The Credit Risk Database in Japan is a Model for the Rest of Asia

Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

Considering the importance of small and medium-sized enterprises (SMEs) for employment and GDP and the number of such firms in Asian countries, there needs to be further efforts to offer SMEs access to finance. Asian economy characteristics are having bank-dominated financial systems and underdeveloped capital markets, and as a result, banks are the main source of financing for SMEs. However, the financial health of SMEs is difficult to evaluate since many do not have solid accounting systems and many SMEs in Asia resort to borrowing money from moneylenders at high interest rates.

Considering the importance of small and medium-sized enterprises (SMEs) for employment and GDP and the number of such firms in Asian countries, there needs to be further efforts to offer SMEs access to finance. Asian economy characteristics are having bank-dominated financial systems and underdeveloped capital markets, and as a result, banks are the main source of financing for SMEs. However, the financial health of SMEs is difficult to evaluate since many do not have solid accounting systems and many SMEs in Asia resort to borrowing money from moneylenders at high interest rates.

Even when firms are able to borrow money from banks, they face high collateral requirements. If banks in Asia had comprehensive information on SMEs, financially sound firms could raise money more easily and at considerably lower costs. The Credit Risk Database (CRD) of Japan shows how SMEs rate based on financial and non-financial data. The CRD collects a huge amount of data on SMEs and uses it to rate them based on statistical analysis.

Credit Risk Database

Founding of the CRD in Japan was in March 2011, as an organization of 52 credit guarantee corporations with the purpose of collecting financial and non-financial data, including default information, on SMEs. The CRD promotes the streamlining and efficiency of SME financing by measuring credit risk and assessing business conditions based on data. Presently, the CRD acts as an infrastructure of data on SMEs. It collects data from credit guarantee corporations throughout Japan, as well as government-affiliated and private financial institutions involved in SME business, and provides its members with assessments of SME business situations and credit risk.

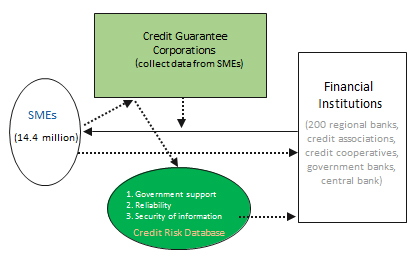

The CRD database exclusively covers SMEs. As of March 2010, the database includes data on 14.4 million corporations and 1.7 million sole proprietorships—more than 50% of all SMEs in Japan—and is by far the largest SME database in Japan (Figure 1).

Figure 1: Credit Risk Database of small and medium-sized enterprises

SME = small and medium-sized enterprise.

Source: Yoshino (2012).

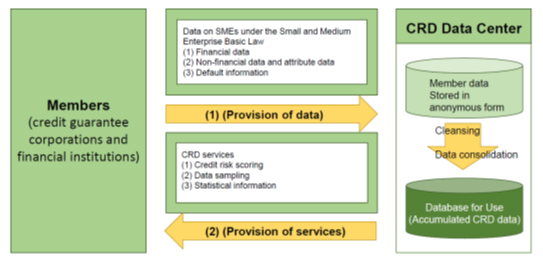

The database for enterprises in default covers 3,289,000 corporations and sole proprietorships. Before the CRD database was formally established, the government invested ¥1.3 billion from the supplementary budgets in FY1999 and FY2000 to finance the setting up of the CRD’s computer system and other operational costs. The CRD Association provides sample data and statistical information as well as scoring services as illustrated in Figure 2 (Yoshino and Taghizadeh-Hesary 2014).

Figure 2: Structure of the Credit Risk Database

CRD = Credit Risk Database, SME = small and medium-sized enterprise.

Source: Credit Risk Database (CRD) website.

In addition to credit rating analysis services, the CRD Association provides consulting services to support the management of SMEs on the assumption that better management of firms will reduce the credit risk for member financial institutions and strengthen the business operations of SMEs. Consulting services have also been offered to member financial institutions to help promote the implementation of the Basel Accords.

Establishing SME databases in other Asian countries

If similar systems could be established in other parts of Asia to accumulate and analyze credit risk data and accurately measure each SME’s credit risk, SMEs would not only be able to raise funds from the banking sector, but could also gain access to the debt market by securitizing their claims.

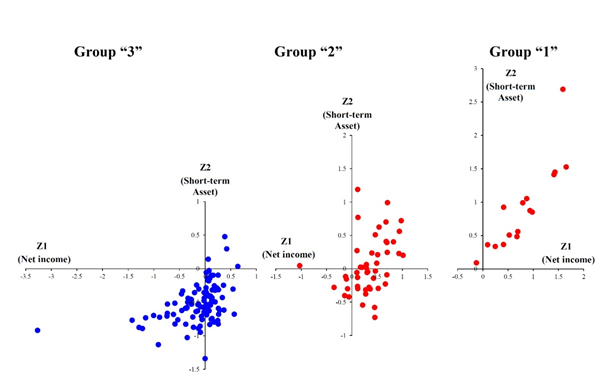

As mentioned earlier, the main purpose of developing such databases is to create the infrastructure for improved credit rating of SMEs. There are various methods for performing credit rating analysis using data on SMEs. A comprehensive credit rating method developed by Yoshino and Taghizadeh-Hesary (2015a, 2015b) employed statistical analysis techniques on various financial variables of a group of SME customers of an Iranian bank. As Figure 3 shows, the analysis classified SMEs into several groups: financially healthy SMEs, medium-risk SMEs, and financially risky SMEs. Yoshino and Taghizadeh-Hesary (2015a, 2015b) explains detailed analytical framework.

Figure 3: Classification of small and medium-sized enterprises

SME = small and medium-sized enterprise.

Note: Group 1 = financially healthy SMEs; Group 2 = medium-risk SMEs; Group 3 = financially risky SMEs.

Source: Yoshino and Taghizadeh-Hesary (2015a, 2015b).

For SMEs in the financially healthy group, banks can lend them more money by charging lower rates of interest with no required collateral. On the other hand, for SMEs in the high-risk group, banks can charge higher rates of interest with greater collateral requirements. If an SME’s performance improves and it moves into a lower risk group, banks can change their interest rates from high to low, accordingly. Similar SME data analysis is underway in Thailand. We hope for the data analysis explained in this paper to expand to many other Asian countries so that more reliable credit rating of SMEs will become possible. When data is not well established, banks lend money to SMEs based on intuition rather than through examination solid data. Establishment of SME databases will reduce information asymmetry between SMEs and lenders.

Although there is a need for having centralized SME databases like the CRD in other Asian countries, this is a long-run target for governments. In the short run, there are varieties of available databases for the credit rating of SMEs. For example, government and private institutions have financial statements of their SME customers for the credit rating of bank customers. In many Asian countries, there are also databases on SMEs kept by the respective tax bureaus of the ministries of finance for use as databases for the credit rating of SMEs.

The necessity of developing SME databases in Asian economies is republished with permission from Asia Pathways