Did Germany Force The Eurozone Into The Debt Crisis?: Michael Pettis

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

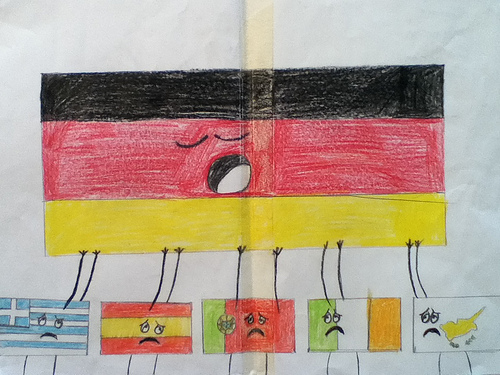

As monetary policy across the eurozone was made to fit German needs, excess German liquidity – accumulated from years of trade surpluses and policy controls – was easily exported into Spain and other peripheral European countries which all saw their trade deficits expand dramatically. In fact, the subsequent imbalance became so large that it led almost inevitably to the European crisis in which we are today.

As monetary policy across the eurozone was made to fit German needs, excess German liquidity – accumulated from years of trade surpluses and policy controls – was easily exported into Spain and other peripheral European countries which all saw their trade deficits expand dramatically. In fact, the subsequent imbalance became so large that it led almost inevitably to the European crisis in which we are today.

One of the reasons that it is been so hard for a lot of analysts, even trained economists, to understand the imbalances that were at the root of the current crisis is that we too easily confuse national savings with household savings. By coincidence there was recently a very interesting debate on the subject involving several economists, and it is pretty clear from the debate that even accounting identities can lead to confusion.

The difference between household and national savings matters because of the impact of national savings on a country’s current account, as I discuss in a recent piece in Foreign Policy. In it I argue that we often and mistakenly think of nations as if they were simply very large households. Because we know that the more a household saves out of current income, the better prepared it is for the future and the more likely to get rich, we assume the same must be true for a country. Or as Mr. Micawber famously insisted:

Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.

But countries are not households. What a country needs to get wealthier is not more savings but rather more productive investment. Domestic savings matter, of course, but only because they are one of the ways, and probably the safest, to fund domestic investment (although perhaps because they are the safest, investment funded by domestic savings can also be misallocated for much longer periods of time than investment funded by external financing).

Saving in itself, however, does not create wealth. It is productive investment that creates wealth. Domestic savings simply represent a postponement of consumption.

In the late 19th Century, as I discuss in my most recent book, economists like John Hobson in the UK and Charles Arthur Conant in the US noticed that the rich countries of the west were exporting large amounts of savings abroad – mostly to what were later called by the dependencia theorists of the 1960s the peripheral nations. Hobson and Conant argued that the reason for this excess savings had to do with income inequality. As more and more wealth is concentrated into the hands of fewer people, consumption rises more slowly than production, largely because the wealthier a person gets, the smaller the share he consumes out of his income. Notice that because savings is simply total production of goods and services minus total consumption, this forces up the national savings rate.

Excess savings, they pointed out, was not a result of old-fashioned thrift but rather a consequence of structural distortions in the economy. The consequence of this “thrift”, furthermore, was not greater wealth but rather structural imbalances in the global economy.

Table of Contents

Confusing Thrift With Inequality

Even economists who really should know better manage to make some fairly impressive mistakes when they discuss Chinese and other savings imbalances, mostly because their understanding of savings can be hopelessly confused. For a typical example, consider a piece Raman Ahmed and Helen Mees, published last year called, “Why do Chinese households save so much?”

In the article the authors try to address the causes of China’s high savings rate, but they do so by thoroughly confusing national savings with household savings. For example they set out trying to prove that financial repression has no impact on China’s savings rate, but because they fail to understand that financial repression does this by reducing the household share of income, and not necessarily by reducing the household savings rate, they find:

China’s monumental savings rate is a popular topic of for policy discussion. It has been blamed for the global financial crisis, currency wars, and the ensuing Great Recession. But what explains the high savings rate?

…Although the savings rate varies significantly per income group, with the lowest income group’s savings rate in urban areas in the single digits and the highest income group’s savings rate at almost 40% of disposable income, we do not find evidence that income inequality as such is a motive for households to save a larger portion of their income, as Jin et al. (2010) have suggested. It would have been the Chinese version of ‘keeping up with the Joneses’, albeit that ‘keeping up with the Wangs’ would not have involved conspicuous consumption but rather conspicuous saving. This would have instigated higher savings rates across the board of deciles of savings rates, with the strongest effect on low-income households. However, using urban data on household savings rates and income inequality from 1985-2009, we do not find this effect present.

There is no evidence that the household savings rate in China is high because of low deposit rates, as Michael Pettis (2012) has asserted time and again, which would indicate that the income effect of lower deposit rates trumps the substitution effect of lower deposit rates. The coefficient of the deposit rate has alternating signs, but is insignificant in every single estimate.

The article purports to discuss what they refer to as China’s “monumental savings rate”, which, according to the authors, has been blamed for the global financial crisis, currency wars, and the ensuing Great Recession, but it focuses on the wrong savings rate. Chinese household savings are not by any definition “monumental”, and they most certainly did not cause the global financial crisis, nor does anyone seriously claim that they did. Chinese household savings rates are high, but not exceptionally high, and because household income is such a low share of GDP, Chinese household savings as a share of GDP, which is what really matters, are even lower than the household savings rate would imply. Chinese household savings are not the problem.

It is China’s national savings rate which is “monumental” and which drives China’s current and capital account imbalances, and the national savings rate is monumentally high because the national consumption rate (which consists mostly of the household consumption rate) is extraordinarily low. The authors have either confused national and household savings rates or they have failed to see that what matters is not the household savings rate but rather total savings. Aside from the fact that there is indeed evidence that Chinese savings are negatively correlated with interest rates, for example a 2011 study done by the IMF, the relationship is one of pure logic.

Related: Is There Any Credibility Left In China’s Bull Case?: Michael Pettis

The important lesson from this article, aside from suggesting just how confused many economists are when it comes to understanding the source of global imbalances, is that national savings represent a lot more than the thriftiness of local households, and as such it has a lot less to do with household or cultural preferences than we think. In fact many factors affect the savings rate of a country, including demographics, the extent of wealth inequality, and the sophistication of consumer credit networks, but when a country has an abnormally high savings rate it is usually because of policies or institutions that restrain the household share of GDP.

This has happened not just in China but also in Germany. In the 1990s Germany could be described as saving too little. It often ran current account deficits during the decade, which means that the country imported capital to fund domestic investment. A country’s current account deficit is simply the difference between how much it invests and how much it saves, and Germans in the 1990s did not always save enough to fund local investment.

But this changed in the first years of the last decade. An agreement among labor unions, businesses and the government to restrain wage growth in Germany (which dropped from 3.2 percent in the decade before 2000 to 1.1 percent in the decade after) caused the household income share of GDP to drop and, with it, the household consumption share. Because the relative decline in German household consumption powered a relative decline in overall German consumption, German saving rates automatically rose.

Notice that German savings rate did not rise because German households decided that they should prepare for a difficult future in the eurozone by saving more. German household preferences had almost nothing to do with it. The German savings rate rose because policies aimed at restraining wage growth and generating employment at home reduced household consumption as a share of GDP.

As national saving soared, the German economy shifted from not having enough savings to cover domestic investment needs to having, after 2001, such high savings that not only could it finance all of its domestic investment needs but it had to invest abroad by exporting large and growing amounts of savings. As it did so its current account surplus soared, to 7.5 percent of GDP in 2007. Martin Wolf, in an excellent Financial Times article on the subject, points out that

between 2000 and 2007, Germany’s current account balance moved from a deficit of 1.7 per cent of gross domestic product to a surplus of 7.5 per cent. Meanwhile, offsetting deficits emerged elsewhere in the eurozone. By 2007, the current account deficit was 15 per cent of GDP in Greece, 10 per cent in Portugal and Spain, and 5 per cent in Ireland.

Employment Policies and The Savings Rate

It is tempting to interpret Germany’s actions as the kind of far-sighted and prudent actions that every country should have followed in order to keep growth rates high and workers employed, but it turns out that these policies did not solve unemployment pressures in Europe, and this is implied in the second sentence of Martin Wolf’s piece. Germany merely shifted unemployment from Germany to elsewhere. How? Because Germany’s export of surplus savings was simply the flip side of policies that forced the country into running a current account surplus.

To explain, let us pretend that Europe consists of only two countries, Spain and Germany. As we have already shown, forcing down the growth rate of German wages relative to GDP caused the household income share of GDP to drop. Unless this was matched by a decision among German households to become much less thrifty, or a decision by Berlin to increase government consumption sharply, the inevitable consequence had to be a reduction in the overall consumption share of GDP, which is just another way of saying that the German national savings rate had to rise. During this period, by the way, and perhaps as a consequence of restraining wages, Germany’s Gini coefficient seems to have risen quite markedly, and the resulting increase in income inequality also affected savings adversely.

As German savings rose, eventually exceeding German investment by a wide margin, Germany had to export the difference, which its banks did largely by making loans into the rest of Europe, and especially those countries that were financially “shallower”. Declining consumption left Germany producing more goods and services than it could absorb domestically, and it exported excess production as the automatic corollary to its export of savings.

Of course the rest of the world had to absorb excess German savings and run the current account deficits that corresponded to Germany’s surpluses. This was always likely to be those eurozone countries that joined the monetary union with a history of higher inflation and currency depreciation than Germany – countries which we are here calling “Spain”. As monetary policy across Europe was made to fit German needs, which was looser than that required by Spain, and as German savings were intermediated by German banks into Spain, the result was likely to be higher wage growth, higher inflation, and soaring asset prices in Spain.

[quote] In fact this is exactly what happened. Spain and the other peripheral European countries all saw their trade deficits expand dramatically or their surpluses (many were running large surpluses in the 1990s) turn into large deficits shortly after the creation of the single currency as their savings rates shifted to accommodate German exports of its excess savings. [/quote]

Related: Spain Still In Pain: No Clear Sign Of Recovery?

The way in which the German exports of savings were absorbed by Spain is at the heart of the subsequent crisis. As long as Spain could not use interest rates, trade intervention, or currency depreciation to block German exports, it had no choice but to balance the excess of German savings over investment. This meant that either its investment would have to rise or its savings would have to fall (or both).

Both occurred. Spain increased investment in infrastructure and in real estate (and less so in manufacturing, probably because German growth occurred at the expense of the manufacturing sectors in the rest of Europe), but it seems to have done both to excess, perhaps because of the sheer amount of capital inflows. After nearly a decade of inflows larger than any it had ever absorbed before, Spain, like nearly every country in history under similar circumstances, ended up with massive amounts of misallocated investment.

But this was not all. If the savings that Germany exported into Spain could not be fully absorbed by the increase in Spanish investment, the only other way to balance was with a sharp fall in Spanish savings. There are two ways Spanish savings could have fallen. First, as the Spanish tradable goods sector lost out to German competition, Spanish unemployment could rise and so force down the Spanish savings rate (unemployed workers still must consume).

Second, Spain could have reduced household savings voluntarily by increasing consumption relative to income. Higher Spanish consumption would cause enough employment growth in the services and real estate sectors to make up for declining employment in the tradable goods sector.

Raising Consumption

Not surprisingly, given the enormous optimism that accompanied the creation of the euro, the latter happened. As German money poured into Spain, helping ignite a stock and real estate boom, ordinary Spaniards began to feel wealthier than they ever had before, especially those who owned their own homes. Thanks to this apparent increase in wealth, they reduced the amount they saved out of current income, as households around the world always do when they feel wealthier. Together the reduction in Spanish savings and the increase in Spanish investment (in infrastructure and real estate) was enough to absorb the full extent of Germany’s export of excess savings.

But at what cost? The imbalance created within Europe by German policies to constrain consumption forced Spain into increasing consumption and boosting investment, much of the latter in wasted real estate projects (as happened in every one of the deficit countries that faced massive capital inflows). There are of course no shortage of moralizers who insist that greed was the driving factor and that Spain wasn’t forced into a consumption boom. “No one put a gun to their heads and forced them to buy flat-screen TVs”, they will say.

Related: The Bane Of Spain: How The Property Market ‘Broke’ The Economy

Related Video: €SPANISH DR€AM – How Spain’s Housing Bubble Destroyed The Nation

But this completely misses the point. Because Germany had to export its excess savings, Spain had no choice except to increase investment or to allow its savings to collapse, with the latter either in the form of a consumption boom or a surge in unemployment. No other option was possible.

To insist that the Spanish crisis is the consequence of venality, stupidity, greed, moral obtuseness and/or political short-sightedness, which has become the preferred explanation of moralizers across Europe begs the question as to why these unflattering qualities only manifested themselves after Spain joined the euro. Were the Spanish people notably more virtuous in the 20th century than in the 21st? It also begs the question as to why vice suddenly trumped virtue in every one of the countries that entered the euro with a history of relatively higher inflation, while those eastern European countries with a history of relatively higher inflation that did not join the euro managed to remain virtuous.

The European crisis, in other words, had almost nothing to do with thrifty Germans and spendthrift Spaniards. It had to do with policies aimed at boosting German employment, the secondary impact of which was to force up German national savings rates excessively. These excess savings had to be absorbed within Europe, and the subsequent imbalances were so large (because German’s savings imbalance was so large) that they led almost inevitably to the circumstances in which we are today.

[quote] For this reason the European crisis cannot be resolved except by forcing down the German savings rate. And not only must German savings rates drop, they must drop substantially, enough to give Germany a large current account deficit. This is the only way the rest of Europe can unwind the imbalances forced upon the region in a way that is least damaging to Europe as a whole. Only in this way can countries like Spain stay within the euro while bringing down unemployment. [/quote]

But lower German savings don’t mean that German families should become less thrifty, only that the average German household should be allowed to retain a much larger share of what Germany produces. If Berlin were to cut consumption taxes, or cut income taxes for the lower and middle classes, or force up wages, total German consumption would rise relative to GDP and so national savings would fall – without requiring any change in the prudent behavior of German households.

As long as it is part of the euro Spain has no choice but to respond to changes in German savings rates. There is nothing mysterious about this process. It is simply the way the balance of payments works, and thrift has nothing to do with it. If Germany does not take steps to force down its savings rate by increasing the household share of GDP, then either all of Europe becomes like Germany, in which case growth slows to a crawl and some other country – maybe the US? – will be forced to resolve Europe’s demand deficiency either through higher unemployment or through higher debt, or Europe must break apart to free Spain and the other peripheral countries from German savings imbalances.

I don’t imagine the rest of the world can absorb demand deficiency from a Germanic Europe, and if Europe tries to force it the result will almost certainly be an eventual collapse in trade relations, so either Germany rebalances or Europe breaks apart. It is hard for me to see many other options.

Related: Another Eurozone Crisis In 2014?: Nouriel Roubini

Related: Spain in Pain: Why Leaving the Euro Is The Lesser of Two Evils: Michael Pettis

By Michael Pettis

Michael Pettis is a senior associate at the Carnegie Asia Programme and professor of finance with Peking University’s Guanghua School of Management. Pettis previously taught at Tsinghua University and Columbia University, and worked on Wall Street in trading, capital markets and corporate finance.

This is an abbreviated version of Excess German savings, not thrift, caused the European crisis republished with permission from China Financial Markets.

Get more special features in your inbox: Subscribe to our newsletter for alerts and daily updates.

Do you have a strong opinion on this article or on the economy? We want to hear from you! Tell us what you think by commenting below, or contribute your own op-ed piece at [email protected]