Avacta Share Price Forecast July 2021 – Time to Buy AVCT?

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Shares of Avacta Group PLC (LSE: AVCT) have been rising recently, as they continue their positive increase from the end of March 2020. The company has entered into a non-exclusive distribution agreement with Calibre Scientific for its proprietary Covid-19 flow tests, which has caught the attention of investors.

Avacta Group PLC – Technical Analysis

According to Avacta Group PLC’s financial statement, the company’s market cap is £311.646 million, with total assets worth £67.462 million. Income for 2020 was at £3.64 million with a profit margin of -519.55% compared to £3.89 million in 2019. At the time of writing, AVCT shares are at £135.3 with an uptrend of 8.24%.

Technical information like oscillators such as Stochastic RSI Fast (3, 3, 14, 14)(48.5), Williams Percent Range (14)(−73.7), Bull Bear Power(−29.5) and Ultimate Oscillator (7, 14, 28)(40.0) is pointing towards neutral. On the other hand, moving averages for Avacta Group PLC such as Exponential Moving Average (100)(200.9), Simple Moving Average (100)(225.8), Exponential Moving Average (200)(185.7) and Simple Moving Average (200)(183.9) is pointing towards selling.

67% of all retail investor accounts lose money when trading CFDs with this provider.

Recent Developments

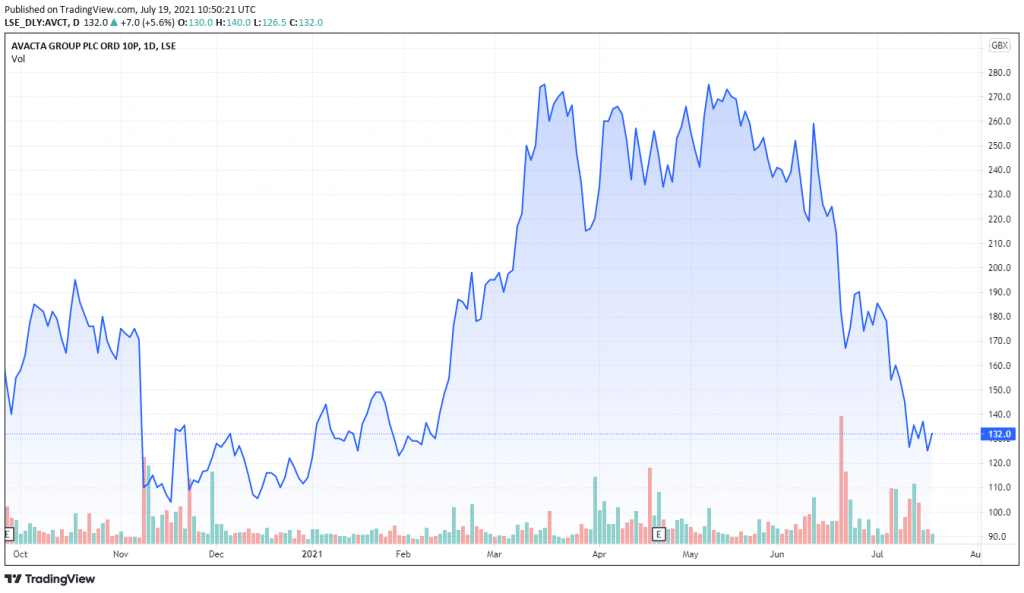

AVCT shares jumped and peaked on May 10th, 2021 at £273. It suffered a drop of 8.76% on July 16th, closing at £125, a 12 point loss since its previous close of £137. However, the company is volatile which increases the chances of share prices increasing again. The company recently announced that it has received the certification of managing, manufacturing, and distributing its proprietary ELISA screening tests, Affimer® and devices for immunodiagnostic in-vitro diagnosis. As a result of this ISO 13485 certification, Avacta can now transfer the CE mark for the AffiDX® SARS-CoV-2 antigen lateral flow test to Mologic. This will also make Avacta that the legal manufacturer of all future in-vitro diagnostic products.

Should You Buy AVCT Shares?

AVCT shares have experienced a 40% decrease in the past month despite the successive positive developments. The UK blue-chip equity benchmark FTSE 100 experienced its biggest fall too during the same period, as investors were in fear of the U.S. central bank slowing down its stimulus package. Since February 2020, Avacta emerged as a strong competitor since it started to pivot away from cancer treatments toward Covid-19 testing. It has experienced a 500% rally since making that change.

However, there are certain risks that investors have to consider for Avacta Group PLC’s shares. The fact that the company has earned a revenue of £3.64 million against a loss of £18 million in 2020 proves that it has yet to make a profit from COVID-19 testing. Its current market cap is more than 140 times its expected revenues for 2021, which is another reason investors stay away from AVCT shares.