Kusama Price Up 2% – Time to Buy KSM?

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Given that it is such a hot commodity, several investors are pushing to buy KSM. KSM has proven to be a solid blockchain stock, making it a good buy for investors in both long and short terms. Below, we will share some insights into KSM, the Kusama network, and what the future looks like.

Kusama: An Incubation Room for Polkadot’s Projects

Kusama is a scalable network of specialized blockchains built using almost the same codebase as Polkadot. Dubbed by many as Polkadot’s “wild, lesser-known cousin,” Kusama is a more experimental version of Polkadot.

The primary use of Kusama is to serve as a testing ground for projects looking to launch on Polkadot. Developers can create anything they dream up, and they can launch on Kusama for the community to comment on and decide on the project’s future.

Kusama soaks the risk of early experimentation, and only projects that prove themselves to be stable enough will be able to move to Polkadot.

Several projects that will launch on Polkadot have had iterations on Kusama. For instance, Polkadot’s MoonBeam smart contract platform, which will bring Ethereum compatibility to the network, first launched on Kusama as MoonRiver.

Community divisions are much faster on Kusama. The chain is also cheaper for developers, which attracts developers to the network.

KSM is Kusama’s native coin – just as DOT functions for the Polkadot blockchain. Users who buy KSM and stake it can vote on network upgrades, just like DOT. Kusama also rewards users with newly minted KSM tokens based on how many they stake. So, many stakers don’t need to buy KSM anymore.

KSM: Price Movements in 2021

KSM has coasted of Polkadot’s popularity quite well. With the latter hyping up Kusama and its functionality, investors have been just as eager to buy KSM as they have been to buy DOT.

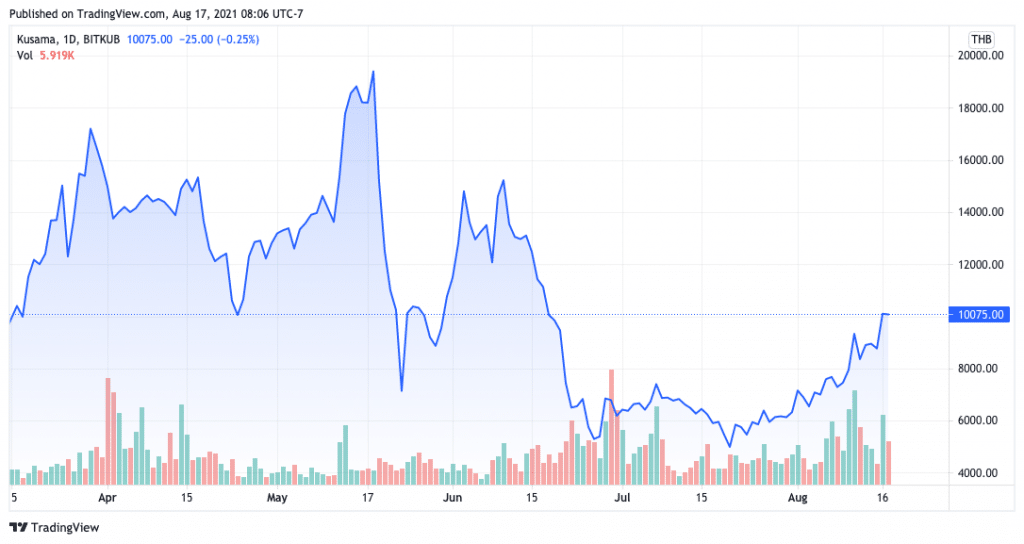

KSM started the year trading at $70.59 and soon jumped to $568.09 on March 29. The gains continued, leading to an all-time high of$625.78 on May 18. Even after several other coins had begun to dip following the onset of the downturn, KSM stayed relatively above water. Its all-time high marked a gain of 786 percent from the start of the year.

But, the gains didn’t last long. The downturn hit KSM, and the slump began. Just 3 days after claiming its all-time high, KSM was hit with sell orders and slumped to $159.02. The slump continued, with KSM eventually bottoming out at $141.41 on July 20, following a market selloff last month.

KSM’s price bottom marked a 77.4 percent drop from its all-time high, but still a healthy 100 percent gain from the start of the year.

Following its bottom, things started to look up again; investors were encouraged to buy KSM as the market recovery began, leading to a current price of $310.81. KSM is up 2 percent in the past 24 hours and 30 percent in the past week.

KSM: Technical & Fundamental Analysis

KSM is doing quite well technically. The asset is trading well above its 20-day moving average (MA) of $238.55, and it just passed its 200-day MAA of $307.60 earlier today. This means that the asset is well placed to make some impressive gains in the coming days.

Moving on, KSM’s relative strength index (RSI) stands at 75.97. That’s not bad for a cryptocurrency, showing that investors have been quick to buy KSM following several successive days of gains.

As for fundamentals, KSM investors will be happy to know that the platform is working hard towards a full launch. Parachain auctions are still going on for Kusama, and last month, KaruraSwap – a decentralized exchange – went live on Polkadot and Kusama.

Karura had emerged as the first winner of Kusama’s parachain slot. With $3.4 million in assets locked and backing from Coinbase Ventures, the company brings a great deal of credibility to the Kusama ecosystem.