Buy Bitcoin Canada – How to Buy Bitcoin in Canada

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Ever wondered how to buy Bitcoin in Canada? If you answered yes to this question then you’re not alone. Thousands of crypto-hungry investors are flocking like sheep to try and gain exposure to the world’s largest cryptocurrency.

In this how to buy Bitcoin beginner’s guide, we’ll be covering how to buy Bitcoin in Canada as well as the best way to buy Bitcoin in Canada. We’ll also reveal the best trading platform to buy Bitcoin in 2021. Read on to learn more.

Table of Contents

Did you know that you can buy Bitcoin Canada in less than five minutes with a regulated cryptocurrency exchange? Let’s look at four simple steps to start trading Bitcoin with a range of payment methods and low fees with a Bitbuy account.

If you’re looking for the best Crypto Exchange Canada you’ll find there are hundreds of viable options out there. But how do you choose the right one for your needs? We’ve spent the time researching the best trading platforms across the board so you don’t have to.

With that in mind, here are the best cryptocurrency exchanges to buy Bitcoin from the comfort of your own home.

Furthermore, because it is registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and works as a Money Services Business, it is regulated by Canadian federal authorities.

Even though its services are currently confined to the Canadian market, the crypto trading platform is expected to expand internationally in the future.

Bitbuy lets you buy Bitcoin and other popular digital currencies including:

Bitbuy charges fees for buying and selling cryptos, making deposits in fiat money, and withdrawing cash and cryptocurrency from the site. Crypto depostis are free, however processing times vary depending on the network; nevertheless, deposits of XLM, XRP, and EOS are processed instantly.

Depending on the payment method you choose, an initial CAD deposit will cost you between 0.5 percent and 1.5 percent. A bank wire transfer, for example, has a flat fee of 0.5 percent.

Bitbuy charges two types of fees for trading. Pro transactions pay 0.1 percent for maker costs and 0.2 percent for taker fees, whereas express trades cost 0.2 percent per trade. Withdrawal costs will vary depending on the mode of withdrawal and the cryptocurrency used.

| Fee Type | Fee Amount |

| Commission | Variable Fixed Fees |

| Deposit Fee | Bank Wire – 0.50%. Interac e-Transfer – 1.50%. |

| Withdrawal Fee | Bank wire – 1.00%. Interac e-Transfer – 1.50%. |

| Minimum deposit | $50 |

| Trading fees | Express trade – flat 0.20% fee on all buys and sells |

| Pro Trade / API Client | Maker – 0.10% Taker 0.20% |

Pros

Cons

You’ll find an abundance when it comes to trading cryptocurrencies CFDs with Capital.com. Over 200 different crypto and currency crosses are available to pick from. When trading BTC/USD CFDs, for example, the typical spread is 165.00.

Capital.com’s main selling point is that all tradable CFD assets can be bought and sold commission-free. From stock CFDs to cryptocurrency CFDs, you can gain low-cost access to a wide range of markets, which is great for beginner traders. This is also useful for day traders because you may pick between long and short orders.

There are no deposit or withdrawal fees when it comes to non-trading fees. Additionally, there are no account or inactivity fees.

As previously stated, deposits and withdrawals are both free, and you can use a variety of payment methods. Bank transfers, credit cards, debit cards, and e-wallets can all be used to deposit funds into your CFD brokerage account. Nonetheless, there are only five base currencies to pick from: the US dollar, the euro, the Polish zloty, the British pound, and the Australian dollar. Conversion costs will apply to other fiat currencies.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Spread Fee | Competitive Spreads |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $0 |

| Account fee | None |

| Cost of trading BTC/USD CFD | Typical Spread: 165.00 |

Pros

Cons

76.72% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Coinbase is one of the most popular cryptocurrency exchanges in the world. It’s a publicly-traded company established in the United States and listed on the NASDAQ. When it comes to trading volumes and client numbers Coinbase is larger than its main competitors, Kraken and Binance.

Our Coinbase Review discovered that after you’ve created an account, you’ll have access to a huge number of cryptocurrencies. Coinbase offers over 40 digital assets including Bitcoin (BTC), Ripple (XRP), Bitcoin Cash (BCH), Ethereum (ETH), Dogecoin and Litecoin (LTC).

Coinbase is one of the most expensive cryptocurrency trading exchanges out there. When using your UK debit card to buy cryptocurrencies at Coinbase this is known as ‘Instant Buy’. Simply put, you will be purchasing your chosen digital currency immediately.

As a result, you’ll be charged a 3.99 percent fee. For example, if you buy £500 worth of Bitcoin using a debit card, the total commission will be £19.95. Also, the typical trading commission at Coinbase is 1.49%. In other words, you’ll pay 1.49% when you buy Bitcoin Canada, and again when you sell Bitcoin. This variable trading commission is calculated on the overall value of your position.

| Debit Card Instant Buy | Debit Card Withdrawal | UK Bank Transfer | Trading Commission |

| 3.99% | 2% | FREE | 1.49% |

Coinbase supports debit cards, bank transfers, and PayPal (for withdrawals only). When it comes to minimum deposits, the crypto exchange has a minimum investment of $1,000 when using SWIFT transfers. Otherwise, the minimum deposit at Coinbase is $0.

Pros

Cons

Now that we’ve covered some of the best places to buy Bitcoin Canada, let’s go through the four simple steps to start trading digital currencies with a regulated exchange.

The best way to buy Bitcoin in Canada is with Bitbuy as it’s fully regulated by FINTRAC and offers great customer service and a user-friendly trading platform.

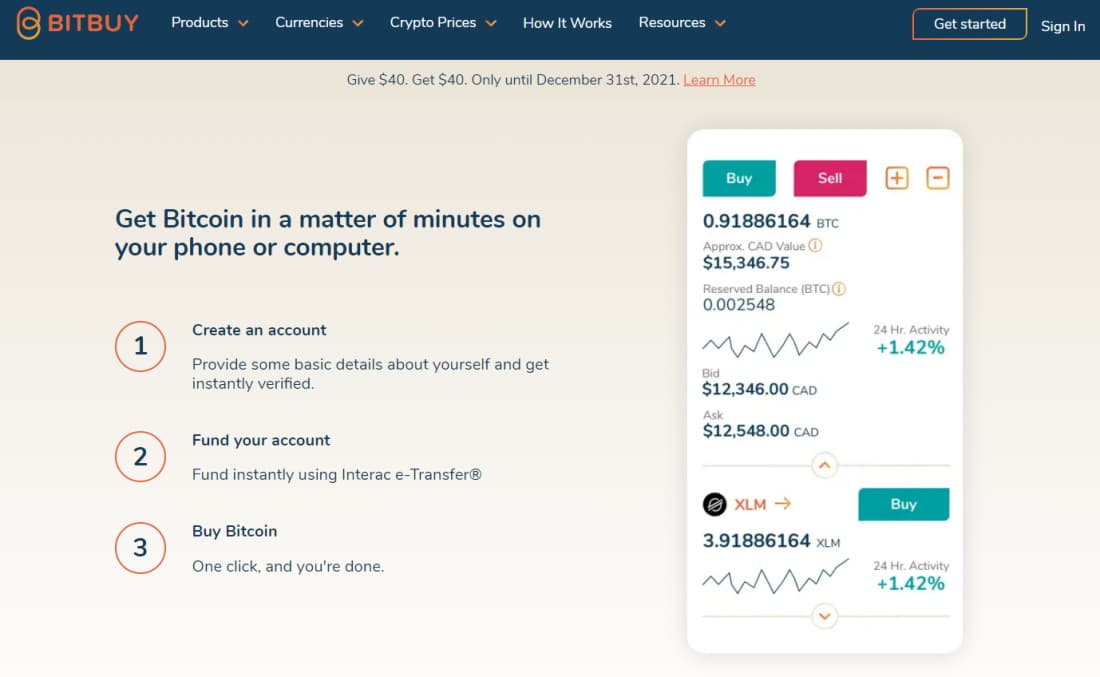

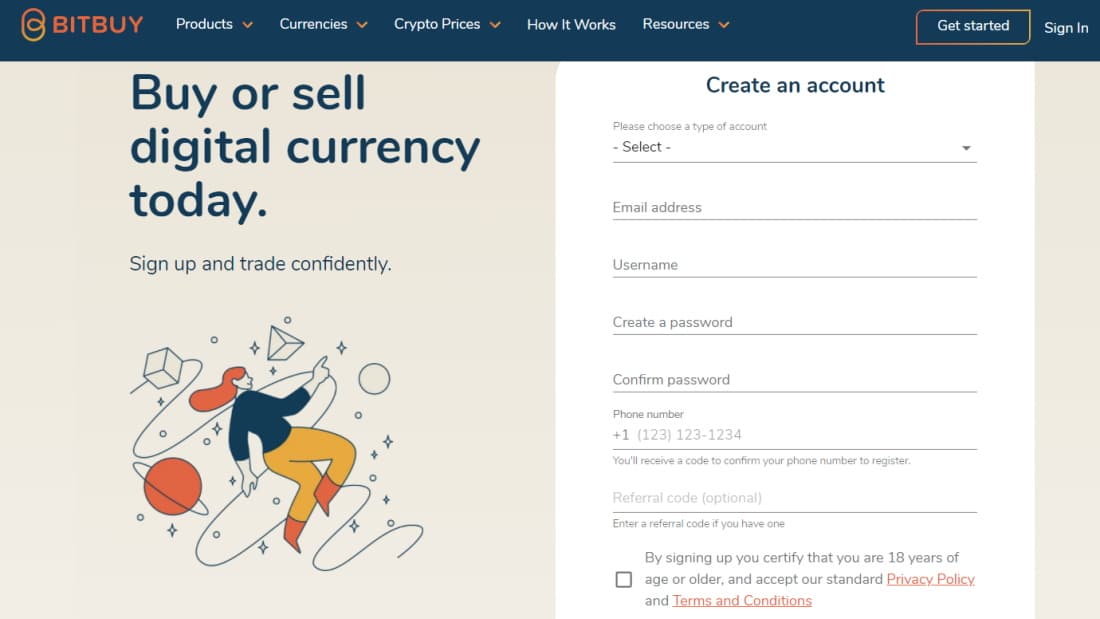

Head over to bitbuy.ca and tap on ‘Get Started’ to open your new trading account. You’ll need to enter some personal information and create a username and password.

Once you’ve filled out the form, accept the terms and conditions and click on ‘Create account’.

You’ll be required to confirm your email address, phone number and verify your identity. As Bitbuy is FINTRAC regulated it means you’ll undergo all the necessary steps and KYC regulations.

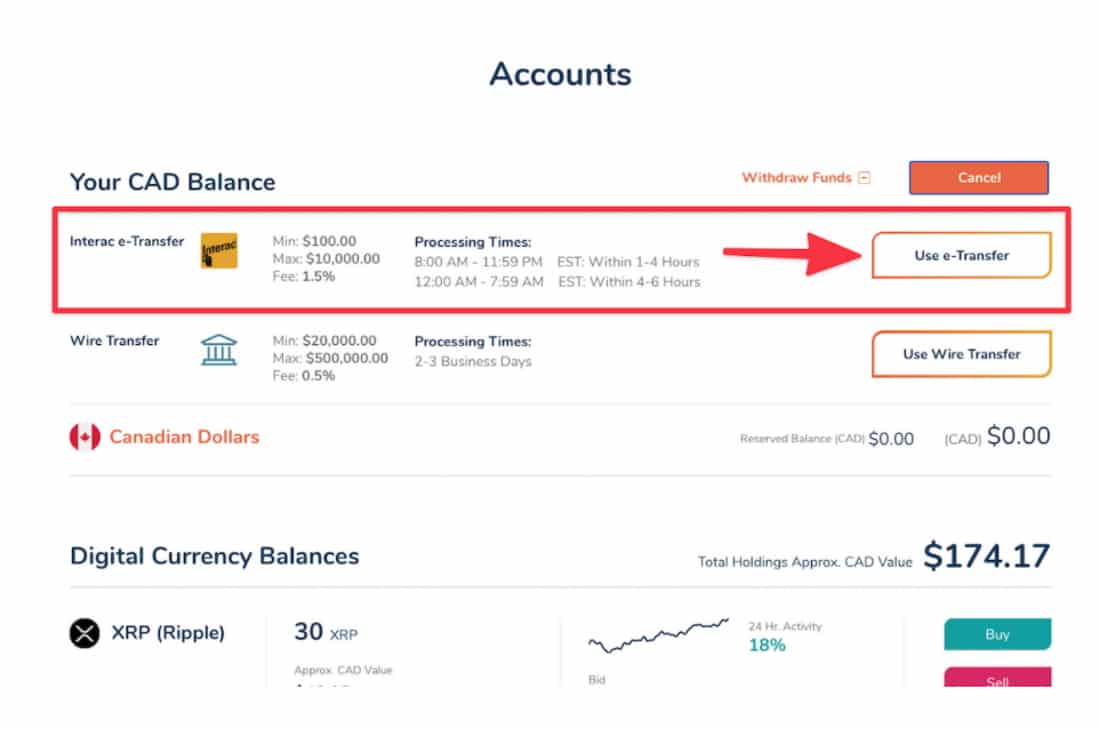

Once your account is successfully verified, you’ll be able to deposit funds into your Bitbuy account with either a bank wire transfer or cryptocurrency Interac e-Transfer. The minimum deposit when using Interac e-Transfer is just $50.

Funding your account is simple; just sign in to your Bitbuy account and select ‘Add Funds’ and then either ‘Use e-Transfer’ or ‘Use Wire Transfer’. Then sign in to your financial institution’s online banking platform and send your e-Transfer. Alternatively, you can conveniently complete this step using the native Bitbuy mobile trading app.

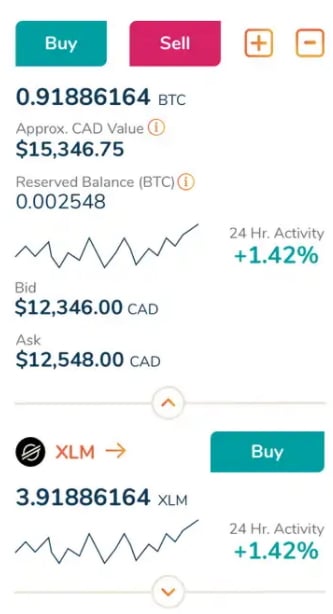

Buying Bitcoin and other altcoins with Bitbuy is straightforward and quick. Visit the ‘Express Trade’ section of your Bitbuy account, find Bitcoin, enter the amount you want to invest in Canadian dollars, and tap ‘Buy’ to open the trade.

Beginners turning to crypto trading for the first time will undoubtedly come across Bitcoin one way or another. Bitcoin uses peer-to-peer blockchain technology that works without the intervention of centralized bodies like governments and central banks.

Bitcoin is open-source, offering a decentralized digital currency to the public. In other words, a cryptocurrency like Bitcoin is a digital version of fiat currency.

Buying Bitcoin is becoming more accessible and easy. You can transfer BTCs from the best Bitcoin wallets Canada to another crypto trader’s unique Bitcoin wallet address.

Bitcoin miners process and verify the payments with sophisticated software. They solve complicated mathematical verification problems created by Bitcoin’s source code.

The hardware is costly, extremely powerful, and consumes a significant amount of energy.

As we’ve already discussed you can buy Bitcoin in Canada by opening a trading account with a top-rated cryptocurrency exchange such as Bitbuy, Capital.com, Coinbase, Kraken, and Binance.

Bitcoin was launched in 2009 by someone using the alias Satoshi Nakamoto. The most important thing to note is that Bitcoin is decentralized. As a result, all Bitcoin transactions are held on a distributed ledger. Simply put, this transparent public database includes everything on the Bitcoin blockchain.

On the Bitcoin network, transactions are confirmed by a process known as mining, which involves advanced computers solving a complex puzzle that results in a block being added to the blockchain. Keeping things simple, the blockchain is simply Bitcoin’s public record — it’s a collection of all transactions that are then divided into blocks. Because each user has a complete copy of the blockchain, these blocks are confirmed by all users on the network, ensuring that no one can steal or scam other Bitcoin traders.

Many crypto-hungry traders use Bitcoin as a store of value, and speculate on its price movements, just as they would with any other leveraged asset class.

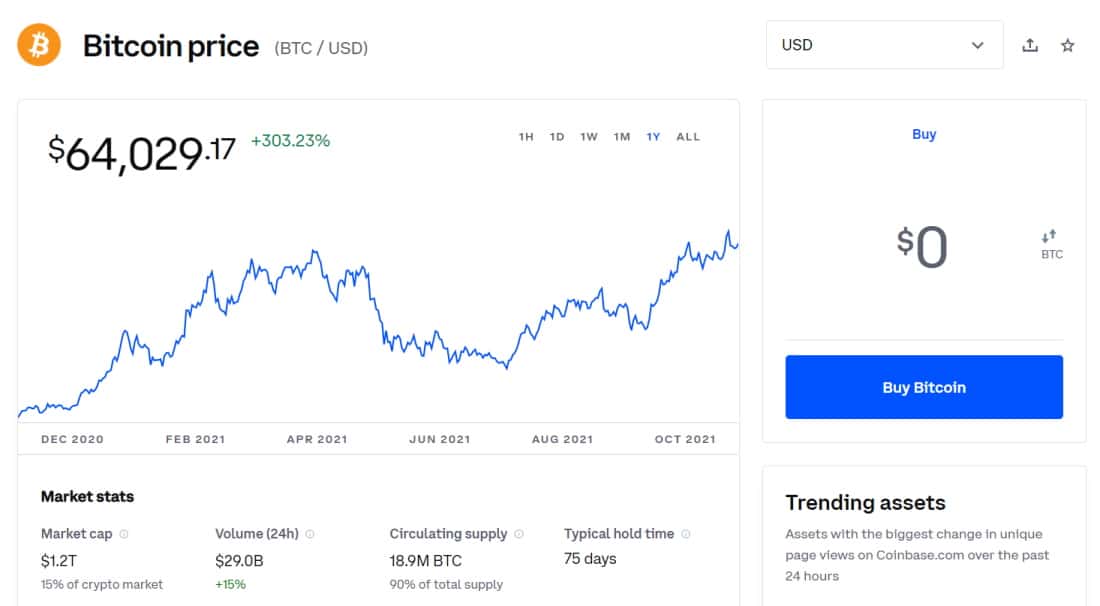

Bitcoin (BTC), alongside other popular altcoins like Ethereum and Litecoin, continues to make headlines. Its market price has dropped over the last five days, falling 4.01% from its record high of $68,789.63 on the 10th of November. Bitcoin is traded on a peer-to-peer basis, which makes Bitbuy one of the best cryptocurrency exchanges to use in 2021 to buy Bitcoin with Canadian dollars.

At the time of writing this beginner’s guide, the live price of Bitcoin is $65,538.31 with a 24-hour trading volume of $27,733,377,003 according to data from coinmarketcap.com. ‘Bitcoin is up 1.37% in the last 24 hours. The current CoinMarketCap ranking is #1, with a live market cap of $1,236,965,131,895 USD. It has a circulating supply of 18,873,925 BTC coins and a max. supply of 21,000,000 BTC coins.’

The cryptocurrency market is volatile and has high liquidity levels. However, digital assets come with high risks. As fast as the market price of Bitcoin can rise it can also plummet. As seen in July 2021 when it fell to $29,731.46. Then just four months later the price hit all-time highs of $68,789.63. That’s an increase of 131.4% during Q3 2021.

Image source: CoinMarketCap.com

Do you have the risk tolerance to buy Bitcoin Canada right now?

The Bitcoin price rally comes in concert with Ethereum’s growing dominance. The price of Ether has jumped by over 30% over the previous month, prompting some market analysts to forecast it as the eventual leading cryptocurrency.

Rahul Rai, crypto hedge fund manager of Market Neutral at BlockTower Capital, expects Ether to beat Bitcoin by mid-2022. Speaking to Markets Insider, he said:

“I definitely think there’s a really good chance for ether to surpass bitcoin. I wouldn’t be surprised if it happened within the cycle. Ethereum is trying to power the rails of all of global finance in the future, and that is a much bigger market, if it does succeed. If it does succeed, and if the thesis plays out, then the market value is going to capture trillions of dollars in global activity, and that’s a much bigger market than what bitcoin’s going up toward.”

Opening an account with a top-rated crypto exchange or trading platform is the best way to buy Bitcoin Canada. Bitbuy is one of the most popular cryptocurrency exchanges since it allows you to buy and sell 9 of the most popular cryptocurrencies with the click of a button.

Interac e-Transfer is an online banking service that allows you to send money to anyone in Canada quickly and safely. Secure banking procedures are used to transfer the funds. Transfers are almost instant, however they could take up to 30 minutes depending on your bank or credit union.

Bitbuy accepts Interac e-Transfer as a means of payment for Bitcoin purchases in Canada. The flat charge on all buys and sales is 0.20 percent.

A bank wire transfer is more expensive than an Interac e-Transfer for purchasing cryptocurrency. A bank wire minimum deposit of $20,000 is required.

Set up a Bitbuy account and get your identity verified. Using a bank wire transfer, deposit CAD into your account. Purchase Bitcoin or any other altcoin that the exchange supports. You can then either keep your cryptocurrencies on the regulated account or transfer them to either cold storage or a hot wallet.

According to statista.com, PayPal is a popular payment option currently, with over 403 million active registered accounts as of Q2 2021. Bitbuy does not accept PayPal, although Capital.com does.

This means you can instantly buy cryptocurrency CFDs with PayPal. Capital.com also doesn’t have deposit fees, allowing you to keep your overall costs down.

To trade Bitcoin anonymously in Canada, use a decentralised cryptocurrency exchange like Binance, Uniswap, or Sushiswap. Decentralized crypto exchanges, on the other hand, are not regulated by centralised financial bodies and hence do not provide the same level of investor protection.

As a result, we only recommend using a regulated broker or cryptocurrency exchange. This way, you can rest assured that your account is safe, that your assets are secure, and that you’re trading on a licenced platform.

When investing in a high-risk asset like this it’s important to keep a balanced perspective and weigh the dangers. With that in mind, here are three key things to remember about the risks when buying Bitcoin in Canada.

The most significant risk involved when purchasing Bitcoin is financial loss. Buying Bitcoin, like forex trading, can result in you losing money if the price falls below the level at which you bought it. In the end, each financial asset has this risk, but Bitcoin (and cryptocurrency in general) is more volatile than others. So, if you’re thinking about investing in Bitcoin in Canada, keep in mind that there’s a potential you’ll lose money.

Since Bitcoin is a digital currency, there’s a chance that your hot wallet could be hacked and stolen. There are several strategies you can use to avoid this nowadays, with the most effective being offline cold storage. As the name suggests, cold storage isn’t directly connected to the internet, making it near impossible for hackers to infiltrate.

Nevertheless, nothing is completely risk-free, so bear this in mind when you consider buying Bitcoin in Canada.

Lastly, there’s still the possibility that legal rules restricting Bitcoin trading will be enacted. Currently, no substantial regulations threatening the cryptocurrency market have been passed by the financial markets, while there are rumors that the SEC is looking into areas where it can crack down on crypto trading.

If this happens, the price of Bitcoin is expected to change dramatically. Investors, on the other hand, have no control over this. Therefore, keeping a vigilant eye on market news is crucial to making good investment decisions.

When you purchase Bitcoin in Canada, you’ll almost certainly want to know how to sell it. Bitbuy makes the process of purchasing and selling cryptocurrencies in Canada as simple as possible.

The following is how you would sell Bitcoin with a Bitbuy account:

All things considered, most crypto-hungry investors are looking at how to buy Bitcoin right now. We’ve covered the best crypto exchanges as well as some of the risks associated with crypto trading.

With some market analysts and hedge fund managers expecting the price of Bitcoin to continue rising, it’s no surprise that Canadian traders are trying to gain exposure to this volatile market. If you’re one of them, will you be adding Bitcoin to your investment portfolio for the rest of 2021?