Buy Cryptocurrency Canada – How To Buy Cryptocurrency Beginner’s Guide 2022

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

If you’re looking to buy cryptocurrency Canada but don’t know where to start, you’re not alone. Trading cryptocurrencies is highly risky, but there are also many opportunities to make positive returns.

Is cryptocurrency trading a good long-term investment? Are there any other ways to gain exposure to the crypto market? Let’s cover everything you need to know about how to buy cryptocurrency in Canada.

Table of Contents

Wondering how to buy cryptocurrency in Canada right now? Here are four easy steps to get you on track to start trading digital assets in a matter of minutes with Canada’s most secure and trusted platform – Bitbuy.

If you’re looking for the best crypto exchanges Canada, make sure you read our comprehensive guide. With so many options to choose from making the right decision can feel like trying to make your way up a river without a paddle.

To help make this process a lot simpler, we’ve reviewed dozens of FINTRAC-regulated crypto platforms and narrowed it down to the top-two best platforms to buy cryptocurrency Canada in 2022. Read on to learn more about each trading platforms’ best features, fees, and supported digital currencies.

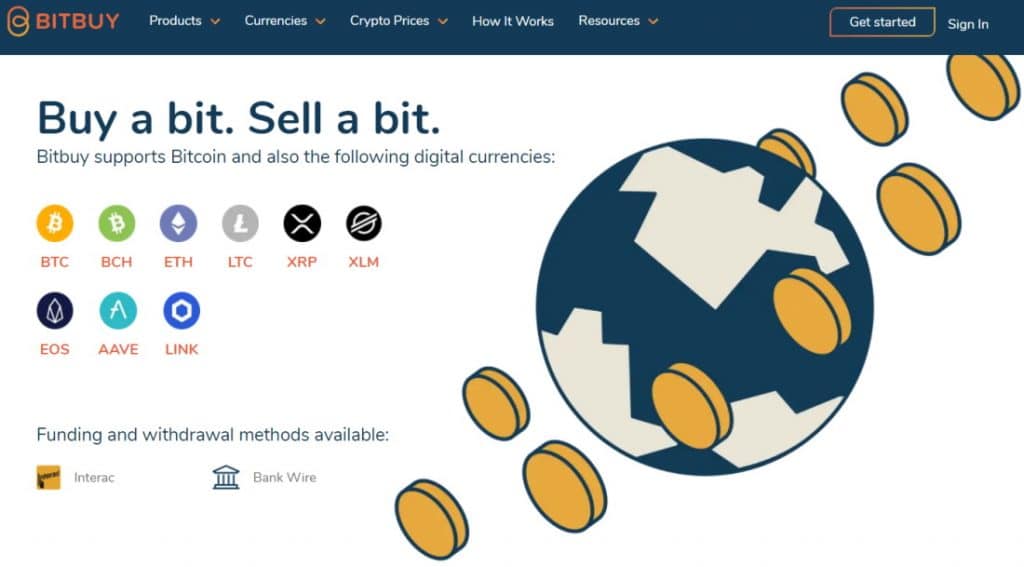

Launched in 2013, Bitbuy was designed to offer a quick, safe, and easy way to buy and sell Bitcoin (BTC) and other popular cryptocurrencies. The crypto exchange’s top-features include the ability to invest in nine different cryptocurrencies (BTC, ETH, LTC, BCH, XLM, XRP, EOS, AAVE, and LINK) directly in Canadian dollars (CAD) and crypto crosses, an innovative trading interface, an OTC desk, and exceptional customer support.

Bitbuy allows you to buy Bitcoin and the following popular altcoins: Chainlink – LINK, Bitcoin Cash – BCH, Eos – EOS, Stellar Lumens – XLM, XRP – Ripple, Ethereum – ETH, AAVE, Litecoin – LTC.

Bitbuy charges fees for buying and selling cryptos, deposits in fiat currency, and withdrawals from the platform in both fiat and cryptocurrency. Cryptocurrency deposits are free, but processing times vary depending on the network – but XLM, XRP, and EOS deposits are processed instantly.

If you’re making an initial CAD deposit this will cost between 0.5% and 1.5% depending on the payment option you use. For example, a bank wire transfer costs a flat fee of 0.5%.

Trading fees with Bitbuy are twofold. Express trades cost 0.2% per trade, while pro trades cost 0.1% for maker fees and 0.2% for taker fees. When it comes to withdrawal fees, this will vary depending on the withdrawal method and the cryptocurrency.

| Fee Type | Fee Amount |

| Commission | Variable Fixed Fees |

| Deposit Fee | Bank Wire – 0.50%. Interac e-Transfer – 1.50%. |

| Withdrawal Fee | Bank wire – 1.00%. Interac e-Transfer – 1.50%. |

| Minimum deposit | $50 |

| Trading fees | Express trade – flat 0.20% fee on all buys and sells |

| Pro Trade / API Client | Maker – 0.10% Taker 0.20% |

Pros

Cons

76.72% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

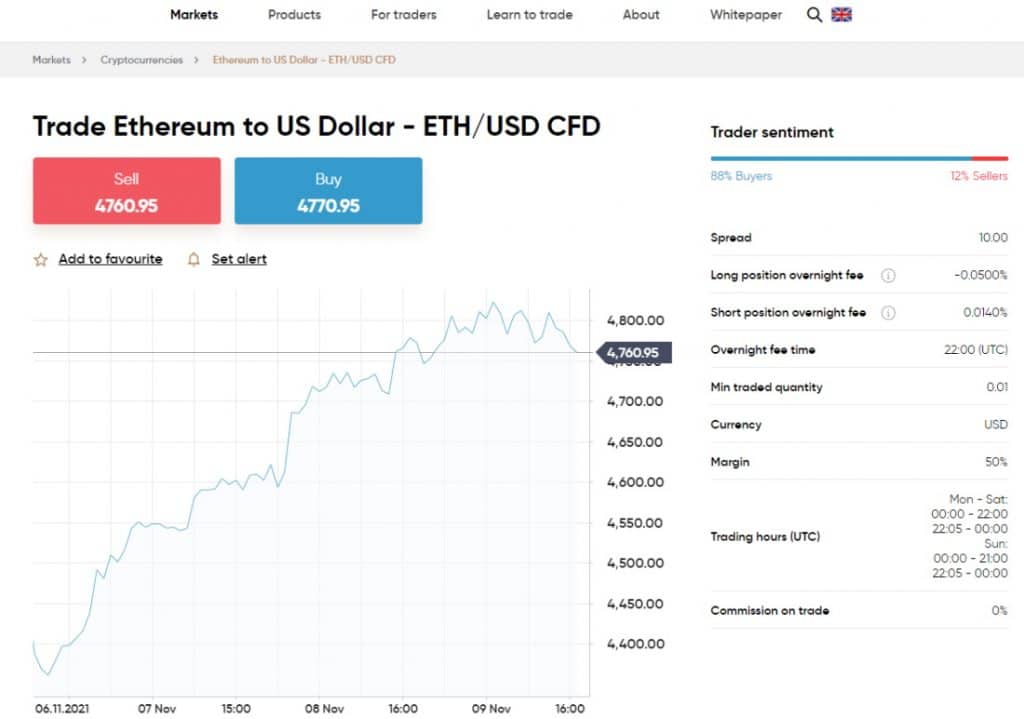

Another top-rated crypto CFD broker worth considering is Capital.com. This global CFD broker is very popular with Canadian traders because of its commission-free fee structure and vast selection of tradable assets. Capital.com is regulated by and registered with the FCA, ASIC, and CySEC, MiFID.

When it comes to trading cryptocurrencies CFDs with Capital.com you’ll be spoilt for choice. There are over 200 different crypto crosses, and currency crosses to choose from. For example, the typical spread when trading BTC/USD CFD is 165.00 pips.

The fact that all tradable assets can be bought and sold commission-free is Capital.com’s best selling point. From share CFDs to crypto CFDs, you can gain access to a plethora of markets at a low cost, which is ideal for new traders. Furthermore, because you can choose between long and short orders, this is ideal for day traders.

In terms of non-trading fees, there are no deposit fees or withdrawal fees. Moreover, there are no inactivity fees or account fees to worry about.

As we’ve already mentioned, deposits and withdrawals are free of charge, and there’s a wide range of payment methods available. These include bank transfers, credit/debit cards, and e-wallets. Nevertheless, there are only five base currencies to choose from including USD, EUR, PLN, GBP, and AUD. Other fiat currencies will incur conversion fees.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Spread Fee | Competitive Spreads |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $0 |

| Account fee | None |

| Cost of trading ETH/USD CFD | Typical Spread: 9.90 Pips |

Pros

Cons

76.72% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

While cryptocurrency trading comes with high risks, the blockchain ecosystem seems to be slowly making its way into mainstream finance. Institutional investors, as well as retail traders, can buy and sell cryptocurrencies with the click of a button.

Let’s cover some of the main reasons why investors are looking to buy cryptocurrency Canada in 2022.

Financial powerhouses including PayPal and Square are making it much simpler and easier for users to buy and sell cryptos on their platforms. Additionally, Tesla made headlines when it bought $1.5 billion worth of BTC at the start of 2021. At some point, the EV manufacturer also made Bitcoin an accepted payment method for its vehicles.

While other factors influence the volatility of the crypto market, the growing adoption of digital assets is a sign of a maturing sector.

Just recently, Bitcoin made a stir when its market price jumped to record highs last witnessed in April. But with the world’s most powerful leaders butting heads at COP26 on ways to tackle climate change, Bitcoin’s energy use is surging once again.

Investing in cryptocurrencies comes with heaps of volatility and high risk. With the price of BTC hitting new highs, many investors are looking to buy into this exciting new market. But what if you can’t stomach the risk? Are there any safer alternatives that give you exposure to this innovative digital market?

Buying cryptocurrencies involves using the best Bitcoin wallets Canada, but this can be complicated for beginner traders. Therefore, you can invest in stocks of companies that support crypto futures trading. Some of the best examples include Coinbase, CME Group, PayPal, and Square.

US Bitcoin futures ETFs, the first of their kind, debuted last month letting investors and crypto enthusiasts get their hands on digital assets outside the confines of crypto exchanges. Namely, the ProShares Bitcoin Strategy ETF (BITO) wrapped up $550M from eager traders.

These ETFs invest in BTC futures contracts, which are agreements to trade the underlying asset in the future for a predetermined price, as opposed to Bitcoin directly.

Imagine you go in at the ground floor when Bitcoin was worth 10 cents in 2010. Had you invested $100 you’d have bagged around 1,000 BTCs.

According to coinmarketcap.com BTC is currently worth $67,792.06, meaning your initial $100 investment would be worth $67,792,060 in Q4 2021. Therefore after 11 years of HODL’ing (buying and holding), you’d stand to make a huge profit.

This is why many crypto-hungry investors are looking for the next best upcoming digital assets that could replicate Bitcoin’s success.

$250 million worth of non-fungible tokens (NFTs) was exchanged last year. Crypto-enthusiasts were quick to start buying and selling NFTs in a whole host of categories including art, music, and in-game items.

For those unaware, NFTs are digital tokens that come with ownership and copyright details. The majority of NFTs are ETH-based tokens. Therefore, you’ll need to buy Ethereum to pay for your NFTs.

With the growing popularity of NFTs, many traders are looking at how to buy cryptocurrency in Canada. If you want to take part in the NFT craze you’ll need to buy cryptocurrency Canada. We recommend opting for Bitbuy or Capital.com.

The best way to buy cryptocurrency in Canada is to open an account with a top-rated crypto exchange or broker. Bitbuy is one the leading crypto exchanges because you’ll be able to buy and sell 9 of the most popular cryptos from the comfort of your own home.

Interac e-Transfer is a quick, safe, and easy way to send money to anyone in Canada via online banking. The payments are transferred through secure banking procedures. Transfers are almost instantaneous, but depending on your bank or credit union, they could take up to half an hour.

Bitbuy supports Interac e-Transfer as a payment method to buy cryptocurrency Canada. As we’ve already discussed, the flat fee on all buys and sells is 0.20%.

If you want to buy cryptocurrency with a bank wire transfer this will be more expensive than Interac e-Transfer. The minimum deposit for bank wire is $20,000.

Open an account and get KYC verified on Bitbuy. Deposit CAD into your account using a bank wire transfer. Purchase Bitcoin or any other altcoin supported by the exchange. You’ll then be able to store your cryptocurrencies on the regulated account or you can transfer them to either offline cold storage or a hot wallet.

PayPal is a popular payment method nowadays with over 403 million active registered accounts as of Q2 2021, according to statista.com. While Bitbuy doesn’t support PayPal, Capital.com does.

This means you can buy cryptocurrency CFDs with PayPal instantly. Capital.com also doesn’t charge deposit fees so you’ll be able to keep your overall expenses to a minimum.

To trade cryptocurrencies in Canada anonymously you’ll need to opt for a decentralized crypto exchange such as Binance, Uniswap, and Sushiswap. However, decentralized crypto exchanges are not regulated by a centralized financial authority and therefore do not offer the same investor protections.

As such, we recommend only choosing a regulated broker or crypto exchange. This way you know your account is secure, your funds are protected, and your buying and selling on a regulated trading platform.

The main risks associated with cryptocurrency trading Canada are tied to market volatility. Cryptocurrencies carry high-risk and are speculative financial instruments. Therefore, understanding these risks is one of the key parts of learning how to buy cryptocurrency in Canada.

Surprise shifts in market sentiment, such as bullish and bearish trends, can drive acute and sudden price fluctuations. On May 19th 2021 the price of Bitcoin fell to $34,356.25. Then on November 19th 2021 BTC reached record highs of $68,530.34 according to coinmarketcap.com.

In the space of 24 hours, the market price of Bitcoin has risen by 6.67%. To put that into perspective, the NASDAQ stock index is up by +0.24% in Tuesday’s trading as of 9:43 am ET.

Cryptocurrencies do not fall under the remit of federal governments or centralized financial institutions like banks. But, as they start to become more popular, financial regulators are being forced to address the issue. The debate is centered on whether digital assets should be categorized as commodities or digital currencies.

Blockchain forks are a split in the blockchain network. The ability to experiment with open-source software is a key feature of cryptocurrencies, and it also helps with blockchain software updates.

Blockchain forks happen when the open-source software used by individual Bitcoin miners doesn’t match. Crypto miners choose which blockchain they’ll continue using. If miners can’t agree on which version of the blockchain to use, this can lead to a blockchain fork. As a result, this can drive heightened market volatility.

Now that you’re aware of the best trading platforms to use, as well as the various payment methods and associated risks, it’s time to look at the actual buying process.

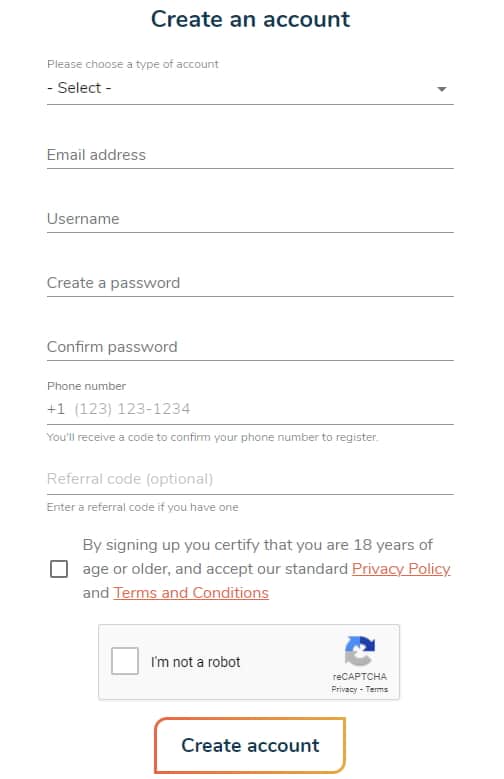

Visit bitbuy.ca and click on ‘Get Started’ to create your new account. You’ll be required to enter some personal details in addition to creating a username and password.

Once you’re done populating the form, accept the terms and conditions and tap on ‘Create account’.

You’ll be asked to confirm your email address, phone number and verify your identity. As Bitbuy is FINTRAC regulated it means you’ll undergo all the necessary steps and regulations to ensure you are who you say you are.

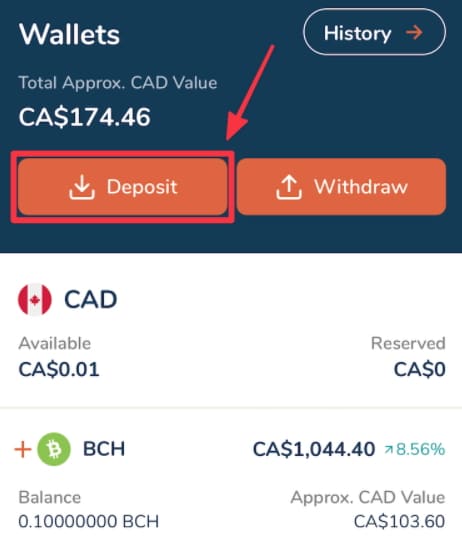

Once you’ve successfully verified your identity, you’ll be able to fund your Bitbuy account with either a bank wire transfer or cryptocurrency Interac e-Transfer. The minimum deposit when using Interac e-Transfer is just $50.

To fund your account simply sign in to your Bitbuy account and select ‘Add Funds’ and then either ‘Use e-Transfer’ or ‘Use Wire Transfer’. Then sign in to your financial institution’s online banking platform and send your e-Transfer. You can also complete this step via the cutting-edge Bitbuy mobile app.

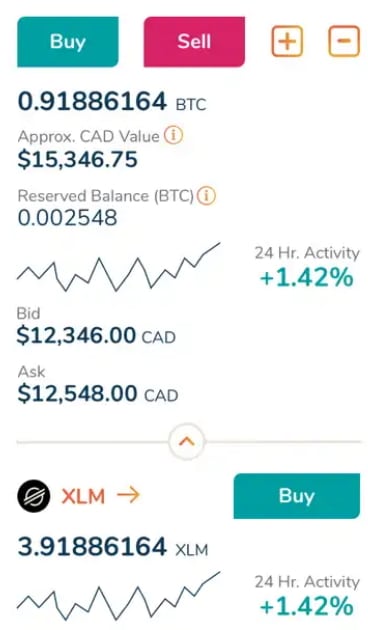

Buying Bitcoin and other altcoins with Bitbuy is simple and easy. Head over to the ‘Express Trade’ section of your account, find the cryptocurrency you want to buy in Canada, enter the CAD amount you want to invest, and tap ‘Buy’ to complete the transaction.

When you buy cryptocurrency Canada, you’ll undoubtedly want to know how to sell your crypto holdings. Bitbuy makes this process as simple as buying cryptocurrency Canada.

Here’s how you’d go about selling cryptocurrency on Bitbuy:

All in all, this beginner’s guide has explored everything you need to know about how to buy cryptocurrency in Canada. From the top-two crypto exchanges to understanding risks and how to trade Bitcoin, Ethereum, and other popular digital assets.

Bitcoin is currently cruising around all-time highs. As more institutional investors and household names start investing in and using cryptocurrencies, some market analysts suggest prices could continue to surge. With that in mind, if you’re looking to buy cryptocurrency Canada right now, follow the link below and open an account with Bitbuy today!