A Dozen Alarming Consumer Debt Statistics

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

21 May 2011.

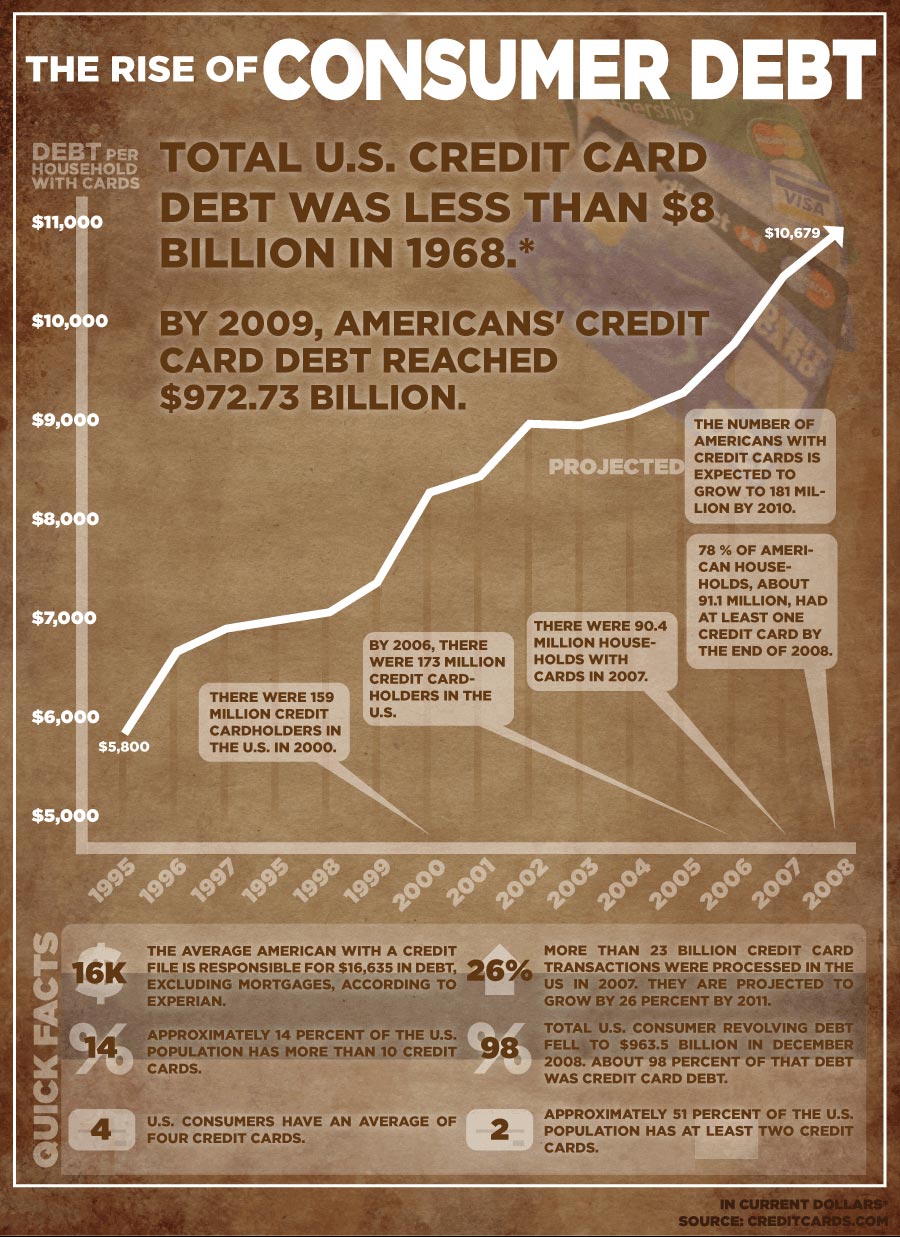

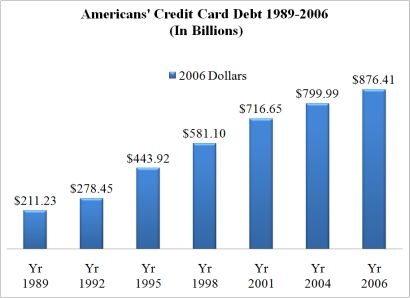

In the US, consumers and households are dangerously in debt. Even after the catastrophic financial crisis in 2008, it seems in 2010 lessons from past mistakes have not been learned and taken on board. The Federal Reserve is looking at $2.4 trillion in unsecured debt. And the numbers just keep rising.

Eighty-eight million accounts and credit lines representing $751 billion in credit have been closed since September 2008.

Here are a dozen alarming consumer debt statistics:

21 May 2011.

In the US, consumers and households are dangerously in debt. Even after the catastrophic financial crisis in 2008, it seems in 2010 lessons from past mistakes have not been learned and taken on board. The Federal Reserve is looking at $2.4 trillion in unsecured debt. And the numbers just keep rising.

Eighty-eight million accounts and credit lines representing $751 billion in credit have been closed since September 2008.

Here are a dozen alarming consumer debt statistics:

1. The total amount of consumer debt in the US is nearly $2.4 trillion in 2010. That’s $7,800 debt per person.

2. Thirty-three percent of that debt is revolving debt (such as credit card debt), the other 67 percent comes from loans (such as car loans, student loans, mortgages and the like).

3. $51 billion worth of fast food was charged to credit cards in 2006, compared to $33.2 billion the previous year.

4. The average credit card debt per cardholder is $5,100, and expected to increase to $6,500 by the end of the year.

5. 1 in 10 consumers has more than 10 credit cards.

6. The average consumer carries 4 credit cards. While the average household carries $6,500 of debt.

7. 1 in 50 households carry more than $20,000 in credit card debt. That amounts to more than 2 million households.

8. 4.5 percent of cardholders are 60 or more days late in their payments.

9. Roughly 2 – 2.5 million Americans seek the help of a credit counselor each year to avoid bankruptcy.

10. On average, clients seeking financial counseling were $43,000 in debt. Of which $20,000 was consumer debt and $8,500 was revolving debt (such as credit card debt).

11. By the end of 2010, there were 115,000 bankruptcy filings in California alone. Across the US, 1 in every 160 people filed for bankruptcy.

12. The states with the highest credit card debts were Alaska ($7,665), Tennessee ($7,054) and Nevada ($6,517).

Statistics sourced from Moneyzine and Hoffman Brinker.Why so much debt?

Late payments on credit card bills are closely linked to unemployment levels. Which in the US, have yet to recover to conducive levels since the financial crisis in 2008. Thirty percent of middle income households in debt also reported medical expenses as the main reason for unpaid balances.

However, the Federal Reserve Bank says: [quote]40 percent of households simply spend more than they earn.[/quote]

Liz Zuliani

EconomyWatch.com

Get budgeting and debt advice on EconomyWatch.

Source: VisualEconomics