Survey Says: September Rate Hike

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

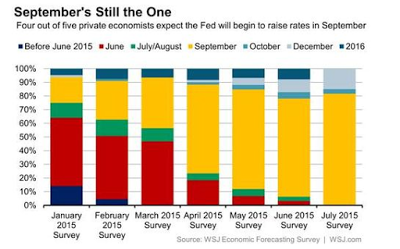

The latest Wall Street Journal survey found that 82% of economists expect a Fed hike in September, completely dismissing a July hike, as this Great Graphic illustrates. A December hike is more likely to occur as noted by 15% of the survey participants.

Last month the survey found 72% expected the hike in September, and 9% favored December. None of the respondents thought the Fed would wait until 2016 to raise rates, which is a first for this year’s surveys.

The latest Wall Street Journal survey found that 82% of economists expect a Fed hike in September, completely dismissing a July hike, as this Great Graphic illustrates. A December hike is more likely to occur as noted by 15% of the survey participants.

Last month the survey found 72% expected the hike in September, and 9% favored December. None of the respondents thought the Fed would wait until 2016 to raise rates, which is a first for this year’s surveys.

Yellen and Fischer have both framed the issue as early and gradual or later and risk a more rapid adjustment. Of course, there are many, including the IMF that disagrees. It has called on the Fed to wait until next year.

Krugman argues that if the Fed is late to raise rates that inflation would rise a little. However, if it is early, the US risks a lost decade. Isn’t that hyperbole? Is the US economy so vulnerable than a small increase in rates would send it down for the count? Does a hike in September really risk ten years of pain?

The way that the Fed handled QE and the tapering was successful. The Fed appears to be sticking with that strategy: Say what you are going to do. Give domestic (and foreign) investors plenty of time to adjust their exposures accordingly. Then do it. This speaks to the Fed’s transparency and credibility.

Often commentators and observers confuse what they think the Fed ought to do with what it is likely to do. Reasonable people differ on the “ought,” but as the Wall Street Journal survey shows, there is a strong majority that expects the Fed to hike in September.

A September rate hike maximizes the Fed’s options. It could go again in December. That would be the two rate hikes that a slim majority of Fed officials thought would be appropriate in at the June meeting. Without hiking rates in September, the Fed loses that option.

When discussing inflation expectations, the Federal Reserve identifies two main measures. One is market-based, and the other is from surveys. There has been a divergence between the two, and in recent months, the Fed has preferred the surveys.

A parallel divergence has been evident in Fed expectations as well. The surveys have more consistently anticipated a Fed hike this year. Here is how we calculate the expectations embedded in the Fed funds futures.

The effective Fed funds rate has averaged the mid-point of the Fed funds 0-25 bp range. We assume it continues to do that in the first half of September. We assume delivery of a 25 bp hike at the conclusion of the FOMC meeting on September 17, and that the funds rate averages the middle of the new 25-50 bp range for the remainder of the month. The effective Fed funds will averages 22.8 bp in September.

To be sure, it is not clear where the Fed funds will trade within a new range once the Fed raises rates. The middle of the range is arguably the neutral assumption. That is one of the elements that are different on this side of the financial crisis. The Federal Reserve has adopted a target range for Fed funds.

Currently, the September Fed funds contract implied yield is 17.5 bp. This is equivalent to about a 50% chance of a hike (compared with 82% in the Wall Street Journal survey). Despite the ostensibly clear signals by Yellen over the past week, the implied yield on the September Fed funds contract is up a single basis point on the week. It is unchanged since the middle of June.

Great Graphic: Fed Expectations–Surveys and the Market is republished with permission from Marc to Market