The ECB and BOE Meet Today, but What Will Change?

The dollar is mixed on the day, but moves have been modest ahead of the ECB meeting. The Euro recovered to trade just above the $1.25 area and sterling is hovering just around $1.5950. The Australian and New Zealand dollars...

U.S. Manufacturing Surge Offsets Europe Deflation Threat

Both U.S. manufacturing and economic activity expanded in October at a much faster rate than economists expected, while a slowdown in Europe hints at an uneven global recovery. Both U.S. manufacturing and economic activity expanded in October at a much...

More Interpretation of the End of the Fed’s Quantitative Easing

The US Federal Reserve this week has moved one step closer to lifting interest rates by ending its controversial bond-buying program. This begins a long-anticipated process that will take many months to complete: the metamorphosis of a dove into a...

The Week in Review: U.S. GDP Rises 3.5% amid Low Interest Rates, Europe Bank Failures

The United States saw 3.5% GDP growth in the third quarter of 2014 while the Federal Reserve expects low bond yields to remain for the foreseeable future. In Europe, growth has come to a standstill, with second quarter GDP growth...

Can the Price of a Big Mac in Denmark Explain the Living Wage?

Bob Trebilock, editor of the Supply Chain Management Review, sent me an interesting email today that poses an interesting set of questions.Bob writes:“A friend sent me an email today with a link to a column by Peter Morici, a well-known...

FOMC: Low Interest Rates to Stay for “Considerable Time”

Record low interest rates on U.S. Treasuries are here to stay, despite expectations a year ago that the end of the quantitative easing would pressure stocks and bonds by causing yields to rise. Record low interest rates on U.S. Treasuries...

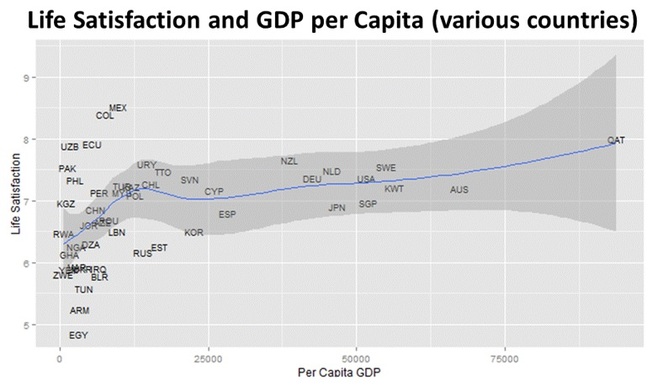

Is There a Better Economic Growth Measure than GDP?

[quote] The day is not far off when the economic problem will take the back seat where it belongs, and the arena of the heart and the head will be occupied or reoccupied, by our real problems – the problems...

Democrats and Republicans unite in calls to rebuild brutal US penal system

The US has a quarter of the world’s prisoners, but only 5% of the world’s population, so the “tough on crime” approach of the past 40 years has not worked. It has left a trail of social and economic destruction,...

U.S. Treasury Rally on the Second ‘Taper-Tantrum’

The prospects that the Federal Reserve would begin slowing its purchases sparked a market meltdown in 2013. The "taper tantrum", as it was dubbed, destabilized the capital markets. Now it is as if the markets have had a second tantrum,...

The U.S. Strong Dollar Policy Remains Intact

Many participants seem confused. Despite the talk about the dollar by different Fed officials, dollar policy is set by the US Treasury. Secretary Lew has been clear. First he reiterated the 20-year old mantra of a strong dollar being in US...

This Week in Review: Job Gains Counter IMF, Fed Pessimism

Equity markets faced declines globally as the IMF downgraded growth expectations and the Federal Reserve said a fragile U.S. economy required more accommodative monetary policies in the short term. Equity markets faced declines globally as the IMF downgraded growth expectations...

Dovish FOMC Minutes Signal Some Push Back Against the Hawks

The dovish FOMC minutes have pushed the consolidative tone into a dollar correction. Asia and European markets extended the dollar decline. These losses brought the greenback near initial retracement objectives or technical targets. The euro approached $1.2800 before running...

How will the Dollar React to the Fed Minutes?

Corrective forces continue to grip the foreign exchange market. Many expect the dollar's downside correction/consolidation to end today. Technically-inspired short-term participants often see 3-4 day counter-trend moves to be typical of market moves. Fundamentally-inspired traders expect the FOMC minutes, which...

IMF Sees Tepid Growth as U.S. Job Openings Surge, Hires Fall

Global growth is going to decelerate while American workers get fewer jobs as employers expect more for less. Global growth is going to decelerate while American workers get fewer jobs as employers expect more for less.The International Monetary Fund announced...

Dollar Pulls Back Slightly But Remains Strong

Corrective forces continue to take hold of the foreign exchange market. It is long overdue and does not appear to be sparked by fundamental developments per se. Many short-term momentum participants had jumped aboard what had looked (and behaved) a...