Micro-Finance Industry ‘Blood Suckers’ Encounter Growing Global Hostility

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

1 February 2011.

Last month, we ran a disturbing Feature on the darker side of the for-profit micro-finance sector in India.

1 February 2011.

Last month, we ran a disturbing Feature on the darker side of the for-profit micro-finance sector in India.

Unfortunately, India is far from the only place in the world where

the once-vaunted micro-credit business has re-created the human misery it was designed to eliminate forever.

Indeed, microcredit is losing its halo in many developing countries.

It was once extolled by world leaders like Bill Clinton and Tony Blair as a powerful tool that could help eliminate poverty,

through loans as small as $50 to cowherds, basket weavers and other poor people for starting or expanding businesses.

But now microloans have prompted political hostility in Bangladesh, Nicaragua and other developing countries as well as India.

In December, the prime minister of Bangladesh, Sheik Hasina Wazed, who had championed microloans alongside President Clinton at talks in Washington in 1997, turned her back on them.

She said microlenders were “sucking blood from the poor in the name of poverty alleviation,”

and she ordered an investigation into Grameen Bank, which had pioneered microcredit

and, with its founder, was awarded the Nobel Peace Prize in 2006.

In India, until recently home to the world’s fastest-growing microcredit businesses,

lending has slowed sharply since Andhra Pradesh, the state with the most microloans, adopted a strict law restricting lending.

In Nicaragua, Pakistan and Bolivia, activists and politicians have urged borrowers not to repay their loans.

The hostility toward microfinance is a sharp reversal from the praise and good will

that politicians, social workers and bankers showered on the sector in the last decade.

Philanthropists and investors poured billions of dollars into nonprofit and profit-making microlenders,

who were considered vital players in achieving the United Nations’ ambitious Millennium Development Goals for 2015 that world leaders set in 2000.

One of the goals was to reduce by half the number of people in extreme poverty.

The attention lavished on microcredit helped the sector reach more than 91 million customers,

most of them women, with loans totaling more than $70 billion by the end of 2009.

India and Bangladesh together account for half of all borrowers.

But as with other trumpeted development initiatives that have promised to lift hundreds of millions from poverty,

microcredit has struggled to turn rhetoric into tangible success.

Done right, these loans have shown promise in allowing some borrowers to build sustainable livelihoods.

But it has also become clear that the rapid growth of microcredit —

in India some lending firms were growing at 60 percent to 100 percent a year —

has made the loans much less effective.

Most borrowers do not appear to be climbing out of poverty,

and a sizable minority is getting trapped in a spiral of debt, according to studies and analysts.

“Credit is both the source of possibilities AND it’s a bond,”

said David Roodman, a senior fellow at the Center for Global Development, a research organization in Washington.

“Credit is often operating at this knife’s edge, and that gets forgotten.”

Even as the results for borrowers have been mixed,

some lenders have minted profits that might make Wall Street bankers envious.

For instance, as we’ve detailed, investors in India’s largest microcredit firm, SKS Microfinance,

sold shares last year for as much as 95 times what they paid for them a few years earlier.

Meanwhile, politicians in developing nations, some of whom had long resented microlenders as competitors for the hearts and minds of the poor,

have taken to depicting lenders as profiteering at the expense of borrowers.

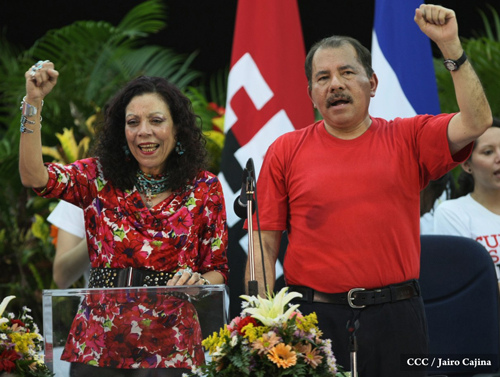

Nicaragua’s president, Daniel Ortega, for example, supported “movimiento no pago,” or the no-pay movement,

which was started in 2008 by farmers after some borrowers could not pay their debts.

Partly as a result of that campaign, a judge recently ordered the liquidation of one of the country’s leading microlenders, Banco del Exito, or Success Bank.

“These crises happen when the microfinance sector gets saturated, when it grows too fast,

and the mechanisms for controlling overindebtedness is not very well developed,”

said Elisabeth Rhyne, a senior official at Accion International, a organization in Boston that invests in microlenders.

“On the political side, politicians or political actors take advantage of an opportunity.

When they see grievances, they go, ‘Wow, we can make some hay with this.’ ”

While a broad thread of resentment and disenchantment runs across the globe,

the hostility toward microcredit stems from different circumstances in each nation.

In Bangladesh, Ms. Hasina appears to have become embittered with Grameen

after its founder, Muhammad Yunus, who shared the Nobel, announced in 2007 that he would start a political party.

At that time, the country was ruled by a caretaker government appointed by the military.

Though Mr. Yunus later gave up on the idea, analysts say Ms. Hasina and Mr. Yunus have not made amends.

Ms. Hasina’s recent comments about microcredit were prompted by a Norwegian documentary

that accused Grameen of improperly transferring to an affiliate $100 million that Norway had donated to it more than a decade ago.

Ms. Hasina said Grameen, 3.4 percent of which is owned by the government, might have transferred the money to avoid taxes.

The bank, which has denied that accusation, reversed the transfer after Norwegian officials objected to it.

Norway recently issued a statement clearing Grameen of wrongdoing.

In India, leaders in Andhra Pradesh, which accounts for about a third of the country’s microloans, have accused lenders of impoverishing customers.

Stories have proliferated in local news media about women who had amassed debts of $1,000 or more

as loan officers cajoled them into borrowing more than they could afford, and then browbeat them to repay.

Many had used the money to pay for televisions or health care or to soften the blow of failed crops, rather than as seed money for businesses.

Microcredit firms in India were also accused of siphoning borrowers from government-run “self-help groups” —

women’s organizations that can borrow small amounts at subsidized interest rates from government-owned banks.

The movement against microcredit was started by opposition politicians in the BJP,

who have encouraged borrowers not to repay their loans,

and accused senior leaders of the ruling Congress Party of being in cahoots with lenders.

The Congress-led state government made the cause its own, and passed a tough new law in December to cap interest rates and regulate collections.

The crisis has had ripples across the nation.

Banks, the primary source of money for microlenders, have turned off the tap because they are worried about the industry’s future.

As a result, microlenders have slowed or stopped lending nationwide.

Grameen Financial Services, a microlender in Bangalore that is not related to Grameen Bank,

has idled 600 new employees it hired just a few months earlier with plans to expand into western and central India.

The firm does not lend in Andhra Pradesh.

“This is frustrating,” said Suresh K. Krishna, managing director of Grameen Financial.

“This is not what we set out for. The whole objective of floating this was to support entrepreneurs and support people in the rural areas and people below the poverty line.”

Industry leaders say they hope the issues will be resolved soon.

The federal government and the Reserve Bank of India, the country’s central bank, are working on new federal regulations to oversee microcredit,

said Alok Prasad, chief executive of the Microfinance Institutions Network.

Still, some industry officials acknowledge that the sector needs to reform itself to overcome political opposition and live up to its promise.

They say organizations that now offer only loans need to diversify into microsavings accounts,

which many specialists assert are much better than loans at easing poverty.

The industry, they say, also needs to speed up efforts to build a credit bureau that would reduce overlending.

And organizations need to measure their success not just by growth and profits,

but by how fast their customers are getting out of poverty, experts said in this article from the New York Times.

“We at microfinance have a job to do to make it easier for politicians to support us,”

said Alex Counts, the chief executive of the Grameen Foundation, a nonprofit in Washington that is not part of Grameen Bank.

“Rather than make claims that get out in front of the research,

we need to impose on ourselves the discipline of transparency about poverty reduction.”

David Caploe PhD

Editor-in-Chief

EconomyWatch.com

President / acalaha.com