Top 5 Cryptocurrency to Buy For Christmas 2021

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Looking to add 5 top cryptocurrency to your portfolio this Christmas? Before you jump in and add any old cryptocurrency to your Christmas list, you need to understand the use cases and features of the token you are planning to invest in and whether the risk-reward potential is right for you.

Here are the top 5 cryptocurrency to consider investing in this holiday season

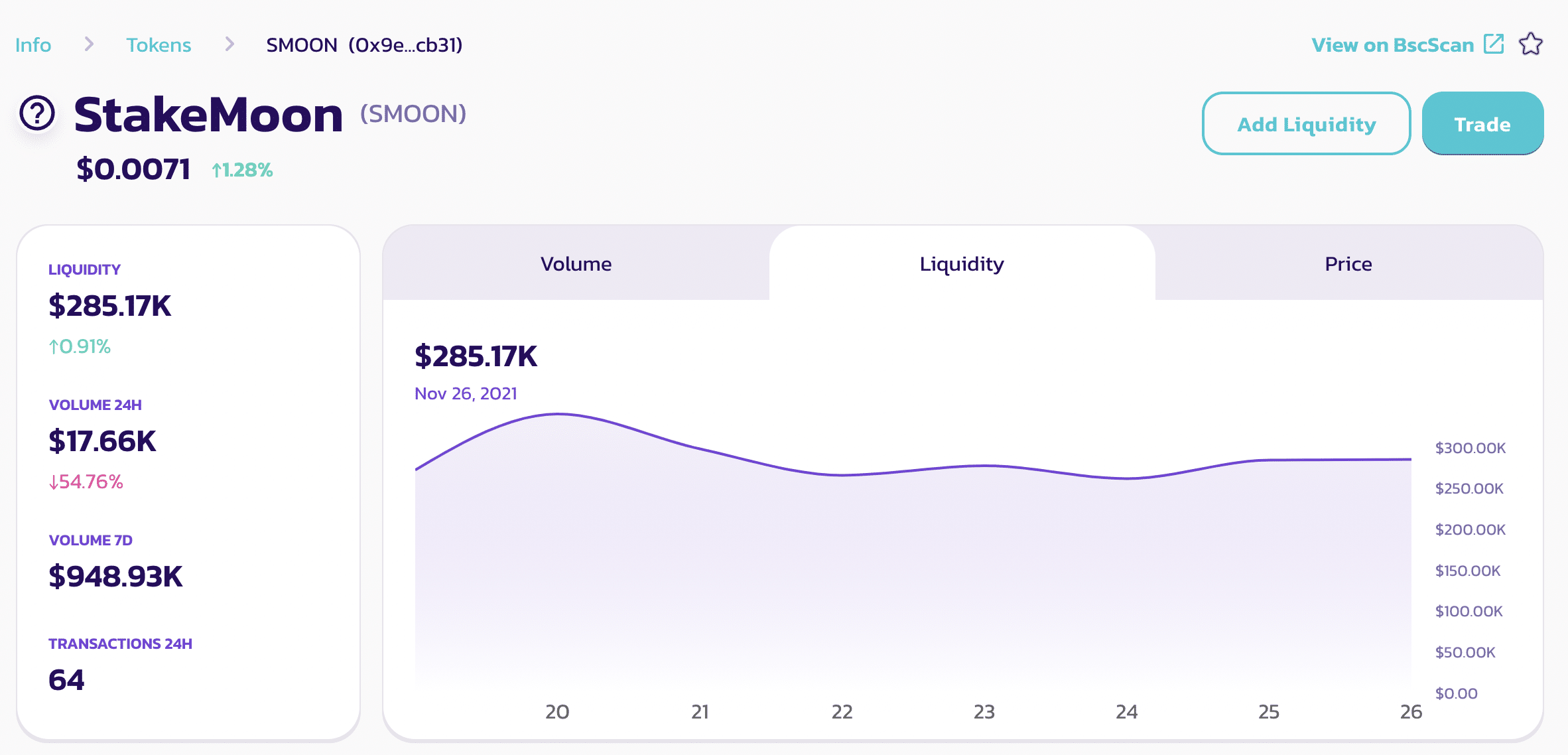

1. StakeMoon (SMOON)

Since launching in early November, StakeMoon has raised $1,200,000 and continues to climb. The new and innovative digital cryptocurrency project is still in its infancy but looks like a promising investment. Striving to reward long-term holders, StakeMoon’s token has a taxation policy that penalizes market speculators, resulting in regular dividend payments for existing token holders and flexible staking rewards.

Transactions attract a taxation rate of 15%. Of this figure, 10% is distributed to existing token holders, while the remaining 5% is allocated to the StakeMoon liquidity pool. The StakeMoon tokens are not locked into a minimum redemption period. Instead, “stakers” can withdraw their StakeMoon at any given time.

StakeMoon has recently launched on the PancakeSwap decentralized exchange (DEX) on November 20, creating a marketplace for users to buy, sell, and trade hundreds of decentralized finance (DeFi) currencies without third-party involvement. The value of StakeMoon will therefore be dictated by market forces.

StakeMoon has been heating up fast and keeping tight on its roadmap, with plans to list on BitMart in early 2022 with CoinGecko and CoinMarketCap listings coming soon.

StakeMoon is a Binance Smart Chain-based autonomous staking and liquidity creating technology, launching new and innovative digital cryptocurrency projects.

To learn more, visit https://stakecoins.com, or follow StakeMoon on Telegram, Twitter and Instagram.

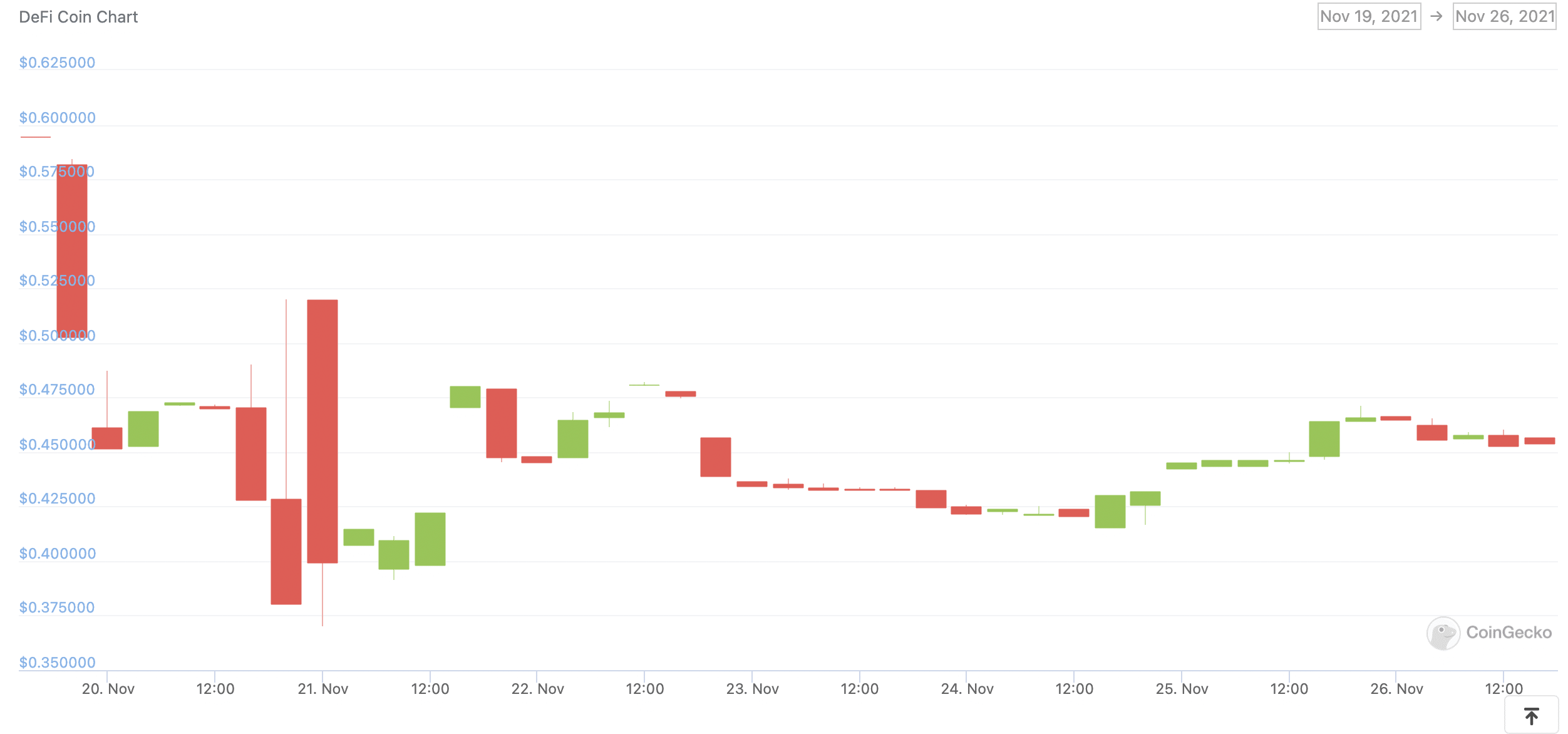

2. DeFi Coin (DEFC)

DeFi Coin (DEFC) is the digital token that represents the DeFiCoins.io website and DeFi Swap exchange. By allowing buyers and sellers to exchange value directly with other market participants – the DeFi Swap exchange ensures that there is no requirement to go through a centralized third party. The DeFi Coin umbrella actively promotes three functions:

- Static Rewards

- Automatic Liquidity Pools

- Manual Burning Strategy

Users are encouraged to hold their DeFi Coin tokens on a long-term basis. This is because transactions are taxed at a rate of 10%. As a result, this discourages day trading – which has the undesired effect of causing increased volatility levels and wild pricing swings.

Perhaps most importantly, 5% of this figure is distributed to existing DeFi Coin token holders, which is not much different from conventional dividend payments. The other 5% is utilized to provide liquidity to decentralized exchange services.

A major benefit of holding DeFi Coin tokens is that users can earn dividends via a static reward system.

DeFi Coin is currently trading at $0.456.

To learn more and purchase DeFi Coin, visit https://deficoins.io and you can also purchase on Bitmart.

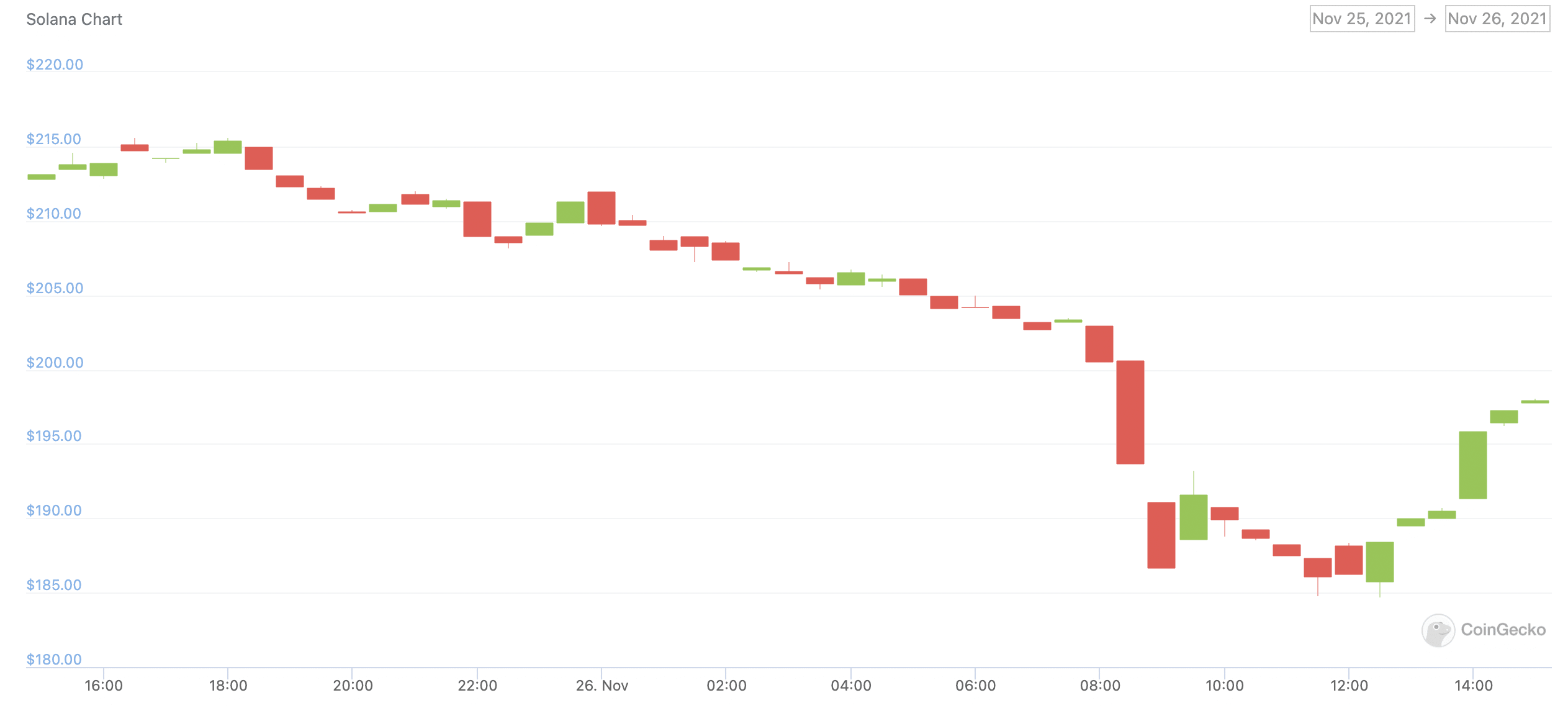

3. Solana (SOL)

Solana is an open-source project implementing a new, high-performance, permissionless blockchain. All about speed, Solana has 400 millisecond block times and as hardware gets faster, so does the network. Solana’s scalability ensures transactions remain less than $0.01 for both developers and users. Price-wise, Solana is currently selling at an average price of $0.00025.

Not only is Solana ultra-fast and low cost, but it is also censorship resistant. This means that the network will remain open for applications to run freely, and transactions will never be stopped.

Solana’s crypto-economic system is designed to promote a healthy, long term self-sustaining economy with participant incentives aligned to the security and decentralization of the network. The main participants in this economy are validation-clients.

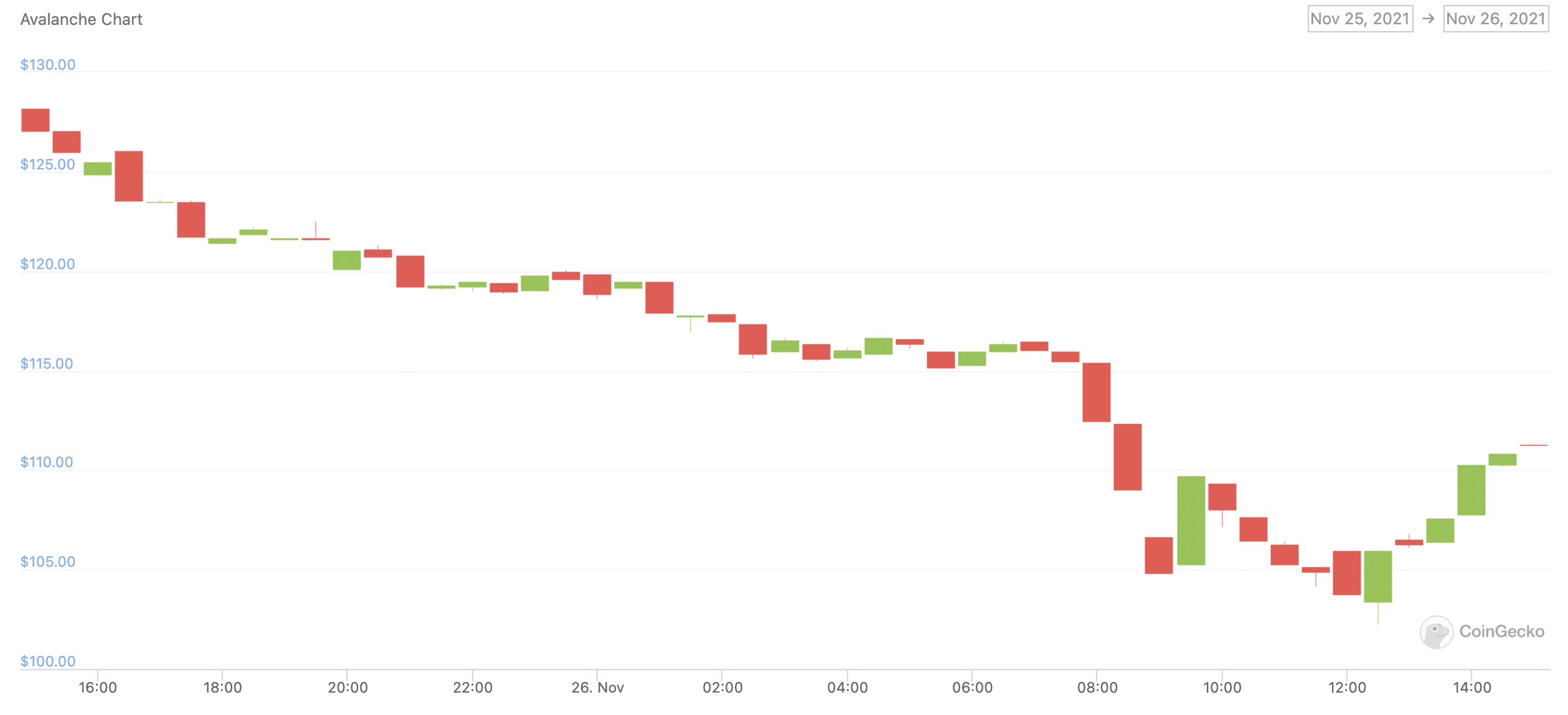

4. Avalanche (AVAX)

Avalanche is an open, programmable smart contracts platform for decentralized applications and is claiming itself as the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol.

The native token secures the network, pays for fees, and provides the basic unit of account between the multiple blockchains deployed on the larger Avalanche network.

The resources spent by a validator for staking are proportional to that validator’s total stake. Avalanche has unique benefits including:

- The rewards accumulated by a validator for validating are proportional to that validator’s total stake.

- Since Avalanche is leaderless, there are no “rich-get-richer” compounding effects. Validators that lock their stake for longer are rewarded more.

- Validators are incentivized to stay online and operate correctly as their rewards are based on proof-of-uptime and proof-of-correctness.

- $AVAX is a capped-supply token, with a maximum cap of 720 million tokens. While capped, $AVAX is still governable.

- The rate at which the maximum cap is reached is subject to governance. Fees are not paid to any specific validator. Instead, they are burned, thus increasing scarcity of the $AVAX.

5. Radix (XRD)

Radix promises to put the fun back into DeFi with a focus on the community, security and scalability. Radix focuses on the community, recognizing each individual developer and allows them to contribute to the online DeFi component library in exchange for direct royalty fees when projects use their components to build the next billion-dollar DeFi application.

Radix is the only decentralized network where developers will be able to build quickly without the constant threat of exploits and hacks, where every improvement will get rewarded, and where scale will never be a bottleneck.

Radix’s unique benefits including:

- 100% of all transaction fees are burned.

- 53.8% of token supply is locked on average across POS networks.

- 300 million XRD per year will go to stakers for securing the network.

- eXRD/SRD bridge will allow users to move quickly between Ethereum and Radix.

Your capital is at risk.

For more information on how to buy cryptocurrency, read our guide at the link.