Can China Alone Save the Eurozone?

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

China is under pressure to bailout European countries facing debt crises. It is in the interest of China to save the eurozone, but China so far seems reluctant to extend a helping hand. As governor of the Chinese central bank, Zhou XiaoChuan told the IMF, it is still too early for China to intervene – which is probably code for “If you think we are buying euros or even euro bonds on any kind of scale while you are in this mess, think again.”

China is under pressure to bailout European countries facing debt crises. It is in the interest of China to save the eurozone, but China so far seems reluctant to extend a helping hand. As governor of the Chinese central bank, Zhou XiaoChuan told the IMF, it is still too early for China to intervene – which is probably code for “If you think we are buying euros or even euro bonds on any kind of scale while you are in this mess, think again.”

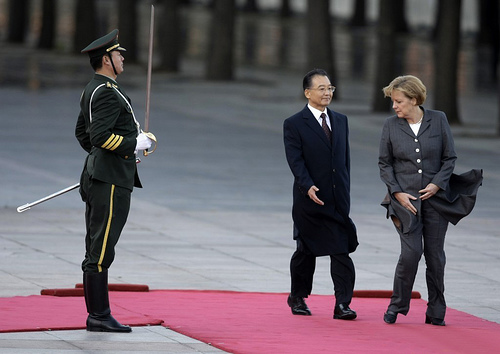

China’s Premier, Wen Jiabao, has said on a number of occasions that China is willing to support Europe. To date, however, China has declined to fill in the details as to what the extent of such help might be or how far it may be prepared to go to help Europe’s political elite find a way out of a dilemma that they seem so palpably to be unable to resolve for themselves.

What is not unclear, however, is that the Chinese, like the rest of us, are exasperated by the lack of political leadership in Europe on the issue. The Euro politicians’ squabbling over the terms of any further Greek bail-out – banks to take 50% haircuts, 60% haircuts, 80% haircuts? – uncannily parallels the recent spectacular and thoroughly disgraceful scene presented by US Republicans and Democrats squabbling right up to the final moments over the raising of the US debt ceiling. The developed world seems singularly bereft of political leadership at present and the Chinese, not surprisingly, feel that a prod in the ribs is in order.

Related: China is sick of US’ hollow promises and reckless government: Stephen S. Roach

The governor of the People’s Bank of China (PCB) Zhou Xiaochuan told the IMF recently that a prompt resolution to the euro-area debt crisis was needed. Referring to Eurozone bank vulnerabilities to sovereign debt, he commented:

[quote]The negative feedback loop between public-sector and private financial institutions’ vulnerabilities weighs heavily on market confidence and limits the effectiveness of macroeconomic policies.[/quote]Zhou kept his comments at the level of what consultants like to call a “helicopter view” of advanced economies, emphasising that leaders in those economies needed to “take prompt measures to repair the financial sector and introduce fundamental reform to the labor and property markets.”

Double-edged sword

It is impossible not to see some irony here in that China has property market issues of its own – a legacy of the massive credit stimulus package it introduced to counteract the 2008 global downturn – for which it has yet to negotiate a successful soft landing. It also has some massive labor market issues, not least because it is running out of fresh labor in the 20 to 35 age group category, the category that works hardest for the lowest wages, to feed into its massive industrialization programme. So it is not surprising to find that property and labor are uppermost in Zhou’s mind.

Related: China’s ghost towns: Overdevelopment in the real estate market

Related: Myths debuked: Why China will have a soft landing: Stephen S. Roach

In the case of Europe, of course, what he has in mind is somewhat different. His reference there is clearly a) to the dodgy property filling Irish and Spanish bank portfolios and b) to the crippling productivity shortfall in Euro peripheral countries by comparison with the labor productivity of Germany and France. Both issues are at the core of the sovereign debt problems that the PIIGS (Portugal, Ireland, Italy, Greece and Spain) are grappling with and until these issues are solved China feels disinclined to act.

[quote]As Zhou told the IMF, it is still too early for China to intervene – which is probably code for “If you think we’re buying euros or even euro bonds on any kind of scale while you are in this mess, think again.” [/quote]The Chinese want a strong Europe to export into and they desperately want an alternative to a rapidly devaluing dollar as a store for their mammoth trade surplus, but they don’t want to jump out of the fire of an eroding dollar into the frying pan of a collapsing euro. In the end though, it is not in China’s interests to sit on its hands while Europe comes apart at the seams. At the very least we can expect its message to European leaders to become ever more forceful and urgent.

Related: Sino-US power play: Why China has to buy US debt

By Anthony Harrington

Anthony Harrington is an award-winning business and energy journalist, writing regularly for the Scotsman newspaper, the Glasgow Herald newspaper, Financial Director magazine, Pensions Insight magazine, CA Magazine, and a number of other publications. He won Business Finance Journalist of the Year 2006, Institute of Financial Accountants, and Journalist of the Year, State Street 2006 Institutional Press Awards, and was runner up in 2007 and 2008.

Does China want to save the Eurozone? is republished with permission from the QFinance Blog.