Tax Code Simplification Presidential Candidate-Style

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

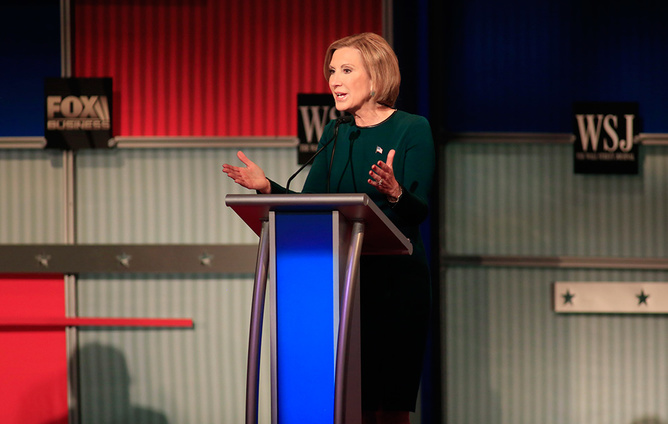

One of the 17 presidential candidates recently said, “I can write a tax code in three pages.” Carly Fiorina is not alone among her fellow 2016 presidential contenders in advocating tax reform and simplification of the tax code. However, none is quite so ambitious.

I suppose that theoretically one could write a tax code on three sheets of paper that would raise enough revenue to fund the US government. Let us consider that challenge for a moment by measuring a baseline first. Then we can consider the issues of simplification.

One of the 17 presidential candidates recently said, “I can write a tax code in three pages.” Carly Fiorina is not alone among her fellow 2016 presidential contenders in advocating tax reform and simplification of the tax code. However, none is quite so ambitious.

I suppose that theoretically one could write a tax code on three sheets of paper that would raise enough revenue to fund the US government. Let us consider that challenge for a moment by measuring a baseline first. Then we can consider the issues of simplification.

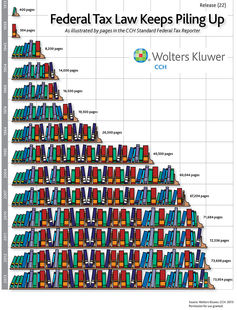

So what is a baseline? Dutch information services company Wolters Kluwer, for one, publishes a softcover two-book version of the Internal Revenue Code (IRC) that is 5,296 pages long. Just for reference purposes, the IRC is known as Title 26 of the United States Code, which is a codified version of all of the statutes passed by Congress and signed by the president.

I downloaded a listing of each section of the IRC, and that alone was 69 pages. If you throw in the Code of Federal Regulations associated with the IRC – the rules written by the Department of the Treasury – you have tens of thousands more.

Wolters Kluwer

However, the body of tax law is more than just the IRC and its legislative and interpretive regulations. It also includes the jurisprudence or “common law,” what we refer to as law established from the sum of all relevant court cases. That of course ignores the thousands of IRS rulings, procedures, legal memoranda, and notices. All told, Wolters Kluwer publishes nearly 74,000 pages of law and interpretations.

Frankly, I have been providing tax advice to clients, Congress, the IRS, and the Treasury Department for 30 years, and I am intimidated by the amount of compression necessary to get it down to three sheets of paper.

How might we simplify over one hundred years (the IRC’s predecessor dates back to 1913) of tax law? In addition, who is responsible for doing so? Could a would-be President Fiorina actually accomplish this?

Candidate Fiorina is serious about simplifying the tax code. However, could she do it? Reuters

Guide to good tax policy

Let us start the thought process with some notions about what is good tax law.

I have a copy of a tax policy concept statement called “Guiding Principles of Good Tax Policy: A Framework for Evaluating Tax Proposals,” prepared by the American Institute of Certified Public Accountants (AICPA). It was first published in 2001 and revised in 2011.

It says there are ten guiding principles of good tax policy:

* equity and fairness

* certainty

* convenience of payment

* economy of collection

* simplicity

* neutrality

* economic growth and efficiency

* transparency and visibility

* minimum tax gap

* appropriate government revenues

So let us say the AICPA got it right for the moment. Some argue that the CPAs of the world (who wrote this framework) have a vested interest in IRC complexity. However, the above list does not sound like that is the case.

In fact, the AICPA issued a second tax policy concept statement entitled “Guiding Principles for Tax Simplification“ in 2002 and republished the document in 2010. These principles include making simplification a priority, minimizing the burdens of compliance, limiting how frequently tax law changes and maintaining consistency among concepts and definitions. In other words, the people most immersed in tax law clearly favor simplicity.

Who is behind the curtain?

So who creates the law? Who has the power to simplify the tax code?

Congress does.

Tax bills generally originate in the House Ways and Means Committee. They wind their way through a legislative negotiation process and ultimately must be approved by both the House and Senate. The president then generally signs those that make it through this gauntlet.

Therefore, I think we are on to a culprit here. The president does not enact legislation, the judges do not enact legislation, and the people do not enact legislation, except through the authority delegated to their representatives in Congress.

I am thinking the bulls-eye is on Capitol Hill, as do the thousands of lobbyists, think tanks and special interest groups, who have a very different level of influence over Congress in a post-Citizens United world.

In fact, Congress directs IRS activities by enacting authorizing statutes. Therefore, if I follow the members of Congress correctly, they have been railing at the IRS for doing what Congress told them to do. In fact, the IRS is struggling to try to do what Congress asked them to do, without adequate funds to do the job.

Try calling the IRS some time! They answer the phone only 37% of the time, according to the IRS Taxpayer Advocate’s published performance measures.

IRS has had to shift people from its customer service functions to administer the Affordable Care Act and the Foreign Account Tax Compliance Act because Congress did not give it funds to cover those requirements.

In fact, IRS workers are so tired of the complexity and unfunded mandates from Congress that employees up for retirement within the next two years – 69% of executives and 48% of management – are highly likely to brain drain away as soon as they can.

The IRS has had to sequester, slash, and hack away at its 100,000 employees so it is down now to roughly 87,000 because of budget cuts. So if you thought of the IRS as some sort of Darth Vader zapping people from a death star (while line dancing, mind you), you are wrong. Picture a group of badly mistreated and beaten-up employees, shaking, as they are in hiding in their basements as a more accurate picture.

The IRS is already struggling to do what Congress asked it to do. Reuters

How do we get to three sheets?

So how do we get a simplified tax code of three sheets given the picture just painted?

A president cannot do it. The president gets to draft a proposed spending budget and send it to Congress. The president can ask/beg/borrow/horse-trade/steal/persuade all he (maybe she, someday) wants to, and the legislation still must come from Congress. The president just gets to say Yea or Nay at the tail end.

Therefore, if we are to get to three sheets, Congress has to do it. That would mean Congress would have to take that AICPA simplification guidance to an extreme.

That leaves us with two questions. Could Congress do it? In addition, would Congress do it?

I suppose Congress could slough off over 100 years of tax law development and just say: “Send in 30% of what you made.”

There, I did it: a tax code in one sentence. However, some questions come up: send to whom? When? All at once? Collected where I work? What does “what I made” mean? Is it 30% of gross sales? Sales after expenses? Which expenses? What if I want a Mercedes truck instead of a Ford truck to expense? Should I expense it all in one year or depreciate it over several years? Can I expense the wages paid to undocumented workers? Can I expense the costs of selling marijuana in my state, where it is legal?

Starting to understand how we got to tens of thousands of pages of tax law after more than 100 years yet?

It is apparent to me that Congress could not reasonably accomplish the feat of whittling that down to three pages. Clearly, a president is barely in the mix of influencers.

Would Congress simplify the IRC if it could? Many of us tax geek scholars explain the tens of thousands of pages of tax law as the largest social programming document on the planet. The IRC, for example, says we get special treatment if we buy a house, make babies, or invest in the next new technology and on and on.

Congress would never give up its ability to influence social and economic behaviors and draft a tax code that simply brings in enough money to cover spending, let alone occupies the space of three sheets.

The US government has cumulatively spent US$18 trillion more than what it has taken in. As long as Congress keeps spending like a proverbial drunken sailor, the tax code will remain long, and lawmakers will remain three sheets to the wind.

Is Fiorina’s tax proposal three sheets to the wind? is republished with permission from The Conversation