Crypto Fraud Cost Americans $9.3B in 2024: FBI

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

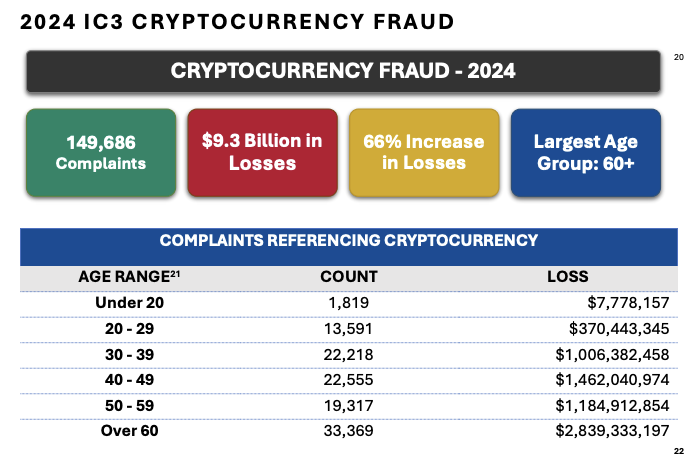

On April 23, the Internet Crime Complaint Center (IC3) of the Federal Bureau of Investigation (FBI) revealed a rise in crypto fraud. Losses jumped over 66% from $5.6 billion in 2023 to over $9 billion in 2024.

The agency received more than 140,000 crypto-related complaints. Victims aged 60 and over filed roughly 33,000 of those reports, losing a combined $2.8 billion.

🚨JUST IN: THE FBI REPORTS THAT AMERICANS LOST $9.3B TO CRYPTOCURRENCY FRAUD IN 2024

— BSCN (@BSCNews) April 24, 2025

Cybercrime Evolves: How Criminals Are Weaponizing Crypto Technology

California and Texas were the hardest-hit states in these scams in the U.S, suffering $1.39 billion and $738 million in losses, respectively.

Ransomware attacks, which rose 9% in 2024, pose the most pervasive threat to critical infrastructure.

Attackers lock systems and demand cryptocurrency payments, disrupting essential services.

At the same time, sextortion scams generated the highest volume of complaints. Fraudsters manipulate photos and videos to create compromising content and threaten to publish it unless victims pay in crypto.

Parallel to these tactics, crypto investment scams, often called “pig butchering,” inflicted their own share of damage. Scammers would build online relationships over days or weeks before pitching fake, high-yield opportunities and vanishing once victims transfer funds.

Crypto ATMs and kiosks have also become tools for fraud, enabling criminals to launder illicit funds quickly.

The FBI’s “Operation Level Up” saved about $285 million by notifying 4,323 victims of cryptocurrency investment fraud between January 2024 and January 2025.

Agents also intervened in over 5,400 cases, referring victims to suicide prevention services following extortion attempts.

Blockchain analytics firm Chainalysis estimated $41 billion in illicit crypto volume last year, with roughly 25% tied to hacking, extortion, trafficking, or scams.

High-profile breaches included a $1.4 billion Bybit heist in February and North Korean hackers seizing more than $1.3 billion.

Chad Yarbrough, the FBI’s criminal cyber branch director, warned that cryptocurrency would remain a key tool for illicit schemes, including cheating investors and laundering proceeds.

With generative AI making scams more scalable, regulators and platforms face increasing pressure to strengthen KYC, transaction monitoring, and public awareness.

Experts warn that 2025 could see even greater fraud losses without stronger defenses.

Global Hunt for Crypto Criminals Heats Up

Authorities haven’t stayed idle. Investigations and arrests are underway across borders.

In April, U.S. officials arrested a Nigerian national for orchestrating a $2.5 million cryptocurrency romance scam that preyed on vulnerable victims.

The scam involved emotional manipulation, fake identities, and crypto wallets to launder funds. He currently faces charges of mail fraud and money laundering, with up to 40 years in prison.

Following an #FBI Boston investigation, Charles Uchenna Nwadavid, of Abuja, Nigeria, has been indicted for allegedly stealing more than $2.5 million from six romance scam victims & transferring their money to cryptocurrency accounts that he controlled. https://t.co/S51gLhxZND pic.twitter.com/sDmlgEfqaT

— FBI Boston (@FBIBoston) April 9, 2025

The investigation is ongoing, with potential further arrests.

Meanwhile, the Australian Securities and Investments Commission (ASIC) secured court orders to shut down 95 companies linked to online investment scams, including “romance baiting” and “pig butchering.”

Some efforts have led to successful recoveries. One such case involved a 73-year-old woman in Delhi Township, Ohio, who was scammed. However, due to swift intervention, authorities were able to help her recover $35k in Bitcoin.