Royal Mail Share Forecast November 2021 – Time to Buy RMG?

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

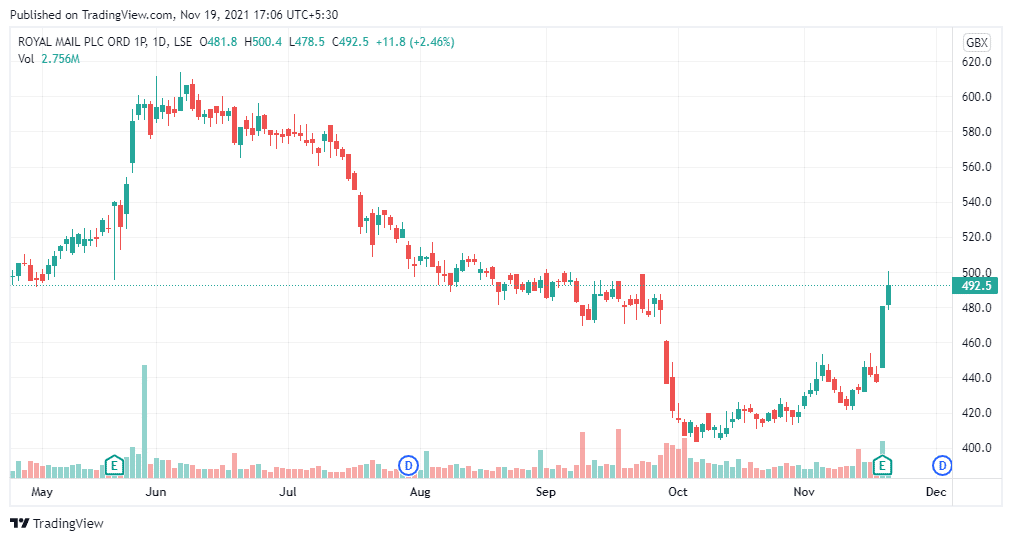

Shares of UK’s designated Universal Postal Service Provider Royal Mail (LSE: RMG) are in the green today, currently trading at 491.4p at the time of writing. The shares shot up 9% trading over 480p, which puts its gain over a one-week period at around 12% and a gain of 60% in the past year. The short surge was caused by the company releasing its half-year results that contained several positive metrics.

Royal Mail – Technical Analysis

The financial statement for Royal Mail indicates a market cap of £480.525 billion with total assets worth £998.5 billion. Revenue for 2020 was at £1263.80 billion with a profit margin of 4.91% compared to £1084.00 billion in 2019.

Oscillators such as Relative Strength Index (14)(73.7) and Stochastic %K (14, 3, 3) (84.0) are neutral while moving averages such as Exponential Moving Average (10)(453.0), Simple Moving Average (10)(445.1), Exponential Moving Average (20)(443.0), Simple Moving Average (20)(437.0) and Exponential Moving Average (30)(441.5) are indicating a buy action.

68% of all retail investor accounts lose money when trading CFDs with this provider.

Recent Developments

Back in August, royal mail was struggling with falling parcel volumes compared to 2020 due to the pandemic. The company was considering a number of cost-cutting measures in response which includes a deal with the Communication Workers Union signed in December 2020 that allows for increased automation.

But after the company recently released half-year results, all those concerns were laid to rest. Positive metrics included an increase of domestic parcel volume of 33% versus H1 2019-20. Revenue was up 7% to reach £6 billion which bolstered operating profits. Operating profits came in at £311 million compared to £331 million. It’s still impressive considering the large restricting costs incurred last year. The company has also set aside £200 million for special dividends and £200 million for share buybacks.

RMG shares have still performed for holders over 2021 despite losing momentum recently. They are up 61% in the last 12 months and 35% year to date. The company also compares very favorably with the FTSE 100 which makes it advantageous to pick RMG shares up rather than buying an index tracker. The company has announced an interim dividend of 6.7p per share this morning but analysts think RMG will return 20.4p per share in FY22.

Should You Buy RMG Shares?

Many investors have stayed away from RMG in the past citing its dwindling letters business and increased competition as major reasons. The company isn’t immune to inflation that has impacted most firms. There is also concern among many that Royal Mail may fail to meet its financial goals over 2022. If this occurs, the company may be forced to increase net debt levels as cash flow is also tight. The competition in the sector is still very high. While strong half-year results are a good thing, Royal Mail isn’t immune from increased competition from other providers.

Royal Mail’s headway could be eroded if customers start to move elsewhere due to deteriorating service. Consumers may lose confidence in the group’s ability to deliver which will result in the company losing market share to its peers. Competition has always been a factor that investors look for when they invest in Royal Mail. It will only increase as more and more businesses try to capitalize on the burgeoning e-commerce market. Inspite of all these risks and challenges, investors should be thrilled by the company’s potential. If it can build over the success it has achieved over the past two years, share prices will skyrocket. Investors should thus capitalize on the low current share valuation and buy RMG to add to their portfolios.