Invest in Penny Stocks – How to Invest in Penny Stocks 2021

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

It’s hard to find someone that doesn’t love a bargain. So much so, that many traders are on the hunt for penny stocks to invest in. As some premium-priced stocks go for thousands of dollars for a single share, investing in penny stocks can be an irresistible temptation.

In this guide, we’ll show you how to invest in penny stocks as well as the best place to buy and sell them while keeping trading costs low.

Table of Contents

If you’re looking for good penny stocks to invest in, you’ll need to choose a top-rated stockbroker like eToro. To learn how to invest in penny stocks right now simply follow these 4 easy steps:

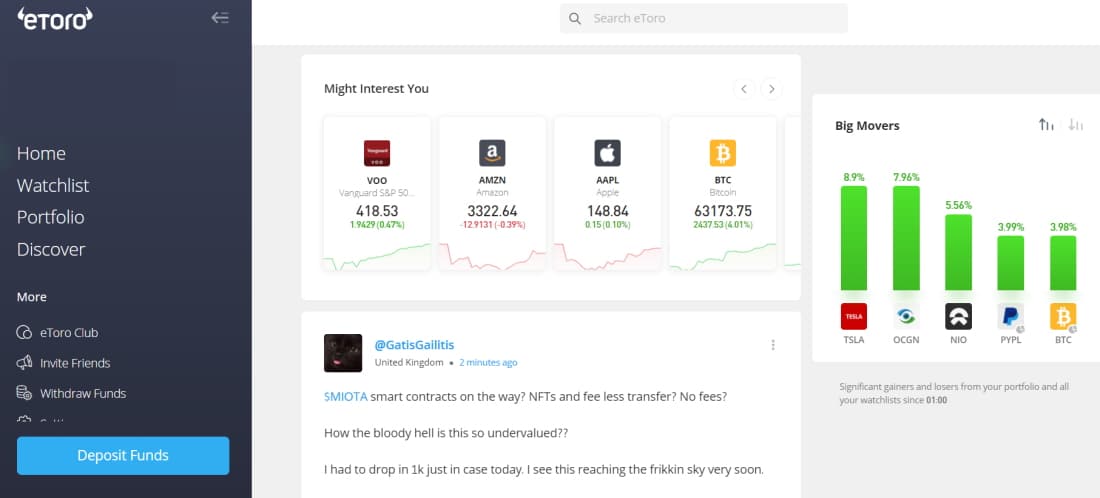

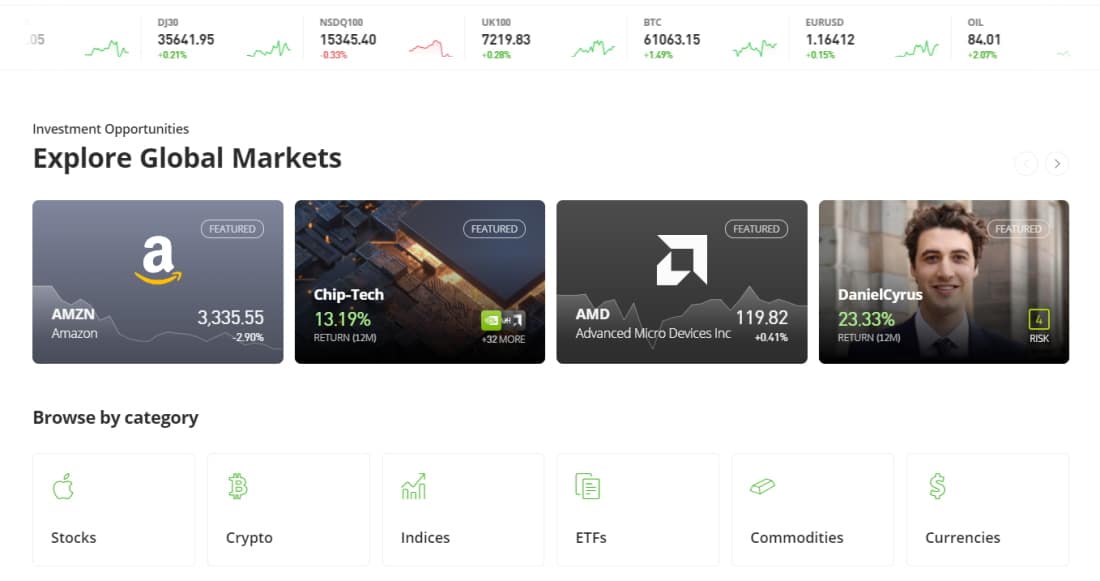

For those trying to find penny stocks to invest in, the first step involves choosing a top-rated stock broker. After sifting through and reviewing tons of online trading platforms, we’ve concluded that eToro is the best online broker to use in 2021.

Not only does it offer commission-free ETF and stock trading, but you can also use copy trading tools to imitate experienced investors from the comfort of your own home.

Nevertheless, read on as we cover an in-depth review and analysis of three top-rated trading platforms in 2021.

Launched in 2006, regulated by several financial regulators, trusted by over 20 million traders. eToro is one of the leading social trading platforms currently

Beginner traders will appreciate this broker’s user-friendly and intuitive UI (user interface). You’ll also have the option to open a demo account where you can practice online trading without running the risk of losing your hard-earned capital.

At eToro you can buy and sell stocks, cryptocurrencies, indices, ETFs, commodities, and forex with the click of a button. When it comes to stock trading, you’ll have access to speculative instruments such as CFDs as well as real stocks and fractional shares.

Thanks to fractional share trading you can purchase portions of a whole share with a minimum investment of just $50. eToro covers stocks that are listed on 17 international exchanges. That means you’ll be able to invest in stocks listed on the New York Stock Exchange (NYSE), NASDAQ, and the LSE (London Stock Exchange).

“Get exactly what you’re paying for with commission-free stock investing – no markup, no ticketing fees, no management fees.” eToro is one of the leading discount brokers, offering 0% commission on stock and ETF trading.

This low-cost trading platform offers 0% commission on stock trading. Plus, there are no deposit fees or account fees to pay. On the other hand, there is a small $5 withdrawal fee, a $10 inactivity fee after 12 months, and a 0.5% conversion fee for non-USD deposits.

eToro is regulated by the FinCEN, FCA, CySEC (Cyprus Securities and Exchange Commission), and ASIC. This means your funds are held in a segregated bank account and you’ll be entitled to compensation if the broker goes into liquidation.

eToro Fees:

| Commission | 0% |

| Deposit fee | Free |

| Withdrawal fee | $5 |

| Inactivity fee | $10 per month after 12 months of no login activity |

| Account fee | None |

Pros

Cons

68% of retail investor accounts lose money when trading CFDs with this provider.

Founded in 2006, AvaTrade is a global CFD and forex broker that is regulated by top-tier financial institutions including the Central Bank of Ireland and ASIC.

AvaTrade provides forex trading as well as a broad range of CFD derivatives, including stocks, bonds, ETFs, commodities, and indices. You may also trade seven different cryptocurrencies straight through the AvaTrade platform with no commissions and no bank fees.

Furthermore, AvaTrade has a wealth of resources and tools for new traders, including a free paper trading account with $100,000 in virtual funds to practise your trading strategy in a risk-free environment, as well as access to more than 250 financial instruments, including crypto trading 24 hours a day, seven days a week.

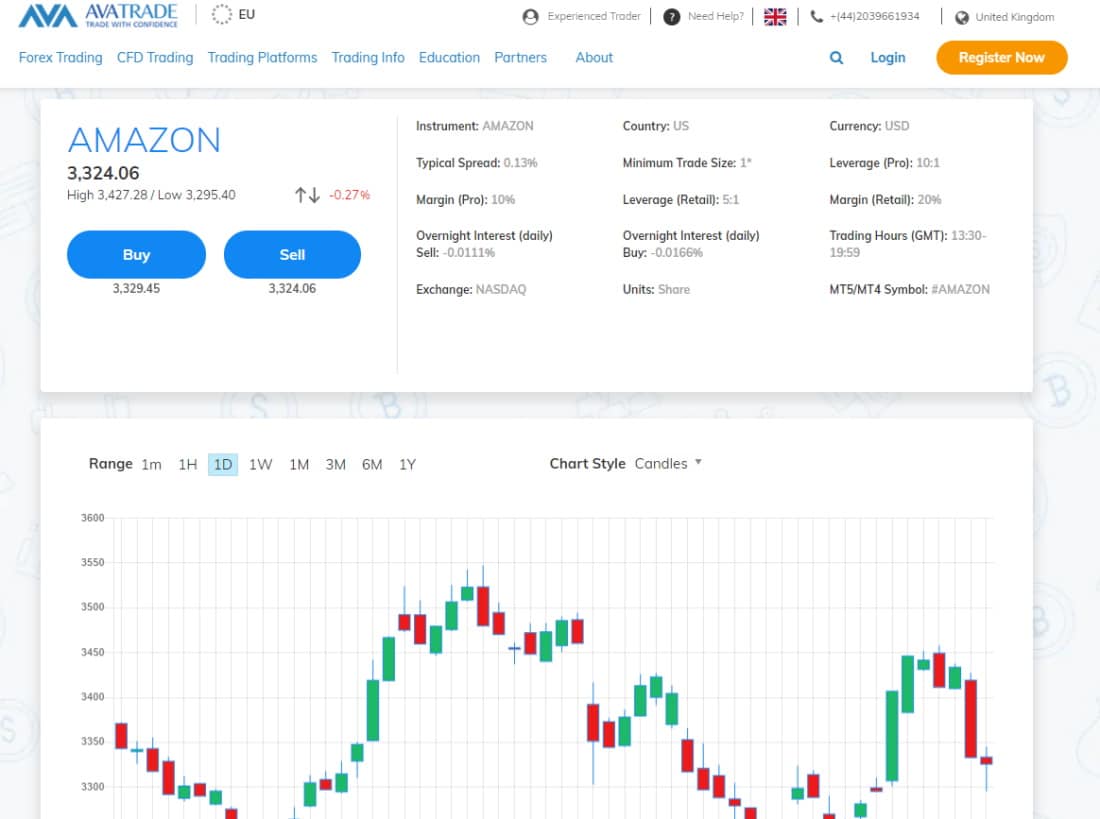

The only trading fees you’ll pay with AvaTrade are the bid-ask spread and the overnight financing fee if you keep positions open past the usual trading hours. When it comes to non-trading fees, there are zero deposit and withdrawal fees, as well as no account fees. On the flip side, AvaTrade account holders are subject to a $50 inactivity fee after three consecutive months of non-use. This is then accompanied by an annual administration fee of $100 after 12 months of inactivity.

Let’s see what fees you can expect to pay when trading stock CFDs on AvaTrade. For example, the typical bid-ask spread on Amazon stocks is 0.13%. The overnight interest fee for a buy position is -0.0166%.

Yes, AvaTrade is regulated by heaps of top-tier financial authorities covering several continents. As a globally recognised CFD broker, AvaTrade is authorised and licensed by the Central Bank of Ireland, ASIC, the Financial Sector Conduct Authority (FSCA) in South Africa, the Japanese Financial Services Agency (FSA), the Financial Futures Association of Japan (FFAJ), and more.

EU-based clients are covered by the Central Bank of Ireland’s investor protection scheme. The protection amount stands at €20,000. Moreover, AvaTrade also provides negative balance protection in all jurisdictions in which it offers its services.

AvaTrade Fee

| Commission | 0% |

| Deposit fee | None |

| Withdrawal fee | None |

| Inactivity fee | $50 after 3 months of inactivity and a $100 administration fee after one year. |

| Account fee | None |

| Minimum deposit | $100 |

Pros

The Central Bank of Ireland, ASIC, and others all regulate AvaTrade

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

Capital.com is a well-known FX and CFD broker that was founded in 2016 and is regulated by a number of major financial regulators, including the Financial Conduct Authority.

Capital.com offers FX trading as well as a wide range of CFD derivatives. Capital.com traders have access to MetaTrader 4, mobile trading apps, web and

Capital.com allows you to trade FX and CFDs. There are 3,418 stock CFDs, 26 index CFDs, 34 commodity CFDs, 138 forex pairs, and cryptocurrency CFD derivatives available.

CFDs, or contracts for difference, are agreements between sellers and purchasers in which the buyer agrees to pay the seller the difference between an underlying asset’s present price and its value at a future date. CFD traders profit from price changes that favour them, as well as the added benefit of now owning the underlying asset. The difference between the trade’s initial and closing prices determines the value of a CFD contract.

The fact that all tradable assets can be bought and sold commission-free is Capital.com’s biggest selling feature, especially when it comes to overall trading expenses. From stock CFDs to cryptocurrency CFDs, you can trade a wide range of markets at a minimal cost, which is great for new traders. Furthermore, this is ideal for day traders because you can pick between long and short leveraged positions.

Non-trading costs are competitive at Capital.com. It’s fantastic that there’s no inactivity fee if you don’t trade for a specific period of time, which is unusual for CFD brokers. There are also no fees for opening an account, making a deposit, or withdrawing money.

Capital.com is regulated by the FCA, ASIC, CySEC, and the National Bank of the Republic of Belarus. UK-based traders will also be pleased to learn that they’re covered by the investor protection of the FSCS meaning you’re entitled to £85,000 in compensation should the broker go into liquidation. Capital.com also offers negative balance protection which means that if your account balance drops below zero you’ll be covered.

Capital.com fees

| Commission | 0% |

| Deposit fee | None |

| Withdrawal fee | None |

| Inactivity fee | None |

| Account fee | None |

Pros

Cons

76.72% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Let’s see how each of these top-rated brokers do when pinned against each other. Choosing the right broker that matches your trading style, needs and objectives depends on your preferences and financial goals. The best stock trading platforms give you access to global markets on a low-cost basis.

| Broker | Commission | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| eToro | 0% | $0 | $5 | $10/month after one year |

| Capital.com | 0% | $0 | $0 | $0 |

| AvaTrade | 0% | $0 | $0 | $50 per quarter after 3 months/$100 after one year |

Now that we’ve covered the best stock brokers to use in 2021, let’s take a look at some of the best penny stocks to invest in right now.

When looking for the best penny stocks to invest in right now, we found Centaur Media (LSE: CAU) one to keep an eye on. Market analysts in London and Wall Street expect that the company’s annual earnings will jump by over 110% in 2022.

According to data from Refinitiv, Centaur Media Plc has a forward P/E ratio of 25.00 and an EBITDA of 14.85.

Centaur Media offers corporate information and marketing services. It organizes events as well. As a result, it’s well-positioned to profit from business investments that historically accompany economic recoveries. Centaur Media is already reaping the benefits of the upturn, announcing last week that its 2021 results should trump analyst forecasts.

If the Covid-19 situation worsens, then this media specialist company could suffer. If lockdown measures are revived, ad spend budgets might be cut and the company’s events division could be shuttered. However, these risks are factored into Centaur’s ridiculously low market valuation, so we still think it’s a good penny stock to invest in. With that said, will you be adding CAU stock to your portfolio?

68% of retail investor accounts lose money when trading CFDs with this provider.

If you’re looking for penny stocks to invest in then DP Eurasia (LSE: DPEU) rings a bell. This penny stock is another bargain stock, listed on the London Stock Exchange that is expected to experience a huge earnings growth in 2022.

The company’s average annual revenue is expected to increase by more than 300 percent year-over-year, according to many City analysts. As a result, DP Eurasia NV has a trailing P/E ratio of 1.3x which is lower than the industry average of 29.3x. This suggests that each dollar of the company’s earnings is being undervalued by the investing community. As such, DPEU is an undervalued stock.

In Turkey, Russia, Georgia, and Azerbaijan, DP Eurasia is the head franchisee of the Domino’s Pizza takeaway business. As the world emerges from the confines of the pandemic, so does the demand for food delivery in these areas. Revenues increased by over 58 percent between January and June, a figure so impressive that the company raised its earnings estimates for the rest of 2021.

Takeaway sales are expected to continue to rise in these countries, according to industry analysts. According to Statista, sales are set to grow at a compound annual growth rate of 10.2 percent from now until 2025. Even though it’s up against growing competition from fast-growing local rivals, DP Eurasia could be one of the best penny stocks to invest in right now.

68% of retail investor accounts lose money when trading CFDs with this provider.

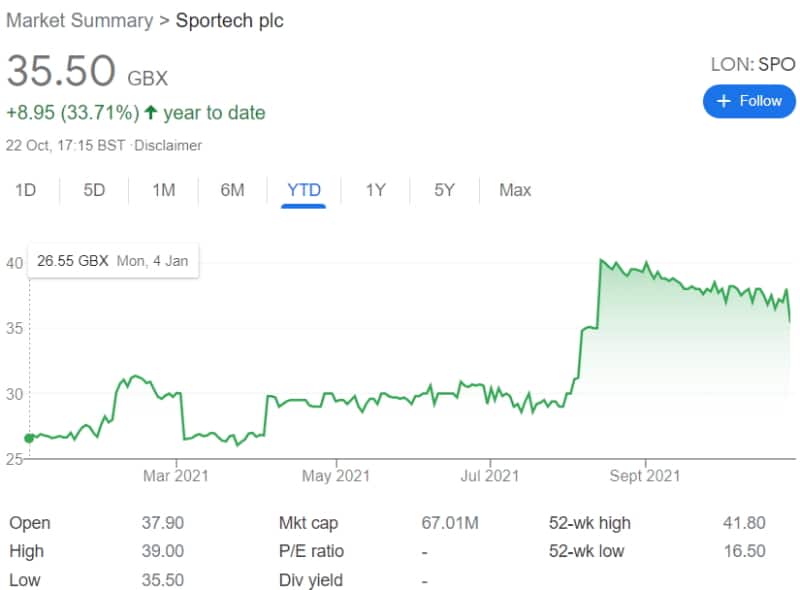

Sportech (LSE: SPO) currently does not provide the same level of value as DP Eurasia. In fact, it currently trades at a TTM P/E ratio of 3.23 and has a market cap of £67.01M. However, considering the enormous opportunities it has in the United States, we believe this high valuation is reasonable.

Sportech is a technology provider for gambling and lottery companies. In Connecticut, it also owns and runs several gaming and sports venues, as well as online betting services.

It had trouble obtaining a sports-betting licence in the past, but it now appears to have turned the corner after signing a 10-year contract with the Connecticut Lottery Corporation in Q3 2021. It’s for this reason that, after three years of losses, City analysts predict this penny stock to turn positive in 2022.

US gambling regulations have eased dramatically in recent times. This means that companies like Sportech are in a good position to capitalize on potential profits.

Future legal changes in this highly-monitored sector might harm Sportech and send its stock price tumbling downwards. Nevertheless, Sportech’s growth prospects are quite promising which is why many investors are adding this penny stock to their watchlists.

68% of retail investor accounts lose money when trading CFDs with this provider.

Penny stocks or penny shares are a common stock that can be bought and sold on US stock markets and UK stock exchanges for anything under $5 and £1 respectively. With such a low share price, chances are the stock will be a highly speculative asset.

Although a penny stock is defined as a stock worth less than £1 or $5 in the United Kingdom and the United States, the definition has been stretched to include equities worth more than these benchmark prices. Overall, penny stocks typically have low share prices. They’re known for their extreme volatility and are considered higher-risk equities with the potential for considerable growth.

Trading penny stocks has a lot of appeal. If you have a budget of £2,000 to invest, you can gain a far higher share percentage in a smaller company whose shares trade for a few pennies, rather than buying blue-chip stocks, which typically cost much more for a much lower percentage of ownership.

Naturally, if your penny stock eventually joins the blue-chip league, you could make significant returns if you use the right investment strategy.

A lot of global brands once traded as penny stocks, including Ford, Monster Beverage, as well as pharmaceutical penny stocks like Novavax.

Penny stock markets are notorious for being extremely volatile, with price swings of up to 20% occurring frequently. As a result, before selecting whether or not to proceed with trade, you must conduct thorough market analysis. It’s also a good idea to trade in sectors with strong market growth rather than industries that are struggling.

Because penny stocks in the UK and abroad don’t see a lot of daily trading volume, it doesn’t always require a significant buy or sell order to impact the price. For example, if a penny stock starts trending on the internet, it can affect the market price as investors start buying out of FOMO (the fear of missing out).

It’s crucial not to get pulled into an investment just because it made a big one-day surge and you don’t want to miss out. What goes up rapidly can also go down quickly, so make sure you’re not impulse buying.

To begin with, penny stocks can be extremely volatile. Let’s take a look at Catenae Innovation PLC, which is one of many examples of how unpredictable penny stocks can be. The company in question operates in the blockchain technology field, and the graph below shows its share price over the last six months.

As you can see from the chart above, CTEA’s stock price was trading at 2.70p in April. Consequently, six months later the price dropped to its current standing of 0.70p as of October 2021.

This represents a downtrend of -74.07% in the space of just six months. But this doesn’t always mean it’s a bad investment as volatile stocks tend to rise and fall. If anything, some market analysts and investors will be buying CTEA stock at its current low price of 0.70p in anticipation of an eventual upswing again.

When it comes to penny stock investing, the issue of liquidity is also worth considering. The market capitalizations of major FTSE 100 corporations are in the billions of pounds. However, in the case of penny stocks, this figure could be as low as a few million. As a result, this could mean that when it comes to buying and selling you may have a hard time doing so.

Furthermore, and perhaps most crucially, while it may be simple to buy your preferred penny stocks, it may not be so simple to sell them. For example, seeing your penny stocks rise 400 percent in a week is great, but if you can’t sell them, you might not be able to cash in on your gains.

When you invest in FTSE 100 stocks, you can rest assured that everyone is on an equal playing field. This means that any information released by the corporation is always made available to the public. As a result, it doesn’t matter if you own one share or a majority stake in the company; everyone gets the same information at the same time.

Failure to do so would result in the company being fined and sanctioned severely. In the case of penny stocks, however, the regulations related to information sharing are substantially looser. This can make it difficult to determine how well the organisation is performing.

Now that we’ve revealed the best penny stocks to invest in 2021, it’s time to learn how to invest in penny stocks. To help you take the first steps here’s how you can invest in penny stocks right now with eToro.

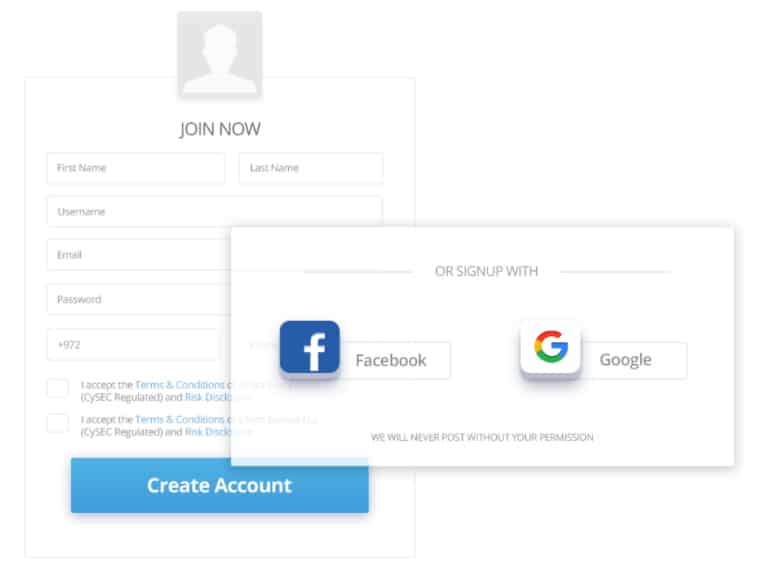

First and foremost, make your way to the eToro website and click on Join Now.

Enter some personal information, such as your:

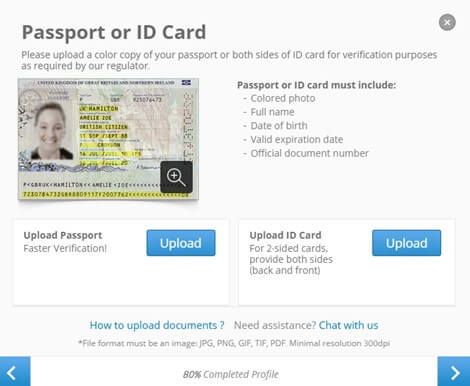

You will then need to upload several documents as part of the KYC process. This includes:

Debit/credit cards, e-wallets, and bank accounts are all accepted payment options. The minimum deposit amount is $50, and there are no deposit fees to pay.

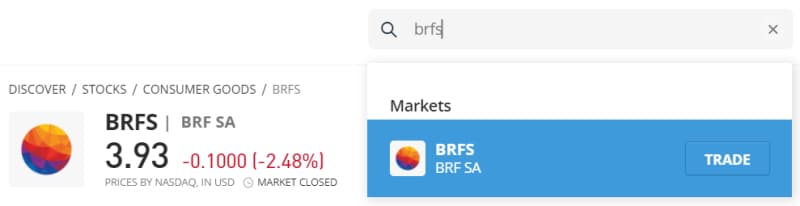

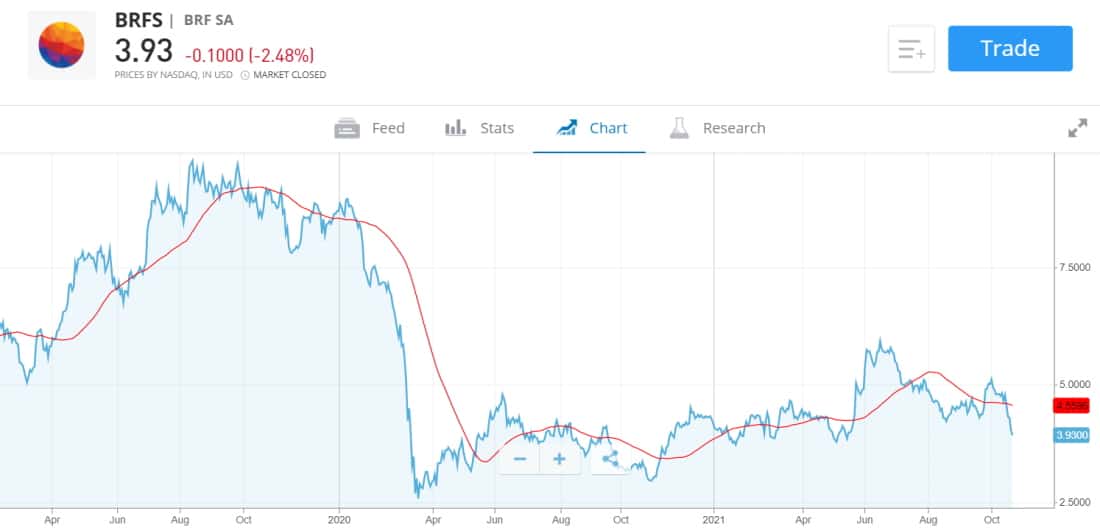

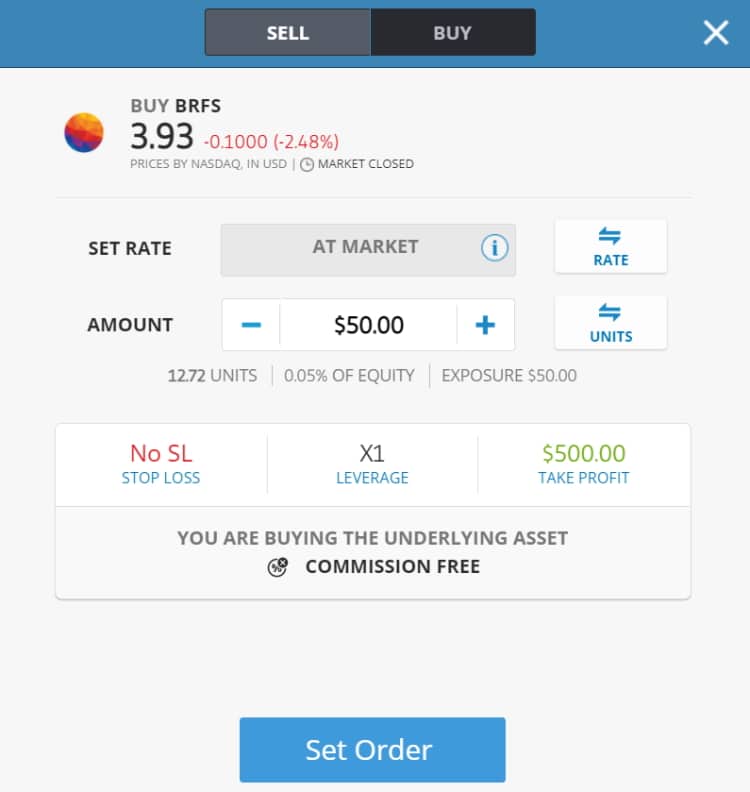

Seeing as eToro offers over 800 stocks from 17 UK and foreign stock markets, it’s best to search for the firm you want to invest in. In this case, we’re looking for the popular penny stock ‘BRF SA’.

You’ll notice that BRF SA’’s stock is worth $3.93, meaning it’s a penny stock. After that, we need to press the ‘Trade’ button.

A pop-up box will appear, where you can enter your preferences for your penny stock investment. All you have to do now is type in the amount you want to invest. This is expressed in US dollars rather than British pounds.

Lastly, to complete your penny stock investment, click the ‘Open Trade’ button.

By now you’ll have a better understanding of how to invest in penny stocks, as well as the best penny stocks to invest in right now. Investing in penny stocks comes with high risk, so make sure you’re only investing money you can afford to lose.

If you’re ready to invest in penny stocks, we recommend buying and selling stocks with eToro. This top-rated social trading platform offers 0% commission trading as well as access to 17 international exchanges.

For the best penny stocks to invest in right now, open an account with eToro today!