Trump’s Trade and Immigration Policies Could Be the Next Big Worry for Fed

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

The minutes of the Federal Reserve’s December meeting show that the US central bank is worried about the trade and immigration policies of President-elect Donald Trump even as it does not mention him by name. The Fed is worried that Trump’s proposed policies could fuel inflation.

“Almost all participants judged that upside risks to the inflation outlook had increased,” said the minutes. They went on to add, “As reasons for this judgment, participants cited recent stronger-than-expected readings on inflation and the likely effects of potential changes in trade and immigration policy.”

Fed Cut Rates by 25 Basis Points in December

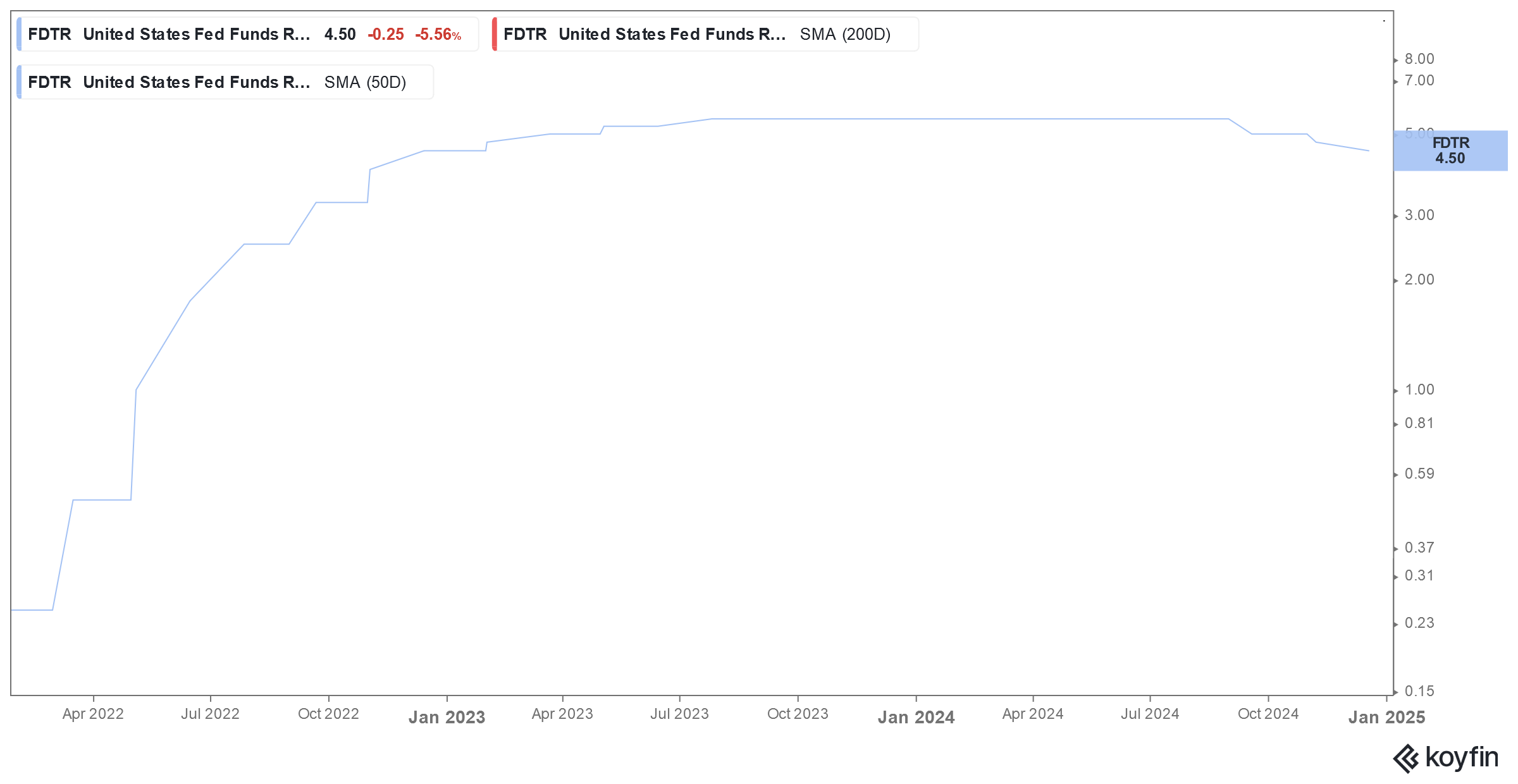

As widely expected, the US Federal Reserve slashed rates by 25 basis points at its meeting last month. However, the so-called dot plot showed Fed now sees only 2 rate cuts of 25 basis points in 2025 prompting other central banks to also weigh their moves.

The current Fed fund rates stand at 4.25%-4.5% after that cut- a level they were in December 2022. The US central bank has cut rates by 100 basis points this year. While it began with a 50-basis point rate cut in September, it followed up with 2 cuts of 25 basis points at subsequent meetings. At his press conference following the December FOMC meeting, Fed chair Jerome Powell said, “Today was a closer call but we decided it was the right call.”

Fed Sees Only Two Rate Cuts in 2025

While a December rate cut always looked like a done deal, markets were more interested in the rate cut outlook for the next year. The dot plot calls for only two rate cuts each in 2025 and 2026, assuming their quantum to be 25 basis points.

At the press conference last month, Fed chair Powell said, “With today’s action, we have lowered our policy rate by a full percentage point from its peak, and our policy stance is now significantly less restrictive.”

He added, “We can therefore be more cautious as we consider further adjustments to our policy rate.” The Fed chair emphasized, “We moved pretty quickly to get to here, and I think going forward obviously we’re moving slower.”

Notably, while US inflation has gradually come down after peaking in mid-2022, it is still higher than the 2% that the Fed target. The core inflation was 3.3% in November

Trump’s Tariffs Could Complicate the Picture

There are risks that Trump’s trade war could push up prices. The president-elect has vowed to impose tariffs on goods coming from countries ranging from Canada to China which could have some inflationary impact. While in his first tenure, Trump claimed that the tariffs are borne by exporting countries, economists disagree and say that they are borne by the US consumer. In one of his interviews last year, Trump said that he cannot “guarantee” that his tariffs won’t hurt Americans.

Outgoing Treasury Secretary Janet Yellen also believes that tariffs would be destabilizing. According to Yellen, “So it would have an adverse impact on the competitiveness of some sectors of the United States economy and could significantly raise costs to households.” He added, “So this is a strategy I worry could derail the progress that we’ve made on inflation and have adverse consequences on growth.”

Fed Sees a Slower Path to Rate Cuts

Meanwhile, the minutes of the Fed’s December meeting show that the US central bank would be cautious on rate cuts going forward. “In discussing the outlook for monetary policy, participants indicated that the Committee was at or near the point at which it would be appropriate to slow the pace of policy easing,” said the minutes.

Fed Chair Jerome Powell Warned of Unsustainable Debt Position

Last fiscal year, the US budget deficit was $1.8 trillion, and while it is still below the pandemic highs, the deficit is significantly higher than what it was prior to the pandemic.

There hasn’t been any respite this fiscal year and in the first two months, the US budget deficit soared 64% YoY to $624 billion. Higher US interest rates are only adding to the burden and the US government spent $1 trillion on interest payments on the ballooning national debt last fiscal year.

Powell has also talked about the need to address the rising US debt situation. In his interview with CBS 60 Minutes last year, he said, “The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy.”

He added, “I think the pandemic was a very special event, and it caused the government to really spend to ward off what looked like very severe downside risks. It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

Trump Said He Won’t Try to Remove Powell as Fed Chair

The Fed chair warned, “we’re effectively — we’re borrowing from future generations. And every generation really should pay for the things that it, that it needs. It can cause the federal government to buy the things that it needs for it, but it really should pay for those things and not hand the bills to our children and grandchildren.”

Notably, while Trump appointed Powell as the Fed chair the relations between the two were quite fraught as Powell raised rates during Trump’s presidency, much to his displeasure. In 2022, Joe Biden repointed Powell as the Fed chair for four years and Trump has said that he won’t try to remove him from the position.

Traders See the Federal Reserve Taking a Cautious Stance in 2025

All said, given the uncertainty over the geopolitical situation and Trump’s tariffs, the Fed might take a more cautious stance toward rate cuts at least in the first half of the next year. Traders are also quite divided over the Fed’s policy in 2025 and while a third of the traders polled by CME FedWatch Tool see the US central bank cutting rates by 25 basis points next year, 31.3% see a 50- basis point rate cut. Just about 20% of the traders see rates being cut by over 50 basis points next year.

Meanwhile, bond markets have also started factoring in a slower path to rate cuts and the 20-year yield rose above 5% while the 10-year yield topped 4.7%.