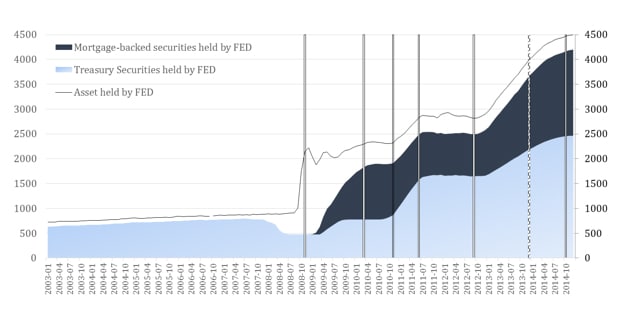

St. Louis Fed President Bullard’s ‘Regimes’

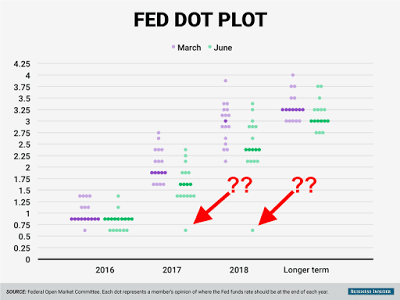

The dot plot the recent FOMC meeting was curious. We noted right away that inexplicably there was one official that apparently anticipated one hike this year and then no hikes in 2017 or 2018. There was also one dot that was missing for a long-term view.