Invest in Index Funds South Africa – Investing in Index Funds Beginner’s Guide 2021

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

If you want to invest in index funds South Africa, you’ll need to pick a fund that tracks your preferred index. In this guide, we’ll show you how to invest in index funds with the best brokers in 2021.

An index fund is a type of investment that tracks the performance of a market index like the FTSE 100 and S&P 500. Index funds are typically made up of a basket of stocks or bonds. Index funds often invest in all of the assets, and they have fund managers whose duty it is to ensure the index fund matches the index’s performance.

Table of Contents

Your capital is at risk.

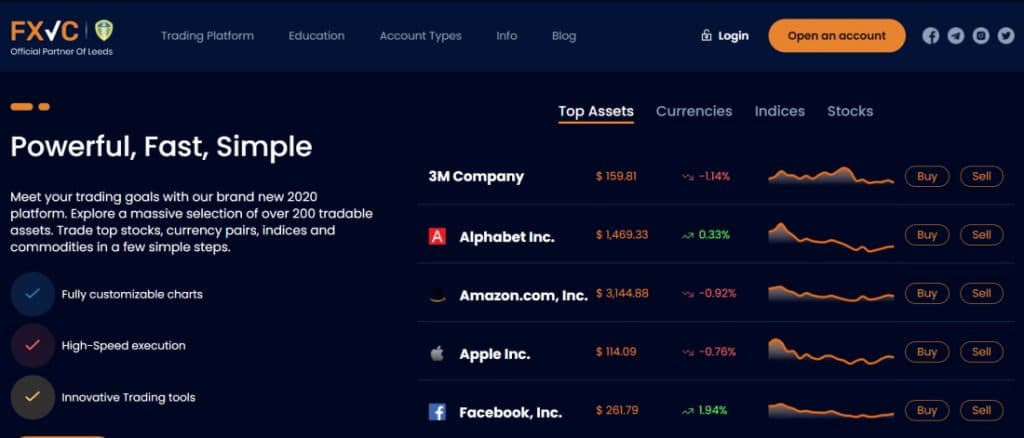

You’ll need to use an online broker to invest in index funds. FXVC is a safe and friendly option for beginners to start investing because of its transparent fee structure and easy-to-use platform.

With a simple Google search you’ll find the market is saturated with an abundance of online brokers. So how do you choose the right broker for your needs?

In this section of our beginner’s guide, we’ll cover three of the best online trading platforms you can use right now.

This is also possible with very low fees, thanks to FXVC’s competitive spreads. This broker also comes out on top when it comes to execution speeds, providing some of the industry’s fastest with incredibly low latency.

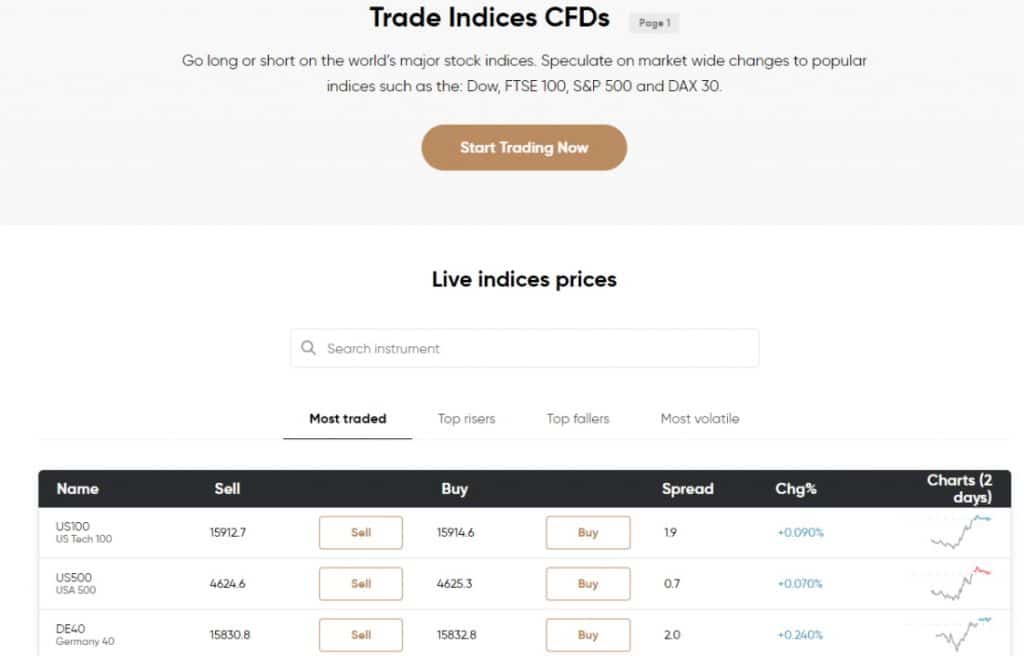

In contrast to other CFD and forex brokers, FXVC has a rather limited portfolio of products and markets. Nevertheless, that covers 300+ tradable assets such as stock index CFDs, as well as bonds and futures.

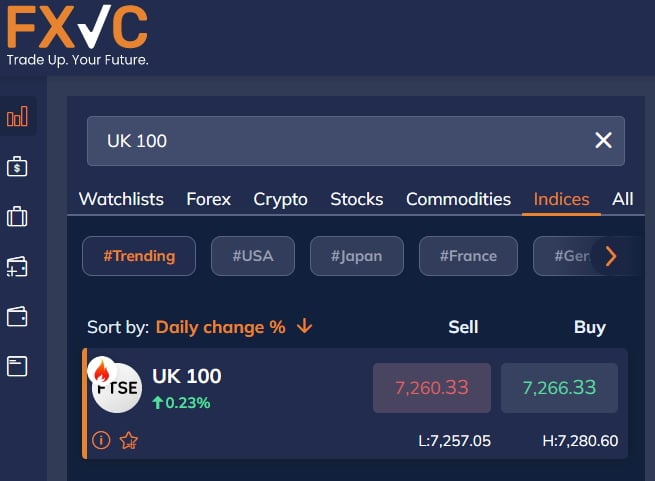

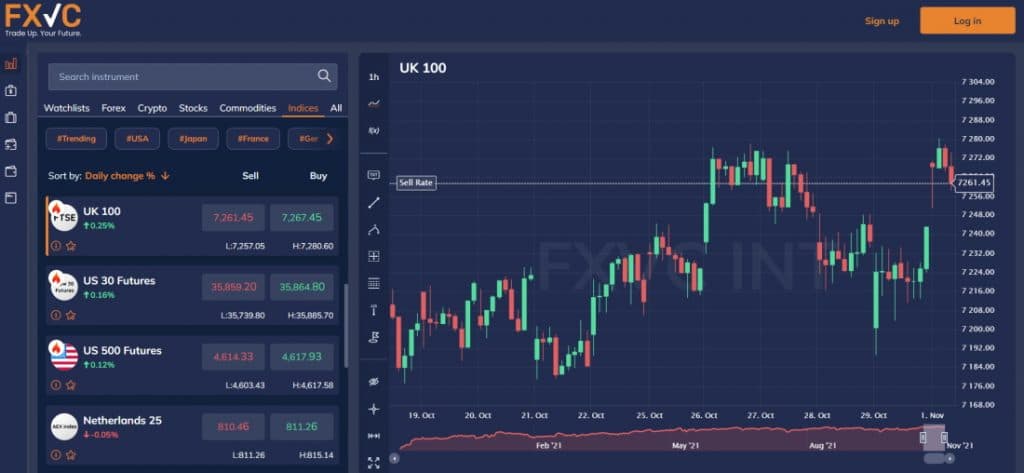

You can search for a specific stock index CFD such as the SPX500, UK100, and the AUS200 via the search bar at the top of the dashboard.

Alternatively, you can browse through the different indices by clicking on the ‘indices’ tab underneath the bar.

The S&P 500 (Standard & Poor’s 500) is a stock index that includes the 500 largest firms in the United States. It is a registered trademark of the joint venture S&P Dow Jones Indices. It is widely regarded as the most accurate measure of the overall performance of US stocks.

FXVC gives you access to a range of stock indices, covering many benchmark indices such as the FTSE 100, and the S&P 500.

The investment goal of this Index Fund is to offer investors a basket of assets that mirrors the performance of the FTSE 100 Index, taking into consideration both capital and income returns. To meet this investment objective, the Fund’s investment policy is to invest in a portfolio of FTSE 100 stocks.

The iShares FTSE 100 UCITS ETF attempts to replicate the performance of the FTSE 100 index through clever weighting strategies adopted by the fund managers. Looking at the fund’s past performance, this ETF did lose 11.64 percent in 2020, with the Covid-19 pandemic playing a big role in this downtrend. In 2019, the fund returned a strong 17.18 percent, and it is already up 9.27% percent year to date. If you want to invest in index funds South Africa, you can do so with FXVC with low fees.

Your capital is at risk.

FXVC is committed to offering its clients with high-quality market data, news, and analysis, as well as instructional materials. Special financial assets, video chart analysis, and negative balance protection are among the broker’s useful tools for a better forex trading experience.

One of the benefits of using FXVC is the unique range of financial instruments. Unlike Interactive Brokers, FXVC has unique financial assets such as Dubai financial index, FAZ, short banks, Gazprom (Russia), GoDaddy, Istanbul stock exchange index, Las Vegas Sands, Lukoil (Russia), Moscow interbank exchange, Oman MSM30, oranges futures, Reuters, S.bank in India, Shanghai composite, Tel Aviv 25, Turkcell (Turkey), and more.

FXVC provides video chart analysis to its clients to assist them in making trading decisions and studying the markets. Financial news, a weekly market overview, and a live market summary are also available from the broker.

One of the most key factors to consider when picking a forex and CFD broker is that of safety and regulations.

FXVC is a trading name for Centralspot Trading (Cyprus) Ltd is a regulated firm by the Cyprus Securities and Exchange Commission (CySEC) under licence No.238/14. FXVC also complies with regulations set by the Markets in Financial Instruments Directive (EU) No 600/2014. (MiFID) is a European regulation that improves financial market transparency across the European Union and standardises regulatory practices.

On top of that, FXVC offers negative balance protection. Negative balance protection means that if a trader’s account goes into negative balance as a result of their trading, their losses will not exceed their initial deposit.

Costs for overnight/rollover (swaps) – At the end of the trading day, FXVC charges overnight/rollover (swaps) fees for FX and CFDs.

Maintenance Fee – FXVC may impose a monthly Maintenance Fee of $20 for managing and maintaining the Client’s Account.

In contrast to other forex brokers in the business, such as Oanda, FXVC does not charge an inactivity fee. In addition, there is no registration fee charged by the broker.

FXVC does not charge a deposit fee, however it does charge a withdrawal cost of 1% of the amount withdrawn, with a $35 minimum withdrawal amount.

| Fee Type | Fee Amount |

| Spread Fee | Variable low spreads |

| Deposit Fee | $0 |

| Withdrawal Fee | 1% |

| Inactivity Fee | None |

| Account Fee | None |

| Cost of investing in Stock Index CFDs | Tight spreads |

Pros

Cons

Your capital is at risk.

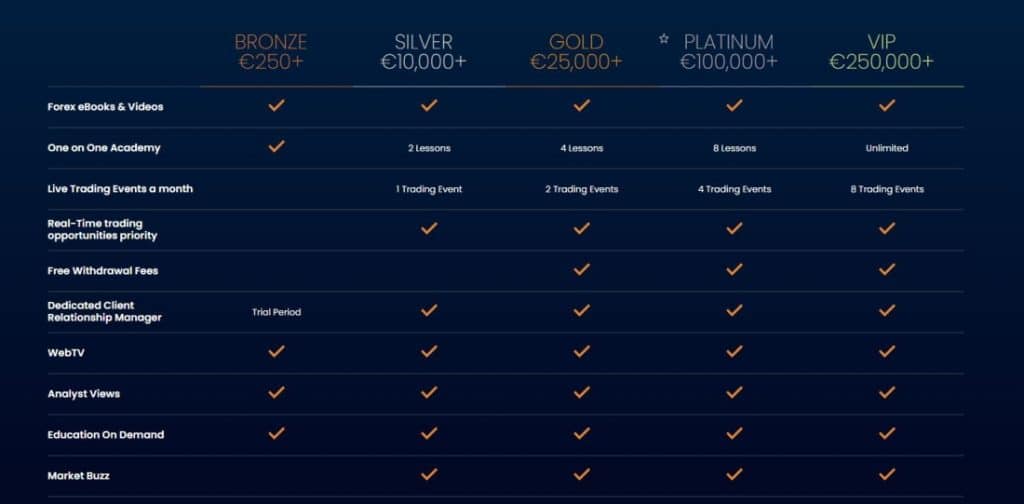

Founded in 2006, AvaTrade is a popular forex and CFD broker that’s authorised by a range of financial regulators, including the Australian Securities and Investments Commission (ASIC) and the Central Bank of Ireland. This trading platform allows you to trade forex, CFDs, and cryptocurrencies without paying any commission.

Trading indices CFDs is a well-balanced way of gaining exposure to the world’s largest financial markets without having to analyse the performance of a single company’s stock.

Online indices trading is an effective way to speculate on the world’s main financial markets while also staying on top of the latest news. Indices are weighted averages of the share prices of the best-performing companies listed on the exchange.

AvaTrade has one of the most comprehensive selections of stock indexes of any online broker, covering US, European and Asian stock indices. Open an AvaTrade brokerage account to trade stock index CFDs with low spreads and reliable, quick execution.

In addition to stock index CFDs, AvaTrade gives you access to just under 60 ETF CFDs. Exchange-traded funds (ETFs) are investment funds that track underlying assets such as indexes, bonds, and commodities and divide ownership into shares.

ETFs are bought and sold on a stock exchange, and their value fluctuates throughout the day as a result of supply and demand, otherwise known as liquidity. ETF trading works in the same way as stock trading, except that ETFs don’t have their own net asset value (NAV), which is computed once a day at the end of the market day.

Some ETFs are designed to mirror the performance of a single country’s stock market. MSCI Brazil Index Fund, MSCI South Korea Index Fund, and just some examples.

ETFs also allow investors to invest in specific sectors. The U.S. Real Estate Index Fund and the Energy Select Sector SPDR are two examples of AvaTrade’s offerings. It’s crucial to understand that all ETFs are traded as CFDs. This means you don’t take ownership of the underlying assets.

The only trading fees you’ll pay with AvaTrade are the bid-ask spread and the overnight financing fee if you keep positions open after the market closes.

There are no deposit or withdrawal fees, as well as no account fees, when it comes to non-trading fees. However, after three months of inactivity, AvaTrade brokerage accounts are subject to a $50 inactivity fee. Following that, after one year of inactivity, a $100 annual administration fee is charged.

AvaTrade, which was founded in 2006 and works on a global scale, is licensed and regulated by many top-tier financial bodies including: The Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority of South Africa, the Financial Services Agency of Japan and the Financial Futures Association of Japan, the Abu Dhabi Global Markets Financial Regulatory Services Authority, CySEC, the Central Bank of Ireland, the BVI Financial Services Commission, and the Israel Securities Authority.

According to AvaTrade, there are several key security features in place that help protect client funds and data. These include:

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Spread Fee | Variable bid-ask spreads |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $50 per quarter after 3 months inactivity |

| Account fee | None |

| Cost of investing in FTSE 100 index CFD | Spread: 0.50 over market |

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

If you’re looking for an online trading platform to invest in CFDs and currency pairs, Capital.com could be the right fit.

Capital.com has a wide range of CFDs, forex and crypto products. But it lacks other popular asset classes such as real funds, and futures. As such, you’ll have access to 37 stock index CFDs, over 3,500 stock CFDs, and 115 ETF CFDs.

With a Capital.com trading account you’ll benefit from commission-free trading as the trading costs are included in the market spread. From CFDs to forex, you’ll have access to heaps of markets on a low-cost basis. The best thing about leveraged, speculative CFD instruments is that you can go either long or short based on how you think the market will perform.

Non-trading costs are also low at Capital.com. It’s fantastic that it doesn’t impose an inactivity fee if you don’t trade for a specific period of time, which is unusual for CFD brokers. There are also no account, deposit, or withdrawal fees.

Capital.com is regulated by top-tier financial institutions such as the UK’s Financial Conduct Authority, ASIC, and CySEC. UK-based clients are protected up to £85,000, while EU-based clients are protected up to €20,000 if the broker goes bankrupt.

Furthermore, Capital.com stores its clients’ funds in separate bank accounts and provides negative balance protection, which means you will be protected if your account balance falls below zero.

| Fee Type | Fee Amount |

| Commission Fee | 0% |

| Spread Fee | Variable dependent on asset |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $0 |

| Account fee | None |

| Cost of investing in UK100 CFD | Spread: 13.0 Pips |

Pros

Cons

76.72% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

| Broker | Commission | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| FXVC | 0% – Low spreads | $0 | 1% | None |

| AvaTrade | 0% | $0 | $0 | $50 per quarter (after 3 months inactivity) |

| Capital.com | 0% | $0 | $0 | NA |

Index funds, like any other investment, carry some risks associated with market volatility. An index fund, by nature, will be exposed to the same risks as the securities that it’s designed to track. Other risks to which the fund may be exposed include:

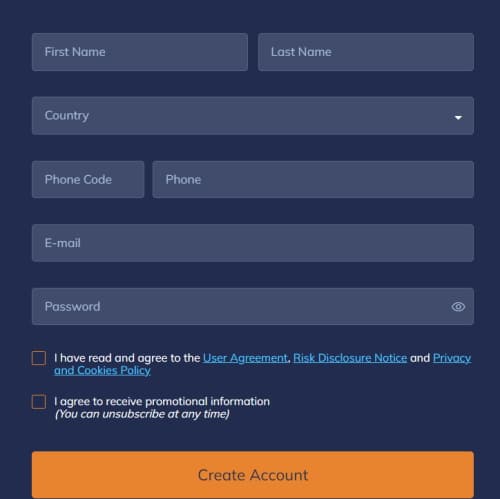

Visit the FXVC website and tap on ‘Sign Up’ to open an account. Once you’ve entered a username, email, and password click on ‘Create Account’ to move to the next step.

Your capital is at risk.

As part of the KYC process you’ll need to verify your brokerage account by uploading proof of identity and address. The verification process is fully-digital and easy. Simply upload copies of your passport or driving license, and a recent utility bill or bank statement.

Funding your account is easy and quick. By clicking on the ‘Deposit Funds’ button you can fund your account using a range of payment options including debit/credit cards, bank transfers, and e-wallets.

The best part is that FXVC doesn’t charge deposit fees and the minimum deposit is just $500.

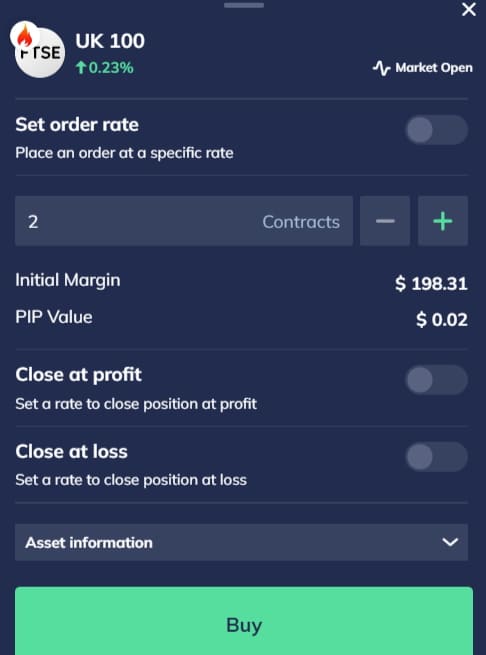

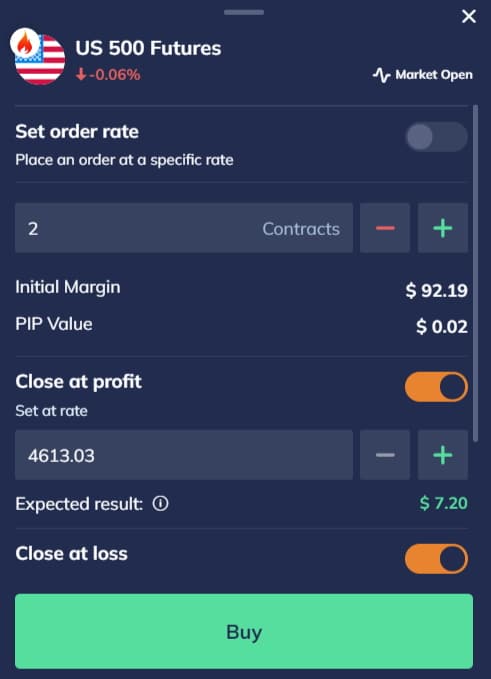

You can search for specific stock index CFDs via the search bar. Alternatively, you can browse through all the available assets by clicking on the ‘Indices’ tab.

Once you’ve picked the asset you want to invest in, simply click on it, enter the amount you want to invest, as well as any stop-loss or take-profit orders, and click Buy, Sell, or ‘place order’ to complete your speculative investment.

Investing in index funds has long been regarded as one of the best long-term investments you can make. They’re inexpensive, provide diversification, and often produce positive returns. Index funds have historically outperformed other types of funds actively managed by leading investment companies.

If you want to gain exposure to index funds South Africa but don’t know where to start, we recommend FXVC. This leading CFD trading platform offers low spreads and a user-friendly trading platform. So, to make the most of investing in index funds follow the link below and open an account today!

Your capital is at risk.