Bitcoin Rally to $47,000 Shows it is the Great Portfolio Diversifier

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

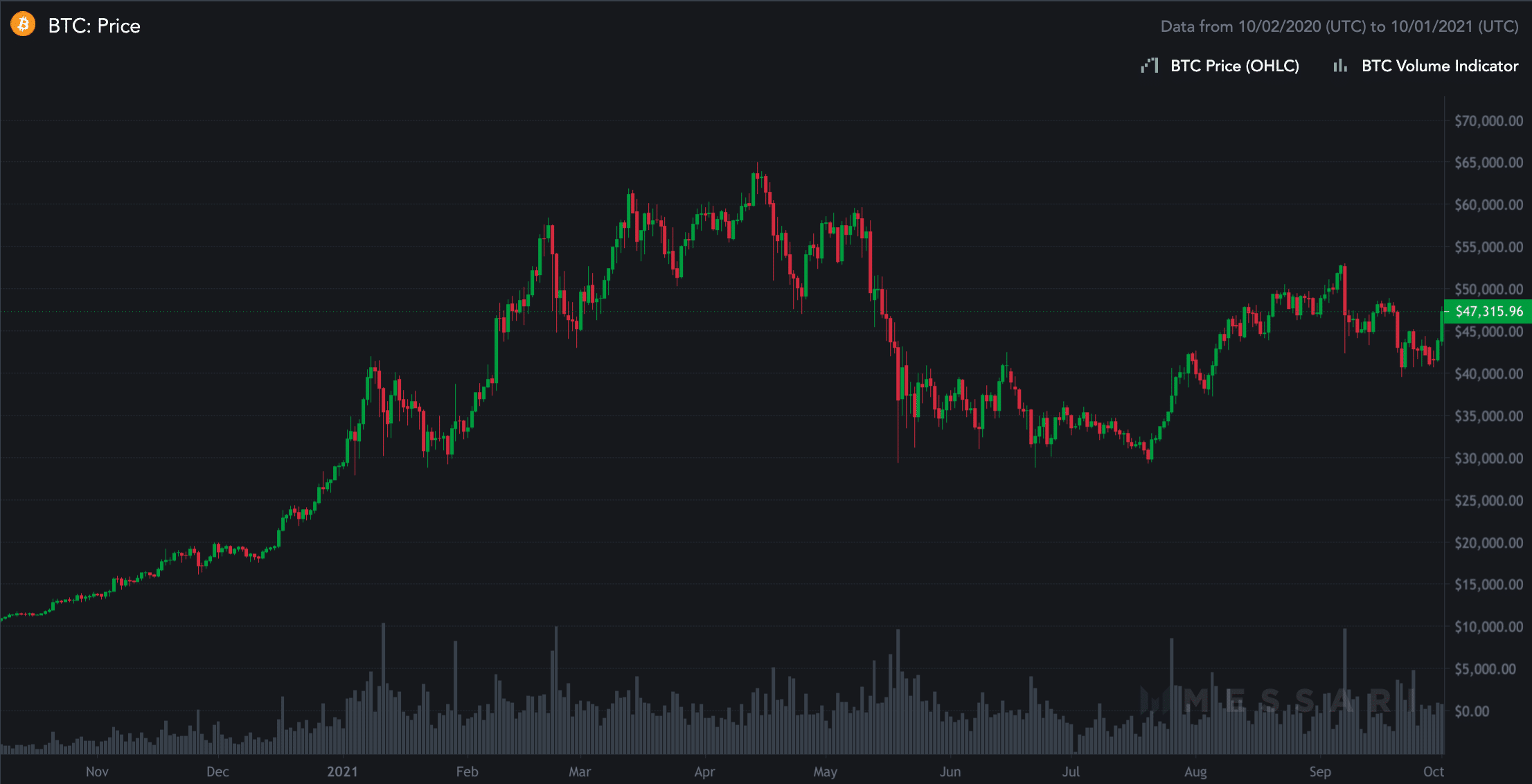

Bitcoin has lifted the entire crypto market higher today, jumping 10% as a confluence of positive news flow brings out the bitcoin buyers.

The leading digital currency is currently trading at $47,196, leaping around $2,000 at the beginning of the US session.

Yesterday chair Jerome Powell let it be known that there was no intention on the part of US Federal Reserve to push for a prohibition on cryptocurrency. That was welcome news for crypto market participants and speaks to the starkly different approach in the US as compared to China, where all crypto activity has been banned.

SEC’s Gensler “look[s] forward” to bitcoin futures ETF filing

Gary Gensler at the Securities and Exchange Commission added to the positive mood music by restating his belief that a bitcoin ETF based on the CME futures product would provide investors with the necessary protections.

Such a product, in Gensler’s view, would fall within the Investments Company Act of 1940 and “provides significant investor protections,” he said, adding “I look forward to staff’s review of such filings.”

That was interpreted as a green light to bring such products to market. To be sure, a futures based product would not be the same as an ETF holding actual bitcoin and having to buy cryptocurrency directly, but it would provide both institutional and retail investors with a compliant route into the asset class.

Visa going all in on blockchain with “universal payments” hub

Other news that may have contributed to the surge in the bitcoin price came from Visa. The payments giant announced that it was working on a “universal payments channel” system that can handle CBDC, stablecoin, crypto and fiat currency all on one platform. Visa sees the new platform as a blockchain interoperability hub.

Visa sounds suitably excited about the possibilities of such a platform. “Imagine splitting the check with your friends, when everyone at the table is using a different type of money — some using CBDC like Sweden’s eKrona, and others preferring a private stablecoin like USDC,” it said in a statement accompanying the release of the news.

DBS bank gets green light for crypto division in Singapore

The good news didn’t stop there. In Asia, the Monetary Authority of Singapore (MAS) has granted a crypto licence to the crypto division (DBS Vickers) of DBS – the largest bank in the city state.

Singapore has been working to make itself the go-to hub for crypto in Asia. With China no longer on the playing field, that leaves Japan and Hong Kong as its main competition – it has one of the most developed regulatory frameworks for crypto, in its attempt to bring crypto in from the regulatory cold while at the same time encouraging financial innovation.

Australia’s Independent Reserve crypto exchange was also granted a licence by MAS).

The DBS Vickers operation is aimed at institutional clients and will use the bank’s previously established crypto exchange – DDEx – for trading.

The move by the regulator “coupled with recent enhancements to DDEx such as round the-clock operations since August, could add to DDEx’s volumes in the coming months and accelerate growth momentum for DBS’ digital asset ecosystem,” the DBS head of capital markets Eng-Kwok Seat Moey.

The fact that bitcoin has bounced so strongly off the low $40,000s it has been trading at for the past few days will further encourage bulls, underlying the relative lack of impact China’s move to ban crypto has had.

If you are looking to buy cryptocurrency in Singapore, check out our guide.

Is this bitcoin’s big uncoupling from equities?

But perhaps the most impressive thing about today’s rally – assuming it holds going into the weekend – is that it is taking place against a backdrop of spreading risk-off sentiment in equity markets.

Part of the narrative that has driven bitcoin higher historically is the claim that it could act as a portfolio diversifier alongside stocks. Such a scenario hasn’t played out this year, until now.

Gold is up today too, so maybe bitcoin is at last baring its digital gold teeth.

Also, PCE [personal consumption expenditure] inflation – the gauge the US Federal Reserve uses for inflation – has come in hotter than expected today in the US; and in the eurozone the inflation reading beat the forecasts (3.4% v 3.3%) as energy prices and supply chain constraints fuel a general rise in prices that increasingly looks like it is going to be anything but transitory.

Indeed, in testimony to Congress yesterday Powell said he could see elevated inflation sustaining into the second half of next year, which seems to stretch his previous definition of “transitory”.

Against an inflationary background, rising bond yields and, sooner than many may have previously expected, rising interest rates, bitcoin and the crypto asset class in general starts to look more attractive.

Buy BTC at eToro from just $50 Now!