hardware devices that are now used to mine Bitcoin require vast amounts of electricity.

Fast forward to late 2021 and Bitcoin mining can only be achieved with an Application-Specific Integrated Circuit, or ASIC. These hardware devices are not only super expensive but can be hard to come by. At the time of writing, it is believed that the most powerful ASIC in this marketplace is the Antminer S19 Pro – which retails for over $10,000 per device.

Even then, to be able to succeed in mining Bitcoin, one Antminer S19 Pro device would not be sufficient. On the contrary, you would likely need an entire room full of devices to stand any chance of being successful in mining a block. And, even if you do have the financial means to do this, you then need to think about electricity consumption.

After all, According to recent figures published by Business Insider, Bitcoin mining now utilizes 91 terawatt-hours of electricity per year. This translates into more electricity consumption than the entire nation of Finland, which is home to over 5 million people. Therefore, any metric that you need to consider when learning how to mine Bitcoin is the cost of electricity in your country of residence.

This is why – even though the process has been illegal in the country for some time now, China dominates the Bitcoin mining arena. After all, electricity prices in the country are super-low, which allows Bitcoin miners to operate day and night in a cost-effective manner. On the other hand, if you’re based in a nation with high energy prices, it’s unlikely that Bitcoin mining will be viable for you.

So now that you have a basic understanding of how Bitcoin mining works, we now need to discuss ‘pools’. This is because, as you can see in the image above, the majority of Bitcoin blocks are mined by a small number of pools that dominate this space. This includes the likes of SlushPool, ViaBTC, F2Pool, and most notably – AntPool.

This means that AntPool will have hardware devices that are not available in the open marketplace and thus – its ASICs will be more powerful than any of the competition. Once the new devices are available for sale, it is believed that AntPool will already have a new and more powerful ASIC at its disposal. With this in mind, attempting to compete with large mining pools would be a financially impossible task.

In the context of Bitcoin mining, the age-old concept of “if you can’t beat them, join them” could not be more fitting. This is because the best Bitcoin mining pools in the market offer their services to individuals of all shapes, sizes, and budgets.

The way this works is the average Joe can elect to contribute their computing power and available electricity resources to the wider pool. In doing so, when you consider that the largest pools in this space have hundreds of thousands of registered miners, this combination amounts to a significant amount of hashing power.

As such, this presents an opportunity to successfully mine Bitcoin in proportion to the amount of power that you are contributing. All you need to do is open an account with your chosen Bitcoin mining pool provider and install the correct settings on your hardware devices. Then, it’s just a case of sitting back and waiting for your share of rewards to be paid – which is typically done on a day-to-day basis.

It goes without saying that if your primary motivation is to earn cryptocurrency passively, Bitcoin cloud mining platforms are the way to go. This is because you will not be required to buy or run a physical hardware device to get started.

Furthermore, as you won’t be doing the mining yourself, you don’t need to worry about huge electricity bills. Instead, cloud mining platforms allow you to enter this space remotely.

If you’re somewhat new to Bitcoin cloud mining, we explain the fundamentals in the sections below:

First and foremost, once you have chosen a suitable Bitcoin cloud mining platform, you will be presented with a range of contracts that you can buy.

Each contract will typically come with a:

The main premise here is that you will invest a certain amount of money and once the contract expires, you will receive your original stake back – plus the respective interest. This interest is essentially your share of any mining rewards that the pool has earned during the contract duration.

Once you have chosen a contract, you will need to pay for it. In many cases, the only payment method accepted is cryptocurrency. However, the best Bitcoin mining platforms also support debit/credit card deposits. As such, this allows you to passively earn Bitcoin even if you do not currently own any digital assets.

Once you have chosen a contract, you will need to pay for it. In many cases, the only payment method accepted is cryptocurrency. However, the best Bitcoin mining platforms also support debit/credit card deposits. As such, this allows you to passively earn Bitcoin even if you do not currently own any digital assets.

As soon as you have purchased your chosen mining contract, you should start earning rewards. The amount that you can earn will vary depending on a range of factors – such as the current Bitcoin mining difficulty and how much hash power the respective pool has.

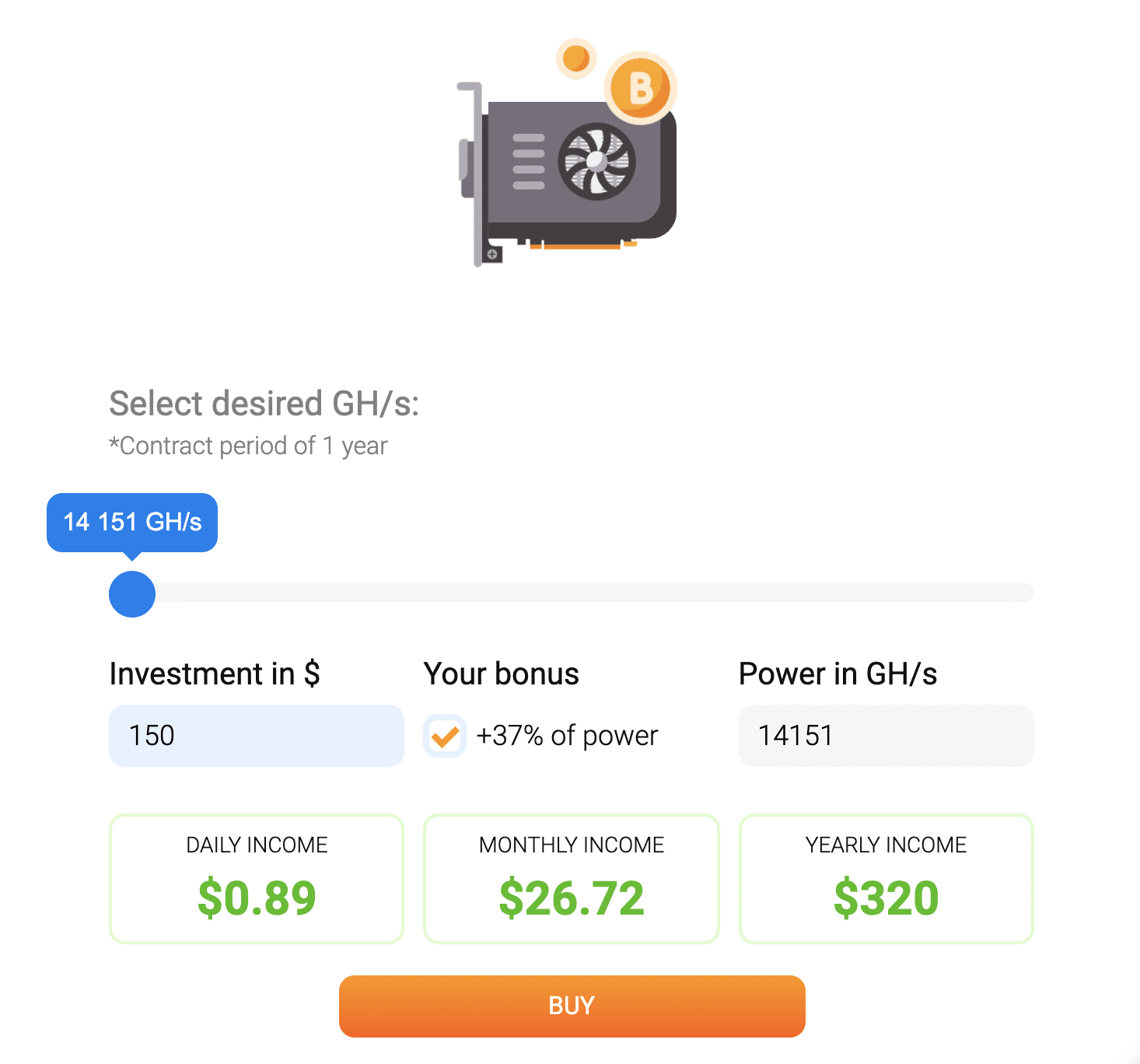

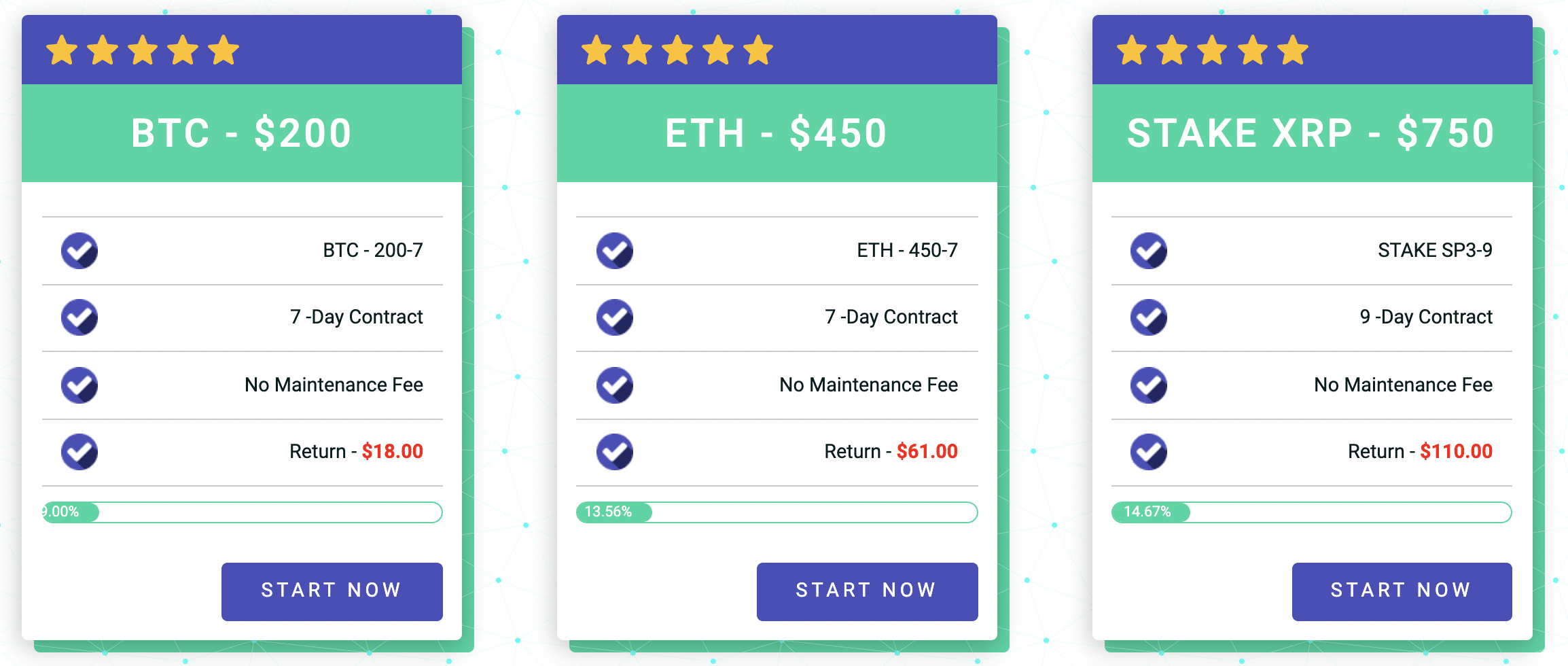

Nevertheless, to give you an idea of your earning potential, below is an example of a Bitcoin mining contract offered by StakeAdvisor:

So, let’s suppose that you decide to invest a total of $2,000 – which would get you 10 contracts. Based on an expected return of $12 per contract, this would return in returns of $120 over a 7 day period. In terms of annualized yields, this amounts to returns of approximately 212%. On the one hand, this illustrates that Bitcoin mining can be very lucrative – especially when you compare these returns to what traditional asset classes offer.

However, your earning potential is also correlated to the price of Bitcoin. After all, it’s all good and well when Bitcoin is trading for tens of thousands of dollars per token. But, if the price of Bitcoin declines to uncomfortable levels, this can make mining unprofitable.

As such, always consider the risks of Bitcoin mining before getting started. With that said, by sticking with short-term contracts such as the 7-day duration offered by the likes of StakeAdvisor, you will ensure that your funds aren’t locked away for too long.

If you like the sound of Bitcoin mining and wish to get started today – you will first need to choose a suitable platform. As we have explained in this guide, the best way to approach this space is to sign up with a top-rated Bitcoin cloud mining site. This will allow you to mine Bitcoin from home without needing to:

In the sections below, we offer full reviews of the best Bitcoin mining platforms in the market right now.

In its most simple form, StakeAdvisor is a cloud cryptocurrency mining platform. This computing power provider enables you to acquire digital assets without having to buy or manage any hardware or dedicate too much of your time to the task. Instead, everything is done via a remote data center with shared processing power.

So, why is this cloud platform a better alternative to traditional methods? Put simply, this is because typically, procuring assets like Bitcoin via mining requires expensive equipment, extensive knowledge, as well as an exponential amount of power. It is highly unlikely that an average investor has access to all these metrics.

StakeAdvisor offers you an alternative approach to obtaining digital assets without having to go through the hassle of mining at home. The mining rigs of this provider are housed and maintained elsewhere. As a user, you do not have to worry about their maintenance or the technicalities of how things work. Instead, you only need to register on the StakeAdvisor platform and purchase contracts. And in return, you will earn cryptocurrencies.

Pros

Cons

As a cloud mining platform, our StakeAdvisor review found that this provider offers you one of the easiest ways to earn cryptocurrencies – especially considering that you do not have to do any of the legwork. Put otherwise, you will not be involved in any part of the mining process. Rather, all you have to do is to buy a contract and you will get digital assets in return.

Here is how you can get started on this platform:

In order to facilitate its services, our StakeAdvisor review discovered that this company houses its cloud mining database in Quebec, Canada. We also find that this is also one of the highest paying providers in the market, providing you with returns of up to 30% – depending on your chosen contract.

Although many cloud mining platforms cater only to Bitcoin, StakeAdvisor also offers you access to Ethereum, Litecoin, Ripple, Dogecoin, XT5-Trading Bot, and digital Yuan.

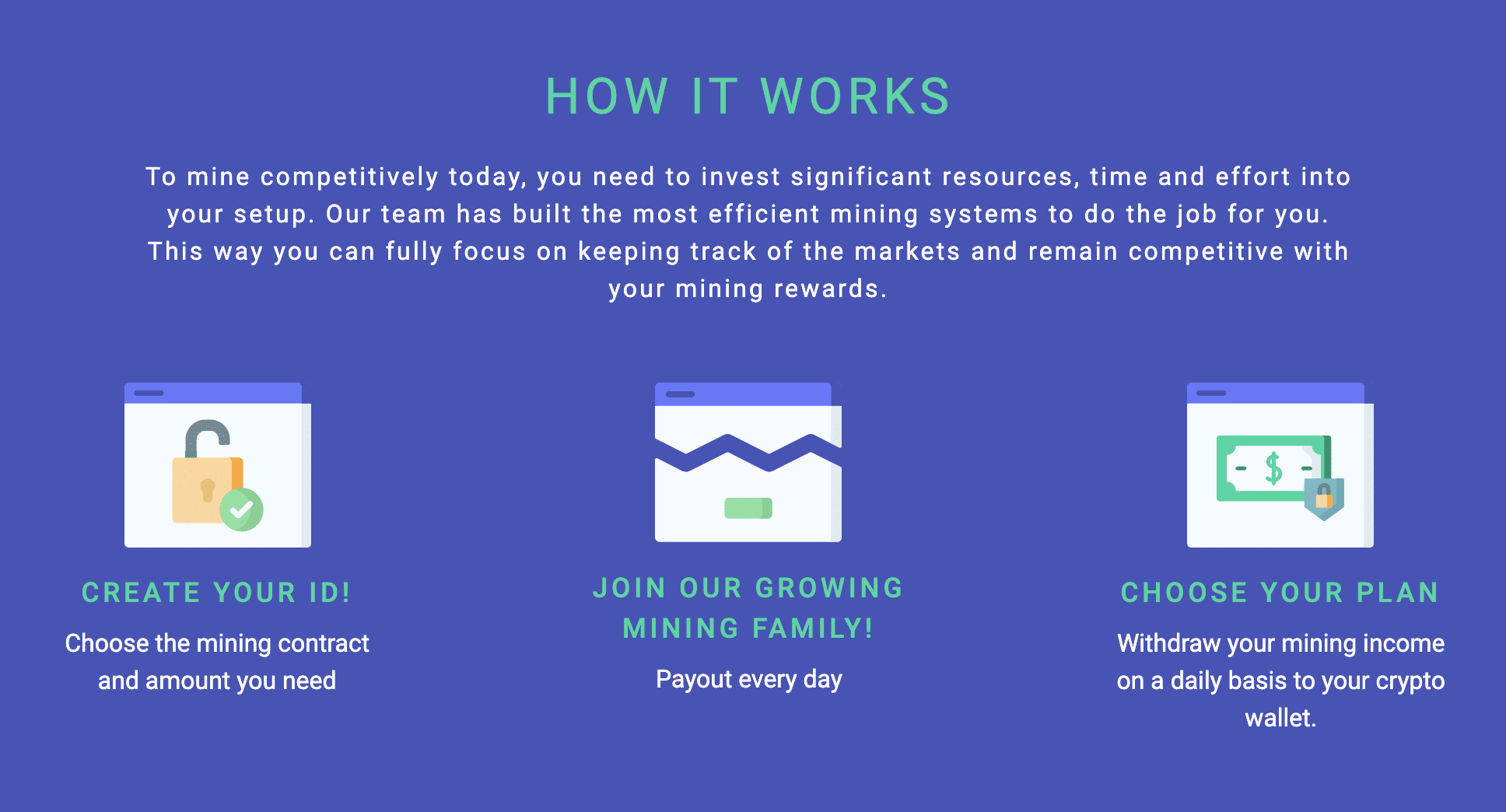

StakeAdvisor allows you to decide which type of mining contract you want to invest in. Upon signing up as a user on the platform, you have the option to pick one from the 12 different choices available.

Here are your options:

The validity of each contract varies, but the minimum duration is of seven days. And as it goes – the more you invest, the longer the length of the contract, which also means better returns. The main interface shows you all the crucial data related to your chosen package, updating you with your mining progress.

Withdrawals can be processed as Bitcoin, Ethereum, or Litecoin. All you need to do is to enter the address of your destination wallet, and the transaction will be completed in 24 hours. You do not have to wait until the validity of the contract expires to retrieve your digital assets.

As you can see, StakeAdvisor makes it incredibly easy for you to passively profit from cryptocurrency mining. The platform comes with the following features to provide you with a better user experience:

In addition to the above, some of you might find it an advantage that the StakeAdvisor platform is also available in the German language. Overall, the onboarding here seems to be pretty simple, and as per the claims of the website, it comes across as an effortless way to make profits in the cryptocurrency arena.

Our StakeAdvisor review observed that apart from what you pay for the contract, the provider does not charge any other fees for you to access its cloud mining service. You can sign up for free, and there are no additional deposit and withdrawal costs involved when using this platform.

The StakeAdvisor platform has made it clear that it uses Smartsupp, a GDPR complaint service to process your personal data and keep it private. However, the StakeAdvisor website does not offer any information on how it protects your funds or whether it offers any investor protection.

In light of this, always consider the risk of investing with a cloud mining platform before proceeding. In other words, once you entrust your money with this provider, there is no way of knowing for sure whether you will receive any returns.

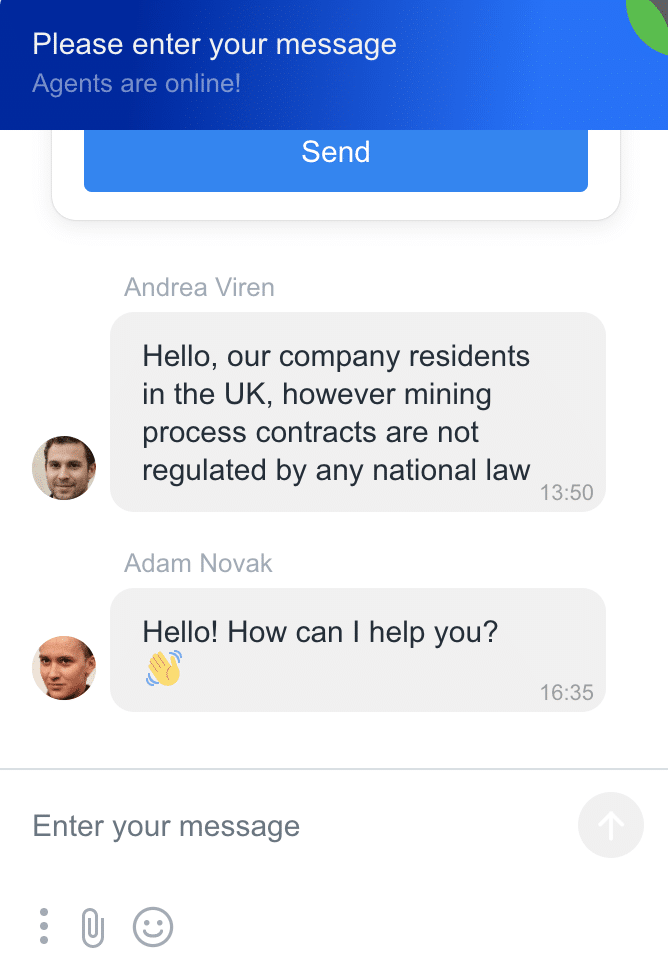

Our StakeAdvisor review found that this platform offers customer support around the clock, accessible via both chat and email. However, it might take a while before you hear back from the team. Meaning, there is no option for you to receive real-time customer support in any way.

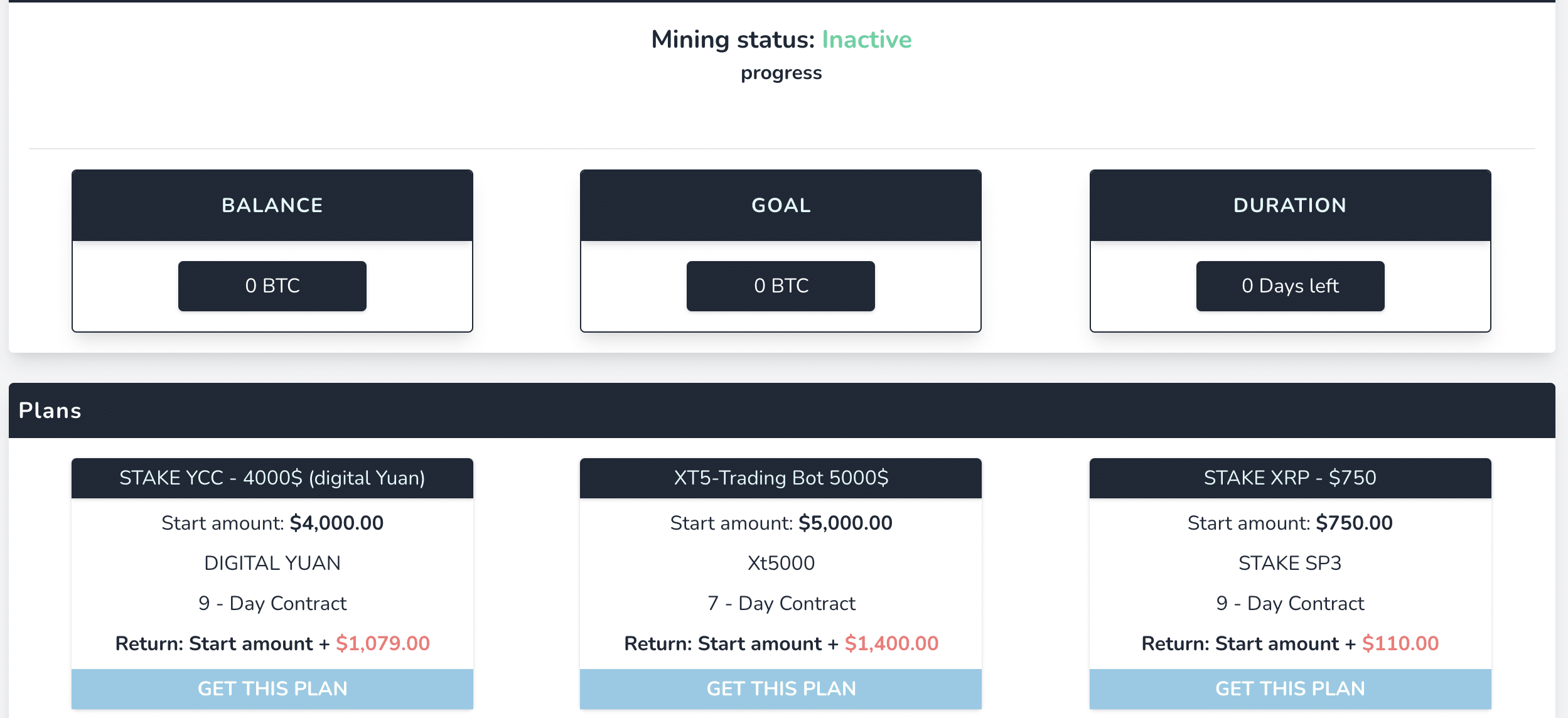

If you do not have the technical expertise or specialist equipment required to build and maintain a crypto rig by yourself, then using a cloud mining platform like Shamining is a great option. Shamining is a leading provider in this market – which allows you to obtain digital assets with minimal investment and effort.

The firm was first set up in 2018 and initially started by outsourcing its crypto farms to third parties. By the end of 2019, the company introduced the Shamining platform, providing a product for individuals to benefit from cloud mining. As a user, all you need to do is buy a contract that allows you to invest in a miner and receive digital assets in return.

The main advantage of using Shamining is that there is no need for you to buy or install any additional equipment. Instead, you only have to go through a simple registration and payment procedure to become an investor.

The payouts are automatic, and you can withdraw the digital funds to your wallet with ease As we move forward with this Shamining review, we will shed some light on how this company works and the security offered.

Pros

Cons

Shamining boasts of having an environmentally friendly infrastructure to facilitate cryptocurrency mining. Its data center parks are distributed in San Jose in the US, London in the UK, and Cape Town in South Africa. Its locations are carefully chosen to make the most of renewable energy sources such as wind and solar to power its mining plants.

In a nutshell, when you invest via Shamining, you are facilitating the running of a mining computer located in one of these locations. To get started with this platform, you have to complete the following steps.

Our Shamining review found that the platform also provides you with the statistics related to your different mining contracts directly from your dashboard. This makes it possible for you to keep track of the miners and your earnings – all in one place.

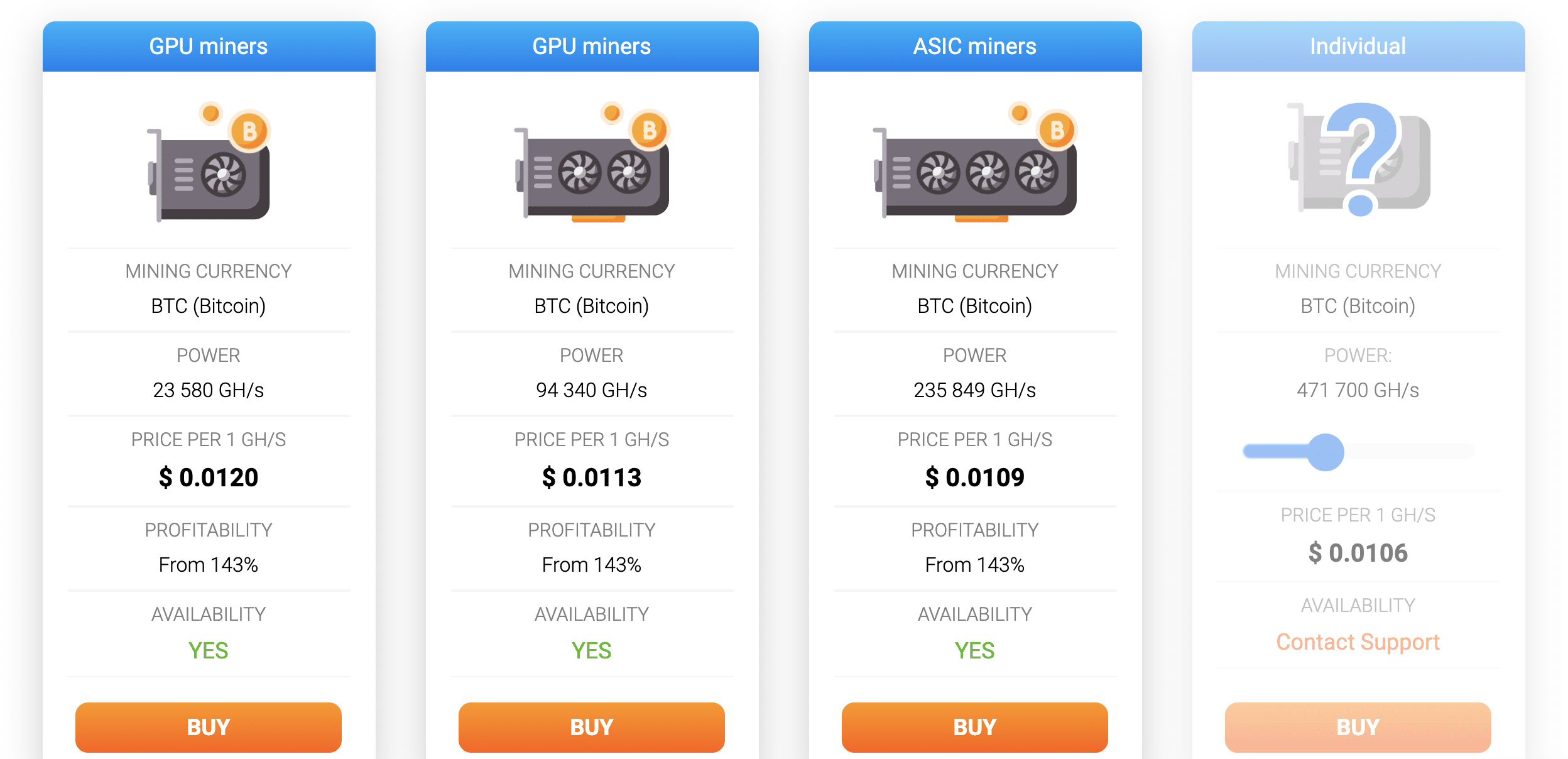

According to the Shamining website, users can choose between GPU and ASIC miners – out of which the latter is more powerful. However, upon signing up on the platform, you are given the option to decide your contract type, based on the GH/s you seek.

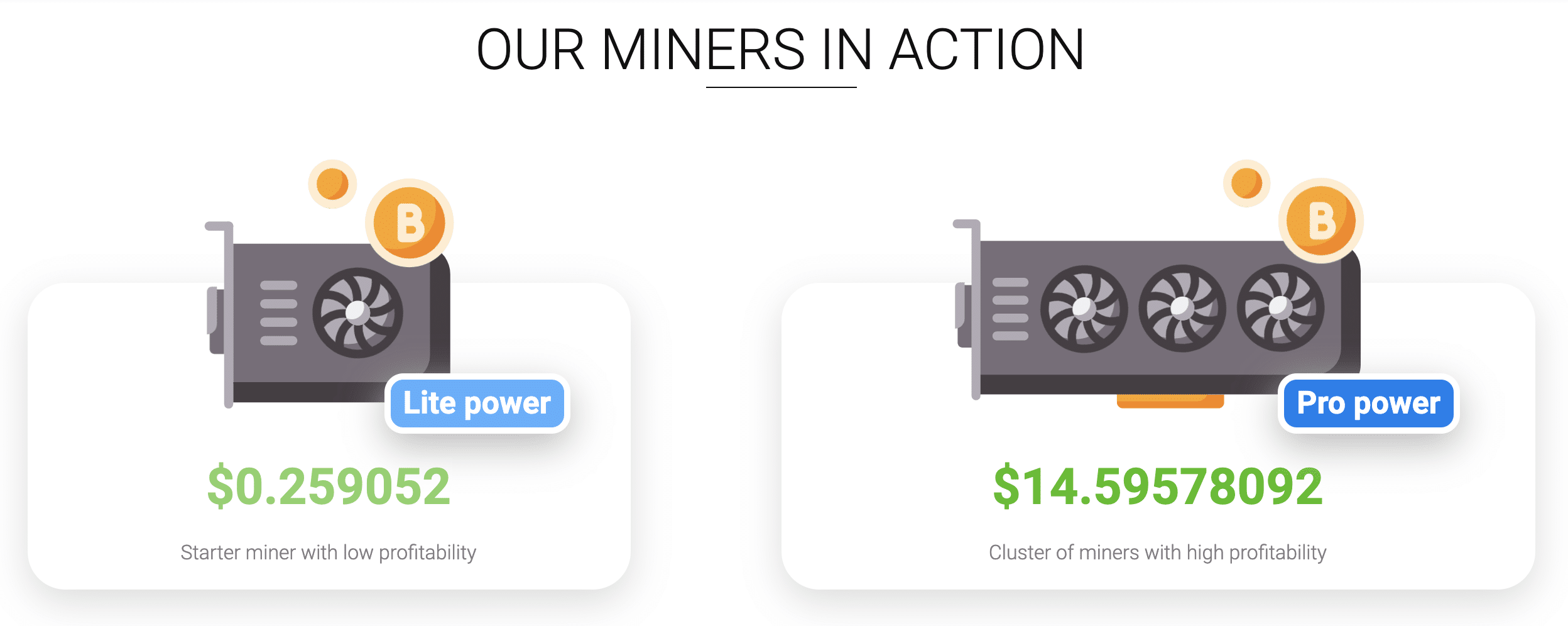

For those unaware, GH/s (gigahash per second) represents the computing power of a mining device. In other words, the higher GH/s, the better productivity, and more returns. Shamining provides you with a calculator to tell you how much you are required to invest based on the GH/s you select.

The calculator also instantly shows how much your daily, monthly, and yearly returns are likely to be. However, note that these are only speculation. The contracts are usually valid for one year. If the cost of mining increases the predicted payout, then the process will be stopped.

Moreover, if the mining remains unprofitable for 21 consecutive days, the payouts and fees are temporarily stopped. It reactivates if the process turns out to be profitable again. However, all these details are not pointed out when you sign a contract. As a user, you need to carefully read the terms & services of Shamining, and educate yourself before investing.

It is possible for a single user to open different contracts at once. However, if you decide to open a custom plan, or invest over $100,000, you need to contact the Shamining team to set up a plan. Crucially, remember that this platform currently supports only Bitcoin mining.

Shamining accepts payments via debit/credit cards and Bitcoin deposits. The platform also takes funding of Bitcoin via its partner sites such as Changelly. However, it is crucial to note that all invoices are issued in EUR. So, if you are to fund the contracts in USD or any other currency, you will have to account for the exchange rate.

Here are the minimum and maximum limits:

Overall, when it comes to making payments, Shamining provides a hassle-free service by supporting plenty of options.

According to the Shaming website, the platform charges both service and maintenance fees. But you will not find these included in the cost of the contract. Instead, these expenses are processed daily and deducted from your balance.

As such, you will know how much the fees are only after you have made an investment. Moreover, our Shamining review found that the platform often increases its fees throughout the duration of the contract, so this is something to keep an eye on.

While researching for this Shamining review, we found that several users have reported high fees – which increases during the duration of the contract. That is, a large portion of the Bitcoin mined will be charged as maintenance costs, and you will receive only a fraction of the cryptocurrencies produced.

In fact, if one takes time to read the terms & services of Shamining, you will notice that this provider excludes liability for any losses or damages that you might suffer when using the platform. This includes any adjustments to the amount of cryptocurrency awarded to miners. In addition to this, Shamining also makes it clear that the platform is not obliged to proactively resolve any payment-related issues.

Altogether, it is evident that if you are to invest your money into mining contracts via Shamining, you are taking a risk, and you will be entirely responsible for the safety of your funds. Furthermore, there is virtually no guarantee that you will receive the returns promised. As such, always proceed with caution.

When you are entrusting your money to another party, it is only natural that you expect reliable customer care. Our Shamining review found that this platform is quick in responding to your queries. You can reach out to the team by sending an email, or through their live chat option available on the website.

The Shamining website is available in multiple languages and offers direct support in English and German. The platform has also listed its address based in the UK, where it is registered as a company.

ECOS Mining is known as one of the most legitimate cloud mining providers in this niche sector of the cryptocurrency arena. This is primarily because it is the first platform that was established by the order of the Armenian government. The company was established as a foundation to build a Free Economic Zone that caters to the blockchain industry, IT sector, and artificial intelligence in the country.

ECOS Mining has been operating since 2017 and has signed an agreement with Hrazdan TPP – which allows it to use over 200mw of power capacity in the Free Economic Zone for running its commercial data mining center. As a resident of the FEZ, ECOS Mining is exempted from paying any taxes on profits, real estate, or VAT to the government.

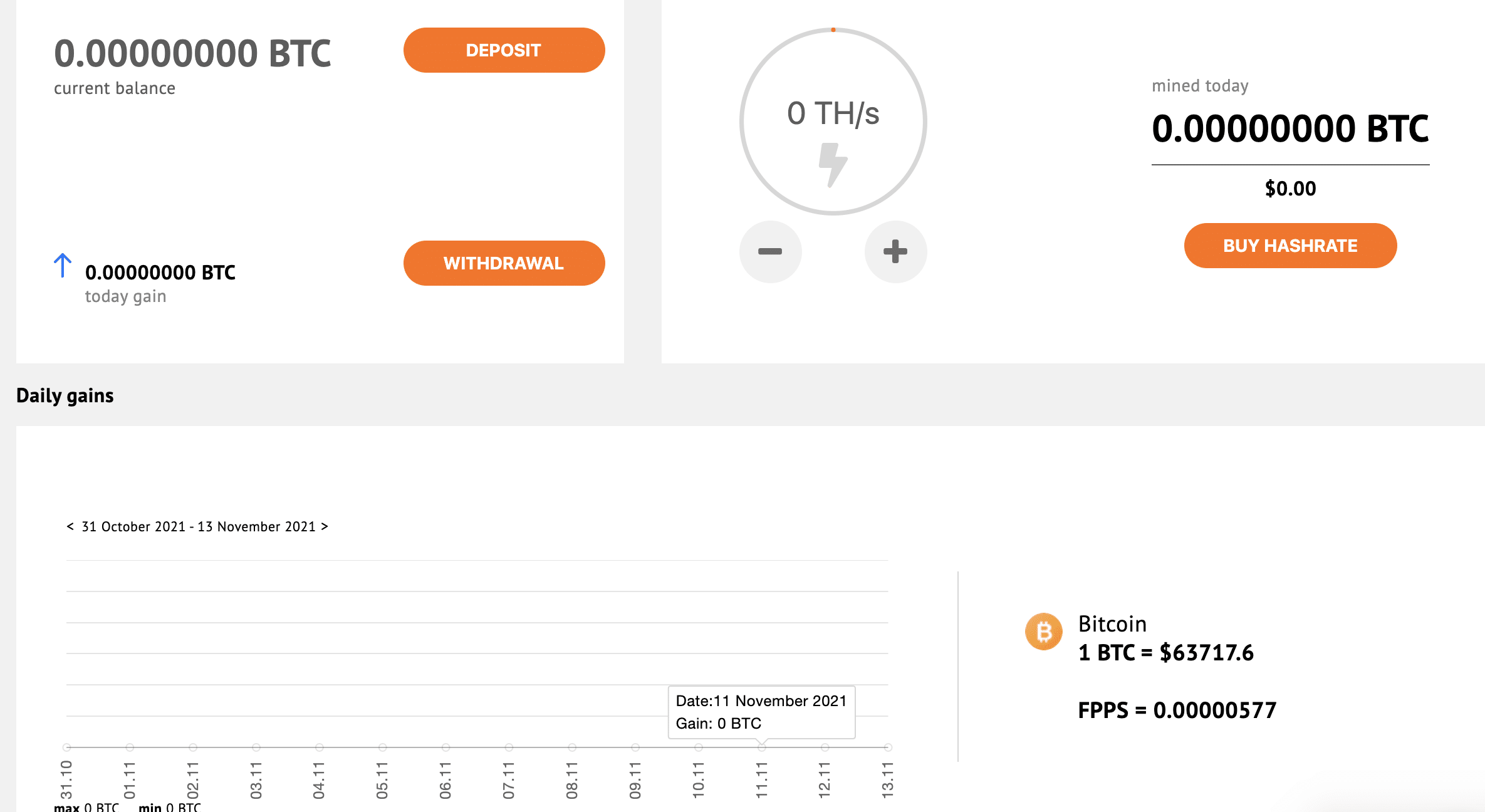

When you purchase a contract with ECOS Mining, you are essentially renting power from its crypto rig. The platform, in turn, charges you service fees for the maintenance and electricity of the equipment. At the end of each day, the Bitcoin tokens produced are updated into your account dashboard, which will then be available for you to withdraw.

The ECOS company also offers other products such as exchange services, payment solutions, and portfolios. Note that while the platform supports several cryptocurrencies, its cloud mining services are provided exclusively for Bitcoin.

Pros

Cons

As this ECOS Mining review covers other products, cloud mining platforms are one of the easiest and most effective ways for you to make money from the cryptocurrency markets, without having to buy or maintain your equipment. If you are to use this company’s services, this is how the process would work:

The platform provides you with relevant data about your contracts and how much Bitcoin you are collecting. The cloud mining payments happen daily, directly deposited to your account balance. However, this will be the amount after the service fees charged by ECOS Mining are deducted.

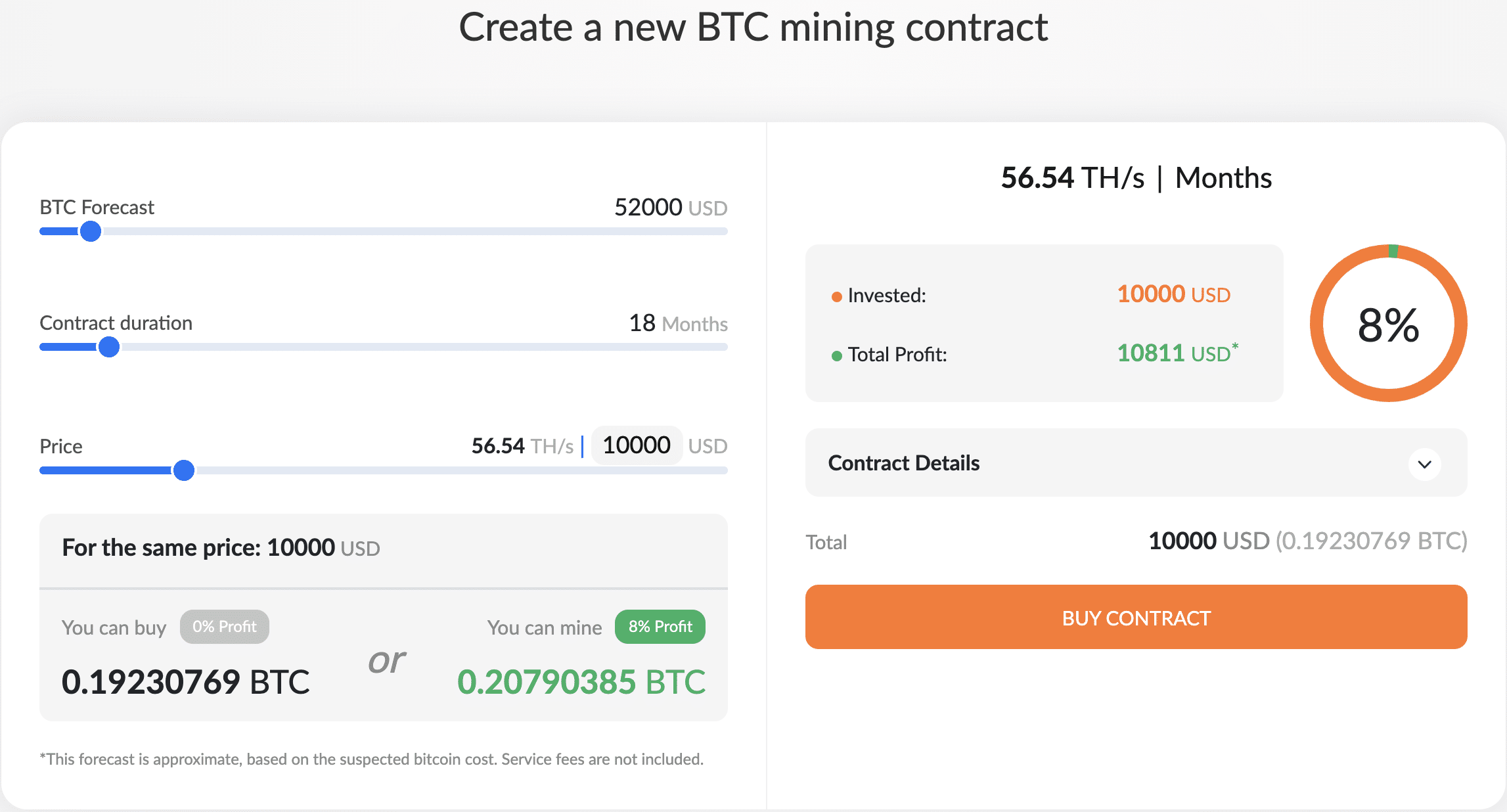

Our ECOS Mining review found that instead of offering you predesigned mining contracts, the platform allows you to create one based on your requirements. For this purpose, you can use a profitability calculator that shows you the Bitcoin output forecast, depending on the amount you invest, and the duration you want.

If you need to access more details, you can always reach out to the customer service team to obtain detailed calculations or help you find an ideal plan. In addition to this, our ECOS Mining review found that you can get a test mining contract as a welcome bonus, by writing to the technical support team.

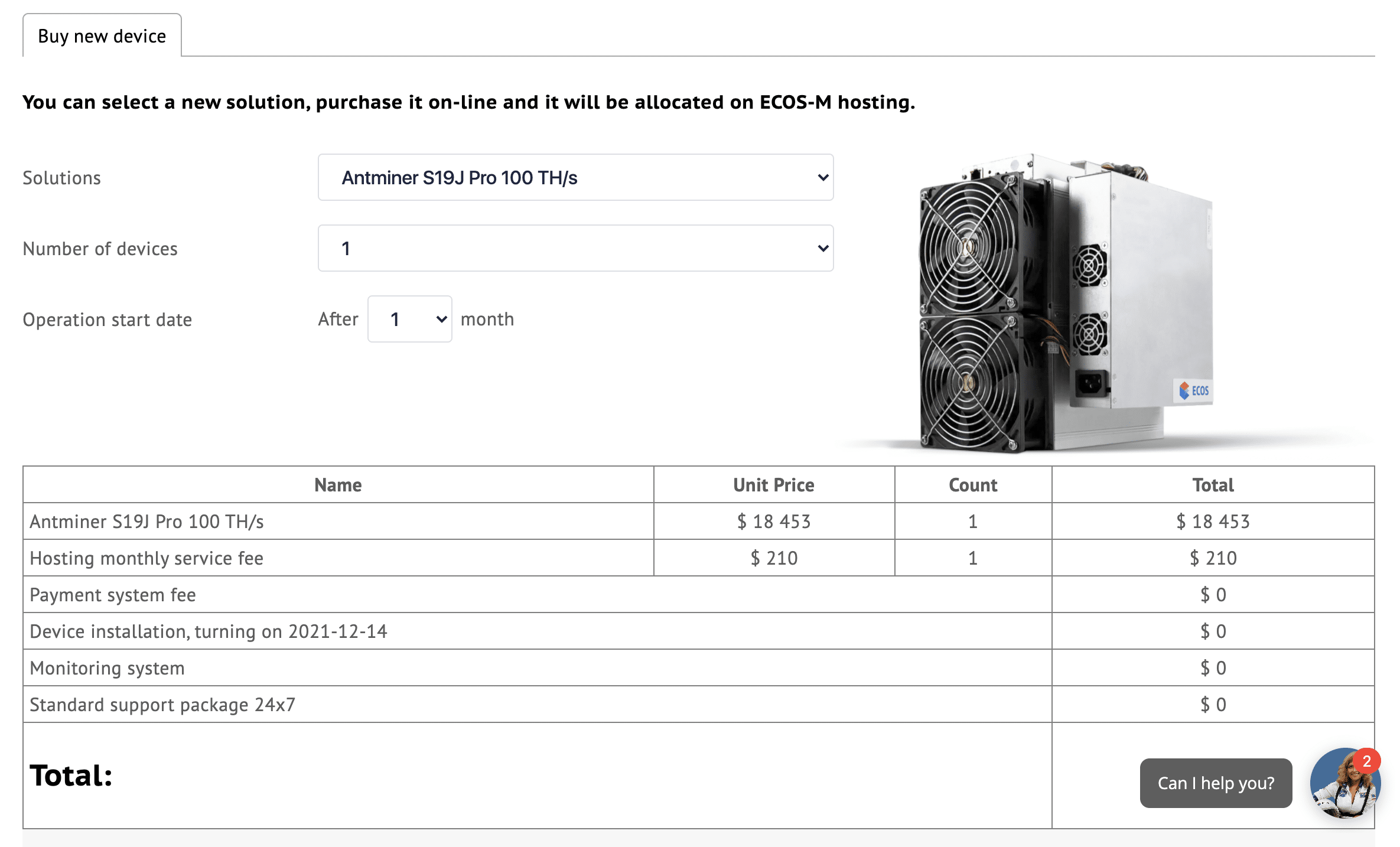

While doing this ECOS Mining review, we also noticed that users have the option to purchase a mining device via this platform. Meaning, you will not be buying a contract. Instead, you can select a new solution based on your requirements, make the payment, and it will be allocated on ECOS-M hosting.

You can purchase up to 250 devices, and set the start date of the operation yourself. The payments are calculated and charged every month. You can also monitor the equipment from your ECOS dashboard, and uninstall it any time you want. Moreover, it is also possible to get the device(s) shipped to any address around the world.

ECOS Mining takes responsibility for any malfunction of the equipment for the first six months after the purchase, and also offers any repairs required during this period for free. This presents users with an alternative solution of having more control over their Bitcoin mining requirements.

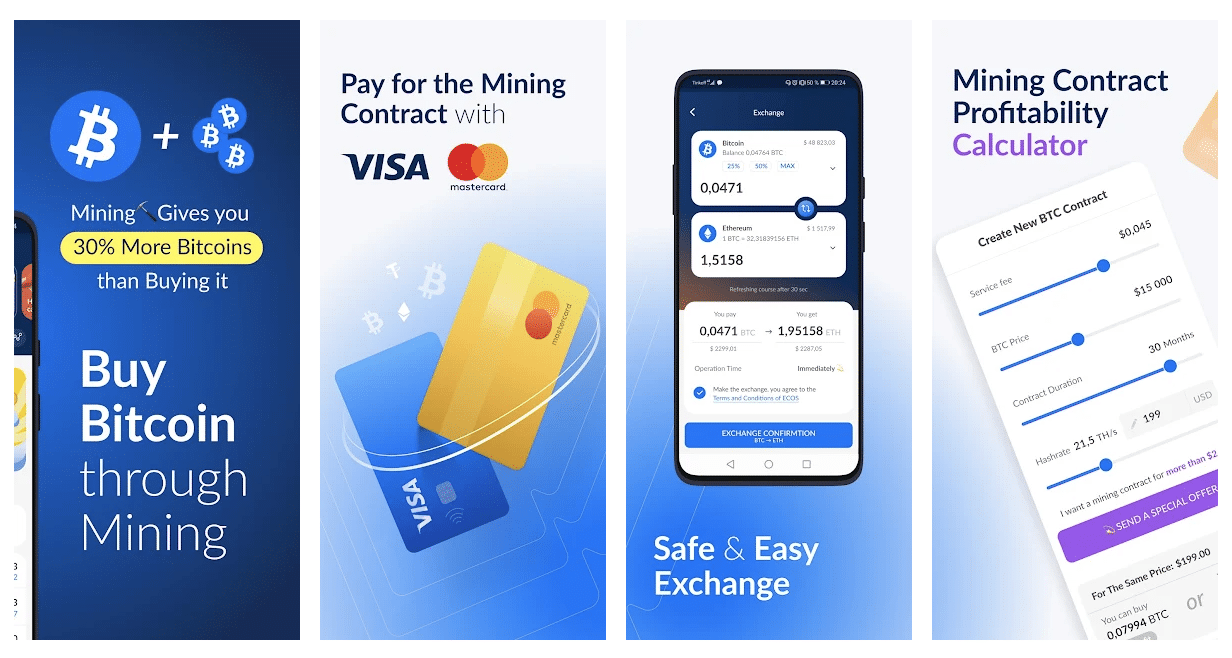

On ECOS Mining, you can pay for your mining contracts using your debit/credit card. This includes cards issued by Visa and Mastercard. Depending on your country of residence, you can also pay via PayPal.

You can also make payments via cryptocurrency deposits using:

Withdrawals are available only in Bitcoin, which you can transfer to your private wallet on a daily basis. However, you will need to meet the minimum withdrawal amount of 0.001 BTC. The maximum that can be transferred is set at 10BTC for a single day.

As with other cloud mining contract providers, ECOS Mining also charges you fees for using its services. Here is what investing with this platform will cost you.

Our ECOS Mining review found that aside from the cost of the contract, you also have to pay for the electricity and maintenance for the equipment. This is calculated as service charge, indicated as 1 TH/s per day. The platform calculates this in Bitcoin and deducts it directly from your ming profits on a daily basis.

It is also possible for you to choose a mining contract with no service charge. However, this means that you will be receiving less hash power, which translates to lower profits. You can use the in-built calculator on the platform to get an idea of how much you are likely to earn, based on the type of plan you choose.

The main cost of using ECOS Mining is the price of the contracts that you invest in. The lowest amount available is $75, which you can pay via a fiat currency transaction, or by making a cryptocurrency deposit. You will be charged an extra 2.5% if you are making the purchase using your debit or credit card.

If you are using ECOS Mining for its cloud mining services, the platform does not take any service fee for processing Bitcoin withdrawals to your private wallet. However, you will have to cover the cost of the transaction, which varies depending on network congestion at the time of the transfer.

Since its launch in 2017, ECOS has developed into a full-fledged cryptocurrency platform. In fact, cloud mining is only one of the services provided by this company. Note that most of these features are available via the mobile version of ECOS, and not via the main website.

Here is a list of the different products offered:

As you can see, this ECOS Mining review found that the provider offers plenty of in-house services. But that said, these features also come with additional fees and charges.

Our ECOS Mining review found that this is one of the few cloud mining platforms that comes with a fully-equipped app. The mobile version is available for both iOS and Android devices and supports all the products of the company. You can also use the profitability calculator to determine your Bitcoin returns easily.

Most importantly, apart from the cloud mining services, all the other products offered by ECOS are accessible only via the mobile app. This means that cryptocurrency wallets, staking, and exchange services are possible only through the application downloadable to your phone. The web platform only allows you to buy contracts or devices.

Looking for the best way to stake your crypto? Check out our list of the best crypto staking platforms! We’ve got all the info you need to make an informed decision about where to put your money.

As our ECOS Mining review mentioned earlier, the company gets its reputation from being one of the most legitimate platforms in this industry. This is primarily due to its close association with the government of Armenia.

However, there is no information regarding any kind of regulation or investor protection provided for users. Given these factors, our ECOS Mining review suggests that you take a closer look at this platform before putting in any money.

When it comes to the security of the platform, we found that ECOS Mining has integrated the following features:

Although the ECOS website mentions KYC, requiring you to provide identity documents, our research team found that this wasn’t the case. In fact, when creating an account to do this ECOS Mining review, the only prerequisite was to verify the submitted email address and phone number. In other words, it did not appear like one had to go through any KYC process to start using the platform.

To conclude this comprehensive Bitcoin mining guide, we are going to show you how to get started in under five minutes with StakeAdvisor. As noted in our StakeAdvisor review above, this Bitcoin mining platform offers $200 contracts with a duration of just 7 days. This is ideal for those of you that wish to assess whether or not Bitcoin mining is worthwhile without needing to lock your funds away for a long period of time.

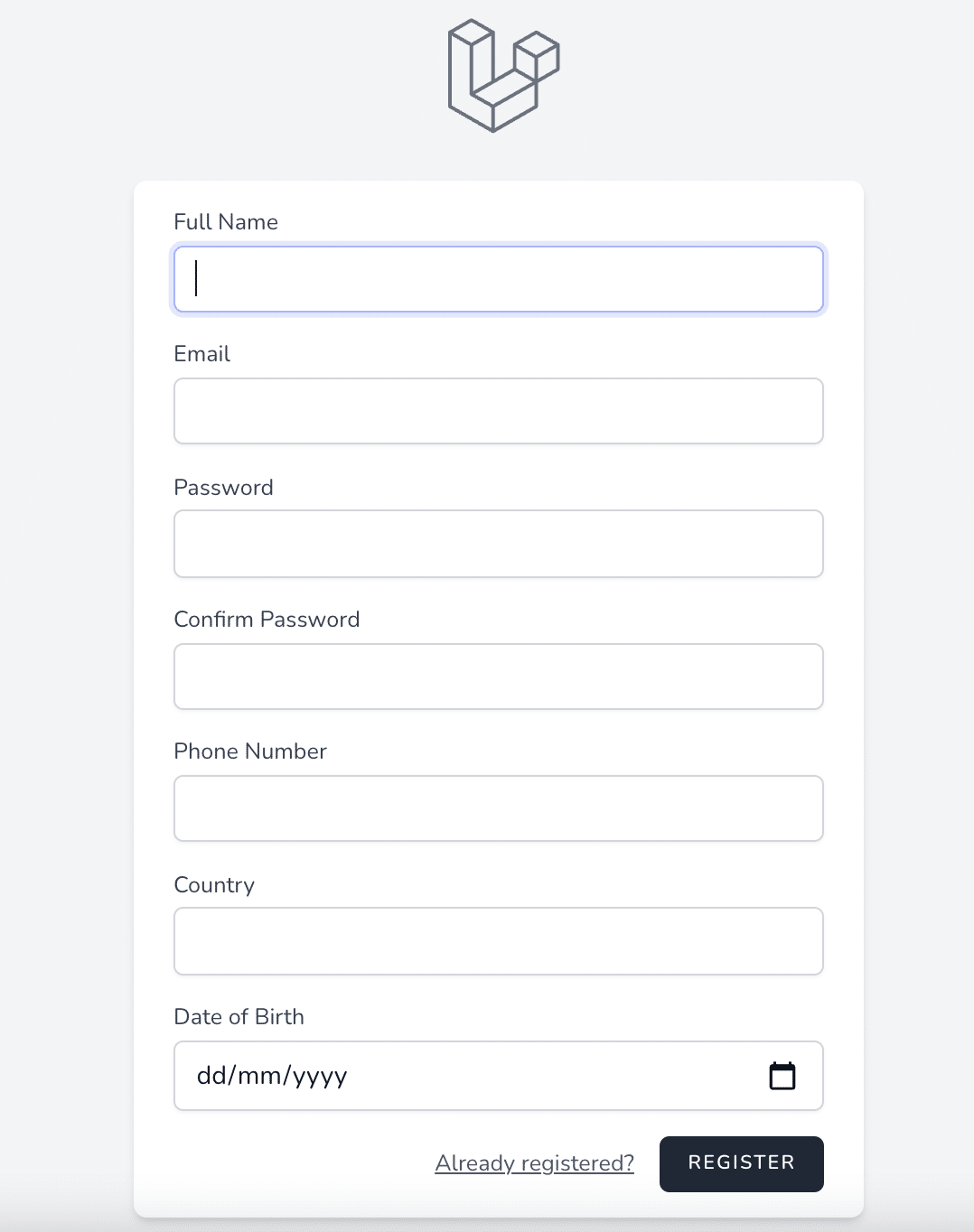

To get the ball rolling, visit the StakeAdvisor website and click on the ‘Get Started’ button. This will take you to the registration page, where you will need to enter some basic personal information and contact details.

This will include your name, date of birth, nationality, phone number, and nationality. Finally, click on the ‘Register’ button to complete the account opening process.

Now you will need to choose a mining contract that takes your interest. If this is your first time mining Bitcoin, it might be wise to stick with a short-term contract. At StakeAdvisor, the shortest contract offered is that of a 7-day period, which comes with a required investment of just $200.

Once you have selected a suitable contract, you will then need to add some funds to your StakeAdvisor account to pay for it. This cloud mining provider offers two options in this respect.

First, if you already have some crypto to hand, you can easily deposit funds by transferring tokens into your StakeAdvisor wallet. Alternatively, if you don’t have any digital assets available, you can use a debit or credit card.

As soon as you have paid for your chosen Bitcoin mining contract, there is nothing else for you to do until it expires. Each and every day, you will receive your share of any mining rewards earned.

Finally, once your Bitcoin mining contract expires, StakeAdvisor will return your original investment. If you opted for the 7-day contract, this will amount to $200. You can then withdraw the funds from StakeAdvisor or elect to reinvest the capital into other Bitcoin mining contracts.

This comprehensive Bitcoin mining guide has explained everything there is to know about this passive investment arena. The key takeaway here is that mining Bitcoin at home with a hardware device is no longer feasible – not least because the space is dominated by large-scale pools.

The good news is that you can earn Bitcoin rewards by joining a cloud mining site. In doing so, you won’t be required to buy any expensive hardware devices or use huge amounts of electricity.

On the contrary, it’s simply a case of buying a Bitcoin mining contract and allowing your digital tokens to work for you. Just remember that as lucrative as Bitcoin mining can be, the process isn’t risk-free. This is why you need to tread carefully when choosing a cloud mining provider.

Bitcoin is on the rise, and now is the perfect time to invest. Our beginner’s guide will show you how to start investing in Bitcoin within minutes. Whether you’re a seasoned investor or just starting out, our guide has everything you need to get started today. So don’t miss out on this opportunity – learn how to invest in Bitcoin today!